If you’re looking for a Super Premium Credit Card that gives rewards on “any” type of spend, then you’ve landed at the right place. In the current scenario where most credit card issuers impose limitations on spending categories, Standard Chartered Ultimate Credit Card comes to rescue not only for those types of spends but also beyond.

Here’s everything you need to know about this infinitely rewarding credit card,

Table of Contents

Overview

| Type | Super Premium Credit Card |

| Reward Rate | 3.3% |

| Annual Fee | 5,000 INR+GST |

| Best for | Voucher redemptions |

| USP | Rewards on all type of spends |

With a reward rate that matches HDFC Infinia and without any redemption limitations, Standard Chartered Ultimate Credit Card is one of the best option for high spenders.

Fees

| Joining Fee | 5,000 INR + GST |

| Welcome Benefit | 6,000 points |

| Renewal Fee | 5,000 INR + GST |

| Renewal Benefit | 5,000 points |

| Renewal Fee waiver | Nil |

The welcome rewards you get is equivalent to the joining fee you pay. It even covers the GST part for that matter for first year but unfortunately not on renewal, as you’ll be short of 1K points.

Anyway, reward points as welcome benefit is a good move compared to the previous welcome benefit that used to give MMT voucher.

Card Design

The card looks pretty good with those golden elements shining on a black background. It looks premium for sure in reality. Moreover, the Mastercard logo adds a nice touch to the overall design.

Rewards

- Reward Rate: 3.3% on most spends

- Rewards expire in: 3 years

As mentioned previously, the USP of the Ultimate card is that it gives rewards on all types of spends irrespective of whether it’s online (or) offline spend. There is no cap whatsoever both for earning and redeeming.

