Yes Bank Credit cards used to be one of the most rewarding credit cards in the Industry when they were initially launched. They used to have mind blowing offers just like this one where they used to give upto 1,00,000 bonus points based on spends.

Those offers were huge by then, with return on spend exceeding even the major players like HDFC. Not just the rewards, even then presentation/box of their premium cards (as you see above) like Yes First Exclusive are some of the best in the industry.

But things started going opposite turn since past 2 years and it seems other complications with YesBank added fuel to the flame, making it even worse. Initially the offers stopped, then came series of devaluations.

June 2021 Devaluation

The latest devaluation that affects the reward rate on select categories and lounge access limits are going LIVE by 15th June 2021. Here’s a quick look on what’s changing:

- Domestic Lounge Access: is now limited to 3/card per quarter for primary & Add-on Exclusive card and limited to only primary card on Preferred Card.

- Reward rate: drops to 0.75% on YFE & 0.5% on YFP (on these select categories)

And you may also “assume” that International lounge access will be limited by mid-2022 or so, as soon foreign travel begins.

This is very much expected, as anyway unlimited lounge access on a free card is not something that can last forever. If you’re aware of the truth behind Lifetime Free Credit cards, you wouldn’t be surprised.

Lucrative EMI offers

So these all changes likely raises the question about taking Yesbank cards going forward. Speaking about which, I would say, they’re still useful for two things:

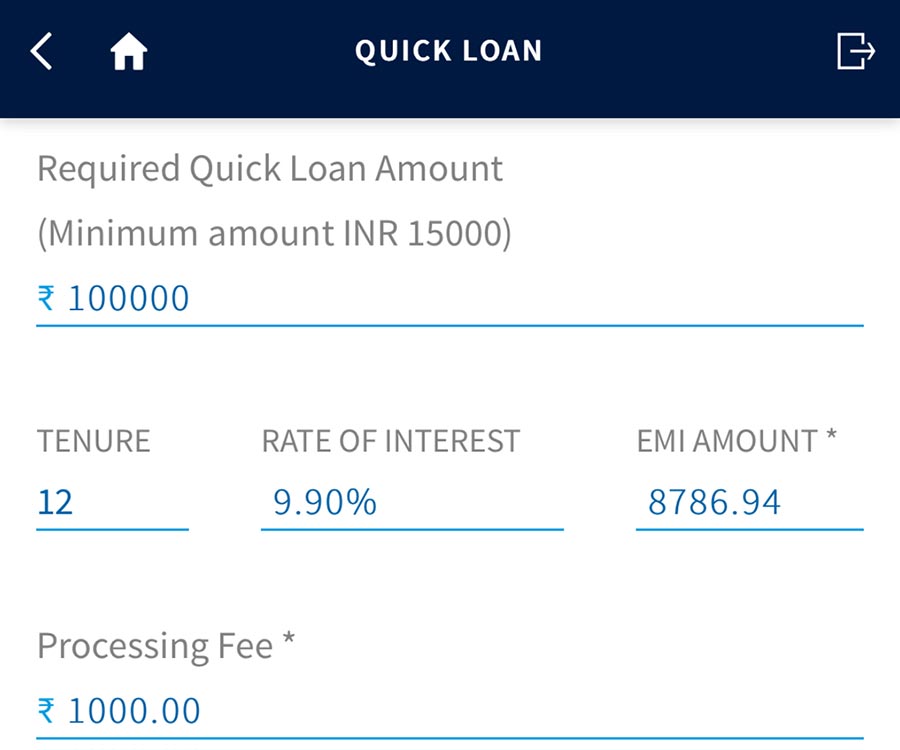

- Loan on Credit card @ 9.9% p.a

- EMI @ 9.9% p.a.

That’s right, Yesbank is one of the very few credit card issuers with such low interest rates on above services.

That alone makes it worthy to hold, for those who need such benefits. Especially the loan on credit card with such interest rates are very rare in the industry.

However, note that above are not standard offers with YesBank credit cards and another issue is that most Yes bank cardholders have relatively low credit limit, so making use of such offers is another challange.

Final Thoughts

While I do not recommend Yes Bank credit cards for anyone as a primary card for rewards, its still worth holding if you’re looking for the EMI/loan offers.

