This is a review by our reader Satish Kumar Agarwal who recently got hands on MakeMyTrip ICICI Bank Visa Signature Credit Card. Over to him:

The current position of ICICI bank in credit card segment doesn’t do justice compared to its banking business. And much to our delight they are now looking more aggressive with the credit card business, which can be seen by the new offerings. Recent online/ spend offers on ICICI bank cards have been good too.

I am an ICICI bank savings account holder since last 18 years and occasionally received emails regarding LTF Platinum chip card. But their Payback reward points system is not something that excites me. That’s the reason I didn’t apply for them. As Siddharth rightly pointed out, only card worth taking from ICICI bank is Jet Sapphiro, which is not in my radar as I am not a frequent flier.

Nevertheless looking at their recent credit card shopping offers, I was looking for one which is not a part of Payback points system and zeroed in on Amazon pay ICICI bank Visa credit card which was launched in last week of October 2018. As this card is by invitation only, I couldn’t apply for one yet. But looks like it will take some time.

Meanwhile on searching their other card offerings, one particular card which impressed me was this MMT ICICI Signature credit card launched recently around September 2018 and this is the review of same.

Table of Contents

Joining Fees

- Joining fee: Rs.2500+GST which comes to 2950/-

- No annual fee thereafter (Looks like they have taken a leaf out of IndusInd bank)

Welcome Offers

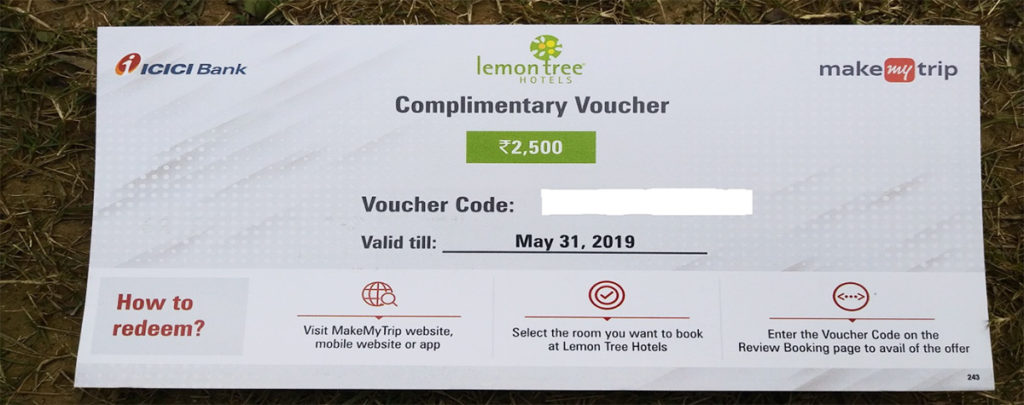

- Lemon Tree hotels voucher worth 2500/- (No min. spend criteria, part of welcome kit)

- My Cash worth 1500/- in MMT account without any usage restrictions (valid for 1 year)

- Auto enrolment to MMTDOUBLEBLACK for 1st year (worth minimum 999/- on paying via HDFC cc else 1499/-) n MMTBLACK programme

- Complementary 10 days Airtel International roaming pack (On booking international flight/ hotel by this card within specified offer period)

If you are able to use the Lemon Tree hotel voucher then this welcome offer may be termed as good one.

Regular Offers

- 1 international lounge visit and 1 spa session at selected domestic airports per year (Via complementary Dreamfolks DragonPass membership)

- 1 complementary railway lounge access per quarter (Currently only 3-4 lounges)

- Domestic airport lounge visits: 2 per quarter via Visa lounge access programme

- 2 complimentary movie tickets every month upto 300 per ticket via BookMyShow under “Buy 1, Get1” offer on first-come, first-serve basis

- Every sixth ride complementary with Ola (Worth upto 150/- max per sixth ride, but must complete 5 rides n use 6th ride within that month, as count will be set zero next month)

Point no. 1 & 2 is what excites me and was a major factor in deciding to go for this card (though complementary access is too low). Also these features are currently available exclusively on a handful of ICICI bank credit cards only.

