With relatively higher number of active accounts, I regularly check my CIBIL score/report every month or even more often at times to monitor the reporting activity from various banks. Just incase if you’re new to CIBIL, they have paid plans which allows you to check score as often as you wish.

- Do you know? You can get CIBIL score for free once a year. If you’ve ICICI wealth a/c, you can also view the full report for free.

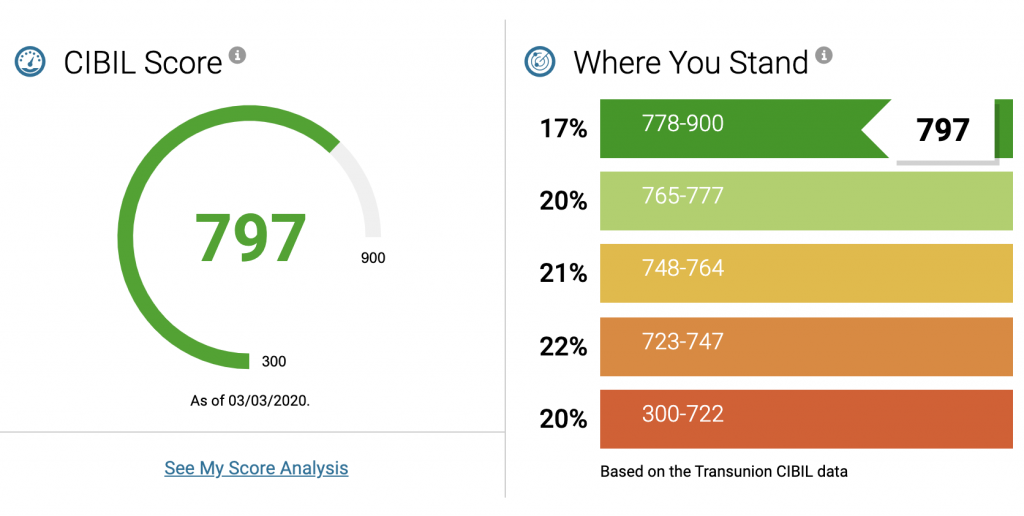

As I’ve the yearly plan with CIBIL, I went ahead and checked my score to get an un-pleasant surprise. My score dropped from 800+ (since past 5+ years) to 797 for the first time, so its worth exploring.

