One of the biggest expectation on HDFC credit cards by many entry-level to premium card holders is the ability to redeem reward points for direct cashback, as flights/hotels or even the shopping vouchers don’t excite many. If you’re one of them, I’ve a news you. HDFC Bank finally decided to give you that privilege of redeeming your reward points to credit card statement credit.

Value of Reward Points

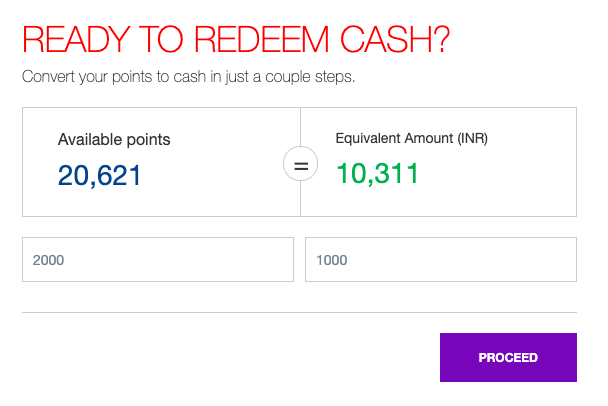

When we speak about stmt. credit, the obvious question is the conversion ratio. From a quick look, it appears that the points to stmt. credit conversion ratio is similar to that of the shopping vouchers that we usually get with HDFC. For ex, with Infinia & Diners Black, the conversion to cash credit would be like 1 Reward point = 0.50 INR

Okay got it, you frequent travellers lost the interest 😀

But well, I think it’s a very decent conversion ratio as it lets you earn 1.6% to 16% as direct cash credit on HDFC Super Premium cards.

How to redeem?

Here are the steps to be followed to redeem your credit card reward points to cash

- Login to HDFC Netbanking

- Goto Cards -> Enquire -> Redeem reward Points -> choose card & proceed

- You’re now on the newly revamped Redemption Portal.

- Goto Redeem Reward Points -> Cash Redemption

- Enter details and proceed

- Expect cash credit in ~7 working days

Note that min. redemption value has to be Rs.500 and Rs.99 would be charged as a convenience fee per redemption, just like SBICards.

I’ve tested it on one of the cards I manage and here’s how the redemption flow looks like:

Should you Convert Points to Cash?

It should not be a primary redemption option for most premium & super premium cardholders, as it instantly reduces the point value by flat 50% or so. But it’s okay to have a mix of both, based on your needs.

I currently use few cards to get direct cash credit to stmt. that allows me to spend anywhere, so I would consider it as an option if other cashback cards give me less returns than this.

Further, this is an amazing option if you’ve points left that expires in next 90 days. While you can’t make instant travel plans, you can now redeem the points instantly.

Bottomline

Its an AMAZING move by HDFC but I wonder how many crores its going to cost the bank in the coming months!

Apart from this, HDFC bank also gave an overall facelift to their reward points redemption portal with more options & controls like better airline redemption forms and more. And now you can also view your 1yr old reward points history, which is awesome. Yet, I wish, they had txn wise info as well.

Overall this move definitely solves the need for most entry-level to premium range of cardholders, but for the top-tier frequent travellers, one would expect the ability to redeem points across even more airlines & hotels. I hope that too happens sometime soon.

What’s your take on this bold move by HDFC Bank? Do you plan to redeem your points to cash credit anytime soon? Feel free to share your thoughts in the comments below.

Thanks to the reader Sidharth for spotting the new feature.

If you encash, then is it going to get taxed?

In case the cashback in a year exceeds Rs 50,000 for individual taxpayers, then it would be subject to gift tax as per Section 56(2) of the Income Tax Act. Its bit easy for self employed, but not sure about Salaried. Ideally its treated as Income/profit from other sources.

Then apart from the 50% discount on cash redemption the tax is another downer. Thanks for information.

I don’t think that this particular aspect of cashback qualifies for Income and hence will not be taxed. This is treated as discount against your expenses and thus won’t be taxed.

I spoke to a CA and it is still gray area. For salaried it’s like getting discount on expense. As long as your cashback isnt above your expense then it should be okay. For business since they could claim their expense, they would have to adjust it with cashback before claiming

HDFC is filling up all the gaps in their product offering or by one. It will interest lot of people carrying cash back cards . Statement credit + 10X is very potent.

SC Manhattan , Citibank cashback card et all. have to rediscover themselves.

