There are entry-level cards with Zero joining fee and then there are super premium cards with high joining fee that comes with a metal form factor.

What if you mix up both segments and issue a free card? That’s OneCard. Here’s everything you need to know about the OneCard metal credit card:

Table of Contents

Overview

| Type | Entry-level Credit Card |

| Reward Rate | 0.2% to 2% |

| Annual Fee | Nil |

| Best for | Low Markup Fee |

| USP | Metal form factor |

Onecard is useful for those who want to experience the metal form factor and the low markup fee, both of which are possible only on super premium credit cards.

Speaking of rewards, regular reward rate is too low but they come up with targeted offers every once in a while that certainly helps to an extent.

What is OneCard?

OneCard is an entry-level credit card launched by FPL Technologies that works on IDFC bank platform through Visa (Signature) network.

While it boasts about a metal form factor like the Amex Platinum or Centurion its like giving you a Maruti 800 that “looks” like an Audi on the outside.

Its a hyped product in a way, but still if your plan is to show off the metal, its still a good choice for that matter.

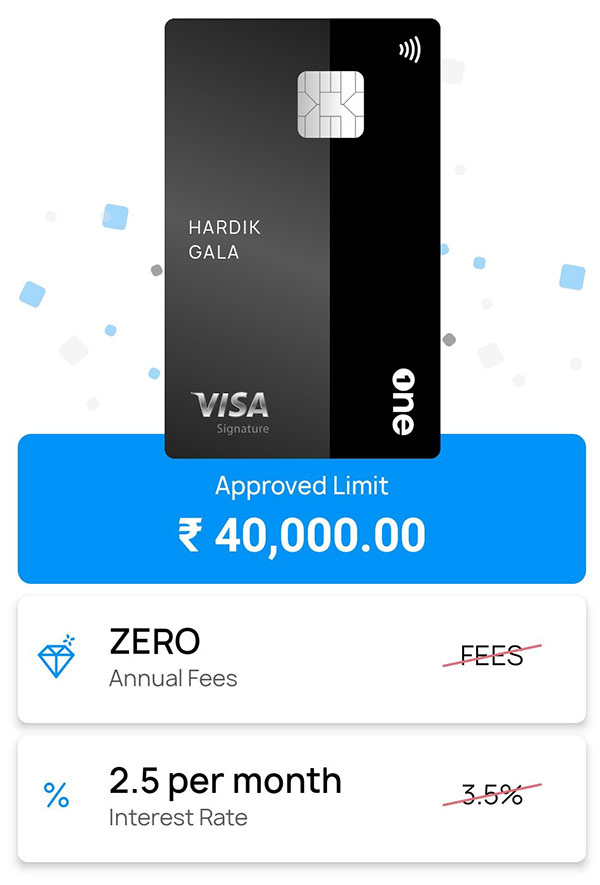

Fees & Charges

| Joining Fee | Nil |

| Annual Fee | Nil |

| Markup Fee | 1%+GST |

| Interest Rate | 2.5% |

Its good to see the low markup fee, which is better than most credit cards but remember the rewards aren’t good enough for it to compete with super premium cards.

As you see, its ideally a lifetime free credit card without any joining or renewal fee. That’s good given that its coming in metal variant.

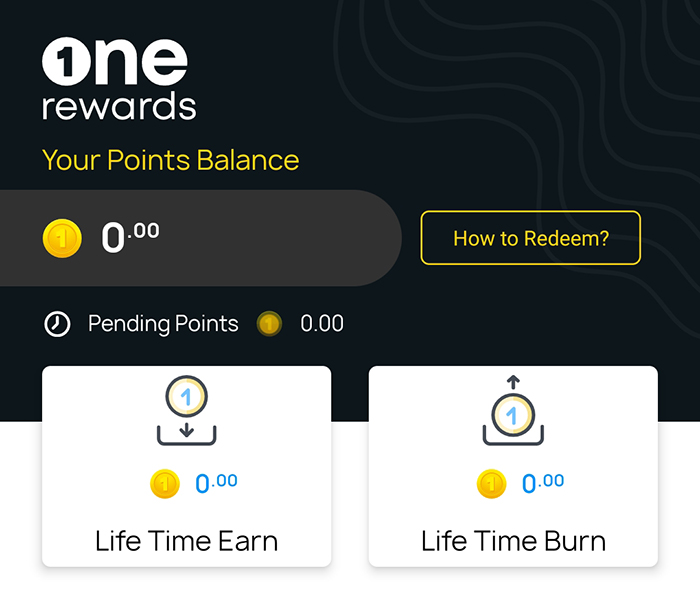

Rewards

| Regular Rewards | 1 RP/ Rs.50 |

| Accelerated Rewards | 5X RP on top 2 categories |

| Point Value | 10 Ps to Rs.1 |

| Regular Reward rate | 0.2% to 2% |

| Accelerated Reward rate | 1% to 10% |

So as you see, the regular reward rate varies anywhere between 0.2% to 2% and in case you get 5X then your reward rate could be anywhere between 1% to 10%

While those are the numbers in theory, in practical, the reward rate is 0.2% to 1% for instant redemption for statement credit.

Note: As tested by one of the user, you don’t get reward points for wallet load and transfers. Amazon pay load shows as transfer.

Benefits

- Form Factor: Metal Card

- Visa Signature Privileges (lounge privileges not confirmed yet)

- Points are issued INSTANTLY

- Points that never expire

- Fractional reward points

How to Apply?

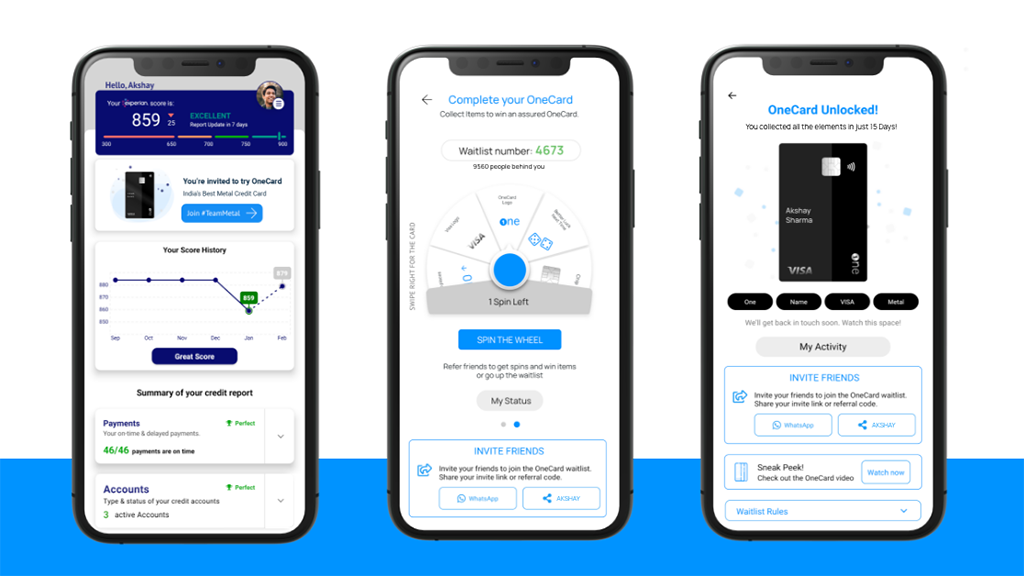

Prior to the launch of OneCard, the company launched the OneScore that gives you free credit score & report (Experian) through App.

Within the app they have an option to show interest for the OneCard. You get into waitlist and you will be informed when its available.

- Update: They’ve stopped taking new users. You may get an option to opt-in after sometime.

OneCard is currently available in 15 cities including Pune, Mumbai, Bangalore, Ahmedabad, Baroda, Surat & Delhi. Other cities maybe added soon.

User Experience

Onboarding:

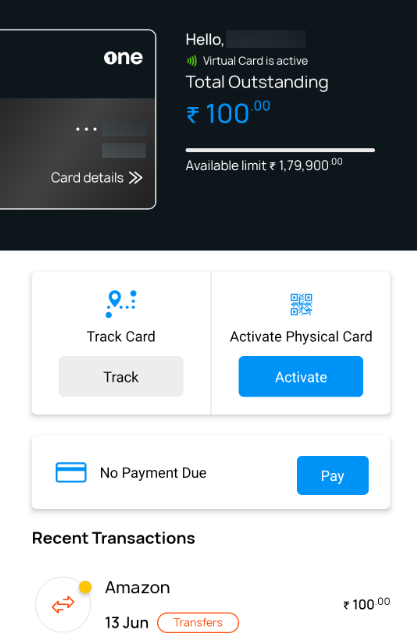

Here’s what one of the user has to say about getting started,

I got the email that I can now get the OneCard. Registration is simple. I downloaded the app from playstore and entered basic details. It didn’t even ask for my PAN number. Just email, phone number along with OTP, mother name and father name.

