As you might have noticed, Kotak Mahindra bank recently launched Indigo co-branded credit cards that are similar to the HDFC Bank’s Indigo Ka-ching cards launched about almost ~2 years ago.

While that’s a good news, there is one more important thing which we will discuss later in the article. First, let’s have a quick look at the Kotak Ka-ching credit cards.

Table of Contents

Kotak Ka-ching cards

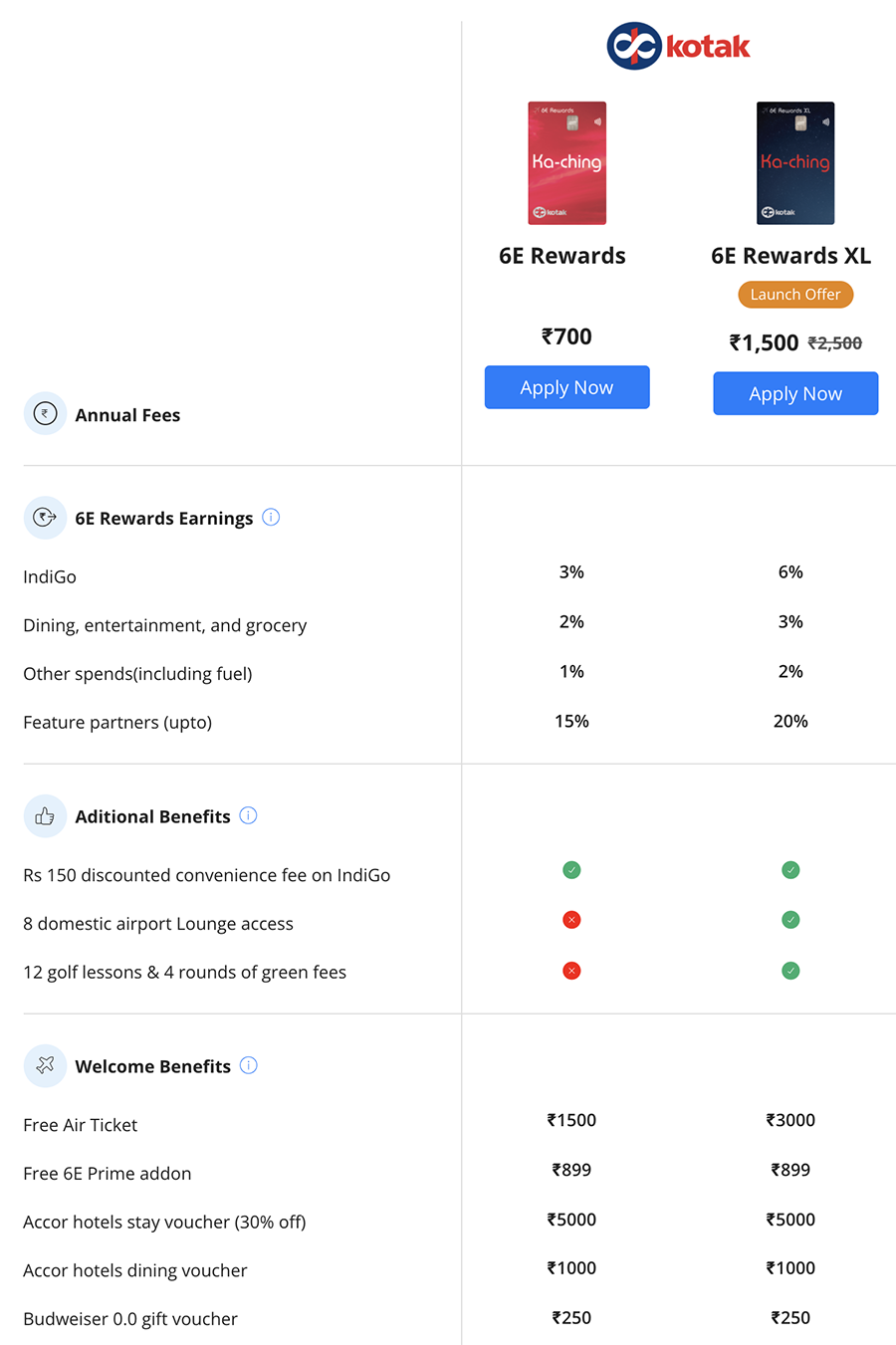

Just like with HDFC, here too there are two variants: 6E Rewards and 6E Rewards XL and they’re powered by visa.

