This is the hands-on experience article of the IDFC First Credit Card. If you’re looking for the features and benefits of this card, do check out here: IDFC First credit card review

I am an IDFC First bank savings account holder since June 2019 and at the time of opening the account the sales executive who came to collect KYC documents told upon enquiry that a credit card launch is approx. 6 months away.

Covid- 19 probably delayed the launch however IDFC was issuing cards (15,000+) to their employees as a trial run few months before public launch. It finally reached public by mid Jan 2021 and here’s my hands on experience with it.

Table of Contents

Application Process

Expressed interest on the pre-launch day itself i.e. 15 Jan 2021 and got this message on screen.

Here’s a quick look at the timeline taken to process the card application:

- 15.01.21 – Expressed interest on website, the day on which Pre-launch happened

- 19.01.21 – Received an sms link to apply for the pre-approved card (link was not working for few hours)

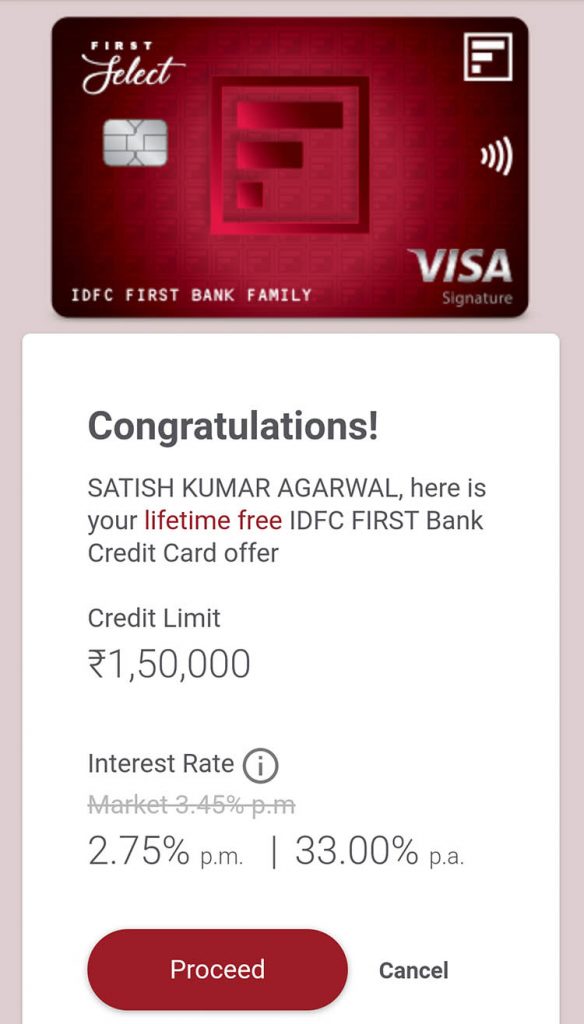

- 20.01.21 – Applied via the link and shown pre-approved card along with variant, limit & interest rate @33% (approved immediately) as shown above

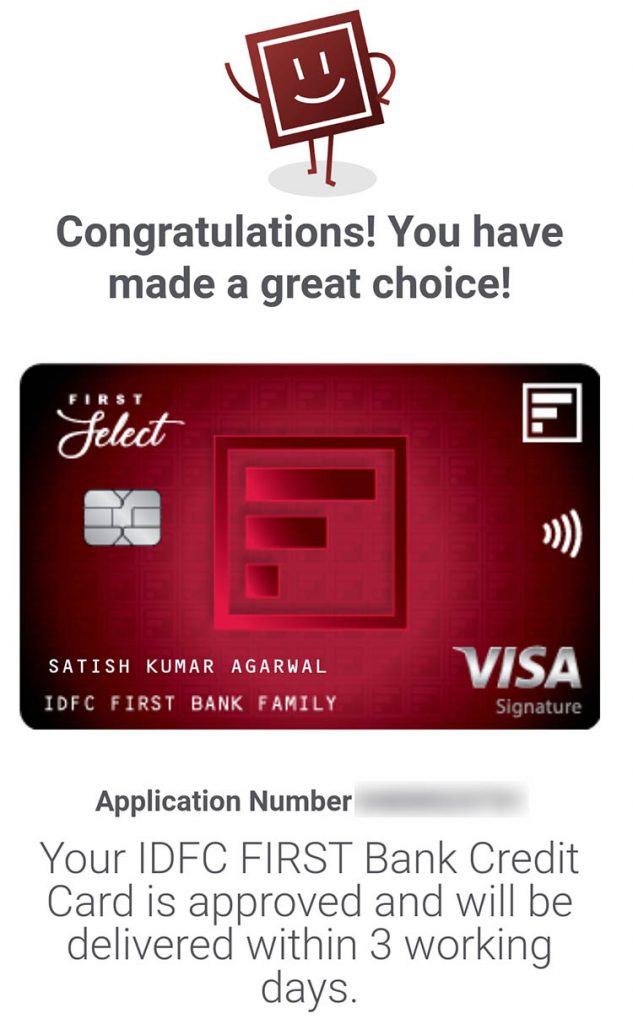

- 22.01.21 – Received courier details for tracking

- 25.01.21 – Received card in a simple yet thoughtfully designed mini envelope without any booklet

So it all happened quite fast as the card was in my hand within 10 days of announcing the launch. Everything went online and kudos to IDFC First bank for this lightning fast processing.