That’s it, the process is completed and the app shows the virtual credit card instantly with eligible credit limit. It’s 1,80,000/-

Currently the app is in beta phase on Playstore and yet to go fully live. Here’s the app visual:

Service:

While the app is sleek and all easy to use, it seems the service/support is not upto the mark. Some have reported that they get robotic responses to their queries. But this may change as they evolve, over time.

Bottom line

- Cardexpert Rating: 3.7/5

As you see, its an entry-level credit card with some fancy features but the very low reward rate of 0.2% on regular spends makes it less attractive. Yet, the 5X rewards on top 2 categories is a good option if you can make use of it.

If you’re new to credit cards, I would highly suggest to go with Flipkart Credit Card or Amazon pay Credit Card or OLA SBI Card that are lot better both in terms of reward rate (~1.5%) and service.

Overall the Visa signature platform, metal form factor, free for life and easy to use app are the major advantages of the card.

Having seen enough of entry-level cards in last 2 years I hardly have any excitement for them. I rather wish someone launch a super premium credit card with innovate features.

Have you got the OneCard by any chance? Feel free to share your experience in the comments below.

Thanks to Hardik, Mahendra & others for sharing the experiences with OneCard.

Hi Sid,

I have the card and I can confirm that the 5X rewards are applicable on the top 2 spend categories.

How do i see the Credit Card invite option?

I am unable to view it in the One Score app.

Hi Akash,

You should find it now. 🙂

I have got it now on the second batch of disbursals.

Hey himanshu, can you tell me about surcharge services which apply in this card

Hi I think now it is compulsory to create a FD to back credit card I know it’s wierd but they now ask for minimum of 10k FD and will give the credit balance of 11k that’s it. Considering that there is no other fees and also the fact that FD gives return of 6.5% still make it good enough.

Creating an FD to avail this card happens when your CIBIL Score is low. Check your Credit Scire through CIBIL (the free ones are not always accurate) and check it for yourself.

This is not the case, it is asking me to create an FD, I live in Delhi and have cibil of 810. I hold premium card like HDFC Infinia and IDFC Wealth. Not sure what logic they have for issuing this card.

my Cibil score on experian is 868, still the app is asking me to create an FD.

i think they have stopped giving cards on credit score and are now asking for an FD.

Received it. They are sending out the metal card now. It looks really cool. But a lot of the transactions for example on Razoepay (for diff merchants) are marked as Others. He ce they do not qualify for the 5x. Also, 5x is availabme on two categories not one. Looks really cool and since it is frew, it doesn’t hurt

Hi viresh,

Any lunch talking to the guys at onecard to change the categories?

Siddharth,

I am a long time reader of your site. But you suggested Flipkart & Amazon card. These are not approved for everyone now a days and even it’s approved provided credit limit are very low.

Get any Axis/ICICI Card and then getting those becomes easy. Even OLA SBICard is good.

u need an axis/icici cc by hand first and then they issue the respected card on the base of limit of ur current card

OneCard is currently available in Pune, Mumbai and Bangalore. Recently they’ve added Ahmedabad, Baroda and Surat. Other cities maybe added soon.

– The card is also available in Delhi NCR and many people have received the card in Delhi NCR.

You donot get the metal card at the moment but you may have the plastic variant for time being.

– As of now, the metal cards are being issued. I got the invite on 4th June and got the metal card on 12th June. My documents were collected in the month of March earlier this year.

Thanks for the updates.

Also, as per customer care with whom I had a word yesterday, they are available in 15 cities currently.

Updated that as well, thanks.

Hi Siddharth how I can cancel the one card

I got this Metal card from Kolkata.

Hello animesh. I want to ask you that is there charges for metal card issurance?

No charges for metal card issuance the first time.

Replacement metal card costs a bomb – Rs 3K

How to apply one credit card

What’s the minimum points required to reedeem the points

Not required minimum points to redeem the points. You can redeem the points only on the spends you have made. Like if u made two rupees transaction on card then u need 20 points to pay that two rupees transaction.

I have recieved the card and spent close to 70k on 4 different categories, now its showing 2 of those 4 spend categories as eligible for 5x rewards.

Hi Rakesh,

Do let us know if there is a clarity on the point value 🙂

Hi Santosh,

I even got excited initially that they are giving 1 re per point, but seems no ! For a transaction of 7499 to pay using pts, they are showing I need 74,990 pts 🙁 so, as Sid mentioned above, 1 Pt value is 10 paisa..which is worst for a prestigious card from IDFC ! I know its still beta though !

So, max return we can expect even after 5x/10x is 50ps – 1rs for each 50 spent.

Its not a prestigious card and it can’t be, as its anyway a free card. That’s the problem with the product.

They messed up by mixing the target groups, created hype and underdeliver.

One card executive called me for feedback on 24 JUN, below are the pointers I gave feed back on.

– Introduce 7x + 10x categories.

– Reward point value is so low(He mentioned..card is still in beta phase..better redemption options are being curated now)

– Appreciated fractional reward points.

– spend based 5x is cool.

– Asked them to give RP even for wallets as wallets themselves have load restrictions !

He kindly noted all the points and said he will fwd these points to feedback team 🙂

I am also get One card credit card with Rs.30000 limit.Its working very fast in any app transaction with fast sms alert.I don’t remember when I gave request to Onecard family.They didn’t ask any pancard, Aadhar card details.,etc.I didn’t know how they approve me with this credit limit.Even 48 days there is no interest also.

But anyway Its good for me for my financial use.

I thank Onecard FPL technology family.

Actually they have started issuing metal cards already. I too did get an email from onecard saying I am now eligible.

Simple onboarding process. You can select your address from any of the address mentioned in Experian report as per other Banks you have cards with.

I am from Bangalore but not in town due to covid. Reached them on Twitter. Got a call, explained the situation, they are holding dispatch of card as they cannot deliver to pan India yet. I guess this is mainly because they use otp based delivery by blue dart and they will deliver to the person only.

While a good product for now, need to wait and see how they manage queries and disputes when their user base increases.

Some clarification on reward points is needed though.

Haven’t used customer care yet.

Twitter has some pics.

But how do you classify it as a “good product” ?

Would like to know with what cards you’re comparing it with.

Hi Sid, that’s why I chose to say “for now”.

-onboarding: no documents hassle and no calls or others. Note: did register on the one score app.

-transparency in rewards (but low reward value can be a downer)

-forex mark up-1%

-form factor: was as trying to get my hands on a metal card for a while but spending levels not that high for AMEX plat or axis burgundy

-sleek app, just compare this with Yes Bank or Indus

-as per MITC in the app, they have a chat feature (currently not live, maybe because of the beta app)

All these with no charges. Still, some things need to be clearer though, but considering beta phase 🙂

PS: going with the 10% accelerated reward rate (not sure when this applies), can this can be 10% cashback which comes near the 13%, regalia (10x) used to have?

Thanks for sharing your views.

For 10% I’m sure its not going to be cashback. But I think they might tie-up with brands for vouchers (hoping they’re known brands). We will need to wait and see.

@ sid.

Hi great website I enjoy going through the information shared and please continue such good work.

Please help me with this query :

I currently have citi rewards card for a few years however I’m thinking to cancel it as the rewards are not good enough the best i can do is get amazon pay gift card out of it for 3000k points. Also i have to pay some amount if i dont spend that much which makes me spend more…and since. Rewards suck i hate doing that.

I also have amazon pay icici card which im very happy with its life time free and gives me good reward every month but the problem is the limit is only 21k which is very low.

I do not want a citi or hdfc card as my family has them.

I was interested in amex mrcc after reading your post but my salary does not meet the criteria…

I mostly pay for groceries at offline + online merchants such as grofers big basket and fuel and do online shopping international + domestic + get fuel from time to time.

My friend is a manager at IndusInd bank and suggested I should get nexxt card from them.

For international shipping ive always used my citi.

Since i can block it temporarily from app makes me feel secured.

What do you suggest which card should I go for?

Hi all,

Can someone comment on what all the categories are?

Thanks!

I got metal card delivered. KYC Doc’s were collected in March second week. Later due to Covid there were no updates. One fine day got an email asking to download app and register. Couldn’t verify PAN, sent email and got it fixed. Selected address for delivery and received in last week.

Right now to apply for this card, we need invitation, can someone share invitation link here

As of now, the card is being rolled in batches to the people who joined the waitlist from January to March. I guess they will open the application to the public once they come out of the beta phase

Why was this article posted so late I am so so back of the line. Sid you are our only trusted source for CCs news well at least mine.

