Ever since Yesbank has arrived in the credit card sector, it has been turning out to be one of the most aggressive bank when it comes up to matching rival bank’s offers. With their top of the line Yes First Exclusive Card, they have directly taken HDFC Infinia and Citi Prestige Like cards head on. One of the prime reasons for holding HDFC Diners Black card in India is the generous 10X program.

What if I told you Yes Bank has now decided to take Diners Black head on? Too good to be true right? This is precisely what has happened. Yesbank has introduced Festive Privileges offer that gives you an opportunity to earn 10X points with partner merchants and upto 2X points with non-partner merchants.

Yesbank’s Festive Privileges Offer:

- Offer Period: 10th October 2017 to 31st October 2017

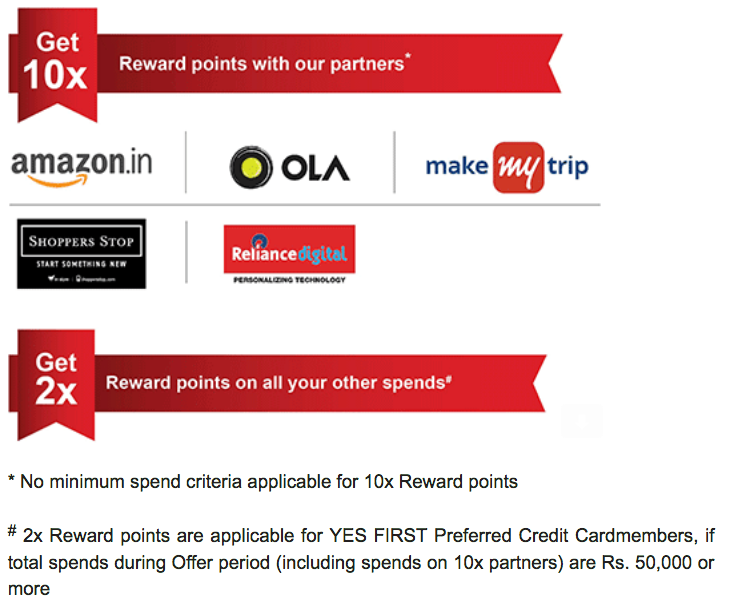

- 10X RPs on spends done on partner merchants. No minimum spend criteria.

- 2X RPs on spends on non-partner merchants (Any other spends online/offline channels besides the partner merchants) IF the total overall spends during the offer period (Partner/non partner merchant transactions) crosses ₹1 Lakh (₹50,000 for Yes First Preferred Cards)

- List of Partner merchants: Amazon, MakeMyTrip, OlaCabs, Shoppers Stop and Reliance Digital.

- Maximum points that can be acquired during this offer period is 1 lakh Bonus RPs. Understand that Bonus rewards points is the extra points, that is 9X and 1X that you are getting over and above the normal earning rate. So, if your bonus RPs somehow exceed 1L RPs, in that case the max cap of bonus RPs is 1 Lakh and you also earn the regularly earned points.

- Example: A person spends 1 Lakh by Yes First Exclusive card on Shoppers Stop (Standard RP- 10,000, Bonus RPs- 90000) and 2 Lakh on non partner merchants (Standard RP- 20,000, Bonus RPs- 20,000). No see that the total bonus RPs is 90,000 + 20,000 = 1, 10,000 RPs. In this case the bonus RPs will be limited to 1 Lakh only. Therefore he will earn a total of Standard RPs (10,000+ 20,000) +Bonus RPS (1,00,000)= 1,30,000 RPs

- Spends will be considered for this offer both for Primary as well as Add-On cards.

- No codes or any app/website specific spends are necessary for these RPs

- Fulfillment: 31st December 2017

What does this mean?

- Yes First Exclusive Base Rate Earning capability is 2.5%. With these offers, you’ll earn a cool 25% value back with partner merchants and 5% with non partner merchants.

- In total you can earn a max of 1 Lakh bonus points. That means you can earn bonus RPs worth ₹25,000 over and above the normally earned RPs that you earn.

- There is no coupon code that is applicable for getting these RPs, as a result you can club the offer with all existing coupon codes for the websites. This is specially good for MakeMyTrip as HDFC Diners Used to put a restriction of using coupon code for getting 10X and 5X points back then, therefore the site specific discounts could not be availed if you used the Diners Black or HDFC Coupon Codes. This is not the case here. You just earn extra for any bookings that you do now.

- The offer also includes, offline partner like Shoppers Stop for all those who love Offline Shopping.