Note that HDFC Ka-ching cards are on MasterCard and are not being issued as of now due to the mastercard ban.

Coming to the benefits, they are almost similar to what HDFC offers but I see that Kotak cards are slightly better in certain aspects, for ex: rewards on Indigo spends are bit more. Here’s the complete comparison of benefits between HDFC & Kotak Ka-ching cards.

Below are the benefits of Kotak cards,

Should you get it?

If you ever wanted to get a Ka-Ching card, you’ll have to take the Kotak card. This is not because HDFC variant is poor, but because there are so many other wonderful cards from HDFC to choose from.

Also fortunately there are not many Kotak credit cards worthy of holding.

That aside, currently the 6E Rewards XL variant is being issued at 1500 INR (launch offer), instead of 2500 INR and you’ll continue to get the welcome ticket valued at 3000 INR.

So now is perhaps the right time to experience the product, if you ever wanted to.

How to get it?

If you’ve a Kotak Ac, chances are you’re already pre-approved for this card. To my surprise, even my 1 week old Kotak Ac is pre-approved for the Ka-ching card.

If you don’t have the Kotak Ac, never mind, you can still get the card in open market by applying online.

Other Kotak cards

Now comes the important news to notice with this launch!

Here’s a quick look at one of the statement made during the ka-ching card launch, as seen on business standard:

“Unsecured credit is the centre of the plate business for us and the good thing today is the unsecured part of our balance sheet is relatively lighter, which gives us a huge headroom to grow as we try to build a balanced book for ourselves. So, it is fair to say, right now, we are extremely bullish on the unsecured credit space and the credit card segment. We are doing a number of things to strengthen our market position in both these businesses”, said Ambuj Chandna, President, Consumer Assets, Kotak Mahindra Bank.

I assume this means Kotak has finally woke up from a long sleep, just like how Axis woke up about ~4 yrs ago.

Surprisingly, Axis woke up with the launch of a co-brand airline card (Vistara) and Kotak too is in the same line, with Indigo.

It seems airlines have some magic wand with them that enlightens the bank’s credit card business. 😀

Final thoughts

Ka-ching credit cards are a great opportunity for Kotak to add more credit card customers and I think this would be relatively easy for them to sell given that these are the first kind of cards in their portfolio to give handsome rewards on regular spends.

Kotak-Indigo is a very good partnership in my opinion as the bank is neither into affluent segment, nor into entry-level banking. This I think fits perfectly well with Indigo’s customers.

And with that, I hope Kotak not only comes up with more premium and super premium cards to strengthen their portfolio but also refresh their existing cards, those with poor rewards – just like how HDFC refreshed their Millennia credit cards.

What’s your thoughts about the newly launched Kotak Ka-ching Credit cards? Feel free to share your thoughts in the comments below.

Sid, From the 2nd Year, for paying renewal fee every year – do we get any benefits?

Nope, only first year

While the online application didn’t yield any quick response, I called up customer care to upgrade one of my recent cards / Mojo with Indigo XL, process was fast, delivered in about a week. Mojo which I applied on their website almost took a month

So if you can’t take advantage of the airline booking 6% rewards which is unlikely for a while, this card (in essence all 6E) cards are effectively only offering 2% rewards for a fee of about 700-2500. Axis ace beats that by a mile, with far lesser fee and better additional rewards.

Also a standard economy indigo roundtrip booking of upto 10k will only get about 600 points, this is even lesser than the 1000 off we usually have available on several cards through MMT.

I fail to see any good benefits here. Something like a milestone reward system similar to Club Vistara cards could have been a great benefit.

Or something unique probably like a special checkin counter or meet n greet for 6E card holders.

What do you think?

Even the reward rate on Vistara card that gives economy tickets aren’t as good as the one giving Biz class tickets.

So it seems only this much they can do on reward rate for economy class, but yes, they could have added other benefits.

Vistara cards are a lot better than this, as there isn’t any cap on ticket booking. Typically an economy ticket costs 4k. So, 1500 joining/annual fee for 4k ticket is huge compared to 3k voucher here for 2500 rupees in indigo.

Also, 125000 spends give free ticket plus 1% CV points, so that is almost 4% reward rate on any spends (compared to 2/3% offered by indigo).

The only good part with indigo is it’s available easily on pretty much every route, while vistara mostly covers Delhi and Mumbai only. Maybe if they merge vistara and air india in future, it will become the best option.

True. Your words makes sense.

I applied for the card, got it yesterday and called cc today for cancelling it.