Cheers

Ajai,

You missed nothing for now, except the piece of metal in hand.

P.S. Didn’t publish this before as they had bad initial impression with waitlist system along with less transparency with reward “point value”.

My score is 851 but am not able to see the option on “show interest in one card”.

Option to show interest in not available in app for me

the annoying thing is before getting the card there is no way to understand & get the t&c document. If existing users share it would be great!. It seems a beta product still.

Also, if anyone can clarify if there is a fuel surcharge? ( i heard it is charges and immmediately reversed. If so, is the reversal through RPs, or actual cash value. And do they also reverse the tax component?

What I meant was the 1% fuel surcharge waiver almost all premium cards have across all petrol pumps.

this is the only document in the onecard app.

drive.google.com/file/d/1weE9UQvfGCnE3lV6V9WVSrweRyucjI7h/view

Thanks man. Apparently this is hosted here too: getonecard.app/legal/MITC_OneCard.pdf

I noticed the T&C seems a bit off. Nowhere is there any mention of fuel surcharge and other charges like in other credit cards. Dont know if its good or bad.

I don’t see any option to apply for the card in the One Score app.

Looks like they stopped taking new requests for now. Might open later.

Today I received the card, I applied just 5 days ago only.

Was cash already on ya card??

Yes. I just checked and I also don’t see this apply banner inside the app.

I’ve a question here. Frequent enquiries would impact our credit report right? How are the enquiries from these apps considered? They’re also counted or skipped from the scoring system.

I read its MITC and noticed the following clause. Not sure if it’s normal. Generally, in case of fradulant transaction if the card holder informs the bank within a timeframe his liability becomes nil unless investigation proves otherwise.

Onecard clause simply states the following –

You will be liable for all losses owing to any misuse that happened with your consent or

knowledge or prior to informing us about loss of card/phone.

Hmmm. I would rather wait before getting this card. too many loose ends/beta product. It may be good to see how they improve. One worry is if things go smoothly, this card will be fine. But for any issues, customer support would probably be non-existent

8.7. Transactions at Fuel Stations: When you use the OneCard to pay for fuel, you will be levied a surcharge. This will be completely waived for the fuel transactions made on OneCard. Such reversal will not include the applicable tax paid on such purchase.

So, there is a fuel surcharge in this card (though only the tax component)

Today I received a spend based offer from sbi card. Spend 25k and get 1k pantaloon voucher.

“Amazon Credit Card”

I ‘ve a SBI SimplyClick Advantage Card ( limit: 22k against the fd of 30k). I don’t have a regular source of income (say an unemployed). I want to apply for Amazon Pay Credit Card. So, I have few questions.

a) Pin Code of my area is not serviceable , so can i use other pin code (which is serviceable) to apply?

b) It asks for Company Name, what to write there? as i don’t have a job.

c) I got my sbi card in September, 2019, so are there 8 months enough to apply for another card?

Please answer

Do not apply using another pincode other than where you are staying coz there is a physical address verification .

You have to share your gps location during your KYC process

Amazon pay card is still provided on card to card basis as of now.

Best you could do is Get a ICICI Platinum credit card against FD wait for some time and apply for amazon pay card

Small Correction Amazon pay card is still not provided on card to card basis as of now.

Do not apply using another pincode other than where you are staying coz there is a physical address verification .

You have to share your gps location during your KYC process

Amazon pay card is still not provided on card to card basis as of now.

Best you could do is Get a ICICI Platinum credit card against FD wait for some time and apply for amazon pay card

Their Fraudulent transaction monitoring system is not adequate. Customer service is also below average. Very high chance of facing financial loss in case of credit card fraud transaction. Beware of it.

Hi Sid,

When I get invitation, I excited and apply card. After seeing the features, I didn’t see any use of the card even though its LTF. I see Amazon pay is more useful compared to OneCard, By default I get 1% in AmazonPay. However, I need to spend in 3 different categories to get same 1%.

I will keep for next 3 months and close the card.

Surprisingly, there is not CIBIL inquiry till now.

Hey Mahendra,

I have seen that for some people, the CIBIL inquiry was done in March and for most of the people, the inquiry was done in May. Along with this, there is also Experian inquiry done in April. Are you sure that you don’t have any inquiries by IDFC First Bank in last 3 months?

Hi Himanshu,

I verified today also. No CIBIL inquiry. My last enquiry done in 2017. After 2017, I took ICICI AmazonPay and OneCard on pre approved basis.

Hi Mahendra,

Seems an unique case. I got an email invitation about a week ago for registering on the app for a new card. I got a cibil enquiry once I registered on the app.

What is the customer care number for one card for any queries or complaint

Hi Sunil,

In app they mentioned 080-45575559 (Mon – Sat 10AM-7PM)

Email : help [at] getonecard.app

I think the best option is to contact them on Twitter. They are very active in reverting queries raised on Twitter.

I have an invite before months but I want to confirm the rewards redemption rate first before applying. As I think this card is providing very less of it and even we need to do transact at least 3 categories to get the boosted points. I have multiple cards for now and I use them as per my requirements and based on the rewards from them.

No. They don’t have an option to pay via UPI QR as of now.

7 months later, any option for QR Code?

Hi Sid,

What is the documentation required for this card? Any documentation done post boarding the customer? or is it all just app based?

I submitted just the regular KYC documents. No income documents were asked even after completing the onboarding process.

hey one card

my name kamini i have received one card by idfc first bank but i miss my activation QR CODE how i can activated my one card

I’m getting 3 lac limit on this.

After reading this article, I’m divided on getting this. Already have 5L on Amazon ICICI and 5L on citi rewards.

Can anyone else confirm that only AADHAR is collected by the card company as physical doc?

In my case at the time of the physical document collection in the month of March, they insisted on Passport or Voter ID card. They were not ready accept Aadhaar in any case.

Since it’s a visa signature card, could someone confirm on lounge access and move tickets (1+1), typically come with visa sign variant

As of now, no. They said they will come up with Visa Siganture benefits later in the future.

Update: The app has been updated earlier this week and now they are gamifying the Waitlist process. There are some wheel spins on joining the waitlist which shows your waitlist position. Its just a gimmick. I tried with 2 different phones ( my dads and mine) and the spin results for first 3 spins were exactly the same. You can get additional wheel spins by completing some activities. So far have been having no luck confirming address and PAN. It keeps throwing the “Internal Server Error”. So everything is still work in progress.

I joined the waitlist today and spun the wheel thrice. hit the jackpot, asked for my selfie, verified my PAN, confirmed my address and the card is issued. Applied just to check the process and the metal card and it worked for me.

Are there any othe card company doing the same no charges no annual fee and no income proof with no fixed deposit please let me know cause it helps students and I’m a student myself and it helps in building credit score. I don’t care if the rewards suck as a student it’s really tight to get a credit card.please let me know what are all the options

You can get cards based on FD

Bro building your credit score should start when you start earning, not when you’re just a student.

Credit card companies need some way of ensuring you are going to pay back if you make a purchase and not end up in default. If you’re using your parents’ income to pay it back, the card should be in their name, so that the company has legal access to your parents’ income.

(You don’t have legal access to your parents’ income)

Not true. You can use your parents income to repay your credit card bills provided they gift it to you and NOT loan it to you 😉

And building credit score should start at 18 years of age or even before that; don’t delay it.

To get one credit card you need to have at least one credit card with good relationship in terms of repayments & card utilization. Since this card is targeted based on credit score from both Experian & Cibil. Only option for students to get credit card is through FD, build a proper credit history, this will be the first step in applying for other cards as well as one card.

What account name of this credit card in civil/experian report?

Iam unable to add my current address to one card application to apply credit card once can you say me how to apply for it

Got Onecard unlocked today. Also, spoke to one of their customer care executives and he responded to all my queries at length. I was given to understand that FPL has issued only 6-7k cards so far and would issue 10k cards through waitlist 2.0 and some additional ones to those who would unlock all 4 elements.

I also checked on visa signature privileges (as I believe there needs to be a reason for Onecard to be on visa signature and not lower variants) and interestingly I was told that all visa sign privileges like BMS offer, lounge accesses etc. would be added soon.

I personally feel, this is a good card to hold for the following reasons –

1. Metal form factor

2. Low FCX markup of 1%

3. No joining or annual fee

4. Visa signature privileges (BMS, lounges etc. which we will know in a month or two)

5. Visa’s global acceptance (makes sense to folks who hold Diners variants & Amex which sometimes have acceptability issues) so good to keep it as an additional card

You may choose to give Onecard a miss if rewards/spend based return is something you are looking for.

