Do you fly Vistara economy class often? This card might save you a decent amount of money while you enjoy the premium service by Air Vistara. Apart from the CV (Club Vistara) points earning potential, Vistara cards are special for its complimentary tickets, given based on your spend milestone. Lets dive directly into the specifics.

- Joining Fee: INR 1,500

- Welcome Bonus: One Complimentary Economy ticket

Milestone benefits on Vistara Platinum Credit Card:

When you spend certain # anywhere with your Axis bank vistara credit card, you’re given with milestone benefits as below.

- Spend Rs.50,000 – 1,000 CV Points

- Spend Rs.1,25,000 – 1 Economy Class ticket

- Spend Rs.2,50,000 – 1 Economy Class ticket

- Also earn: 2 CV Points for every Rs.200 spent

That may appear to be nice, but its actually not. You need to pay extra Rs.1,000 or so as “taxes” to redeem these complimentary tickets.

Apart from welcome bonus, on spending about 2.5L, you’ll end up with

- 2 Economy class tickets + 3,500 CV Points

- Tip: Use CV points for Upgrades

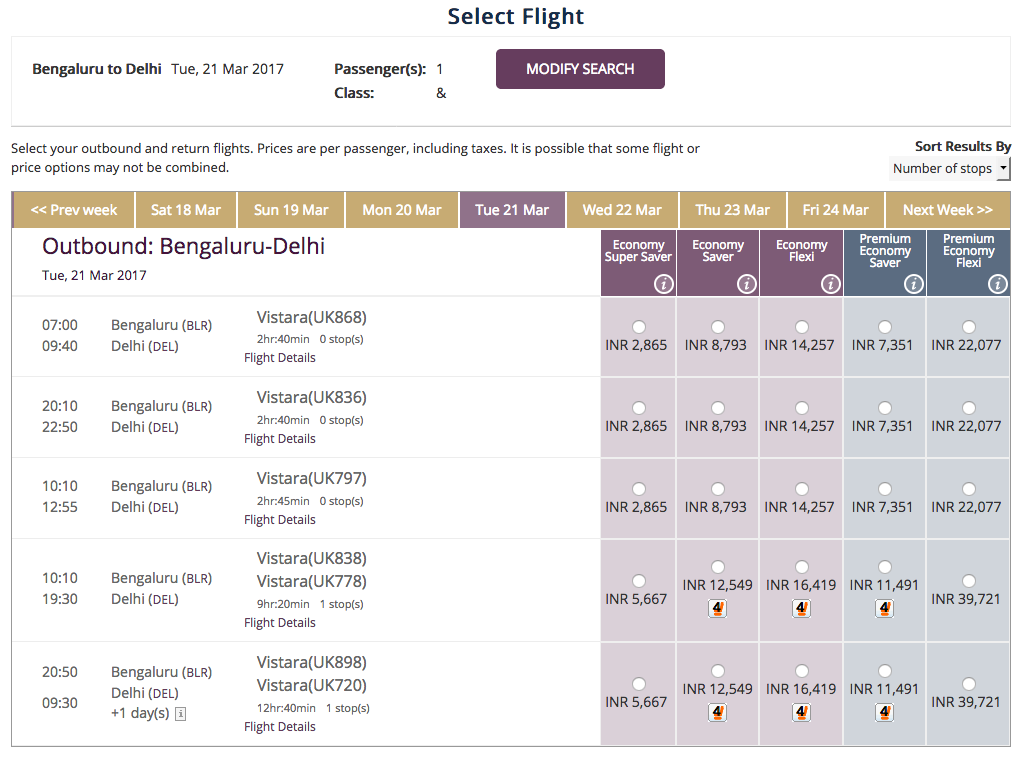

Now, what’s the value of it? For this, i took route BLR->DEL and here are the values

- Approx cost of 2 Revenue tickets: ~Rs.6,000

- Approx cost of 2 redemption’s: ~Rs.2,000

- Savings: ~Rs.4,000 (or less)