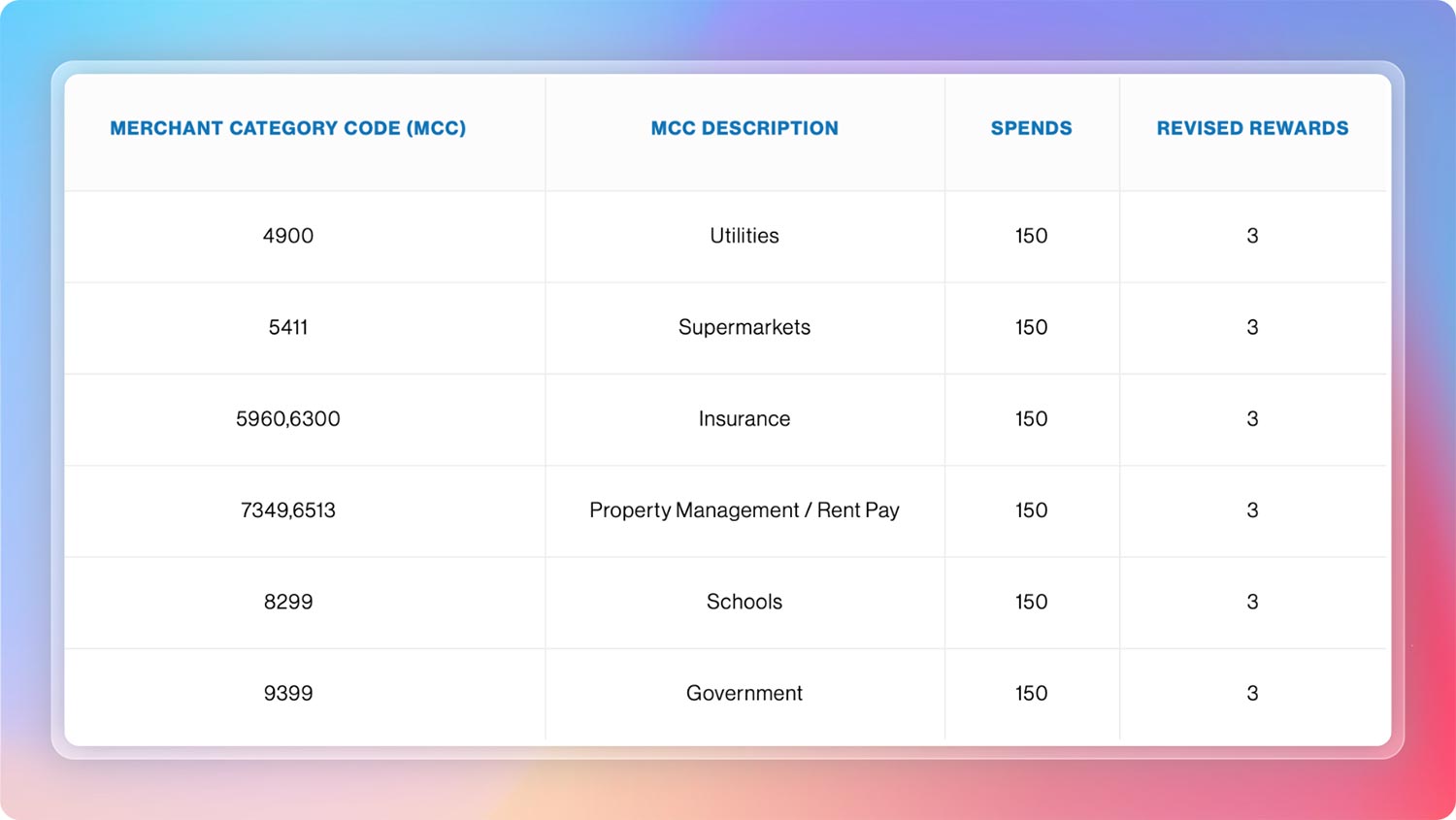

However, SCB has finally come up with revision of rewards on select categories (as below) which will only earn ~2% rewards going forward (eff. 2nd April 2023).

- Select Categories: 2% as rewards

- Rent Payment fee: 1% + GST will be levied additionally

Redemptions

- Redemption type: Vouchers

- Redemption Fee: 99 INR +GST

While we don’t have any “airline/hotel” transfer partners with SC Ultimate credit card as of now, we can redeem points for a long list of vouchers at 1:1 ratio.

Here are some of the vouchers you can expect to redeem using reward points on Standard Chartered Ultimate Credit Card.

- Shopping: Myntra, Nykaa, Pantaloons, Levis, etc

- Electronics: Croma

- OTA: MakeMyTrip, EaseMyTrip

- Hotels: Marriott Hotels, Taj Hotels, ITC Hotels

- Cabs: Uber

- Airline: Vistara Voucher

- Luxury brands like Luxe, Armani, etc.

Note: the voucher brands keeps changing from time to time.

Generally, cardholders redeem points for Croma vouchers, as this is probably the only card that gives pretty good value for shopping electronics. But if you’re into travel, you can explore whole lot of options.

Forex Markup Fee

- Forex Markup Fee: 2%+GST = 2.36%

- Net gain: 0.94%

While its not an outstanding gain, it’s still fine for those who doesn’t have HDFC Infinia or Axis Reserve Credit Cards, as you don’t loose anything for doing foreign currency spends on Standard Chartered Ultimate credit card.

Airport Lounge Access

| ACCESS TYPE | VIA | LIMIT |

|---|---|---|

| Domestic (Primary) | Visa / Mastercard | 4/Qtr |

| International (Primary) | Priority Pass | 1/month |

- Spend criteria for Intl lounge access: 20,000 INR spend in previous month

A true Super Premium Credit Card usually comes with an unlimited lounge access benefit across the globe not only for primary but also for add-on cardholders.

However, with Standard Chartered Ultimate it’s quite limited when it comes to lounge access. Moreover, to enjoy the complimentary international lounge access, a minimum spending requirement has to be met, as mentioned above.

Golf Benefit

- Complimentary Golf Games: 1/month at these Golf courses

- Complimentary Golf Lessons: 1/month at these Golf coaching locations

While above is the inbuilt Golf benefit available on Standard Chartered Ultimate Credit Card, you can also avail additional games & lessons if you’re holding the Mastercard variant of SC Ultimate.

Mastercard World Golf benefit gives you additional 4 golf games per year and 1 golf lesson per month.

Other Benefits

- Duty Free Spends: Get 5% cashback on duty-free transactions at over 1000+ airports across the world, with a max. cashback of 1,000 INR per month.

- Movie Benefit: You can get the Buy1 Get 1 Visa Infinite Offer if you’re holding Visa variant of the SC Ultimate Credit Card.

- Fuel surcharge waiver: 1% waiver & no rewards on fuel spends (eff. 2nd April 2023).

Eligibility

- ITR: 24L p.a.

- Other Bank Credit Card: ~5L Credit Limit

- Existing SC Credit Card: ~4L Credit Limit

The eligibility criteria for the Standard Chartered Ultimate Credit Card may vary from time to time. However, the information above can provide you with an idea of what Standard Chartered bank is typically looking for from a prospective customer.

How to Apply?

You may apply online on Standard Chartered bank website, but chances of rejection is high recently.

So the easiest way to get Standard Chartered Ultimate Credit Card is to first get Standard Chartered Smart Credit Card and then apply for SC Ultimate using the existing credit card relationship with the bank.

You’ll just need to authenticate your existing SC credit card to get 2nd card from Standard Chartered and its just a matter of few clicks.

You’ll however need to be approved for a good credit limit for this to work, which is very much possible if you’ve higher limits on other credit cards.

If the application is stuck and not responding beyond a point, worry not, you’ll likely get a call from backend in a week or two.