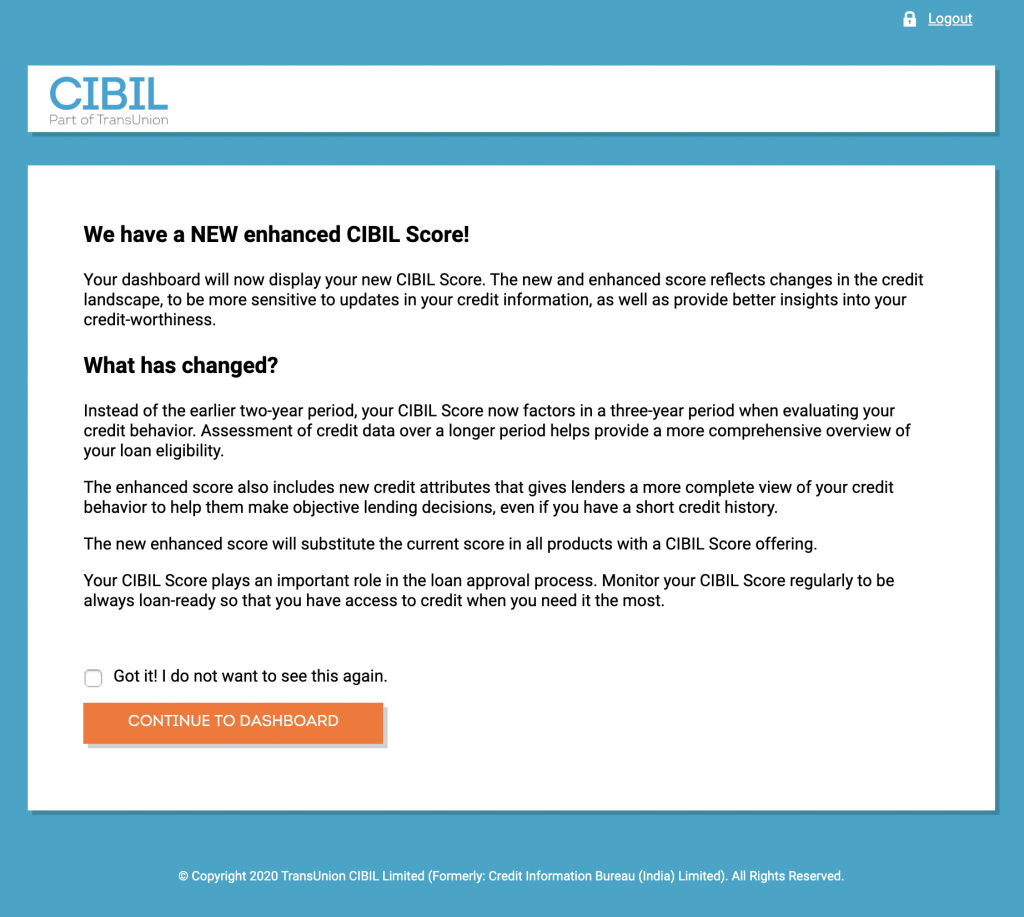

What has changed?

CIBIL has the answer for you already and this is what they have to say:

So they say that they’re factoring in 3-years a/c activity to determine our credit-worthiness, instead of 2 years (as before, as they say).

But that’s vague and I guess they would have added some more parameters to the algorithm, ideally to make it tough to cross the 800 mark.

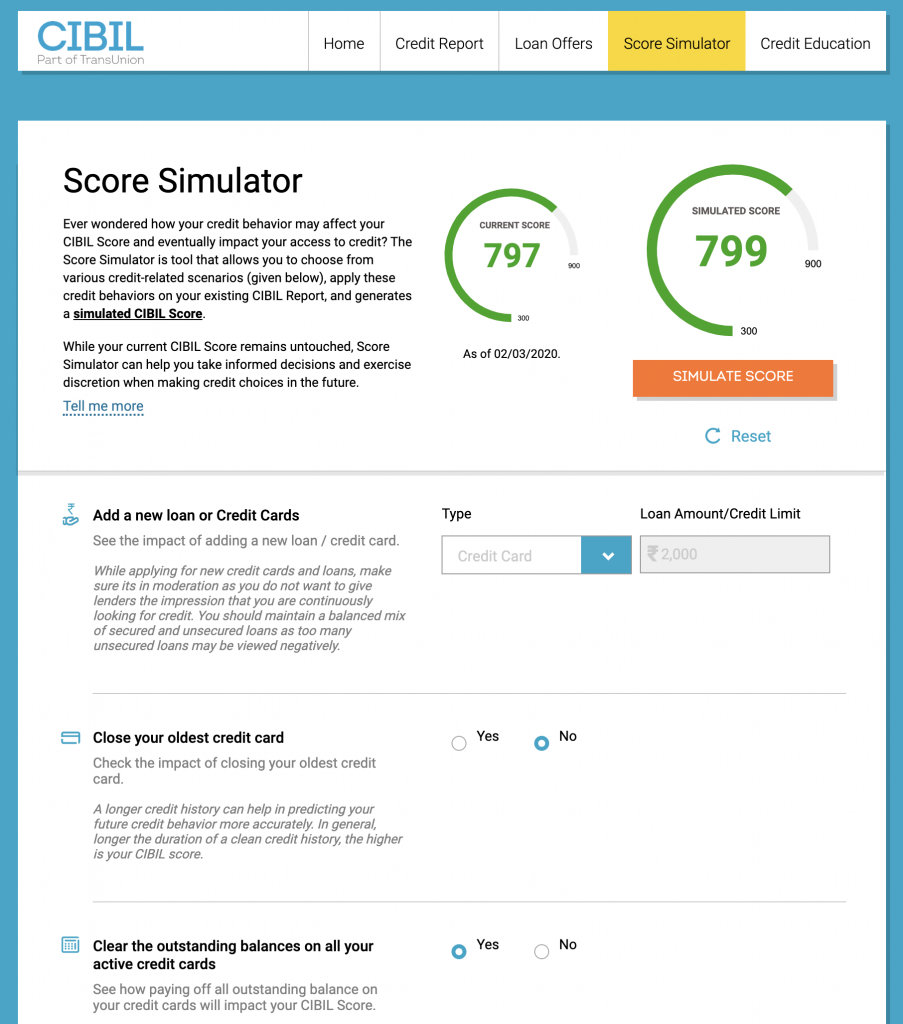

For ex, I even tried their score simulator to check the probable score if I clear all my outstanding on cards and I was surprised to see that it helped only to raise the score by 2 points.

