As you know, I recently got the American Express Platinum charge card and this article is all about the hands on experience of the same. If you’re looking for features & benefits of the card, You can read the detail review here: American Express Platinum Card Review

Table of Contents

Why Amex Platinum?

One fine day my friend got the 125K MR Points Upgrade Offer and he quickly called up his credit card guy (ofcourse me!) to check if its worth it. As he’s already into Marriott/ITC, it totally made sense to grab it.

And when I got the opportunity to get one as a supplementary card, I accepted it with open hands, just to experience the metal form factor as the most important reason. 🙂

Application Process

It took about 10 days for the application to be processed and the primary card to be delivered. Then, another week for applying and receiving my supplementary card.

Unboxing

Both Primary & supplementary cards are delivered in similar box as that of the primary card. The only difference though is that the card holder case of Primary card has some wooden finish while supplementary card came in plain grey finish. Here are some pictures,

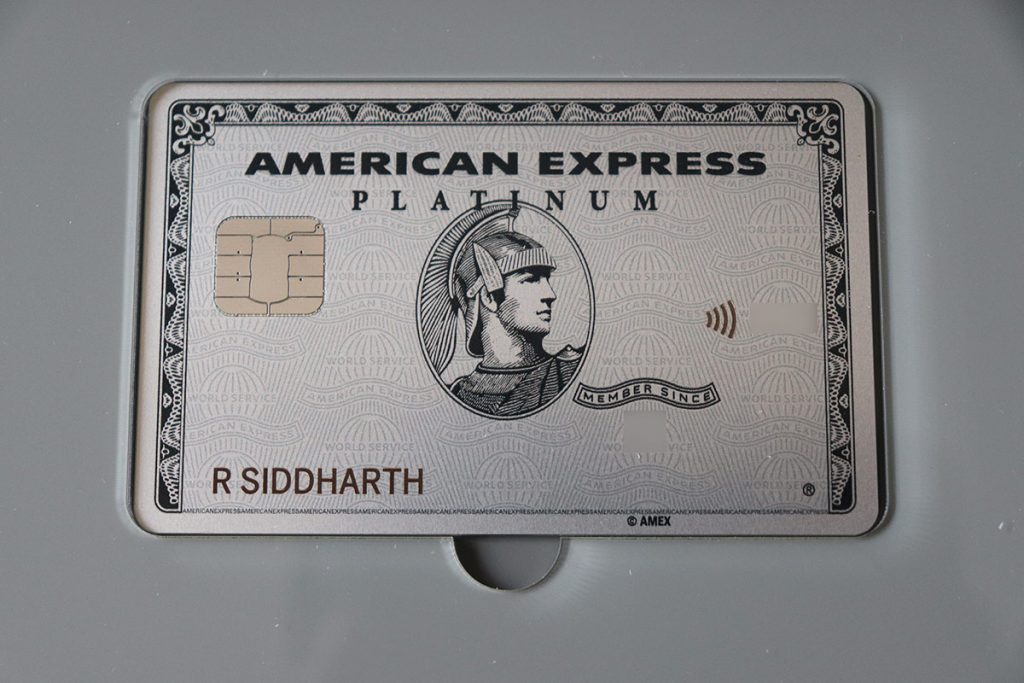

The Metal Form Factor

Its a contactless enabled card that looks pretty solid and weighs much on wallet. You could very well feel the weight by holding in hands as it weighs 3X more than a typical plastic credit card.

Here’s are the weight comparison done by one of the reader and cardholder Saurav with his plastic & metal Amex Platinum cards.

The card is not fully metal as you may assume, meaning the front side is metal and the back side has thin layer of paper/plastic with magnetic stripe, card number and the other details.

I’ve made a quick video for you to get better idea of how it actually looks in reality. Check out:

Getting Started

Amex customer care didn’t Wow me for the first time when I wanted info on how to enroll and other related details, esp. for supp. cards. I called up multiple times to finally figure that out. Its super simple and you can do all of it online in matter of minutes.

