When it comes to Travel, we always look out for coupons and cashback’s to reduce the travel costs as much as possible. But what if i say, you can Travel for free? With below travel credit cards, you can get free flights, hotels, lounge access and even more.

I’ve listed these cards considering domestic travel in mind, if you’re looking for the best cards for foreign travel, check out 7 Best Credit Cards for International Travel. Here are some of the best credit cards for domestic travel,

Table of Contents

Best Travel Credit Cards in India:

1. Amex Platinum Travel Credit Card

With around 8% reward rate as default feature, this is one of the best travel credit card in India especially who fly frequently on Indigo. Added to that, their aggressive promos like Amex fuel cashback offer and other travel offers with Makemytrip makes this card one of the best travel card in India.

- Special Benefit: Indigo Vouchers

- Full Review: Amex Platinum Travel Credit Card Review

2. HDFC Diners Black Credit Card

With 10X Reward points that gives you the ability to save a whooping 33% on spends with partner brands, HDFC Diners Club Black credit card stands on top of all cards in the Indian subcontinent. That means, your hotels/flights can be 33% Cheaper!

- Special Benefit: 10X rewards on Travel

- Full Review: HDFC Diners Black Review

3. Axis Bank Privilege Credit Card

To make the best use of this card, you need to spend 2.5L after which you’ll get Rs.7,500 value back as reward points & travel vouchers from Yatra. If you’re a traveler, this is a must have credit card in your wallet. Or, if you’re having an Amex/Diners card which doesnt have 100% acceptance, this is one of the best card to have as a backup.

- Special Benefit: Rs.5,000 Yatra Vouchers on 2.5L Spend

- Full Review: Axis Bank Privilege Credit Card Review

4. Jet Airways American Express Platinum Credit Card

This is not only the top tier Jet card that can earn you maximum JPMiles, but also the one which gives access to American Express proprietary lounges in Mumbai & Delhi which is its unique benefit. If you’re interested in accumulating more JPMiles, check out my list of Best Credit Cards to Earn 1000’s of JPMiles.

- Special Benefit: Access to Amex Proprietary Lounges

- Full Review: Jet Airways American Express Credit Card Review

5. SBI Air India Signature Card

Its the top end Air India Credit card with SBI which made a history in the past. It has been devalued recently, though worth holding if you’ve a lot of expenses to put on. If you can redeem the miles close to Rs.1 per mile, this will give you earn rate of about 10% which is quite a nice reward rate.

- Special Benefit: 2L Airmiles on 20L Spend

- Full Review: SBI Air India Signature Credit Card Review

6. Citi Premier Miles Credit Card

With 1.8% default reward rate, Citi premier miles is as good as regalia without the Priority Pass complimentary visits. The major difference though, is its high joining fee of Rs.3,000+tax which gets compensated with welcome bonus, but not much for renewals.

- Special Benefit: Better hotel/airline points transfer partners

- Full Review: Citibank Premier Miles Credit Card Review

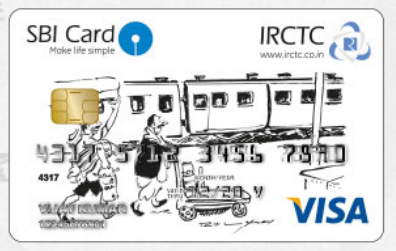

7. SBI IRCTC Credit Card

With excellent connectivity to entire country, train journeys are quite common in India. I hardly travel by train, but almost all of my friends who are at work in Chennai or Bangalore prefer train over bus journey as it is less tiring and less hole in the pocket. With SBI IRCTC credit card, you have the chance of saving upto 10% on your train tickets and redeem them back for train journeys. Nice isn’t it?

With excellent connectivity to entire country, train journeys are quite common in India. I hardly travel by train, but almost all of my friends who are at work in Chennai or Bangalore prefer train over bus journey as it is less tiring and less hole in the pocket. With SBI IRCTC credit card, you have the chance of saving upto 10% on your train tickets and redeem them back for train journeys. Nice isn’t it?

Bottomline:

So Which is the Best travel card? If you’re still wondering which travel credit card to get, i would say: Get 2-3 of them, because each card has unique benefits on its own and will be good for any frequent traveler. I’m holding some of these cards and i do make best value out of it, every year.

