Update: Kindly refer IDFC First Bank Credit Card Review (All Variants) for detailed review (or) Hands-on Experience with IDFC First Select Credit Card for application process and more.

The New Year 2021 has given me two good news w.r.t. IDFC First Bank. First, my IDFC shares finally got into +ve side almost after ~3 years. Second, now comes the news about the launch of new IDFC First Bank range of credit cards.

While these are the first proprietary IDFC First Bank Credit card products, not to forget about the OneCard – the metal credit card for masses which also runs on IDFC Banking system.

Table of Contents

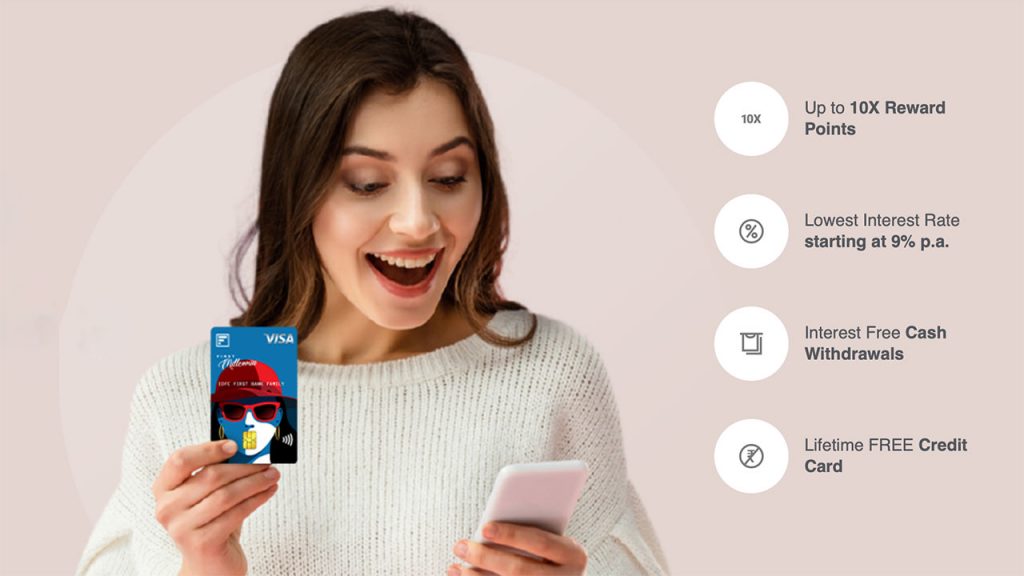

The USP

Before getting into details, let’s have a quick look at what IDFC intends to do in the crowded credit card industry.

- Low Interest credit cards (9% p.a.)

- Lifetime Free Credit Cards

- No Expiry of reward points

- No Finance charges for cash w/d (Rs.250 w/d fee applicable)

- Railway lounge access (on all cards)

IDFC First is getting a good name recently because of their premium IDFC First Visa Signature Debit card (25K balance a/c) + high interest yielding savings accounts as they give you mind blowing 7% rate of interest while most other banks are at half of it.

So it seems they intend to use the same weapon to capture a good market share in credit cards too, by providing revolving interest rates as low as 9% p.a., which is just Rs.750 a month on revolving balance of 1L.

Of-course this low interest rate is not for all, but for the credit worthy individuals based on various factors.

This would definitely be a game changer in the entry level segment and would even end up in changing the way we Indians see credit cards, meaning, we may start to revolve balances like Americans.

Credit Card Variants

There are no major difference between different cards esp. when it comes to rewards. You get the same 1.5% on online spends and 2.5% on spends >20K and on birthday.

The difference is on the additional benefit like movie/lounge/golf etc. While we may see various cards in detail later, here’s my super quick review of these cards:

- Millennia/Classic Variant: is really good, as it will let you earn 10X rewards as long as you can spend more than 20K. That’s upto nice 2.5% return on spend on entry level card.

- Select Variant: is good too as you will enjoy the Visa Signature privileges like Buy1Get1 movie benefit, lounge access, etc

- Wealth Variant: is good for the features it comes with, provided its a free card too on Visa Infinite variant with 1.5% forex markup fee. But its not impressive enough to pull super premium credit card customers from other banks.

I wish they had Airport meet & greet, airport transfer sort of services. Which one do you think is better?

Eligibility Criteria

Given the fact that all cards are free for life, the confusion now is, how would the bank decide the eligibility?

That could be done via combination of various factors, like ITR, savings accounts balances, or spending pattern on their debit cards or even via Credit reports.

Update: Here are the eligibility criteria for respective cards known so far:

- Millennia: Age between 21-35 year olds, with income less than ₹12 lakh

- Classic: Age >35 and ITR over ₹12 lakh

- Select: Age >35 and ITR ₹15 lakh and ₹35 lakh

- Wealth: ITR >35 Lakhs (or) high HNW with bank, like >10L balance

The bank may as well upgrade the cardholders based on spends. We will know that in coming months.

When will they be launched?

Existing IDFC bank customers already started getting the credit cards.

For others, its expected to be launched for public by March/April 2021. And not to forget, IDFC Bank has been issuing employee-variant credit cards for their bank employees since past 2 months.

How to Apply?

You may show interest on their website for the card you wish and you may expect a response from them by late Feb 2021.

Having a Savings a/c is not mandatory, yet it may help, as its a common sense for banks to put bank’s customers on priority compared to the open market customers.

Opening an Ac with IDFC First bank is super easy. It hardly took me 5 mins to complete the online-only application process via Aadhaar authentication and another 5 mins to setup the mobile app. The a/c is already funded & functional.

They do Video KYC to lift the limits on account. That took me another 10 mins or so. Overall I’m happy with the smooth onboarding experience for their savings ac.

Is It worth Applying?

Looking at the frequent targeted offers they’re throwing for their debit card customers, Yes, I would suggest to get the IDFC credit cards for a rewarding 2021. Here’s a quick look at one of the recent offers on a debit card.

But yes, we still don’t know the points redemption system, customer care support quality, etc which will define where IDFC First credit cards are headed to.

What’s your thoughts on the upcoming IDFC First Bank credit cards? Feel free to share your thoughts in the comments below.

Thanks for the write-up. I went through their MITC, CMA and PG. The Fx markup comes with DCC clause unlike other banks. The card termination TnC clause is a but unnerving as well. Let’s see how things unfold when they are actually launched.

the dcc clause if superfluous actually. some sites in india like google domains etc, actually bill you the usd equivalent amount and show only in INR ( implicit dcc -doesn’t give you option to pay in usd). This calls out these practices I suppose. No end-user significance

Their Wealth variant has 4 spa visits per quarter benefits as per my understanding, which is sufficiently juicy. I suppose it will be via Dreamfolks Dragonpass card.