Long pending demand of customers about transaction wide reward point summary probably soon be implemented. This is learned from multiple executives serving in Infinia desk. Most of them are already aware that how much trouble customer has to face for contacting customer support each time.

Don’t know what’s holding HDFC from providing the same to customers for long time?

Same is easily viewable to any HDFC employee when we visit branch or call customer support. Just that HDFC isn’t willing to share it with customers.

Currently Standard Chartered & American Express both give transaction wise summary of reward points earned.

Even Axis Bank provides transaction wise summary of edge rewards.

As well as icici

Where does ICICI show transaction wise summary?

But ICICI amazon pay cc doesn’t.

Yes, this! Is there anyway at all to view this?

Hi,

Is there any way we can redeem our HDFC reward points for Amazon Pay Balance?,I am unable to find it in the catalogue.

Thanks 🙂

Hi A2Z,

Is this true – “that transaction wise points are viewable by any HDFC employee when we visit the branch or call customer support”?

Did you also imply that if we visit the branch we can get the info on transaction wise points history?

If true, this is really big. If there is any way at all that one can view this please let me know.

it is a problem.for me also how currently we get the transaction wide reward info. all the customer care number i tried was failed

Really very good move

Looks like the conversion ratio is 0.2 for Diners premium cards.. This is a 60% devaluation from the redemption ratio on flights which is 0.5!

I’ll probably stick to redeeming this for flights and use my Iconia cards for spends where I plan to cash out the points

Same for Regalia. Cashes out at Re. 0.20/point, 43% less than Re. 0.35/point that I mark it for.

I can’t bring myself to book flights using HDFC Portal. Too cumbersome. Particularly if there’s change in plans or you need OTA support.

Same here for regalia, conversion ratio is 1:0.2, it is better to go with flights 🙂

Any additional options given to customers is always welcome.. whether to exercise or not is the customer’s choice, but good move to at least provide the option!

The conversion ratio for diners clubmiles is also 0.2 . Not worth redeeming this for cash. Insta vouchers seems better value

Good move. I need to close my diners for converting it to regalia. I can at least get some value from my diners card

Awesome siddharth. Already redeemed all my DCB points. 🙂 Never know when they will stop this.

For Regalia the conversion is 5 pt = Re. 1. Thats Rs 200 for 1000 pts which is a very poor conversion rate. They have just introduced the option just for the sake of it. Pretty disappointed.

What if a person is not having account with hdfc bank?

The cashback will come as a credit to the credit card. So a bank account isn’t required.

Nothing to do with account…cash will be credited to your credit card statement..

Still works

You get credit in your credit card account, not bank account

Even if u have hdfc account, the cash credit will reflect in ur credit card account and not in savings account

With my DCB I had converted them all to JPMiles and had a good convert for my Russia trip. After I downgraded to Regalia the points have accumulated to about 67000 points but I just cant make up my mind where to spend them.

With this offer I am thinking of upgrading my card to DCB/Infinia and cashing out but stupid Regalia still stuck with 6L limit so no upgrade offer 🙁

HDFC says my ITR of 18L is good only for 6L but then again I had 8L+ with DCB. Any advise how to upgrade the limit by atleast 2L?

If you upgrade, my understading is your points will get transferred on 1:2 ratio. Not worth the effort i feel.

Is this appilicable with every hdfc bank.

Hi,

Sid what a gift. Thanks for sharing this. Happy teachers day to you. In a way, you are my teacher. Thanks for teaching the value of using Credit cards.

Also, what would be the gift tax percent? Would again gst be calculated on gift tax?

Thanks in advance.

It seems, for my titanium card cash redemption option is not available.

Regalia and Regalia first are available at 5 points = Rs1, whats the use of it anyway?

Now it’s 6.6 points = 1rupee.Loss for me. I wud have redeemed earlier.

When i saw the heading of the article – I am so excited because HDFC started giving statement credit. But as you said when you talked about conversion factor – disappointed.. I have regalia they are giving .2 per point, which is really bad. Usually on vouchers – they will give 1000rs voucher for 2800 points. If i do cash credit for 2800 – i only get 560 ruppes.. Which is so disappointing…

Right even for Dinners platinum it is showing .2 per point, which is disappointing

This is typically targeted at people who donno much about maximising on points and have loss of points laying around unused. From a business point of view this is a liability for HDFC so they might want to get rid of a lot of such points hence the move. Also it’ll help a lot of people with pending payments make use of it and come forward to settle their debts. Another reason for giving this option is a basic credit card user will find this to be the most attractive feature a long as they can save a few bucks. It’ll help them get new users too

I am Dr . T.Raghunath Mysuru. I came to USA for vocation from 17/7/19 to 02/01/ 19 . Before coming to USA I applied for redemption of my credit card in the month of May and submitted redemption form to nearby branch of VVMohalla. In this regards I met bank Manager for not getting reward product of western external storage device but I could not get. If such is the situation what is use of credit card.