- Just as Uber has partnered with HDFC Diners Club as 10X merchant, it’s good to see now Ola Also grabbing some lime light along with Yes Bank.

- In a Nutshell, it is a great offer and there is no restriction on kind of items that you buy from any of these merchants. I am quite sure, you’ll even get 10X points for Railway tickets that you buy from MakeMyTrip. It cannot get any better than this.

We’ve been recommending yesbank cards for quite sometime knowing how aggressive they can become in coming years. Just incase if you’ve missed it, check out: Why Should you Apply for an YES Bank Credit Card

Are you excited to know about this offer? Will you be making the most use of it? Do let us know your strategy for spends during diwali with Yes First Exclusive/Preferred or any cards you hold. Sharing is caring. Happy Diwali in advance to all our Readers..

If I am not making any spend in the merchant partner and I am making more than 50000 spends in non partner merchant through online, am I still eligible for 2X offer. I think so, Plz confirm

Yes, you are eligible!

Hi,

This is an awesome offer. As per the offer, 10X is valid even for Ola Cabs. Do we get 10X RP for loading on Ola Wallet? Or is it only for direct card payment in Ola Cabs.

You should be getting 10X for Ola Wallet. I’m quite sure about this.

I have actually loaded my ola money wallet this morning even before the offer was rolled out. Lucky me 🙂

In OLA loading money in wallet or directly paying for cab via cc SBI SimplyCLICK offers 10X points

Best guess is it will same with yes bank offer as well.

Finally….. I have also received this Offer !!

Phew .. I kept on waiting for them to include me ( a new Yes First Preferred User) in their Offers and its here.

Yes, this is a Really Amazing Offer esp. considering the Partners – Amazon, MMT, SS , Ola (All top in their respective categories)

Query-

One of the T&C points is :

“The Offer is applicable only on Retail Spends done using YES FIRST Preferred Credit Card”

[Refer to Point no 3 in section : Who is eligible for the offer]

Can someone through more light on this ??

Does it means Utility payments or Bill Payments not covered??

The offer is for all Yes First Customers. Well, it’s difficult to say as of now but it seems it won’t be counted. However if you spend it through other apps like Paytm or PhonePe or FreeCharge it will be counted as Retail Spends.

They should explain “Retail Spends” more clearly in T&C

I’ve already checked with them about this. Retail spends are (according to them) any spends other than fuel. They told me that utility bills counted as retail spends.

Great!!

Retail spend would typically include spends excluding balance transfers, cash

withdrawals, charges for cash withdrawals, annual fees, interest, finance

charges, and any other such charges.

Is this valid for Yes First Business card as well ? Yes Bank is now not giving Yes Preferred & Exclusive to business owners. Not even on a card on card basis.

I am not really sure my friend.

Like last year Yes has again tied up with Paytm and together they are giving cool 15k cashback in iphone 8.

I have got a new Yes Exclusive card some 20 days back. I have not yet received any mail on the offer….Will I be eligible for the offer

Yes you should be. There was no mention in the terms and conditions that this offer is for select customers. In my understanding, this is for all Yes First Customers. So definitely go ahead and make the purchases. Besides I too didnt get any email. All we got was an SMS.

I got the card a week ago. I called bank, they did mention that I’m eligible.

Can you post the link to actual webpage?

Its already there.

Maximum points that can be acquired during this offer period is 50,000 Bonus RPs for Yes Prosperity Edge Card.

Cool.

Can we Buy Amazon gift card or bank card from amazon.in to use this offer?

Yes

Only problem is now is keeping track of all bonus points

In Aug 10 Days Festive Spends Bonanza

In Sep Enjoy DOUBLE Reward Points on ONLINE Spends!

in Sep 3X Reward Points on spends 20th to 30th September 2017

In Oct This one

Yes Bank is in high gear

I got the mail today regarding this offer. It is really amazing that Yes Bank is providing such great offers almost every month..

Hi all

If you use Samsung pay and yes bank cards you can get upto 1500 cashback on 5 transactions of atleast Rs. 500.

This offer is applicable for prosperity edge customers too! 25k limit for 2x. 10x partners remains same.

Great!!!

Does lic premium payment count as retail spend ? I have a sizable premium to pay.

Apart from this offer, i have also recieved an offer for additional 1% cashback for international transc. I have done few international transc today. Will it count for the initial offer of 2x reward point or it will be treated as separate. I asked CC they said i will get 1%cashback from offer2 + 2x rewards points from offer1 😀. Not sure if its true.

