Axis Bank has very many premium and super premium credit cards and also the Atlas Credit Card which serves as a starter for those exploring the world of airmiles.

Axis Bank Atlas Credit Card is one of a kind, quite unique the way it works but at the same time looks complicated for most. That said, here’s a simple guide to help you understand it better and use it effectively, if you choose to apply for one.

Table of Contents

Overview

| Type | Travel Credit Card |

| Reward Rate | 4% to 18% |

| Annual Fee | 5,000+GST |

| Best for | Direct Hotel & Airline Spends |

| USP | Tiered benefits based on spends |

Ideally its best suited for most premium credit card users with a focus on travel and it also serves as a good replacement for Axis Magnus in 2024 post it’s devaluation.

Fees

| Joining Fee | 5,000 INR+GST |

| Welcome Benefit | 2500 Edge Miles (5,000 INR value easily) |

| Renewal Fee | 5,000 INR+GST |

| Renewal Benefit | 0 Edge miles (Silver) 2,500 Edge miles (Gold) 5,000 Edge miles (Platinum) |

| Renewal Fee waiver | Nil |

The welcome benefit of 2.5K edge miles can be transferred to ITC (among others) and can be redeemed for 5,000 INR worth of stay, food, etc at ITC hotels.

Or, if you’re into Accor hotels (Ibis, Novotel, Sofitel, Fairmont, Raffles, etc) then you would get about 9,000 INR in value.

It means you’re paying 5K INR and getting value upto 9K INR – that’s like an overnight gain of 50% in value.

While there is no renewal fee waiver option on this card, the good thing about the Atlas Credit Card is that it gives attractive renewal benefit if you spend well during the card anniversary year.

Design

The design looks not only neat, simple and beautiful but also relevant to the type of card, so is the choice of name: Atlas.

If you’ve had the card in hand, you would agree that the card looks and feels as good as you see in the image above.

Rewards

Unlike all other Axis Credit Cards, Axis Atlas doesn’t earn “Edge Rewards”, but it earns “Edge Miles”.

It’s a separate miles balance that reflects on the Axis Edge Rewards account and is not linked with any other product so far.

| SPEND TYPE | Edge Miles | REWARD RATE (EDGE REWARDS PORTAL) | REWARD RATE (POINTS TRANSFER) | Max. Cap (per month) |

|---|---|---|---|---|

| Regular Spends | 2 / 100 INR | 2% | ~4% | – |

| Axis Travel Edge Portal, Airlines & Hotels (Direct) | 5 / 100 INR | 5% | ~10% | 2L INR Spend |

It is to be noted that if you intend to pre-pay for flights/hotels using travel edge portal, Axis Magnus [burgundy variant with 5:4] might be a better option.

Excluded spends for milestone benefit along with respective MCC’s:

- Wallet: 6540

- Rent: 6513

- Gold/ Jewellery: 5094, 5944

- Insurance: 6300, 6381, 5960, 6012, 6051

- Government Institutions: 9222, 9311, 9399, 9402

- Utilities: 4814, 4816, 4899, 4900

- Fuel: 5541, 5542, 5983

While the exclusions are expected, excluding gold/insurance/utilities are totally unfair.

Redemption

There are multiple options to redeem edge miles, broadly divined into two, as below:

- Redeem on Travel Edge portal: 1:1 (for flights/hotels)

- Transfer Edge miles to airline/hotel partners

While redeeming on travel edge portal is the super simple option with a static value, we don’t get great value there.

Instead, one can transfer the points to airlines and hotels and get pretty good value. Here’s a quick look at the transfer ratio.

| Airline | Conversion Rate (Edge Miles:Partner Miles) |

|---|---|

| All Airlines* | 1:2 |

| Hotels: IHG & ITC | 1:2 |

| Hotel: Marriot Bonvoy | 2:1 |

- Airlines: United, Singapore Airlines, Turkish, Etihad, Qatar, Air France, Ethiopian, Vistara & Spicejet

As you can see, the transfer ratio is 1:2 across all airlines & hotels, except for Marriott Bonvoy which is at 2:1. So it’s not wise to transfer these points to Marriott from Atlas Credit Card.

If you’re into Marriott, you can however transfer your points to ITC and then to Marriott (2 ITC points = 3 MB points), but this is limited to 10K points per quarter or so.