If everything fails, the only option left is to open Standard Chartered Priority Savings Account (30L balance) and apply for the card based on the banking relationship.

Bottomline

- Cardexpert Rating: 4.3/5

Standard Chartered Ultimate Credit Card has been one of the best credit cards in India for many years in a row and it continues to shine in 2023 as well.

It certainly remains as a truly Ultimate Credit card in the super premium segment, especially for those who are primarily looking for non-travel reward redemption options on ongoing spends.

Got queries? Get answers to all your questions around credit cards, rewards, airmiles, etc with the One-on-One Credit Card consultation service.

Do you hold Standard Chartered Ultimate Credit Card? Feel free to share your experiences in the comments below.

Do you get rewards on Redgiraffe rent payments?

No known exclusions “as of now”.

yes

How to apply on card to card basis using other bank credit card?

Reward points is a big farce – a publicity stunt – making the card holder a joker. The reward points disappear for no reason. None in the bank is able to explain the reasons for such disappearance. If the bank announces an award, they have no right to withdraw the award without informing the awardee. Overall a cheap publicity stunt

Now that’s interesting. It rarely happens with SCB unless the spends are very high.

Definitely one of the top 5 cards in India with USP being points on all trasactions. Another notable benefit is, the points arent calculated based on chunks of spends like 100 rupees or 150 rupees. every 30 rupees gives 1 point which is even more beneficial

This has been my primary card for last 2 years. Its a no non sense card with straight rewards and redemption options. I have been accumulating points on this instead of Infinia and diners Black as in last 2 years due to covid 19 travel was limited.

Today i got this card!

SC systems are strange. I have been a priority customer for 6 years with decent NRV and ongoing investments and a salary credit every month.

I recently applied for this card via my RM and was rejected. He suggested applying for a lower end card first followed by a request to upgrade. Eventually got SC manhattan with a 2L limit( less than 1 month of salary credit ). God only knows what heuristics SC applies when issuing cards.

Anyways, decided to move out of SC into Kotak. Kotak seems to have a better handle on how to handle HNWI clients.

Siddharth, Can you please help on booking golf lesson on the master card variant. Customer care seems to have no knowledge. Got one concierge number that is not connecting as well. I can book calling master card concierge however as you mentioned ultimate card has it’s golf benefits wants to know how to book that. Also is duty free cashback available on Bengaluru domestic departure as well?

The application gets stuck in “processing” after clicking submit.

I’ve been having the same issue since months. Not sure how others are applying online. Haven’t yet found a solution. Even emailed their customer care and they are clueless. If any work around please inform

Got this card today. Simple steps i followed for C2C –

1. Apply on website. Enter total income 25L (though I don’t have this much)

2. Select other card statement in proofs instead of salary slip

3. Got instant rejection

4. Got a call next morning. I told them I can’t share my payslip. Instead i can send my ICICI card statement with 11L limit.

5. Confirmed my official email id

6. Got my virtual card today

As far as I know, there are no accelerated rewards on this card. This makes it less exciting than HDFC DCB.

This card has been jinxed 😵💫😵💫

Dear client, from 2 Apr’23, your StanChart Ultimate credit card will earn 3 reward points on every INR 150 spent on select categories. Now, enjoy 1% surcharge waiver on fuel transactions. Please note that no reward points will be earned on fuel transactions. Know more: bit.ly/41AlY0n

Unfortunately a sad news of many!

A resurgence of SC Titanium card for fuel.

But rewards on that too is trimmed sometime back isn’t it?

Shykes. That’s so bad. I swear by Stan C ultimate for every spend and with reward rate now revised to 2% , an Amazon icici credit card is a much better card!

Just when I was thinking to dump a couple of cards due to SC Ultimate this came up 🙂

I guess this means it’s not more a no exception card.

1) Transactions on Utilities, Supermarkets, Insurance, Property Management, Schools & Government payments will now earn 3 reward points on every INR 150 spent.

2) No reward points will be earned on Fuel transactions. However, you will now enjoy a surcharge waiver of 1% on fuel spends. Fuel surcharge waiver amount will be capped at INR 1000 per month.

Still 2% rewards on these categories is “good” as most others give nothing.

Diners black gives 3.3%

HDFC does not give on most of these categories, not sure about the diners series though. These categories – Utilities, Supermarkets, Insurance, Property Management, Schools & Government payments – what is the position for DCB?

Sir please write about new transfer partners added with HDFC Infinia. Waiting for that article from your side

I guess there is still no capping of reward points on loading of wallets. Also I understand from customer care that lounge access in india and abroad are available to add on card holders too if 20k is spent in the previous month on add in card

Its on rent payment too now

Dear Client,

Thank you for banking with us!

We would like to inform you that effective 2 April, 2023 you will be charged a 1% processing fee (plus applicable taxes) for rental payments made using Standard Chartered credit cards. For more details, click here

We hope to be of service to you at all times.

