The need for liquidity is at an all time high and consumers are facing what is termed the ‘cash crunch’. In light of this, CRED has rolled out their RentPay service enabling their members to now pay rent by directly transferring the amount to their landlord using their credit card and UPI. Here’s everything you need to know,

Table of Contents

What is CRED?

CRED is a member only app reserved for the few having very good credit score (750 and above). It allows you to pay all your credit card bills from a single place and you get rewarded for it as well.

I’ve personally got well over Rs.25,000 worth of benefits since its launch in late 2018. The detailed review of the app is here: CRED Review just incase if you’re new to it.

What is RentPay?

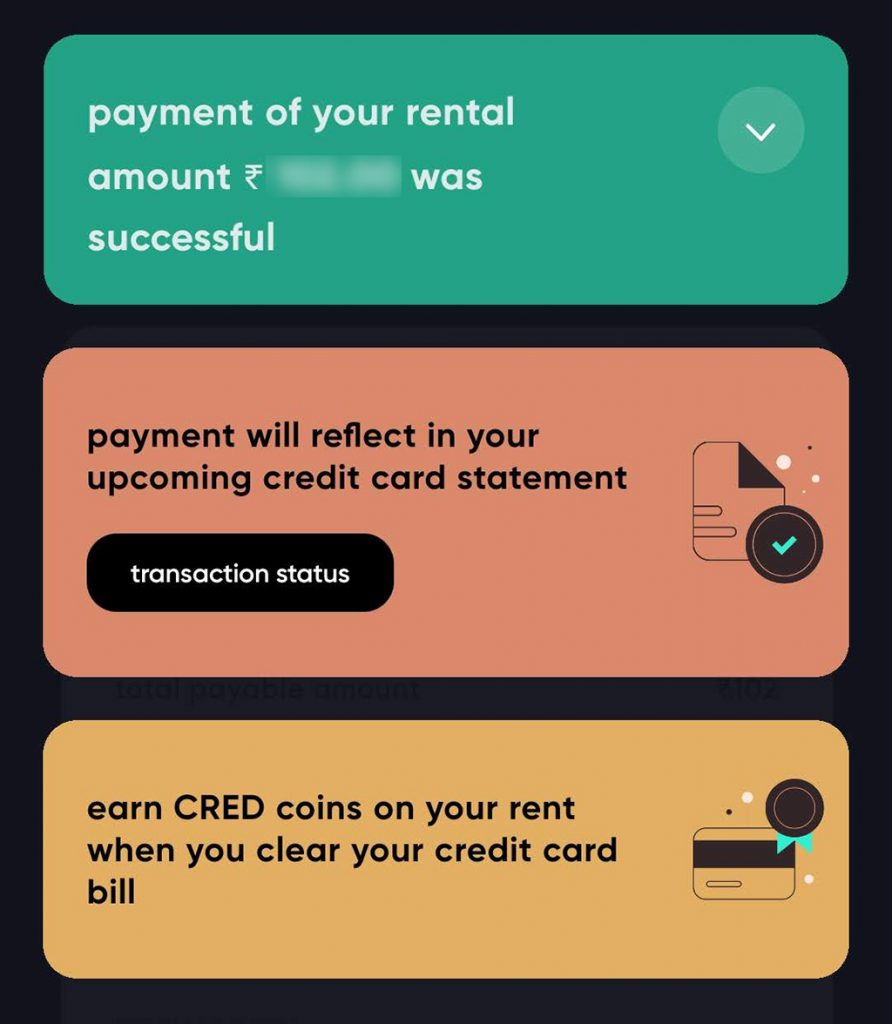

RentPay is one of the latest product by CRED built exclusively for its members as a solution for rent payments.

It allows you to pay your rent through credit card in a simple 3-step hassle free process.

It is not only the most user friendly app for rent payments, but also comes with many other benefits with it.

Benefits of RentPay

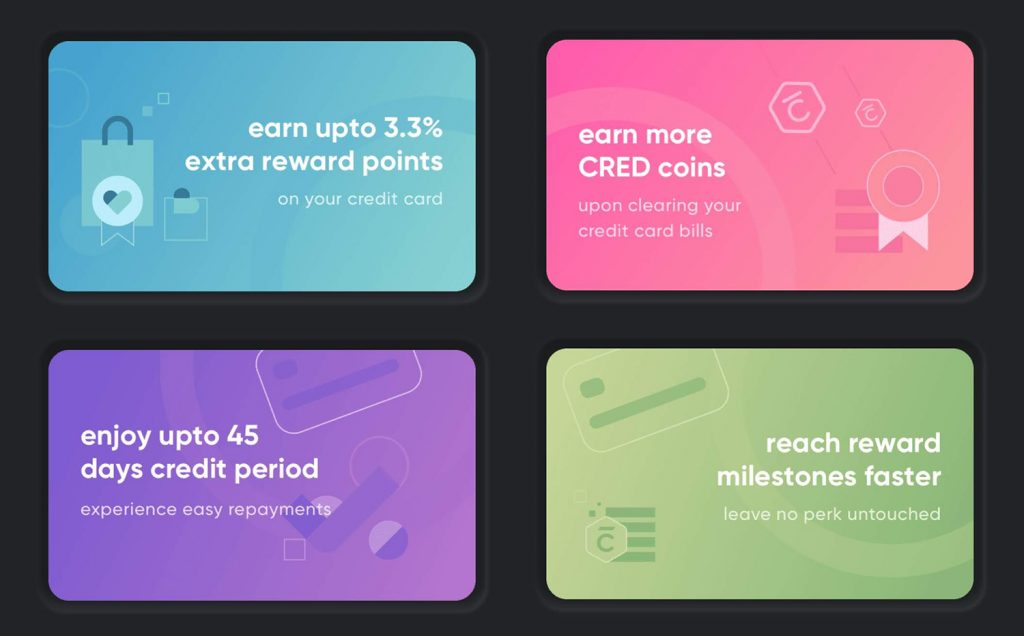

- Credit Card Rewards: Most premium & super premium credit cards comes with a reward rate of 2% and above, sometimes as good as 3.3% in which case, you earn something back on every rupee you spend.