Hello,

Have you got Relationship manager in VV Puram branch?

Hi Siddharth,

What’s the eligibilty criteria for HDFC Diners Black card? Can I get it on a card on card basis? I hold SCB Ultimate with a limit of 5 Lakhs

how much transactions to do in a month or till how many months we can remain without transaction in hdfc credit card dinner black so that the card doesn’t gets blocked

Makes so little sense to me, even if I travel lesser, still redeeming on flights/hotels makes sense vs. cashing out.

Agree that it can be useful for some people!

Hi,

In HDFC netbanking offer, I am getting a message that I am eligible for upgradation for my account to Imperia banking. Shall I go ahead with it? Currently I am Preferred customer with the bank but dont pay any fees for it.

I hold Regalia First credit card as well with a limit of 3lacs. Will upgrading my account help me to get super premium card (like Infinia)? I do not have any other relationship with bank like loan or FD as of now, but I am their customer since last 9 yrs.

Will upgrading to Imperia attract extra charges?

Thanks

Hi arun , are you maintaining the required balances for the preferred banking programme i.e 2 lakhs AMB?

Yes

Any comment on this pls?

Only 0.2 conversion for Diners premium, losing out on things.

I tried for Regalia and for that the conversion rate is a dismal 1 Reward point = 0.20 INR.

I would prefer to use the reward points for gift vouchers e.g. for Reliance Digital. There the conversion rate is more than 30%.

I think for Reliance digital it is 1 Reward point = 0.35 INR and for chroma 1 Reward point = 0.30 INR

as i can check by converting reward points into value of voucher it gives.

So infinia doesn’t really give 3.3% return? Thought they give 3.3% on gift vouchers and travel miles but I guess that was not accurate

3.3% return is when u redeem ur inifinia points at Re1 value for booking hotels/air tickets, etc on the hdfc portal

Great share as always Siddharth. Seems HDFC is trying to up its game against SBI card which has been very aggressive in garnering market share. Even though point to rupee conversion ratio is lesser than sbi card but it dies add value options to the existing customers of HDFC cards. Hope HDFC takes improves the rupee value offering soon to make it a worthwhile proposition.

Rs 0.20 for 1 Point for Regalia is very less

Flights remains the best for conversion of RP’s

Redeem 75000 points into RS.15000

Very low redemption regalia first

Converted my 128900 point to Rs 64450 on my Infinia card.

Three years in more than enough time to plan travel and hotel bookings or explore other reward options no point in redeeming it for a cash value of 50%

Checked in multiple logins it seems 0.2 for all cards except infinia and diners black. For them it is 0.5

Sid, I have a question that is not related to this offer. I have been having a Regalia for the past 3 years and I received n invite for Infinia upgrade. After accepting the invite, I realized that I forgot about the “Milestone Bonus” for Regalia (15K points) that I’m eligible for. Should I wait for the Regalia anniversary for the milestone bonus to post or should I call and request them to post them right away? Or is there any other way? I applied for the upgrade only Yesterday.

It should be added automatically as soon as you reach the spend. If not, you can ask the bank to check.

Thanks for the quick response. I had reached the spend limit a few months back… but, I was told that the Milestone Bonus points will only post on the anniversary date.

It used to be, then they changed to monthly and they daily (as of early 2019). Not sure if they changed it again.

I got the milestone benefit in the month I reached milestone in Regalia. I just checked my card statements

Hey Sid! Is there a limit on number of HDFC credit cards one person can hold ?

for me 10k credited on the month of reaching milestone, remaining 5k(when enquired) they said within 90 days after renewal. Waiting for 90days completion half way thru!

Hey,

Small query – So I have 3000 points (I know very less here) which Im trying to redeem for spencers vouchers. As there are only 1000 and 2000 denominations. Im thinking to take 3 X 1000 voucher. So the question will they charge 99 x3 as redemtion charge or only 99 rs?

TIA

Hi Vineeth,

If you do it in a single transaction then only 99 (Increasing quantity of vouchers to get is single transaction) . But if you receive successfully redeemed and then again try to do it then its a separate transaction so again the charges.

