American Express India started reporting credit limits to Credit bureaus and here’s everything you need to know.

In the Past

Amex for a long time has the habit of not reporting Credit Limits & even high credit usage to credit bureaus like CIBIL. Many other issuers too don’t report credit limits, for ex, HDFC doesnt report Credit limit but reports High credit, which helps to an extent.

Why its important?

This used to be a problem for some, for ex, your “Utilization ratio” is affected when Amex limits are not taken into account, thereby impacting your credit score negatively.

Also when you apply for other bank card through card-on-card basis with Amex statement, they can’t verify if you really have the mentioned “X” credit limit. So, many issuers used to stay away from amex for card on card applications despite being the fact that they’re one of the best cardholders to target.

So all these are changing as American express has started to report Credit Limit along with the high credit to credit bureaus like CIBIL. I just logged into CIBIL to check and I could confirm the same as I see my Amex Platinum Travel credit card reflecting both Credit Limit and the High credit.

However its yet to reflect for Amex Reserve, maybe as I’m not using it or maybe because both are on different billing cycle. Will update the status on Reserve by month end.

That said, Amex opened their credit limit enhancement system recently but continues to keep strict criteria to be eligible for a limit enhancement. Yet, it doesn’t affect most negatively, as anyway the limit is extended for those who have significant spends.

Just incase if you are not in the Amex ecosystem yet, here are some of American Express cards worth applying,

- Amex Plat Travel (Currently FREE + 4000 Reward Points)

- Amex MRCC (Currently FREE + 4000 Reward Points)

Did you notice the Amex credit limit data getting shared with CIBIL and other credit bureaus? Feel free to share your thoughts in the comments below. Thanks to Rakesh for spotting this change.

Interesting. Though when I refreshed my score, I didn’t find anything for my charge card. I was not expecting reporting of the credit limit, but was expecting a high credit report at the least.

Not reflecting for my charge card either. Let’s wait for a month and see. They maybe rolling out this phases.

HI Sid,

I can Confirm that they are now reporting this for charge cards too. It shows a credit limit on my Gold charge card along with my Plat Travel and it’s a 7 digit figure for the Gold charge card. Though the interesting fact is that when I used their spend checker tool it approved me till about 4L higher than the limit reported to CIBIL, so it’s still all a bit sketchy in my point of view.

It’s Showing for my Platinum charge card,

Even being charge card it’s showing credit limit which is even less then billed amount of last cycle.

That’s strange.

Mine is the exact opposite. It shows a 7 digit figure as a credit limit for my Gold Charge even though my billed amount was not even 10% of that more over using the spend checker tool, it approved me till about 4L higher than the reported limit of my charge card. Strange !!!

Sid, do yhou think is this because of some Rules from RBI or any other institution having oversight? Any idea on this?

If yes, maybe we can expect HDFC to report as well. That would be good for me as my DCB has more than 70% of my total overall limit

Not sure about it. I asked someone close to the topic but not getting any solid answer to it.

I have been using HDFC Regalia since 2016 August and upgraded to DCB in 2019 Nov.

HDFC has always been present in the report. So I guess it reports to the exchanges regularly.

HDFC didn’t/doesn’t report for me. Regalia limit wasn’t reported & then Infinia to isn’t.

No surprise HDFC still lags behind in this metric, among others. They seemingly work on their technology with an abacus in the 21st century.

Not at all, they can do it if they need to. This is more of “I don’t want to show you my data”.

But to be frank, I never thought HDFC has so many issues with customer service until i was in a tight spot.

Lost wallet containing SCB Ultimate, DCB, AMEX MRCC, One Card.

AMEX-instant reissue with card reaching me in 48 Hrs (tier 1 city though) 48 Hours of down time as there is no virtual card.

SCB- blocked instant card issued in 5-6 hours, visible in app. card reached me in two days

One card- instantly turned card ‘off in app. as card reissue fee is 3K for metal.

HDFC- No temporary use off feature

I set all limits to 0. But the best part only available in netbanking. Every time cumbersome process to open and close.

if i report to customer care, card is instantly blocked with no option of instant card. Unfortunately card address was an old address. requested for nearest branch delivery.

the process for nearest branch delivery is; card gets dispatched to your address on record. then it will come back then raise approval with nearby bank branch manager (which as per CC takes 5 days) then shipment will be re directed.

While DCB is a good card, they are only having customers of the product not the service. Once day when 10X stops, HDFC is going to lose lot of customers.

HDFC address change form submitted 7 days ago no update!

All cards have a temporary block feature. HDFC doesn’t and everyone can control card usage in App. EXCEPT FOR HDFC!!

>HDFC address change form submitted 7 days ago no update!

Yup, just went through this and was told to go in person to submit the address change form as they “don’t do it online.”

The stupider parts of this is, that there is no real way to find my RM’s contact details from Net Banking, and when I call the mobile number to arrange a call back, it won’t recognize my registered number.

I had to resort to twitter to get a call back from the bank!

Yes, both my Amex MRCC & Plat travel limits are showing on CIBIL

It will probably reflect when Amex submits users data for the month. Typicall after bill is generated.

I still don’t find this on any of my 3 cards from AMEX even after refreshing the CIBIL score today.

Probably it’s all based on the reporting dates for each and every card .