Rewards

- Flight bookings on MMT – 1%

- Hotel/ holiday bookings on MMT – 2%

- Domestic spends outside MMT – 0.6%

- International spends outside MMT – 0.75%

Milestone spends

- Spend 2.5 lacs – 1100 My Cash each anniversary year

- Spend 5 lacs – 4000 My Cash (additional over n above 1100) each anniversary year

Earning rate of this card is around 1% if used in a mix of categories mentioned above, which is below expectation for a Visa Signature card. As renewal charges are NIL 2nd year onwards, this may still be acceptable.

But if used frequently for bookings flights/ hotels on MMT then courtesy MMTBLACK (I am already MMTBLACK member via Yes bank complementary offer email link and hence I confirm this) the earning rate shoots to as good as 6% on spending 50K. Though My Cash earned via MMTBLACK route has a validity of 3 months only.

My Experience

Application Process: I applied via bank website apply online link on 25th November and got a call next day regarding the application. I was told that physical application along with documents will be picked up same day. But the bank executive came after a gap of 2 days i.e. on 28th November.

Surprisingly the application form asked for 2 references and their contact numbers also, which was kind of unheard by me so far. And the form mentioned the processing time as within 21 working days.

Upon enquiring I was told by the executive that form will be couriered to their card processing area and then only further action will take place. Again kind of bombed by their working in this digital age. Not a good experience so far.

Flow of card processing:

- 25.11.18– Applied for the card via Apply Online link on ICICI bank website

- 28.11.18– Visit by ICICI executive for application form & KYC documents pickup

- 22.12.18– Received application reference no. via email (1st communication after applying)

- 02.01.19– Received card approval information via sms & email

- 05.01.19– Received card dispatch alert via sms & email

- 06.01.19– Card delivered & received delivery confirmation sms & email

- 13.01.19– Dreamfolks DragonPass delivered

They took almost 21 working days to provide me the application reference number. And card delivery took 31 working days after documents were picked up, which is quite long. In comparison my YFP card took only 12 working days or so.

Bottomline

This card is best used for its unique experiences like railway lounge access/ airport spa session, merchant based promo offers apart from using it for its regular offers and not for very high spends.

- Cardexpert Rating: 3.5/5 [yasr_overall_rating]

While its not a great card, its still worth holding if you’re not yet invited for Amazon Pay Credit Card. What’s your thoughts on the ICICI MMT Card?

Did your provided income documents ?

How is the credit limit in comparision to other credit cards you hold ?

Dear Captain

Yes. Provided latest 2 months salary slip.

Limit is the lowest among my other cc’s.

did they ask for bank statement of salary account?? in my case they insisted for the same during tele-verification even though i have a gold privilege account with them and an existing coral credit card with CL of 2.10 lakhs. They told that salary slip only will not suffice. I have complained to their customer service and the issue has been escalated. Presently i am waiting for a reply.

Dear Arnab

Can’t exactly remember, but think I too was asked for and provided bank statement of salary account.

In my case after about 2 weeks of escalations and negotiations they have upgraded my coral card to mmt visa signature (which they initially claimed was not possible) without any further kyc documents and also have transferred the existing credit limit to the new card and have asked me to inform them on receipt of new card so that they can close my coral credit card…

Hi Arnab,

For Upgrading from Coral to MMT Signature, did you applied through Branch or CC.

I Called CC and got reply that they can’t do this.

So I called CC and requested them to upgrade my existing Coral credit card to ICICI MMT Signature card. They told it is possible and after two days I got an e-mail that the card is approved and dispatched. After 4 days I received the card and guess what I was given a separate card. My Coral credit card is intact and I can continue using both cards, Limit is not shared too! between cards.

I have never given a salary slip for the credit cards I got. SBI, ICICI – 2. All cards based on cibil score.

Appears to be a good option if one was about to pay for MMT Black anyway. Holds good for a year in that case. Frankly I’d like to see better rewards on MMT spend, this is worse than debit cards. Either that or they should make MMT Black a standard offering on this, instead of first year only.

Card looks cool though.

Dear Amex Guy

MMT BLACK membership once taken is for lifetime. Only caveat is the spend counter gets reset to zero at the end of every year for earning rewards. So MMTBLACK feature is kinda permanent to MMT account once enrolled.

