After merging with Citi Bank, Axis Bank has been absorbing the USP’s of Citi slowly & steadily, one of which is their ability to transfer credit card reward points to partner airline and hotel loyalty program.

Axis Bank had recently launched their Atlas Credit Card (Citi Premier miles kind) and have been adding new points & miles transfer partners ever since the launch.

Transfer Edge Rewards to Partner Miles

Now the situation has got even better as Axis Bank has enabled the points transfer option on other credit cards as well that earns regular Edge Reward Points.

This is a major incident in the history of Indian Credit Cards!

Because this opens up an option for Indians living in any nook and corner of the country (because of the footprint of Axis Bank) to explore the points and miles industry giving them the ability to fly & stay in luxury through points and miles.

While this was possible even before with Citi & American Express cards, their reach to penetrate the entire country was a problem, now solved!

Not only that, the conversion rates are lucrative so much so that it makes Axis Magnus Credit Card the best points and miles credit card not only in India but in the “world” – thanks to the monthly milestone benefit.

Even without the milestone benefit, the reward rate (points transfer) on regular spends done on affluent cards are pretty attractive, twice as that much of Amex.

That said, if you do not hold Axis Magnus and wish to apply for one, consider doing so this month, so that you’ll be eligible for milestone benefits for spends done from next month onwards.

Improved Premium Support

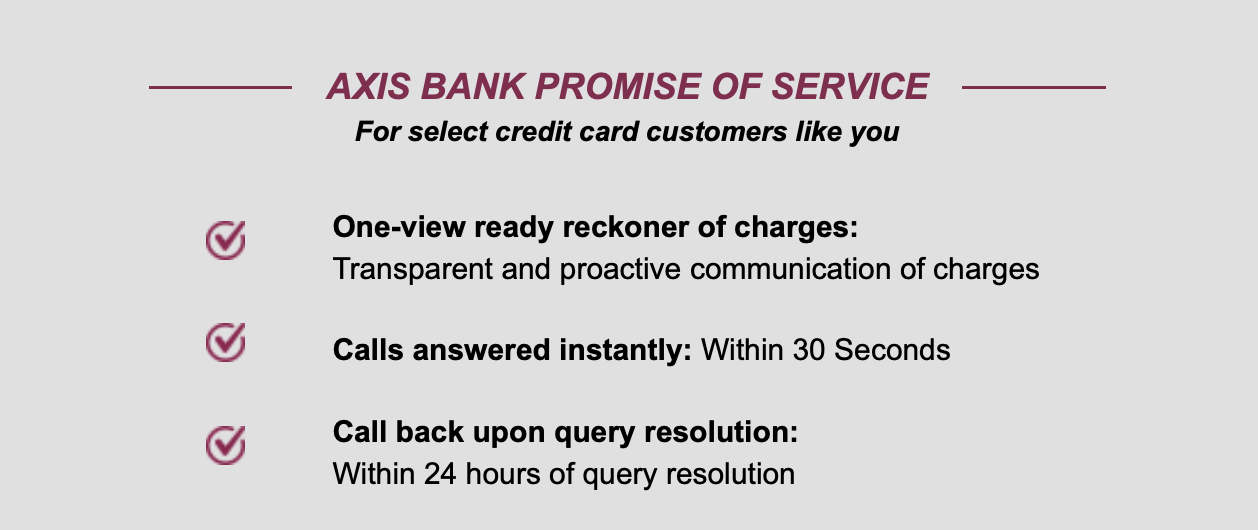

While this new ability is good in a way, Axis seems to be focusing on improving the premium customer support as well lately. Now Axis can “Promise” on their premium support, as they say.

Here’s a quick look at their recent newsletter on the same:

In reality too it certainly has improved a lot compared to what I’ve experienced in the past. And they do callback and inform once the issue is sorted.

While it’s still not “perfect” as American Express level of support, I’m sure Axis can get there soon, so Citi customers appears to be safe.

Bottom line

With all the above updates, Axis Bank Premium range of Credit Cards alone are sufficient to hold for most premium credit card holders, at-least in 2022 or until the competition wakes up!

That said, it’s going to be a tough time for American Express India (that just got out of ban) to sell their premium credit cards because they just lost its major USP (Marriott transfers).

If you’re new to Axis Bank and wish to optimise your Axis strategy, you may consider taking my Axis premium content which will be useful if you’re exploring Axis Bank Credit Cards.

Or, if you need a helping hand to plan your entire credit card strategy, you may check out my One-on-One Credit Card consultation service.

On the axis grab deal portal, Amazon is a partner. And is transaction done via the amazon business account also is credited with points?

Smartbuy was accepting it, until few months back Amazon business is not accepted in smartbuy. Only personal amazon Accepted are accepted

Even on personal a/c we’re not getting bonus points, so not worth risking IMO.

Does Axis allow holding more than 3 credit cards?

I am a Burngundy customer but my application for Select credit card is denied repeatedly

Nope, very rare.

I am already holding three Axis cards. Getting repeated SMS from Citi to allow my information to be shared with Axis. What will happen when Axis formally takesover Citi? Will I loose one card.

Bro! Wth! Seriously Wth!

This article is the best article of the decade! If viewers can decode the real value of the point transfer!

Tons of thanks to you, transferred 2,40,000 marriott points now (f0r 300000 Edge Points). Valued upto 5,00,000 Rs Max and 300,000 Rs min….