Update: In the 3rd week of April, received the message that interest rate has been reduced to 22%

The Card

IDFC First Select card looks quite similar to its IDFC Visa Signature debit card except:

- Card details are printed (whereas its embossed on Debit Card)

- Front of the card has only name, all details viz. card no., cvv, expiry date are on the backside

- No signature panel on the back (rightly removed, which anyway is of no use)

- VISA logo on the card carries distinctive metallic reflective look (first time seen by me)

Reward Points Redemption

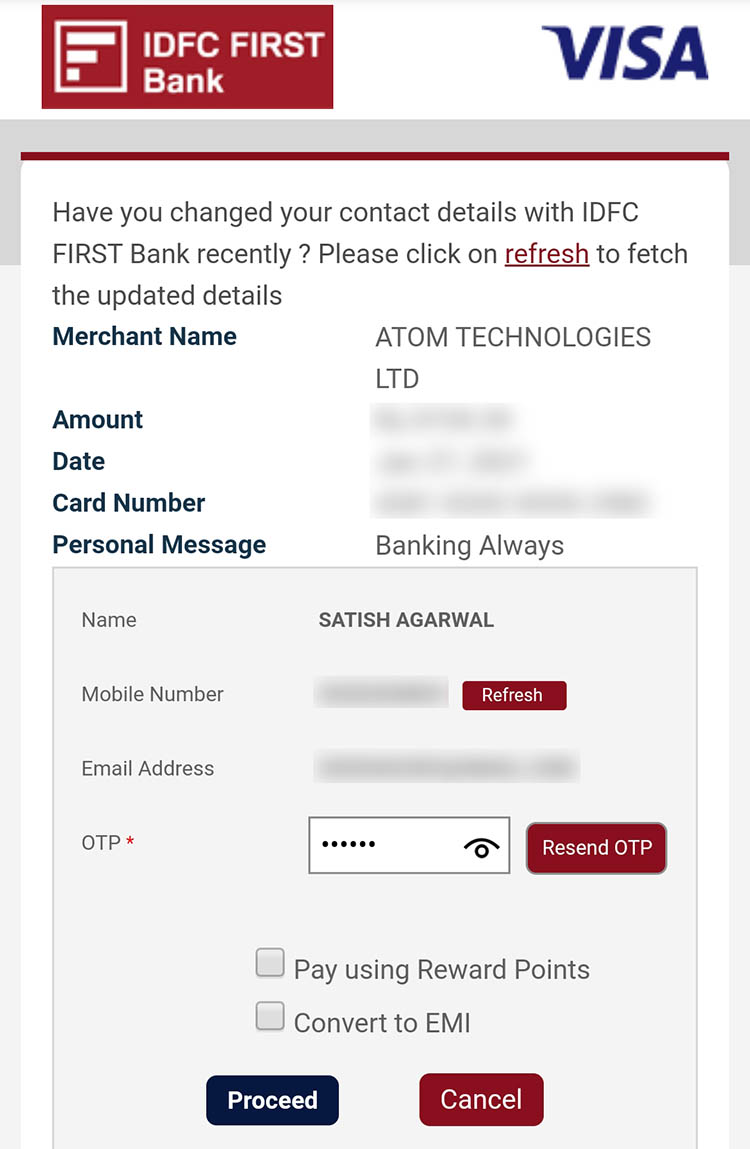

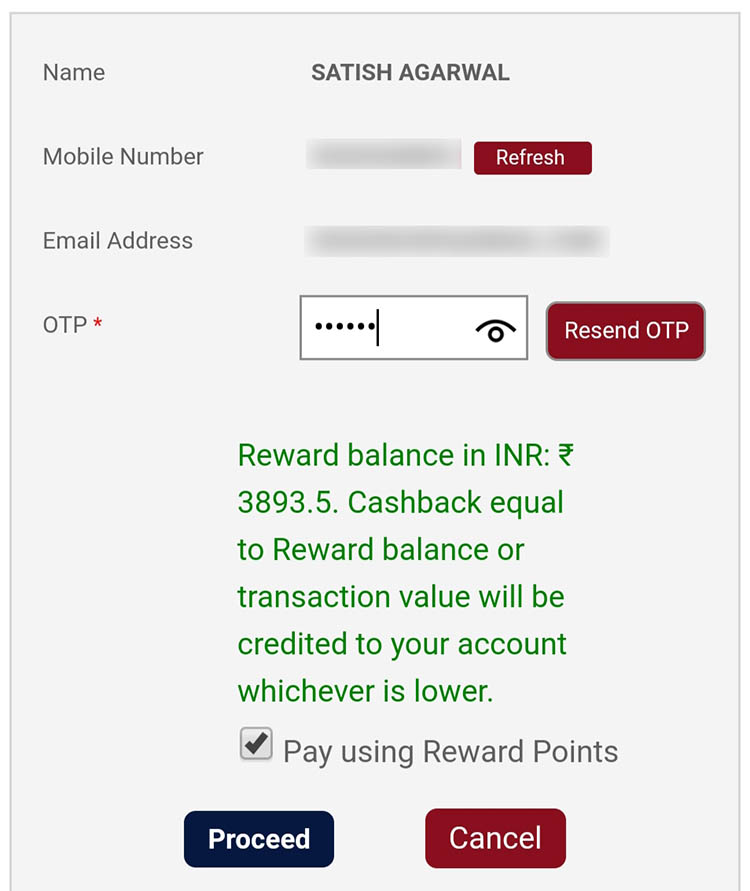

What I liked most is: Reward Points can be redeemed when placing an order online itself, similar to how Amex points redemption work.