Ya, but availing spa during Covid times is bit risky.

Nice to see new player in market. Will apply if the reward rates are good for the premium card as I am happy with the combo of infinia+dcb+SC ultimate.

No. It’s safe if we wear masks in spa. I think we should go for it

I got call from Idfc first bank and took my details offered idfc select credit card with 1.5 L limit on call only. When will my card reflects in bank mobile app and in how many days it will be delivered.

I have received the card in 10days, from the date of applied.

It would be nice to see a tough fight – Post-sanctions HDFC v/s Newly launched IDFC Cards. Expect some great offers from HDFC in coming days, to protect its supremacy.

Lol. Tough fight? Not even a lame fight to start with, not by a long shot!

Card is impressive but I will apply after launch of the card. Need to read terms & conditions like txns type exclusion for reward points etc.

Not interesting at all for high end customers. Infinia still d best. Except..

Only rs. 150 i think on cash withdrawal (with no interest), and 1.5% fcy markup on the wealth variant. So, instead of carrying a Currency card for foreign travel in future, this could be a much better option. Just take this card, remove cash from foreign atm, and you’re good to go with a fee of Rs. 150 only. This is sply. true for countries that dont use major currencies like USD, Euro and Pound.

The eligibility criterial is based on the income. For wealth card the income needs to be more than 36 lakhs per annum. And for Select it should be between 12 lakh and 36 lakh. Got this info from IDFC credit card customer care.

Thanks for this info.

What about Millennia and classic card eligibility…??

I doubt this, I talked with my RM today and he said, initially these cards will be limited to existing customers only til March. There is no application process as of now & card will be offered basis past banking relationship & cibil score, very similar to Kotak model. Card will be automatically offered without documentation. In this case how are they going to determine income then?

Details are yet to be worked. Same with differentiating benefits between cards. Picture will be clearer around march.

May while opening as account annual income has to be filled.

Hopefully they take in applications based on card on card basis. 🙂

The branch people call me and told me the eligibility for the wealth card is 3 lakh income per month. Upon telling them that I am a proprietor they requested for 36 Plus ITR of 2 years more information will be released in Feb end.

I guess maintaining account with idfc helps. Got a message from IDFC for lifetime free select credit card. They had all information about me already. Application process took only 2 mins and in next min my credit card was approved. Now waiting for the delivery of credit card (will take max 3 days according to IDFC)…

Whats the acc balance you maintaining? I guess they are checking that, you may tell me the range like above 1 lac or below that?

After how many days it reflects in mobile app?

Idfc first bank’s customer care is definitely one of the better ones that I have experienced. The waiting time is almost non existent and the staff is extremely polite and eager to help. I have 3 accounts in the family with them now and the service has been more than satisfactory.

Looking forward to the wealth variant – mainly because its issued on the visa infinite platform. 😀

Hey Sid,

I’m a relatively new reader and as soon as I heard the news, I came straight here to see what you’d have to say about it.

Although a day late, with the details and analysis spot on, you did not disappoint.

Also, thumbs up on the investment in the bank!

Patience is indeed a rewarding virtue in the markets.

IDFC Cards Rewards rate is same for all variants. Again interest rate is depends on customer profile (like CIBIL score).

Premium cards only scope on benefits offered by VISA card type (Lounge access, paytm movies discount).

Disappointing point is no airport lounge access outside of India. (all free visits only for domestic and international airport lounges in India)

Am having ONECARD, but dojt know how to redeem my 5.6K reward points. There is no option for that.

Dude, open app. Click on gift icon which is third from left in the bottom most row. on that page, there is option of REDEEM. Click on that and select the eligible transaction. Eligible transaction should be below INR 560.

You can redeem it against previous qualifying transactions. In the rewards section, there is a “Redeem” button. Press on that and you’ll see transactions against which the points can be redeemed.

Generally the qualifying transactions are the ones which require less points than you currently have. In your case, qualifying transactions would be below Rs. 560 (1 reward point = Rs. 0.1)

There is an option in application itself to redeem them. You need to redeem them against the transactions you made.

Take the statement credit of the star marked* transactions from your statement. You have to redeem points against those transactions marked with “*”

OneCard customer here,

Use your reward points to redeem against your bill. Option is there in the app. Look for blue star on the transaction. That can be paid off with your points

Would opening a 25k mab saving account now helps in getting credit card.

It really doesn’t help. I have the same 25K mab account and keep 5 lakhs in that account. Never got a notification or invite for the credit card.

Visit your IDFC branch and the staff will check for your pre-approved credit card. If you want, they help you complete the online application with your OTP about 2-3 times during the process. The card comes to your address within a week and usually gets generated on the same day of application and you receive an email with your new card’s last four digits. Alternatively, call your RM and ask him to check if you can’t visit a branch.

Meaning, even those who are not pre-approved can get the card this way?

No Sid. What I meant is that everyone with an IDFC account in active status is pre-approved for a credit card but maybe they were not intimated through email or sms. For those who have active accounts, they can visit the branch and apply for their already approved card instead of waiting for the sms or email.

Actually, I have 25k account since January and I don’t have any offer as of now for any variant of credit card. Already talked with customer care. Ass per them, need to have account for at least 6 months.

Is there any charges for Signature debit card comes with 25k+ account…??

25k account offers free debit card.

No. Refer the article on this separately by searching on home page here.

No

Nil till you maintain a 25k+ balance.

The savings a/c giving 7% interest – does it have any condition like a/c balance when minimum 1lakh is entitled for 7% interest rate? If it falls below 1 lakh, the interest rate will come down to 4/5 %….I remember kotak having this clause few years back. Can some one pls confirm? Thanks.

Earlier it was like that only. 6% below 1 lac and 7% above it.

Removed that clause w.e.f. 01.01.2021. So you earn 7% flat for any amount upto 1 crore.

Its 6% below one lakh amount. If it crosses 1 lakh whole amount is eligible for 7% interest.

It changed recently. Currently it’s 7% till 1 crore or less.

Is IDFC First Bank safe ? I am a bit sceptical after the Yes Bank moratorium.

Yes Bank was under moratorium for a short period of time.

Even Yes Bank is a safe option currently.

Scheduled Commercial Banks don’t just go bust in India. RBI steps in and saves the day.

So idfc doesn’t have a wealth account prog. yet but they surely do want to launch wealth credit card before that!

They do have a wealth program. I got a call last year from a wealth RM about my account being assigned to the wealth management team. But I do not avail any services or offers so I told them right away.