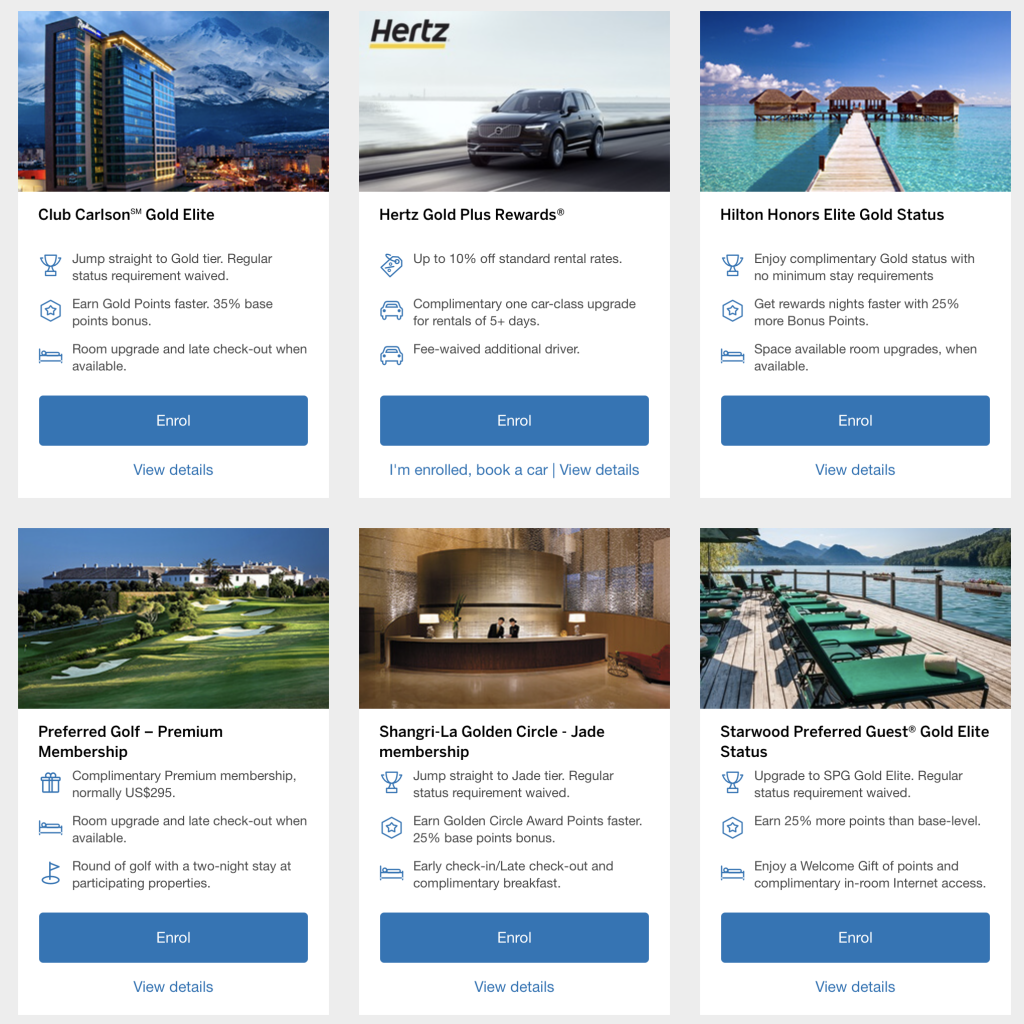

First thing you must do is link the card to your Amex online account. I went with creating a separate account for this Supp. card, for enrolling to various hotel privileges.

Amex has a single page to enroll into various programs. It looks like this,

Bottomline

Access to Platinum Travel desk, hotel privileges, Platinum only Amex offers are some of the few advantages of holding Amex Platinum Charge Card.

If Amex really wants to attract a mass crowd for this card, they may probably need to look into adding renewal benefits.

That said, its totally worth it even for renewal, as long as you do >30 nights a year in hotels, so as to experience all the benefits that comes with the card.

Are you holding Amex Platinum Card? Feel free to share your hands on experiences in the comments below.

Pretty disappointed with the plat card. Their concierge isn’t upto what they promise at point of sale. Not one but 4 instances where they failed last year.

Can you share more in detail? That would give others better idea as to what not to expect from the concierge.

Instance 1: I tried to get Oberoi Udaivilas booked 3 weeks in advance during my anniversary. Even though direct reservation was available with Oberoi, Amex couldn’t arrange the room through them. Also they misinformed the rates applicable (on email).

Instance 2: I tried to book a cruise on New year’s Eve by giving 3 weeks notice off Mumbai. The concierge didn’t follow up on my case. I had to call them up continually on my own to take update. Eventually, the cruise was booked out and I couldn’t make it.

Instance 3: I tried to book ITC grand Goa through them after the hotel opened. They didn’t have the hotel on their list.

Instance 4: I asked them how to redeem the points through the app, and the app was throwing an error for last 2 days continually. Their executive could not assist.