Tried this out recently and the transaction value didn’t become zero, rather the txn was as usual + I received statement cash back credit equivalent to the transaction within just 2 days, which is swift by any standard.

RPs redemption options are as good as cash credit currently. Other options like Amazon, Flipkart and almost all popular brand GVs are also available.

What’s more, you are free to input the GV amount and can redeem upto max possible limit of RPs available and not a preset 500, 1000 kind of GV. This is similar to SBICard AURUM redemption system, as both are handled by the same company.

Reward points can be redeemed via in-app link too, which doesn’t require further login.

EMI conversion option is also seen in OTP entry stage, though I am yet to try it out. These are some real innovative options for a new entrant in the industry.

Credit Limit

I exceeded the 80% credit limit via a particular transaction (Covid 19 initial hospitalisation bill) and immediately came an email & sms to remind the same. Once used more than 80% credit limit, I had to prepay to use it for further transactions.

Best part is even though I have used the entire assigned credit limit in this stmt. cycle, I can still prepay and use the card further and earn Reward Points.

But I can’t use more than assigned credit limit on the same day, as few attempts to pay even small bills failed that day miserably. Card was perfectly working next day.

Note: This daily limit is also being experienced on HDFC & SBI credit cards these days.

Customer Support

Every time I have connected to their customer support in last 1.5 years of relationship (about 10 times), it has mostly been a pleasant experience & found them polite.

Their thoughtfully designed new mobile app (though hangs a bit more frequently) has plenty of options and fewer clicks required to perform each operation.

It has options to Chat/ Video chat in-app.

Thought to give it a try and was instantly connected to Video support and on inquiring about Wealth card upgrade, I was told to try after 6 months and the card team will look into basis internal criteria.

Via in-app chat I requested for CL enhancement (even temporary for 1 month only) in 4th week of April keeping in mind credit utilization ratio reaching/ exceeding 100%, but was politely denied. I was conveyed that minimum 6 months time period is required to look into.

Drawbacks

Not giving reward points for Insurance transactions is a big thumbs down. At least RPs with a monthly limit for these transactions could have been better.

Also any kind of wallet load (online transaction) will most likely earn RPs at base rate, i.e. 3X (3 points per 100 spent). This is as per their CS executive on call. However in reality, I have received 6X RPs in current billing cycle.

Being a recent entrant in credit card industry, its old netbanking UI/ mobile app for credit card has nil/ limited options. I successfully migrated to new portal via a link (in a comment) posted in inaugural article within 5 minutes. You may try via the same link here.

Bottom line

My experience with IDFC First Select credit card has been one of the more pleasant and rewarding one especially because my HDFC Diners Black credit card had acceptance issues frequently during Covid-19 hospitalization in mid April 2021.

Also the simple and easy redemption system similar to vanilla cashback cards makes it a wonderful credit card for beginners.

All good so far and I’m waiting to see some IDFC targeted offers just like those they send to the debit cards now and then.

Wallet loads earn 6x rewards. Have received reward points accordingly.

Dear Ramesh

It’s great then. CS executive told otherwise. Let’s see in card statement, if they reduce it or not.

Is it 6x or 6 RP per 100 INR Spend.

Both are different.

6X= 6 RP per 100/- for online transactions, in case of IDFC Credit Cards.

Hi are mobiwik wallet load get 6x or 3x? I plan a recharge of 1.2 lacs

I am trying to apply for the card but as soon as I punch the name and phone number for the OTP the page errors out with 404 messages.Is anyone also facing the same problem?

Dear Dilpreet

Did you get sms with a link to apply. If so, then wait for few hours. In my case also link was not working for sometime.

Wallet load is counted as online spend and earns 6X/10X.

It’s good to know this dear Abhi. Haven’t tried wallet loading yet. Will see to it.

Bro could u please tell about the reward system in wallet loading. Could u please load a small amount and see if one can get rewards for wallet loading. I am planning to get this card. Your efforts and help will be really appreciated.

6X i.e. 1.5%

May I know what is the interest rate when Balance transfer as Emi for 3 or 6 months from another card to IDfc card and

For this dear Amith I think you will have to ring IDFC CS or have a chat in-app, as I neither saw any information regarding balance transfer on IDFC website nor received any promo sms/ email about this.

i applied on their website about 6 weeks back. I have a credit score of about 780. have yet to hear back from them. i don’t have any other relationship.

Dear Neil

I think you will have to wait bit longer, because even new savings ac customers have not been issued one.

In 1st phase, they are issuing to existing customers mostly with older than 6 months relationship

I want to apply…IDFC First Bank Credit Card….n Saving Account also…. details pl.