Regards,

Standard Chartered Bank

I received my card just today. I got this card just for rent payments. I think it doesn’t make sense to continue with this.

Can I call the bank and block this card without paying joining fee?

I made a payment of 48000, would I get rewards for it if I block it?

Keep the card. Very good card, what if one benefit is reduced/withdrawn?

Not easy to get this card.

I was about to do the same. Good thing I was unable to apply due to their website issues. That leaves us with a vital question ,for Sid-what’s the best card for rental payments now?

I had shifted my spend on school payment to Sc from infinia. Looks like need to use infinia again now. School fees is a major spend in metros.

SBI Cashback gives 5% on education fee payments. I have done quite a number of times from CRED.

The currency exchange rate comes to 4.13% (3.5 plus gst) less 1.5% cash back (no gst benefit ) which is 2.63% and not 2.36% as mentioned.

Even with current changes to the points system, it gives more points than other cards but since March 2022, they have started charging the 99 plus gst on vouchers as well (no matter what evoucher value is obtained). The choices for redemption although appear varied, the actual useful options are very few (jewellery (with exceptions), electronics etc) and keep changing from time to time.

Siddharth, you should create a post on which cards and portals are still best for rent payment? With Infinia, DCB and now SC Ultimate almost negating benefits of rent payment via credit cards, we definitely need some new cards just for rent payments – which for high spenders will be at least 5-6 Lacs annual expense.

So here’s how you can go about it:

1. Find lesser known rent payment service providers, as they don’t report rent MCC

2. Use rent payment apps and pay using wallet/payment gateways that don’t report MCC

There are sweet spots, you’ll have to do a bit of trial and error.

Can we know it before hand without making a payment? My Plan is to try multiple apps and observe if I am being charged 1% extra or not.

We would like to inform you that effective 2 April, 2023 you will be charged a 1% processing fee (plus applicable taxes) for rental payments made using Standard Chartered credit cards.

The rent payment from credit card has become so ridiculous that both vendor and credit card company are charging the customer for same transaction.

Why should credit card companies charge customer for making rent payment, why can’t they charge vendors like all other transactions and let vendor recover it from the customer.

Sid it will be good if you review uni nx wave even though it’s rewards are lacklustrous.

But has v good design and LTF

Hehehe Sid, did you just jinxed this card? A day after your recent review (28th Feb), SCB Ultimate came up with these restrictions (1st Mar). Anyways its was bound to happen soon. While I can understand the restricted reward points on most of these categories (because of their heavy abuse), I wonder why have they also included “Supermarkets”?

Also, I hope RedGirraffe now comes up with different merchant category codes (especially for non-rental registrations). For example, apart from rent payment, I also use RedGirraffe for payment of Society Maintenance and School Fees. But I fear these too will be considered as “Rent” based on the blanket MCC of RedGirraffe and unnecessarily will be charged 1% processing fee plus taxes, which would be so unfair.

Lol, felt the same. But ideally bank can’t do such changes in such a short time. Probably it’s bad timing.

Supermarket spends is indeed a surprise. Maybe some were misusing it, else wouldn’t make it to the list.

Siddharth, request you to please analyze DCB rewards and it’s relevance after subsequent devaluations

Don’t worry about RedGirraffe, RG transactions are tracked as insurance spends. Infact we should hope that it doesn’t change. And if you ask their CC, they dont even know whats their MCC.

I asked my bank. It’s 6300 for rentpay

Hi SID,

Please suggest an alternate credit card to Standard Chartered ULTIMATE compared on effective reward rates.

It seems SCB is determined to kill ULTIMATE(ly) which has now lost the edge over its competition with following policy changes topped up with annual renewal cost of Rs. 5000/- + 18% GST and fewer Reward Points Redemption Options in Vouchers.

Effective 2 April, 2023:

1) Transactions on Utilities, Supermarkets, Insurance, Property Management, Schools & Government payments will now earn 3 reward points on every INR 150 spent.

2) No reward points will be earned on Fuel transactions. However, you will now enjoy a surcharge waiver of 1% on fuel spends. Fuel surcharge waiver amount will be capped at INR 1000 per month.

3) You will be charged a 1% processing fee (plus applicable taxes) for rental payments made using Standard Chartered credit cards.

Good that rent services are finally been charged by credit card companies. When they are not realising any income in the money transfer, then why will they give reward points on the same? They are here for business and not offering freebies. Plus there is a need to plug all business transactions from personal credit cards.

Not sure how company is not making income. I am pretty sure they charge a fee from the vendor for the transaction and by not giving points for rent payment, how does that impact their card processing fee.

Out of context question while everyone worries about the RP – my CC limit on SC is capped at 10k. How do I take it to at least few lakhs? I have to keep refilling it. Also, I’ve never used it for a transaction of over 10k.