Well my journey to one card started with the one credit report app download, it took almost a month to get the card has the app was updated & later getting the spins to move up the wait list. I was asked to verify my PAN card, for card approval & for higher limits to upload 6 months bank statement. Meanwhile my card was approved for Rs 1 lac limit, which was adequate as I have 14 credit cards from various bank with 6 digit credit limit.

Coming back to one credit card, once card is approved one card app needs to be downloaded with login credentials a virtual card will be active for online shopping transaction. The transactions are fast and seamless as transaction details are mentioned to check discrepancy in case of undisputed transaction.

There are around 15 categories based on top priority from dining, shopping online, utility payments and so on. Reward points are also credited immediately after the transaction. Overall a very instinctive experience. Most of the features such as card on/off, international transaction, NFC transaction an be disabled in one go through the app. For international shopping forex markup is 1% which is lowest in market when compared to ultra premium cards apart from axis burgundy private client cards. Well exclusive offers will be rolled as mentioned in app since its in Beta phase.

FPL tech has received $10 million dollar funding in month of august 2020. Since fintech will create a unique proposition in market with available resources & bring spend based analytics in creating unique experience to credit card holders.

Hoping this One card will revolutionize other budget credit cards with its LTF card fees, attractive interest charges in market & a wide scope for a premium laser etched metal card.

They are not sending me the invite even after having excellent CIBIL & Experian scores, having IDFC account with high balance & also at the much higher position in the waitlist…

People who are like at 100k-112k are getting the cards issued to them instantly but I’m not even getting the invite & I am waiting since March & also was on their waitlist 1.0…I have 10 years of excellent Credit history & 8 active credit cards & all my cards have 6 digits credit limits too…I referred few people & they all got the cards but I did not…

When I asked them why I am not getting any invite, they replied to me, “It’s RANDOM”…LOL…That means it doesn’t matter if you are at the bottom of the waitlist or at the top, they will issue cards randomly…

I sent them 3 emails & they didn’t even bother to reply to any of them…

Same.. lol… they said they have decided not to issue the card at this time. My referrals had the card unlocked and mailed already! So much for One Card!

I just got this card. Credit limit is 1,80,000 like yours. I have amex rewards card and platinum reserve card 95,000 and 75,000. I have one hdfc money back credit card worth 32,000. I am applying gold charge card next should I apply for Icici amazon card as well?

Hi, I’ve unlocked One Card from the onescore app but I’d put an incorrect e-mail id while registering for onescore app.Now, I’m not able to sign up on one card app. I’ve tried contacting One card at their mail id but I’m not getting a reply. I’ve tried calling them but I cant reach to their customer support executive.

Any way change my registered e-mail id or reach a customer support executive?

@Jimit, Their customer care sucks big time…I also emailed them several times, no response at all…Called their phone CC & got automatic voice & no human rep & calls get disconnected every-time…I don’t think I will get the card even after being fully eligible for it & being at a high position in the waitlist…

Give a feed back in play store for the app. They will help you.

Tweet @OneCardHelp. They will definitely help you. Good people.

Got the card. Easy onboarding.. Less paperwork and yeah!! its METAL.

Are there any credit/debit cards apart from Amex which offer metal cards?

How much time it will take to card approval.

I was there on their waitlist 1.0 and now at 2.0…I’m now at 12k+… People who joined using my refer code got the cards even though they were like after 100k in the waitlist 2.0…I’m at 12k and waiting since March and still nothing… Unlocked 3 elements, couldn’t unlock the metal one but I’m an existing IDFC customer with excellent CIBIL and Experian scores and also uploaded my IDFC statement in the app which has a high balance, Confirmed my PAN and Aadhar and these suckers still not sending me invite and people joining and instantly geeting the cards issued… I sent them email 3 times, no reply at all… I don’t know on what basis they are selecting whom to give the cards first…

They updated the app today and capped the max refer to 10 people only so I can’t even refer now to jump up the queue…

I don’t know the meaning of creating this fake waitlist where people who are at 100-115k are getting the cards instantly but I’m not, even being at 12k…

Well Sushrut , use the referral code of the people you referred to get the free spin & update your address details. This is one of the easiest way since you are just one step away from getting the metal card. I never uploaded my statement even though being IDFC customer for last 2 years. One card algorithm picks people based on lottery scheme, which is totally luck based. Try one of the above steps to get the card.

Dear Manjunath, Already used all the codes & I don’t have any more spin left…Among the last three people I referred, for one person I got only “2” & “3” spins & for the other two, I got the same GooglePay type message “Better Luck Next Time”…I don’t have any more spins left & I’m now totally sick-n-tired of waiting since march & still nothing…I don’t think they will give me the card even though I’m fully eligible for it…

I have already updated my PAN & address details on the vry first day of the app install & like mentioned before, also uploaded my IDFC statement…They have capped the max referral limit to 10 people in their new app update & I am no longer interested in spamming people with my Referral code because people who were at more than 100-120k got the cards but I still didn’t even receive the invite being at 12k & having excellent credit scores & having 8 other credit cards…

I just sent an email to FPL Tech’s CEO from my official email id keeping OneCard support emails in the email CC…Now I will see how they can not respond…

I don’t even know if I ever showed interest/joined the waitlist, still out of no where, got the approval, applied using the mobile number and OTP, that’s it. VCC generated instantly, Physical card got delivered within 4 days.

This is like a weird lo*tery where you didn’t even participate & still getting a message saying you won the lottery lol…

I joined the queue last week & was instantly approved. Got the card delivered. It has got stunning looks. Considering its free, its worth to add this to wallet. Onboarding process was seamless, Just confirmed PAN, uploaded bank statement & confirmed address. There was no cibil/experian enquiry on account. Overall great onboarding experience & great looking card, very good app. But that’s about it, in terms of rewards this card is poor. But it can be kept bcoz of LTF.

The gamification part is just a gimmick & don’t fall for it, they will approve you on backend manually then only you can hit the jackpot on app. Confirmed this with cofounder of FPL tech(We are same college alumni). Try your luck connecting with him on social media, if you wan’t to expedite your approval for card.

Buddy how can I conact him as I don’t know his name ?? Could you Please give me his name or his social media profile or even his email so that I can contact him ?? I promise I won’t mention to him that from whom I got his contact details…

I sent emails to both their onecard support email & the FPLetch support email multiple times but never got any response from them…

Any help would be highly appreciated…I am waiting since March…I’m at 12k in the waitlist, Confirmed my PAN & address & also uploaded my IDFC statement in the app…Have excellent Experian & CIBIL with 10 years of credit history without a single default…But people who are at the bottom of the waitlist arr getting the cards & not me…I live in tier 1 city Kolkata so my location can’t be an excuse for them too…

Even I was 10119 on 5th march. Also received sms for kyc doc pick up. Then it was like aap katar mein hain even after regular interaction with their customer care. They have run hard CIBIL enquiry twice for me. Now the score on their app is not getting.refreshed and they don’t seem to care. It seems all these hype was created to impress upon venture capitalists to secure funding and now they have slowed down

People whom I referred all got the cards even without collecting any damn elements & being in like 100k-120k+ but they are not sending me invite…I am also waiting since March & fully eligible for the card…

Most card companies do this…They will give cards to people who are not much interested & not to those who are really eager to get them…

I sent them emails multiple times & still no response…

I wish IDFC directly launched this card & not through a crap unknown company whom nobody ever heard before…

Im using OneScore app since 2 months, applied for the card when I got the chance on 1st September 2020.

Was at 95k+ rank, did basic 3 spins, went on to 75k. Didn’t bat an eye after that.

To my surprise, 3 days ago I got a mail that it’s been approved!

I honestly find the waitlist a gimmick to create hype and I don’t even bank with IDFC.

In my opinion the reason Ive got approval so quickly is:

1. 800+ credit score (With NO negatives ever)

2. Super Premium card in my credit report(Amex Plat)

3. Luck 😛

Just continue maintaining a super healthy credit report, I’m sure they’ve got their bots monitoring the same.

All the best 🙂

I think you should put the LUCK at the no.1 position…It’s a damn lottery & they are issuing cards to whomever they want to & not based on their eligibility criteria…

I have 848 Experian & Over 800+ CIBIL with no negatives & no defaults ever too & I’m using cards since last 10 years & have 8 cards from all top banks of India…

I’m at 12k since last like 1 month & people getting cards just after 2-3 spins who were at like 120k+…

I don’t have any luck so maybe they won’t give me the card…This company doesn’t even bother to reply to their emails…

Have you checked the app recently? Was in a similar position and the randomly checked the app last week and it said your OneCard has been approved. Limit is low but I guess I’m interested in checking out a metal card.