Thanks for the info. This branch I visited has no clue about it……….

I have switched over my savings account from Kotak to IDFC only for the simple reason that Kotak reduced its interest rate from 6.00% to 4.00% within a span pf just 1 year, although they did it gradually in phases, but that was their main campaign that 6 is better than 3.5 and sadly could not stick to delivering the promised 6.00% in the long run. Hope IDFC which is now giving 7.00% interest flat on the savings account continues to do so, hopefully. Awaiting the credit card launch from IDFC with eagerness as I have closed my Kotak Credit card too.

Although I do not use the revolving facility and end up paying the entire amount on due date of every card i have ever held, it will be a pleasure to acquire the IDFC credit card.

Good Morning

Thanks for updating, really it should be game in credit card market as IDFC will be charging 9% as interest p.a. IDFC will capture huge market I would like apply asap after opening for open market.

Regards

It’s a good step to capture the market, but the bank also keep maintain in future.

Most of people fear to bear the annual charge, company should work on it.

The good thing is all the cards offered by IDFC bank are lifetime free. Hence no harm to get one with domestic lounge access. This will force other banks to offer lifetime free credit cards. Even DBS is supposed to launch credit card soon.

Good time ahead for Credit card customers.

Idfc is really customer oriented bank. The type of service they are giving are really enthralling. Have got already my HDFC Bank account. The higher on saving bank account is bonus for us. Eagerly waiting for credit card from IDFC first bank.

Pretty aggressive stance taken by IDFC bank, they already have a sizeable base of debit card customers. Pretty strange though that all 4 credit cards have the same rewards structure, all being LTF reminds me of Yes Bank cards(Who are also planning to go very aggressive again with their distribution.

Sid nice article !

How do you arrive at the “1.5% on online spends and 2.5% on spends >20K ” part.

Thanks

6X points * 0.25 = 1.5%

10X points *0.25 = 2.5%

10X Points has cap on a bill statement of 20000,

so if your statement is 1lac you get 10k RP and so on

except EMI and Fuel

Hi, will having one card credit card will be considered as idfc costumer?

I recently opened an account with IDFC … received welcome letter but no signature debit card till date… No option to apply there… Not able to login from new app.. No branch in kashmir valley… How expect credit card…

login through old app, and on netbanking use opened before 15th dec link

Talked to customer care as well as branch people. They currently don’t have any eligibility criteria and expect the same in about 15-20 days.

Upon enquiry that what NRV they consider as good enough, branch executive told to be 10 lacs or so. It may give rough idea for Wealth card issuance. Fingers crossed for the tncs.

Received a call today from the IDFC Bank Credit card department.

He wanted to know how I know about their cards.

Also told me I may receive a link for application by this week. Waiting for this link !

Are you having savings account?

Yes but didn’t receive anything yet.

I have heard Not every savings account holder has received the offer. Some will get in Feb.

And for non account holder it’s waiting till Feb end might go to March also.

My NRV is high with IDFC. Banks generally issue card without even thinking about it with this high NRV.

My registered address and branch are the main issue I think. Non-tier 1 & 2 city 🙁

Now it all makes sense, why HDFC upgraded the high spending regalia customers to Infinia and DCB.

With this card being lifetime free, it’s a death blow to regalia.

Ah not at all. The PP lounge access is missing on IDFC cards.

well, the interest-free cash withdrawal is not really interest-free. In a single withdrawal, you won’t be able to withdraw more than 10K for another bank’s ATM and given IDFC Bank’s ATMs are rare, you will end up paying 2.5% as a processing fee for a 10 k withdrawl

I applied for their their Credit card today and got it allotted on the same day within moments. I got an invite through SMS and applied then and there itself. I’m allotted with select variant. I have Platinum corporate salary account with IDFC since September 2020. These were the communications received after applying.

Congratulations! Your application for the IDFC FIRST Bank Credit Card has been received. Your application reference number is XXXXXXX.

Hooray! Your super rewarding experience starts today.Your IDFC FIRST Bank Credit Card ending XX0XXX is issued and will be delivered shortly.Your Customer ID is XXXXXXX.

Which variant did u get? Most people with account in idfc get select Version of credit card

I got offered Select and picked it up.

I was told by the rep, after checking with her supervisor on my specific request, that Wealth Card is not yet launched.

She said in 5-6 months card upgrade and limit enhancements will kick in.

On the other hand a reader here, Amit, seems to have been offered Wealth Card.

What another reader said is correct by the looks of it – Savings account balances between 1L and 10L may have been offered Select.

Cheers

S&S

Hi Siddharth, This is as per my discussion with IDFC customer care.

Select CC has 16 domestic lounge access (4/quarter), Movie offer through Paytm (bms visa signature movie offer is not applicable). Wealth version has less forex markup (1.5%), international lounge access (through VISA infinite and not through Dragon Pass). Offered only to IDFC customers, no add-on card benefit , 48 day interest free atm withdrawal (cash advance applicable) and no annual fee.

International lounge access through VISA is offered through Lounge Key then if not standalone PP/DP

Received SMS today for Pre-approved IDFC Select Credit card to apply free for life.

Great to see IDFC sending out credit card offers in very quick manner since launch.

WIll share more details.

just received the Message today mentioning ” Presenting FIRST Select Card from IDFC First Bank with never expiring 10X rewards on monthly spends above Rs. 20,000, 6X on online and 3X on offline. Avail Today” But the link in Message is not opening as of now.

Got an invite today and Applied immediately. IDFc is offering generous limit to its customer’s. I opened a zero balance account long long back and did not maintain any balance but still offered their select variant card.

Credit limit assigned ???

It seems IDFC website is unable to handle the load of the users. Just now received message from IDFC regarding Credit card and when tried to access their website, found out that its not working.

received the following message from IDFC Bank

“Presenting FIRST Select Credit Card from IDFC FIRST Bank with never expiring 10X rewards on monthly spends above Rs. 20,000, 6X on online and 3X on offline. Avail today, free for life: ” link”

link didn’t work though…

“Requested URL was rejected.. please consult your administrator ; your support ID is “

IDFC website down for now

Update—

Link now working..

applied and Card got generated instantly..

NO CIBIL HIT..

Limit is on the lower side though.. 1.6L

How long since you have the Account?

I have account since July 2020. .

no invite yet for spouse account, opened in sept 2020,

CIBIL will be updated within 3 months of new account opening.

Received the card today.. select variant looks quite similar to the visa signature debit card , except card number behind, name just printed, not embossed..

set the PIN via link provided.

the card details are yet to reflect IDFC mobile app/ website .