Dear J D

Please go to IDFC bank website n apply, they will contact. Or else Google your city’s IDFC branch contact no. and talk to them.

@Sathish Kumar Agarwal

Your description:

“””20.01.21 – Applied via the link and shown pre-approved card along with variant, limit & interest rate @33% (approved immediately) as shown above”””

Is Aadhaar verification required for card process?

Or

Can you post the steps followed while proceeding with the link ?

No aadhaar was required bro. Mobile linked to savings ac OTP verification and that’s all, if I can remember correctly.

Thanks. I received SMS link 20 days back to apply for the card. But, the card got declined as I have a dormant a/c with IDFC opened in 2017. I shall put some funds and try again.

have u guys got the Free Road Side Assistance(RSA) worth ₹1,399 ?

Need more details on RSA. Anyone with more info, please share.

idfcfirstbank.com/content/dam/idfcfirstbank/pdf/credit-card/FIRST-Select-Privileges.pdf (5th Page)

Road Side Assistance

Offer Details: Complimentary Road Side Assistance (RSA) all over India, up to 4 times in a year worth ₹

1399 on your IDFC FIRST Select Credit Card through Global Assure.

How to Avail:

1. IDFC FIRST Bank card holder should call Toll-free Number 18005723860 to avail Emergency

Road side Assistance (RSA).

2. IDFC FIRST Bank card holder will share their Full Name, last four digits as on card to

Global Assure to claim RSA services. Upon validation of above details a fleet vehicle will

be sent to the cardholder location.

3. IDFC FIRST Bank card holder will show any own Govt ID proof / Car ID (RC Copy, PUC

Certificate, Insurance Copy) to the fleet vehicle agent. RSA Service will be provided post

validation and name match on Govt ID/Car ID with the name on the IDFC FIRST Bank

credit card.

4. All the services to IDFC First Bank card holder will be provided as per the below mentioned

terms & conditions.

5. IDFC First Bank card holder can avail up to a maximum of 4 complimentary RSA services in a

year.

Used it today. Called the helpline number and the technician arrived in just 20 min. Well behaved ..

IDFC service rocks. All my future loans will be from this bank

Great to learn.

Can you share some more details on what exactly u used it for etc .. and how smooth was the service.

I got the select card with 3.35 lacs limit. But i still find it hard to make use of the card since i hold DCB and SC ultimate and i switch between both for online spends and everyday spends. Any inputs on what other spends can i divert to select card which wouldn’t make sense to be spent on DCB or SC Ultimate?

Wallet Reloads.

I am Fd member of Idfc but I applied for credit card but no reply why?

anyone heard of upgrade from Select to Wealth?

For me I was told to wait at least 6m

Satish I am maitaining about 5 lacs in IDFC first account from 15 Sep approx.

But badluck currently no sourcing started in Bihar where I am residing.

I had followwd same process and got sms reply that we are unable to provide you a card right now

So, where are you from?

and would changing branch to Delhi/Jharkhand will make difference in getting card offer?

Should I change it?

It’s not the branch but your residential address that matters.

are you sure because in almost every bank with Preapprpved card after being preapproved doesn’t matter where your address in in village or any pin code.

If card offer is preapproved they send card on amy address.

Dear Real Techie

Talk to BM, where you hold your account. You might as well get it approved via him, otherwise he should be able to tell you the reason of not getting pre-approved.

Same reason sir.

Card processing not started yet in Bihar.

Already had a talk with bm as well cluster head.

Were you hospitalized yourself? How are you doing now? How was your course of the disease?

I will using the IDFC accout from past 3 years but I didnt received any pre approved offer of Credit card not received.

Hi Satish,

Can we upgrade one card ( IDFC ) to select credit card?

Dear Varun

I don’t think you will be able to do that. Rather open an account with them (if you already don’t have one), and within 6 months, you may expect pre-approved card offer or else connect with BM, if you want to have one.

Thanks for your kind response.

Covid positive on 13.04.2021, negative on 05.05.2021. Discharged on 26.04.2021.

Lung infection CT score was 14/25 before hospitalization.

Doctor has said during last OPD visit 4 days back that pneumonia traces are still there. Medicines will be taken for atleast 1 month to get completely cured.

Last phase of my recovery is under progress. Should be perfectly all right in about 10-15 days or so to atleast resume duty.

TC and wishing speedy recovery!

Thanks bro 😊

Wish you a very speedy recovery…Take care

Thanks bro 😊

On IDFC Select CC, did anyone of you tried the free lounge access. It didn’t work for me during the month of March 2021. Luckily, I had backup.

Did you check the list of lounges applicable on their website before the trip. I usually do this, because list of lounges varies in general quarterly/ half yearly with every bank.

Yes, in March 2021, I used IDFC select to avail lounge access to bangalore airport

In the new website airport lounge access is not showing up for select credit card. It shows only the 4 railway lounges per qtr. Anyone used it recently.

Rent payment on Redgirraffe using payzapp has considered as insurance transactions therefore no reward points with idfc cards.

That’s bad. Do you have any idea Rent payment via nobroker is considered as insurance too or reward point are been credited for it?