I am checking the app daily since last 2 months just to see you don’t have any spins left & you are on the waitlist…

I hope I get the card before the vaccine for Covid comes lol…Waiting since March…

Love the low forex markup on this, useful for small purchases for me. This can act as a ~0% fee forex card, since you can get 1% back on top 2 categories (5x accelerated rewards; including the ‘Others’ category). Only need to pay the GST component of the forex fee, which amounts to 0.18%. And since the points can be redeemed directly for statement credit, this is pretty great for a no-fee card. For the right person, it’s easily the best card for foreign currency spends and accessible to people who cannot meet the requirements for premium cards or don’t want to pay a heavy annual fee for credit cards with low forex markup.

Pro-tips for people who are having a tough time meeting the 3 categories:

1. Loading bigbasket/Supr Daily/grocery store app wallets (even as low as 10 INR) would be considered as a grocery spend and not a wallet load, giving you the ‘Groceries’ category.

2. Recharging prepaid mobile (even a 10 INR topup) is considered as a bill payment, giving you the ‘Bills and Utilities’ category. You can do other bill payments or part of bill payments as well, like DTH/postpaid/internet, etc. Just make sure you pay DIRECTLY and not load it into a wallet and pay via that wallet. Wallet loads are counted as ‘Transfer’ and are not eligible for any category or points.

3. I loaded 100 INR into Freecharge wallet, but it was calculated as ‘Bills and Utilities’ instead of ‘Transfer’ and I am getting reward points for it. I believe this won’t last long, though. Try it and check what you get.

4. Transferring money via PayPal to someone in another country is considered as an ‘Other’ category spend, and is eligible for category computation and points for the 5x accelerated rewards. If you are using this, make sure that PayPal charges you in the base currency of the receipient and not in INR as they have a high forex markup. Let your OneCard do the conversion as it charges only 1% and gives 0.2-1% cashback.

Even if you are unable to reach 3 categories, this card is still pretty good with the base reward rate of 0.2%. You would effectively pay only 0.98% inclusive of GST (1% + 0.18% GST – 0.2% rewards), which is still very good for a no-fee credit card in India.

Plus it is made of metal, it’s pretty heavy, and great to flex. 😛

I have had many cards. This is the first card which got issued seamlessly. No documents , blah blah. Joined waitlist. Activated within 10days. No fuss. Millenials will love the simple process.

It’s a lottery & you should buy a lo*tery right now because your luck seems to be amazing…I’m waiting since march & still nothing…Have excellent credit scores, referred many people, have IDFC account, living in a Tier-1 city, have 8 other cards from all top banks of India & still nothing…

Just got it limit only 1L

How to generate pin for virtual card

I did not get into any waitlist. I was registered on the onescore app and suddenly, one fine day, I received a pre-approved card offer.

I sent an email with some queries to One Card team but haven’t received any reply in two weeks even after reminders.

I have following questions for people here who have similar experience getting the card.

1. Will there be a hard credit enquiry if I apply for the pre-approved OneCard credit card?

2. What all documents are required for the application?

3. Is there a physical verification step in the application process? (Considering Covid-19)

I read through different application scenarios in the previous comments. The process seems to vary across users. I would like to get answers for the above questions from someone who has received the card same way as described above.

no hard cibil enquiry or any physical verification. Just apply and verify with aadhaar otp and one selfie is required plus bank will be verified using your upi id and Re.1 will be deposited to bank by upi id given. Thats all virtual card will be generated. I got 30K limit. Juat todat 18 september, my cibil was 775 , experian score was 843. No hard enquiry was done.

Tried 2-3 months back , did their gimmick of spin. Got mail on Sunday. Updated my selfie . They pick address from cibil. Voila

Card got delivered on Tuesday morning by bluedart.

Now reading this thread.

Apart from metal form factor I find no visible benefit over my other cards.

Read somewhere in T&C that if I close this card before 6 months then I need to pay some charge in tune of thousands.

Thanks

Deepak

Got the Card yesterday, through limit is less 65k as my old card has 110k.

Reward is not upto mark, can’t even compare to Basic icici card.

Used 8000 on cred app but it is shown as transfer.

Except metal and zero fess, there is nothing in this card.

No document, No call, online boarding, zero intervance. at 15000 rank I unlock this card.

If you don’t do international transactions, there is no such extra benefits having this card…I have to do that a lot for my personal & business purpose and the 1% Foreign Currency Markup is very useful for me to save money…

Was waiting for the card since march….Was at 12k in their waitlist 2.0…An Existing IDFC customer, Have excellent Credit history of several years with 8 cards from all top banks of India…referred many people still they were neither sending me the invite nor they were responding to my emails..

Yesterday night I emailed FPL Tech’s CEO from my business email ID complaining against the same…And today one of their staffs called me himself & after just 10 minutes they activated the OneCard for me…I got 1.75L limit…

When I was sending emails from my gmail they were not responding & now when I sent their CEO an email from my Official ID with my associations with Microsoft, Google, ASUS, AMD & Amazon in the email signature, the very next day their support person calling me & I got message that I have unlocked my OneCard which clearly proves what someone here wrote before…The waitlist is TOTAL FAKE & they manually approve from their back-end…

I should have contacted him before instead of waiting for so many months lol…

I didnt face any waitlist. I applied on app, and the card came in less than a week of applying.

Hi bro , I got the card but all my transaction are declined can you please give the ceo’s email id , it will be really helpful.

Got the card today, came quick. Got this just because its metal card, pretty heavy

I was getting notification from last 3 weeks to apply for onecard. CL provided was of 1.8L. I ignored it. But when I checked today, I got the offer with CL of 8.5L. I applied immediately and activated the virtual card. I think I got the revised CL probably because I currently hold 8 cards and highest CL is 10L.

Hi Guru,

Which bank card you hold has such a high limit? Any tips on how to get credit limit enhancement?

Following

I GOT THE INVITATION, BUT I’M NOT BELONGS TO AMONG CITIES LIST

I registered last week on the OneScore app and was waitlisted at ~112,300.

Used the lucky spin few times in the app and I was now waitlisted at 26,738.

After 3 days I got notification that I can apply for card with CL 285K.

I applied got virtual card activated.

The card has been dispatched today.

I applied for this card only to get the feel of metal card.

Pros:

On-boarding is hassle free and is the best I guess. I hope that every other provider comes up with this

Cons:

Samsung Pay not supported yet.

Rewards is very less

Looks like the card comes at a cost, not in terms of money but privacy.

I noticed that after getting this card, I am getting almost 3-5 calls daily from multiple telemarketing entities like credit card, Loan, insurance

I got message from OneCard that I am eligible for card with 1.8L Credit limit and all new users getting bonus offer. In dilema to go for this card or not as i am using SCB Ultimate & Infinia for my spends.

“Joining Bonus Offer! Get 5,000 Reward Points if you activate your OneCard between 19-Sep-2020 to 30-Sep-2020.

* Once the card is activated, points will be credited by 15-Oct-20”

I have just installed the one score app on 19 sep for checking credit score.i know my credit score coz I have CIBIL subscription and I have just installed it just for the sake of checking out the app.i have checked only Experian score.i did not give consent to check CIBIL score.i got a mail on 25 SEP saying Congratulations Venkata Narayana Reddy,It’s time to celebrate!

We’re thrilled to share that you’re among the selected few to receive OneCard. To get it, download the app from the Play Store.I did not join waitlist.i have just got my Amazon pay icici card a week back so I wanted to wait for six months before applying for any other card.and I didn’t want two hard enquiries in quick succession.its like waitlist doesn’t matter and they are approving manually as they like.I got the invite without joining waitlist and without applying for it

I have just installed the one score app on 19 sep for checking credit score.i know my credit score coz I have CIBIL subscription and I have just installed it just for the sake of checking out the app.i have checked only Experian score.i did not give consent to check CIBIL score.i got a mail on 25 SEP saying Congratulations Venkata Narayana Reddy,It’s time to celebrate!

We’re thrilled to share that you’re among the selected few to receive OneCard. To get it, download the app from the Play Store.I did not join waitlist.i have just got my Amazon pay icici card a week back so I wanted to wait for six months before applying for any other card.and I didn’t want two hard enquiries in quick succession.its like waitlist doesn’t matter and they are approving manually as they like.I got the invite without joining waitlist and without applying for it.

@Sidharth .will there be a hard enquiry in my credit report if I activate the one card now.i am asking this coz as its pre approved card what’s the need for hard enquiry

@Doc Venkat

I had a similar experience like yours. Installed the app one day and a few days later got the offer for the card. I did take the bet though and to my surprise there was no enquiry made on my CIBIL/Experian. Also no documents were needed.

I noticed one thing, the card’s pre-approved limit fluctuates according to your CIBIL or Experian score that’s reflecting in the OneScore app. This is even when we have not even touched the invite for activating the card.