Bottomline

I checked with some of my friends and it seems most of them have got their scores down as well, so it appears some major change to the algorithm has been implemented.

But we never know if it will be same or get better based on activity in future. So we might need to wait for sometime to actually see what’s happening.

This may not make much difference to most as anyway the report is what is the most important part than the score. But it is sad to see this happen especially when banks & RBI are moving towards giving better interest rates & benefits for customers with better score.

That said, has your score gone up or down? Your inputs would help figure out what’s happening in this landscape.

These “scores” are meaningless. It is their own interpretation of your credit file and they use it as a way of providing an indication of their opinion. It is not visible to lenders, who have their own assessment criteria for credit scoring based on the information held on your files.

No one has a “one score to suit them all credit score”. Essentially, the numbers given to you by the agencies are totally worthless 🙂

Hi Shivi,

I believe it is visible to lenders. All the bits and pieces. In fact, when I request for a report from banks, they do provide a copy.

In fact, when applying for a new card, every bank I applied to, made a CIBIL inquiry. Don’t know how much it mattered to them though.

AG – The CIBIL report which is visible to the lender is different from the ones given to customers. More often than not there is a difference of 50+ points in both. I applied for a car loan a few years back & my cibil showed 770 points while the one which the bank collected from the bureau had 690. Followed it up with another loan after a few months and again the score differential was 60 points. I did manage to secure both loans but the scoring criteria is definitely not the same!

The same happened with me too. I applied for a car loan. I had the CIBIL SCORE of 820. I got it through icici bank wealth account. But the score sent to lender was mere 731. It costed me .5% in interest rates. Never understood why two separate scores.

I have earlier worked with the credit card team of a bank so happen to know the possible reason.

Earlier, CIBIL had only 1 score. Then they upgraded their scoring mechanism so got v1 and v2 score. Banks could opt for v2 but given the bureaucracy, adoption of new systems is slow in banks and requires many levels of approvals. So most continued to use the v1 score. The one given to the customer will be the latest version though. This could be the reason for the difference. v2 was generally better than v1.

With this upgrade, may be there will be a v3 in place…

@SKJ can you let me know how you found out the difference of interest rates. Also I just started earning, wanted to know how much role does a credit score affect the interest rate and to what extent are they negotiable

I agree the more that score shows its getting ridiculous most people are trying to live a honest living but the score keep kicking them in the arse. Its seems pretty unfair to use the credit scores to justify there action to turn you down. As stock market continue to downturn the credit aint gonna help it just make it even worse for everyone.

What are you talking about? Stockmarket affecting cards and loan capabilities of an individual? I think you are confused between Crisil and Cibil!

Btw, ICICI WM account gives you 2 reports per month free. One via desktop site and other on mobile app. Refresh period is 15 days.

For HDFC-CIBIL tie-up, refresh period is 45 days.

What is the link to check the HDFC-CIBIL score check?

I would just suggest everyone to check through Paisa Bazaar. It shows scores from all the four agencies.

Bad suggestion there, Parekh. Once you give your number to paisabazaar etc. they will mess up your credit bureau enquiry section and keep on repeatedly pestering you for loans n cards. Also you didn’t mention here that they give you only score and not reports. This is what we are discussing here in the first place. Forget score n concentrate on report analysis.

Although I check my reports directly at CIBIL website, I have used bankbazar services to check my score and peruse my report for free on a monthly basis.

1. There is only a soft enquiry so score will not be affected.

2. There may be an odd call (once in a few months) but there is no pestering.

3. You can download your report, which is presented in a much better way (visually) than the original one.

Instead of Bazaars, HDFC link is still better. Updated report once in a quarter for free (for not just HDFC customers) looks like a good option. Also, HDFC mostly honors DND and if ur number is in DND you’d hardly get any advertisements from them.

I have had a good experience with them. I dont get that many calls. And even I do I just say I am not interested. It does not change my score at all.

Also, it gives the entire report and not just the score.

Btw I would like to know how to check through HDFC?

It’s given under the write up of Cibil/hdfc on this site Roy but that link is only working for those who registered through it in the past. It ain’t accepting new enrolments

Major score drop from 800 to 760. Timely payments, no balances on card, decent usage. Wonder what has changed.

Yes… I refreshed my score and and noticed that score has changed from @815 earlier to 732. Really surprising….