Generally, ITC is the goto option for most cardholders to get better value, as it’s lot less complicated and also allows to transfer the points further to Marriott Bonvoy.

If you wish to explore international airline redemptions, our simple guides are here: Singapore Airlines – KrisFlyer & United Airlines – MileagePlus (more to follow soon).

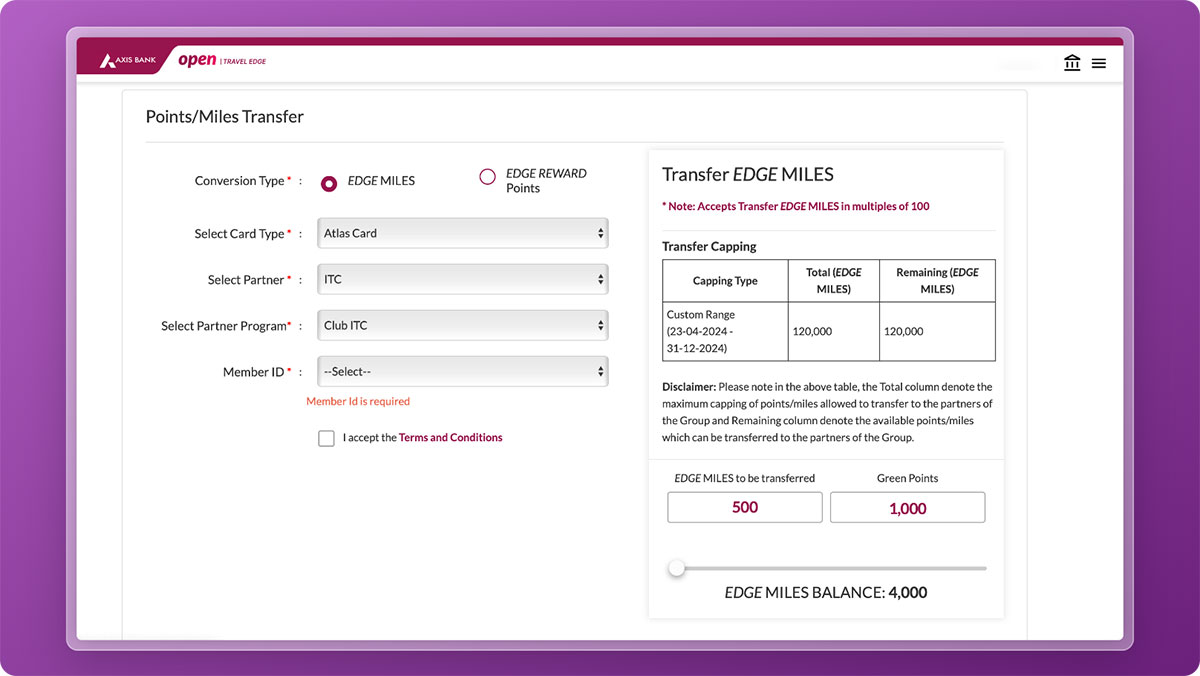

Redemption Capping

- Group A: 30,000 Edge Miles (60K partner miles)

- Group B: 1,20,000 Edge Miles (2.4L partner miles)

While the card is heavily devalued (which was anyway expected), above limits are fair enough for a card that sells for 5K INR with eligibility not being a problem for most in the segment.

Milestone Benefit

| Spend Requirement | Milestone Benefit |

|---|---|

| 3 Lakhs | 2,500 Edge Miles |

| 7.5 Lakhs | 2,500 Edge Miles |

| 15 Lakhs | 5,000 Edge Miles |

Assuming you’re able to do “regular” spends of 15 Lakhs, you’ll get 40,000 Edge Miles (30K+10K) that can be easily valued at 80,000 INR (like with ITC) or even ~1,44,000 INR (Accor & airline sweet spots), with an amazing reward rate.

Do note that the excluded MCC’s for earning regular Edge Miles are applicable for Milestone benefit as well.

Membership Tiers

| Membership Tier | Annual Spends |

|---|---|

| Silver | < Rs. 7.5 lacs |

| Gold | Rs. 7.5 lacs to Rs. 15 lacs |

| Platinum | Rs. 15 lacs & above |

Axis Atlas Credit Card comes with membership tiers and it’s a unique system in the credit card industry.