- Milestone Spend Rewards: While you get default rewards as above, you may also be eligible for the credit card milestone benefits which could be different types like Spend based milestone benefit, inbuilt milestone benefit or even the milestone benefits like fee waiver.

- CRED Coins: Apart from credit card rewards, you also get CRED coins for paying credit card bills.

- Credit Period: You get ~45 day credit period from credit card companies to clear the due.

That’s not everything, as you may also get many other indirect benefits once you frequently spend & repay the rent dues on time using a credit card. Like, chances are you get better spend based offers, better credit limit & you may score that upgrade you always wanted.

And of-course as these repayments are reported to CIBIL and other credit reporting agencies, so your score could get better, means better interest rates on your home/car loans that you might take in future.

Charges

- Service Charge (Credit Card): Upto 1.5% (including GST)

- Service Charge (UPI): Nil

Service charges are nothing but the charges added to rent amount while paying via CRED RentPay. These are basically the transaction fee charged by the payment gateways.

It appears that the service charge remains at above levels even for Amex & Diners, which is a good news. And no charge for UPI is nice to see as well.

While you might wonder how some service providers are doing at a low service charge, its because they’re in the user acquisition phase. Eventually everyone will have to come to this range, sooner or later.

How much can I save?

How much you can save ideally depends on which credit card you hold. Assuming you’ve monthly rent of Rs.30K, let’s figure out the potential net savings (actual rewards value – service charge) in a year across various cards.

- HDFC Infinia / HDFC Diners Black: Rs.6480 (as Reward points, usable for any hotel/flight redemptions)

- Vistara Signature: ~Rs.8,500 (2 Premium Economy tickets, considering each ticket at 7K)

- SBI Prime: ~Rs.2000 (Pizza Hut Vouchers as quarterly milestones + Fee waiver)

So, as you see, it highly depends on what card you use. Above are some mix of various premium, super premium & airline cards optimized for spends of Rs.3.6L a year.

But you’re going to have other spends as well on the card, so it makes sense to calculate your total annual spend and choose a credit card that gives you maximum value on your total spends (regular spends + Rent Payments).

Do check out the best credit cards in 2020 for complete list of premium and super premium credit cards that you can use to maximize your net savings according to your needs.

How to use it?