Instance 4: when I highlighted the above instances to them, they suggested that a dedicated concierge manager be assigned to which I agreed. They never called back to assign anybody till date (more than 4 weeks now).

Instance 5: At the time of taking the card, they mentioned that exclusive invites for special events shall be shared. Therehave been no invites for past 9 months of card membership even though my city is Gurgaon/Delhi.

+1 to this. I have a similar list of consistent failures.. the conceirge is filled with postmen who will relay information from the first Google search result.

So off the top of my head, in the past 8-9 months I have at least received invitations to special curations as Monaco Grand Prix, noma opening in Denmark, Super Bowl, Boxing Day Test (Ind v Aus), Cannes Film Festival, CWC Semi Finals/Finals, Bryan Adams Gurgaon, Oscars. You did not receive any of these? There is at least a couple of events where Amex is doing something special every month.

Amex special invite events are expensive, but includes a lot of curated stuff. But I’m pretty shocked to hear you did not receive them. Maybe call in and check if you’re enrolled? I never had to, FWIW. Exclusive invite events are not free, and cost significantly more than regular tickets. But you get access to special area/activity if the tickets are available for general public (eg they had a special cruise event for monaco grand prix, included in lofty ticket price which also included hotel and several dinners). You get access if not (eg noma opening and Oscars).

As for your concierge experience, looks like you did not get patched through to a travel counsellor, a regular concierge person took the request for follow up and botched the reservation somehow. Insist for a travel counsellor (the call automatically goes to concierge if they are all busy) and they will get it done. Just ask to call the hotel if it’s not on the list.

I have the same issue. Their concierge will say they cannot do that and this and all excused.

The travel desk sounds like i have called the fish market. I wanted to get a booking done for the family tip to UK, first they took a whole day to get back, and then they gave me a price much higher than going with airlines.

The tele support people speak very well and trained to be polite, but they don’t have half the knowledge of what needs to be done.

Can you imagine, i call them to cancel and the person calling me back would try twice in a row when my line is busy and then drop me a mail that they tried and asking for a time to call, when i write back to call me at a specific time get no replay and call me 2 or 3 days later.

Sad to say, i am giving it up. You will take this card only if you have loads of money to spend to show off a metal card that is little worse than a paper weight, but looks pretty like a good paper weight.

DONT TAKE THIS CARD TO EXPECT QUALITY OF SERVICE, COST 80k INCLUDING TAXES.

Their travel desk is useless. My whole day wasted in getting a resolution on my issue. Even their twitter handle doesn’t respond.

Superb service is a myth.

More detail

You have only given details about the metal form factor and a few other privileges that’s already mentioned everywhere. Did you actually try to do a travel reservation through travel desk? How will you save if you are doing more than 30 nights. Do they offer better rates, schemes like 4th night or 3rd night free? I mean what’s really different except keeping some metal in your wallet that cost you upwards of 75k. After all it’s no longer prestigious also.

This is one of the reason why I delay hands on experience article. But this one though, I maynot really experience to the level that the card has to offer.

By 30 nights i mean, if you do 10 nights each in Marriott, Hilton, Shanri-La/Taj you can get phenomenal value out of it with upgrades, breakfast benefit etc.

For more, check out original review article’s comments where you could find Amex Guy’s expert advice.

They dont offer better rates on airline of hotel. They dont even do the booking fast. I have tried it. You are paying to flaunt a metal card, as simple as that. I have had it for a year, and i think the platinum reserve does as good a job at a fraction of the cost. Not that you dont have a limt as they claim, funny part is that my reserve has a better credit limit that my metal, lol. Funny ah.

No invites for invite only events, actually nothing. You get more points for dollar spend, that accounts to not much.

One of my close friend has this card ..can I get this card as supplementary ? I have heard supplementary cards are only for family members

Only Amex allows it. So yes, you can.

Thank you siddharth

Thanks for the post! I recently got this card by using your referral link and am trying to understand the benefits for supplementary card holders.

– I understand that Priority Pass is for only one supplementary card holder, but can all supplementary card holders use the card alone to gain access wherever possible? (e.g. Amex, Centurion, Delta lounges etc.?)

– Do supplementary card holders also get the Fine Hotels benefit?

– Do they have access to Platinum travel which gives discounts on business class tickets?

It would be great if you can document a table with benefits for primary members and which of those are applicable for supplementary card members.

Hi Siddharth, I know you’ve given an approximate numerical value to utilizing points earned on this card. Would you be comfortable sharing, how to maximize usage of this card to earn comparatively higher rewards. Maybe adding tricks you’d personally use will help!