Any idea about when the details are reported by every bank, is it always 1st of the Month or billing cycle based

Based on the statement date. Usually shows up couple of days after the statement is generated.

I have 11 cards but never able to get my dream amex card…any idea how to get it

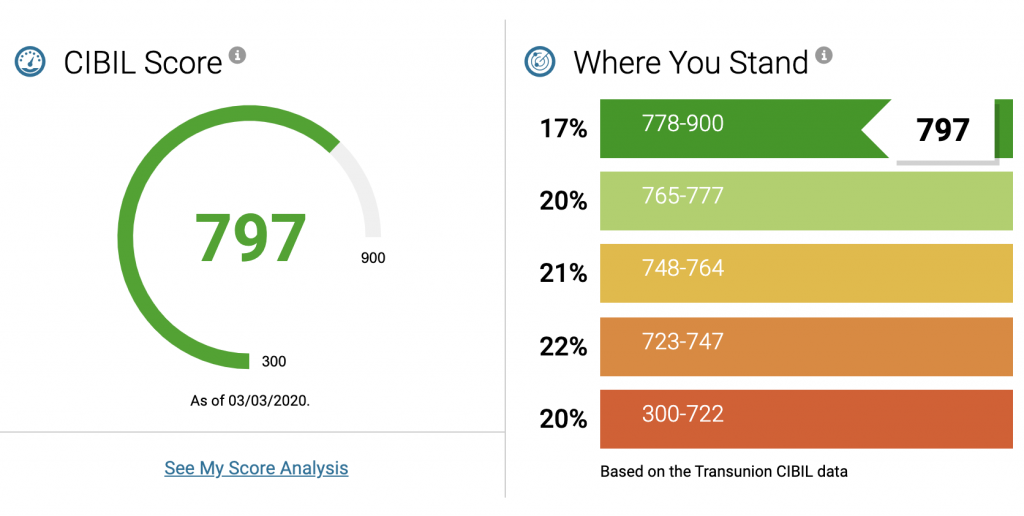

What is your CIBIL score?

790

Score ain’t relevant imho.

Does he live/work in AmEx sourcing location? If yes, then which is his “dream AmEx variant & what’s his ITR & whether or not he is working in MNC and finally is his credit report clean? ~ More relevant.

Good move from Amex. Haven’t yet reflected for my Amex MRCC though. Hopefully, should be up and running from next cycle.

Hope HDFC would soon join, I have the highest credit limit on my HDFC Millennia, and if they start reporting the limit, my score might possibly improve as the utilization ratio would better. Don’t know if they have some system by which it is kind of already factored in, but not sure of that.

Hi Siddharth,

Thanks for the great website!

I have been using HDFC Regalia for some time and have a credit limit of 10L. Recently applied for an upgrade but was told that I don’t meet the criteria even though CTC is >25L. My score is down in spite of timely payments for 3 years due to utilization ratio not being calculated properly.

I am planning to change my daily driver to some other card but don’t want to land up in a similar scenario. Can’t apply for American express as working from home in a tier 2 city. Going to refer to your best credit card article for the right card but could you advise which companies report credit limits properly?

SBICard and ICICI Bank are two CC such issuers.

Thanks a ton! Would you know if IDFC or Indus do it as well?

IndusInd does not, atleast not till now !

Thanks for the info!

My credit limit for both MRCC and Platinum Travel is getting reflected in CIBIL now.

Idfc’s one card does report. Indusind reports report as well.

Thanks for the info Santosh!

Sid, I have too many cards with high utilizations of credit limit.

My question is how to avoid high credit utiliation? If I pay back my CC bill before BILL GENERATION DATE do credit card companies report cibi outstanding bill amount or the expenses which I spent in the month. I want to show lesser credit utilization in cibil. Any trics are there help me with that one. At present doing balance transfers, using apps like cred, nobroker to withdraw money and paying other card bill and next same process I am following. simply transferring and withdrawing amount from one card to another to avoind higher intrest rates which incurs in rollover . Pls help and dont ignore my query and if possible post your analysis regarding credit utilisation topic.

Be ready to get income tax notice sometime very soon

PS that they offer very good coffee when they slap u with heavy penalty

Naveen,

From what you are describing it no longer seems to be about credit utilization but more about financial discipline.

You’re on a slippery slope which might lead to irrevocable damage to your credit score and even being on the wrong side of the law.

Try to avoid adding any new expense to your card altogether. Research into ways to clear credit card debt faster. There are plenty of articles available externally.

All the best!

I am the one who is responsible for it. I reported to Amex customer care, Head of the customer services, and Manager of the customer service. Spoke at length with the Manager and explained to him how it is negatively impacting CIBIL and omission of information is also misreporting. He was very patient and helpful and I also explained to him that if it is not done, then writing a mail to RBI would be the appropriate action. You can click on my name and you will be directed to an email a screenshot to prove it. I started this on the 8th of March. I feel so happy that it benefited everyone.

HDFC is another bank that is not reporting this data, as I am aware but don’t have an HDFC credit card. So someone should follow up with them and probably they will also do it 🙂

All cards and loans report it regularly. I have checked my report. If in doubt, subscribe to cibil. Or some sites give you the report for free but you have to then live with its annoying telecallers for loans and cards.