I have an Infinia with a 15L limit, a Prestige with a 9L limit and Emeralde with 6L limit.

Hi, Facing the same issue. Let me know if you were able to increase.

That’s alarming. This has happened to me about 15+ years ago with Deutsche Bank Credit Card. But back then the credit limit was only 50k and it was suddenly reduced to 10k without notice. I was trying to use the card and it kept declining and when I called customer care they told me that it was for internal reasons. I cancelled the card immediately. Soon the bank closed the credit cards business and it was handed over to Indusind.

Given that this has happened to SCB customers too, I am afraid what’s going on. Is SCB going to close down it’s card business too? Anyway I am closing my Ultimate card after my EMi on it is over as I am not happy with their customer support, or lake of it thereof, recently and the reward rate too took a huge hit.

Hi Siddharth, thanks for so prompt updation.

What’s your advice, is it time to again switch Back to Infinia from SC ultimate.

Awaiting reply sid sir

Tough question with little inputs.

In the latest update there is no mention of Reward points on Wallet load. Does that mean we will still get 3.3% reward on walls t lod txns?

So if I load the Payz app wallet with ultimate card and pay my house rent through red giraffe on Payz app. What will be the net reward rate?

I have been an SC credit card customer for past 12 years and recently upgraded to SC Ultimate. I had done a few EMI transactions and they seem to create a different account called Instabuy account. Even though we purchase through the primary card, the outstanding amount in the statement doesnt reflect the EMIs and we need to do some calculations with the EMI amount from the Instabuy account and then pay them together. I usually pay the outstanding amount shown on the statement, which resulted in huge interest charges. In fact I had checked with customer care before payment and they misguided. Tried to get reversal from SC but no use. I am planning to close the card as their customer service seems to be very bad.

Deepesh,

I have been using the ultimate cc for 2.5+ years. Every month I would pay total OS amount (cc bill + instabuy emi). SC would auto allocate the amount to instabuy emi. In March 23 month their system did not auto allocate the amount. Then April 23 I receive instabuy bill with pay asap and another email to pay asap so that credit score is not impacted. I paid the instabuy OS and then called Call center to transfer the funds into instabuy. Then I paid the cc bill amount. In May 23 month bill I found 10k+ interest charged. On enquiry I found that in the month of April 23 the amount that I paid for cc bill was auto allocated into instabuy and as a result the cc bill was not fully paid. 4 call center calls, 3 exchange of emails with customer care head with all details and highlighting their mistake in March 23 (not allocating due into instabuy automatically) they have said that in next month they will credit the 10k+ interest amount. I am doubtful that they will and it is just a written assurance.

if it does not then I will email to principal officer as per the grievance mechanism of the SC and if that does not works then I will write to banking ombudsman by filling form on RBI website.

this is the only way to deal with SC bank. I’m going to hold on to the card till I’m able to redeem the reward points (at present the reward points option are very poor). But after that I am going to close the card. There has to be a consistent and transparent working method.

Do follow the SC grievance mechanism to get the refunds. Search for SC bank grievance officer on google. You will get a pdf.

Though at first it (use to) appear as a good card, but in fact it never was. Now, I’d have closed is immediately if I’d be holding one. All the redemption categories are overpriced. Also for vouchers, you’d normally get discount if not using vouchers (eg for Taj you can easily get 14% or more discount (10% copper+4%neu for just for copper, higher tier would get more)) so with this redemption value at best is around 2.8% worst maybe 1.5-2. Now with supermarket/utilities/insurance all big spends out of window, a complete useless card for the target audience. (not to mention pathetic/almost non existent lounge access. 1/month means you can’t use it even for 1 trip which will have at-least 2 legs if within the month.

I don’t see any jewellery voucher options (Tanishq/Joyalukkas etc) for redemption. Any idea if it’s temporary or they have removed these permenantly. With the recent devaluation, if they are removing the jewellery voucher options also, then it’s a big bummer. Any insights on this will be helpful

Maybe they’re out of stock. You’ll have to wait for some time and see. It has happened to me many times. I’d plan on getting a voucher and then it won’t be there. After a while it will be there again. Have seen that happen with Kiehl’s, Nykaa and Mytra Vouchers which I usually go for. Has at times even taken a few weeks to be back in stock.

voucher of jewellery brands like (kalyan/Tanishq/PCJ) and tata Croma is removed permantely, Amazon was already removed 2-3 years before so, No reason to hold the card. I have 70k+ point but only Fashion & Clothing brands are available for redemption which is not beneficial.

I did a few transactions on Wallet and rent in March. No reward points credited. I thought that the effective date was 2nd April.

StanC posts the points as soon as the trasaction is posted. But not this time.

Anyone else facing the same issue ?!