I am no expert but it seems to me that they are providing the cards to few individuals based on the track record of credit score which is fetched monthly for us on the app as we use it to monitor the credit score (via soft enquiry). I know it’s not the best of sentence phrasing but really I can’t explain it in another way.

So yeah that’s my take on the card activation and invite acceptance.

When did you get the card delivered. Did you check your CIBIL report after getting the card?

@Venkat

I got it like 2weeks back and checked my cibil report in details twice after that out of curiosity lol. But nope no hard enquiries till date. I have also used the card for few transactions and seems it is really all in all a pre-approved card for a select few customers. I would say if you want to give it a try go ahead. Grab it while the invite lasts.

@ Anirban Majumdar

Can you elaborate the steps in application process. Did it ask for any documentary support for address proof. Did you get the option to enter your current address or did it take the address from your aadhaar card as communication address.The reason I ask is am from ANdhra pradesh and I live in Pune. My hometown is not serviceable.

@Doc Venkat

No proofs was needed for the application. No documents no paper work nothing. The app displayed the available addresses on my cibil report and asked me to choose from them. In short, if you have a credit card at your current address and have held it for more than three months, your current address should be reflecting in the application for you to select. The virtual card will be activated then and there. The physical card will be sent via courier to your selected address within 4-5 working days. You can track it on the app itself.

are you sure they send the physical card within 4-5 days ?

i have applied, clicked selfie and got virtual card activated

yet it says to fill a google form and someone will come to physically verify

can you clarify ??

Looks like a good card. Getting 2% rewards for all spends except wallet load. Got 1.8L limit which is lower as compare to my other cards. But that’s okay.

Axis Flipkart card gives 1.5% & 5% on Flipkart

Amazon Pay card gives 1% % 5% on Amazon Prime

Paytm First card gives 1%

Hence this card looks good to me.

Siddarth, this is one the Best reviewed based on which i have applied the card and got it. The experience of applying and getting to use the card in less than 5 min it is amazing. Applied and got the Visa Virtual card with limit of Rs 90k and used it on wallet and worked like charm. Thanks for this post, and all the users for their feedback/comments.

Step 1 > Download One Score app from Android store > input your name as per PAN and it fetches the information from CIBIL and Experian Credit score > I guess bases on your credit score it recommend you to go for

One Metal Card and ask you to download second app ‘OneCard’

Step 2 > Open OneCard app > input basic information and add a selfie and you are done, it instantly gives you the credit limit, and online version virtual card is available to use immediately.

Only suggestion if i can ask from all readers here, if we can write to ‘one bank’ lender to make re-issue of Metal Card charges to lower from Rs 5k to something reasonable like Rs 500/Rs 1000 or whatever actual metal card cost, don’t think definitely cost Rs 5k.

I would recommend this card to all who are looking for free for life card.

This card really s*cks, their system behaves weird, paying utility bills at PayTM shows as transfers, ideally it should be categorized as Utilities, when questioned they have no clue, customer support has no idea what they are doing and no resolution, very pathetic service offered. Even rewards earned are of no use, you cant redeem then for nothing and no clue on reward rate also. If you just want piece of metal, then you can hold this card. If not it takes minimum 2 years for them to stabilize the system and go to full pledged market.

Reward can be redeemed for statement credit

Normal reward rate is 0.2%

Accelerated reward is 1% on top two spends type

Reward rate is not that good as compared to other cards

The metal card is just an gimmick

Their onboarding process was good and an example for rest of credit card issuers

Their swipe to pay is good only need to swipe on app to pay no need to wait for OTP

I am not sure but thats against the RBI guideline but that’s was for debit were burden lies on account holders

Since in credit card burden lies on card issuer they can use swipe to pay

Burden for stopping fraudulent transactions lies on credit card issuer

Use Mobikwik or Amazon pay platform to pay utility bills (broadband). Use HSBC Platinum card for Rs 50 discount on utility bills of value above Rs 500, if paid on amazon platform, applicable for add on card as separate card. Similarly Amex Smart earn credit card gives 5X points (max 200 points/month/card) for utility payments transacted over Amazon. Since these cards post transaction as utilities on above mentioned platforms. Mobikwik platform provides cashback of 1% for credit card bills paid on there platform, since Cred has become useless in rewards redemption. This super cash (cashback) in Mobikwik can be used to pay utility bills or can be converted to cash. Every card company categorizes utilities transactions differently.

I got one card with limit of 9.3lacs. I don’t know what are benefits of this card. Should I use it even as looks like it have no attractive benefits.

Only benefit I feel is the app experience. It has best app among all CC till now. Maybe Paytm Could beat it in this section. Other than that its nothing special.

I got my card without any document submission. as this one is my first credit card

They are asking for income proof. Generally, I have seen people settle for salary slips (I work for a MNC). But these guys are asking directly for netbanking login or a bank statement for the last 6 months. I felt like this is too much to ask. Has everyone here who got the card submitted this?

Yes that is normal and even a few big banks & Paisabazaar etc also ask for that…I logged onto my IDFC netbanking in their app & let the app to get the details…It sometimes helps in geting a higher CC limit…I got the card with 1.75L limit so logging into netbaning didn’t get me a high limit compared to what I have in my IDFC savings account but i got the card anyways…

It’s safe but If you want just peace of mind, login to the netbanking & let the app to get your statement & then simply change your netbanking password…As simple as that… And I have also did that even though I knew it was not necessary… 🙂

Dear Sir,

My card has been activated since September month, but ATM withdrawal and POS services are not activated yet.

Please activate the given services as soon as possible.

You have to contact onecard support for that.this website does not provide any card services.this is just an card review website

Tweet @OneCardHelp. Your issues will be solved.

Hi,

What is this card visible in credit score ?

For me in experian, it’s visible as consumer loan from IDFC.

In Cibil scrore, there was 2 entry from IDFC. one is personal loan and another one is business loan.

All those entries from June month, when I applied and receive the card on August last week.

Use app to activate card and enable those

You need to enable via app.

Various options are available when you click on card details.

Now, Onecard can be applied for without joining waitlist. It’s direct now as per their new update.

Hi Sid,

Today I got notification to increase the limit from a profile section of the app. MY limit upgraded from 1.8Lac to 4.7Lac.

Hi Mahendra,

How frequently did you use the card? And how big were your spends, I’m just asking to see if it would be possible for me to hit those spends to get the limit enhancement offer.

Cheers.

Hi AG,

I use this card rarely. I got limit enhancement afteer using the card for international transactions couple of times.

Received Limit Enhancement offer. 66% increment after just 3 statement generation. Accepted.

Hi MrNightStar, we’re offering you an increase in your OneCard credit limit this festive season. Check the offer in your app to accept it. This is a limited period offer, so hurry!

LE claim period offered was 1Nov- 30 Nov.

Wait…… What?! Your official name in Aadhar and PAN card is Night Star?! Beta Night Star!

“Hi MrNightStar, we’re offering you an increase in your OneCard credit limit…” Really now…..

haha, no, it’s Tarun. my actual name in quite recognizable by search engines.

next time use XXX?

I applied today and the card was approved instantly without need of any physical documents. Only AADHAAR OTP was asked and I got magical credit limit of Rs. 5 lakhs . I couldn’t believe my eyes and so in order to verify I did online transaction immediately. It went through smoothly. This was my 4th credit card application in the last 2 months. I was wondering whether it will be approved or not but it was approved surprisingly. The limit is mind blowing. I love One Card even though it lacks in rewards points. It’s application process is revolutionary.

My OneCard was issued today with a limit of ₹ 6.85 lakhs. I am just thinking of where to use it as the reward rate is very low. I use MRCC for 1.50 lakhs so as to get the fee waived. Thereafter HDFC Regalia or ICICI Amazon Pay. I use Smart Earn for Flipkart and Uber spends. So not much scope left for OneCard. I don’t think it will have lounge access as the card is LFT. I would be surprised if it does.

That’s really high lmt. Congrats

I would give the card 2* out of 5. The reward rate is low, and the pathetic reward redemption makes it practically useless. You can only redeem points on a specific transaction, only if your points balance can FULLY cover the transaction. So if your transactions are 1000 rs and above, and you have 8000 points, the points are useless. The result is that you will always have leftover points.

The only saving grace (which prevented a 1* rating) is the cool looks, great app, and complete transparency in points reward and redemption. Every other card issuer can learn a lot from them. But without the core offering, this card will get 0% of my spends vs SBI Elite, Axis Vistara infinite, DCB, Amex plat travel, Amex MRCC, and Citi premier miles.

Do this:

Add money on freecharge and payoff that transaction using points. Ik, it’s not same, but it’s what it’s.

