As you might know, American Express India has been very cautious when it comes to Credit Limit Enhancements on their cards post Covid-19 pandemic and the credit card issuer kept the requests on hold for almost a year now.

This is because they were generous with the limits previously and maybe don’t want to take too much risk post covid.

However, Amex started taking credit limit enhancement requests from 18th Jan 2021. but, there is a slight twist in this.

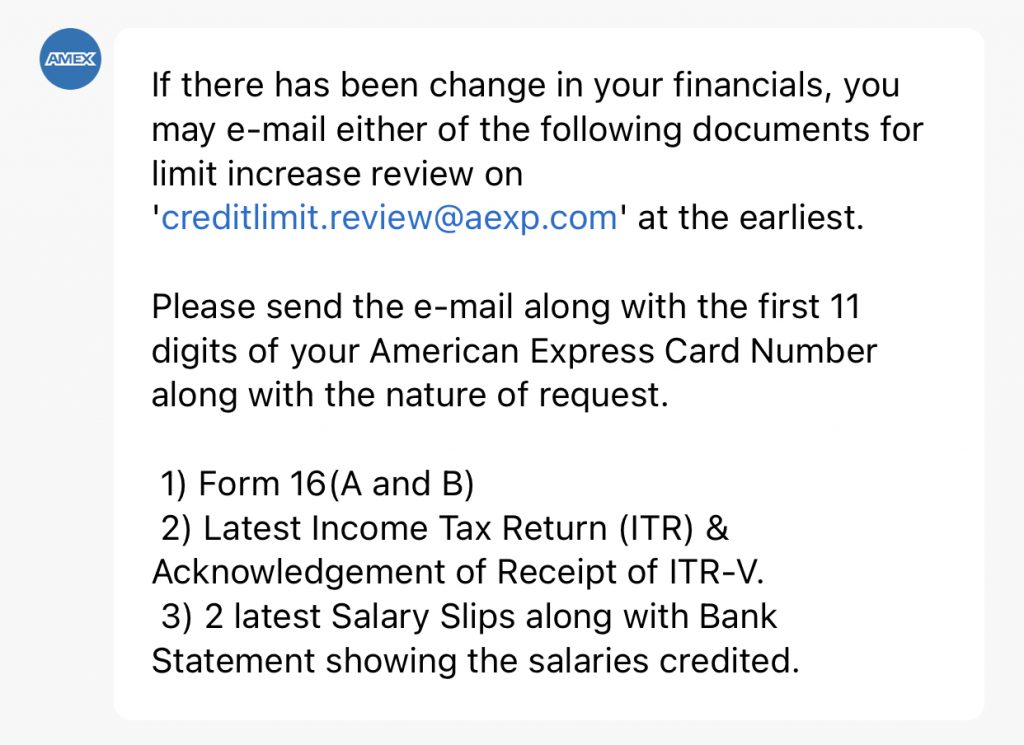

Earlier, they used to enhance the limit instantly over the call simply by sharing the updated income orally. Now, you will need to email them the updated financials, post which the review will happen.

How to Request for increase in Credit Limit?

Check out this response from Amex chat rep. It might take upto ~7 days for them to process the request.

The Issue

The issue with this kind of requests is that you will not know how much limit is being offered to you before you choose to take it or not.

For ex, they may offer you a limit enhancement of Rs.1,000 just like how I got sometime back and once its updated you’ll need to wait for next 6 months to request again.

Best Practices

I wouldn’t suggest to request for a limit enhancement if the spends are too low on the card account, as they usually factor in both the spends & ITR to decide the new limit.

Final Thoughts

This new method doesn’t make any sense actually because the updated financials would be for the period FY 2019-20, which is not very much affected by pandemic.

But, maybe their idea is to slow down the requests so as to reduce the potential risk. Surprising thing is how HDFC affords aggressive limit enhancements even during pandemic!

Anyway, something is better than nothing. Do let us know how these requests turns out for you. I’ll share my experience in a week time, stay tuned!

Hey Sid,

I was being offered a higher limit without me raising any request or providing any financials. I was issued the card back in September and this week i got a higher limit than the one i got during card approval. Approximately 20% higher.

Interesting. It’s quite rare for Amex to send Auto LE offers in my experience.

Sid, I don’t agree to you

I was also offered LE twice in past from amex.

While no other bank offer me LE automatically and without documents even though I have good spends + good salary in mnc.

I’ll just say amex play different game than other providers, same might be the reason they offered me LE while other banks specially hdfc do not offer me.

Well sid, i have got multple times auto LE offers . i remember multiple times getting Auto LE emails.

If you never ask, they do. My companion Reserve gets LE at least once a year, except 2020 of course.

Do you mean an auto LE on the Platinum Reserve upon usage or even without spending on it.

@Amex Guy – I am still waiting for that CiTi UI card which you had hoped to get in 2017-18!!

My Reserve is still stuck at 2.5lac yes it did have a LE when I requested with new ITR @ 33lac of Rs.5,000 in 2019. Yes Rs.5000 LE maybe because I hold a lot of cards or have an auto loan IDK what the reason is but still have sent them new ITR lets see what they do.