Yes that’s true.

Will the offer be valid if we load Amazon pay balance?

Yes. I think so. We get 10X points for Diners . It should be the same with Yesbank.

I am from Patiala, i tried apply online for yes bank prosperity edge but my city is not listed their, also i am not a yes bank customer, i have HDFC REGALIA CREDIT CARD with 6lac limit, CAN I APPLY FOR YES BANK CARD IN PATIALA BRANCH ?

No in all probabilities you can’t as Yesbank might not have started sourcing their cards in Patiala. You may still visit the branch and ask them if they can. If yes then do that.

Hi I want to apply for a yes first exclusive credit card. I am fine with paying the charges for the same. However, it seems they have a requirement of 50 lacs yearly income. However I do have diners credit card. Is there any way I can still get the exclusive cc?

If your Credit Limit is 8 Lakhs or more on your existing card, then you can get the card LTF. However, if you don’t then you have to resort to the ITR/Salary based criteria of ₹50 Lakh/annum which is ridiculously high for most people in India if not all.

I hold a Diners Black with a limit of 7.8 L. Will I be eligible to get this Yes First Exclusive LTF card? I can in no way meet the income criteria as they mention.

Card on card limut is Rs.8 L. Try and get the limit increased first. I the meantime talk to Custcare of Yesbank about eligibility can it be lowered inyour case.

Hi Roy Sir!

I appreciate you & Siddharth for keep sharing and energizing us.

If you load ola money & transfer it to any bank means ola charge us of 4%+gst. Total money transfer limit is 25k per month for ola account.

I am holding yes first preferred. In this manner if I do transaction for 25k means I loose approx 5% right away. But I will earn 10x rewards ie 20% . So the earning amount is Rs. 3750(15%).

Am I right Sir’jee?

Hi, thanks for the kind words. Yes, you are correct. But problem is just like any other wallet, Ola Wallet too would be having a limit I guess.

T&C for the offer

YES BANK reserves the right to disqualify/ exclude any merchant establishment or Cardmember

from the Offer, if any fraudulent activity is identified as being carried out for the purpose of availing

the Offer or otherwise by use of the Card

Now if all of sudden you use the card at offer merchants for a high value transaction or for the first time it set in motion a lot of risk management tools at the banker end as well as merchant end…. the result of which could be in your favor or not.

Wont be a problem as long as someone misuse wallet load for w/d. They got enough time to disqualify them if needed!

I hold a Preferred card from Yes Bank. I was trying to calculate how much we need to spend with a partner merchant (say Amazon) to earn the max Bonus RP of 100,000. On Preferred card, I earn 8RP for every Rs. 100 spend. So differential 9x rewards work out to 72RP for every Rs.100. Therefore to earn 100,000RP, I need to spend Rs. 138,888 on Partner Merchants. I checked with Yes Bank and there appears to be no restriction on buying gold or jewellery (say from Amazon) under this offer. I am thinking of buying MMTC gold coins from Amazon to earn these bonus points.

Hi Siddharth and Abhishek,

Is this Offer extended to Yes First Business Credit Card as well.

Interested to know how does Yes Fist Business CC compares to Yes First Preferred CC.

Thanks

Difficult to say my friend. will let you know if we know.

Ues Bank has recently launched uber ultra hyper premium credit card recently. It uses master card world elite platform. Yes bank is first bank to bring this platform in india. This credit card will be invite only card. Yes bank announced that only select 2500 people will be given this credit card. Not much info available online regarding this card.

If anyone gets more info kindly share here.

If possible please write an article on said card.

Regards

Yes. A review will soon be written by Sid.

Guys.. Payzaap also charging 2% charges from Nov 7th onwards… All wallets closed…

HI,

1) Anyone here got an upgrade from Yes Preferred to Yes Exclusive. I got the Yes Preferred card in April ( was told Exclusive has stopped issuing on Card on Card basis)

I was told, I can get an upgrade in 6 months. Now they are refusing an upgrade, with one reason or another.

2) Also, anyone applied for a New Yes Exclusive card on Card on Card Basis. What is the criteria you are told?

I asked them if cancelling this current Yes Preferred card and applying a fresh Yes exclusive will help? That too they tell isn’t possible.

Reason given, my CTC has higher variable component, they want a higher fixed CTC, only then possible.

What are the qualifying criteria?

I hold HDFC Diners Black with 5.75 Lacs credit limit.