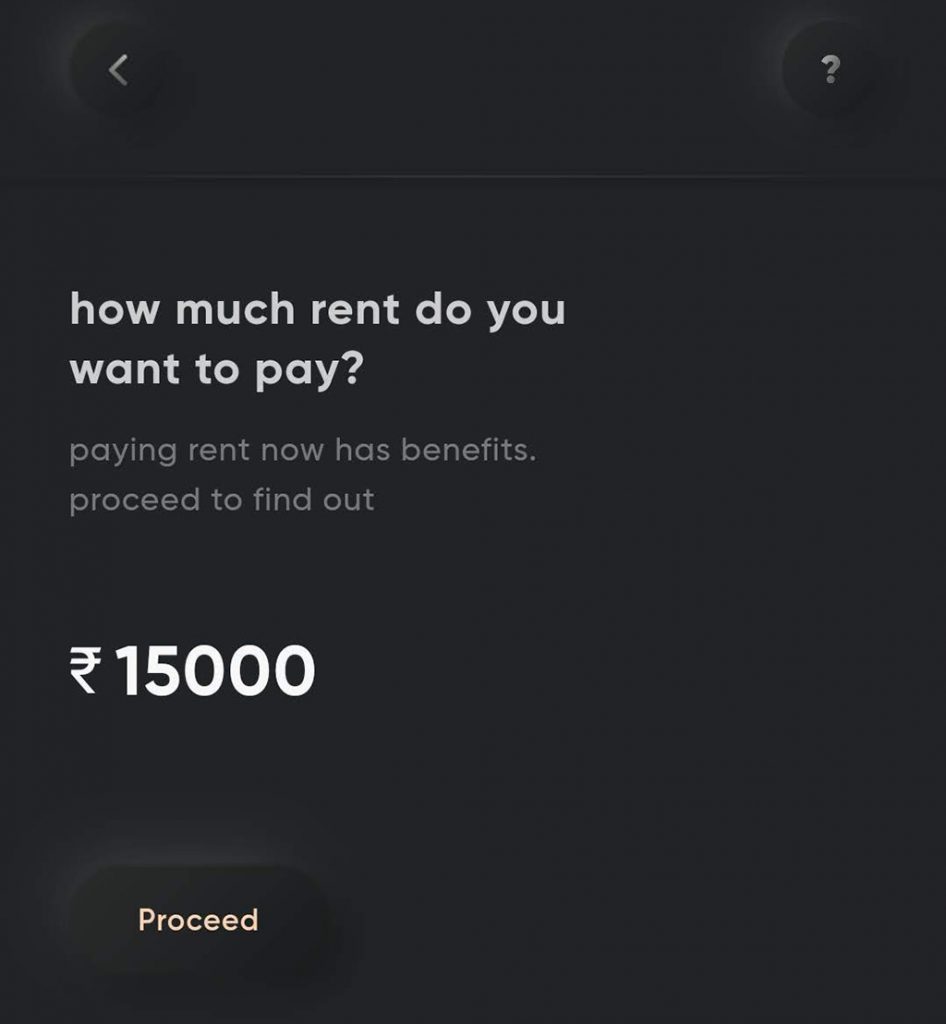

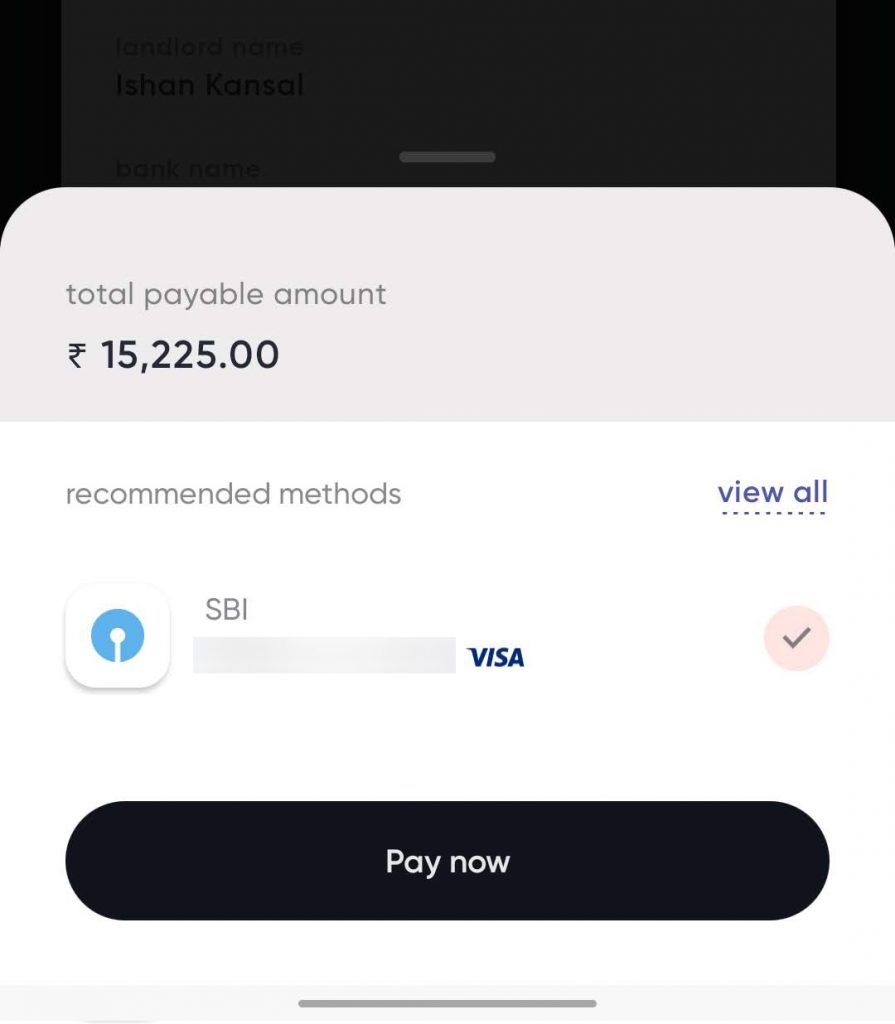

RentPay has an incredibly easy to use interface and is very straightforward. Paying rent is a quick 3 step process as below,

- Just enter the amount you wish to pay.