Yup upon first look of the card I also felt nice.

MMT BLACK is different from MMT DOUBLE BLACK which provides free cancellation on hotels and flight bookings which is different from MMT BLACK. MMT BLACK provides spend based my cash which could be used for partner vouchers or to use while booking in MMT.

Rightly pointed out dear Sharathkumar. As this review itself was quite long, I didn’t provide much details of MMTBLACK/ MMT DOUBLEBLACK.

They require separate reviews to do justice.

Pls make one. It would be useful for many 🙂

Dear Sid

I will try one shortly. Thanks.

Yes, I meant MMT Double Black, the thing that costs 1499 a year. That needs to be a permanent feature of this card.

Dear Amex Guy

If they offered MMT DOUBLEBLACK as permanent feature, then this card would have been a no brainer for frequent fliers n hotel users.

Maybe they could have taken 500 as renewal fee and given DOUBLEBLACK as renewal benefit.

Well, it’s LTF after joining fees. So doubt most people will look to discontinue even if MMT doubleBlack is not offered

Need your application reference no to investigate the delay in card application process..

Regards

Rajesh Tejnani,icici bank

Dear Rajesh

Card Application Ref. No is 18122209635.

Even I had bad experience with this card application.

Recieved Mmt plat after 20-30 days though applied for MMT signature.

Had to follow up few times to reverse the joining fees and cancel that card and recieved Mmt signature after another 30-40 days. Total close to 2 months from application date .

Card looks good, premium looking.

For me, it’s mainly worth due to Mmt doubleBlack and gocash+ – settles the joining fees.

The spa and railway lounge are benefits I am looking forward to.

And ola rides also make it interesting (though most times use uber due to HDFC diners premium).

Btw, anyone can help how to claim the doubleBlack/gocash+ and also the spa access?

And railways access includes which stations?

Dear Priyansh

Airport Spa access is via Dreamfolks DragonPass card. You must have recd it.

Railway lounge access includes New Delhi, Vishakhapatnam, Jaipur (doubtful). More stations may be added in future.

Didn’t recieve Dragon pass card as far as I can tell (will still check the envelope day after once back at office).

Thanks for the information.

For me DragonPass came in a separate envelope exactly 1 week after card delivery. Though tnc mentions it to be within 45 days after payment of joining fee.

Hope it helps.

It’ll be sent once you make a couple of transactions on your Visa cc. Make sure they’re above 500 each.

The dragonpass is shipped separately.

Dear Priyansh

MMTBLACK n MMT DOUBLEBLACK membership link will be sent to your email containing a code. If you apply this code on your MMT account, your membership will be activated.

Hi Rajesh,

I also applied for Signature card but after 30 days got Platinum card. Application number 18111209578. When contacted customer care they said to re-apply it by sending sms MMTCARD to 5676766 and again provide all the documents required.

The executive who collected the documents also didn’t respond to my calls or msgs further.

I have applied for ICICI Bank credit card, but my application got declined by the bank without any specific reason..

I have application for coral Amex online and they declined it without any reason as of now I am already having two CC from SBI ABD HDFC and working with reputed PSU

Very low earning rate in comparison to CITI Premier miles.

Fees for Premier miles is ₹3,000 per year. And in first year you get 10,000 points worth ₹4,500 if spend on the dedicated website.

Also normal earnings is 4 points per ₹100 & 10 points on air tickets and hotels. This translate a return of 1.8% to 4.5% on travel spends.

Dear Amit

While your points are valid, please see this perspective–

1. Outside metro cities, difficult to get approved for Citibank Premier Miles card compared to MMT ICICI card

2. While joining benefit is good, but 3000 miles for renewal fee of 3540/- is too bad every year

3. No international lounge access here

Though reward points earning rate of Citi Premier Miles card is better than MMT ICICI Signature card, still one has to earn enough points to jusify the renewal fee first.

Hi Satish, what are the tnc for using Lemon tree voucher. Have you managed to use it successfully. Do you consider it as a true “welcome benefit” in terms of usefulness

Dear Amit G

tncs are not much, but per night charges for Lemon Tree Hotel properties are in the range of 7000+. Locations are also limited to few cities only.