Had same issue, clear your cache, then see the magic.

Received mssg today from idfc saying that you are eligible for idfc first select credit card with a link you apply.

Got the invite link but throws error.

Received message today from IDFC to apply for credit card along with link to apply for it. Instantly showing up credit limit and interest rate post clinking the link. Need to fill up few details and your credit card number is generated in few minutes. As mentioned it is saying card will be delivered in 3 days.

Card Variant provided – Select

Rate of Interest offered on revolving credit ????

I have received invitation today from IDFC through SMS for Wealth Credit card.

SMS contains hyperlink which redirect to webpage where we need to just provide details like DOB, mobile number, employer name and office address\office email. Last page is to enable different type of transactions (international\contactless etc) and that’s set. Card will be issued instantly.

Since I already have IDFC saving account. majority of details like nominee, address were auto filled.

But I like the IDFC process where cards are being issued instantly. No need to submit any documents and no wait time for card processing.

But no virtual card available right now. Only last few digits are shared over email\sms. We need to wait till card gets actually delivered.

Also on IDFC Mobile app, there is no option to view credit card yet. Maybe they will do it soon.

Wealth card that’s great. If you not mind can you share how much NRV relationship approx you maintain with IDFC?

Do you have other relationship as well along with saving account?

Hey Amit,

Could you share your NRV with bank if you don’t mind?

And were you able to figure out the eligibility criteria for wealth card?

My relation is exactly 1yr old and on average my balance with them has been over 1m, they have offered wealth variant. On the other hand, wife has less than 1yr old acc and avge balance always around 1L, she’s been offered Classic.

Rishabh/Sai,

NRV is definitely very high. Although I can not tell how much 🙂

I have directly received sms from IDFC Bank today with the link. So I think eligibility is decided by the bank purely based on balance in Saving account. I hold account with IDFC bank since it was launched.

Wealth card will be rarely issued for sure.

For exact eligibility of wealth card, better to contact RM or Customer care or maybe SID will provide update soon.

I have been maintaining around 5-6 lacs for the most part of last year. Got offer for select card.

Since how long do you have the Account?

i also got offer for wealth. i clicked on link and there was option for entering dob and mobile. after i entered details i got otp and after entering the otp it says oops couldn’t find an offer at the moment. i did not understand if its a pre approved offer or just false sms . or it takes time to apply after receiving sms.

any one plz reply if you have any idea about this

same happened with me also. i already have first select credit card but received sms for wealth credit card. on trying to apply the error occurs.

happened with me too , received message for select card and on offer page its says ” oops no offer currently”

Weird

Try after a day or two. It seems to take a while for it to be activated on their end.

Hi,

I’ve got my card approved…I’ve got First classic credit card.

Good to see IDFC credit cards being rolled out so fast…

What is the criteria. What is your minimum balance in account. Anything which you can sense

Since when do you have a Savings account with them ?

All variants- spend 15K in first 90days to get a 500 voucher (not sure which brand). On wealth variant, complimentary golf is only when you spend min 20K in preceeding month.

The 500 welcome voucher offer could be included in article above, since its for all variants.

I’ve been using IDFC bank account as my salary account since past 2 years. Today I’ve received SMS from the bank about pre-approved IDFC SELECT card with the link to apply. When I opened it would instantly shows you and card Limit along with the ROI offered for you( for me its 1.5% PM) . And then when you select to proceed, all you details are pre-populated there, you just have to submit. Bingo!! with in few seconds it got approved and instantly received SMS with the last 4 digit of the card number and says card would get delivered within 3 days to the mailing address.

I would say IDFC have super fast service wrt card approval and processing.

Exited to receive it, let see how their offers would be when compared with my existing HDFC DC, AMEX Platinum and SBI Prime cards.

I applied both for myself and my dad. I got the select card and my father got the wealth card. I had 3-5 lakhs balance on average, and my father had 20-30 lakhs balance on average over the past year. I guess you need at least 15-20 lakhs NRV to get the wealth card.

Existing customers have started getting Pre-approved offers. I have applied for the Classic one today. I was eligible for Millenia and Classic only:( It is lifetime free so it’s a win win!

Today i have got preapproved select variant card. After i applied to that preapproved offer my select card number also been generated and will be delivered to me shortly with in a few seconds of claming the preapproved offer . Its lighting quick by idfc bank great

I got SMS for Classic credit card invitation. On entering DOB and mobile no, I was shown limit of 51k. The application was processed instantly and approved and customer id and card no was generated. Although, the online application process had some glitches. I am an existing IDFC customer and have a savings account with them since a couple of years. Overall good experience!

I received the delivery of the physical card (Select card) today within the promised timelines of 3 days. That was super quick service by IDFC First card. Now lets see how it goes with the card usage and the offers.

Can you please verify if it gives points on wallet load? Couldn’t find this in cursory look of TnC.

Which courier delivered by idfc credit card

Received the invite for First Select credit card via SMS today. They offered a credit limit of just 1 lakh and interest rate is 2.99% per month. I have credit score of 800+ across CIBIL, Equifax and Experian and no late payment history, so it is strange that they considered the highest interest rate slab. The application process is extremely smooth and doesn’t take more than 2-3 mins.

I got invite for select variant, even after maintaining high NRV. Not sure what’s NRV for wealth variant, when I check with RM he told now it’s only online processing and it’ll take 1-2 months for branch to process credit card application, also no clarity on variant eligibility yet.

This 10X thing is a little confusing. What do they mean by all spends above 20k. Is that cumulative value in a bill cycle or per swipe amount. I mean will I receive 10X points on all spends once I reach 20k spends in a cycle or is it instead for all swipes worth 20k or more in value?

I think, average balance between 1L & 10L have got select invite. CC told me only advantage of wealth is golf benefits, 500 BMS. Spa visit feature is yet to be started, to be started in 4-6 months. But he said I can upgrade after 6 months of usage to wealth

How many credit cards do you have? Also is there a limit on the number of cards we can have?

No limit on number of cards you can have. A few on the forum held over 15.

I have 26 cards personally.

Really you can have 26 cards. Can you give some details or throw light on this

Short of just 4-5. That’d make 1 for every day of the month. You Can Do It!

Oh, man! Cool

which are they, please name them

Got call today from IDFC customer care for pre-approved IDFC Select credit card variant. Credit card application process was speedy. I am having IDFC savings A/c for many years which I have never used except 1-2 txns. Got limit of 1.78L. CIBIL-790. I always used to get pre-approved personal loan offers ranging between 3L-7L which I never availed.