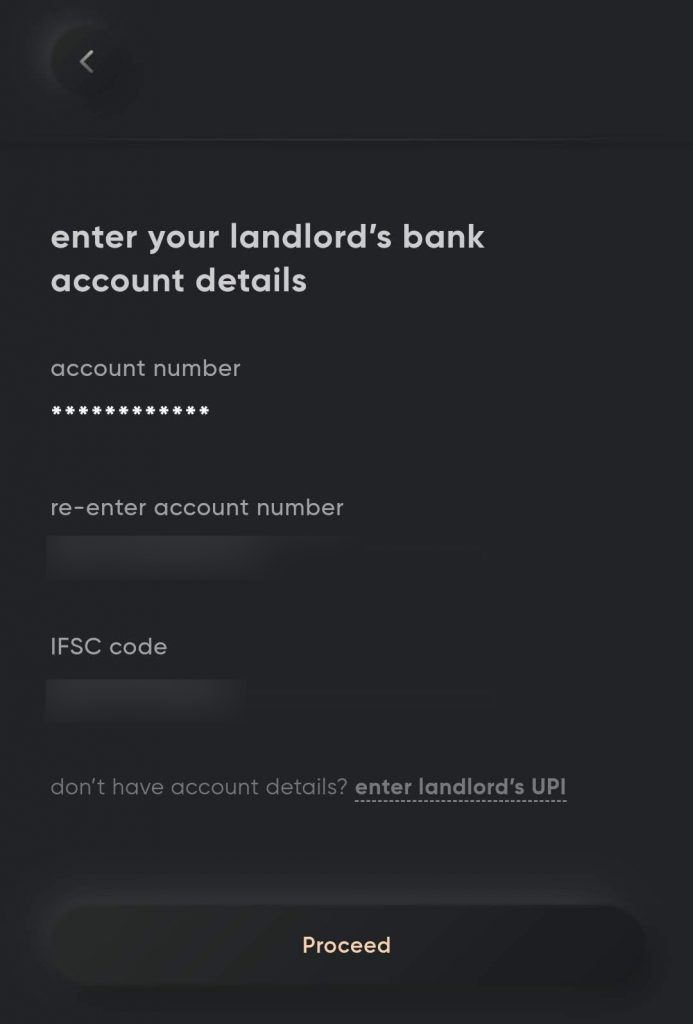

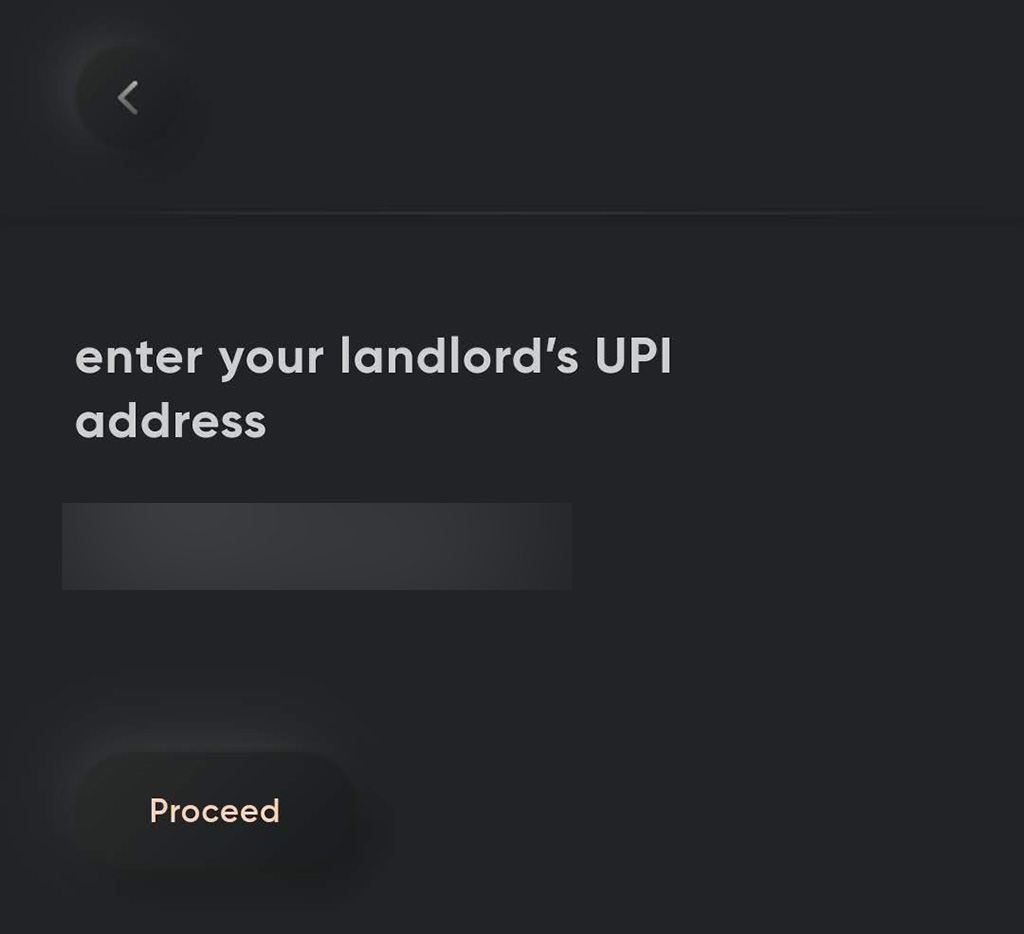

- Enter details of your landlord. You can add a landlord bank account with UPI as well.

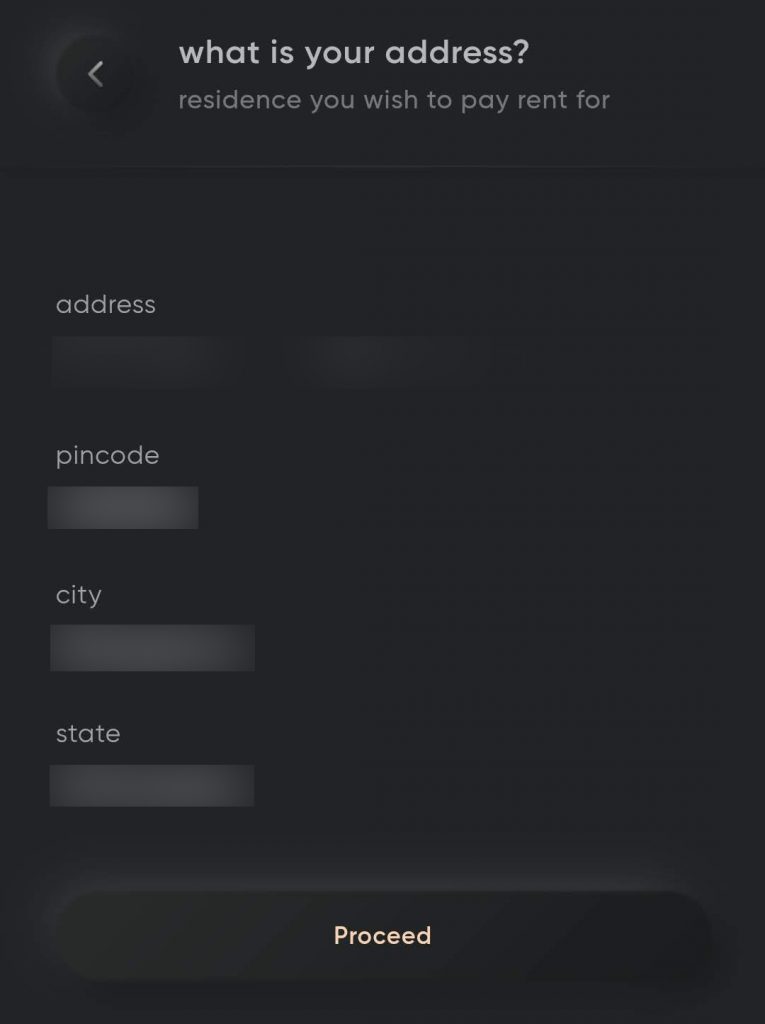

- Add your address for which you’re paying rent and you are done. The rent gets instantly transferred

All of the above can be done in a minute or two max and you don’t need to waste time uploading the rent agreements, wait for activations etc. Its all instant. Here’s the flow of entire rent payment process in pictures:

Eligibility

- You just need to be a CRED member with Credit Score > 750

Even-though RentPay is eligible for all CRED members, it went live only for select members for now. Its expected to be rolled out for “all” in a phased manner, in coming “weeks”.

