This article covers only the hands-on experience with the Axis Bank Reserve Credit Card. If you’re looking for a detailed review of Reserve, please check out this article: Axis Reserve Review

Application process

- Day 1: Applied Offline

- Day 2: Got an email that application is being processed

- Day 3: CIBIL enquiry happened. Surprise, because it was Sunday.

- Day 4: Card approved and I can see the card on app and marked as transit.

- Day 10: Card Delivered.

I was super surprised to see that this fresh application got approved in under 72 hrs despite a weekend in between.

Back in time Axis used to take ~15 days to process a fresh application, but due to some of the recent changes in Axis onboarding system certain applications gets ultra fast approvals.

That said, it was not just another application, I meticulously planned for it and executed with all the best practices that I’ve mentioned in the premium content. So it all went as expected.

Not to forget that “upgrades” however are processed almost instantly – I’ve covered this along with all other Axis application routes in detail in the Premium Content.

But I’m not sure if they take upgrade requests for Reserve Credit Card.

Unboxing

While the approval was ultra fast, the card took a while to reach though, not sure why because the recent Magnus arrived in 4 days from the date of application.

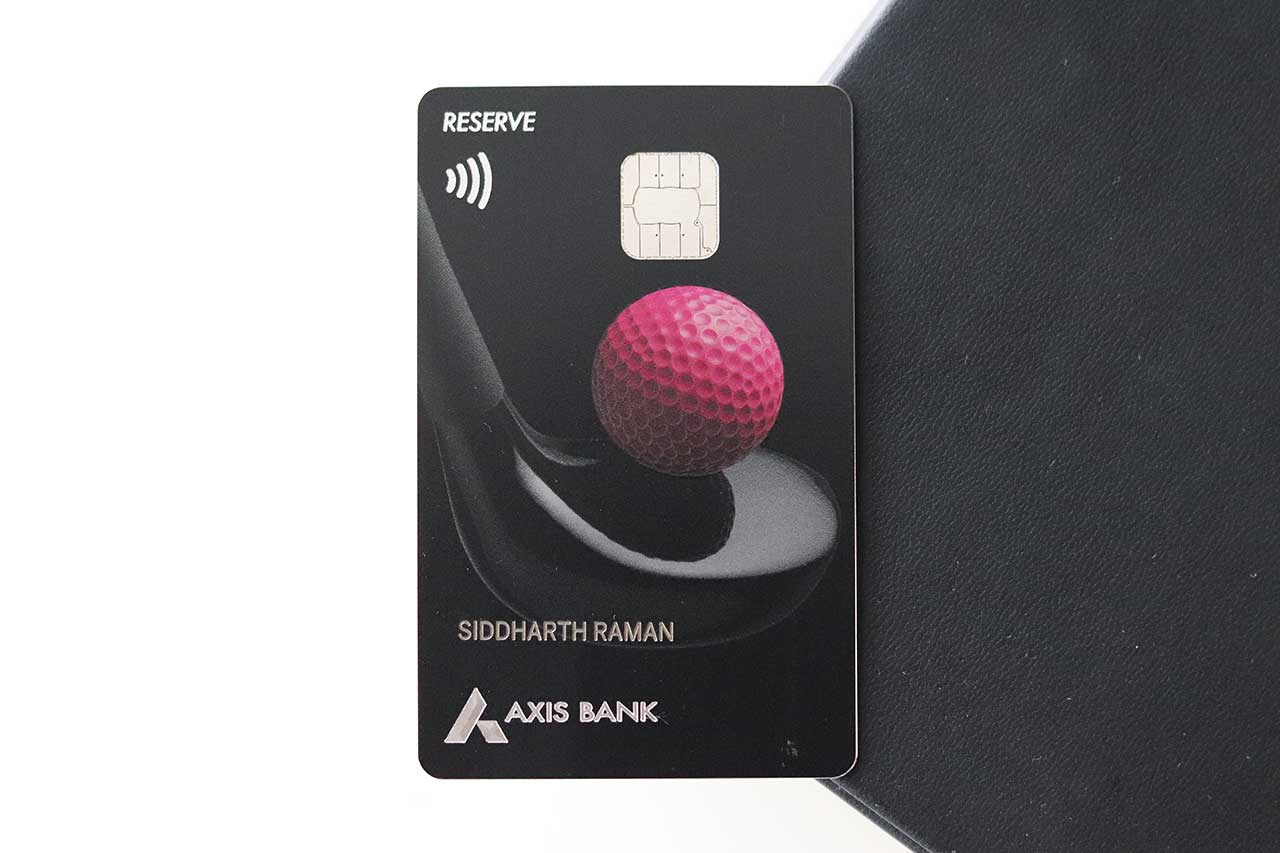

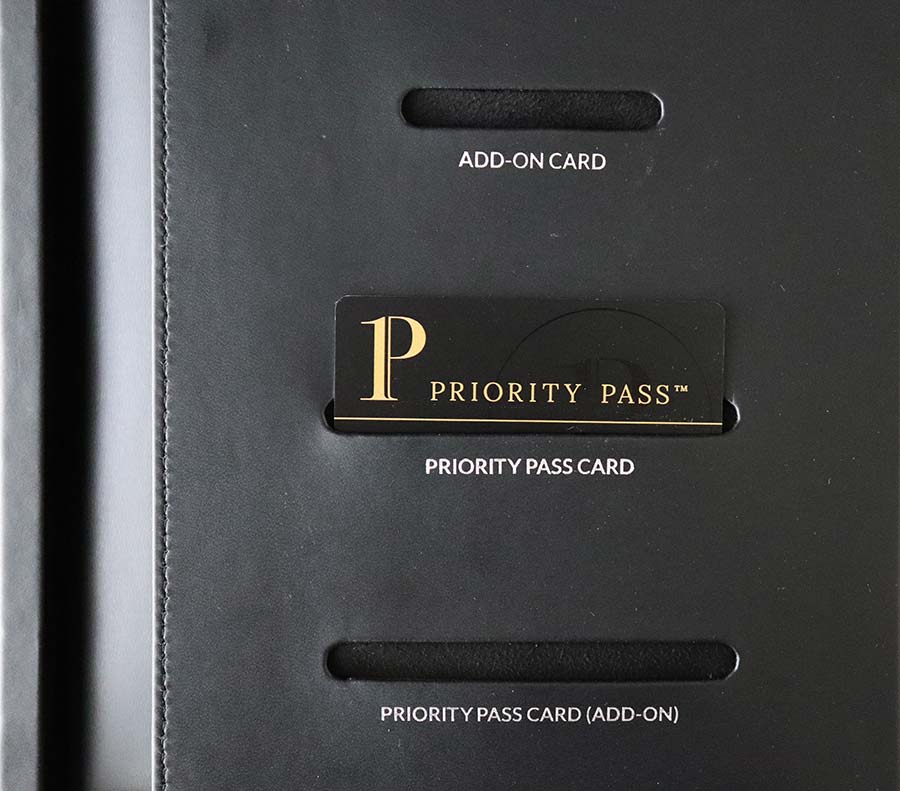

Anyway, Reserve comes in a super premium leather box which feels good both inside and out. It’s as good as a premium jewellery box. Here are some unboxing images,

The leather feels so good to touch and the material is definitely premium that even after many months it still looks the same. Though it attracts fingerprints.