Also I noticed that in “Account Information”, I see an entry which I am not aware what it is all about –

Member Name: ADITYA BIRLA F L

Account Type: Other

Account Number: LXW-MXXXXXXXXXXXX ( some account no is provided)

Ownership: Individual

Sanctioned Amount: 50,000

Current Balance: 100

Date Opened / Disbursed: 27/01/2020

Date Reported And Certified: 31/01/2020

I dont know what this entry is. Haven’t applied for any loan or card… curious what this is… Only thing I remember is that a SBI credit card guy apparently was checking my card eligibility and in process took lots of details – Name, PAN, DOB etc and he entered it on his tablet… But I walked away from him the moment he asked for an OTP received on my mobile which i didnt provide him… Is this something to be worried about? What can I do about this?

Hey Prasenjit,

This Ola Money Postpaid Plus Account. Recently, all pay later accounts are being reported to CIBIL and due to this, I have 3 new accounts now in a span of 1 month. The first one is CLIX Finance (Paytm Postpaid) which is being reported as Consumer Loan. Then, there is IDFC First( Flipkart Pay Later) which is being reported as Personal Loan of Rs. 60K and then the last is Aditya Birla F L (Ola Postpaid Plus) which is being reported as Others with a Sanctioned amount of Rs. 50000.

The worse thing about them is that they are being reported as Personal Loan and Consumer Durable Loan.

Thanks Himanshu!

Thanks for the post Himanshu. Didn’t know these details.

I can see IDFC FIRST BANK LIMITED is added in my report as credit card account, but i do not have flipkart pay later, as just checked now. Have you any idea who else can use IDFC FIRST BANK LIMITED ?

It’s most likely your OLA postpaid account with higher limit and elongated repayment cycle.

With the help of that info someone might have taken loan in your name. Better contact Aditya birla finance first and enquire about this. Than file complaint if it is true.

Ola postpaid

Same issue is with me too. I’m not able to trace what kind of loan it is. It’s showing I’ve taken loan from Aditya birla FL, but I’ve not at all taken.

Thanks for update Siddarth.

My CIBIL Score has gone down in the Feb month. ~40 drop in the score from 790+ to 753 inspite of good credit behaviour. I was attributing it to my recent Infinia card approval. This is not good for us.

I finally got an explanation for a drop in my CIBIL score, which i also didn’t expect. But thankfully, its still above 800.

And what was the explanation given?

I mean , the change in method of calculating the score, as Siddharth has told in his blog.

My score is also down just below 800. I attribute the same to my opening a lot of credit card accounts in recent times.

Taken verbatim from CIBIL page

One of the factors your CIBIL Score depends on is the number of active loan/credit card accounts reported in the last 24 months that carry a current balance. A high balance on such active accounts will impact your CIBIL Score. Paying off the balances on the loan and credit card accounts as well as not having too many open lines of credit with current balances will help maintain your CIBIL Score.

*I pay most of my dues even before bill generation.

CRIF score was already a 50 point lesser than CIBIL and I guess both have now been arriving at a similar methodology. This is only my guess. Just before this change, there was a 50 point consistent difference in my CRIF vs CIBIL scores, which are almost at par now.

Rechecked CIBIL after your post.

CIBIL Score gone up 30 points from 765 to 795 and Experian jumped from 855 to 893.

The only thing I have done in the past 2 months is that I have closed 3 of my credit cards with collective CL of 10 lakhs.

Hi Shivi,

Could you provide some more details such as the average age of your closed Credit cards, credit limit for your existing cards etc.

As far as I know, closure of cards having high credit limits adversely affects CIBIL score. Correct me if I am wrong.

Thanks

Closing of credit card doesn’t necessarily affect credit score negatively. The logic is that if your total credit limit decreases and your spends is the same, the credit utilisation percentage can shoot up by even 100%. If you can pay up all bills and then close cards thus managing credit utilisation, your score won’t get affected.

Hi Siddharth,

Following your blog for a long time.

Checked my score, it has reduced as well.

Besides in my credit report, the limit for couple of credit cards.

Any idea how I can get it fixed?

Yes. They have come up with a new version of score. What you miss in the article is, what does a Cibil score represent? It represents the probability of default in the next 11 months. I am assuming that you generally make timely payment, hence your score already factors in that you will make the payments. A two point shift is justified.

Also, the banks will now change their CIBIL score cut-offs to adjust the new score. You will be surprised to know that large majority had a higher score in V3 than V2.

