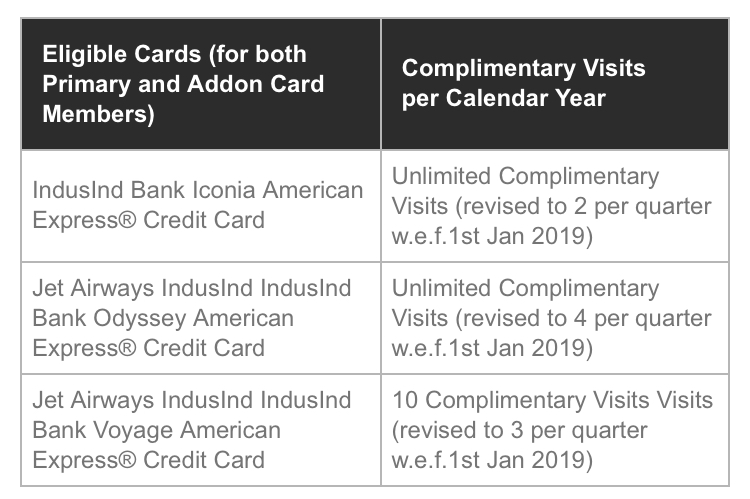

Yes, the day has come! Indusind credit cards especially Iconia American Express is one of the very few cards in the country with unlimited Airport lounge access to primary & add-on cardholders. This is now changing eff. 2019.

I first noticed this update on my Iconia credit card statement and on cross checking the website, i could see below notice:

That’s mere 2/Qtr from unlimited which is too tough to live with for some, who got the card just for the sake of Lounge access.

Bottomline:

This is very much expected, as banks can’t absorb the losses beyond a certain extent. Earlier this year, ICICI bank too had limited the visits to “4/qtr” from “unlimited” on Jet Sapphiro Amex cards.

Only card left with unlimited access for now is Amex Jet Card which may as well get a limit soon if many start using them. Maybe Amex is doing it to pull the cardholders to their own system, or maybe not? Anyway, the party is getting over on Indusind cards in ~2 months.

Going forward, you might need to hold multiple credit cards if you need more lounge access or maybe move to one of the super premium credit card to enjoy Unlimited lounge access.

Any of you guys got Indusind Iconia just for Airport Lounge access? If so, what’s your plan now? Do let us know in the comments below.

The lounge access was the only USP besides 2% cashback on weekends. Now will have to shift spends to something else.

Expected. I think Amex also limited the lounge access on the Platinum Reserve card as well. If they are doing so on their own premium cards then it is only expected that the benefits on these network cards will also be capped. As Amex aggressively expands at their lower end cards, they are either limiting the benefits on the premium ones or increasing the fees. But I expect more offers and benefits from Amex going forward as they need to keep the customer based engaged.

Problem with Reserve is, sizeable portion of users are frequent flyers who use lounges. Not good for Amex, unless they see good txn on those cards like on super premium cards, which i don’t think is happening on Reserve.

FWIW, Reserve never had unlimited lounge benefit, as far back as I can remember. I don’t think it was ever pitched as a traveller card. It always came with a useless PP. The hotel benefits also cater to once-a-year family vacation.

It was always a card pitched for providing half of Plat’s golf program, and was initially available at a one-time fee of 50K.

The way they sell it now is by giving it LTF to mid-higher income people at partner MNCs. Don’t hold your breath for it getting any better.

The Reserve card has started other benefits like monthly BMS/Flipkart vouchers of Rs. 500 on spending Rs. 25k every calendar month. Also, the complimentary Prime membership with EazyDiner on this card makes going out for food and drinks an absolute delight!

Regarding BMS/Flipkart — That’s a temporary offer not a stable benefit.

The EazyDiner is a proper benefit. I use EazyDiner a lot, but I’ve realised the app works pretty much the same without Prime membership. You can buy prepaid coupons where most savings happen, without Prime membership. Very few restaurants are “Prime Exclusive” and even those offer 20% off without membership. So you’re really getting 5% extra off on a very small subset of places. Everything else works the same just with regular membership. It is something, but not really valuable. Took me while to realise this as I was always on Prime and thought all the offers are exclusive to membership, until I saw my friend’s account without Prime. This benefit will stay, as Asia regional head of Amex sits on board of EazyDiner.

If you like ED offers, check out new Nearbuy, it will blow you away.

I still feel it is worth to hold this card as it provides lounge access for add-on card holders too. There are very few cards that provide lounge access to add-on card holders.

Regalia does

Regalia provides only international lounge access (Outside India) via Priority pass. For Domestic lounges, You may be able to swipe the add on card in lounge but the total limit combined for a Regalia card is 2 Visits / Quarter.