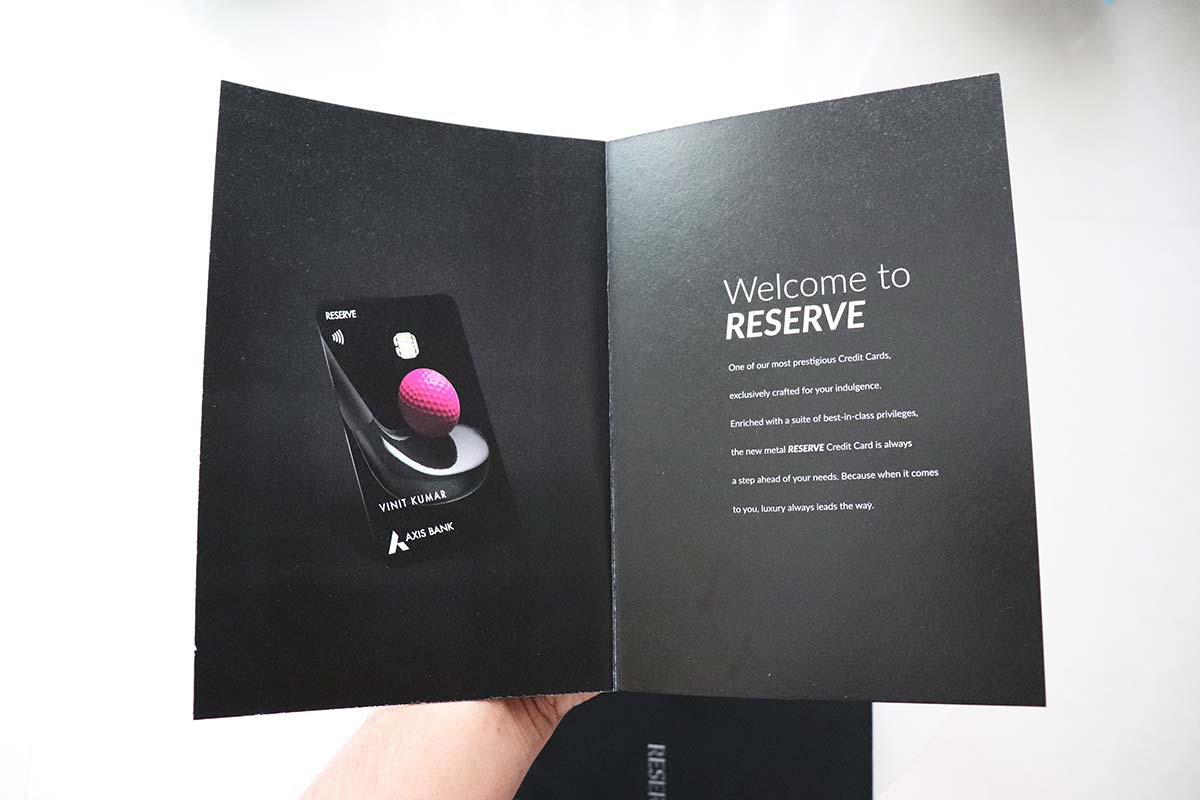

That aside, just like Magnus, Reserve also has these simple leaflets that covers the primary product features, card details and a hotel benefits activation form.

That aside, you also get a card features booklet in full black. The pages are like 200 GSM each. Pretty good.

Support

Their Premium/burgundy support gets basic things done but poor for escalations. Hope they fulfil the bonus points issues when a customer raises an escalation, which HDFC is very good at, even-though their fulfilment system is not accurate.

Holding on to the request for months together with same “will be done soon” response is totally irritating and I’ve gone through that once.

I wish the bank gives more power to support to close the requests in ~3 days, at-least for the requests coming from premium cards that costs >10K INR.

Rewards

While the inbuilt rewards system is bit low, I was lucky to grab 2X & 3X rewards which improved my overall reward rate to an extent that I’m no longer complaining about the rewards on the card.

I think if they do it couple of times a year, it’s more than enough to get >2% reward rate, but whether they will run them again or not is a tricky question.

Also, the grab deals system with 10K cap even for reserve is too low. It deserves at-least 50K cap. Remember, its still a hit or miss though!

Hotel Benefits

To activate Marriott/ITC/Accor benefits, they need you to email a scan copy of the signed leaflet that comes with the card.

The Marriott & Accor benefits were activated in under a week but the ITC benefit is still not activated for me for unknown reasons. (Update:ITC physical vouchers delivered on 2nd request)

Club Marriott is completely digital while Accor sends like 20+ physical coupons to the address. Physical coupons in 2022. Hmm! Anyone paying 60K for a card have no time to spend in going through physical coupons.