My credit utilization percentage shot up to 8% form 1% before. Checked the report, and no new credit was utilized.

And the score went down by 6 pts. Was 755 before, now it’s 749, which I don’t think is a good sign.

Clearing all outstanding balances would increase the score by 10 points. And adding a new credit card would decrease the score by 2 points. Adding a home loan, and clearing outstanding balances though would boost the score by 20 points.

Overall, not a good sign for me.

One thing I observed it that they are including the HDFC insta loan or jumbo loan outstanding to the credit utilization ratio, without considering the limits on hdfc and amex cards. Which will significantly increase the utilization ratios for those who opt for the hdfc loans on credit cards.

When I calculate my current outstanding with current limit without considering HDFC and AMEX limits, the increase in utilization ratio makes sense.

This would be the single biggest change they made in this update.

HDFC is not reporting credit limit on their credit cards to CIBIL for the last several years. No idea whether they used to report earlier. I’ve checked with customer care few years back about this. They didn’t had any clue and was giving me standard reply like they cannot change CIBIL score and all. So I dropped that attempt.

That’s true only for those hdfc cards where the CL is reported to cibil. My Infinia limit is still not reported.

These CBIL people are very Worst they give report Blindly without verification of records provided by bank people, they are not even eligible for as scoring agency . They simply doing copy paste . They not even qualified people to assess any individual credit worthiness. There are many other factors influence for everyone credit worthiness.

Need your help and I got a lot of questions. Appreciate your help in advance brother.

My score dropped from 750 to 670 and the Axis credit card I applied got rejected. Any info on how much the score declines once an application gets rejected in old process?

I checked my score and i was surprised. My score went from 767 to 817.

20 point dip from 827 to 807. was surprised!! But it all makes sense now. Ive been maxxing out my hdfc regalia for the past 2 months(planning to upgrade to dcb in the coming future) , so could that also contribute to reducing the score?

Dropped from ~850 to ~735. Unexpected.

That’s a huge drop. A lot of new cards of late + balance build up on cards?….

Just 1 new card, but did apply for a few only to get rejected. Seems to be a general trend, more applications , lower score, but such a huge drop is surprising.

“Just 1 new card, but did apply for a few only to get rejected” – That should explain the drop in view of the new CIBIL calculations

Surprisingly I have been having problems with my score since last 1 year and I have sent them so many mails. Recently I found that it got increased by 20 points.

For me score seemed to have improved from 779 to 791

My score fell from 837 to 800. I have been checking my credit score regularly (Almost daily) from last 6 months and have been checking on when and how the banks report the update to CIBIL. from what i have noticed, CItibank is the best in reporting and they report to CIBIL by 2nd of every month. YES Bank, HDFC and ICICI does it by 10th, AMEX by 15th-17th and Standard chartered by end of every month. I have home loan from Bajaj and OD from Tata and Bajaj which get reported to Cibil by 20th to 28th of every month. for some reason HDFC and AMEX cards does not have credit limit mentioned. Wanted to check if this is the same for everyone? I have even raised a dispute for HDFC as my limit is 15L but got a response that Bank refused to update and take it up with bank. Had some issues on CITI which were cleared within next update.

Even I noticed the same thing with HDFC and Amex. Although in my case, HDFC reports a credit limit which is much lower than I have. I reported to Cibil and Experian. They told me to take it up with the bank. I also did that. However, HDFC refused to report updated Credit limit. It says bank does not report credit limit at all. This is not correct as in my case I do have credit limit mentioned.

Reply from HDFC “We wish to clarify that card credit limit will not be updated in cibil, only the highest value transaction made in card will be updated in cibil from bank end.”

Based on my reading, the cut off date is

HDFC , SCB, YES and Axis – Last date of the month

SBI – 12th of every month

Amex & ICICI & Citibank- 1 day before bill generation

Reported to bureaus within 15-20 days of the cut off date.

Wow….you have excellent credit limit in HDFC.

15 Lakhs is just too much.

May I ask about your taxable income as per ITR ??

My annual income as per ITR is 12,90,000 and I am self employed.

I am curious to know about yours.

I Have not taken any loans and my cibil range as per ICICI bank netbanking was 830+ But what i noticed that after getting Icici rubyx and amazon pay card it droped to 780 odd. People who has tons of money can care the damn for CIBIL score 🙂

Mine is only 2 points down comparison to 49 days ago. Now it’s 781.

