At this time when coronavirus has severe impact across all industries, the need for liquidity is at an all time high. CRED, the credit card bill payments platform has rolled out access to a credit-line exclusively for its members named CRED Stash. It maybe categorised as a personal loan product, but there is more to it. Here is everything you need to know,

Table of Contents

What is CRED?

CRED is a member only app reserved for the few having very good credit score (750 and above). The app allows you to pay all your credit card bills from a single place and you get rewarded for it as well.

I’ve personally got well over Rs.30,000 worth of benefits since its launch in late 2018. The detailed review of the app is here: CRED Review just incase if you’re new to it.

What is CRED Stash?

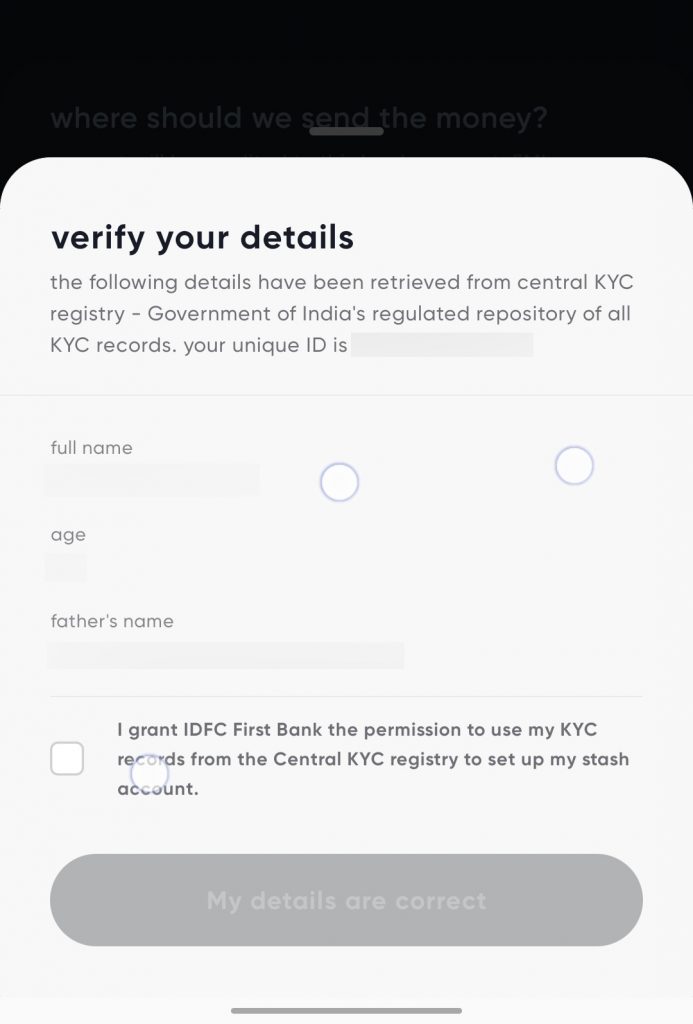

CRED Stash is the personal creditline given for CRED members, available at attractive interest rates compared to a typical personal loan and is completely a digital lending service that utilizes CKYC service setup by government for easier KYC process across financial institutions. Hence no more verification calls, no site visits, delays, etc – Its instantly available.

Its as simple as few taps and your money is in your a/c in a matter of minute or two. Makes sense isn’t it? I mean we have proved our credit worthiness over years by keeping the credit score good and why should we need to wait for a week or so for approval and disbursal?!

I wish this instant eligibility/approval system becomes a standard for all Credit Card applications too in near future.

These perks seems to be possible on CRED because all of its members have a better credit score, thus making the entire community creditworthy and trustworthy.

Charges

- Processing Fee: 1% to 2% (dynamic)

- Interest Rates: 11% to 16% (dynamic)

- Foreclosure Charges: Nil

- Part Payment Charges: Nil

Processing fee appears to be dynamic and is upto 2% depending on various factors like loan amount, credit score etc.

Interest rates appears to be in the range of ~13% for most test amounts I did but it could vary anytime as there maybe different lending partners providing different rates based on various parameters. For now, they have partnered with IDFC First bank and plans to add more in coming months.