“Amex Guy” keeps giving substantial amount of knowledge, maybe collaborating with him and giving a more comprehensive “travel hack” sort of review of this card?

It will help those who see initial and renewal cost as a deterrent better understand this product.

Understood. Will do!

Do we get hotel loyalty points or qualifying nights at hotels if we book through travel agents, or is it considered when booked directly through hotel?

Only direct bookings gives you points.

Hey!!! Thanks for share this important article😍😍😍😍😍😍😍😍😍

Hey Sid, I got my card yesterday but I can’t find the single enrollment page you’ve mentioned. I already had account on American Express website and I added this card. Could you kindly assist?

PS, my packing is completely different from yours. I got a wooden holder for the card (is this what you meant the wooden finish is?).

Thank you.

You’re right – Wooden holder.

Enroll link updated in content.

do supplementary card holder also enjoys elite membership for all hotel chains? I m informed by the customer care executive that only the primary card holder gets it..

Supps get hotel memberships, but not dining memberships. Just ask your supps to create an Amex account and use the link in the article to enroll them.

Hi Sidharth,

Can you share details about the page on which you registered for all the elite memberships. I could not locate it on amex website

Thanks,

Aseem Garg

Here’s the Link

Hey Sid, I just got off the phone with customer service. For certain services such as the insurance we have to manually send letters which we get as part of welcome kit. There’s not auto or digital enrollment for these.

Hi Sid,

I have been using the Corporate Platinum Card and the concierge was not upto the mark plus one does not get so many benefits that are marketed. Got a Personal Platinum also this month after going through Amex Guys comments. Concierge is slightly better and you do get some discounts on hotels and air tickets but nothing that would move the needle. lets see if they give upgrades. I feel the fees though high can be recuperated through Mariott Bonvoy but Amex needs to top up membership points on renewal otherwise I don’t see myself and a lot of others renewing the card.

Don’t compare US and Indian, you get what you get in India. That being said, I wouldn’t also recommend all to just read someone else’s opinion and go for this card. You pay ~70k for a bloody credit card membership, if you can’t take away at least a lakh from this card simply ignore it and go with other cards. If you decide to take or ditch this card based on someone else’s opinion, it just proves there are two fools in the conversation.

This card works for me period, I don’t recommend nor discourage it to others now. Amex`s own website has ton of information, please read thro them and this article even a hundred times, do your homework (as I always say) and then decide…

Got an invite today upgrade from travel platinum to this card by email. While I do travel a lot, I still don’t think I can extract the most value from this card. For flights, I almost always have enough points on my HDFC DCB to get it done.

I don’t “always” stay in hilton/taj/shangri-la etc. I kind of look at the best-rated hotel in a particular destination on tripadvisor , check a few things like location, amenities etc and then book. Not every time it happens that the best hotel is from one of these chain. So, paying 60k+taxes wouldn’t work for me. But still its a brilliant card for the frequent travelers. May be i will take this one someday but not now.

I too got the same offer 🙂

@ Siddharth, you mentioned the AMEX Platinum charge card you received is a supplementary card. Could you confirm if you’re able to get complimentary access to both Amex lounges in T2 Mumbai and T3 Delhi airports using this card or it is restricted only to the primary member?

Hi Rahul,

Supp. Card members can use that individually.

Cheers,

Kiran

Amex Plat Charge will get you four Supp cards for free (it was six earlier). And all of these supp cards will get you access to the Amex Lounges.

Got an invite today to upgrade to Platinum from my existing Platinum Travel. Thinking to reject considering the whoooping 60K fee. Dont we have any spend based rewards in metal.card compared to other existing cards?

Got the upgrade offer with 125000 MR Points.Though its good in terms of Mariott hotel but most of the hotels are kind of business hotels in City rather than in beaches or hill stations?

Though I travel frequently and want to stay in premium resorts still 70000 is too much,the timeline to upgrade is till June 31st and I am a dilemma whether to go for it or not?

Moreover my Platinum travel card is LTF and after a year if I want to cancel Platinum charge card as renewal benefit is of no value then I wont be able to get LTF variant of platinum travel card

How to get Taj Gold Innercircle in this program ?

I guess by linking your Shang and Taj accounts since Shang Jade automatically makes you Taj Gold.

Also, was there anything specific card activity that triggered the upgrade ?