In other words, you get <1.6% value back, as you spend 2.5L to save Rs.4,000. Maybe a decent return for most who want to have hands on the Vistara card. But i can rather route my expenses on Diners black and get 3.3% value back with which i can take a revenue ticket without going through the whole process. We can’t compare a basic/premium card though. But just my thoughts 🙂

Features of Axis Vistara Card:

- CardExpert Rating: 3.5/5 [yasr_overall_rating]

- Reward rate: Upto 1.6% as complimentary tickets

- Complementary Airport lounge access: 2 Visits/quarter via Visa Lounge Access Program

- Fuel Surcharge Waiver: Nil

- Foreign Exchange Markup fee: 3.5% + Service Tax

- Renewal Fee Waiver: Nil

- Special Features: Club Vistara Membership & Travel Insurance Protection

As you can see, its a very basic card and it delivers decent value for a beginner. Note that the you can get maximum value from the voucher only on long distance flights. If you’re redeeming it on short distance flights, its better not to take the card, as the value you get goes as low as 1% or even less.

Have something to say? Share your thoughts in comments below.

but what if you can buy a higher base price ticket for the complimentary bit?

Yes, using on such high priced ticket is what is all worth it 🙂

Hi..my bank just tried to sell me the axis platinum vistara credit card. I am a little concerned on the welcome gift of an economy ticket work 8k. Is there any catch on that? Also, would I be better off without the platinum vistara since 1500 annually seems a bit too high to me

To use the voucher, you need to pay taxes ~1k while booking.

If you don’t fly often, its better to go for Axis MyZone credit card instead of vistara cards.

They are giving one economy base fare waived off ticket on joining. So, for joining fees of 1500, can i get a free vistara ticket, going for 6000+800tax now, for 2300 ? That is 1500 joining fee + 800tax?

It depends. As far as i know, taxes are usually around 1k+

But yes, if you can see such fares, you can redeem the voucher for the same.

How much do they take from application to generation of voucher code?? Has anybody got any experience? I have applied today, need to book by 10th Oct. Feasible ??

Taxes are very low. From Bangalore to Delhi I paid around 725.

Delhi Mumbai was around 450

Delhi Bangalore was around 450 too.

The best part is if you reschedule your flight you don’t pay any rescheduling price but only 10% points are deducted from the balance points.

Mine took over a month. And voucher code will only be issued once you pay the joining fees. So no point on banking on that.

I want this card but am not a customer and axis bank wants 6lpa income proof.

Why don’t they issue it card on card basis?

I don’t think Axis does card-on-card. They rely on txn’s or income doc.

Hi Sid

Seems someone called me from my axis bank branch claiming vistara platinum to be LTF for me , is this a legitimate call or is it fraudulent?

Hi Sid,

Is this free ticket available for out of India?

I got a call from axis bank and they offered me “Axis Vistara Platinium Card”.

Offering free tickets (To and Fro) on 1500 Rupee payment for which is applicable for international flight as well.

Can you please confirm if I can book international tickets on this offer as well.

No. Domestic only, for now.

Can I get economy ticket to join vistra plantinium card

I think 3 tickets per year is a very good deal compared with even what most premium cards offer. You took the example of ticekts costing 6k for return, but I’ve got free tickets (1000 to be paid as taxes) when the market rate was 15k (booked 2-3 days before travel).

Having tried a few other cards and understanding the redemption rate game, I’ve come back to this card, now with the signature variant.

Supposed I have 3 Codes received . Can I use 3 codes same time and Same Journey

Supposed I have 3 Codes received . Can I use 3 codes same time and Same Journey. Please confirm

Do I get access to MasterCard lounges with a Visa credit card?

Apparently, the lounge at Kolkata airport is not there in the Visa credit card list. Axis Bank officials said that I can access lounge with visa credit card . But I am not sure.