I tried my best to spend couple of days exploring Accor Plus and these dining vouchers only to say that its not worth it. I see very low value in India but if you fly to SE Asia you get wonderful value.

Concierge

Their concierge line is easy to reach as well, though the lifestyle requests sent to concierge takes about 2-3 days to get actioned.

I tried their medical concierge to find a dermatologist in Bangalore. They did find a nice doctor but the costing they shared was quite high.

I sent the details of the same doctor to Amex Platinum Concierge and got an appointment for almost half the rate. 🙂

Final Thoughts

The experience with Reserve has been overall good and I hope it to get lot better in the coming years as Axis would absorb Citi Credit Card customers and hopefully implement Citi grade support systems in place.

A bit of fine tuning the product might help in improving the true value of benefits offered, which would also result in more takers. For now though, its a wonderful product only for a select few.

I am using it from almost a year and m quite happy..the airport transfers takes care of half of the joining fees and who doesn’t want to take a ride on BMW or Merc ?

Hotel vouchers are good. Credit limit is decent however i haven’t got it since i got this card. Currently i have alot of rewards point which i will encash once the new iphone comes out.. overall happy with the card ..just wish they had more airport transport options.

Sid,

Did you give up any of your existing cards to get this one? Or were you finally able to get a fourth one from Axis?

I haven’t tried for 4th card recently Kushal.

I had the burgundy private credit card but was not a burgundy private client so had to pay 50k+ tax which was the same as the Reserve. Overall for same value the Reserve is better infact earlier Reserve was much cheaper the hike in the price was not warrantied.

I got a LTF MyZone when I surrendered my burgundy credit card oddly enough they asked me to submit the card at the branch for cancellation which I did. Also funny was the 4Lac limit I got for all my Axis cards including the burgundy private credit card.

That’s right, but in what situation you ended up taking Burgundy private credit card? I see few others too holding it with a fee and wonder why!

I was a burgundy customer but with a family account setup and had requested upgrade for my Select with Reserve which was 30k or so at that time but the bank rejected the same. I threatened to remove all my family accounts if nothing was done to which the BM told me that the Regional Head can help with it but only with program linked card like Priority,Select & Burgundy Credit Card but they will have to take his approval & I will be charged a fee to which I agreed. The card comes in a locker type box but is not a worth while card at all infact I have recently taken a Magnus for all my expenses with Infinia taking a back seat.

Hi Ajai,

When I approached even with fees, they didn’t agree unless there was 5Cr TRV or so.

Hi Sid,

During that time it was only cc to provide 0 markup and no charges for cash withdrawal as well. Any other suggestions or suggestions to get one pls.?

You directly jumped from Private to Myzone. Bank didn’t offered anything above myzone as LTF?

There is an Axis Airtel credit card released Sid. Is it any good? Thinking to swap my flipkart axis card to it looking at swiggy/zomato 10% off feature. ur inputs?

It seems to have higher cashback % than the Ace credit card but unlike the Ace this comes with a cap of only Rs 300 per category. Considering that you get 25% cashback for Airtel payments on Airtel Thanks App. That means if you pay a bill of Rs 1200 for your Fibernet connection then it’s already reached. So any other Airtel payments you make won’t get you anything. Other service provided bills can also be paid on this app but it will only earn you 1% cashback. Other non-telecom related payments on the app like electricity, gas and other utility bill payments get you 10% cashback but again with Rs 300 limit. That means if you pay a electricity bill of Rs 3000 then you’d have already reached that max limit and nothing more you would earn. It’s not clear whether the further transactions would at least earn the default 1% cashback as their T&C doesn’t explain that clearly. So, while this card looks appealing on the outlook it’s not actually anywhere close to the Ace credit card which comes for the same annual fee. Not only that. This card can be applied only through Airtel Thanks App and not everyone is eligible. I’ve been an Airtel customer for over 2 decades and now have 2 fiber internet connections, a DTH and a prepaid but I don’t still seem to be eligible for this card. This means it’s not clear what their criteria for eligibility is as that too is not explained in their T&C. All this is probably why this card has not been talked about much.