I don’t use no broker. So I have no idea. I am using either ace card or diners black for rent pay on payzapp.

Axis Ace is working on payzapp for rent payments? I heard no axis cards work on payzapp for rent payment.

Yes, I never had any problem with Axis ace with Payzapp. It always ask for CVV.

Did anyone paid rent through nobroker.com via idfc credit card. Did you received the reward points or not.

Hello Everyone,

I hold my account with India’s First branch of IDFC bank which is in Naman chambers , BKC, MUMBAI since its inception. Earlier my min. balance was Rs.2-3L , CURRENTLY its 13L , Still didn’t get any kind of approval for any type of card. visited their branch. BM is unable to do anything on my case , did mail to RNO (Nodal officer) but still it didn’t worked out yet. My CIBIL score is 780 & Experian score is 816. Kindly suggest any other option please.

Use the account actively for 4- 6 months.

Looking at so many comments on ppl not getting wealth.. looks i got really lucky.

They initially offered me select or some other variant ,, i had told its either wealth or nothing. They agreed in a day and issued the same.

had ~10 L in my IDFC account with some of it in short term FD. May be that helped

Congrats man!

I’m trying the same but no luck.

May I know how much was the credit limit?

5L

I opened an IDFC savings account in early Feb. today they sent me an offer to get the select credit card

Caution:

I was trying to make a rent payment through Redgiraffe using this card so that I could save on high free imposed by cred/nobroker/similar others.

Tried making payment through net banking but it only accepts saving accounts. So registered on payzapp and made payment through IDFC credit card. I have been debited rewards points (usual as well as 10x) since it has been categorised as a insurance transaction in their systems.

I have taken up the issue with nodal officer done their customer care was of no use.

Even HDFC bank treats redgiraffe payzapp payments as insurance but it gives reward points

While it had been more than 2 years since my last CL enhancement on my INFINA card. I decide to put the card on cold to check if I get any enhancement offer and since April I haven’t made any spends on my INFINA card. To my dismay i suddenly see today an reduction of 9 lac on my credit limit. This is the 1st time ever I have got a limit reduced it’s been more than 10 years I have been using cards this is been my 1st experience.

Cheers,

Kiran

I see more and more people with reduced credit limit in the last 1 week; so it’s definitely not you alone. Most have got their limits reduced by 50-75%~

Never heard anything like that. Really surprised. Well when the card has NPSL then I don’t think that it will be an issue wrt the use.

Share if i am missing something.

Please divulge more as why it was done and what could be the triggers for it.

NPSL will not give you unlimited credit limit. It would at best give you 50% more limit for a month.

Thanks for the clarification. I wasn’t aware of it.

Thats strange.. Unusual for HDFC bank to reduce credit limits that too by such large amounts

Has happened before too, in 2009, due to weak economy.

I have been offered an pre-approved IDFC Select credit card. I was interested in Wealth variant as I already have Diners black which is more rewarding. Should I opt for Select variant now and look for upgrade to Wealth later. I know I won’t be using this card much so upgrade might be difficult later.

I was in the same situation but took it yesterday. I was told upgrades would happen in 4 to 6 months after getting the card. I took a chance.

Same here.. I dont want select.. They have given a select with 4 lakh credit limit.

I too have diners black but have taken the select card since it’s lifetime free and may be useful for movie offers later. Wealth card only added benefit is spa visits.

Hey is that 10x reward point on incremental spends greater then 10000 is on doing the trxn of greater then 20k or doing 5k*4 transaction separetly?

My RM called for the card. I told him I dont want select and want the wealth version.

However, they said that currently wealth is for high nrv around 50 lakhs. And select is what they offer even to senior employees of idfc as well. Dont know how true it is, most RMs across banks have no clue about cards or they just plain lie. Anyways i applied for select and got the card in 60 seconds or so.

Hopefully the card should be delivered tomorrow which will be less than 48 hours from application to delivery.

My wife have idfc saving account, got the offer today on her mobile,

She maintains Min balance of 15 lac.

Got offer for select card, when applied they immediately rejected it,

CiBIL score is 785

God know what is their criteria.

Even HDFC n SBi gave her 3.80 lac limit .

#IDFC sucks, planning to move out from it.

Reapply in a day. I got IDFC select card With 3.5lakhs limit reapplying on same link next day. I have only 10k balance in IDFC account.

Recently got approved for IDFC First Select Credit Card. Application Process is not at all smooth. I am a IDFC Savings Account Holder for Last 4 months…received link to apply…tried applying multiple times but on the last page always received the message that my application was rejected since i did not meet the internal criteria. I escalated the issue to the IDFC First team on twitter and after chasing them multiple times received a call from their customer care.. turns out that there is some issue with the form and it did not take my employer details…gave out the details on phone and card got issued in an hour or so…

The Bank app is not good at all and while I can see e- version of the card when I login to the Net Banking Portal on the Browser, i am unable to see it on the app…Card is yet to be delivered so have no experience of handling and using it

I also received auto approval link for select card. When applied it says rejected and doesn’t say any reason. When I asked my RM to check he says its some backend system issue and he doesn’t have any details for rejection and asked to again try to apply for card. He shared me the new link to apply. I again applied and it again got rejected with no reason. RM has no clue and asked to wait few months before reapplying. Asked him to share the escalation matrix since then he is not responding. Such a stupid bank and such stupid RMs. I have dropped a note to them to close my saving account as well.