What about HDFC Diners Black? I thought it had unlimited access.

That’s a super premium card, doesn’t count in this discussion.

Hey Sid,

Since the Credit Card charges are same as time of admission (IndusInd has one time fee concept) shouldn’t the benefits also be retained at same level ?

You are right in saying many got this card just for the lounge access facility and per se no other reason for going for an AMEX co brand in India given their pathetic acceptance levels.

Shouldn’t this as well be part of MITC where in all fees and benefits at time of admission is retained as long as account is active ? .

Even here, Jet cards are given more visits. My personal guess is that a significant part of this lounge access is coming from Jet marketing budget. We all know how that is going to end.

I, for one, would love some sort of sensible limit put on Amex Jet, or Amex’s own lounges pulled out of the program. The Delhi Amex lounge is too tiny, especially during peak hours. Twice this month alone, I had to sit at the bar and wait for a table for 25-30 mins. They were sorry and gave free alcohol. But if I looked at the access list while entering, I was the only non-Jet card access on the whole sheet. So I’m thinking limits similar to Reserve should be imposed, and that should solve the problem.

Yeah. Jet takes 50% of the fees and hopefully share 50% on lounge access charges too. I think it’ll happen on Jet card too soon as everyone will be moving there now.

Does DCB Add on gets complimentary lounge access?

Which is the best card (the cheaper the better) to get lounge access for primary as well as add on cardholder? Maximum 2 lounge visits in a quarter required.

Try…Kotak Royal Singature card ! They give mostly LTF and it gives lounge access for addon card too ! 2 visits per quarter.

Regalia/ yes first preffered both are lifetime free

Hi Sujit,

We wish to inform you that the complimentary lounge access is an Amex feature and has been revised by Amex.

We request you to reconsider your decision regarding card cancellation and sincerely hope that you will give us an opportunity to serve you better.

Assuring you the best of our services.

Thanks,

Team IndusInd Bank.

They don’t charge renewal fees. Why would you want to cancel? It is not a bad card for weekend spends, Amex Connect offers, (if you don’t have another Amex card), and IndusInd seasonal offers.

I will now put all my spends on the Vistara infinite. Have to atleast reap the benefits of the 11800 i paid 😂

Other cards i have are sbi irctc card, indus iconia amex, regalia, citi cash back and amex eds gold, icici platinum, hsbc plat and kotak royale sig. None of my cards is decent and all rounder🤐

sujit,

regalia is best all rounder card.

In your situation the quickest solution to an all rounder card would be to upgrade to Citi PremierMiles. It is essentially free for first 2 years.

You can also upgrade Everyday Spend card to Platinum Travel card. You can also look into Payback card.

I think for spends up to 15 lacs that’s a good spread. You go from Vistara to Platinum Travel/Payback, and then Citi PM. That is easily 4-5% return o spend, in practically redeemable travel credits that you can use as you please.

I’m suggesting this based on your preference of Vistara Infinite.

Thanks buddy. Vistara infinite was kind of an impulsive decision 😁. How is premiere miles free for 2 years? I had an amex payback card but then payback points are close to worthless..!

Payback points are not useless. Each point is Rs 0.25. easily redeemable at any future group outlet (big Bazaar, central, brand factory etc) plus at hpcl fuel outlets for fuel without any redemption fee. Once in a while payback runs offers like double value for each point at their brand outlets. Then each point can be redeemed for 0.50

Hi amex guy,

Are amex offers applicable on partnership cards like Iconia ? If yes, is this for all offers or selected offers?

Regards,

Mr. Verma

Amex offers are not applicable on partner cards like Iconia.

Depends on offer. Some are applicable others are not.

Hey Sid,

I think its time you update “The best credit card of 2018 ” list since with the change in Lounge access facility Iconia will fall from grace.

May be you can have a separate category of top 5 cards for Lounge Benefits.

hI SID

IS there any card from indusind which is life time free ?, no joining fee

which card you suggest now good whit indusind bank ? want to apply on card on card , need good reward or LTF

thanks

@ sam J

Take Platinum Aura. It was issued LTF for me.

It has many categories where ur Reward rate is 2% value (other categories 1% & 0.5%) and the reward points can be easily redeemed for statement cash.

Hi all,

Indusind going to revise the reward earning hugely on the spends of utilities, insurance, Govt payments and fee payments from 1st August 2019. The party is over with Indusind. A huge devaluation is going to happen.

Can i redeem my points to cash in iconia amex card?

From 1st March 2024, the value of non-cash redemption (excluding airmiles) will be 1 RP = Rs.0.75

From 1st March 2024, the value of cash redemption will be 1 RP = Rs.0.50