Coming to welcome benefits– they are adequately compensated by credit of 1500 My cash having unrestricted usage on MMT with 1 year validity n MMTBLACK and MMT DOUBLEBLACK membership worth approx 1500 minimum.

Hi Amit,

I believe it won’t true welcome benefit unless you can use the voucher for food and other services at hotel.

This is because online hotel booking sites like MMT, Yatra etc. usually provide better rate (after use of promo code & wallet cash) than direct booking with hotel.

Dear Parag

Please see the image of Lemon Tree voucher provided in review. The voucher is to be redeemed on MMT app or website only and not direct booking to hotel website.

Hello Siddharth & Satish Kr. Agarwal,

Thanks a lot fr efforts from fellow card enthusiasts like me..

Interesting to see banks follow this site and take comments seriously..

My question – is there any harm if i upgrade my icici visa coral to icici signature mmt card ? Upgrade to this card is allowed ?

I have also recvd invitation for icici amazon card which i already applied and recieved.

Dear Praveen Katiyar

Coral to MMT Signature?

You have to talk to customer care regarding this.

I personally felt this card a lot better than Coral (payback system is worst rewarding)

taking into account overall features. Though it depends person to person.

Hi Praveen,

You can’t upgrade Your Coral card to MMT Signature. You need apply this card as Separate card. I have already called ICICI CC and got above reply.

Regards,

Saroj

Dear Saroj & Satish Kr. Agarwal,

Thanks for reply.

Hello guys, thinking to get this card as i was looking to get a icici card from sometime, can someone let me know do icici bank provide cards on c2c basis and if yes eligibility for this card and how old card should be, as i am new to credit card world and my first card is just 14 months old! Thanks

Dear Hardik

Do ICICI bank provides cards c2c/ how old card- Yes/ Minimum 1 year.

Eligibility of this card- Not clear, but 1 lac plus limit on C2C or 50K salary should be good.

Thanks for information satish, i have 2 cards above 1 lakh limit but both are in range of 6 months old, as my first card is 14 months old, i have to apply online or visit branch for getting icici card on c2c basis?

Dear Hardik

For c2c with any bank you have to visit branch only. No online option.

What is the reward rate for spends other than on MMT ?

Dear Praveen

Please go through the review carefully. Its mentioned already in article.

Extremely sorry.. i missed it..

Thanks for reply & efforts.

HI SATISH JI,

WILL I BE ABLE TO GET THE OFFERS THOSE ARE ON ICICI CREDIT CARD WITH ICICI MMT PLATINUM CARD?

hello everyone

I want to hold icici sapphiro amex . My ITR is 5.5 lacs per annum. Having regalia with limit of Rs 3lacs.

Am i eligible for sapphiro? Should i apply on ITR basis or Card to Card?

from where should i apply? jet privledge or branch or online. I have no relationship with icici.

Thanks

Sir,

I applied for it unknowingly and got approved with ICICI MMT PLATINUM CC…

I’M NOT A FLYER AT ALL.

Can i use the card for online purchases/no cost emi… just like normal icici cards?

I need reply Sir.

@Dr Sreenivasulu

Yes. You can use this card for purchases like any other credit card. You will be able to avail all ICICI bank offers on this card as well.

You don’t need to be a flyer at all. It’s just that rewards will be little more if transactions are done on MMT.

Thankyou somuch Sir, for the confirmation.

I want to get this card on other credit card basis and not providing itr, can someone confirm do icici bank provide c2c basis and what should be card age, if someone has got icici credit card on c2c it would be helpful, share your experience too🙂

Hardik,

You can apply c2c basis for any ICICI card. I personally got through using my existing cc.

Will there still be a hard enquiry on the credit report ?

@Bhavya

Yes, there will be hard enquiry as usual with any cc application.

Yes i gave my hdfc regalia with 4.5l statement and approved for icici coral for 4.5 limit and please note your old card is atleast one year old and only offline mode for card application is accepted

@Raj and @amit thanks guys for quick reply, actually i am facing issue with my current itr and its been send again to itd for some reason and i am new to credit card thing, i have 2 cards older than 1 year with below 1 lakh limit and 3 cards above 6 months only with above 1 lakh limit and i think they would need above 1 lakh limit card as it’s visa signature and satish too is saying above 1 lakh, so would above 6 months card will do?