So that means they are offering purely on the basis of CIBIL

This Idfc credit card is of no use . it’s just no comparison with Hdfc Infinia or Hdfc Diners

Useless card

10x is a farce here

Quick maths

Hdfc infinia you get 5 on 150 which is 3.3% return and on 10x it’s 33% return if you travel else yoy get 16.5% return if you redeem through vouchers

Idfc card 10x on 20k spent is actually 2.5% return which is crap

I agree but IDFC credit cards can not be compared with super premium cards provided by other banks. I think that is not fair for new entrant.

We can not ignore USP of providing all cards LTF by IDFC.

That will act as game changer in credit card industry. Also IDFC will improve in providing more benefits once they are stable.

YOU ARE RIGHT ABOUT THAT

HDFC INFINA HAS REWARDS RATE AS BELOW

Default Reward Rate: 3.3%

Accelerated Reward Rate: 6.6% (2X on Dining/airvistara/hdfcbankinfinia)

Accelerated Reward Rate: 33% (10X with limited partners)

But is a decent card which is offering 2.5% cashback for people who don’t have infina card

That 2.5% is only above 25000.

Atleast that is the sense I get from reading “10X Reward Points on all Spends above ₹20,000”.

Can anyone confirm this or does that mean that 2.5% will apply to all if spends hit 20k in a month?

I got my card approved, yesterday only First Signature

Got call from idfc about pre-approved offer for select variant. She told the offer is there till 17-feb-2021. I told her that i m not interested in the select variant but the wealth variant only and already using other banks top card. She asked for which card and i told her HDFC Infinia. According to her they will revert if any possibility is there for wealth variant.

@addy Do let us know if they agreed for wealth variant 🙂

Not yet but they revised the credit limit to more than double than earlier offer and interest rate of 20% (earlier it was 36%). I have still not taken the offer. I m trying to figure whether amb of 10 lakhs or above can trigger wealth card.

My card was approved (select card) and I received an email stating that I can start using the card right away. But from where can I get the card details?

Netbanking under credit card section.

Is anyone who has an account already with IDFC and also has a card with One Card getting pre approval offers ?

Yes got both the cards now… One Card & IDFC Select card. Having saving account with IDFC.

Yes, I have oncecard as well IDC select card. Along with savings account

I hold IDFC niyo account. Got a call from IDFC bank informing me that I am pre-approved for classic credit card having credit limit of 0.9lakhs. What stumped me was that the executive told me that on taking the credit card there won’t be any CIBIL enquiry as it is “pre-approved” and so my credit score won’t be hit.

Can anyone please confirm this?

I applied for saving account with 10k balance, amount got deducted, no sms or email acknowledgement from the Bank regards the amount, haven’t received account details too.. its been 3 days. Customer care team do not respond on tweets, calls do not go through for non customers. Definitely, cannot be opened in 5 minutes. Pls correct that. I went through 100s of other tweets where ppl are complaining about lack of transparency. Pathetic experience.

I think so this is possible.

I went though same issue, I reached the nearest bank branch and they assisted to receover my account. They provided me with the cust id and account number. Once i got it, i contacted the CC and all was sorted in 1 day time.

I got preapproved message from idfc for idfc select card, have no account in idfc got link clicked no 2 min approved with card no saying limit 1.9 lac n you get card within 3 working days today I got mail with statement dt n detail of card, I have no account but I had capital first loan account which I paid fully on March before lockdown that time they merged with idfc n cust id generated so being good cust n record I got approved so they don’t want to loose old n good cust 🙂 also planning saving account opening.. Now

Got IDFC Select Card physically delivered today!

Select Card, Card limit 1.16 Lakh, Interest Rate APR 35%, bit disappointed here, my NRV around 4 Lakhs

I have a good credit history, the credit limit could have been higher with less interest rate, my bad

But extremely happy with the speedy and thoughtful process of IDFC First Bank, escaping the hassle of submitting physical documents and waiting for ages like in Axis Bank

Anyone with a Niyo IDFC savings account who has received this pre-approved offer for IDFC CC?

Same question from me too ;p

Not me…

Yes. I hold a Niyo IDFC account and got the pre-approved offer for Select CC

What was the NRV you were maintaining with them and which card offer you received?

I did get the offer even though my account is a Niyo IDFC account, got the select variant with a okayish limit. Problem being that both the old IDFC app and new NIyo app don’t show the credit card and access to the new app is in phases. That can be tricky ! I think should have just got a normal IDFC account

What was the NRV you were maintaining with them and which card offer you received?

I too received Select CC with my Niyo Account with them. NRV is in thousands to be precise <50k.

CIBIL is around 793 (last checked in Dec 20).

Limit Told by representative was 1.51L, I already hold various cards(ACE, DCB, FK Axis, AZ ICICI and so on) so thought to skip it, as it will hit CIBIL, the last CC CIBIL hit was in Sept 2020.

They surely aren't considering only NRV.

Received card today. IDFC certainly believes a lot in equality. Same RP across variants and same sort of welcome kit for all. A tiny envelope with no brochures or booklets or congratulatory letters inside. Just a simple looking card with details printed, no embossing, there’s an insignificant printed word Wealth though. No info on complimentary lounge/spa/movies. Their redemption is through poshvine. Pretty no-nonsense stuff.

Pretty run-of-the-mill if you ask me. That’s like making one feel insignificant and question his/her decision on taking this card

@Abhi,

Welcome to wealth club. 🙂

Information related with Lounges\spas and features are available online in PDF documents.

It seems most number of domestic lounges are available with Wealth Card. They have also provided list of applicable International lounges.

Only information missing is dreamfolks privilege card. Not sure when the card will be issued to wealth customers.

Hi, that pdf looks quite minimalistic, I couldn’t find much details but I’d like to see those lounge/spa lists. Is there somewhere else to look for? I scanned that QR in their welcome envelope but it says I m not onboarded on their new platform yet. They don’t have a dedicated site for crcards, nor its integrated with netbanking acc. Even cust care doesn’t have answers to many points. Seems like idfc was low on preparedness before launching.

Customers onboarded by IDFC after 15Dec have been given access to new portal , which also has a credit card section. Customers onboarded prior to 15Dec still have to use old netbanking till they are migrated. So until then, how do old customers view credit card spends, simply wait until the statement comes? Have done a few spends but my RP balance still shows 0 on poshvine.

Hi Abhi

Same for me. Looks like it will take some time for them before migrating old customers too. But in any case it is expected to be done latest by March end. As new card only customers are likely allowed to apply by then.

It happened because IDFC likely hurried the launch before tying up the back end properly.

You can ask bank to take request for migration on special case. I got my account migrated post card issuance citing the reason to check Credit card details online.