Hi Siddharth

Which Axis bank card would you recommend to use on grab deals??

regards

Sid – you seem to have more than a dozen credit cards at least. How do you manage all the cards? May be an article on that would be enlightening 🙂

Hello Sid! Few things to note. As you mentioned it took a lot of time to deliver the hotel memberships, the reason being you applied them through their email support, which is not good at all. The simple solution is taking help of your RM. I was provided with Club Marriott membership only (which is not a decent one actually) through email support and it took a month but no other membership came. And my RM reached out to me if everything is going fine with this card or not, and I let him know the issue. Thereafter he just asked me to drop a mail to his mail id, he escalated with Burgundy Green Channel and it took only 3 days to get the physical kits and membership vouchers to get delivered.

For Accorplus, I’m not sure why you’re not finding it useful. It has some decent amount of value addition to it with like 4 free dining vouchers, some upgrades as well. Btw with recent changes you get 2 free nights instead of 1.

Also talk with your RM. They can pull out a joining fee reversal at certain spends made on your card. Ofcourse that person need to be capable of.

You mentioned Accorplus having physical vouchers, but ITC is also having the same.

One more additional thing, keep your points stacked up at this time. Soon edge points of Reserve, Onecard Burgundy Private and yet to be launched Onecard of Burgundy, and probably Of Magnus, can be transferred as edge miles for much better value.

***

How do you say this -> Accorplus – 2 nights? I can see only one on my account, card received by feb. My RM is not able to get me Magnus or Atlas for Free with Burgundy account let alone Reserve.

Accorplus has a recent change with the membership that comes with Reserve and Burgundy Private cc aka Axis One Card. I too have 1 night only. But there are three people I personally know (2 Reserve card holders, 1 Axis One card holder) having 2 nights with Accorplus.

Btw not all RMs can pull off such stuffs. Internal contacts matter. I mentioned, as it’s doable and being done 🙂

Thanks for sharing an update on the Accor plus upgraded benefit, Subhankar. I’ve got my membership issues sorted in a week of the article.

From my experience too RM has no power on CC operations. Maybe UHNI RM’s in metros have the contacts to handle the issues better.

So I will get the benefit next year then. I will also push RM for FYF for any one of the cards Atlas/Magnus/Vistara infinite.

Hi Subhankar

I agree with you on the Accor Plus Membership. I think it is great value given it is applicable at more than 1000 hotels, including brands like Fairmont, Sofitel and Novotel Hotels and other brands in 5 countries I travel to including Australia, Singapore, Indonesia, Thailand and NZ. A 50% discount for 2 people means you pay only for one person … thats big saving too apart from 2 nights and vouchers that can be used in India

How can we apply is the main problem. There is no way to apply on the app or online. Kindly suggest!

Hi Sid,

My whole credit card game has been planned based on your reviews. Happy to inform that recently I used miles to experience Singapore Airlines Suites. And boy what an experience.

Was thanking you for that 😊.

Also recently I am exploring Axis reserve vs Amex plat charge (recently started accepting Applications again.)

Can you do a head to head comparison between the two.

My travels are usually 60% domestic 30% Africas & 10% SEA.

So bit confused in which card I can eke out more value.

Thanks

Got my reserve today. Lets use it for a year then reevaluate

Hi

Any idea how much time will it take for delivery.. my card got approved yesterday, don’t see on the app though (currently have magnus)

I m slightly anxious as i am flying abroad on next Saturday, just hope that i can get the card and enjoy the lower forex fees and 2x points on international spends.

Regards

With in how many days welcome bonus points will be credited after joining fee is charged to card and first transaction is done ?

Hi.

The Airport transfers offered by Axis Reserve are 4 per calendar year or 4 per card anniversary year?

For example, my card renewal is May 2024.

If I have 4 airport transfers right now in 2023, will I get 4 more in Jan 2024?

Accor Hot Deals are stuff of dreams. A hotel in Goa gave a bill for 42000 when I called and I booked the same rooms for 20500 through accor hot deals. I dont see any better value