While it used to make sense in the past because of it’s airport concierge and airport transfer services, it no longer makes sense to complicate the product with such membership tiers, though it exists for the sake of lounge access and the renewal benefit.

Airport Lounge Access

The complimentary lounge access limits on Axis Atlas Credit Card works as per the tiered system mentioned below.

| Membership Tier | Domestic Visits | International Visits |

|---|---|---|

| Silver | 8 | 4 |

| Gold | 12 | 6 |

| Platinum | 18 | 12 |

- Note: Above visits covers both Primary cardholder + guests, if any.

So, as you see above, the good news about the Atlas Card is that we can avail these complimentary lounge access both for primary cardholder & guests, just like the Axis Reserve Credit Card.

However, note that sometimes you might be charged for the guests (glitch) and if that happens, just drop them an email requesting for the reversal just incase if the charges are not auto reversed as confirmed by Axis customer support.

Should you take Atlas?

For all those who were enjoying the Magnus at 5:4 points transfer in 2023 and unable to get the “Magnus for Burgundy” post devaluation, Axis Atlas is a wonderful option to take in 2024 even after the devaluation of Atlas in 2024.

As the rewards are now capped, adding Amex Platinum Travel Card would make sense for most travellers, as it’s being issued as “First Year Free”.

My Experience

I got the Axis Atlas Credit Card when it was initially launched. The dedicated card management dashboard for Atlas on Mobile & net-banking works wonderfully well.

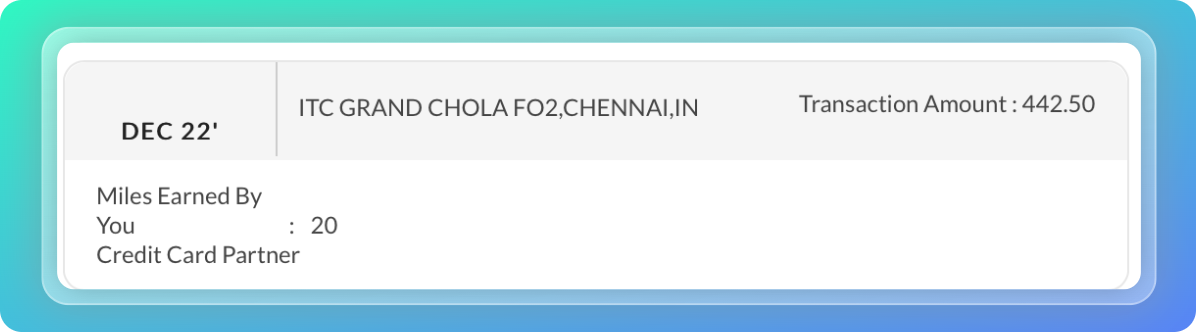

Apart from that, the 5X rewards gets credited for hotel spends on time, hopefully so for airlines. I did a small txn few months ago to check the same and it does work as expected.

Eligibility

- Annual Income: 9 Lakhs & above

- Existing other Bank Credit Card: ~3 Lakhs (or) above limit

It’s historically easy to get approved, so you may not need to worry about it. Further, not to forget that you may hold upto 3 Axis Bank Credit Cards simultaneously at any point in time.

How to Apply?

You may apply online on Axis Bank website in a matter of few clicks. Axis Bank is recently known for processing fresh credit card applications pretty fast, like card delivery in 5 days at times.

Generally you may get the card approved within a week from the date of application and one more week for card delivery.

If you’re new to bank, not to worry, you don’t need to open a fresh Axis Bank Savings A/c to get an Axis Credit Card.

Bottom line

- Cardexpert Rating: 5/5

Overall Axis Bank’s Atlas Credit Card is a wonderful card at this fee range and has the ability to earn miles that can give return on spend as good as ~7% (like accor) which is in par with the India’s long standing best travel credit card: Amex Platinum Travel.

If you intend to have 3 best premium credit cards from Axis Bank, Atlas can be one among – others being Axis Magnus for Burgundy & Axis Vistara Infinite.

Do you’ve Axis Bank Atlas Credit Card? Feel free to share your experiences in the comments below.