That aside, there are no other charges for foreclosure & part payments, which is usually in the range of 3% with existing personal loan products.

CRED Stash Vs Personal Loans

- Its INSTANT: CRED Stash is an INSTANT credit line in both senses: Approval and Disbursal. A typical personal loan is not instant unless you’re pre-approved based on your relationship with the bank, in which case the loan amount usually depends on your NRV with bank.

- Its FLEXIBLE: CRED Stash by industry standards is an extremely flexible creditline. For ex, if you’re approved for 5L credit line, You may withdraw 2L today, 1L next month & 1L more after a month etc and once you’ve funds, clear all loans at once, without any fees. Flexibility like this is hard to find when it comes to anything related to direct handling of money.

- Attractive Interest Rates: Personal loans generally comes with 16% or above interest rates unless you’ve a premium banking relationship with a bank. With CRED Stash though, getting 13% or even lower rate is possible just with your credit history.

- User Experience: An user friendly interface & a frictionless process is what we get with CRED compared to a typical personal loan product. Then there are some good animations throughout the process for some fun, before you have the real fun with the money.

How much can I save?

To figure out how much one could save via CRED stash over conventional personal loans, let’s assume you take 2L loan at 13% with CRED, compared to 2L loan at 16% elsewhere. Let’s assume 0.75% difference in processing fee as I see in most cases. And also, lets assume you close the loan in half way (at 1L). With above assumption here are the savings:

- Savings via interest: Rs.3000

- Savings via Processing Fee: Rs.1500

- Savings via Pre-closure: Rs.3000

- Total Savings: ~Rs.7500

I personally see a great value with nil foreclosure fee & pre-closure charges as it not only helps us save but also gives the flexibility with which comes peace of mind.

Application Process

It has a super user-friendly application flow, so easy that you don’t even need to know what to do prior, as the app guides you well on each page. You get to see everything (loan summary with all details) on the final page before you tap the last button to withdraw.