They migrated my account on d same day after submitting request.

I am able to see credit card in netbanking now. I guess by now, everyone should be able to see credit card details through netbanking.

But I can not see credit card control section where we can block\unblock card for different types of transactions. I hope IDFC will enable that option soon.

Login through this portal. At the welcome page you’ll be asked to switch to new portal. Wait for 5-10 minutes for data migration. Now use new portal/app to login.

Do note: You would need your registered mobile and customer ID for the switch, so keep it handy.

Received an ordinary looking Dreamfolks card today. Didn’t have to apply separately, they just sent it.

What’s the difference between dragon pass or priority pass. Sid can you have one topic on same as well.

Lounge numbers are more or less the same; some lounges even have a pool. DP gives you extra benefits like SPA usage, discount on airport restaurants & shops/ meet & greet services, airport limo etc. while PP is only for lounges.

There is already a write-up on DP. Search for it.

I want to know how to use golf pass on credit card.

How to use other facilities on credit card like concierge services and other services.

Call the number given on the back of your card.

I got Select variant of IDFC credit card 2 days back . I have made a payment of 5000 to Tanishq through their App using my IDFC credit card, but got only 150 reward points. Isn’t the online payments have to get 6 points @100. Shouldn’t I have got 300 points. Anybody please clarify.

150 is right. Offline spends 3X and online spends 6X

I feel – ‘Wealth’ variant has less benefits as compared to ‘Select’ variant as of now, if you exclude Golf benefit in Wealth, which very few people use in this times! Any views

Not really. You get golf benefits, international lounges & spa, a better offer on book my show – buy one get one offer on movie tickets of up to ₹500 per ticket twice every month, reduced FX Markup at 1.5% and much more.

All idfc cards have 1.5 markup

That is plain wrong.

Only Wealth is 1.5%. Select is 1.99%, and the others are 3.5%.

If anyone has already found the answers:

1. Are there RP for e-wallet loading? If yes, is it 3x or 6x?

2. Are the complimentary international lounge access only for lounges in Indian airports i.e. those in international departures side?

3. Will there eventually be a separate pass/card for spa and international lounges, like DP, to be delivered later? The welcome pack didn’t have any.

4. BMS offer on wealth variant is subject to any quotas? Asking because many other banks have daily quotas. Though Idfc debit card offer doesn’t have quotas.

5. Looks like RP redemption is through poshvine, but is there a fee, or limit on how many free redemptions are allowed?

Where are you checking the reward points?

Idfc poshvine portal

With wealth card you can access 100s of international lounges in foreign countries. List is available on internet through visa website. Even lounge located at domestic terminals of international airport outside India are are also accessible.

1+1 offer is through paytm and there is no quota as of now.

As per idfc bank claim no fee on reward point redemption.

Thanks for clarifying.

RP for wallet loading is 6x, unless it is PIN based. If the gateway accepts payment through PIN then its 3x. Generally, OTP based online transactions will earn 6x, and PIN based transactions done on physical terminals or online will earn 3x.

No redemption fees.

I got a call from IDFC informing me that i am preapproved for Millenia credit card and a link for applying for it over SMS. If I apply, will there be a CIBIL inquiry?

Yes. Any new credit card enquiry would result in a hard inquiry at CIBIL because it’s a request for credit – a request for an unsecured loan.

On a tangential note, this is the reason why some card applications get rejected when the issuer sees a lot of CIBIL inquiries in the Credit Report.

Not always true. If the bank knows you well (Old account + NRV) then they will approve with a low limit as per my experiences.

Not always true @WallStreetBets – I had 9 CIBIL entries in 2017 within a span of 4 months. It did nothing to harm my score( or even help it). All Cards got approved with pretty high limits.

I believe we are speaking about different things, and I agree to both your points.

I’m only saying that there will be a hard enquiry for a new card application because it’s a new line of unsecured credit. Maybe issuers are already prepared to give you the card, but are formally required to check.

Therefore, it will show up in the CIBIL report sooner or later. (I once saw an inquiry that occured in September, but only showed up the following Jan).

I also got an enquiry for my “pre-approved” Amex Smart Earn LTF credit card provided as a Companion Card to my MRCC.

A lot of inquiries in a short period of time may affect the approval for some issuers(mostly abroad), but our experience in India has been favourable.

CIBIL inquiry depends on person to person. For some preapproved applications, there is no inquiry like mine OneCard.

ICICI also doesn’t do CIBIL inquiry when the card is preapproved on the internet banking or Mobile as per 2019 and recent information.

Axis do an inquiry on a pre-approved application as per 2019 data. Axis doesn’t do an inquiry for Ace card for the existing card holder. I think they also don’t do for upgrade or downgrade.

On my CIBIL report there is 9 inquiry in 2020. I have an account with most of them I applied for a card and they approve but a low limit on recent applications.

My pre-approved CC from ICICI had CIBIL enquiry which showed up after 3 months. Same for IndusInd. LTF, pre approved cards both of them but for sure there was a hard pull

Hi Shivi,

Which variant of Indusind Card did you get LTF. They are usually very particular about one-time joining fee. Were you having an existing relationship with IndusInd then.

Legend was LTF. No joining fee. I had an add-on Exclusive account with them with no balance. Both card & account are now closed.

With idfc first bank pre approved card no cıbıl inquiry. I checked my cıbıl today only.

Hi Rex,

I am dependent on websites that offer free cibil check so i get to know about the enquiries after a couple of months.

But do the hard enquiries get reflected immediately? The idfc sales guy who had called me had also said that there won’t be a cibil enquiry.

Yes, any credit enquiry gets reflected immediately. While it takes 1-3 months to reflect new account and payment positions.

Zero doubt on these two issues.

I mostly get an SMS fro CIBIL for hard query, almost instantly (while on CC application page.) For IDFC pre approved millennia on my wife’s account I didn’t get any messege, so most probably an enquiry hasn’t happened YET.

Check again after 4 months. They don’t update CIBIL instantly.

Got the card today bur disappointed with the offers. You will get ₹500 voucher if you are going to spend 15000 in 90 days.

Which variant?

How are 10x calculated? If the first payment in the month is, say ₹30000, would it be 10x for the entire ₹30000 or for ₹10000?

10K is what I hear, with limits based on billing month/cycle.

guess it is 20000 with 6X and 10000 with 10X

I have a savings account with idfc and received the select credit card offer from them . It took a few minutes to fill in and its supposedly been despatched. They have sent me my limits and percentages , etc by email. The limit is just 1.6 lakhs, interest is nearly 36 % , but my itr is also around 5 lakhs , so no issues. And i never carry over , so interest rates are meaningless. Just collecting cards, i normally use amazon icici and hdfc regalia .