Card is being given out quite easily (which is good) as lower category SC cards are getting limit enhancements for existing customers, but reward rate is going down on major categories (which is bad), so the card deserves some amount of rating downgrade. Was considering upgrade from LTF Titanium but dropped the idea, will continue swiping Titanium at fuel pumps.

Fuel being a major spend in metros, what are the best fuel cards now. I used to use SC ultimate but no points on it now. Anyways I am gradually moving all my spends to infinia now.

Does anyone know how to close a standard chartered Ultimate CC ?

I checked the 360 rewards redemption and they have now removed Makemytrip and Croma vouchers from the website.

SC is offering upgrade to Smart Card, and have also offered upgrade to Ultimate. But after the recent devaluation, decided not to go for it. Using SC Super Value Tytanium.

Looks like Croma vouchers are no longer available for redemption as of March 27, 2023. This, along with the RP reduction on my most heavily used categories, severely limits the benefit for me. Considering closing this card.

Bigbasket and Croma vouchers have disappeared from rewards portal. Making a case for closing the card after recent devaluation.

I just checked out rewards redemption options today. It has shrunk a lot lot than what it used to be. Barely any good option as earlier. Earlier I used to prefer SC Ultimate vs Infinia unless until I am not buying a gyftr voucher. Now, seems like I can spend usual daily spends on Infinia rather than Ultimate. Your thoughts?

Feeling the same. I have 90k points with no good deal to redeem.

But what i find when I am checking the 360 rewards catalogue with out login there are good options like apple laptop & iphone, samsung laptop & tabs. But after logging in all those options are not available.

Nowadays all types are cards are charged with 99 plus Gst or 1 % for rent payment and SC rewards are worst in terms of redeeming it. From what i have seen earlier. It has been devalued many times over a period of time. I am planning to close my SC Manhattan which i have for past 18years and still they charge me 999 plus GST. even after meeting the thresh hold reversal spends. When called they say they will reverse after four months internal team will check and reverse we dont need to call they said now it is five months still dont see reversal. Banks are taking people for a ride.

Got OnePlus Nord buds as a welcome gift, nice surprise i would say 😄

When I called for closure of cards somewhere in April all of sudden I get LE to 489000 and they upgraded it to SC ultimate and also they went ahead and upgrade my easemytrip card within a month to scsmart card am not sure it is upgrade but a downgrade however they reversed my manhattan 999 plus gst and this I spent to nil it. Now I see vouchers keep disappearing again and when you try to trf points it gives error stating system issue unable to process for past six months or a year . Will see for a year and check rp on all transaction if anything missing may close it.

Hi All,

I am using the SC Ultimate card for about 2.5+ years and accumulated over 90k points. What i find is that when I visit the rewards points website of SC 360 rewards, I can see apple laptop & mobiles, samsung laptops and tabs. But when I login all of the above are not available for redemption and some very ordinary stuffs like there for redemption.

Has anybody else also faced the same issue? Coz now the 90k points are feeling like useless with no real good option to redeem.

That’s really strange. Haven’t seen anything like that in almost 6 years of using this card. Do you have multiple SCB cards? If so then you will have to select the Ultimate card from the top right menu. If that’s not the case then this must be some strange technical glitch.

Yes all the rewards have been reduced considerably and very ordinary stuff is there. Vouchers are not any attractive now (removed croma, myntra). all other redemptions are costlier (they are available cheap on other websites)

I also faced similar issues with redemption.

A general rule of thumb of the credit card game is that for best value you should not redeem rewards for catalogue items, but only for statement credit or vouchers.

The issue is also that SC does not have most of the highly sought after vouchers but that depends. You could still redeem the 90k for Taj/Marriott vouchers (equivalent value) if you are planning on a vacation, or even for Imagine store vouchers to buy Apple stuff. I’ve heard of someone who recently redeemed his 30k points for Decathalon vouchers and bought a bicycle.

I think its time to change the rating from 4.8/5 after all the revisions in earnings and lesser redemption options (no big basket no Tanishq GVs now)

Did everyone getting rewards ? For the renewal fee of annual 5000/-

Takes anywhere between 60-90 days for the rewards to be credited.

Yes, I have received.

Scb is a big scam for rewards.

When they see there is big spends on a specific category then they stop giving rewards on the same. When the bank says rewards on every spend then they should have not kept the fuel category left out.

Please suggest other card for earning rewards on fuel spends (big spends on fuel)

Nearly all cards restrict rewards on fuel. Your best bet would be one of the fuel-specific cards like SBI BPCL Octane or Axis IOCL. But these too come with caps and conditions. For instance even fuel cards do not usually reward spends above a certain threshold, like Rs.10000 a month for SBI. A good option otherwise is Axis Magnus which rewards regularly but the one time spend has to be above Rs.4000.