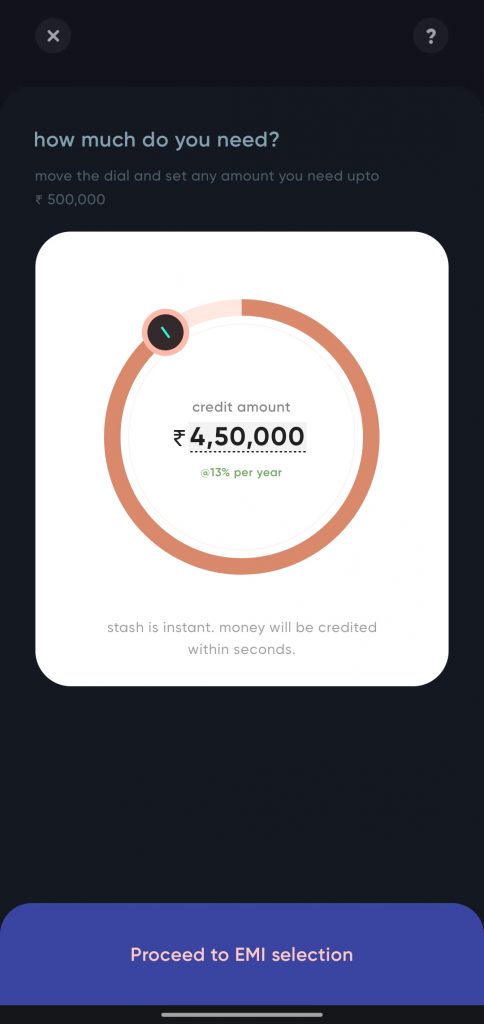

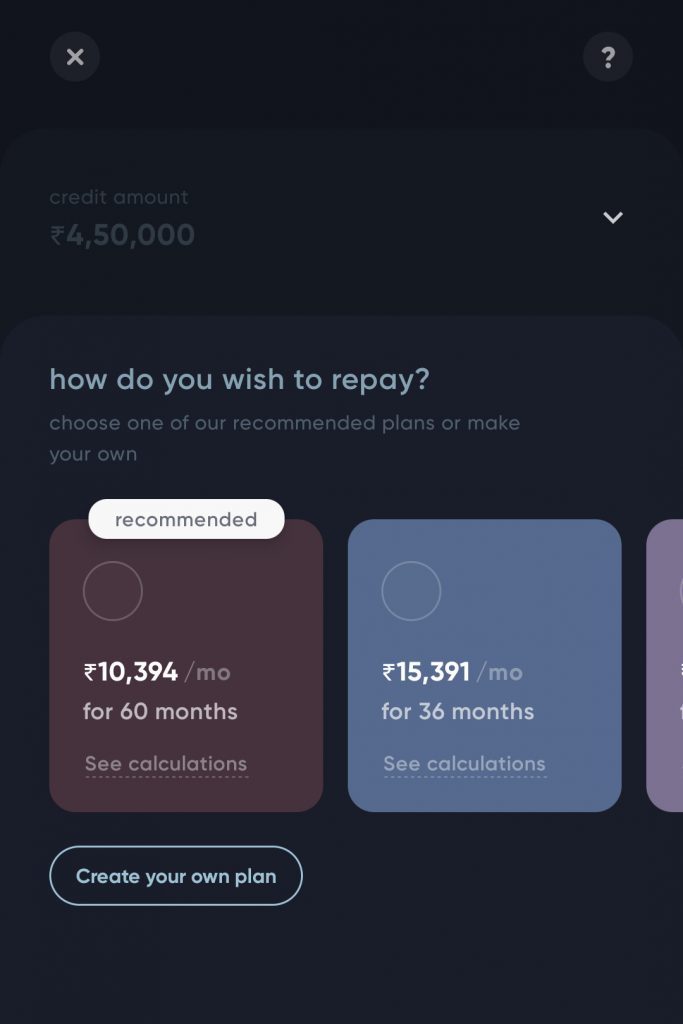

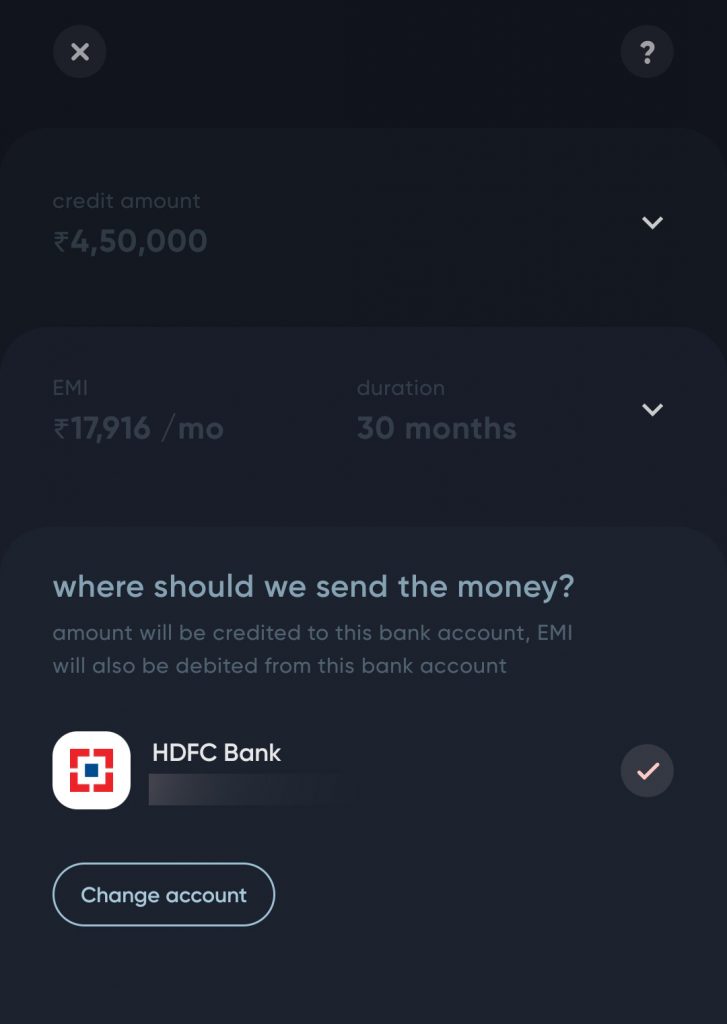

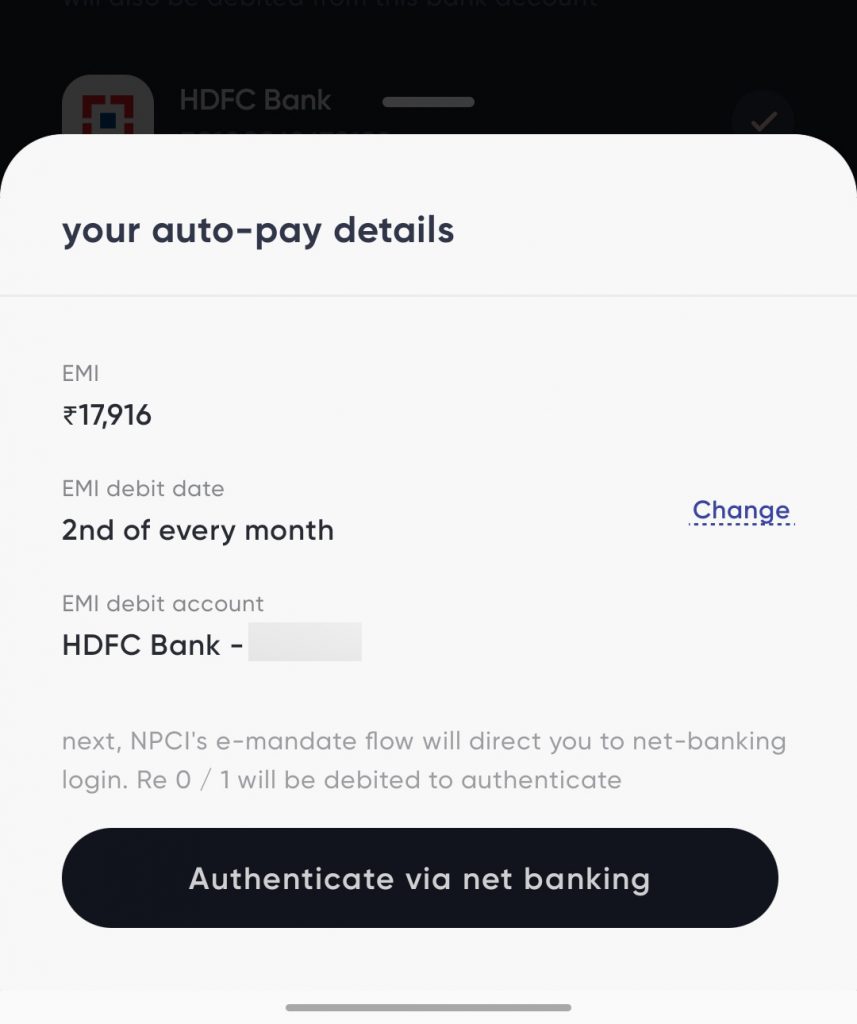

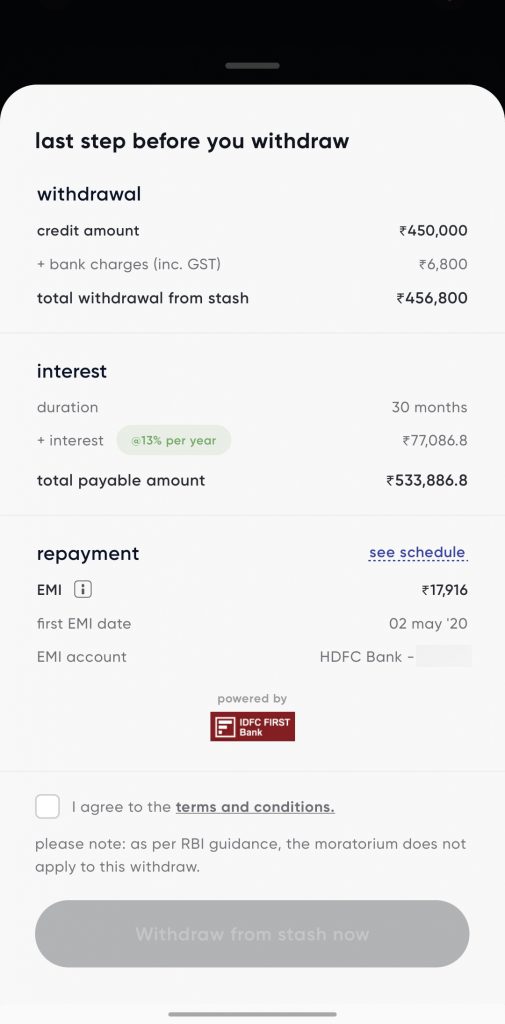

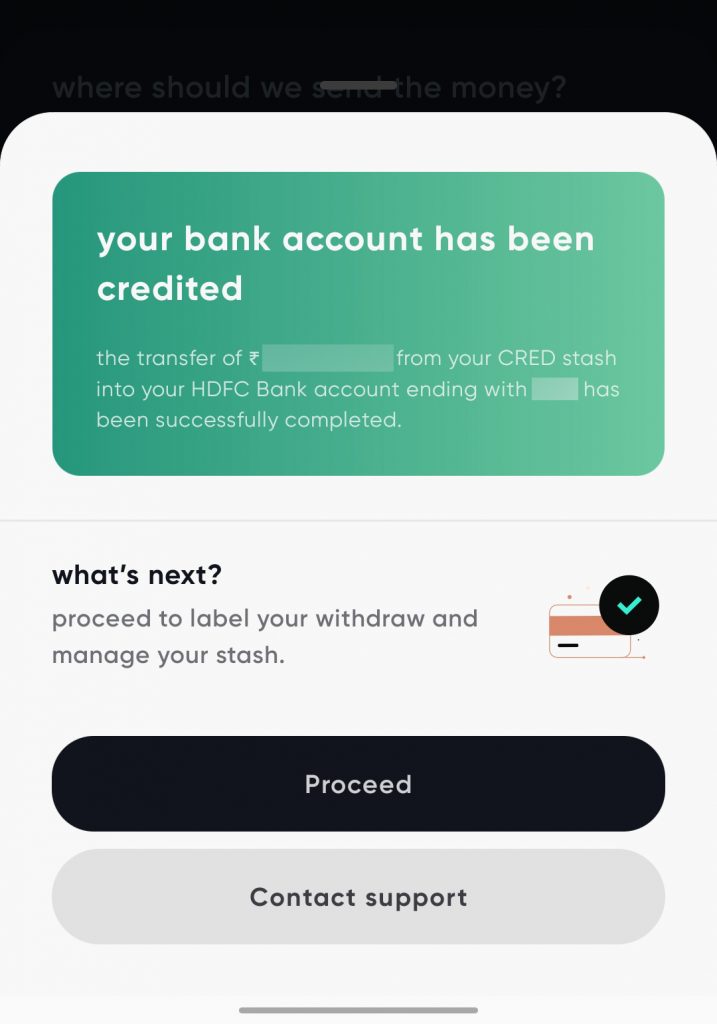

The money is then instantly transferred to your chosen bank account. The entire process is done digitally, including the auto-debit setup for EMI. Here’s a visual treat for your eyes about the entire flow:

Credit Line & Eligibility

- To be eligible for CRED Stash, you just need to be a CRED member

- Credit Line: Depends on your credit report, score & many other factors as usual.

Even-though CRED Stash is eligible for all CRED members, its currently in beta and went live only for select members, for now. Its expected to be rolled out for “all” in a phased manner, in coming “weeks”.

However, do note that you need their latest app (with a redesigned UI) for you to avail the service. If eligible, you should be able to see the same on your CRED app’s home screen.

So if you’re using the old version, go ahead and update it. Or, if you do not have the CRED app yet, here’s the download link.

Bottomline

- Cardexpert Rating: 4.9/5 [yasr_overall_rating]

CRED Stash is undoubtedly an amazing product for Indians looking for quick cash either for an emergency or other personal needs without hidden fees & complications. Its instant, flexible, fully digital, user-friendly, all that comes with an attractive interest rate. What else could we dream of?!