So you may gladly take it if you’re given as LTF, else better to ignore. There are so many other credit cards in the country to choose from. The list is here, just incase if you’re confused: Best credit cards in 2021.

What’s your thoughts about Yesbank credit cards in 2021? Feel free to share your thoughts in the comments below.

Yes Bank Cards are a dying product in Yes Portfolio with many devaluatiins within the last couple of years.

The only ones who should hold on to these are the ones with LTF cards just for using this as a low interest EMI cards.

I just redeemed all of the points for Amazon Pay vouchers expecting another round of devaluations for redemptions soon

@Sid

One more feature i.e. 1.75% + GST (=2.065%) foreign currency conversion charges (half of the general industry rates i.e. 3.5% + GST = 4.13%), although can be used in a very limited scenario(maybe online trxn in Foreign currency) these days, again make holding these cards worth for someone who does not have Premium/Super-Premium cards.

I hope this benefit has not changed.

It used to be 1% and now has been increased to 1.75%.

Can i apply for yes preferred card lft if i dont have a bank account with yes Bank?

Yes, you can

Yes. I have YFE without any other relation

Check the banks website usually all cards are LTF

Yes you can ……even though you dont have any account in Yesbank

@Joydeep Banerjee

Its a shit bank . They promised to give Yes first exclusive if i open FD and I opened around 5 lakhs. After opeining within 1 week they said policy changed and they cannot give CC. Only reason i still have account is high interest rates.

I pulled off 90% of my fd after bank reported another 3k crores loss.

@Siddharth

I have posted some details about devaluation of YES bank card rewards program in Yes cards page 15 days back. That was not posted.

Anyway I will post here again with details soon.

Currently, Yes bank credit cards are more or less like Kotak credit cards.

GST(18%) will be charged on interest of quick loan. This makes effective interest rate of 11.7% in our hand.. Not a good offer..

Where did you see that ? Normally there is no GST on interest. It is NOT a service or goods. Also, as per the emi calculated above it is 9.9%. Only on processing fee there should be GST.

Most of the banks charges GST but in Hdfc credit card if you avail PLCC there is no GST

Hey! @Sid (A) nice and fruitful expertise blog for CC users (basic & premium customers) keep it up!!! Please make one article on banking experience with State bank of Mauritius (India) on Private wealth and as they are lauching their Credit cards soon. One card is there which is Step up CC from Paisabazaar app. If any one has any experience on this bank please share.

I have been banking with them. They are fine.

Nothing especially good or bad. There are only a few branches in the country so it is not good for daily banking needs. If you can everything online, it is fine. Their web interface and app are very basic with extremely limited functionality.

I am holding Yes bank credit card from the past 5 years. From the past two years their offers are pathetic and i feel bad for using other banks cards. Yes bank service used to be top notch missing that.

@ Siddharth:

Hi, I just love your website and the amazing details that are posted by you. I need some help from you on salary account.

I have salary account currently with Punjab National Bank. Since the time Nirav Modi siphoned off their funds, PNB has started charging average people like me on petty issues. So I wish to move on to some other bank. At present, I have explored three options:

i. IDFC First Bank

ii. HDFC Bank

iii. Axis Bank

My main account is with SBI but wish to have salary account with some other bank. Now IDFC First has everything expensive. The eligibility for even their basic credit card is beyond my reach. Their personal loans and home loans are also expensive. Even their branch network is small. So it won’t be that useful even if I open zero balance salary account with them.

HDFC seems to have everything reasonably good. But they are giving Millennia Debit Card and I am not so sure about it. Read somewhere that its reward points expire within a year. I am already holding Regalia First credit card with them since last 3 years but they are yet to offer me upgrade to Regalia. My CIBIL score is reasonably good.

Now last option is that of Axis Bank. They have good features and also giving Debit Card with twice airport lounge access in a quarter against 1 given by Millennia. But their other options like Housing Loan, Personal Loans etc are marginally expensive than HDFC. I also have a bad experience with them. They attracted me with a “freecharge credit card” with NIL joining fees in January 2021 but after issuing the same, they applied joining fees against it. Maybe it was one bad experience with Axis Bank.