Hi Sid,

I got the Atlas card just 3 weeks back.

I want to add something…

Atlas card has a capping of 100 Edge Miles for Insurance transactions.

Further, there is no clarity on whether govt. services payment and insurance will be counted towards milestones or not.

I did a pos transaction at St.Laurn Hotel, Shirdi…

Got only 1X points. I am unsure if this reward comes (1X + 4X) or 5X …

Regards,

Avijeet Mohanty

Same question

Is it worth spending (Direct International Hotel) via Atlas than Reserve?

Both are at similar reward rate for intl hotel spends. But reserve is better as you don’t need to worry about MCC issues.

@Sid Does this give 5 / 100 INR on makemytrip or yatra also in addition to direct bookings.

No

No, it doesn’t give 5x on aggregator websites

Hi Sid, I have activated my Atlas card on March 4th and did a number of transactions until today. But, I’m yet to receive atlas miles for any transactions and even the welcome gift miles is also not credited. What might be the reason?

Hi sid, Thanks for such nice articles. I wish to know that will i get edge miles for using atlas card for government payments like income tax payments. It seems to be a grey area. I got 2% cash back using ace and edge points using Magnus but customer care says there wont be any cash back in ace or points in magnus. Can you please clarify from your experience. Thanks

Hi Sid,

As per this line from Axis Bank site,

You would get 17,500 milestone edge miles in total (all milestone benefits) for spending Rs. 15L. So when you do Rs.15L regular spends, you would get 47,500 miles and not 40,000 miles which makes it a minimum of 6.3% benefit on transferring miles.

Milestone Benefits

Unlock upto 17,500 EDGE Miles on achieving the Spends Milestone.

Hi, Do we get PP complimentary with Atlas?

Thanks

Vivek

No PP, its a dragon pass and that no physical card. Just you can manage all in the app itself right from booking lounge ,M&G and Airport transfer

Can we use Atlas for mobile wallet topup like paytm & mobikwik? I am unable to add money into mobile wallet using Atlas and need it to be done urgently.

Axis Atlas doesn’t seem to have Emirates as an airline partner. Can the Edge Miles be transferred to ITC and then from ITC to Emirates? If yes, what’s the ratio there?

Also, with regard to the 4 visits to international lounges under the Silver tier, is there a list of lounges covered? And are these visits fully complimentary or it’s just a complimentary Priority Pass with paid access, as is the case with Amex Platinum Travel?

I’m confused between Axis Atlas (Silver tier) and Amex Platinum Travel. Although I probably won’t be meeting the annual spending thresholds on either of them, I’m looking for a card that would offer international lounge access and work with (incl. conversion) most number of international airlines. Which one would be your pick?

Hi Sid,

Nice reviews on the site. I am a Millennia user since 2 years and looking to get second card. All my banking needs have been taken care by HDFC till now so the obvious step is to get a new / upgrade to a Regalia. HDFC recently launched Regalia Gold. Comes with complimentary MMT Black and Vistara Silver memebership. Another option that seems attractive to me is Axis Bank Atlas Credit Card. As I plan to keep usage mostly for flights / shopping, what is your recommendation from the two above? Also, any other recommendations ?

Are you planning on reviewing the new Regalia Gold ?

Cheers

@sid

In light of recent devaluation of magnus , does this card make sense for Miles and hotel points transfer ?

Ofcourse. Everyone who can’t meet Burgundy criteria will move to Atlas.

Hi Siddharth

Would that statement be fully accurate ?

One would be paying the annual fee

12000 including GST for old members

Vs effectively Zero for the Atlas considering the annual benefit

So that 12000 would need to be setoff

Against what extra advantages you get

So I’m.sure there must be a point of diminishing returns vs the Atlas

I mean

Even the magnus + burgandy

Paying 12k annual

Will have to be compared with the atals

Which would effectively be zero annually

I am new to atlas and got it approved last week.

One basic question if anyone can help – I am in silver tier at the beginning and if I spend 7.5 lacs in an anniversary year, I will move to the gold tier. So will the gold tier be applicable only for the remainder of anniversary year, or is it gold tier for the next year? If it is remainder of anniversary year, does it mean that the tiering gets refreshed and back to silver at the start of every year?

