As you might know, last year I took the Amex health Insurance underwritten by ICICI Lombard especially for its OPD benefit of Rs.10,000. Do check above link if you’re new to this.

So its time to avail the benefit.

But well, the virus had other ideas. So it got delayed but anyway I fortunately got my new specs from Titan Eye Plus and the invoice was done in last 5 mins of closing the store. FYI, that’s the last day of my insurance policy period as well. 😀

Reimbursement

So with the invoice in hand I called up ICICI Lombard about the process. This took about 20+ calls/emails (which I have covered in detail below) and I was finally said to share below details:

- OPD Claim form (you may google it, not linking here as it may change)

- All Invoices (only one in my case)

- Cancelled Cheque

- ID/Address Proofs

The same was emailed to both of these email ID’s: ihealthcare [at] icicilombard.com and customersupport [at] icicilombard.com

Note: If you intend to claim for specs, remember that it covers only the lens part and not the frame.

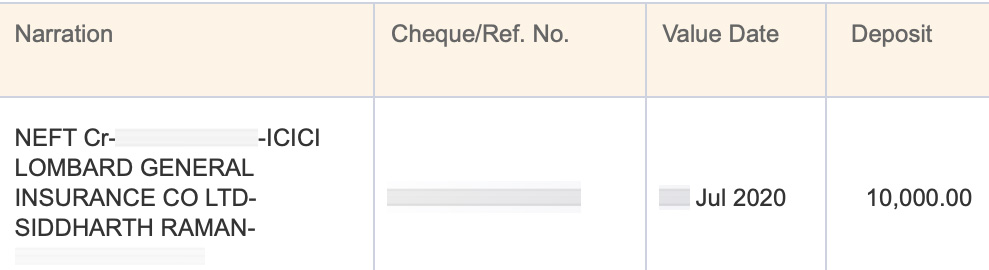

The Rs.10,000 reimbursement was successfully deposited to the mentioned bank a/c after ~10 days of sending the documents.

Policy Renewal

So after re-imbursement comes the renewal of the policy.

Initially when I opted for the insurance, I was said that renewal will be slightly cheaper, like 5% or so. ICICI guys even said it could be 10% cheaper if I go with 2 yr renewal.

But to my surprise it got higher by about ~ INR 2000. I think its due to Covid-19 but not sure though. When I tried to negotiate, I was given a option without OPD benefit. So my renewal options were like,

- ~Rs.8,000 – 10L cover, without OPD benefit

- ~Rs.16,000 – 10L cover, with Rs.10,000 OPD benefit

So ideally, I can pay Rs.8K more and get Rs.10K value back. That’s a good deal but I don’t intend to change my specs every year just for the sake of availing this benefit and also no plans to use Gym/Yoga.

So I went with the ~8K plan.

Covid-19 Updates

Speaking of health insurance, you might as well ask “What about covid-19 claims?”. Below is what I heard so far!

The above policy covers hospitalisation expenses related to Covid-19. And when I asked whether it also covers the “kit expense”, I was said that there are some limits to it.

2 kits every day, upto ~Rs.800/kit is the maximum claim limit for testing kits with ICICI Lombard, as per the update I got by 1st week Oct 2020.

I think this could change from time to time based on what price government puts on the covid-19 testing kits.

Customer Service

While it all looks simple and easy, I had to make like 20+ calls/emails to get this done.

That is because American Express Insurance team (both health & motor) is probably the worst you could come across in the Amex ecosystem.

The most disappointing part is that Amex says they’ve dedicated team with ICICI Lombard but the real fact is that they don’t actually exist. At-least that’s what I could conclude from my past 20+ calls in an attempt to reach them.

Amex Plat Concierge too can’t help much as they simply connect to the so called dedicated line via conference and it disconnects after few mins, every single time.

Overall am totally disappointed with the time I wasted in getting this sorted. I’ve been reporting this car/health insurance team issue to Amex every year yet nothing improves.

But well, at-least the good news is you don’t need to worry about them. Following above should help you claim the OPD benefit on time.

Bottom line

Even-though there are issues when it comes to support, overall the ICICI Lombard policy is still one of the best, atleast for my needs. Ideally its good for individuals in ~30 age group.

If you intend to go for family cover, I would suggest to go for other options. I personally took one from Star Health for parents as that’s what is popular in Tamilnadu and also has good hospital coverage. So your options may vary with location.

That all said, if you’re new to American Express and would like to avail these Rs.10,000 OPD insurance benefit just like I did, its good to start with one of these two cards:

- Amex MRCC (Currently FREE)

- Amex Plat Travel (Currently FREE)

Do you have Health insurance from American Express or from any other providers? Feel free to share your experiences in the comments below.

I am also waiting for the claim. Did you send them physical copies as well through courier .Is it required doctor prescription for specs as well?

Scan copies were sufficient by then. No prescription required, just the invoice would do.

Thank you siddharth. will follow and update the status here.

I have a personal health insurance through ICICI Lombard directly. And their claim process has been superb. I claimed once in 2017 for a hospitalisation pertaining to my daughter.

They processed the claim in under 4 hours, and my subsequent post-hospitalisation claims were smooth as well. I had sent them the docs, upon receipt a claim-ID was generated with a committed closure time, and the money hit my bank account without me having to place a call.

I was expecting a policy sourced through Amex to be either at par or even better than one sourced through a retail channel. So disappointed with your experience.

Good to know. I think I would have had better experience if I had tried to reach out to ICICI directly for these support. But poor me, thought going via Amex would be better, which went opposite in my case.

What should I do to get my UHID number

Star health has got a very bad reputation on claims….have you ever had dealt with it (unfortunate though)

I heard the claim issue is with policies having low cover, like 2L. Those with >5L gets good service. Moreover knew the agent, so have that additional support in my case.