Yes, i’m hearing this recently about Yes Exclusive. It looks like most cards they issued Card on Card not giving them expected returns, so they’re sticking to income levels.

In such Cases, spending high + high relationship value + 6 months card age should help for upgrade.

Try posting your form-16 to chennai office with upgrade request. Worked for my friend.

Thanks Suresh and Sid

Local Branch Manager refused Upgrade. Let me try the method to mail details to Chennai Office.

HDFC Diners Blacks asks for 1.75 Lakh Salary. These gusy asking for 3.25 Gross per month in salary slip.. Seems very high. Some corporates may tailor the CTC to benefit employees, so shouldn’t bank also look at ITR / FOrm 16, rather than monthly salary slips..

Regards,

Manav

The best deal using this card at the moment would be to buy iPhone 8 from Reliance digital. They are offering 70% buy back on the phone. This is what the deal looks like:

IPhone 8 price: -64000

Jio recharge: -9995 ( 1 year)

70% Buy back: 44800 (in vouchers)

10x yes bank Exclusive: 16000

so effectively you pay Rs 13195 for 1 year use of iPhone 8 + Jio 3 GB daily plan.

Additionally if you are in businesses you can avail GST Input ( Rs 5800) + depreciation claims.

Isn’t the deal too tempting ?

Yeah. Indeed. It can’t be any better.

I checked after seeing your comment, Reliance Digital said they cannot issues b2b invoice with my company’s GST number on it. So you can’t really claim GST input, unfortunately. Still the best way to buy though.

Guys please cover StanC 5% cashback offer. The offer might not be as lucrative as this but still it is great as there is no restriction on spend category .

Informative article Dr., and thanks for that

Can you please make us more informed on recently launched HDFC Bank EasyEmi on Debit cards.

Cheers!

Will do. Thanks

Hi!

pl let me know if entitle for 10X if load in amzon pay wallet ?

Regards

I think yes

Happy Diwali everyone.

YesBank gave low Credit Limit on Regalia Card-on-Card basis to me…. just 20% of Regalia 5L limit…

Whereas on same Card basis, IndusInd gave me a 5L limit….

Now due to this 10X offer, I am already consuming nearly 60-70% of my limits….

Hope, they increase my limit in future!

Yes, they did the same with us too.

Did the Credit Limit got increased later ??

Yes

Ola money now has stopped wallet to wallet and wallet to bank transfers for non KYC customers and limit also 10k only now. So we have to request for wallet upgrade for any money transfers and more limit.

Not sure if the receiving person also needs to have a upgraded wallet in wallet to wallet transfers.

Btw I will still load around 10k in ola money wallets for getting this 10x points.

Are emi transactions for phones/tv on amazon eligible for 10x offer ?

I think yes as Yesbank no where mentions that EMI doesn’t accrue points unlike HDFC which has specifically said so.

How ola wallet is upgraded and bank transfer is done?

Please help.

Thanks.

Anyone got reward points for the 1st offer 3x spends on all payments whose cutoff date was 31st October ?

Not till now…

Still have few more days left. Let’s wait and see.

I got the points

I am able to see the bonus points added to “Reward points – Earned this cycle”, its showing total of (bonus points + current unbilled amount points).

I have still not received the points.

I am talking about the offer in September. Sorry the fulfillment date is Nov 30.

I am not sure about this, have seen in some otheer forum

That there is an probability of income tax notice on the card u spend(usually on high spends in an year)

Any idea about it?

I am a bit concerned about my yes bank preferred card

Banks report to IT Dept if you spend more than ₹2Lakh in a year on your credit card. That is common. You will get notice only if they think you are not properly filling up ITR. Like say for eg your ITR is less than your credit card spend in a year. Then may be. Otherwise not.

Like for example in year 2016-17 i have my savings as 5lac and filed itr of 6lac

Now in year of 2017-18 my card spend is 8lac, and itr will be 6.5lac, is there any chance of getting notice? As the savings are there to cop up the card bill?

Not sure about it

Yes, the notice you get is through email for compliance. You can very well say that the extra expense is through your savings.

Hi Rishi / Abhishek

Kindly note

Cc payment in FY exceeding 10 lacs is reported nowadays. (Payment through bank account/ electronic mode)

If it is cash then, over 1 lac.

If you have the income don’t need to worry or you can spread your spend on various credit cards.

Enjoy!

Ok is it? Thats great.

Thats a different information what i have from one of my friend named google and a very good friend who works in income tax

As per him the total spend on ur card if is >2lac, it will be reported to incometax.