Atlas credit cardholders’ tier will be evaluated at the beginning of the each anniversary year on the basis of the previous year card spends. (copied from latest T&C document)

Hi Sid,

I already have Magnus credit card LTF and have an offer of LTF Atlas credit card as well. Should I go for it?

Considering I have Axis Burgundy account as well.

Can you please share details of airline sweet spots?

Does this card consider spends on add on card for tier upgrade

Hi,

i am currently using Magnus and after the devaluation even a regalia is a better card for me to use. I am looking for a credit card to use exclusively to make utility payments, as most cards have stopped giving reward points for utility payments or give out reduced rewards for the same. This brings me to atlas, I have been reading about it a lot but nowhere it mentions about utility rewards. I want to know if i get 2 reward points per 100 for utility bill payments. As my utility bill spends are close to 1lk per month, I am looking for a card that gives me best benefit in terms of rewards. If not atlas which other card would be sensible given my high utility bill payments.

My whole utility bill payments have been shifted to Amazon pay voucher 25k per month per amex card + 2 add-ons which makes it 75k per month Amazon pay.

So accordingly I buy the vouchers and keep it to pay for the utility , insurance premiums, and bills etc.

For insurance premiums greater than 1 lacs and govt spendngs I use stan chartered ultimate card which gives me 3 points per 150 instead of usual 5 points per 150.

Hi sid, thanks for the info of the card. I currently have DCB and trying to get one more from axis. I don’t have any account with axis. Do they provide this card LTF and also C2C basis?

Not LTF for sure. C2C yes.

Please clarify whether we get Edgemiles on utility bill payments while doing payments on Axis Atlas card.

1)Can atlas guest visits be used for international lounge access also or only for domestic?

2) do atlas addon card holder can avail both domestic and international lounge access?

Atlas has both international and domestic lounge access via Dreamfolks. It can be availed for both primary card holder as well as guests.

Can we take 8 guests at one go with atlas card?

Technically Yes, as it is QR code based. Not Tested

Is it eight guests in Magnus as well in Atlas also?

You can check in the app while booking. It will show whether its complimentary or not for guest. I have taken 3 guest along with me in Singapore lounge. Really its an easy way to get into the lounge rather than using PP as they dont do any checks

Are govt spends considered for milestones and points.

Yes , I got 2 percent points for income tax payment ( some extra charge 0.8 %) and considered for milestone

Is it a good choice to take axis atlas after the devaluation of axis magnus?

Atlas provide 2X for Gyftyr vouchers? Then it is equivalent to hotel transactions 😉 . I got the card activated today. I will find put in next couple of weeks. But if somebody knows let’s reduce wait time.

But I’m not able to buy gyftr vouchers using atlas card and somewhere even i read it can be only used for traveledge not for giftedge. Correct?

Hi Sid,

Thanks for the details review you write on credit cards. Nowadays I just come to this site for any card related details. It’s easy to find the benefits in your article than searching it in card website.

I have applied for this Atlas card. I have a question though. Assume that I transfer my edge miles into my Accor Plus membership (I Accor Plus which is equivalent to Silver in ALL). Do we need to do some minimum nights booking or spending in Accor to use these transferred miles? Or it can be used without any pre-conditions? I remember something like this long back in Jet Airways loyalty program.

Regards,

Shrinidhi

There is no spend requirement, but min. points that can be burned is 2000/1000 (and in chunks of) depending on the tier.

No

Hi, any idea on what the devaluation is going to be like. I’m sitting on the fence to get a new card after completing 4 lacs on the plat travel. Atlas is good as of now but worried if I take it now and it gets devalued before I hitting any milestones then it won’t make sense. I’m not worried if deval only to mean exclusion of rent/ utility/ insurance etc. My spends are not much in those categories anyway

I am expecting the devaluation / changes to be like:

– Earn 4 Edge Miles per Rs.100 spend for non-airline/hotel transactions AND change the conversion ratio for airline transfer partners to 2:1 (base rewards will be cut to 2% from 4%). Yes, to align it with Citi PremierMiles.

– No more Edge Miles for Government and Utility (like all Axis cards).

– The milestone bonus Miles will go away.

I am sure they won’t touch the Tier structure as it is way too much of a USP and it also would require a lot of tech revision and possibly vendor re-contracting which is expensive.