Hence, if you’re in cash crunch, its better to go with CRED Stash over Personal Loans, Loan on Credit Card, Credit Card EMI, Balance transfer, etc as all these usually come with higher interest rates without flexibility.

Its indeed a great product by CRED that fixes all the pain points of existing personal loan concept. It is likely to be a game changer in personal finance in 2020 and beyond.

What’s your take on CRED Stash? Feel free to share your thoughts in the comments below.

I didn’t understand this statement. “I personally see a great value with nil processing fee & pre-closure charges as it not only helps us save but also gives the flexibility with which comes peace of mind.” Is the processing fee NIL or dynamic 1-2%?

Ah, that’s supposed to be “foreclosure”. Updated it, thanks.

Why this message showing ????

Cibil score is 730 currently.

CRED cash is unavailable for withdrawals

all relationships go through hurdles, this is no different. changes in our bank partner’s approval criteria have made CRED cash unavailable for you. we are working with our bank partners to bring it back for you. we will notify you when it’s available again.

I guess this Personal Credit Line amount enquiry will be reflected in CIBIL. Not sure though, need clarification. As funds will be sponsored by IDFC First Bank only.

Likely, as IDFC First or others will fetch credit report and the loan will be reported to CIBIL as well. I think it should work similar to Amazon Pay EMI via Capfloat

Wow amazing. Since HDFC has stopped Jumbo Loan for majority of us CRED appears to be the best place for loan. If someone invests in stock market today than he can expect more than 13% annual return in the long run.

For those new to stocks,

Investing Basics: Never invest using a borrowed money.

For others,

Its not legally allowed either (I heard so)

But yes, even 50% gain is doable in current situation, if all goes well.

Siddharth I don’t see any option to check for loan in my and my 2 family members CRED ac. Where exactly is it located ?

Its being rolled out in a phased manner, might take few weeks.

I second the never invest on borrowed money mantra.. unless you’re as successful as warren buffet was 😀

I use Cred to pay may CC bill from last 4 years , but I have lost my money in single day, after I saw your review about payment of other and I got more customers is still crying for return money.why?

Have you your Customer support no or any way to reach about Query where we get to know?

Then how can you say Cred will not charge after paid of Loan amout.

One of the worst app where cread is making fool of his client. And there is no any way to get Answer after emails.

Ah so HDFC stopped Jumbo Loan for All! I thought it was only for me; still getting Insta loan option there so far.

Its not like that @Shivi. I still have JUMBO loan offer of Rs.600000 as on today.

So CRED STASH is more like a no visit personal loan and not like the apple credit card right? Does it mean that lets say i get a credit line of 250000- then in that case i can borrow upto 250000 and chose the emi options??

Yes.

and here it comes! the most awaited revenue model, the timing is perfect of course given there’s a liquidity crunch out there. I have always been wondering for the past year how will CRED make their money, and it was sort of obvious, all the data that’s being collected on everyone’s spending pattern and repayment pattern allows them to optimise who is a worthy customer to pay the loan back, I’m guessing even banks did not have so much data!

Hopefully they will compete with the likes of loans provided by credit card issuing bank themselves (EMIs/Jumbo Loans) and end up eating their business probably! It’ll be good to see some competition

do this business have really that much proftability?i guess hardly they get interest margin of 5 to 8% per year.While business person gets mostly this margin per month.

8% per month~ 96% per year?! Which bank loan has been looting you at 5-8% per month?!

Cred is not the one putting this money upfront, so they are not eating bank business here. This is being backed by a bank, so the business is theirs. The model is exactly the same as MoneyView or Walnut tying up with NBFCs to dispense loans. Cred is only providing a tech front and some advanced analytics on repayment patterns, some part of which will potentially be available to banks through their business tie up with Credit Bureaus. The only thing Cred knows on top of that is your category wise spending if you are giving email access to statements and they probably surreptitiously track SMS also for that. Walnut and MoneyView have already been in this data dense space with other lesser known ones vying for the pie. Sooner or later their is going to be big consolidation here and with the deepest pockets, Cred may just end up acquiring competitors for more customers and promoting its own app on to them.

Call Standard Chartered or Paisa Bazar. Paisabazar guy will get you in contact with the SC guys. They give personal loans at 11%, with documents like pay slip etc. 0% processing fee.