However, do note that you need their latest app (with a redesigned UI) for you to avail the service. If eligible, you should be able to see the same on your CRED app’s home screen.

So if you’re using the old version, go ahead and update it. Or, if you do not have the CRED app yet, here’s the download link.

Bottomline

- Cardexpert Rating: 4.2/5 [yasr_overall_rating]

While there are other services as well that allow you to pay your rent via Credit Card with attractive transaction charges, the smooth 3-step rent transfer is hard to find.

Its just like Android vs Apple: when apple implements a feature, it feels mind blowing to use it, but well that comes at a premium and so CRED’s RentPay.

But then, it shouldn’t matter as long as you hold one or many of the premium or super premium credit cards in the country that rewards you more than the fee charged.

Hopefully CRED will come out with auto-pay rent option on Credit Card as well along with payment of other expenses such as maintenance and rent deposit. These bigger expenses shifting to Credit Card will help get more points, more liquidity, more interest free period!

Have you tried the Rentpay by CRED? Feel free to share your thoughts in the comments below.

Paying through RedGiraffe (RG) through PayZapp (credit via Credit Card) is better rewarding than this option. Charges are lower, get Rs 200 as cash back and RG gives you additional vouchers in the end. I can pay credit card bills through CRED so those points are anyways I can take credit of.

Hi Manish,

What is RedGiraffe? How to use

I second this. Charges on Cred are pretty high. Only plus side is first time setup is better. If one can spend sometime to setup with RedGiraffe, the gains are worth much more than Cred.

On the other hand, cred is venturing into other business areas now which is a good thing as they need to start earning to sustain their product. I heard they will enter into credit business as well. Maybe personal loan or credit card or ola postpaid like feature.. they have data of millions of users of competing card companies, their usage patterns, credit history. They can easily create targeted products for their vast user base.

how to pay rent via payzapp?

@siddharth

Please upgrade comment section and add the option for uploading 1 Image

If any one has querry they easily explain to other

For me Redgirafee is better … pay through payzapp … settlement time max 3 days …also there charges are less and addition 200 back per month by billpay coupon. But good article ! keep posting !

Hey, I also use Payzapp + Redgiraffe, what is this coupon you talk about ?

Apply coupon BILLPAY while payment from payzapp towards redgirraffe. 125 rs cashback in 10 working days we will get

Now with 2x offer on hdfc + cred rent pay, I think one will save more with CRED, as overall rewards are now 6.6% (hdfc diners black and infinia / Standard Chartered Ultimate) and charges are 1.5%. So net benefit of 5.1%, which should be better than Redgiraffe. The only downside is this offer gets extended at the beginning of the month. As such, one can only guarantee that 2x offer is till Mar 31. Hopefully on Apr 1, hdfc extends the offer again, as they have done so previously this yr.

2x offer is only on Diners Black and not on Infinia. Similarly for StanC, ultimate has been specifically excluded from the offer. Also, Cred+DCB offer will continue till 31 May, as mentioned on Cred app

Till what limit we can pay rent?

I don’t see any limit as such, for now. But common sense says, they may allow as much as required if there is a proof. We will know rules for these cases in months time as they evolve.

Now CRED is allowing to Pay upto 2 lakh. I was just trying to enter more..

Go a popup.. Payment above 2 lakh rs are currently not supported

Thanks,

Nagaraja D

To be honest I would still stick with RedGirraffe for rent payments just because their service charges is very low compared to Cred Rentpay. Not to mention paying the rent via Redgiraffe through Payzapp using their Billpay code nets you additional maximum off 200 INR in savings a month.

At 27k rent, I earn 900 RPs+ 200 Cash Back – 124.25, which in a year nets me 11709 on my Diners Black.

Payment through PayZapp doesn’t give you RP. You only get 200 cashback. Confirmed twice from customer representative.

@Amit. No. I have paid rent multiple times through Payzapp and there is no issue in getting reward points. It generally get posted 1 or 2 days after the transaction is settled from merchant side. I was told that this is to ensure that insurance transactions are not given points more than the cap. Payzapp can be used for any type of payment including insurance, hence such limitation.

It depends on the card you use – i get reward points on Axis Vistara Infinite, SC Ultimate and HDFC Jet Diners through Payzapp.

Are you still reward points for redgirraffe.com rentpay transactions via payzapp?

Thanks for the info.. very useful.. I have the following doubts..

i) Is there any limit for the number of landlords that can be added, say one has two rooms on rent.

ii) What if someone uses it for making payment to servant/cook etc, as only UPI ID is the key.

1. Upto 2 landlords. Proof could be asked for in case any anamolies are detected.

2. Proofs could be asked anytime based on internal checks.

Well without the rent agreement and any paper work, I can transfer the money to any bank account and earn rewards points. It doesn’t even ask for Landlord PAN for authenticity. I assume later they will modify to the system to make more robust and avoid misuse. Currently I use red giraffe for the payment and happy with 3.3 rewards rate on my infinia.

Yes, those may come when they see unusual payment patterns. Anyway I heard even now it will ask for Landlord PAN if its >50K.

Other than IT dept compliance, I don’t think they’d care about higher payments. They are charging 1.5 % Which would easily cover for their MDR for most cards. (Except for Diners) I think Shivi or someone mentioned having 2% even with AmEX, so even Cred may have got better deal for Amex. Diners is probably only one they are giving from their pocket. Master/Visa surely they cover the cost.

They won’t. But RBI will, hence they might need to put few restrictions based on how it all goes.