In this case then Atlas will become absolutely useless for everyday usage because even OG Magnus with 2.4% return will be better than this and it also has Gift Edge.

Only an extremely small set of very niche people who have huge direct bookings on airlines and hotels will find it useful.

If they drop the reward rate, they may not drop the milestone benefit, it would only improve.

But let’s not get into too much prediction for now.

Life is lot better to live in the moment, granular prediction maybe good for choosing stocks though. 🙂

Do we get Atlas Edge miles for payment made on the Adda app towards Apartment maintenance changes. Adda charges a 2.7% charge on credit card payment and it doesn’t support Diner/Amex, so only option is VISA/Master and I dont want to give it 2.7% unless I can get 2% back from the card and also move towards spend based benefits

Hi Siddharth,

Axis Bank has suspended my Edge Reward account because I used my Atlas Card on the BhartNXT application to transfer money to my friend’s account.

They said that these transactions are non-personal and asked me to provide the invoices that I downloaded from the BharatNXT application. Still, they are not convinced and are not ready to reactivate my Edge Rewards account.

So I am wondering if there’s a way I can convince them to get my Edge Rewards account activated again.

Please assist and provide some tips.

Regards

Javed K

What is the reward rate on international/forex transactions?

If you use the axis edge miles to convert it in Turkish miles it gives you 1:4 ratio.

so for 1 edge miles you get 4 turkish miles. you get 4x reward redemption.

Normal conversion ratio is 1:2 only and occasionally there will be an offer of 1:4.Did you get any update for 1:4 ?

Considering the recent devaluation announcement effective Feb 16th, don’t think Turkish Miles is that attractive now

I just had to post this comment so that it can help others. I hold an Axis Vistara Infinite card and wanted to switch to Axis Atlas card due to better value in rewards (Vistara Business class vouchers do not work very well for me as my travel is usually last minute) I applied for Atlas on the Axis bank website, submitted all details, hard copies of income documents with the representative and waited for 2 weeks for Atlas to be approved (status showed as pending). Meanwhile, I just called Axis helpline and they told me I am eligible for an Atlas card and it can be processed within 10 days. I reluctantly agreed since 1 application was already pending. and behold! it was approved in 2 mins and I got a digital Atlas card on my Axis Mobile app! Dont know why would they want someone to fill in all the details on their website when it can happen in 2 mins on the phone!!!!!

Atlas miles are not posted for more than a month .Booked flight via travel edge and the travel also over 20 days back and still miles are not credited. Even for other transactions also the normal miles are not credited. Axis always known for this

Will government transaction be counted for milestone and rewards?

It will be till 20th April 2024

After that they will stop giving points for them or Milestone Spending

Has anyone faced a challenge in getting Atlas card? I hold a Magnus card and Vistara Infinite card already. Have cumulative spends of more than 19 lacs on the 2 cards. Have applied for Atlas card nearly 5 times now, my application has been rejected every time.

As an NRI do I have the option to apply for Atlas Credit Card?

Axis bank started to devaluation on the card. Airport meet and Greet has veen removed, Along with atlas , a Grouping system and quota to transfer implemented for most cards?

Axis bank Atlas card just got a devaluation, Sid can you please update this to include the same.

Can i use Atlas add-on card to access lounge in India ??

sadly even after achieving platinum before 20 april, they have removed all good benifits now like meet and greet and airport transfer..shud have used it before 20.. lets see if they credit 10k oe 5k miles after platinum achievment

If you reached the milestone before 20th, they will honor the original terms.

Can you update Atlas review after recent changes.

Thanks for asking. Updated few days ago.

ITC to Bonvoy cap is reduced from 15K to 10K per qtr.

Updated, thank you.

Meanwhile, have they lifted the limits on ITC to ITC transfers?

Hey Sid, What is that limit of 2lakhs? Is it applicable only for accelerated spends on Travel edge or Both on airlines as well as travel edge?

Could u pls do a comparison between atlas and regalia gold?

Can you add details on gyftr – if Amazon is 2x or not?

With the recent Infinia limit to 10k per card, I am looking for an alternative – need about 1L per month spends on Amazon pay 🙂

Many were using this on govt. spends, now this gone , doesn’t look a good card.