Their USP gonna be metal and easy approval, people who will take them may either not use it at all or will don’t care about rewards. People use debit cards afterall. xD

I have been approved Axis Bank Ace Card today. So all offline shopping I can do with this card and get 2 % cash back. My online shopping is done using ICICI Amazon pay, HDFC Regalia or Amex cards, whichever is most beneficial in terms of reward. So cant really make out where to use OneCard.

If you don’t do international transactions, this card won’t be any different for you…I got this card just for my international transactions because no other Credit card in India comes with just 1% Forex Currency Markup…

One card will soon have “apply for higher limit” option.

Actually the option is live already and I have used it to increase my limit fron 1.5L to 2.5L.

But one card seriously needs to revamp it’s reward structure, if not it will struggle to attract customers in the competitive market. Great app and application process will get one card Into a customers pocket but only rewards or offers will make customers to remove from the pocket and use it.

Cheers!

After how many months you got LE.

My card was approved immediately. No waiting list.

Correct. There are only some other credit cards which have 0% Foreign currency markup and even a few debit cards with 0% or 1 % markup but no other credit card with 1% markup. Also, you do have a few credit cards with 2% markup whose effective reward rate reduces the markup to nil or even gives you better rewards but then again no other card to charge you 1% out of your pocket 🙂

Signed up on OneScore app and can see OneCard approved with 180k limit.

I don’t intend to take this up. I’ll wait and see if they bump up the limit or offer any joining bonus. If they do, I’ll apply, else I’ll let this pass.

I have noticed maximum limit is 180k.

Even I have 180k. Not seen more than this

I was offered a limit of 10 lacs at the time of signing up itself currently it’s 10.5 lacs

Using the card majority for online transaction.

Keeping the card at home mostly while traveling far.

If lost, reissuance of metal will be 5k and for plastic it’s 150

Hi,

I applied today, got approved instantly and got a limit of 5L. Let’s see how it works out.

Mannant congrats. Could you tell us what was CIBIL score and how much credit limit you have in your highest card ?

Had a very bad experience with this card. Please note that if any transaction gets reversed or refunded they don’t consider it as payment. This means they won’t consider this refunded money and will ask you to pay that statement fully and the refunded money will be credited in next month statement. And because of these things got charged with late payment and interest charges. Sent several mails to customer care and now copied it to escalation team. Hoping to close this card soon.

I may be wrong but this is common practice by most of

the banks.

I don’t think it’s something different than what other card companies do. The refunded amount generally gets billed in next statement only. Also, if there is an issue with the amount, you need to first raise a dispute.

Did you raise a dispute, only then you aren’t liable to pay for it.

That’s true for all banks/cards. Refunded amount (Cr.) is not considered as payment and is reflected in your next statement as adjusted towards your purchases (Dr.) – It’s given in their TnC as well.

OneCard is pathetic when it comes to refunds. Firstly they delay crediting refund towards card. Secondly they do not count it as repayment. Even if many banks follow that, still being newbie they could have relaxed on that part.

Also for me they did goofup of adding refund as debit entry & their silly customer support sounds very arrogant.

With ridiculous rewards rate this card is good only for eating bhel !!!

Did you spoke to customer care?

I wanted to change the billing cycle so I tried calling them but the call never got connected.

Later from somewhere I got to know that OneCard has same billing Date for every customer. 1st of every month.

Are you all has billing date as 1st?

I have applied card 20 days back , still it is not unlocked.

Christmas offer. Guaranteed 75 pts for 100spend. 10 times per day. Effectively 7.5% return. Will check it out on freecharge xD

On similar note, can anyone suggest me card for wallet spending?

Except BOB Select/Eterna and AMEX MRCC.

7.5 % is possible when you are able to redeem the rewards but I am not sure on what sort of transactions we can redeem the rewards. Can you let me know?

I thought to load up freecharge wallet and redeem it on that transaction. But i don’t know why i didn’t or couldn’t do that. I redeemed it against DMRC card load transaction.

Anyway, i hit 5,000 load limit of freecharge, and have got 8600 pts in xmas offer, effectively worth 860, now just got to figure how to spend xD

They closed freecharge load loophole. Now instead of it being counted as “Bills and Utilities” it is correctly labeled as “Transfers” as on 25.12.20.

Any wallet load card suggestions guys?

I saw this post 3 days back. Installed the app and followed steps mentioned and the card was issued right away. Took me 10mins for the whole procedure. Metal card was delivered yesterday. This kind of promptness is something totally new for me in India.

Hi Vignesh,

Yes. Everything is Excellent about this card starting from onboarding to customer care. However main drawback about this card is reward rate. Its like they are providing proche car without engine.

Yss Really Right I m using this card 2 month July & august But I watch Reward Rate Very Low 10 Points = 1 rs Then i transfer my Usage Back to my Regalia….

What’s proche?

It is Porsche I think

Weekend offer for 9th and 10th Jan. Spend 5000 or more in any category and get 5000 BP. Effectively 10% return.

Bought amazon voucher through gyftr. Counted as ‘Shopping’.

Fulfillment is 25th Jan.

I have got a lifetime free upgrade to Infinia and I am cancelling all the cards I have except Amex MRCC and smart earn and AXIS Bank Ace. With Infinia I have achieved the ultimate and I have no intention of applying for any card in future.

I’d recommend to keep one card on each network – Visa, MC & AmEx to escape the rather unpleasant surprise in case their payment network crashes. Has happened twice in 2 years with me already.

I’d recommend to keep one card on each network – Visa, MC & AmEx to escape the rather unpleasant surprise in case their payment network crashes. Has happened twice in 2 years with me already.

How to redeem the points can any one explain?

I am Using This Card From 6 Month But This Card Account Not Show In My CIBIL Report. i tweet to Onecard Team he say ” we are working on this and it shall reflect in your CIBIL Report as Soon as Possible.”

Easy onboarding process. Nothing exciting about this card, except the 1% foreign currency markup fees which is lowest amongs all Indian credit cards. So good for people who spend abroad frequently. App is easy to use.

I had issue with onecard from past 8 days. Am continuously dropping message in chat but no proper response and they are not responding simply they are closing my tickets. My issue: In jan my bill is 110694 and in that i got a refund of 189 rupees so i paid remaining110505 on time . So keeping this 189 as reason they charged 4010 as interest for 189 balance which i got refund. This is the worst I have ever seen. I need proper explanation for this issue as soon as possible. I don’t want to use your services anymore. I have different bank cards but no one is charging in this way. Am ready to pay whichever i have used but this is not acceptable. If my mistake is there I am ready to pay the amount but this is not at all good.

Raised ticket number for the same issue for 8 days are 107957,109181,113599 without any future information and notice simply closing tickets.

It’s with all credit cards. Did you even read the credit card’s Terms and Conditions? I think not!

Same Issue with me, And there is no explanation from Onecard compained to RBI Today.

I participated in OneCard Sweet Fest and I am happy to announce that I won a total of 1,61,466 rewards points worth Rs. 16,146.

Sweet!

And how much did you spend to earn these RPs?

I got a spend based offer ‘Spend at least 1000 on your onecard from 15th april to 30th april and get assured 5000 bonus reward points’

That’s an astonishing 50% return considering 10 points = 1 Rupee

How to get this reward redeemed from app. They are denying the rewards to be redeemed.

I have applied for the card but its not confirmed because of my address issue, I’m not in the particular address that the card is available. can i apply it again after 6 months ?? or I couldn’t able to?

Don’t take one card…. If you get any issue no one will respond.. customer care support is worst I called many time but no use. I sent mails two to three times they are not responding. They are giving such a worst service.

As of May 2022… they are VERY responsive.

Sent them a mail yesterday (May 2) morning and received a reply tdoay (May 3) noon. What more can you expect from a free card? 2 hours response??

About Rs. 5 lakhs.

They reserved onecard .

What does it means?

I have 10000 reward points but they are not allowing me to redeem the same. I don’t know what to say. Where to contact. They say to redeem you need to earn more points.

You can pay off any other Transaction using points.

So if you have 10k points , you can redeem it on any 1000₹ Transaction (10k =₹1k).

So just do any 1000₹ and redeem on it after 2 days as instant cashback repayment to your statement

Hi,

Any info on the OneCard Lite. Apparantly you have to open an FD and the credit limit is then 110% of the FD amount. 🙂 Why will one block money to get a credit card? Seems an exercise in futility for no worthy rewards in sight. Will give OneCard a total miss.

This is for people having a bad credit score. Almost all banks provide CC on lien basis. Don’t see anything wrong here.

Date – 17-7-2021

The company is manipulating through the advertisement.

One Member – Metal Card.

One lite – Plastic Card. (FD Option)

Be aware of this fraud.

Does this card get updated in CIBIL?