Yesterday applied for Select with 3L CL. I do not have any prior relationship with IDFC. Today video KYC completed. Will update on the application process.

Yes, now anyone can apply for a IDFC credit card online from their website. No need to have any prior relationship with the bank. If you have a good cibil score, and holding any other credit cards with good credit limit, the chances of approval are very high, on a card to card basis. You will get to know the approval / rejection instantly. I got my IDFC Select card instantly with a decent credit limit and VKYC, a couple of weeks ago. Go for it guys give it a try.

Finally got the card approved and appearing on Mobile App.

My pre-approved select cc application got denied due to banks internal policy. When I escalated the issue to regional head via my RM, I got the response that application is denied with the internal status “Live Loan Count Reject Rule”.

I have an outgoing car loan, home loan and personal loan along with 8 cc. This may be the reason for rejection. They would have a count check before approving the application. They asked me to apply after 3 months for credit review check. Strange that yesterday only I got approved for BOB life time free card with no questions.

This is strange. You have some secure loan in report but I only had insucure accounts, (9 active cards and 1 personal loan) in cibil report. But still IDFC Cc was delivered within 2 days post accepting the pre approve offer.

I had a 5 year old saving account with IDFC.

Hi satish, I have got hdfc regalia, idfc first select both. Which is good. Both are lifetime free for me.

For accelerated reward points on Smartbuy use Regalia. IDFC card gives good value when you spend more than 20k in a billing cycle as it gives 2.5% return above 20k

Anyone got credit card upgrade offer from IDFC? I want to upgrade from classic to select.

i have more than required salary for select but classic was pre-approved.

Planning to make car purchase using this card. The extra 2% charges can be compensated using the reward points. Also guys use ackodrive for car purchase. You will get extra 25-30k discount on all cars vs normal dealers

How much time does idfc take to credit points

2-3 days, but you can use these points only after statement generation.

For spends above 20k are the 10x reward points credited after couple of days or at the end of the billing cycle?

Incremental 10X RPs are credited alongwith statement generation

I tried to apply

Variant offered select with no income docs

Limit shown 4L

Interest 0.75 pm/9% pa

Video kyc pending

Should I go ahead ? Is it worth ?

Offcourse it’s worth.

Yes it is good card variant to go for

I’m facing strange issue with my idfc select credit card. Its not working on POS machine (either chip or contactless). Both POS and contactless transactions are enabled on my card. Talked to customer care they told no issue on their side. Replaced the card, it worked for few days then again same issue. For your note, card is handled very carefully and no damage . I’m able to use the card for online transactions. Any idea what could be wrong?

Faced same issue. Got the card changed. Yet to do any transaction with new card.

@sid/Satish

i was approved for classic but i can get select if i upload an existing card statement (i filled my Citi PM with 7L limit as existing card). Now when i try to upload the cc statement it is throwing all kind of errors. any workaround for this?

TIA

Where you are uploading and what kind of errors you are getting?

i am uploading on the url generated after filling in details (mobile, PAN etc).

I have been pre-approved for Select but I think I can get Wealth on Card to Card basis. But unlike you I am not getting any option to upload my CC statement. I just get an option to proceed with my existing pre approved Select card.

Can you please guide me where exactly to upload CC statement in case I am pre approved for Select but want Wealth Card.

its a Russian roulette of one of the following.

1. Details not captured. Please retry

2. Please upload two months statement

3. File is not in the desired format

@Neil I had applied by uploading statement and application was successfully placed. Not sure if the size of the file you are trying to upload or format of the file is causing problem. But their card processing is very slow and poor. I had to tweet for them to finally approve.

the file of the individual file is less than 200 kb. it is in pdf format generated from Citi website

Remove spaces from filename and filepath. Keep the file is c folder and limit the size and upload should work.

Tried this too and doesn’t work. seems like the credit card gods don’t want to me hold IDFC First CC.

Their support is so pathetic that I sometimes think why I am going through all this trouble. May be its a sign to skip IDFC First altogether.

Same problem I faced during my regalia statement upload of September month

then I tried August month statement and it uploaded success fully

So u can also try this.

Tried this too. but no luck

I received my Select card yesterday.

Limit 300,000

Interest- 20%

Trying to find out the statement date. can’t find it on the IDFC First Bank app. Any pointers?

They send out an email with the details such as limit, interest rate, and the due date.

You will receive a welcome email, which will have this information.

are lic website spends going to get 2.5% above INR 20,000?

No. Insurance spends are not rewarded.

Does paying insurance bills through paytm app using IDFC card provides 10 RPs?. I feel this should work but not tried

Oh damn. It was actually not insurance but pm senior citizens pension cum fd scheme

Hi Guys,

I had received pre-approved offer for IDFC Select card, I did the application process hoping that the card would be approved directly.

But now I have received notification that my card application is rejected. The background team had a word with me for my office address for verification (But it is closed from past 1+ year due to Covid-19) as the work is totally WFH.