And why would you wait to go for that hassle when you can get instant line of credit with CRED?

Cause Cred minimum rate as per this post is 11%. And minimum processing fee is 1%. (makes the min rate 12%+). And this is for only 5L.

StanC, will deposit many times that amount, per your eligibility that is, at a cheaper rate, within 3 days. All online. So why not, unless you really need it instantly.

Even SBI doesn’t provide 11% personal loan to best of its customers. SBI raise money at 3-4% from customers.

I doubt SC is providing 11% , 0 processing fee loa that too via paisa bazar…..there must be some catch.

Hi , there are two credit scores in cred ( Experian and CRIF ). To avail cred stash does user need 750+ score in both bureaus or anyone is enough.

For me both scores are below 750. i think that was the reason Cred stash is not showing up, but i m not sure of that.

I have >800 score in both but still i am not able to see the offer. I think they are rolling out slowly, you should be able to see it in few days.

So far I cannot see any loan offer in our 3 CRED accounts. I also want to inform that CRED’s advertisement is live in national T.V.

Have got an 811 savings account in Kotak Mahindra bank…I tried to get the 250000 loan, but after emi setup and clearing bank details setup, my account is accepting only 99999/- due to which the transaction is getting cancelled again and again…can u help?

I don’t think of it as a compelling product,it is definitely better than the rates offered by NBFC but nowhere close to Banks , SBI offers Personal loans at 10.6% with 0.75% processing fees for people with excellent credit scores , Now a days even citi is offering loan at 11% with no processing fees & the process is as seamless as it could be .

Rates in proximity of 15% are good for people with low scores.

It’s more to do with the ease and instant availability of credit line than rate of interest.

By Providing KYC at Respective Bank. ( Hard Copy )

PAN , Aadhar. Card and all.

I tried to get the 150000 loan, but after emi setup and clearing bank details setup, my account is accepting only 99999/-.

Due to which criteria this limit stops at 99999??

Your account could be insta account, check your account type, if it is Insta account then get it converted to Normal account

Can you please provide steps to convert account from insta to normal

Are you sure, there is a processing fee on Stash? I do not remember seeing one. I think, their interest is on a higher side compared to HDFC who were offering PL for 10.75% and 1% proceessing fee, capped at 2500 or so for under 10Lakh. But, must admit this is a great product and the rates are still competitive with leading banks. A quick thought which crossed my mind is, for lower amounts(say under 50K) , dont you think the Rent pay option is a better one if you have multiple Cred accounts in your house? We can transfer the money to the bank using a credit card and earn points on it as well. And if its a premium card, the processing fee of 1.5% is lesser than the3.3% rewards rate..Just a thought!

Cred Stash got unlocked for me 5-6 days back, with limit of 3.5lacs and ROI of 14.5 percent. I am Cred member since Dec 2018, with Experian 835 and Crif of 759. Checking bank balance and credit score through app for last 2-3 month may have helped to trigger the offer.

The amount didn’t credited in my account yet

Hi ,

Assume my Cred Stash amount is 2,50,000. and ROI 13%.

If Suppose i want to close my loan account within 3 months then how much extra amount i need pay?

If not then only amount collected from me is Processing Fee and only 3 Months interest for 2,50,000 correct?.

After closing will get NOC?

Naveen, did you get answer for this? I am also looking for same..

As per the stament

17916(emi)*30(months)=5,37,480

But the anmount ( including tax and service charge) is 5,33,886( amount payble…

Now were does 5,37,480-5,33,886=3594 goes?????????????? Please explain

Thanks

They must be capitalizing the processing fee.

While Authenticating the Auto pay, I see mandate amount 99999 and end date for 2030. However, I am only opting for a 6 month loan. Why is that date shown and amount as that big?

Same question for me.

Plz clarify

Wonder how my CRIF rating went down in 1 year. Refreshed on Cred and saw it lose 28pts. No new loans or credit cards in past 1 year, no late payments or defaults, only one credit card I have closed this year and another corporate amex card which wasn’t renewed due to covid. Limits on many of my credit cards were increased hence even my utilization percentage came down. Interestingly my Experian score increased 2pts in same period. Now there’s a huge 200+ difference between my Experian and Crif scores. Cibil also is fairly high and Transunion I haven’t checked. Wonder if I need a loan which agency’s report would lenders go by??

