As we expected last week when HDFC add-on card offer went live, the American Express supplementary card offer is also back. This time as MR points based offer over amazon vouchers as per Jan-March 2020 campaign.

It also comes with similar value as the old offer in terms of points. But now the biggest change is the spend requirement. Here’s everything you need to know:

Table of Contents

Offer Details

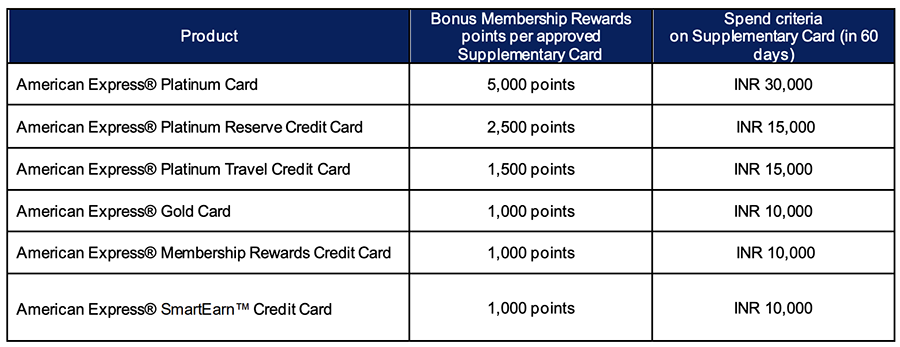

- Offer: Get AMEX Membership Rewards Points upto 5000 points per card, as above.

- Offer Period: September 1, 2020 till October 31, 2020 , and the Add-on Card should be approved on or before November 30, 2020

- Requirement: The spend criteria (as mentioned in the table above) to be met on the Add-on Card within 60 days of Add-on Card approval

- Fulfilment: On or before February 28, 2021

- Apply Supp Card Now

- Source

So basically they’ve increased spends, increased spend period but kept the voucher/point value more or less similar to the previous offer.

That aside, you may also need to know how many complimentary Supplementary cards are eligible for each of the card. Here are the numbers,

- Amex Platinum / Amex Plat Reserve: 4 Supp. Cards

- Amex Plat Travel / Amex Jet: 2 Supp. Cards

- Amex MRCC / Amex Gold Charge: 2 Supp. Cards

- Smart Earn: 1 Supp. Card

Is it a good offer?

Absolutely!!

It’s basically like getting paid for applying supplementary card for loved ones. So sharing is not only caring but also rewarding.

If you’re holding Amex Platinum, this will help you add 20,000 more points to your kitty. I value that at ~Rs.10,000 (minimum). FYI, You may maximise your Amex MR points value in very many ways.

That’s so sweet isn’t it? Well, not really.

It maybe bit bitter too, as soon as you see spend requirement. But not to worry, that’s why we have e-wallets (like Paytm, Mobikwik) and Amex very much encourages you to spend on them while other issuers are doing the opposite.

Final Thoughts

Its good to see the Supplementary offer to be back on American Express cards, but I wish it could have been bit better.

While I’m not against the spend requirement, I feel the points given is bit on lower side for the spends it demands. Could have come up with slightly more points!

But overall its an amazing value and you get to earn significant points on premium variants.

If you’re new to Amex, you can also get some of the American Express Cards as FREE for First Year, so you not only get free cards but also earn these additional MR points via complimentary supp. cards.

- Amex Plat Travel (Currently FREE)

- Amex MRCC (Currently FREE)

I was personally waiting for this offer and so planning to add new supplementary cards to my recently applied Amex Platinum.

What’s your thoughts on the new Amex Supp. card offer? Feel free to share your thoughts in the comments below.

Thanks is for the update

I agree, the points are on the lower side. Btw I’m still waiting on my Amazon vouchers from March fulfilment offer

Hi Siddharth,

I hold AMEX MRCC card and was thinking, if I apply for a supplementary card, will that also give me 1000 points on 4*1000 spends per month?