Whom shall I connect with for this situation.

Thanks,

Akshay

Hi,

I have got millennia cc. How to upgrade to select?

Different banks.

IDFC Bank also issues card variant with Millenia name.

IDFC Basic card name is also Millennia

It’s First Millenia by IDFC bank, not Millenia. Though now i can see the “First” word is non existent in their marketing brochure.

Finally i received a message stating that select card is approved and they also sent download link of idfc app, but physical card may arrive in 5 working days as per them. But it was quite a uneventful journey with them. Application submitted online 11 Nov for vide KYC completed in 13 as there was issue with their link after calling them several times. for some reason the status was moved from 19 nov to 22nd , 24th and then 30th Nov although it was in credit review, and the bank resubmitted the application with same number stating unable to verify my address and they sent link which i updated after 24hrs a person came and verified the address and after 24hrs i get message stating approved with quite a limit 161K with 2% interest which showed on application , i presume it will remain the same interest 2%. This is the 4th card i faced issues other three were SBI Axis and ICICI Pay all have been received but yet to receive physical card of idfc. will post my experience with IDFC Select card later. Till then chao all

Oh one more thing it was applied as card to card basis and i do not have savings or any account with IDFC.

Alok Congrats. How much limit you had in your other bank’s credit card ?

Strange but ranchi, capital of jharkhand is in their unserviceable area for open market acquisition despite having two branches

Are 10x points rewarded for spends greater than 20000 in a calendar month or statement month ?

Statement month.

When applying for IDFC card while providing details it asks name as per Aadhaar. Is aadhaar mandatory for applying IDFC credit card? Has anyone applied and received it without providing aadaar details?

Aadhar not mandatory for idfc or any other credit card, bank may try to push for aadhar-based as it may save them some verification costs and speed up the process, but you can always opt for non-aadhar based application.

Hi Jasond,

I got it in Jamshedpur

Yes, they said it was available only in Jamshedpur in jharkhand, sounds strange, also same for the kotak cards as well.

I don’t have any other relationship with IDFC. I have select Credit card, can I get upgrade offer for Wealth. Any one aware of the process?

Has anybody availed longue access benefit on this card? And any idea can the addon card holder also avail it (similar to how its mentioned in hdfc diners privilege card, here its not mentioned clearly ).

It’s clearly mentioned in the add on card pack that benifits are shared including lounge access

Hi Sid & Satish,

I have a query on 10x spend above 20K.

I used the card for my monthly rental payment which is over 20K. Then i used the card for an offline retail transaction. As per the statement i received only 3x points. My understanding is that i should receive 10x on this transaction.

Has anyone else experienced the same?

Have always received 10X above 20K spends, whether offline or online. 10X is given with statement generation, not before that.

Are you paying rental through RedGirrafe ?

For me, IDFC does not pay RP for redgirrafe rent pay. It shows it as insurance transaction and NO RPs for insurance. However, it should still count it towards 20K, though I am not sure about it. (Maybe they have calculated other spends to be within 20K and this one goes beyond 20K but no RPs for this one, other stays in 3x)

Hi.

I have a Millennia First CC with a credit limit of 1 lac.

I have a credit score of 800+ and credit cards with HDFC and ICICI bank, each having a limit of more than 3.5 lacs.

Any idea when would i be considered by IDFC bank for limit enhancement and card update.

IDFC CC limit enhancement n upgrade systems are still in a nascent stage, hence few n irregular. My Select card itself is more than 12 months old with decent spends, still no LE or Upgrade.

I received add on card offer on my First Wealth credit card but while applying it says details not found. Anyone facing similar issues?

Still waiting for the add on card offer on my Wealth card, I was told that I need to use the card for atleast 6 months to get the offer.

Yes, I faced same issue and raised a complaint. After 4 days or so, they reverted that problem has been resolved and I was able to apply for Add on card on my Wealth card. I had made 15k+ spend on the card before raising the issue.

Does IDFC also send credit card to nearest branch like some other banks?

Tried rental payment using paytm and cred but both failed. On inquiry, got to know that they have disabled it as per their internal policy! I mean why would one go with credit card if rental payments are not allowed!!

Evan Axis Ace is removing cashback for rent. payments from next month. This might be an industry wise case going forward. Possible due to heavy manufactured spending and people transferring to own accounts in the name of rent.

Rent Payment was allowed before and people were misusing it for rewards, so they disabled it recently.

On 27th Feb I successfully paid rent using cred and idfc select.

Rent payments thro CC is a very recent trend. I’m sure 99% of the people using CC are gonna continue using it even without rent payment feature. Just that it will be difficult reaching spend thresholds

Absolutely. And this is heavily misused. Using rent to manufacture spends is openly discussed in most credit card groups and forums. The clamp down was inevitable. Besides, rent payment isn’t the only use or purpose of a credit card.

are add on cards treated separately in the bank? lounge access and movie offers will be applied to add on card as well?

No and Yes.

Lounge Access: Checked with the lounge POS for the remaining limit on add on card and it showed 3, which translates Add on, Primary shares the same limit, though can be swiped separately as well.

Movie offer: Yes it can be redeemed separately as the card number for Add-ons are different.