I have a plat travel myself, but no such mail for me

I am having Plat travel card for more than years and every year spending around 5 Lakhs and this year around 10L and limit also increased to 6L

May be I spent more than 10L this year ,I would have got the upgrade offer

Amex upgrade isn’t exactly upgrade, it adds a card to your account. Your Plat travel will stay as an LTF unless you choose to cancel. The only card that will be cancelled when you get Plat is the gold charge card.

ITC Culinaire is going away June 21st. So it will be advisable to get the card before that if you must, and enroll before it goes away. It will still be good for a year if you get it by that date.

Amex Guy,

I already have another Amex CC that is MRCC and now If I opt for the upgrade then I will be having 3 credit cards with Amex that is not allowed

Max 2 cards only allowed,not sure how it will work

Thanks for the Input I am still in the dilemma whether to go for this upgrade or not?

As they are offering 1.25L MR points ,what would be the ideal value of those if I transfer to Mariott,probably around 50k ?

This is not a credit card, it is a charge card. Amex allows 2 credit + 1 charge card.

Do not get the card if you value 1.25L MR points at any value under INR 1.25L. Ideally, you should look for at least Rs. 1.5/point and Re. 1 at the worst case. This is a card for serious travel hackers, it’s pretty much a scratch-able piece of metal for everyone else.

My rule of thumb with cards is simple — if I have to think too much about it, I won’t get it.

Could you please share a few hacks to redeem my MR points? Or share a link about it?

I am not sure you can 1re/point in all hotels.

When I consider Mussoorie property which is cat5 ,its 35000 points/night that is around 20k,how to get 1 re/point here and I feel the same with most of the cat5 hotels

Only when we go for cat1 and cat2 hotels,can we get better values ?

Plz let us know how to get maximum out of the MR points in terms of transfer to Mariott

Mouli ,

How did you get offered 1.25L MR points? I contacted my sales rep and offered me 1L MR points.

Pls shed some light

Aryaman,

Even SId mentioned that in the article,at times they used to give this 1.25L MR points offers and may be applicable for few

I didn’t request for the upgrade and its by invitation only

I’m curious Siddharth, so please educate me. How is it that you got a supplementary card from your friend? So basically does that mean, you’ll use your supplementary Platinum card and your friend will pay the bill and you’ll settle with him later or how does it work? Because if my undertsnding is correct, he must be placing lot of trust in you to be responsible with the supp card.

Perks of a decade old friendship!

Hi Sid,

Any idea on the timelines for Elite Hotel status to show up ? Primarily Hilton & Shangri-La ? Its been 3-4 days since i enrolled & no activity on the same.

~Neo

3-10 Days max.

Thanks,

Do they create loyalty IDs basis the info provided ( i gave my existing Hilton #, but just gave email id for Carlson & Shang)

~Neo

Yes, if you’ve entered an existing membership number then that gets the upgraded status. If you’ve just entered your email address, they will create a new membership for you.

Hey Sid,

How much MR points do I get for paying utility bills like electricity on my Platinum charge card?

No points are provided for utilities payment, insurance, fuels. Check Amex site.

I have received upgrade invite to platinum card with benefit of 55 k taj vouchers or 1.25 lakh reward points .

Just wanted to know what’s the rewards conversion rate for platinum card ?

Should I opt for the points or taj vouchers ?

+1 – I initially received an invite for 45k Taj vouchers and now AmEx sent another email with 55k Taj Vouchers amongst other benefits. It seems alright if there is an organic spend of 90k in first 3 months (which is when you get the Taj Vouchers). Thoughts?

With Taj Vouchers, you know exactly the rupee value you are getting. With MR points, the value depends on how you redeem. There is a post on how to maximize MR points. If you think you can get at least ₹0.5/MR then the 1.25L MR is a better option. That’s what I chose.

Makes Sense. Thanks Alok.

Just an update..I cancelled my Plat Charge card today. Process was fairly simple..I was told that I would get a call from the Retention team and offered no renewal benefit, neither a reduced fees as well…I know people who are paying 35K as renewal fees but I guess they need to recover the cost of paying Farhan Akhtar as well. I would have spent 25L in an annual on the card but that’s not much considering what others spend…She said that the same was not in her hands and she has sent the request and will call me back in 2 days. I told her why call when you can go ahead and cancel. She claimed that you might be able to get a good offer…so I politely declined and said, u should have convinced me and not wait for approvals. Anyway I feel that the retention team of Amex needs to improve and at least learn from Stan Chart Retention team. Believe me they are really really courteous and ensure you do not leave the system so easily.