So I wish to know the following among HDFC and Axis Bank:

i. Whose customer service is better;

ii. In long run, which of these banks offer better upgrades to their customers.

Thanks.

Suggest you prefer HDFC, if you get 0 balance account, preferred relationship if you get is good, you get debit card with up to 1% returns up to 750 per month

I would like to suggest HDFC if you are a salaried person.

1. When it comes to customer support I feel IDFC (even classic banking) is way better than HDFC and Axis, However once you get HDFC preferred status, you can get very good support from HDFC customer care via RM.

2. When it comes to credit cards, offers and frequent upgrades on cc, HDFC has upper hand (DCB and Infinia are best in CC market). just want to point out IDFC just entered the market and have no credit card to compete with HDFC super premium cards. However I would suggest to use Axis ace credit card as secondary one as it gives 5 % on bills.

3. when comes to debit card, I won’t recommend them for lounge access, CC are better, however if really need lounge access, go for HDFC platinum. It gives better features than IDFC visa signature or Axis cards.

I hope my answer will help you to decide.

Yes bank reward point value is not Rs 0.25 but Rs 0.10 because Rs 5000 amazon voucher is available for 50,000 points. Same goes for all the other vouchers. So yes bank is giving 12 reward point per Rs 200 which is 0.6% .

I got first Yes bank basic LTF credit card in 2018 or 2019 start. Within a year, got two times upgrade to Yes first Exclusive LTF card. After that no upgrade.

In 2019 started redeeming rewards.

In 2019 – 4000 rewards=1000 cleartrip voucher.

In 2020 beginning – same

In 2020 middle or later part- 6660 reward points = 1000 cleartrip voucher.

In 2021 (currently) – 10000 reward points = 1000 cleartrip/amazon voucher.

So, Yesbank devalued rewards points by 2.5 times within a year, which no other bank done in my knowledge. However, the reward points earning is almost same as in 2018/19.

Hence, I have stopped using Yesbank card from this month on wards.

I hold YFE for last 3 years .. now the reward rate is 10000 points for 1000 rs Amazon voucher.

Seems like time to put card in cold storage

Got a pre approved offer for life time free yes business card with priority pass lounge facility last week. Having liked my regalia priority pass experience, (a 7 hour stop over in kl went very well due to pp) i accepted. Guy came home, took signs on form, no other documents required and card despatched today. Any issues in having 2 pp cards from different banks ? I already have too many free cards, i am just a collector now. Though the usefulness of good credit cards was brought home a fortnight back when i bought a expensive tv at zero % interest, with a 24 month emi. If i make full payment now, a penalty of 3% is their but i get a discount of 23k rupees on the tv price. No such discounted pricing if i make full payment for the tv. Use your cards wisely and its great.

wow. even i got ipad and laptop at 10k and 10% discount respectivey on 9 months and 6 months emi respectively, which discounts i could not have got if i paid the full price upfront. amazing world.

These devaluations will lead to shifting of expenses to other cards. Not much rewarding now.

Once upon a time it used to be a competitor of HDFC cards but now it’s just trash.

Strange system for applying for priority pass. Have to send a filled application form by courier to yesbank Chennai office. Dont think i will be doing that in a hurry as i have pp through hdfc and international travel is a distant dream in present environment.

Bad customer support. I got the Yes Credit First Preferred card only 10 days ago and they randomly keep switching off the domestic transactions permission by themselves. So it works half the times. When I call them they have no clue. For some reason I cannot enable it on their app. Tried on their website. Still didnt’work. Transactions continue to decline. Finally decided to do away with this new card.

do add-on cardholders still have access to mc/visa domestic lounges?

In 2019 I opened yes bank acc only with condition that they give yes first exclusive on card on card basis and by opening fd of 5 lakhs plus . I did everything what bank asked and after I returned to India around trip of 1 month bank denied giving card and also my bad luck of RBI morotorium just happened . It’s definitely a shit bank and I am glad I did not get their cards. Icici came forward and gave me LTF rubyx and Amazon pay card without any hesitation . The only thing what worked was their fd was of higher interest and after maturity I pulled off all amount. I still have an account and not sure why I am holding. And will not recommend.

Further devaluation on account of domestic and international lounge access