Claim process itself is bad. They need claim form from hospital. My in laws have 10L policy with Star. My mother in law had to get admitted to hospital for some tme but it was not network hospital. So decided will go for reimbursement. But they asked for claim form from hospital which hospital ppl say they don’t give any such thing, they have given discharge summary, thats what is all as per their policy. Star told me only alternate is to get a stamped letter from hospital stating they don’t give any other claim form ??? Could it get more ridiculous?

After much research, and directly contacting ICICI Lombard, I actually collected a lot of details on this whole scheme.

Firstly the name of the plan is “healthyU”, it was this one time I actually called Amazon ICICI support guys regarding a query, and after gracefully resolving it, they wanted to sell me insurance, I gave it a listen and honestly I was a bit spellbound when I recalled the benefits were similar to what I heard in the Amex insurance plans, although what I didn’t know was the plan via Amex was a slight bit costlier probably as Amex was in the middle and when you buy directly from ICICI Lombard, you definitely save without changing the T&C . Note that the spokesperson over the phone told me this plan was only available from the call centres and can’t be purchased when you visit an ICICI brand (a hoax). I happily bought the policy over the phone with the executive for my wife for a premium of 20K, cover of 25L (OPD benefit = 25K, so basically 5k benefit), however the card was in my name and eventually when the policy came it was in my name, but the age, gender, etc. was of my wife, which was a super rookie mistake by the system. After much back and forth, I was able to finally get this policy cancelled and a full refund was issued. So then I went to my nearest ICICI branch to discuss this mess, and the lady there took my iMobile and showed me the same plan was available and it was 1k cheaper (so only 19K premium). Note there are other plans based on SI:

10L cover – 12,500/- premium (10K OPD) <– This is what Amex sells too

15L cover – 15,200/- premium (15K OPD)

20L cover – 17,700/- premium (20K OPD)

25L cover – 20,000/- premium (25K OPD)

Note that if you buy this plan via the call center, you have to pay a full premium, however when you buy via iMobile, you get a 5% discount on the above mentioned amount. I earlier was skeptical to buy directly from ICICI, since I completely hold high regards for the Amex service, but after reading this blog, it seems better to just go ahead directly with ICICI Lombard.

Hope this helps

Thanks you very much for sharing. Highly useful info for those trying to maximize OPD benefits.

Advantage with amex is when you taken 10 lac premium and you exhaust it. Amex will cover an additional 10 lac from ther end. Which makes 20 lac cover for 10 lac premium.

That’s what i was told by amex representatives.

Cheers,

Kiran

When I tried to explore the ICICI lombard complete health care policy, the premium is less but spectacle charges are not included.

Looks like buying from AMEX is better. However, waiting for my claim to be approved.

Star health is the worst insurance provider in the country. We own a mid-size hospital and accept all the insurance companies Except Star Health, many of our friends who own hospitals do the same. We decline cases/patients which can generate multiples Lakhs of revenue, nope, no amount of money is worth dealing with crooks like Star Health.

I made two Star Heath claims in July for my in-laws, who where down with Covid. It went off well. They have a fantastic tracking system – I used to get notified when hospital used to send the material to them for initial notification and also as part of final settlement. My experience was pretty good.

I got the same policy from Amex and I got reimbursement for the whole including frames. I sent the physical invoice directly to ICICI claims office. And regards to pricing it changes based on your age bucket. It stays the same from Age 27- 40 I think. Not sure though. I paid it for 2 years and got 10% off.

Yes. I am having a difficult experience. No revert on anything. Have sent them so many documents. It has taken me days to scan and send. Amex and ICICI Lombard, where are the promises of 15 days claim settlement?

Hey Sid,

You just sent one invoice. Was that of amount INR 10k totally?

It was around 15K

Thanks!

Please consider tax saving @30% on Rs 16000 premium with OPD. It is still a good option.

I have directly purchase with ICICI lombard for Rs 26500 for two years for myself for 10 lakh sum insured with 10k OPD and slight more benefits than the AMEX variant.

Very confused about your experience. The emails and the information I have to send were given to me by the regular Amex customer care person. They even sent me the form on email. This was last year. I have to check if they gave me Amex email or ICICI email. I think it was Amex.

While the invoice needs to be of coverage year, they told me it was okay to send in invoices 3-4 months late as per my convenience.

My premium did go down in year 1. This year it has increased by about 800 bucks. I’m thinking COVID is the reason.

Update for article — They have stopped accepting documents through email. There is an ILTakeCare app which the customer support says can help you upload documents, but if you file OPD claim after the year end, the last year’s policy is not displayed. So the only option for those filing after year end is to send originals to Hyderabad.

I pay 20-25k annually for a gym membership.

How should I use this policy to get the best OPD benefits?

1) Buy Policy then gym membership then claim

or

2) Buy Policy then membership then claim (but make claim in the last 90 days of the policy)

Does taking OPD benefit affect medical claims in case of any emergency?

Did you fill the doctor’s name while claiming OPD benefit for spectacles?

My experience with ICICI Lombard is pathetic as the customer service team are Illiterate to an extent that the replies of rejections are very sub standard english. Their claim processing percentage would be below 10% as they will reject for very silly reasons which nobody knows including their own Customer service as even they don’t know why rejections happened and can only give you probable reasons. Its a fraud and I will suggest everyone to avoid this and go for better service providers. They will tell you that particular OPD covers Specs etc, but reject your claim when you submit stating their policies changed in current year though you would have taken insurance earlier where they sold the insurance claiming it covers dental and spectacles.

DO NOT PURCHASE, ITS A FRAUD