Hi Indian Guy,

With an ITR of 5 lpa , how did you manage to get regalia ?

they never check itr when upgrading. They look into your credit utilization and timely payment. if that is good then you are good for an upgrade. I started with gold card from HDFC and now ended up with regalia. i never wanted regalia, but they force me into upgrading as they couldnt give the gold credit card with higher limits when it was time for renewal.

Its 5 lakhs now since i have left the corporate sector a few years back. But i was in middle upper management and it seems my credit history is still good, score above 800 . But i am still inundated with credit card offers, though i reveal my present finances while accepting their offers. I have 5 cards. Though i normally use just Amazon icici and hdfc . I got the hdfc card for just their international lounge access, excellent experience. For domestic lounges , i have a few debit cards too.

I have a NRV of over 80 lakhs with IDFC personally and well over a crore for family. For the past two years I have kept over 10 lakhs in IDFC savings account as liquid cash due to 7% interest rate (now changed to 6). My CIBIL score is around 800 with many cards and no adverse information. I got a link via WhatsApp a couple of weeks back to apply. Did so and it stated there was no pre approved offer available. Called RM and he couldn’t care less. Totally disappointed and will be moving my account to other banks. Don’t really need this card as I have much better cards like Indusind Pinnacle and RBL Insignia as well as Yes Exclusive. With limits between 4 to 8 lakhs. Still disappointed that it was not approved despite having a good relationship with them.

It was not pre approved because they know these are not for you. You deserve amex platinum, hdfc infinia or Citi prestige or more.. Don’t waste your effort on such small issues. Try for super premium cards..

+1

I feel you were not using that account & it was for keeping the money only. That’s the only plausible explanation to your situation

Well, all my family and friends holding IDFC account with more than 25k average balance received pre-approval for one of the varients depending on the balance. I am really surprised you did not get one at all. It is not about the transactions as most people use IDFC to park funds only. I think it must be a system technical error…

Yes, my wife, who has no credit history also received an offer for the wealth variant. It was instantly approved with no documentation for a limit of 9.4 lakhs. The card arrived in 2 days. I also keep receiving sms and email offers but everytime I click, it says no offer available after otp verification.

Got pre approved offer for millennia and classic.. rejected it. Will wait to see if they offer select

I doubt anyone even got this 7-9% revolving rate of interest. It seems like a big marketing gimmick only

Got 9% on Wealth variant. Thats the minimum.

Dayum

10X Rewards are not actually 2.5%, since its incremental spends above 20k. So for purchases less than 20k, you will be earning 6X (1.5%) for online transactions and 3X(0.75%) for offline transactions.

So Rewards will vary from >=0.75% to <2.50%.

You can redeem points earned during a cycle only after statement generation. Got my first statement and did my first redemption also.

Had got 6pts per 100 for wallet loads on the first 20K spent, and 10pts per 100 on spends beyond 20K. Lot of redemption options like amazon flipkart and all major retail and online brands, and you can choose your voucher value from a wide price range. So no pre-fixed denominations like 500 or 2000, you can simply set values like 670 or 245 etc depending on your points balance and how many you wish to redeem. No redemption fee.

I got my first statement for my Wealth card. I made only two transactions. The first was for fuel in BP for Rs.3800 and the second was for Rs.998 at a restaurant. I received only 30 points. The reward points page said no 10x for fuel transactions but I did not realise that there will be no points at all. I was expecting at least the 3x points total 114 for the fuel and was wondering if I would get 27 or 30 points for the Rs.998 payment. This makes me wonder should I pay my insurance premium with this credit card online and would I get 6x points or nothing at all…Has anyone else had a similar transaction for which no points were accumulated?

I spoke to IDFC today and clarified a few things :-

1. No reward points for spends on Fuel, Utility Bill Payments, Gold/Jewellery purchases or Insurance premium payments. Their website said no 10x but the fact is no reward points at all.

2. The first Rs.20,000 spends will accumulate 3x for offline and 6x for online. Thereafter, all transactions will get 10x. But any transactions mentioned above such as fuel or insurance will not get any reward points so will be excluded when accumulating towards the Rs.20,000 threshold to achieve 10x.

3. All transactions will be counted for the welcome offer of Rs.500 voucher as long as Rs.15,000 is reached. This includes fuel, insurance transactions as well, since the welcome offer is not related to the reward points.

4. I was told that the fuel, insurance exclusions are found in the T&C but I could not find it. If anyone has seen it, please share link. Meantime, I have asked IDFC to credit my points for my fuel payment as they have not clearly mentioned it anywhere (only not eligible for 10x).

5. With so many exclusions, it could be difficult to accumulate the points as my major spends mostly fall within the said excluded categories. I get 5% with ICICI Amazon card anytime on my Amazon purchases and Axis Flipkart card gets me 5% on Flipkart. It seems that the main benefit is the wallet reloads. I am not so excited about this card anymore as I was earlier…

Thanks buddy

Will we get rewards point for NPS transactions?

I don’t know about NPS. But they said also no points at all for any EMI transactions, any transaction converted as EMI, any cash withdrawals…

slightly off the topic though.

Which credit/debit card is best for making NPS payments?

With CRED not offering any decent benefit on CC payments, which app can be used for CC bill payment using which debit card to get maximum benefit.

Not much detailed explanation.

Looking for a detailed post of each card. Including rewards 3x 6x 10x calculator according to spends offline/online.

Benefits of each card compared like – Forex , spas , lounges etc…

Take a paid consultation for your detailed queries 🙂

I received a link and applied and got the Wealth First variant. I have a savings account with IDFC since Oct

Anybody know how to request addon cards?

Call the call center of IDFC credit card at 18605001111 and they will guide. I have not applied for add on cards so not sure how it works…

I’ve an existing offer on net banking for wealth cc with 2L limit. It says no documentation required. I just maintain the 25k balance & do transactions regularly from 4 years.

Maintaining 25k in any account which is not in regular use is a mistake. If the account is being used its fine. Else changeover to the 10k minimum balance.

“& do transactions regularly from 4 years”

-_-

Sent them an email and received Dreamfolks privilege card in about 10 days

I received the IDFC First Wealth CC today. I got a call a few days ago, and the CC was approved within just 1 day, and I received the details via SMS. I am not an IDFC Bank SB customer. I received the card with interest rate of 33% p.a though. Its a good card because its LTF, but I don’t think it compares to Infinia etc (which I really hope I get somehow!).

If you’re not a savings bank account holder, do you mind to say what relationship do you hold with IDFC First bank?