Only one 99,still banks has not gone that bad in charging customers

No, they will charge 99 only, it means 99 for one redemption.

Standard Chartered Ultimate and Yes First Exclusive do not charge redemption fee and have somewhat better redemption options. (Reward rate is the same for flights / vouchers). Also have DCB but only use it for 10x. I prefer to use SCU in other than 10x transactions.

On a side note, Amazon.in considers dinners cards as Rupay and is offering 10% off upto 400 in current Diwali sale. Club this with 10x through smartbuy and you save quite a bit. 10% + 33% on DCB.

Sid

I am not a traveler so what other redemption offers full value on HDFC DCB / Regalia cards?

Hi Sid

Checked th redemption portal and I can say for say now that travel gives full value and cash redemption is at half value. Rest catalogue is at half or less value so it’s useless compared to cash.

Do let me know if I’m wrong.

Hi All,

I got upgrade offer from monyback to regalia first few years ago. It didn’t excite me as there is no option to redeem as cash in regalia first. Now cash back option is made available for all hdfc credit cards. But Reward ratio for Money back and Regalia first is 0.2% for redeem as cash credit. Earning ration is still same for both cards. 4 points for 150 in RF and 2×2 points for 150 in MB. only difference lacking in RF is rewards redemption fee where as currently no charge in money back. So still holding my money back card than upgrading to regalia first. Any other thoughts?

I have got the RF card upgraded from Moneyback and done by RM. Now after reading all these it seems I have done mistake. I mostly purchase from Amazon and Flipkart and I use Amazon ICICI card and SBI Simply Click card respectively. Can anyone tell me if I can cancel the RF card and continue using Moneyback card though I got SMS Moneyback card will be deactivated once I start using RF card or on a certain date whichever is earlier ? Will RF card will be beneficial for me if I dont travel much ?

Downgrade not allowed immediately, so maybe you need to wait for 6 months from time of upgrade.

hi

i have just redeemed my hdfc credit card rewards point, but i want to cancel redemption , what is the procedure.can anyone plz help

HDFC is giving from every 100 points Rs.20. It is not Rs.50 as mentioned above.

You are talking of cash redemption. Thread talks of travel redemption

Its been more than two month, I have not received any cash redemption balance.

Please help me. feeling its a fraud service.

Tamijit, look at your credit card statement, in that the credit would be reflected. Redemption should be at least Rs 500.

HDFC has recently included flipkart and Uber vouchers. However this is not shown in the catalog but when you try redemption through portal, it comes up.

The conversion is poor

Uber 500 coupon –> 3330 points (I use a regalia cc, not sure if the rates are different for other cards).

Flipart 1000 coupon —> 6660 points (Same as above but minimum denomination is 1000)

Can anybody confirm if this RP to Statement Credit Option is still seen on the Rewards Portal?

I tried searching through the rewards, but this option was nowhere to be seen.

Go to Netbanking. Cards > Enquire > Redeem Reward Points > choose card > Click on Redeem points in new window. It will show cash redemption option there.

HDFC Regalia.

Redemption has changed.

now converting points to cash are around Rs 0.20 per point

my points are 4561 Equivalent to Rs 912

Redemption on other products is around Rs 0.35 per point

eg Tupperware grater is 1120 points and Its approx price is Rs 400

this card is not as lucrative as it used to be and even other super-premium cards of HDFC since the conversion rate is decreased. Currently, the best card overall is ICICI Amazon pay Credit Card since no annual charges and renewal charges.

directly amount transferred in amazon pay balance.

But we all never redeem for cash. The best use has always been travel for tickets.

You are taking just one aspect of HDFC Regalia. This still doesn’t compare to Amazon Pay card. Not by a very very very long shot! I have never come across anyone redeeming reward points for cash on HDFC Cards.

Is it so? For me its showing 1RP=0.15 INR and even for vouchers from brands like croma it’s showing 1RP=0.22INR

Which variant ? Cant be infinia/regalia

Regalia first

Infinia reward point to cash redemption has changed to Rs 0.3 per point now

Yes, same for diners Black. I redeemed all the available reward points today for cash, after completing the redemption process online, realised that the cashback was not 50 paisa per point. No point in redeeming for cash going forward.

Hello Sir. I just have a small query .When i use my Reward points in exchange for Cash Redemption, Will that amount be paid to my Credit Card ?

How is the value of reward points increases or decreases if I always choose cash as my redemption option ??