I am just concerned about what could be the impact on my PAN if my ITR (which to be filed) in the coming year is less than the total debits on my card(FY). Along with a saving which was used to help paying the card bills.

Logically i have paid tax on whatever i have in saving and should not make impact on me.

But (not logically) what actually can be the impact in above scenario.

In plain and simple language- NOTHING. So don’t sweat it out dude. Take care and declare returns honestly.

Hi,

Will it make a difference if payment is made for let’s say cousin for a cellphone or huge LIC payment via credit card for which corresponding cheque is received ?

The same can explained to the IT Dept ?

Thanks.

As long as you’re spending within your yearly income – without any manufactured spending, you should be fine. As even if you get a notice, you can answer.

Hi Guys,

Can any one review Yes Private Card?

Cheers,

Kiran

Yes. In sometime yes.

Dear Siddharth

Yes bank launches new super premium credit card… Yes Private in Mastercard World Elite series

Any news for extension of 10x or 2x?

It is over. No extension.

Interestingly…. Someone was mentioning tracking of Bonus Rewards Points crediting in Credit Card in above Comments…

In this regards I found IndusInd to be most transparent and clear…. They mention Points earned against Each Transaction in the Monthly statement….

This is just Great from IndusInd…

Unlike Yes , Hdfc etc where they mention just the accumulated points and one does not know where he has got the points / where he has not….

(Or, has to maintain a tracker to chk Reward Points )

Kudos to IndusInd for this Transparency…

I second that.

Yes also better in this aspect, This month I got Bonus reward points and I got SMS and Email stating that I got 20k bonus reward points for the September spends

Even American Express I saw the same. They have a full list of transaction and point you get or don’t get..

Its fully Transparent..

also, I forgot to mention that IndusInd also mentions Merchant-Category against each spend….. I do not know the Usefulness of this currently …. but still find it extremely good step for Transparency from IndusInd.

Definitely this kind of transparency ( from IndusInd) is a neat feature for consumers like us.

Amex is definitely very transparent in thr rewarding system and in my ICICI Rubyx VISA statement also I get number of points earned against each transaction. Though adding merchant category to each transaction helps in some cards like Kotak Feast

Received around 28k rewards points for offer which ran from 22-31 Aug.

again 3x & 2x spend based offer from yes bank from 17/11 to 26/11.

Hi Sid

Details of new 3x/2x :

Spend period 17th November 2017 to 26th November 2017

The maximum bonus Reward Points is capped at 20,000 RP.

Fulfillment on or before 31st January 2018

Targets are personalized.

Hope you got the email/ sms too. 🙂

Yes, i did receive as well. Looks like they’ll run this spend based offer every month-end as they’re doing so for past few months.

Where did you see this offer? Unable to find details

Everyone has received in their email.

I haven’t got the SMS/email 😐 Probably it’s targeted to people with lower spends

Might be the case.

Got SMS and email yesterday

OFFERINGS DESIGNED FOR YOU

Earn 3X Reward Points Spend Rs. 96000

Earn 2X Reward Points Spend Rs. 77000

Offer Period: 17 th to 26 th November 2017

Terms & Conditions:

Offer available to select YES FIRST Credit Cardmembers only

Bonanza Rewards will be credited to eligible Cardmembers account by 31 st January 2018

For detailed Terms & Conditions, Click Here

Yes, everyone has got personalised offers.

The spend limits have been increased considerably for the same offer from before.Is it just me or for all?

It is based on how much you routinely spend. Personalised offers

My Limit is 1.5L and every month, I am spending more than 75% of my limit.Last time I got below limit for September 20th to 30th

Earn 3X Reward Points Spend Rs. 119000

Earn 2X Reward Points Spend Rs. 101000

Offer Period: 20 th to 30 th September 2017

If I were you, I wouldn’t use so much of my limit. Ask them to increase your credit limit if the card is at least 6 months older. Your spends are quite on the upper side, so that’s why your target range is more

Hi All

The limitation is that bonus is capped at 20K which you will achieve on spend:

A. Rs. 1 Lac with Yes First Exclusive. (total 30k points = 7.5% returns)

B. Rs. 1.25 Lacs with Yes First Preferred. (total 30k points = 6% returns)

No bonus over that.

I too received a mailer and sms from yes bank for 2X and 3x offer. My targets are awe

some though 10,000 for 2x and 15000 for 3x . Just perfectly timed for insurance premium payments 😉 anyone has thoughts on how lic premiums can be paid through credit card and avoid the convenience fee ?