Mine came down 42 points in the new version. There’s surely some big change there 😉

My score increased to 805 from 785.

I am not able to login to account. Forgot password doesn’t work, setting up account from scratch obviously doesn’t work. Has anyone faced similar issue ? Stuck with this issue for last 6 months

yes. me too. never got a new password after clicking the ‘forgot password’

guess they are done with giving free reports(even though they are obligated to). they want you to pay up. Sad!

Message from CIBIL for forget password. They are expecting us to call them first during working days /hours.

===========================================================================

The information you have entered is already registered with us.

What to do Next

Please login now and complete your request.

If you do not remember your login credentials then, you need to contact our Customer Support Helpline Monday to Friday 10AM-6PM at 022-61404300.

=======================================================

Now I clicked the forget password and it worked….! I have been able to reset the password without calling their numbers.

Because of this, not able to access my report through hdfc as well. This is really bad. Not sure how can we escalate this ?

881 down to 868 – hmm nothing that i did at all. i have 4 cards and that seems to be average according to these guys :).

WTH!!! My score has dropped from 811 to 772. No late payments on Loans and Credit cards, though applied for 3 credit cards in last 2 months. I think they are reducing the scores the more you apply for credit cards. Very bad system.

Ofc they reduce score the more you apply! That’s how it’s supposed to work!!

My Cibil score is down by 33 points, but surprisingly Experian score is up by 38 points.

My CIBIL score has dropped but my CRIF / Experian score has gone up. Strange.

Anyway, I had a Standard Chartered Credit card which i opened in 2003 which I stopped using sometime around 2012.

This doesn’t figure at all in my Experian report, shows up as “CLOSED” in CRIF with last reported date of 31-05-2015 and shows up as “ACTIVE” in CIBIL report with last reported date of 30-04-2018

Can some of the experts in this forum advise me on how to rectify this anomaly? Needless to say, I have no relationship today with SCB.

I had a similar situation with SCB where they issued a credit card with out even asking along with a salary account and for revenge I never used it. Years later I wrote to SC on email with screenshot from CIBIL, and they confirmed to update credit bureaus, it was so simple.

Hi iam Balaji my case is very bad cibil dept not working my score is 816 when bankers enq section showing 535,595 cibil it’s self send message on my report regading this dispute on enq IQ for more than 6 months also bankers asking what is your real name becoz name also different great cibil fist hobey or RBI has to take necessary action.

Siddharth,

With 797 you are placed in the top slot (778-900). Earlier any score which was only marginally above 800 was in the second slot. You are in the category of most creditworthy people. Score is just a number , but for lenders you are in the best category. So enjoy.

Hi Everyone here.

Any way to get a cibil report for free? I am aware of paisabazaar.

I have already used my free report for the year from Cibil.

Any other methods of getting a cibil report for free?

Yep. Open ICICI wealth management account. Then you get 2 cibil reports free every month! Or use hdfc cibil link and get a report free every 45 days! Just concentrate on the report analysis. Forget the number.

Hey Shivi, thanks!

where can i get cibil report from HDFC? Creditmart hdfclife?

Can you share the link or guide me please?

My score Increased from 746 to 766. In the last 2 months I applied for 3 credit cards..

If the new algorithm is bad for me, then then new algorithm is bad for everyone. And so it is bad for no one. The rank ordering is still the same. Plain and simple logic. 😃

No its not the same. Underlying variables have changed. Very few remained at same slab, some jumped up, few got knocked down and some got kicked real hard. It will take few months to figure out what’s going on with the new calculation.

I’ll wait for the new FY before getting Cibil from banks so that am sure to get the new methodology on paper

Actually, it is the reverse in my case with the new algorithm. Increased from 785 to 791.

My cibil score still constant for last two months.

My CIBIL dropped down by 2 points and still marginally below 800. I have a 2 year old Unsecured Overdraft Loan of 30 Lakhs. But have repaid all overdraft and the balance is full 30 Lakhs since last 6 months ie. no borrowing since last 6 months from the available 30 lakhs, and hence, no EMI since last 6 months, and also, no AMC charges. Now my question is – Should i foreclose this overdraft loan by paying foreclosure charges of 4% + GST (comes to around 1.33 lakhs) bcoz there is simply no requirement at all at present since there are surplus funds and not requiring any loan. Will closing this 30 Lakh unsecured loan boost my CIBIL score. Or, i just keep it till the time it completes its term in year 2025. I may still not pay any AMC charges since i am not borrowing any money from the overdraft ! I am also due to take a housing loan in the comning 3 years !