Love You Sid.

Why am I excited? Ofcourse Axis will remove this points transfer ratio soon, this will make them go bankrupt, so I had transferred all the points immediately.

Axis did the same mistake in Spicejet credit card, after knowing the mistake, they had put on hold within 2 month of launch, lol

I’m equally excited as you are but such bulk transfer only goes for multiple manual reviews and approvals before processing.

So You’ve just raised a flag!

That aside, it wont break the bank ideally as not many have that much points as of now as we were busy redeeming for Myntra vouchers assuming it gives a great value. 😀

And even in future only the monthly milestone benefit on Magnus is a concern which they may drop/change anytime.

Otherwise I don’t see a change coming in under an year, unless everyone here start to transfer in lakhs every month. 🙂

Hi Sid,

YEs, but I did it in Multiple of 40k only 🙂

And there wasnt any manual intevention.

Got credited into my MArriott account in Realtime. Superfast it was.

Even Amex has the real time transfers now a days.

But usually the first time registration takes time, but in Axis , thats also realtime! Quite impressive.

And yeah, as long as they dont remove the Monthly Bonus, lets have fun.

But by the time they stop monthly bonus, I am sure some Bank will issue Marriott co branded card… ( Benefits may not be as per your prediction you did few years back 😛 ). This co-branded card will save me 20nights to maintain my Platinum/Titanium elite with Marriott.

Ha ha, clever You.

Glad to see Axis doing realtime transfers as well, yeah did a transfer with Amex to Marriott a week back and was happy to see it reflect realtime.

Yes yes, I’m still counting on Amex for the Marriott Co-branded card. Hope Amex comes back with a bang with new launches. 😀

Hi Sid

Amex is back with a small Bang for now.

Amex to Marriott Ratio.

After 3 years, they are bringing back this offer, but with only 30% extra.

Was expecting this since June 2020. Uk, Canada, Australia, US, every where Alex Rolled out 40-60% additional bonus transfer. But not in India during Covid

Good that atleast now they brought this back

https://www.cardexpert.in/amex-points-transfer-offer-get-50-extra-marriott-bonvoy-points/

Just covered, thanks for the inputs on offers that went live in other countries.

Instead of transferring directly to marriot Bonvoy, you should have transferred to itc green points and from there transfer to Bonvoy.

2 green points = 3 Bonvoy points

Why not redeem Axis points to ITC as 5:4 & then C green points to Marriott as 2:3, so the net would be 5:6 for Marriott instead of direct 5:4

Hi Sujeet and Sumit

Valid point. But only 60k points allowed in a calendar year from ITC to Marriott.

We have hell lot of time to finish this quota.

How did you managed to accumulate 3 lakh points? Did you earn from accelerated reward rate transactions or normal ones

Can you please explain how is 1 edge reward point valued at INR 1+

Would be quite helpful to someone like me who is new to Edge rewards

Thanks in advance

Quote:

Why am I excited? Ofcourse Axis will remove this points transfer ratio soon, this will make them go bankrupt, so I had transferred all the points immediately.

Hi Sid

Told you right, Axis has removed ITC & United Airlines.

Then the ratio is 5:1 for all Marrriott, Vistara, etc.

But Axis did something irritating and unprofessional, after knowing the mistake, they could just rectify it. But since it will take some time to change it on the live portal (Travel Edge) , these people have put on hold for all card users in posting the Milestone points! So cheap of them, really!

Totally disappointed! Thank god I transferred all my points 🙂

Guess, you may have to edit or delete the whole Article now.

But I suggest you to keep this as such—– with Article HEADING ending as *OFFER NO MORE VALID*

This article needs to be on internet to show how dumb idiots are working with Axis bank’s corporate team 😉

I did a check with Axis and i’m told that its some sort of bug, like the one happened during initial days. Let’s hope it gets back to previous form.

But yes, poor implementation whatsoever and that takes peace out of mind for some. 😀

hi sid

all transfer partners now showing 5:1 conversion ratio…

ITC and other options are back….

Wait, weren’t they already leading in cashback category with Axis Ace, Flipkart and Airtel cards. So you mean to say that Axis is set to rule in all credit card segments 🤣.

That aside it is actually useless for people with medium spends, as even privilege/select/priority/Burgundy cards are not included for higher redemption rates. Also, most of the partners are for international flights only. Only air asia and spicejet are good, but air asia has very limited routes and spicejet is very unreliable with delays/cancellations.

Totally, Axis is the talk of the town lately.

I have recently converted my edge reward points to spice club points and came to know that they give 50p value for one point. Can you tell what value other airlines are providing for their points?

Spends is a personal thing but will be great if people can share how we can accumulate points faster on Magnus card. I hope people don’t reply with share your card 😀

What exactly you are looking for?

like HDFC has smartbuy, havent explored grab deals on axis bank. If someone can give a quick tutorial on that? Apart from grab deals, anything else where buying using axis cards give more points, or categories which dont give any points like maybe wallet loads

Am Sure Sid is a very very professional guy. Even if i am gonna spit out the tricks and hacks here, he will definitely approve the comment.

But i may be an amateur to guide you in a right path.

That’s why Sid has this One to One consultation. Avail this benefits to earn in Lakhs.

https://www.cardexpert.in/credit-card-consultation/