The best way to select the cards are based on your yearly spend, for ex, if you spends are like 5L a year, there is no point in getting Air India Signature card, rather you can go for Amex Plat travel or Axis privilege card.

If you happen to spend a Lot every year, you might also need to check out the Super Premium Credit Cards as well. Or, if you fly often with a particular airline, do check out the Best Airline Credit Cards in India.

What travel cards do you have and how does it help you save money? Share your thoughts in comments below.

Why no mention of cards from Citibank ?

The Premier miles card effectively gives you up to 5 airline miles(transferable to ~8 airline programs + 3 hotel programs) per Rs 100 spent.

The Prestige gives you up to 8 airline miles per Rs 100 spent and also 4th night free when you book hotels through their concierge.

Prestige is super premium one with big charges, and Premier miles not that great with renewal fees. I’ve still mentioned them in a sentence 🙂

Agreed that Prestige is super premium, but at least you should give Premier Miles a fair chance. 🙂

The card does costs you Rs 2100 annually. (Rs 3000 + 450 service tax – 3000 renewal bonus miles( Rs 1350 if used at premiermiles.co.in portal ) ). And for that price you get a card that gives you effective 1.8% cashback at minimum and 4.5% cashback for payments made directly at airline portals and 10x partners. Also the VISA variant gives you 8 visits per quarter to Airport lounges in India. Plus the added flexibility of 14 airline partners and 4 hotel reward programs to transfer your Premiermiles to, which is the highest in India.

And not to mention Citibank’s credibility – these premier miles don’t expire ever and also their reward programs are pretty stable with proper communication happening before any changes, which is unlike that of other banks like HDFC – that introduced point expiry and removed all Diners Club airline partners except Jet, AI and SQ without informing and also devalued it’s point value for non Diners card – which I think was a very cheap act of cheating your customers by HDFC.

I don’t want to sound like a Citi fan boy but I feel that if Axis Bank Privilege Credit Card can make it to the list, the Citi Premiermiles surely can. But then again, its my opinion 🙂

Sure, i do get it but i’m just not ok with the renewal charges somehow. Anyways i’ll be topping up the list with Premier Miles and one more card shortly 😉

you are right.HDFC is a Indian mentality bank.

Can you tell me if i can get this CITI premiere card for free.lol

curently i have hdfc diners premium

Amex proprietary lounge is discontinued in Mumbai

what about credit cards that are offered from banks like syndicate bank and punjab national banks ?

I’m thinking of taking a Syndicate Bank credit card as i have my SB account there. does it have any extra benefit compared to the other standard credit card providers ?

credit cards i currently hold

1. HDFC Superia card with 5L limit

2. ICICI Platinum card (got it recently as no annual fee/no joining fee)

3. Standard Chartered Platinum Rewards Card (applied for it recently)

4. holding an Add-on Card of SBI Titanium Credit Card (dad is primary holder) again no fee here too.

should i surrender any card ? or keep them all and apply for Syndicate Credit Card ??

It maybe good just in case you need a credit line,

but from rewards and benefits perspective, Syndicate bank cards stands nowhere in the market.

How would you compare :

1) HDFC Regalia First

2) Air India SBI Platinum card (not Signature)

3) Citi Premier Miles

4) Yes First Preferred

It all depends on what “benefit” you need.

Hello Siddharth,

Myself also Siddharth from New Delhi, This mail is with reference to a travel credit card which is having a facility of airport lounge access although I travel very limited 3 to 4 times in a quarter of the year but yes still I wish to have this facility DOM/INTL. Secondly, card must having some discount while booking some hotels & flights online.

I would also inform you that currently I am holding Manahattan credit card, SBI Railway platinum card, Amex payback, Citi bank Indian oil card, HDFC All miles.

I have seen your reviews for HDFC Regalia, Citi premier & Amex Travel card but still in doubt which one is the best.

Please advice.

Regards

Siddharth

Hey Siddharth,

Amex plat travel card and any HDFC Diners card would serve your purpose. 🙂

Many thanks Siddharth.. based on your advice I will proceed with HDFC Diners club black credit card.

Thanks or your prompt response…appreciate!!!