Are ICICI co-branded credit cards eligible for all ICICI marketing promotions unlike HDFC JetPrivilige cards? Thinking to apply for ICICI MMT Platinum/Signature credit card.

Dear GTMAX

Though haven’t availed any ICICI offer since card setup, I m pretty sure all ICICI offers will work. And don’t apply for MMT Platinum, its very basic card. Only Signature variant is good.

Hello,

I had also applied for ICICI MMT Signature Card last month. And as promised, I have received complimentary MMTDOUBLEBLACK membership coupon last week. But the problem is that I am already a MMTDOUBLEBLACK member (although I have used all my quotas for free cancellation) till June 2019.

I am able to renew my membership, but when I am using above complimentary coupon, it’s saying “I am already a member”.

Now I tried contacting customer care, but they are clueless about the issue (though they have confirmed the obvious, that since I am already registered I can not use the coupon).

So my question to all the “Card Expert” is this, will the coupon be valid till June (as there is no information about validity in the mail) or elsewhere?

Dear Mayank

Very tricky situation for you. I will only suggest you to keep in touch with customer care and if that doesn’t work, escalate via social media so that atleast you get the remaining months of MMTDOUBLEBLACK if not full 12 months.

Can you apply through card on card basis ?

I visited an ICICI bank branch with an intention to apply for ICICI MakeMyTrip card. However, I just asked if they offer any of their cards as lifetime free. They asked me the company for which I work as well as my salary and told me that they can process the dual cards of Rubyx on Amex and Mastercard as Lifetime free for me. Visiting a branch was a good way to get this processed as only Platinum card is available as LTF through online channel. Went ahead with Rubyx card application as this would give me a better chance to upgrade to Sapphiro 6-12 months down the line.

1 March – Filled application in the branch and submitted the documents

8 March – Received application number as it was put into processing

13 March – Received message of Card approval

1 April – Received the card today

Negatives:

1. When I called on 14th March to confirm if the card has been indeed issued as LTF, to my surprise I was told that the usual fees and charges are applicable on this card. I had to reach out to the concerned person again who had processed this application. He had then put it an internal service request and got the pricing code changed to LTF which was done by 20th March

2. Took an extremely long time between card approval to card delivery

3. Last name mentioned incorrectly on the account

I think error in name is there habbit in my case to my last name printed is different from my real last name and also tried calling CC but not able to talk to them as always after validation call getting disconnected so much frustrated

Yes. More than 1 year old card with 1 lac+ limit may help.

@Satish

What about lounge access for the add on card holder ? Is it a separate limit of visits or shared between the primary and secondary card holders ?

Dear Bhavya

Though I couldn’t find any information about lounge access for add on card holders, its safe to assume that lounge access is complementary for Primary card holder only via Visa lounge access programme.

If you want lounge access for add on card holders also, look at super premium card section in this website.

Hi,

The lemon tree voucher given along with the card does not work. Neither MMt nor icici is taking responsibility. Did anyone else faced the same issue?

Can anyone enlighten me as to how the reward points credited through mmt signature card are dsa played. Its supposed to show as my cash in MMT, right? IMobile app shows reward points but not mycash in my MMT? And how does one redeem the reward points then if it doesnt show up in mycash

The points goes as mycash, which you can redeem/use for full while booking tickets/hotels on mmt

AM not able to get the international roaming offer activated also.

Neither MMT nor ICICI is helping. These guys are selling the cards with features which you will never get.

Lemon tree voucher didnt tried yet

Hi all,

ICICI launched a new credit card in collaboration with Goibibo.

Sid: Please try to review the card.

Thank you.

Dear ARR

I don’t think its a credit card. As per my understanding its a travel card and available as ready to purchase. Please correct me, if I am wrong.

Can we use this card for purchasing electronic items?

@Satish Babu N M

You can purchase anything. Just that default reward rate on this card is low compared to premium cards like Regalia. If you have any super premium cards than use that.

Hi,

@Satish Kumar Agarwal

Thanks for this ultimate review. I finally have this card in my wallet. I wanted to know what all facilities are complimentary included in the railway lounge access? Have you experienced it yet?