I’m trying to get the Wealth variant credit card, but I’m still waiting for the pre-approved offer.

Hi Sandesh – I had absolutely no relationship with the bank before this. I had simply filled the form on their website and I received a phone call, and we took it from there.

Hey kaus,

Do you have any other relationship with the bank?

Hi Pramtesh – I don’t.

Got the DreamFolks membership card today automatically after getting the Wealth card about a month back.

And the interest rate on the Wealth card is 9%. I am not sure how another Wealth card would come with 33%. Their website mentions all Wealth varient to be at 9% and the 33% would be the Millennia or the Classic card. By the way, do you mean that non-IDFC customers started getting credit cards as well?

Yeah, not sure why I got it at 33%. My understanding was that Wealth card is at 9%. However, that wasn’t the case with me.

And, yes, non-IDFC customers started getting the CCs as well.

It doesn’t mention “all Wealth varient to be at 9% and the 33% would be the Millennia or the Classic card”.

It says any variant can have any interest rate from 9% to 35.88%

Hi sid

received wealth card today.with 5 lac limit. without having any a/c or relation with idfc bank. i just applied through their website. the guy visited my home and did KYC through is cell phone. and told me im eligible for wealth card.

but didnt get dragon pass with it.

bunty

Wealth card without an a/c – That’s a surprise. Btw, I just got denied “with” the ac 😀

Yep, I received the Wealth card without an account (or any relationship)..

its strange to hear from you that you got denied cc from idfc as you are having all premium cards provide any reason for that .

Anyone knows the criteria?

Received “Thank you for showing interest in IDFC FIRST Bank Credit Card. We are currently not able to offer you a Credit Card due to bank’s internal policy. We value your relationship and will get in touch with you once we have an offer for you.” when applied using mail.

High 6 figures MAB, 785 CIBIL, 20 yo.

Age might be the factor, most probable factor.

+1

When are the 10x points credited, are they credited when the transaction gets updated in the unbilled or upon generation of monthly bill. I made purchase of Rs.55000 online but have received only 6x points corresponding to the transaction amount. Haven’t received 4x points for the transaction amount of above Rs.20000 which in this case is Rs.35000. Their customer care is useless, they do not reply to any email.

It shows like that while unbilled, but after billing, it seems to be corrected.

Received an invitation for a wealth card and got the card today, within 2 days after applying. Have a salary account with IDFC.

r,g

Have a savings account with IDFC with balance upwards of 30 lacs. Yet I was denied a credit card by them today stating internal policy. I have CIBIL score of 825+ and practically every super premium card in the market.

Wondering what the reason could be!

IDFC and HDFC have only one letter different. That’s the only reason I could think of. 🙂

“I have ….. practically every super premium card in the market.” ~ This could be the reason. Too many cards/open credit lines

I got a similar message but a week later, I got an invite for the wealth variant. Initially, the RM gave me the link to select variant to check and the system must have checked against the select variant and shot the message.

Similar experience with my spouse. I have got ‘select’ variant with average maintenance of 5-6 lakhs in savings account . My spouse was yet to get invite that time. So transferred funds from other accounts to spouse account and kept a good balance (+10L) . Within one month got invite for ‘wealth ‘ variant as intended. so far so good.

Immediately after submitting the application, it got rejected citing internal policies. Actually there is no information sought in the application which qualifies for a ‘rejection’., just address, and some basic stuff. No CIBIL hit too.

Contacted the customer care, they were also clue less of what happened. Got a call after 2-3 days from their escalation desk quoting it was a technical glitch which they are trying to resolve.

its more than a month since.. no update..

Hi Kaus great news from you.

Good to hear that IDFC has started rolling out cards for Non account holder.

Last month i had shown interest in the website. The representative applied online on 15th March but coming to my society. Immediately it showed i got select card with 3.75l limit. Received the final approval msg with customer id on 17th. Though i gave not received the physical card yet i can see the card details in the new portal

I too got the card with ~10l limit and 9% interest offer.

10L? What’s your relationship with them?

Got decline for Wealth despite maintaining balance on SB for about an year or so.

Transferred balance because of decline. Received sms for Select variant, applied and its on the way – getting as its free anyway. Not so appealing except for rewards on wallet loads.

Received my wealth card and dragonpass as well. Same for my wife. Very smooth and fast services by IDFC

Applied for Wealth Card since it’s free.

In a few days, the executive contacted me. I am a professional and show very low income (<5 lakhs) in ITR. I told this to the executive for which he asked the highest credit limit on any other card that I hold.

I have a Diners Black with 11.5 lakhs limit and a CIBIL rating of 792. He said he can process the application on card-to-card basis. Had to give him the latest Diners Black statement and within 10 days I got the Wealth card with 13.8 lakhs credit limit. The interest rate is however 33%, but that's alright!

How to contact that executive?

Even I want to apply Card -to Card basis via my Diners black

My interest rate on select card reduced from 35 to 18 % as per sms from idfc.

Approved for IDFC FIRST Wealth variant with 9% interest (0.75%PM) today. Limit 5L. Superfast, straightfwd and easy online process. With Wealth of freatues, this looks to be a great addition alongside DCB in my wallet.

Shahil, can you let us know how you applied for the card?

Could someone help me understand how many international/domestic/spa visits are allowed on each Idfc first wealth credit card (which is a visa infinite variant) and dreamfolks pass? It’s 4 per qtr.

Let me put it this way – would I be able to use credit card for 4 domestic lounge accesses/qtr and dreamfolks for 4 International lounge accesses/qtr? Or it would be total 4 domestic, international or spa regardless card and dreamfolks combined?

Could someone elaborate on this? Customer care executives don’t have much idea.

Dear Shail

It should be 4 domestic airport lounge via Wealth card + 4 International lounge + 4 Spa visits via Dragonpass card in general. CS is new for credit cards, so don’t go by their words.

Anyway do try if you travel and let us all know.

I made a transaction of Rs 1.5 L a couple of days back on my first wealth card. I see around 4500 points for this transaction. I think, I should be getting around 13600 points – 3x up 20k pos transaction and 10x on remaining 1.3L.

Does anyone have an idea how stuff works? Is there a lead time for certain X points to be credited when a 10x eligibile transaction is made.

9100 points will be credited after statement is generated . all points will reflect in statement also .

10x points will be credited when statement generated.

The remaining points for 10X eligible transactions will be posted on statement generation and you can redeem them immediately after statement generation.

Dear SJ

Wait for statement generation. You can see all these points details in statment clearly. And earned points during a cycle can be used only after statement for that cycle is generated.