So, here is my experience with the Axis Bank Vistara Platinum application process.

I was traveling from DEL to BOM in the last week of November when I saw an Axis Bank Kiosk at T3 Airport. I went to the kiosk and asked the sales guy if there is a way by which I can apply on a C2C basis. He told me I can apply on C2C basis only if I have a Jet Privilege Card or else, I’ll have to share my salary slips or ITR.

I remembered someone here discussing that one can apply for the Vistara card if he/she has flown in Vistara 2 times in the last 6 months. So, I asked him if I can apply with Vistara Boarding Pass. So, they told me they can process the application if I have flown in Vistara for at least 2 times in the last 6 months. Interestingly, I had Vistara Silver Tier (thanks to SBI Card Prime) and I was flying Premium Economy that day. The guy shared my CV ID with someone on call and said I can apply for any Vistara Card without any income documents. The guy took the boarding pass copy along KYC documents.

One week after applying, I received an SMS stating that the application has been received by Axis Bank and the office verification was done on the following day. Exactly 21 days from the date of application, I received an SMS stating that the application was approved.

As I have read many comments of Axis Bank Card holders that Axis is not good in terms of granting limits, I was hoping of getting a quite low limit on this card. Shockingly, this card came with the highest credit limit of all the 7 cards that I hold already.

As per my experience, Axis is most generous for high credit limit approval.

Hi Himanshu,

1. Are you Salaried or Self employed? I hope they would have taken application through Tab or did they take application through paper?

2. If you are Salaried, how do you know they are coming for office verification? I have applied for so many cards but I never had any instance somebody calling me for verification even when I was Salaried, everything happened in backend.

Because if we apply through tab, the application confirmation should come instantly. Hence I asked.

Hi Sharath,

1. I am Salaried. They took the application via paper. Though I did not ask why he is not taking the application via the tab, I asked how the whole process works. The guy told me that the application along with all documents will be sent to Axis Bank’s main processing center which is in Noida. There, they will upload the application details and then it will be processed. Maybe that is why I received the application ID one week after applying the application. The CIBIL inquiry was done on the same day of receiving the application number.

2. Actually, this was the first time when the bank has verified my address. The verification guy came to my office reception and asked me a few things that I mentioned in the application. I had no idea that someone was coming for office verification.

I paid a bill of INR…… to Vistara card. And by mistake I paid the bill twice for the same amount. Axix bank relationship manager then told me, the amt will automatically come to my account. But it did not come. When I contacted Axis customer care, they deducted unbilled amt by the date of refund and gave me balance amt.

This was not expected from Axis Bank.

Shame on Axis credit card division and their services.

I AM USING AXIS BANK VISTARA PLATINUM card BUT when i returned the billed amount on & before due date upto june 2020 the rest of EMI genereted by bank was not closed on scheduled write off done before the expected time. so it was not expected from bank while contacted Mr. Dinesh sir told on phone that within a week you will get reply but still i didnot got any answer from the concern authority………………… i am happy with using the card but unexpected amount of billing done by credit card section on transaction is not as per schedule explained …….at the time of getting card…………… also even after using 2 years of card usage.. no benefits of free ticket has been given by the Vistara airlines or by the axis bank system.

If i joined this card by paying 1500 and want to book a ticket tomorrow and the cost is 10k-15k for the flight, so can i redeem the voucher and book ticket by just paying 1000RS as Tax ? so the total would be just (1500 joining fee)+ 1000 tax = 2500RS for a one way ticket ?

Hi,

Have anyone tried extending the validity of the complimentary ticket received on renewal.?

Any information on the process, charges will be helpful as I’ve one unused ticket expiring next month.

Thanks

When we book through complementary ticket. Does this Chd-Delhi-Goa sector ticket count as one ticket?

My credit limit for this card is 1.25L monthly.

Axis bank is saying that this is the maximum limit they give for this card. Is this correct?