Abhi, Cred calculation methods changed in the early 2020, which effected all the users.

You may google for more info.

CIBIL I meant.

Hi, my transunion CIBIL score is fine, and even Experian is good. Issue is with CRIF highmark which is absurdly low and strangely dropped further. Equifax I haven’t checked but after googling I found that banks mostly stick to CIBIL transunion scores to in their lending decisions. Presumably Crif isn’t so popular among lenders.

When I have applied cred cash loan- 1,20,000 – at the time of processing payment from NPCI Amount is showing 99,999. If I change the amount then same figure are showing.?

Yes, I also faced the issue . and the tenure is also showing of 10 years till 2031 .

i have emailed cred support but no response yet .

Don’t worry. It is not a problem. It is showing for auto debit facility. Ignore it and just proceed to next step.You will not face any problem and can withdraw any amount. I also faced this issue at the beginning. But after that I successfully withdrawn 250000/- from there.

I have Axis bank savings account…I tried to get the 250000 loan, but after emi setup and clearing bank details setup, my account is accepting only 99999/- due to which the transaction is getting cancelled again and again…can u help?

I have Selected the Amount of 100000 for 18 months. but when I open my internet banking showing me on details Start date:- 15-02-2021 to End date 15-02-2031

means the loan period is 10 years. please clear me this?

I already shared this with a cred support team. but he has not replied to me .

I also facing same issue. Did you got any reply?

Hi Sid

Why i am not getting preclose option, which i used before. It needs to be open on high priority. Thanks for understanding!

Best Regards

A.Deepak Prakash

Hi team

My cred cash not visible suddenly any reason.

Below message iam getting as in cred cash

Changes in our lending partner’s approval criteria have made CRED cash unavailable for you. We don’t like abrupt endings either we will notify you when it’s is available again.

Below message I got

Changes in our lending partner’s approval criteria have made CRED cash unavailable for you. We don’t like abrupt endings either we will notify you when it’s is available again.

CRED cash is unavailable for withdrawals

all relationships go through hurdles, this is no different. changes in our bank partner’s approval criteria have made CRED cash unavailable for you. we are working with our bank partners to bring it back for you. we will notify you when it’s available again

Any response from CRED ?

I am unable to get money through cred cash it’s showing me finally that account type in mandate is different from CBS ……so please help to get solution of this problem so I can get money as soon as possible.

When does the cred cash show up in CIBIL report ? Any one have a idea or checked ?

After the first payment ? Or the month the loan was availed ?

PLEASE HELP get this information.

cred cash is just there as a decoration for one year, now when i tried to take some cash, its telling as unavailable because of changes in bank policy! utter rubbish, am never believing in cred from now

There is problem to withdraw that it always shows that account type is different from CBS . So kindly solve my problems.

cred cash withdrawal time start date end date 10 years difference showing what is that why showing 10 years difference..

Partial payment option not available, this makes cred cash same as PL from banks.

========Support Email====

Greetings from CRED!

Thanks for contacting CRED regarding the part payment. We at CRED are concerned with the issue and understand it for you and would like to assure you that this query will be resolved by CRED with all the possible and best information regarding the same.

We are writing this email to inform you that we can understand that you want to repay the loan amount partially so that your emotional burden of the loan could be less but unfortunately, part payment is not available in the CRED application as the lending partner which is IDFC First bank not accepting the part payment of the loan because it will become an overdue issue for a long time in your CRED account and this is applicable for all the CRED users. Also, our concerned team is working to add more features of payments for our users, like you, and you will be notified of that.

Further, apart from the part payment, we do have an option of foreclosure, in this, you can pay the total outstanding amount anytime with no foreclosure charges through the CRED application. Also, the interest will be charged only till the date of foreclosure, and not for the entire duration.

Below message iam getting as in cred cash

Changes in our lending partner’s approval criteria have made CRED cash unavailable for you. We don’t like abrupt endings either we will notify you when it’s is available again.