Maybe Siddharth could come up with an article reviewing the best fuel cards?

1. Swipe MRCC in multiples of 1500/- at least 4 times a month -> 1000 Bonus points. If you reach 20K spends/month -> 1000 bonus points extra

2. See which Petrol bunks are near your place.. take a Fuel card. I have Axis IOCL (Limit: 5k/month I think) & BoB Energie (Limit: 6250/- per month) – both are near my place. You can try those which are convenient for you.

SCB is a big no after using Ultimate card for the last few months.

Although they say Rewards on all categories except for reduced rewards on some specific ones, any deviations in reward when reported is responded in a robotic manner with no explanation as to why the reward calculation doesn’t match.

Somehow I felt their customer care is very rude and doesn’t even both the about hearing you out and just disconnects the call

Reward redemption is a joke, when you think about getting one available in their portal all of a sudden that particular one disappears without a trace

Such a pathetic service

i have been an avid user of the SC Ultimate card but after the recent demotion of the earning rate as well as the redemption catalogue being so juvenile, I have now applied for a cancellation of the card. However, I am now on the lookout for a worthy card that can now be my go to Credit Card. Pls do suggest if you come across any.

Same here. I too am planning to close this card once my EMI on it ends. But I too am unable to spot a worthy replacement. I already have the Infinia but was still using this card heavily because it was giving 3.3% unconditionally till the recent devaluation whereas with Infinia we only get 3.3% if we use it for flights/Apple products etc.

Was eyeing AU Zenith but that got devalued significantly too. And Magnus is useful only if once spends 1L at least on it every month. That’s not possible for me as I have many other cards for specific purposes like Infinia for Flipkart, ICICI Amazon Pay for Amazon, Tata New Infinity for Tata Ney, Ace for GPay. Even otherwise my spend on cards very rarely reach 1L in a month, even all cards combined.

However I am eyeing the SBI Octane card which offers 6.25% returns on BPCL for petrol and cooking gas too. I’ve been trying for a week now and their website application process is broken all this while. Maybe I should visit a branch instead. My only apprehension towards this card is that it’s SBI and I’ve heard many horror stories regarding them.

I feel, we’ll be eventually using multiple cards depending on where we are using them. Likewise, my spends don’t fulfil Magnus’s requirements and with a rumoured devaluation of Magnus, Magnus may be out of the question too. I get a feeling that the age of credit card devaluation has begun. Once the large players start, the others will follow suite.

Thank you for letting us know about SBI Octane, I do have a BPCL next to me.

I want to know if SCB has restricted issuing add-on cards on Ultimate. I was told by Vashi branch the same but I still applied for my wife in Apr. Today I received a mail stating that it cannot be issued with the reason “Does not meet bank policy norms”.

Hey Sid.. Wanted to check if the renewal Benefit is applicable for all the years or only the 2nd year for Ultimate card.

Hi Sid,

Which card in your opinion is the best when someone is paying around 35L a year for insurance( policy, premium) ?

Already hold Infinia(2000RP capping) and Indusind Metal Hertiatge(1% return)

The card is getting useless now. No good vouchers to redeem. Very less options to redeem infact. Was looking to get MMT vouchers. Sometime back wanted croma vouchers and they are also not there from long time. Have many points to redeem but of no use.

I called the customer care to cancel my Ultimate card due to poor reward system. I got a call from CC team and assured me for good reward reductions like Amazon and flipkart in 2-3 months but I didn’t convinced. Finally they are agreed to reverse the annual fee once assessed and closed the cancellation request with those comments. Once the annual fee is added on my card, I called the customer care and get that charge reversed. This happened in last month.

SCB has charged me for international lounge access on 16th Nov. I have spent 65K on 28th Oct which was billed on 10th Nov. On checking with SCB they have informed one needs to spend in previous statement month not previous calendar month. such morons they are. I am cancelling all 3 cards (Ultimate/Platinum/Smart)

This card has become useless of late. They even removed Firstcry as well which I redeemed last year.

Exactly one year after your review! Key updates on my ultimate this week !

1. Offered refund of annual charges and gst when I called up for cancellation of the card citing “poor rewards catalogue”

2. You cannot combine rewards points between the primary and secondary credit card. Points need to be redeemed independently with separate redemption charges

3. Bill payment to the card needs to be independently to primary and secondary card. Transfer of amount is a big headache if done at a consolidated level.

4. Interest charges are levied sometimes if payment is not done to primary and secondary card respectively.

5. Not worth holding it anymore!

To avoid multiple redemption charges on primary and secondary points redemption, just call them first and place a request to transfer reward points from all Secondary cards to the Primary Card. Once all the secondary card points are emptied out, redeem the points from the primary card (that is, if you find any good option for redemption – hahaha) and pay the redemption fee just one time.