Apologies for the repost…this is what I found on their website

Limited period offer*: Get stay vouchers from Taj, SeleQtions and Vivanta Hotels worth INR 20,000 on first year renewal of Cardmembership

Hi Siddharth, I too received Amex Platinum upgrade offer membership fee 60k +GST with 60K Taj voucher or 1.25 lac MR points. I am not sure whether I can use 60k Taj voucher even though it has better value. I was informed that I can use these points hotel vouchers or even can redeem under 18k/24k gold membership category since it is a charge card. Is this correct? If yes, this would give app. 55 K of Amazon vouchers (8k amazon voucher for 18K points). And I will get the card benefits too. Please advise if I am wrong. Also, can you suggest if any better option to get better value from MR points. Thank you.

I got an upgrade offer from Amex for Platinum charge today ! with 1.25L MR points and 60K+gst as fee.

still checking as to how I can make use for max benefit ! My obvious ways to earn points are ” International spends” which are going to give 3x points and going to wait till I see the Marriott conversion offer of 50% more and going to transfer to my club Marriott (I get 1.87L marriot points) and enjoy cool hotels across India 🙂

Amex supp called me and said that… though its ‘No Pre Set Limit’.. internally they approve certain limit ..and I asked what happens If I need to use more credit… they said you can payoff 50% of approved internal limit and reuse !

But overall, the points accumulation is good on international transactions ! but I’m not hoping they will reverse the fee for 2nd year !

Am on my last few days to cancel the platinum metal. Just not worth the money. For some it may work, but my amex reserve does the job just a well for my needs.

The retention does nothing, i have spent over 30 lakhs last year, they don’t care. May be not much for them. But a pretty looking card for sure, but am not there yet to renew, i got some benefit from the first year, renewal not happening.

Hi Vikram. How is the experience with plat reserve? And what are the benefits?

Sid / Amex guy,

Can we get Plat Reserve card as a companion card with Plat charge ?

Do you see any value in taking this ?

And also any thoughts if Amex is approving new companion cards !

Thanks

Yes, you can. Do check the review of Plat charge, updated with lot more info today, including companion card.

P.S. Everything is almost normal with Amex for now, except Credit limit Enhancement, which is on hold.

I got offer this month for upgrade to platinum charge card from my existing MRCC. I am very happy with my MRCC card for day to day usage. My infinia card from HDFC is in the proces but I am seriously thinking to get Amex platinum too. The upgrad eoffer seem to be cut down considering what people got last year, though not bad still. They are giving me 1.15 lacs points as welcome bonus on upgrade. I do travel but again I don’t like to force myself to only stay in expensive hotel just because Amex has a partnership there (as even with discount it might not be worth it). But I did some research and here’s what I think how I can make most out of this card and not only get my investment in this card back but make some profit too:

– Convert welcome bonus MR point os 1.15 lacs into one of the airline miles. Mostly my preference is for Emirates, but Amex has tie up with almost all airlines. All airlines has 2 MR point to one mile conversion ration. If you do the math, 1.15 lac points will get you 57500 Emirates miles. If you go on Emirate website and go for buy miles option, 57500 miles are worth 1.32 lacs! Hey, and now you can travel anywhere Emirate can go 🙂 Also, Emirate miles remain valid for 4 years, and besides, you can only transfer ten days before to your ticket booking, as Amex points don’t expire and it says 10 days for transfer completion/process. This will now get your 71K back and make you 60K profit! Also, when you use 57K miles for ticket booking, they would save you much more cash than 1.32 lacs! So if you consider than you would make anywhere between 60-80K profit.

– Use Amex platinum for special cashback offers. This would be value add on top of above huge return, which already got my investment back. Recently, I know ther ewas offer for platinum holders to get 100% cashback (upto 18K) for commonly used avenues like bigbasket shopping. These promotions would be cherry on top. They are/will do more of these due to Covid and restricted travel.

– Use longue a couple times when I travel next year. This, too, would be additional ROI.

– When I travel next year, and do end up staying in Amex partner hotels, might even transfer points to those.

I think doing this would get me my cost back and get profit anywhere between 60K-1lac. But this card is not for everyone though. If you don’t see yourself travelling or booking hotels or using any advertised benefits, then you are putting money for the metal card and show off.

How to redeem/transfer soon to be expiring Skywards(Emirates) miles? Is there a way it can be redeemed from India to any hotel points?

Hi Sid, any benefit to continue with Amex Plat Metal? Not many offers these days – we had 100% cashback 1-2 years back. For renewal they are offering max 80k points while I asked 1L points. Any suggestions pls.?

I got that closed, nevertheless 🙂