Hi All,

Certain changes to the Reward Program on your FIRST Select Credit Card.

> Effective 17th May 2022, minimum spends required in a billing cycle to unlock 10X Reward Points is being revised from ₹20,000 to ₹25,000.

> Accrual of 1X = 1 Reward Point per ₹100 will change to 1X = 1 Reward Point per ₹125.

> Effective 1st Oct 2022, Reward redemption through any redemption channel will attract a small convenience charge of ₹99 (+ applicable taxes) per redemption transaction.

Party is over.

This is the highlighted communication received via mail.

Effective 17th May 2022, for subsequent billing cycles, minimum spends required in a billing cycle to unlock 10X Reward Points is being revised from ₹20,000 to ₹25,000. Your accrual of 1X = 1 Reward Point per ₹100 will change to 1X = 1 Reward Point per ₹125. Your Reward Points will continue to have a value of ₹0.25 per Reward Point.

Effective 1st Oct 2022, Reward redemption through any redemption channel will attract a small convenience charge of ₹99 (+ applicable taxes) per redemption transaction. Since you are an existing customer, you have adequate time to redeem your accumulated Reward Points without any redemption charges for redemptions done before 1st Oct 2022.

It is over. I think they have enough issued cards why did they have to change and put redemption fee us gst for it. Usage could have been more on their card if they had kept as is. Now customers will think twice even to transact until it is required. Reducing rent payme t from 10x to 3 x is also a downplayer .

Not the smartest thing to devalue the reward rates. OK with convenience charges for redemption as most banks have it. But when Flipkart Axis and a number of other cards would give consistently good and better rates, this is not the way I expected IDFC to go about. And unlike say Amex who also add some value while devaluing, there is nothing at all. Not great…

I got an email that i used more than credit limit of 2 lakhs, used for paying genuine expenses like jewellery and school fees, which came more than credit limit and all my points withheld.. I dont think card is worth for any big purchases

Dear Customer,

We have observed from your recent Credit Card usage that you are violating the terms of use of the Cardmember Agreement. You have used the aforementioned Credit Card in excess of the prescribed Credit Limit, thereby accumulating undue Reward Points.

Please note that we have withheld the Reward Points accumulated on your Credit Card account, through the transactions done in the current statement cycle.

Hi Guru,

Its the stupidest thing done by IDFC bank. Every credit card issuer bank either declines the transaction if it is over & above the assigned credit limit or imposes an over-limit fee as per their rules. But blocking the card & withholding the RP’s for the transactions done by the customer, its completely wrong and deficiency in service. Nowhere in any bank’s rules, it is mentioned that spending beyond a credit limit is a crime and could lead to card cancellation. At the end of the day, whatever purchases were done by the customer, were genuine. Banks make money due to few such users who fall in such situations but they cannot be dealt with such actions.

His card is not blocked/canceled, only his reward points (for the current statement cycle) only were withheld.

Once upon a time, I spent beyond my limit on my StanC Titanium card, because my add-on card holder had done some high spends I wasnt aware of. All they did is levied an over-limit fee in my statement, which I can understand is valid. But I got regular RPs, even on the portion that was spent beyond the limit, there was no claw-back. You cant be double penalized by having to pay fee as well as surrender points. I am baffled with IDFC behavior. On a separate note owing to recent changes, I am shifting my spends away from IDFC wealth to other cards. I don’t get targeted promotions also. Their debit card RP feature also never saw the light of the day yet. I m not aware of anyone in their wealth program who really got complimentary locker either. I m looking to close my relationship with IDFC except retain the credit card since it is LTF.

Genuine or not, you can’t (shouldn’t) spend more than the ‘Available credit limit’. All banks charge a hefty fee on ‘Overdraft’. You’ll soon (probably in next statement) be charged with that.

it’s not the drawback of IDFC, it’s your mistake.

When you say we shouldn’t spend more than credit limit, do you mean cumulative spends throughout the month should not exceed my card’s limit ?

I thought we can repay the spent amount in mid of the cycle and then spend again. For example, if my credit limit is 2 Lakhs I can spend 2 Lakhs today, then pay that amount and again spend 2 Lakhs. Is that not allowed ?

Hi Saurabh,

Yes, that can be done anytime. Payment can be made in advance before the billing date, but what IDFC bank did is wrong. I am using cards from more than 10yrs. never came across such rule of any bank. Most of the bank insist to make payment in advance to release credit limit.

I swiped within credit limit, paid the amount swiped in full and then paid for another expense. Overall spend for the billing cycle was over credit limit. lets say card has 2 lakhs limit, swiped for 1.5 laks, paid 1.5 laks and then swiped again next day for 1 lakhs.. there is no overdraft fee for this . But since overall spend was coming greater than credit limit(2 laks) in the same billing cycle, idfc withheld all the points for 2.5 laks, which is the problem here

Okay,

I got your point. I also did this some 7-8 years ago with ICICI. Don’t know if my points were withheld or not! At that time, we care a little about reward points.

But don’t think IDFC has done a right thing. May be if you had a chat with them regarding this, then the points could be saved. You can still chat with them (over phone/mail and the best twitter) with you genuine point of view, they can reverse the points as a goodwill gesture. Please have a try.