Cheers..!!!

Siddharth

which card is best for racking up jp miles quickly.currently i have hdfc diners card.

I think you need to add Axis Bank Vistara card to the list. I have been using their Infinite card for last six months and it has given me the best value after Amex Platinum Travel card.

Will consider on that when i update the article 🙂

Agree. It is outstanding…

Hi,

I have accululated around 43000 points on my hdfc regalia in last 2 months.

the redemption options look quite sad on the website all tupperware and some apparel brands.

IS there a way to utilise them in airlines booking ?

Yes you can. Check regalia website.

hi sid ,

first hats off to you for graet knowledge abt cards . i m regular reader of your articles .

Here i think you missed yatra sbi card , its just 499+ annual fee ( Waived off 90000 spent )

recently i desided to go with card & replaced with simply click . for domestic trip its best economical card . & reward rate is also very good . for me its best bcoz its gives 6 times promo code on domestic travel worth rs 6000 & additional 500rs voucher every 30000 spend on yatra . welcome gift additional .

Hey how about Axis Bank Vistara credit cards and especially the Vistara Signature Card. I guess it could make it to this list considering 3 premium economy tickets on a spend of 4.5L. Wondering how it would compare against the likes of Amex Platinum Travel Credit Card, Axis Bank Privilege and Jet Airways American Express Credit Card. Can you do a quick comparison among these three?

I an a new credit card user and holding Diners Premium so can’t get Diners Black for now.

Its a good card for metros. But the fact that the Vistara has less connectivity across India made it out of the list.

Sir,

Most of the card holders are based in Metro…

Regards

Nipun

I wanted to apply for SBI IRCTC credit card based on your reviews. I tried to apply online through sbi card website. I am already using SBI Simplysave card. So entered option of already customer of sbi card. After that it asked to enter my card details and registered mobile number. After entering the details it displayed sbi customer executive will contact you. But it has been a month no one called. I mailed them about the same got a reply wait. But again no reply. Can anyone using SBI IRCTC credit card advise me how to apply for this card.? I will be thankful to him/her.

Isn’t there anyone who can guide me regarding how to apply for SBI IRCTC credit card.. Kindly someone guide me..

You have to apply as a new customer.

Does the HDFC Diners Club Rewards Credit Card offers free Domestic and International Lounge Visits free. If yes, How many. As it is not clear from their site?

The site says :

“Sit back and relax in leading lounges across the world through Exclusive Lounge Prorgam

Largest airport lounge program, with access to 25+ lounges in India”

But it does not make a mention of the number of free Lounge Visits (Domestic and international).

Requesting your inputs in this regard.

Hi Siddharth, you haven’t mentioned the annual fees of all the cards. My annual spends on flights is around 40-50k, do suggest one good one for it

Any comparison for Jet airways ICICI Sapphiro Card?

I am from Kerala and work in Guwahati Assam. I fly by economy once in two months . Spend around 75000_100000 a year on flight booking. Don’t stay at hotels much. Will it be beneficial for me to get any travel credit cards.

Kindly advise

Sharaf, do go for the Citi PremierMiles Card. They have very good offers on flight tickets on MakeMyTrip. Also since the miles accrued are agnostic, you can redeem it on any airline.

i would like the suggestion on which card to get for air booking domestic & international and also for hotel booking. Looking for something with cashback or which gives much discount.

Please suggest

Thanks

Nowadays all bank cards give site specific discounts. But if u have spends of around Rs.4l then amex travel is a good card. It also gives discounts on mmt + if u spend on mmt and have mmt blcack u will earn rewards there also.

Best offers are almost always on Citi and HDFC cards. Suggest Citi PremierMiles or HDFC Diners ClubMiles.

For flight booking nothing can beat hdfc smartbuy via diners black or even clubmiles valid till 30th sept and may be extended soon.

Hi,

I would like to know there is any credit card offering cash back for road transport ( bus ticket booking )

HDFC Diners Club card via RedBus.

Regards,

Mr . Verma

Does anybody here hold SBI IRCTC card as an upgrade? What triggered the upgrade? I want this card but I am unable to have the auto-upgrade feature offer this specific card to me via SBI card website.

Are there any credit cards which are best suited for bus travel?