Hi Sid,

How do we get 9000 value using 2500 Edge Miles? Do we use the direct transfer using Axis Travel website to convert edge miles to Accor? Or is there some other way?

You’ll need to use Travel Edge to transfer Edge Miles to Accor to get that value.

Sir, but when transferring 2500 edge reward points – I am getting 5000 accor points. So how are those 5000 accor points equal to 9000 value?

The real crippling blow to this card is the laughable 30K transfer limit of Miles to Group A transfer partners. All important partners like Marriott, SQ, Avios, etc. fall in this group. This itself makes this card useless for any kind of high spends. This, combined with the long list of exclusions has made it quite a normal card. Axis’ unpredictable behaviour makes it risky actually.

There are two important use cases of this card now. You can use it exclusively for hotel/flight benefits alone for up to 3L a year. Or, if you have heavy offline purchases to do (no-excluded) for up to 15L a year without milestones or accelerated benefits. And of course, it is good only for Miles transfer.

I still feel 30K EM (60K partner miles) for Group A is fair enough limit for this card category and yes, it’s better to keep it exclusively for travel spends.

Do you think post devaluation, it is still better than Amex Platinum Travel?

They’re both in par as they give similar return on spend. Atlas is even better if spends are higher and you get better benefits as well.

Recently, i learnt that there is no spend threshold for accessing lounges.

Atlas or DCB?

Considering the annual spends of around 8 LPA(1.2-1.5L for travel), means DCB annual fee is waived off and for Atlas we get 2.5k Edge miles.

Most of the time I find buying directly on hotel or airline websites makes us pay more and we cannot apply any card offers. So is buying through axis atlas card justified? Do we get 5x edge miles on buying through MMT or similar websites?

No, you won’t. MMT and other such websites have an MCC of 4722 (Travel Agencies and Tour Operators). They won’t give you 5x.

How to achieve 18% reward rate on this card?

(As you have mentioned it in the starting of the article.)

Using transfer to accor and accor value at 1.8

Travel Rewards 5% -> Transfer to Accor (X2)-> 1 Accor Point = 1.8 INR

Return 5%*2*1.8 =18%

If anyone is wondering, here are the groups:

Group A: Accor Hotels (Accor Live Limitless), Air Canada (Aeroplan), Ethiopian Airlines, Etihad (Etihad Guest), Japan Airlines (JAL Mileage Bank), Marriott International (Marriott Bonvoy), Qatar Airways, Singapore Airlines (Krisflyer), Turkish Airlines, Thai Airways (Royal Orchid Plus), United Airlines (MileagePlus), Wyndham Hotels (Wyndham Rewards)

Group B: Air France-KLM (Flying Blue), Air India (Flying Returns), Air Asia, ITC, IHG® Hotels & Resorts (IHG One Rewards), Qantas Airways (Qantas Frequent Flyer), SpiceJet, Vistara (TATA SIA Airlines Ltd)

The crippling fact is that a max of 1.5L points can be redeemed in a year, and assuming you earn everything through their 5x program, that means you shouldn’t spend more than 15L per year on this card.

Now this get’s worse when you only consider the good FF programs (group A). Since group A is limited to just 30k, you can only spend 3L before the reward rate drops by 5x.

Can NRIs apply for this card?

Anybody has info on why the traveledge portal only shows limited flights? I’m trying to search some flights however it shows only limited number of flights compared to other aggregators.

What is the reward rate on axis atlas when used on grabdeals and traveledge.

What is the current validity of Atlas Edge Miles ?

Axis seems hellbent on wanting to Upgrade me to an Atlas card from my Horizon card ( erstwhile CITI).

Does it make any sense?

Would love to hear your thoughts

Hi Sid

I got an Axis Atlas Credit Card but I’m not able to login to Travel Edge portal (which is required to transfer Edge Miles – to Accor for example) as I don’t have an Axis Bank Account and it is not accepting my Credit Card Customer ID, it is asking for Net banking customer ID.

Is there a way to login to travel edge portal without an Axis bank account?

If not, which saving account type should I open that charges least or NIL account opening or maintenance charges?

You need to create internet Banking login. You don’t need savings account for that. With credit card also you can create. I too did same thing. With those login details you can login into edge portal.