RBI will not care. There is no capping on cash transactions on CC or credit accounts. Entire corporate card programs work that way, even for individual employees. Unless this leads to massive swipe and run cases, I don’t think RBI will cause issues.

The people caring about this in time will be credit card companies. They expect a much higher transaction charge and interest from day 1 on cash transactions. Which is main reason they are after manufactured spend. So misusing this will trigger them.

RBI don’t allow peer to peer payments via CC, hence my comment.

If the rent is above 50k, it will ask you for PAN number

Thanks,

Nagaraja D

Bro what do u mean by misuse, they are chargind upto 1.5% fees for credit load, is that a very lower rate,SBI offers credit transfer at 1.27% p.m. so please do not worry about misuse, even in that case they are earning something.They are not allowing transfers for free.

More like 3%, since RG takes 0.4% as txn fee

Hi Sid! Thanks for this article. May I know the alternatives to this service with lesser transaction charges? Thanks!

So many popped up recently, but the know names in industry are Redgirraffe & nobroker.

Hi Sid! Yet again a great article.I have been reading your articles and got benefitted a lot .Your articles and inputs from other readers helped me to gain many Rps so far from being a newbie an year ago.

For rent payments below are popular options:

1.Redgirraffe- 0.39% ( lowest fee and accepts Diners)

2.Nobroker-Rs 99 upto 10k & Rs149 10k onwards ( doesn’t accept Amex and diners cards as of now)

3.Paymatrix-2.99% ( Accepts all major cards incl. Amex .except diners)

4.Paydeck-2.5% for T+1 day payment and 2.65 % for same day payment ( doesn’t accept Diners and Amex)

Basically I wanted to pay my apartment maintenance fee through credit card and came across above options. I wanted use my Diners club back card for this, but apart from Redgiraffe no one else is supporting.But Redgiraffe doesn’t support maintenance payment.Used my Amex platinum travel card through “paymatrix”.

Even though I may not gain much but I can reach milestones faster. Still looking for better alternative.Hopefully I can use CRED.

Once again thanks and keep up the good work !

Hi Prasanna,

I pay my society maintenance charges and my kid’s school fees too using Red girraffe. I understand that Red giraffe in partnership with HSBC bank is launching a mega offer this month. Looking forward to it. But yes, Rent, maintenance charges & school fees are all paid at 0.39% using Red girraffe. But they don’t allow AMEX cards since AMEX charges are much higher.

Hi Rohit,

Thanks for your input.

But when i checked with Redgirraffe ,they said rent agreement is required for registration. Upon contacting further ,their cust. care replied to me that Maintenance fee payment is not acceptable though their platform.

But your answer surprised me. Can you please elaborate how did you manage to get Refgirraffe ID for Maintenance fee payment ?

If someone pay a Rent bill on Red girrffe.Com/ Cred aap through SBI prime credit card

What Kind of reward points they earn

100 per 20Rp or 100 per 2Rp

I am asking because I have simply click credit card I got a upgrade to Prime

Hi Ashish,

Did you try out paying through SBI prime and the 5% RP?

Thanks,

Jeevan

Paymatrix also supports amazon pay and you can buy Amazon vouchers from smartbuy. Even though the charges are high (~4%) but still you earn almost 9% even on a card like Regalia.

One can also pay rent using credit card on Mobikwik, if anyone can take their astronomical charges of 3.95%+gst.

Hi Sid, If I pay using Amex MRCC card, will I get reward points?

I am planning to use my Amex Plat Reserve for this.

Rent: ₹26k pm

Spend based voucher: ₹500

Reward points worth: ₹200-250 based on redemption

Charges: ₹395

Net gain per month: ₹300-350

Not bad but not good too.

Not great savings in a quick look, but it could get you renewal fee waiver, which is 10K 🙂

What is the spend requirements to get the waiver? I went through their website and couldn’t find this figure.

They don’t publish that figure and keep changing it often, ideally 2L-5L spend should get you anywhere between 50% to 100% waiver.

Will help to achieve Rs 4 lacs milestone on Amex Platinum Travel Credit Card (though at Rs 6k charges).

Hi Sid,

How about using American express Travel card?

Will it be beneficial? Is it eligible?

That’s bit tricky as these spends will be reported as utilities. If so, you may not receive regular points with Amex, though Milestone benefits should be eligible. Have and wait and see the reality though.

For some strange reason, I get RP on electricity bill payment using paytm or Amazon billpay on AmEx Plat Travel. In app it shows transaction date and RP0 but at the end of month my total RPs have RPs from bill pay transactions. (It is easier to make that out if bill pay is the only transaction in the month and amount is in 30-50k range.

Good option if you are looking to use Amex for rent payments. Else payzapp / RG works best IMO

Hi Siddharth, could you please point me under which section is this option appearing?

Do check CRED Home Screen in a week or two, not up for all at the moment.

Thanks

As others have already stated, RedGiraffe continues to be the better options, unless you specifically need to use AMEX.

The only other thing is that the RedGiraffe onboarding requires documentation to be submitted.

Hi Siddharth,

Thanks for the informative articles.

Would like to know like rent pay is there any app/service which can be used to pay school fees with credit card.

Regards,

Vaibhav

Hi,

Red giraffe offers academy fees payment option and Paytm also offers payment for certain institutions.

Hope this helps.

Cheers,

Kiran

Thanks.

Pay school, college or coaching fees also via redgirraffe. Charges are same as rent i.e. Rs39+gst (i.e. 46) per 10K .

You need to obtain institute’s bank acc details like IFSC and acc no. and setup payment via RG.

My kids school doesn’t provide account details and insists on payment only via their app or cheque, otherwise they find it difficult to track payments, hence I can’t use RG. Try with your school.

Thanks.