It’s not a loan. It’s an overdraft. Both have different impact.

How did you manage to get an unsecured OD facility for that big an amount? I mean which bank does that? If you dont mind then could you mention your banker for that account. Cheers 🙂

For me it’s increased by few points, after being constant for 2 years.

There’s likely some glitches as my total available credit minus the HDFC and non reporters has dropped by over 10L, even though I haven’t closed any cards, made my utilisation go up. And we all know how they react to disputes, i also feel its getting pointless to continue paying yearly fee.

Hi Sid,

My cibil score went down by 20 points. I saw one enquiry from ICICI Bank while I didn’t put any request for a new credit card, I was just asking customer care for limit enhancement which was done on phone, but that they were showing as inquiry. Can that be disputed? Will it help increase the score by a few points if they remove the inquiry.

Thanks in advance.

Hi Shankar,

Don’t think it’s worth the time and effort to dispute the enquiry. Such things are part of the game. In my case, there were 2 inquiries from SCB for 1 SCB Ultimate application.

And a single application for vistara SBI card has led to 4 enquiries. It led to a fall in cibil from 778 to 771 in one day

CIBIL is not updated on a daily or even weekly basis but monthly+ basis

The same thing happened with me in Amex. Asking for Limit enhancement led to an cibil enquiry.

I asked ICICI why was there a Cibil check just for limit increase request?

I don’t know how it was taken but they did another cibil check and told me limit increase is not possible.

They dont even read what the customer has written!

3 CIBIL score in one day.

Few months back I applied for personal loan from SBI. Manager pulled CIBIL through application interface available to him (let’s call it manual CIBIL) score came out to be 795. I was surprised to see it because few days back it was 770 on CIBIL website (let’s call it website CIBIL). When I checked it again on same day on CIBIL website score was still 770. I was confused.

When manager processed my loan application, there is automatic CIBIL inquiry by SBI system and CIBIL came out to be 660( automatic CIBIL from bank system). 3 CIBIL score on same day, huge variation. When I asked manager he was clueless. Due to poor 660 CIBIL (automatically pull by bank system my interest rate would have been higher but manager attached manual CIBIL report and proceed the application. It went through but I am still confused with 3 CIBIL score on a single day.

Can anybody explain this mystery?

Regards

This is EXACTLY what i have been saying for the past 5 years!

What is the point of knowing through its website when CIBIL score shown to bank is totally different.

Verification of records should be the sole purpose.

Mine is increased from 820 to 833..

What the heck is happening with cred. I made 3 payments on 5th. They failed yes bank payment and i had to pay 2 days past due date. Now the citbank payment is still pending and due date was 9th. It is still showing processing….they are playing with people score…..the app has become useless anyways.

Thats why i make most of my CRED payments atleast a week to 10 days in advance. Though in most cases it gets credited to card in 2 days max im surprised in your case its taking so long. From which bank did you make the payment??

I have been using cred since beta stage never faced such issues. I am making payment from Axis Bank.

Faced same issue but mine credited today..seems some technical problem from cred,few more people mentioned in the reviews in google play store that payments made on 5th are not yet credited to their cards.

I too faced delayed processing issues for SC credit card payment. The Cred rewards are no longer rewarding. Most are just minor discounts.

Cibil for bank/nbfc is different from our individual we get all detail who is pulling cibil etc but score difference comes around 80-100 point as they different criteria in cibil 2.0 what we use is cibil1.0..risk ratio /how old/payment/how offen you apply all factor affect in cibil2.0 one of my friend is manager in Canada bank he said.. So if your score is 800 in 1.0 then in 2.0 possible 700-730 will comes but In same sometimes risk ratio is in your favour like limited loan secured/non scerured limited card then possible not major effect

My score increased 6 points from 784 to 790. I always clear my dues and currently own 7 credit cards. Not sure what was the reason for the increase, but I am not complaining.

My score also reduced, barely made to 800 + , but this will not change credit worthiness of anyone , because the spectrum is now changed for all. Rather every FIs will have to re-calibrate with regards to this new scale. Secondly most Retail FIs were already checking the report apart from only score to check for 36 months track , or at-least this is the norm for Mortgage . In-fact there is lot of talk for CIBIL score made more sensitive by covering more factors .