As in, will I be eligible for 2000 points per month on spends of 4*1000 on both the cards?

Also, you have been doing a great job with the website.

1K points is given on card account level in which Supp. cards are part of it.

Amex has to continue encouraging wallet loads, as they know their acceptability otherwise is quite low. Moreover, since their revenue is primarily driven by MDR, rather than EMI conversions etc, it doesnt matter much to them whether you spend on wallets or in other categories.

And then issue with wallets is that many small merchants are moving towards UPI option and not accepting payments from wallet balances. This can indirectly hit Amex.

the spendings on supp. card, is it part of overall spend or the spend on each card is considered separate?

Good that AMEX has resumed this incentivised supplementary card programme. But yes, you’re right, I too strongly feel that the incentive, (especially on the higher annual fee and the higher spend required cards for this offer) could have been better.

The thing to note here is that your authorised/supplementary cardholder will also have to take their new supplementary card as an additional account on their CIBIL and EXPERIAN credit reports (authorised/supplementary credit card user accounts don’t show up on C.R.I.F. HIGHMARK and EQUIFAX as of yet). This again is subjective, as it could dissuade many from applying for an add-on card with AMEX, owing to the reduced average age of accounts and a slight score hit (though this doesn’t involve a hard enquiry) being the cause of worry.

I wonder why AMEX in India doesn’t go about with their supplementary card account reporting on the credit bureaus as other Indian banks do. I’ve never seen any other Indian bank take that route of reporting the supplementary credit card accounts to the credit bureaus. AMEX probably here follows its global protocol of add-on card programme. But AMEX needs to realise that in India, supplementary card accounts don’t help in building credit from scratch while it helps in the U.S. and perhaps in other foreign lands where AMEX has its presence.

So I’d suggest going ahead with this only if your family member really intends to participate in making purchases using an AMEX, or if he/she really wants one.

Good that you accrue a bunch of points, but it might make the CIBIL and EXPERIAN reports for your loved ones slightly more complicated.

If you’re someone who doesn’t already have a family member at your place with a supplementary AMEX, one should surely take it as you’d collect quite a few miles (if redeemed wisely for transfer partners). While for someone who has already distributed a number of supplementary cards at home, you might now have a reason to think otherwise.

Now only if AmEx would start issuing cards in non-network places!

Wow! This is music to my ears.. Was waiting for some time for such an offer to apply for a supp card! Thanks for the update.

I guess the bonus MR points are less when we compare it to the min spend to be attained within 60 days. Should I wait for another supplementary offer in the near future or go for this one only?

Hi Sid,

I’ve a different query. What’s the documents collection process for AMEX? My city isn’t listed on AMEX. If it’s online, can I provide a serviceable city address of relatives and get the card delivered?

Has anyone got limit enhancement recently? I have been thing from past 3 months

Same question, has anyone got a credit limit enhancement during this period? Have made several calls but was told on every occasion that it is on hold. Latest call made was on the 1st of September 2020 to check for limit enhancement.

LE is on hold till the mid of October.

What will be the additional annual and joining fee for the add on card?

Hi sid..and experts here

icici bank is such a worst in crediting reward points. i made a bulk purchase of around 4 lakhs in july -aug and was supposed to get around 20k amazon reward points..however after statement generation,rewards were not credited and when made complaint,they said to reslove the issue in a week.however after 20+ days,i see my card was deactivated fron their end.. they advertise unlimited reward points,but they give unlimited “dhoka”..?.i have 15+ years of association with the bank and they never bother to loss a customer..

is anything can be done to recover card and reward points

you still care about points? if your card is deactivated front their end then that means u must forget about apay cc as well as points now since it’s permanent deactivated.

i hold

icici sapphiro

citi rewards

yes first exclusive

stanchart manhatten

amex gold

wanted to apply for HDFC regalia

kindly advise which one to keep and which one can be surrendered

amex is for loading wallet

which card to use exclusively for all generic purposes, small grocers, chemists, petrol pumps, online shopping, sweet shop etc

thanks & regards