While Cred has made it super convenient, 1.5% is quite higher than competition. Also, redgiraffe makes sense for most, a big problem there is that amex is not supported. Best option for amex platinum travel card holders is paymatrix.com – charges are exorbitantly high (2%), but they have an ongoing offer with mobikwik that provides 5% supercash (upto 700 INR), and when u pay via mobikwik you also get the normal MR points apart from milestone spends!

Would love to hear about a better alternative though…

What do you do with 700 mobikwik supercash ? I earned around 200 or something few months ago, all it gets me 2-3 Rs discount in bill payment and once a month Rs 5 cash 😀

Thanks sid for such a helpful article. I m using cred for a long time. I can’t see rent payment option in my app. I hv updated app but still it is not showing. I m using apple phone. Please help

Thanks to Cred, now many people will know about Redgiraffe RentPay option. even a simple google search is showing it first. This would only bring traction to Redgiraffe 🙂

Is rent receipt generated out of CRED for paying rents similar to Nobroker and Red Giraffe?

Is this payment booked under peer-to-peer transaction? In that case, hdfc won’t give any points.

“utilities”.

@Siddharth,

HSBC & Red girraffe have jointly launched an offer on all HSBC cards used for Rent & School Fees on REd giraffe RentPay. The offer carries a Rs 5000/- cashback too. I have an HSBC cashback card. Are there other options? and would there be additional RP’s available on the offer? Please suggest

Can you give details of the offer? Is it targetted offer or for all?

Hi Rohit, can you share details of the Hsbc Redgiraffe offer. Have a HSBC card but haven’t received any such communication.

Can you please shed some more information about this HSBC – Red Girraffe offer?

Hello Sanchit,

HSBC offer is available on redgirraffe’s website. Apparently there is a cashback of Rs 5000/- and RP’s too.

Today my CRED app got activated with the option for rent payment

One query on nobroker. It supports payment using Paytm as well. So, if we pay using paytm which is loaded using Amex, I’ll be getting the rewards points as well since Amex provides reward points for wallet transactions as well. Please correct me if I’m wrong.

No it will not fetch any membership reward points. The transaction will appear as “PayTm Utilities” abd hence Amex cards will not fetch any reward points even if transacted through PayTm on No Broker. Moreover, I think it’s also mentioned while making the payment that points will not be earned but will be counted for spend based offers.

You cannot pay from wallet on NoBroker.

Once you move above 50k paying as Rent on CRED Rent Pay you will need to furnish PAN Card of Landloard. It’s mentioned on their Terms&Conditions which is as per regulations.

For payzapp payments isn’t HDFC Rewards debit card the best option given it gives 5% back on all payzapp payments (except wallet reloads). Its capped till 2000 so I guess max advantage would be for payments till 40000.

Anyone paid rent using Amex? Did the transaction earn points?

Yes, received the points with my Amex Platinum Travel Card

Using an Amex shouldn’t be a problem since this is a rent-pay which doesn’t figure into the utility category. Also, since its the first month, it will take time for them to figure out the quirks. Usually, just a phone call to the customer service helps me get my points. For eg, my NPS payments on Amex were getting coded as insurance and so I wasn’t getting points (during non-bonus days). I just called them and explained to the difference and once they fixed it hasn’t happened to me again.

Anyone tried this with the Amex plat charge ? With the 2x promo going on, seems a good deal even after 1.5% fee

Hey, Yep!

I’ve paid rent and earned points as well.. 2X!

Can someone please guide me on the best payment method in terms of reward points to use my Regalia First Credit Card for paying rent through RG i.e. is it SmartPay , PayZapp or Instapay? I am new to credit cards and just registered on RG last week for paying rent. Thanks.

First thing you should do is to upgrade your card to regalia or diners privilege. Bcoz even for flights/hotels redemption the value is 30p/point compared to 50p/point on cards like regalia/clubmiles/privilege and 1Re/point for diners black. So my suggestion would be is to upgrade your card first so that you can milk the maximum value out of Red Giraffe.

You can use promo “BILLPAY” on payzapp to get some cashback.

Also Payzapp gives you flexibility to use any Visa/MC/Diners card.

Nobroker has resumed payment via AMEX. The charges are relatively low. For instance payment of 14k with amex is 150 in Nobroker, 210 in Cred.

Guys!! don’t update your CRED app at any cost!! Ai made the mistake and paid for it! In the new version, no matter how many cards you pay the bill for, you will get only 1 card to slide down.

@Sid, I think you should make an article warning users.

Unable to grasp “you will get only 1 card to slide down”. I see all cards in the list. More info please.

By card, I didn’t mean the credit card, The cash back slide down that you get also called the Kill Bill. I made a payment for all my cards, all upwards of 10k and received only 1 Kill Bill which scratched off to Rs 7 only.

You faced this issue today? I tried yesterday and it shows all credit cards, I’m able to pick the card I want to make the payment.

All cards are visible/payable for me.

But facing a different problem. Every time ‘Lifestyle’ tab is clicked, the app is getting closed. Maybe they are working on for something new as I can see two and only two tabs namely ‘Introducing WIN’ & ‘Discover’ under lifestyle.

The comment is regarding kill the bill mystery reward cards. Only one upto Rs.1000 card and one upto Rs.5000 card is available per month per user. This is in the updated app where they have split the win section containing mystery rewards and rewards section containing brand rewards.

Which of the following cards will be rewardful for paying a rent of 10k?

1. American Express Rewards card

2. SimplyCLICK SBI Card

3. Citibank Rewards Platinum

4. Dinersclub Rewards card

I have HDFC regalia master credit card. Can anybody please advise me on how procedure of enrolling myself for RG thru this credit card

Hello Anil, You may visit redgirraffe.com and the process is basic & self-explanatory. else just call or whatsapp them. hope this helps.