I could see that, whenever credit utilization is reduced the CIBIL score increased by 2 or 3 points. Similarly, while closing any of the existing credit card.

As others have mentioned before, HDFC doesn’t report CL to CIBIL, and earlier when doing the utilization, they (CIBIL) won’t include HDFC (DCB) card. But now with new calculations, they started including the utilization in total due amount, but they still don’t have HDFC CL in total CL available, which shoots up the utilization significantly!

Any ideas on how to take this up with CIBIL?

The algo has gone completely mad , utilization in my case jumped from 34% to 178% in 5 days , lowering my score from 787 to 766 , cant even dispute it

Can you guys help please what to do further ?

Nothing that can be done except maybe, hypothetically speaking, you file a PIL in court asking CIBIL to come out with a logical step towards report generation and credit utilization for those cards which do not not disclose credit card limits to the credit bureau

Can anybody tell me if Axis Bank Credit limit is reported in CIBIL ? My cibil has took a big hit because of not paying HDFC due . HDFC does not report credit limit so utilization ratio is too high always .

Yes, Nischal, Axis Bank Credit Card limit is reported in the CIBIL records.

It may or may not. The only bank that reports the CL for sure is SBI.

Yes, Axis reports CL.

@ Topic:

I think the new CIBIL analysis factors in the non disclosure of credit limit by credit card companies or the underlying parameters somehow. My utilisation has gone off the charts too (400%) but the score has not taken a hit and has rather improved even after closing 4 credit cards with combined CL of over 35L in the last 4 months OR maybe it’s still too early for that effect to be weighed in. Now with the lockdown and moratorium in effect on loans & credit card outstanding I expect fresh update in all credit bureaus happening not before July/Aug.

Checked my score on paytm its free. The score has deopped from 806 to 790. So no worries i guess. It is showing total card limit of Rs.37.65 and current utilisation of 2%.

Checked my wifes score. Hers is virtually same 805. But total card limit is not updated.

My cibil score has gone up from 757 to 788. My utilization has been coming down since the end of 2018. I have brought down to 9% from 35% ranges. It took me one and a half years. This could be the reason why my credit score went up. Because the new algo considers 3 years history.

It’s a new way make money by CIBIL during Covid Pandemic & thereafter so that people not even in need of loan at present, out of curiosity of future may renew !!!

Hi cibil was increased from 726 to 792 after change of algorithm. But again it has come down to 742 this month. 50 pts drop not sure why as I haven’t missed any payment plus not taken any new loan. Only thing I observed on my cibil is account information is not updated since Feb 2020. That might be the reason for drop of 50 pts. Does anyone see the same thing in their report?

This has become a pain. Score used to be 800+ and it dropped to 730 or so after this new algorithm. And with the current situation with credit limits getting cut down by banks, I think it is going to slide down further. A quick question I have is: I have a housing loan running and wanted an additional amount of loan with the bank to pay the builder. I think the banks will again recheck CIBIL as the previous loan was sanctioned almost 2 years back and disbursed. Do you think the lower CIBIL score will deny me the loan, since the score has gone below 750. I’ve heard reports that all the major banks are scaling back on loan disbursements due to the economic climate. Any opinion on this will be useful.

Hey, Can anyone tell me when does CIBIL score gets deducted after a Hard pull/check. Is it before the check or after?

For eg. My score currently is 752. If i apply for a credit card now and the officials do a hard check will they see 752 or a reduced score?

Hello, In nov 2020 my cibil score was 800 and this month when I received report from Paisabazaar it is reduced to 720. This is ridiculous as nothing changed from last month, not sure what happened in one month.

Though one change I see that in 2011 there was a restructured loan on Credit card which was paid and closed and up till nov 2020 last reported date was August 2014, I see in dec 2020 month that it says last reported date as 31-Oct 2020, could this have impacted, if yes, then its incorrect as that account is closed 6 years back, I dont have any default, any overdue and 100%on time payment story.

Any suggestions anyone?

HDFC bank does not share credit limit with cibil. I got below reply from bank customer care officer and cibil will take high credit amount as credit limit and calculate credit score accordingly.

“This is with reference to your e-mail regarding Credit card Limit on your HDFC Bank credit card account.

We take this opportunity to inform you that the Credit card Limit is not being reported to the credit information companies. Alternatively, the high credit amount is being reported which is the highest monthly usage on the card since its inception. Policies of the bank will not be altered for one customer. “