Yes! Every month

I applied it six months back and forgot as i thought that it won’t be delivered. 2 days back i recieved it. It looks beautiful. I am planning to spend on two categories only so as to maximise returns. As i have other cards also which i can spend on other categories. Got limit of 105000. They never even called to verify details that i filled. So smooth process for issuing card but too slow.

Got it. Limit of 6 lac odd. Use it mostly for purchases abroad online because of the low mark-up fee. So far so good. Happy with the interface. But they don’t email the statement – which is a bit weird, so Cred doesn’t pick it up.

Is there any difference whether card is based on IDFC, Federal or SBM bank. Since it says co-branded card on idfc website wanted it on IDFC platform, but when applying via app it takes on SBM alone no other option to change it to IDFC.

Sada how does it matter if its co-branded with IDFC or SBM India?

Benefits are all the same Bro.

Hello, this is SuhasB I’m using OneCard credit card from past 8months and now they r charging intrest without any reason if I compliment also they are not responding properly and the customer team Mr.Vivek also not giving any details about if I tel to give a cal to superviser to solve this problem they are not responding this ONECARD is worst in and the customer care officers r not good and not responding properly. And OneCard team plz refund my money back .

They are now accepting new card applications. My wife’s just got approved against an FD amount (as she has no credit history).

My Experian score is currently 840 and 763 on CIBIL. It still prompts me to open an FD. I found it weird.

They provide CIBIL, Salary slip or ITR option for some selected cities only. I also have a good CIBIL score but not able to avail this option due to non-serviceable PIN code. Only FD option is showing. This is quite disappointing and there is no option to change the PIN code once you have registered.

Why dont you make an FD ? They give 6% Interest with SBM India – much higher than ICICI Bank’s 3% (Regular) or 3.5% (Senior Ciizen) that I was offered in April 2022 via their Website / Imobile app.

Just in day I got v card limit of 10lacks like my Infinia it’s wonderful of approval process just 30 minutes it’s completed

Superb process.

I tried aplying , they have downloaded my experian report , but somehow my application doesnt move ahead

Tried mailing them , they replied we will look into this a week back

I got the card approved in 2 days flat. Not sure how and why but so far so good. Applied on 1st Feb and on 2nd Feb the executive took my kyc docs from my residence. Today on 4th Feb i got a call from their customer care asking me to click a selfie for them over a video call and then it got approved with a 2.10 lac limit instantly.

I refferred 5 people successfully during offer period but received 1 Amazon voucher and 4 refferal reward points.

Afte complaints the credited the refferal but still 4 Amazon vouchers ate not shared. Their customer support is pathetic and they are asking me to share whatsapp screenshots.

Not much benefit holding the card and incase of any real issues customer will be screwed.

OneCard customer care is quite poor. I would say worst amongst the private players.

I hold OneCard (issued with IDFC as a banking partner) from their initial phase.

Few days back, got SMS to upgrade to new metal card. Upon checking, learnt that it is change of banking partner as they are exiting their partnership with IDFC.

But when asked if this change of card issuing partner from IDFC to new (BOB / Federal etc) will entail any CIBIL enquiry (ideally shouldn’t be), they are giving contradictory information. Customer Care over call say, no change. Customer Care over email says, yes new enquiry.

Hence really lost.

A very good spend based offer on One card is running valid till 31st March. Spend minimum 5000 on any Insurance and get flat 5000 points worth Rs. 500. Simple get upto 10% value back. Very useful since many have their policy payments in March.

Big offers on Swiggy, Grofers, Yatra. Could a review be posted again please?

Hi all,

Now onecard chaged it’s banking partner to federal Bank. It seems it’s mandatory to apply new card again. Of course it’s free metal card again. Now they introduced new features

1. Autopay

2. Gpay enabled

3. Subscription hub(not sure what it is)

4. 5000 reward points

Does OneCard mention which banking partner (they seemed to have tied up with Bob Financial, Federal and SBM) it will change to when it gives the notification?

I have not recieved any messages for change of card. Will my current one continue to work?

Once you opt for new card, it will ask to do KYC and post that at final page before last acceptance it will show you the banking partner name at bottom.

I got BoB, some got Federal etc.

Hi sir,

They are changing IDFC first banking partner to Federal Bank.

Mine is IDFC first bank partner.

OneCard is with SBM India as of May 2022.

I sent an email and got the following reply from 0ne Card customer care

“We wish to inform you that as per the migration offer, a new card will be setup and initiated. Please note that there won’t be any hard enquiry on your credit report and also this will not impact your score. In case you see that there is a hard enquiry on the account, request you to share the screenshot of the same so that we can get it rectified.

We appreciate your understanding and will wait for your response.”

I have a query, are cred cashback rewards getting added to onecard. I dont see them credited yet whereas in cred app it shows as already credited.

Now cred cashback is crediting to Cred account itself instead of card account.

Did anyone get the new onecard.Today I got a notification saying I get 50000 more limit on my new card.What about enquiry in credit report and account opening date of new card

I applied for upgrade last week. Approved and got the new card details in system after 30 mins but no update yet on dispatch of the new card.

Did you check your cibil or any report from other beareu after upgrading to new card

Not yet – will do it after 1 billing cycle.

I got the card exactly 32 days after completing the KYC.One of the worst experiences I faced with a credit card customer care team.Till the day I got the card the status in the app was showing as KYC pickup pending although KYC pickup was done the next day I completed my KYC online.

Hi Venkat,

I checked my latest Credit Score report, this was after generation of credit card bill on the new OneCard (upgraded one, change of banking partner).

Still don’t see the new card account details reflected in Credit Report. Further as expected there was no additional credit enquiry

The customer support is extremely poor. No call center. We need to contact either through email or twitter. No quick response. After i upgraded my card from idfc to federal, i got oneliner statement. Balance transfer from idfc instead of itemized bill. I contacted via email , Twitter. I even raised dispute transaction also. No fruitful reply from them. Finally i found it in app itself. Imagine if it is serious issue and the way response is very bad.

Hi Mahendra, OneCard does have a call centre – 1860-266-1111

Me and one of my friend has not received the statement for the last month. Has anyone faced same issue?

I am a one card user and I am here to share my experience. Please do no go for this card. They are a bogus company with ZERO (Zero, Zero, Zero) customer care. They do not have any management. They do not reply to any emails, no calls back, LONG LONG waiting on calls which eventually gets disconnected. I am trying to raise a dispute against a transaction since 2 months and trust me I am unable to do so.

I am written emails to even their CEO, CFO etc but no, not even one reply from them.

They are a marketing company who has a target to add X number of cards.

They do not give anything about customer experience. Do not go with their fancy app. App is of no use where there is no one to resolve your query.

Side note: they have copied app’s most of UI from Cred.

i have a onecard lite, will i get the metal card in the future or not, without increasing fd to 50k?

No, you won’t get a metal card unless you add FD and make it 50,000

Don’t get into their referal marketing trap, they will refuse to give you rewards for reference later on.

Here’s what they told me on my referal:

Hi Aditya,

Greetings from OneCard!

In response to the preceding email under ticket id 1254577, we tried contacting you on your registered no. however we missed the opportunity to talk to you as there was no response from your end.

We want to let you know that your referral has entered an invalid referral code—not your genuine referral code.

Actual Referral Code – ****

Referral Code Punched by Harsha – ****

As a result, the application for your friend was not processed with your recommendation.

We regret having to let you know that we are unable to apply the referral bonuses to this reference.

We appreciate your patience and understanding in this matter.

Thanks & Regards

Muskan

Customer Experience Team

Team OneCard.

I also referred a friend and he successfully got the Card but i didn’t get any referral points. On checking was told that there was a referral holiday and my friend joined using my link in that referral holiday hence no points. No prior information was provided on this “referral holiday” and it was all communicated post facto

I recived one mail from one card that if u do not upgrade your existing one card then you will be given IDFC Wealth Credit card as a replacement by 3rd september. If this happens then its a win win situation for customers who has not updated their one card.

I have OneCard (IDFC) and have not changed to Federal Bank due to certain reason (Can’t enter OTP due to glitch). Today afternoon I received SMS for applying IDFC Wealth Card (I’m their banking customer too and earlier had inferior card pre approved). The limit of IDFC Wealth is same as OneCard.

So, what you are saying maybe true. Update your experience if IDFC Wealth is issued to you too.

If you r getting opportunity for IDFC Wealth card then go for it. It will be far better than one card. I have not received any message for applying wealth card and I also do not have any saving account with IDFC bank.

Received IDFC Wealth CC today through BlueDart. Also changed OneCard to BOB Issued card after that. OneCard details changed in app, card is being printed.

Wow! Two cards against one and hopefully no credit enquiry.