Dear BhavyeG

Thanks for your kind words. Haven’t used railway lounges so far, yet as per my knowledge food menu and items provided is quite less and not unlimited buffet like in airport lounges. As there are only 3-4 stations which has this facility so far, best idea is to enquire over the counter to avoid nasty surprises later.

Hello,

Though I havent used the benefits yet. I have got the following info from ICICI website.

Q.7. What facilities do I get in the railway lounge?

The complimentary access to railway lounge will include the below facilities:

Two hours’ of lounge stay in normal seating

Breakfast or Lunch or Dinner as per the time of visit and as per the offering by lounge

operator at that particular time of visit

Unlimited tea & coffee with cookies

Free Wi-Fi

Newspaper & magazine

Any additional service such as recliners or more shall be chargeable separate as per the

operator price for that service.

Will update after using the benefits.

1, Free access to the lounge.

2. Food – options given to select. Not the unlimited buffet though they offered it in the days cards haven’t started offering complimentary railway lounge access.

i registered mmt platinum credit card and i have registered in makemytrip site with voucher code.. but i didnt recieve 500 mycash

@jaggu

500 mycash would be credited into your mmt wallet within 45 working days post payment of joining fee.

I just got accepted for this card. Very excited to move forward from Coral to MMT signature. Great review as well.

I have some questions though:

1. Is dragonpass auto renewed or expires after a certain period?

2. Does dragonpass visits clash with complimentary visa lounge visits?

3. How do you rate it for a frequent traveler?

Thanks!

Hello Satish ji,

I just got this ICICI MMT Signature card. Thank you for the review. I have one question. Have you tried adding this card to your amazon account ??

I recently added it to my amazon account, whenever I go to payment page a weird logo comes along with the card details. Have you noticed that logo?

One more wierd thing I encountered is bank name that appears before the card number, here in this card that too is missing only Visa displays there, and third thing is card number shows 4Bxxxx format rather than like other cards like SBI Bank 555xxxxxx ? If required I will also upload image of that payment screen.

Can you please enlighten me about that which logi is that I researched about it, it’s some spanish logo. Why it comes for Indian ICICI Bank Credit card?

Regards

Vipin

@Vipin

I noticed all these things long back. But as there is no problem with transactions anywhere so I never bothered about it.

I have added 10+ cards from various banks to amazon for payment and this logo looks unique and I even like it being different. I have this perspective.

Received this card without joining fee.

Although i applied with fee. The person who came to collect documents said in his device it is showing NJF(no joining fee).

Received lemon tree Vocuher with the card it self and now waiting for mmt benifits although i think i’ll not get mmt benifits since i didn’t paid any joining fee but still fingers crossed 😀

Great that you got it LTF.

Hey amit, how did you applied for card? Like card to card from other bank or itr, salary slip and do you hold savings account with them? Lastly the device , like icici have started taking device application like sbi?

@Satish ji,

The logo is of some Spanish Bank ‘Telbanco’ which means Cash Dispenser. Why would ICICI hire such platform? A bit weird for me, but still it’s good as it’s working smoothly.

Satish ji, do you have Amazon ICICI card ? Have you got invite for the same after adding MMT Signature in Amazon account ?

Regards

Vipin

@Vipin

Answer is Yes to both. And it took exactly 3 months to be precise.

It’s probably at technical bug at Amazon’s end where they are using BIN to identify which bank the card belongs to.

How are points credited to the MMT account? Is there a separate process to link the ICICI and MMT account?

I applied for and received the MMT ICICI Visa Signature card. However, even after nearly 4 months, I am yet to receive the promised Rs. 1500/- mycash or the MMT Double Black membership. Several calls to the helpline has not resulted in action. One of the helpline executives suggested that I contact MMT for the same but the MMT helpline executive expressed inability to sort out the matter. In the meantime I have stopped using the card.

@Manas – Mmt is going downhill then. MMT has also devalued 50% of flights point received in MMT black program. Hotel vouchers are also not available anymore for mycash redemption. You can use this card for lounge access.

Even i haven’t received 1500 mycash yet even after 4 months of receiving the card. Any idea how long they usually take?