Somehow, doesn’t appeal to me – couldn’t figure out how to avail the 50% discount on Accor.

Too many conditions for the free flight voucher of 3k.

Amar, can you please share more info on the conditions for the free flight ticket voucher?

Its 3 transactions every calendar month for the first 3 months to be eligible for the voucher.

I received the card on 25th December – so I have effectively 6 days this month to make 3 transactions.

For Accor – I went to Accor website as mentioned in the welcome letter- there is no option of getting the discount. May be we will get it as cashback. No clue as to how to avail the Rs 1000 Accor F&B discount too.

Cc told me to do at least a transaction for 3 months

Thanks Amar, yes it is 3 transactions for first 3 months to get the voucher

Hi all,

HDFC 6E Rewards XL is one of the worst cards in the industry. Don’t go for it.

Whether annual fee of Rs 1500 applicable for 1st year or lifetime?

Dhruv this should be for each year when checked with cc.

Hi Siddharth,

After having a LTF Infinia and Axis Vistara, I don’t see a point of these cards. I would rather book my tickets on smartbuy than using this card. What are your thoughts, should I apply for this?

I was one of the top 15 kotak customers to get this indigo rewards xl credit card , still my account in indigo is not activated. I applied through indiog website, entered my kotak bank details and was pre-approved for this.

To get 3000 voucher , I need to do transactions for first three months every month.

Also, transaction points will be added after 90 days.i.e For transaction done in december , points would be credited by indigo in March. Meaning, you cannot use your card points to redeem/book indigo flights in the first 3 months of the card usage.

Thanks for sharing this info.

That’s poor. They need to fine tune these t&c then.

First, 3 purchases each in the first consecutive months is designed to not end-up giving customers the 3K voucher while pocketing the annual fee. This is by the way a first-year offer only. Like the reviewer have mentioned the other welcome offers are utterly cumbersome to claim with no clear instructions. Coming to the so-called 6E Reward, the 6E Rewards Dashboard for the Kotak Ka-ching card was not up & running till 17-Jan-2022. While offering this card to customers neither Indigo nor Kotak (guess even HDFC) state on the website or application that they’ll take 90 days to credit the reward points to your 6E account. Rather they choose to conveniently bury this in the 6E Rewards Terms & Conditions. Below is excerpt from their T&Cs:

8. Earning of 6E Rewards

8.1 6E Rewards are credited to a Member’s Membership Account on a bi-monthly, monthly or quarterly basis, subject to confirmation from the IndiGo Bank Partner or Program Partner, as the case may be.

While the T&C states that 6E Rewards can also be credited on bi-monthly or monthly they’ve chosen the longest duration of quarterly (90 days). In today’s age and technology, I wonder if HDFC/Kotak are physical verifying paper trail of each transaction before confirming the eligible points.

IMHO, even if you’re a regular flier with Indigo don’t opt for this card as in it’s current form with it’s restrictive T&C’s it will not be worth the effort and spend

so, It seems Indigo does not want to give 3000 voucher at all, they told me that the 3 transactions per month rule starts from the day the card is activated, no matter you receive the card on the last day of the month or you only have only few hours left in that month . Means if u receive card on 30th November and if you could not do 3 transactions on 30th November itself due to some kota-indigo tieup issue, sorry, you won’t get the voucher.

Really funny bank with funny people , policies and customer support

It seems that Kotak just removed the Golf benefits for the 6E Rewards XL card in just a day after this article got published.

How does one go about applying for the card? The Indigo website is absolutely hopeless.

Keep getting “something went wrong” or similar.

I do hold a Kotak bank account, as well as a home loan.

But after going over the bit about no renewal rewards, and 90 days wait, I am seriously having second thoughts about applying.

Did your points arrive yet, and has the service quality improved/turnaround times resolved or fixed?

I recently took a 6E XL card issued by Kotak. I have been noticing that I have been getting free food and beverage on all Smartbuy bookings. The only common denominator is my mobile number as I have booked for self and family separately.

Are you guys also experiencing this? Have been booking Indigo flights on Smartbuy since 2019 but never have I got free F&B.

I also booked 2 tickets recently from cleartrip (not via Smartbuy) and don’t have the indigo card also and neither did I opt for flexi-fare. But got free seat selection and food options in one of them. So it seems indigo is giving random upgrades.

That happens when you book via easemytrip , this also happens to me when i choose EMT , but i dont have 6e card

Its not because of the websites you are using . It is because the corp fares come lower sometimes so websites punch that and give it to you.