SC Ultimate card reward redemption catalogue is completely useless right now. Their 1RP = Re.1 benefit is too good, but the catalogue to redeem the RPs should have some good options atleast. Very sad!

Once again victim of horrible service by SCB. My rent transaction didnt go thru at 1st instance so it was credited back after 2 days of transaction. 2nd transaction was successful. I was charged for both rent transactions. On asking them to reverse duplicate charges they agreed but never reversed. After multiple requests they came up with new ploy that every debit will attract charges even if transaction is not successful. On threatening them to cancel card and RBI complaint, they promised to reverse charge but they told me they are legally right and will not reverse any such duplicate charge in future. Once reversed. I will cancel all cards. Please think twice before taking SCB cards

I closed my card last week. Redeeming points has really become a pain.

Their catalogue has become limited lately. No more Vistara airlines etc. I am now going back to my good old Amex which I discontinued last year. Had decent value redeeming for Taj vouchers so many times.

Standard chartered has seriously limited the redemption catalogue. Seems like a planned move to lock the customers in and get some money out of the rewards doled out.

As soon as i end up redeeming the accumulated points i do not intend to get back to SC forever. Shady practices!

Standard chartered -Ultimate card user since last few years . No way you can redeem points , I feel I am stuck. All the vendor tieups are low class . No travel or econmerce like Amazon or flipkart vouchers . Please try HDFC Infinia or SBI AURUM CARD instead .

I had cancelled my Ultimate card few months ago. Strangely they did not cancelled my Addon Ultimate cards. On contacting the cutomer care, I was informed that because I’m holding another SCB credit card (Manhattan – useless card which I’m holding only because its LTF), I can continue to hold these Addon cards for free! So basically I’m still able to keep a “premium” card without paying any renewal fees…this loophole would have been really exciting if only the pathetic rewards catalogue had improved.

All of a sudden, SCB has decided to drastically reduce my credit limit (to less than 10% of what it previously was) with no intimation whatsoever. I was out shopping and it was very embarrassing to see a supposedly premium card get declined with an error about insufficient credit limit.

I called them and was told that from now on, this will happen every 6 months and I have to email their Card Services team each time if I want it reversed.

I’m going to redeem my points on their already useless catalogue and close this card ASAP.

Have been using SCB for the better part of a decade and SCB’s ULTIMATE used to be one of the best cards for high spenders, with excellent redemption and useful reward catalogue. Sadly, of late that seems to have changed with the useless reward catalogue. It is understandable banks are losing heavily on Credit Card businesses, but for that Banks themselves to be blamed as they launched plethora of cards with unsustainable Reward Points and spend categories. In the process they have bamboozled creamy customers. In the end they lost on cards as well as a good customer base too. First why promise the moon only to crash to earth?

I believe almost all are in same boat. This just became useless because of rewards catalogue. It used to be good earlier. But now after devaluations and especially the cro rewards redumotion process and voucher choices it’s just waste. I believe everyone is waiting for the Amazon voucher or any other useful voucher to be available in the catalogue. Once it’s available everyone is going to redeem all points and cancel this crap card.

@Sid: Pls check the rating and probably you need to reduce as it’s not longer worth 4.8/5

Dropped the rating a bit, thanks.

That aside, I did visit the branch recently and was told something new (new cards or more redemption options) is expected to happen in the next 2-3 months. While I don’t believe the branch statements usually, I hope they do some refresh on this.

I was told this last year as well, nothing changed….

I was in a mood to cancel this card but paid the annual fees 1 last time last November. If nothing changes will cancel this card or ask for any other ltf card from SC as the limit on this is high. Imagine I redeemed 27k point I think on Bodyshop vouchers 😄. I am still left with many points.

I’m holding this card for almost two years, but I have not seen any croma or MakeMyTrip voucher for redemption, uber also discontinued from more than one year. At present, I am not finding any useful voucher. Please update voucher details in review, it is misleading for new users

Has anyone ever got the Annual fee waiver? Also, I think the vouchers section should be updated, the vouchers mentioned don’t ever come anymore. I have been looking for the past 1 yr and Croma, Myntra, Pantaloons etc vouchers are never available. The only ones available are mostly those you wouldn’t want.

I recently got annual fee waiver by hard bargaining based on non availability of good vouchers. Annual fee was charged and I was in mood of cancellation before next renewal had I not got the waiver.

Also since I hold Infinia and ICICI EPM, SC Ultimate doesn’t look much useful (except where both Infinia and EPM don’t give points i.e. govt payments). But where to even use those points is the issue.

I too got an annual fee waiver in Q4 2024 and they promised to revamp their rewards structure. It has been 8 months, there have been no updates to the rewards redemption as promised by them and could not find a proper reason to use this card / points. So, just closed it without waiting for this year’s renewal time.