Still haven’t received 1500 mycash nor mmt doubleblack invitation, despite 6 months from card activation. Any idea whom to contact?

did you pay the joining fees?

Obviously sir. They charge it within 30 days of card activation

Did Somebody received 1500 mycash post usage of this card? Can anybody confirm this?

Received 1500 MMT cash within 1 month of getting the card and redeemed also for flight booking. Please call ICICI customer care or email them. Don’t leave it so easily.

Enjoyed O2 Spa foot reflexology 30 minutes session at Hyderabad Airport couple of weeks back. Dreamfolks DragonPass lone complimentary spa session per year is what makes this card worthy.

Per year is each membership year or calendar year?

Also, how many cards does ICICI Bank allow you to hold at a time? Is it possible to hold more than 1 co-branded card?

Calender year.

I have two. MMT & Amazon, both are co-branded.

satish. limit is shared or separate?

For my MMT n Amazon Pay card it’s shared, though it might be confusing at times as available limit shown after any spend is independent.

I have 3 icici cards- MMT signature, Rubyx & amazon pay- All are ltf

How did you manage to get MMT signature as LTF?

Mmt icici cards r LTF after u pay onw time joining fee

Hi GTMAX,

They have predefined list of corporate for ltf cards, Hence when I requested this card through phone, They delivered it within 5 days, but it was MMT platinum. So I requested again for signature variant, So they sent again this time in 2 days. So I have got 2500+2000 lemon tree hotel vouchers which I already used for 2 different bookings as that voucher is part of welcome kit. They also credited 1500 mycash as joining benefit even though there is no joining fee charged.Doubleblack membership though I may not get, As I am already a member though no complaints lol. Seems like there is no way for MMT to know pricing of this card so might be a loophole.

nikhil, shared limit or separate limit in all 3 cards?

Hi Ashish,

Amazon pay & Rubyx had same limits but definitely not shared because later on I got LE on rubyx but not on amazon. MMT signature has different limit which is highest among 3

I got amazon pay icici card after adding my MMT icici credit card details to amazon website and got approved with in no time without any documents collection or any telephonic/physical verification and got card on hands in 3days. To my surprise, until MMT card details, though I was getting application for amazon pay card, the app was showing my city as not serviceable. This is the loyalty of Existing relationship. By the way, I got individual same limits on both cards but not shared as oppose to icici credit card policy.

Hi Nikhil,

I have a LTF Rubyx card basis that list of corporates provision. Didn’t know that was also applicable on MMT cobrand cards.. You applied for this card over the phone??

Due to using Amazon Pay credit card, I didn’t use my MMT Platinum since 1year at all which have same limits of 35k. As my city is unserviceable to Amex cards, I place a new request for ICICI HPCL CORAL AMEX CARD basis on shared Limit of my existing MMT Platinum card. 😍 But, to my surprise I got an LE from 35k to 1lac overnight on my MMT card displayed on i-mobile app. My ICICI HPCL AMEX card approved as well. Don’t know abt sanctioned limit till card delivered. Based on this, again today I called to CC to request for LE of Amazon Pay card but denied saying that customer can’t request for LE on Amazon Pay card. Bank will offer the LE automatically.

I Got an offer to upgrade to either Sapphiro or MMT Signature. I chose the later one because the Sapphiro has such poor rewards rate and annual fee of 3500+tax doesn’t make sense to me.

Now they are giving MMT holiday voucher instead of the lemon tree hotel voucher.

Any practical experience with the holiday voucher? Is it any good?

Did you receive voucher with the card, how was your experience about the fees/charges in your first Statement

Yeah, received within the card envelope. But I don’t find it much useful because most of the MMT holiday packages are costly. 2500 hardly covers anything.

About fees, it charged 2500+gst I guess. They created 1500 back in MMT wallet after 2 months of payment. And received an MMT black membership coupon as well.

Was charged 750 plus gst for using the Dreamfolks icici mmt card in 02 spa in Mumbai in card statement? Don’t know why ? when called customer care they are saying minimum 5000 Rs spend to made in calender quarter for free Domestic Airport Lounge access.

But This Spa service is from Dreamfolks right without any conditions as far as I remember when I took the card.