I haven’t paid LIC premiums before. So no idea. However, do their online portal charge convenience fee for the same? You can also create standing instructions with Yesbank for the same.

I think Convenience charges are waived off for Online payments (Digital India)

… Bigger issue seems to be that LIC Premiums can be paid atleast 1month before the Premium Due Date…

If I do the premium payment through LIC website , the payment gateway is billdesk and there are various slabs of convenience fees based amount paid. If the payment is done through ewallet there is no fee. I did a couple of payments through different wallets and it worked. Now my last policy premium is more than 20k so I cannot use the ewallet workaround as there is a rbi cap of 20k per month per wallet.

See, in most cases for payment through e wallet, if you allow the transaction to occur, you will be allowed to fill up credit/debit card details. Such transactions are not counted towards wallet loading in which you are try to pay to the merchant directly. Don’t top up the wallet 1st. Just land on the wallet page and it should tell you to recharge due to insufficient funds.

Use jio money. It has 1 Lac limit. I used for LIC only through yes first. I loaded jio money 1st n then paid premium. Got normal points too.

I too received the same milestones. Om yes prosperity it is 5X om 7500 and 3X on 5000. Yes bank is proving to be a better card and giving tough competition to other. These offer do make people to forcefully spend.

Rahul,

Sure that Jio Money has 1 lac limit? i tried for lic payment of 30 k in august. it didnt go thru. ( seems its 20k)

Balpreet

Oh yes. See we have to use adhar card for jio. That’s why it’s fully compliant Kyc account with limit if 1lac. Call customer care of jio money n get clarity.

Yes… I have too received 3x / 2x customized offer..

YES CC is seriously after making major inroads into Top 3 Positions.

Getting Aggressive Offers every month !!

Now I am Sure That they will again have an Aggressive Dec-Jan New Year Offer too !!

Hi!

I have also received offer, however limit is only 20K bonus points which is very less comparative to earlier offers

Offer is back for Period: 17 th to 26 th November 2017

How to Stop Physical Statements in Yes CC ?? and keeping ONLY Email Statements

There is no option in Internet Banking & Yes App.

You have to call them and ask them to do this. On the other hand the form that you fill up while applying also has the option of only e statement.

I think you need to call them and do this for you.

Did anyone received 10X & 2X points credited onto their Card account?

Has anyone received the 3x/2x points for the september offer. The due date was november. Ita december now.

Yes, I could see the bonus points added today.

They would be credited once Statement for this month is generated

I received today

Received around 19k points for transactions done on Yes first preferred card in September.

Received the points today.

I got points but not sure whether that is only for 2x on online spends that was there till september 20th or for 3x./2x also. Anyhow will get an email in another 2 days from yes

Yes Bank bonus Offer spend ₹20,000 and get 5000 bonus points.

Offer validity 16th December to 31st December

Received points for october 10X spends today. Also december offer for me is 5000 points in 15k on prefered and 2000 points on 10k on prosperity card.

Cool. I’m yet to receive the October 10X though.

I received 40 K reward points for 10X and 2X offer few days back.

Did you receive any emails as Yesbank always emails regarding the bonus points. I didn’t receive any emails but I did receive the bonus points I guess. I’ll have to count to see how much bonus points did I get.

I too received points but no sms or email like previous instances

Yes me too.

Received 100000 points but no communication from bank.

Got the message today.

Yes. Had received the points earlier itself but got the sms and email today.

Pingback: 20+ Best Credit Cards in India 2018 (Rewards & Cashback) | CardExpert

They started Spend basis reward points again, I ‘ve received email for 110K spend 8K reward points.

Mohan,

How much were you spending in the recent months and how old is your card ?

Seems like targeted offer not for all.Is it YFP or YFE ?

Thanks,

Mouli

I’ve received BMS vouchers offer and not spend based bonus reward points offer. Targeted and personalized offers given.

Any idea if Yesbank will come up with some festive offers this time around?

Even I am waiting, although I have around 1 lac rewards points accumulated in last 6-7 months of usage. Not finding a good deal to spend these. Wish Amazon coupons are back.

Last year Yes bank announced this offer one week before Diwali, so going by the previous year pattern they might announce by November 1 st or end of October

Hi all

I’m quite sure Yes Bank will be running offers. Just that their communication department is so poor that the offer is communicated a few days after the offer period has already begun. Like they want to include prior spends so you are already participating and then you are hooked. 😉