Hi i am existing cred member and i tried to pay Rent using cred but why they are asking for Rent agreement? Please help me if i dont have rent agreement now with me how do i pay my rent

Still yesterday they didn’t ask rent agreement.

But today cred ask rent agreement to pay the rent

So cred become useless now

Siddharth please update the article.

Has anyone tried paying through SBI prime for RentPay(Cred or redgirraffee) and got the 5%RP? If this is an option then i would get the SBI prime cc. If not, which cc gives the best RPs for statement credit?

Hi Jeevan,

I am not sure whether 5% getting or not. But there is limit of 3000 reward points on every month for bill payment. You will get max 750 per month.

I paid my rent using CRED (27.5k) on 31st May and it didn’t ask for a rental agreement. Also I used my AMEX platinum travel card and got regular reward points too.

I have been a frequent user of CRED ever since its launch late 2018 and have got over 20K + cashbacks on different card payments. But like many, I have wondered, how much VC money they would be spending to acquire and retain customers. From frequent 3figure/4figure cashbacks, now its getting difficult to even get cashbacks :). The keep tweaking their cashbacks eligibility every month. CRED still is the best app to pay your bills when you compare it with others like Paytm, PhonePe etc. The UI design is also very sleek.

The rent pay is a brilliant method for them to engage with users on their platform. I have used this service twice in May and June. In May, they charged a fee of 1.5% and in May it got increased to 1.55%. I am sure it will go up again in June.

Apart from paying rent, this can also be used to get quick money into your account at a low convenience fee..Paytm charges 2% for loading above 10K and another 2% for transferring to a bank. So compared7%, 1.55% is pretty neat.

Can anyone tell is there a way to use credit card amount to transfer fund to another account ? I guess with HDFC payzaap i can add money to wallet and then transfer and cost 2.36% with no reward points. Is there any other way with lower charges ?

Guys need your guidance regarding recent failed transaction on cred. On 30 th June i made credit card bill payment of 4000₹ via NetBanking of bank of india which failed. The money was deducted. On 1st July cred responded that they received the payment and they will refund which should reflect in bank account within 7 working days. the refund was made on 2nd July according to them. But till date (23 July) I have not received the refund.

I made 1st complaint regarding refund on cred on 13 th July to which they gave UTR no of refund and asked me to contact bank. On contacting bank branch with the UTR no was of no use.

2nd complaint was made on 17 the July in which they first asked for account statement which I provided them. They again gave me the same UTR number and asked me to contact bank and then again closed the complaint as resolved.

On (22nd July) 3rd time raising the complaint they again asked for latest one month account statement and also a email confirmation from bank that they haven’t received refund. Now on contacting bank for the same they refused to provide written or email confirmation saying that there is no provision for the same.

Has anyone faced such issue and how to get it resolved?? Any guidance would be welcome.

Its job of Cred to contact the bank and resolve the issue. Bank won’t listen to your requests. Escalate to highest possible level in Cred. I am not in favour of using Cred. They earn by selling your data.

My Indusind Iconia Amex transaction is failing on Cred during rent payments. Anyone facing the same issue? Planning to take advantage of the current 2x promo on Iconia Amex. Pls confirm if anyone did a successful transaction recently on Cred thru Iconia Amex?

It looks like they have stopped accepting AmEx cards as of today(August 3, 2020).

Even I am getting a message saying that amex is having low success rate.

What are the other options to use Amex for paying rent?

You can use PayMatrix but with higher processing fee of 2-2.5%

How was your experience with PayMatrix ?

Is the customer care supportive and responsive like Redgiraffe ?

Can I send 20k per month with my regalia card without being asked for rental agreement on cred ?

Yes, you can send under 50k every month without being asked for rental agreement.

Is it safe if I use cred rent pay just for milestone benefit as I am not living in a rented property but i will transfer the money in my known account!

Anyone knows how much is Cred charges for rent payment using Diners card? For March, Cred is a 2X partner for diners, replacing nobroker.

1.5% is charged for rent payment

Hello..i want to know that if i pay my rent or any amount to someone through direct my UPI account, then

(1) is there any extra charges applicable?

(2) do i receive cred points by doing above.

Thanks in advance for your reply

Don’t use CRED for your rent payment. My payment is declined and the amount is deducted from the account. It received by CRED but they didn’t transfer it to my owner. They said the amount to be refunded by 5-7 days if the payment declines. Their system is not functioning properly.

Amex cards is not working for rent pay on cred as of today. Which other site can i use to pay rent via amex card and earn rewards points?

Hi Drhunter,

You can use paytm to make rent payments via Amex.

Yes i ended up usibg paytm. Charges were only 1% surprisingly. But i did not get any points on transaction as it gets mentioned as paytm utility. But at least it counts towards milestone spends.

It’s Not working. Even Paytm is NOT supporting Amex anymore to pay rent. I tried wouldn’t allow Amex cards !

Cred is offering 2001₹ cashback over 3 months with HDFC cards. That should at least sweeten the deal for 3 months. But the catch is, choice of the gift card is with them. Did any of you get your gift cards? If so, please share which one was it.

Are we still getting HDFC rewards points through Cred Rent Pay?

Cred is not supporting Amex payment now

Hey! Does that mean I can make any number of transactions to my Landlord (Which is also in fact my bank account) to fulfill my spend criteria for a fee waiver for multiple cards?

@Cheap Thrills

Lol I had same doubt. Legally speaking I don’t own house so is it allowed to pay rent to my father who has hdfc account too? There is nothing wrong here. Instead of giving for rent to someone else my father would be letting out for me.

I am sure many might be already practicing this 😜please advice on this if so then what’s the procedure Coz I never used any rent payment methods.

Which mcc code is used while paying insurance payment on cred? Can I use it to pay large amount of premium and receive normal Cc points. This used to work on apay now it has stopped