On the other hand is it really logical to hold Reserve anymore have still requested a gold change card as a companion card to it. The customer care has taken the request and product team will call up but they said its a hard sell and instead of a gold change card they would give a Membership CC as a companion card which I dont want.

Congrats. What was your spending amount and pattern ?

I pinged the amex chat rep now and they asked to call the credit team directly… didn’t say anything about docs ..

Spent around 26 Lakh Rupees (across 3 Amex cards on my account) in the last 13 months. Happened to enquire about a limit enhancement today, was asked to send in the financial docs. Have a remarkable spend + payment history with AMEX for the last 7 years. I was a bit surprised to hear this.

It’s due to Covid-19 related hiccups. CIBIL and all credit bureaus would be useless going forward for a few years. See it as restarting of economy from 0.

The biggest point to remember here is that Amex is just a Credit card company. Whereas HDFC or any other bank is a full time bank with 100 different options to make money out of a customer. With that keeping in mind, the risk factors for amex and any other bank would always be different.

@ Dhaval – AmEx India is not just a credit card company. It has license from RBI to operate as a restricted, scheduled bank to carry on its’ travel-related businesses (apart from credit cards) and also receive institutional deposits (with pretty good RoI i must say). It also provides payment solutions to corporates and other entities for their purchases like inventory, fixed assets,payroll cost and other expenses.

It’s American Express BANKING Corporation.

I’ve been limit enhancement by HDFC , Kotak & Amex without any document in last six months.

Amex denied the LE due to no recent ITR “Internal company audit delay” so thats it and I can request for LE now after 6 months I guess. BTW according to them spends of 40-50k per month on a Reserve merits 2.5lac limit and only ITR can give any upliftment now a days.

Amex declined for LE on Platinum Travel card. The executive simply said that he has checked current outstanding dues and that was pretty less so I should be using my crad more. This was the most lame excuse I got as I have been paying my dues as per my convenience but also been using the card regularly. How can the “current outstaing” be a measure of average usage?? Very disappointed. They could have simply said that they are still not taking request for enhancement but this was not at all expected from AMEX.

Amex offered LE today. Though i haven’t requested for any such limit enhancement. And to my suprise they have increased the limit 4 times. No such income proof asked. Just they simply called me and asked for consent for limit enhancement and its done.

Wow Rohit congrats. Could you please tell us about your old and new limit. Also age, type and spends on card. It will help a lot of us.

Siddharth I will be completing 6 months this 20th of April on my SmartaEarn card. My total spends is about Rs. 1,00,000 only and my ITR is of Rs. 6 lakhs. I want LE. So should I ask for it or should I wait for automatic LE ? Is more spends required ?

If you’re nearing the existing CL, you can ask for LE. I see auto LE rarely happening after Covid. More spends always helps.

My current limit is Rs. 55,000 and I utilise about Rs. 5,000 – 15,000 every month.

Usage is quite low to justify the LE request.

I was offered a 25% increase on my MRCC card last week. Just had to give my consent through SMS. And this was even before the six month statement.

Very interesting. Haven’t ever heard Amex doing LE before 6 month period.

Upon my request my MRCC’s limit was enhanced from Rs. 80,000 to Rs. 1,00,000.

Today I got a beautiful email for limit enhancements offer from Rs. 1 lakh to Rs. 2 lakhs. I accepted it and the new limit reflected immediate. Important thing to note is that just about less than 2 months ago I manually requested for LE and it was enhanced from 80k to 100k.

Received spend based limit enhancement from my existing limit to ₹6.00lakh.

“Reach the spend milestone of ₹1,80,000 in the next 90 days* from the date of enrolment to enjoy the enhanced spend limit of ₹6,00,000 on your American Express Card.”

Spends (net of cashback and reversals) on the enrolled Card within 90 days from the day of enrolment will be considered.

Enrolments done from 3 July 2021 until 2 August 2021 will be considered eligible under the offer.

Offer valid from 3 July 2021 until 30 October 2021.

In case spend milestone not reached, the credit limit will be reinstated to original value.

Curious about this offer. Was it likely due to minimal to nil usage?

To avail the spend based limit enhancement offered by AMEX, can an individual subscribe ₹60000 per month for three months in Tier II of NPS and withdraw the same after one month to meet the condition mentioned by AMEX.

Is subscription to NPS Tier II treated as “spend”?

Contributions to NPS beyond Rs. 50,000/- per year via credit cards can raise red flags. The card issuing bank can request additional income documents.

Got LE from 1.95L t0 2.5L without raising any request. Have just 65k spends in last 4 month but this was sweet.

Got issued Amex Plat Travel with limit of just 50k 1 year ago. With a total spend of over 5 lacs in entire year, haven’t received any mail for LE. When I asked them to increase the limit, they asked for ITR which is double of last year(~9 lacs). Still, the LE request got declined. Don’t know what more they want.

Do you pay off most balance before the statement is generated. Amex has a quirk. They consider only billed balances for evaluating limit enhancement (for LE requests from customer.)