This is a review by one of our reader Bhavye Goel who holds multiple Kotak Credit Cards in his family.

After my hunt for the best grocery card in India ie. Kotak Essentia Platinum Credit Card I started searching for a card which could yield me returns on my dining spends as this was the area where I was spending a lot too.

I wanted something which could give me rewards from those small solo meals to grand family dinners and a card which would work at every food joint which accepts card be it a roadside dhaba or a fine dining restaurant and not just partner restaurants of HDFC/AXIS or ICICI for which generally we have a card in our family always like credit or debit.

There were two cards which had the potential to serve my purpose one was Kotak Feast Gold Credit Card and other one was Kotak Delight Platinum Credit Card.

But after seeing too many conditions in Feast Card like that only first five Dining and Entertainment transactions will be eligible for cashback I rejected it because my spends were usually limited from Rs. 100-200 for my lunch in office hours.

Finally I applied for Kotak Delight Platinum Credit Card on my father’s behalf as according to the manager only one card is given per CRN. Though he was misinformed as now I have two cards on my CRN.

Table of Contents

Joining Fees

- Joining fees: Rs 1999 + GST

- Welcome Offer: 2 BookMyShow vouchers worth 200 each on first swipe if you apply online directly with Kotak.

- Annual fees: Rs 299 + GST (2nd year onwards non-waiverable)

- Add on card fees: Rs 249 + GST

Application Process

The application process was smooth as we had applied through the branch because there was no welcome offer at that time which is running currently on Kotak Cards and the branch staff collected all the documents from my home and got the form filled and signed.

It was the first Credit Card in my father’s name but he had a credit history because of the car loan. Here’s how the card looks like (greyish),

Credit Limit: The card was delivered in around 10 days and I was surprised to see a meagre credit limit of Rs.15,000 for a person who was maintaining an Ace savings account with Kotak Mahindra Bank and balance always hovering in 7 digits.

The thing that was more funny about this limit was that we were unable to even use the benefits of this card because of the cashback condition which I have mentioned below. Our multiple limit enhancement requests to customer care and even to the branch manager were turned down by asking us to wait for 6 months for the limit to be reviewed.

Rewards

- 10% Cash-Back on Dining. (Coffee Shops | Fast food joints| Pizza joint | Pubs | Restaurants)

- 10% Cash-Back on Movies (Movie Theatres | Plays)

- Maximum transaction size: Rs. 4,000/txn

- Maximum Cash-back: Rs. 600/month

- Milestone Benefit: Spend Rs. 1,25,000 every 6 months and get 4 free PVR tickets Or Rs.750 cashback.

A maximum Cash-back of Rs. 600 including both Dining & Entertainment transactions will be given in a monthly billing cycle. Maximum transaction size is Rs. 4,000 to be eligible for cashback. So better split your dining bills which are greater than 4000 and swipe the card twice to be eligible for the cashback.

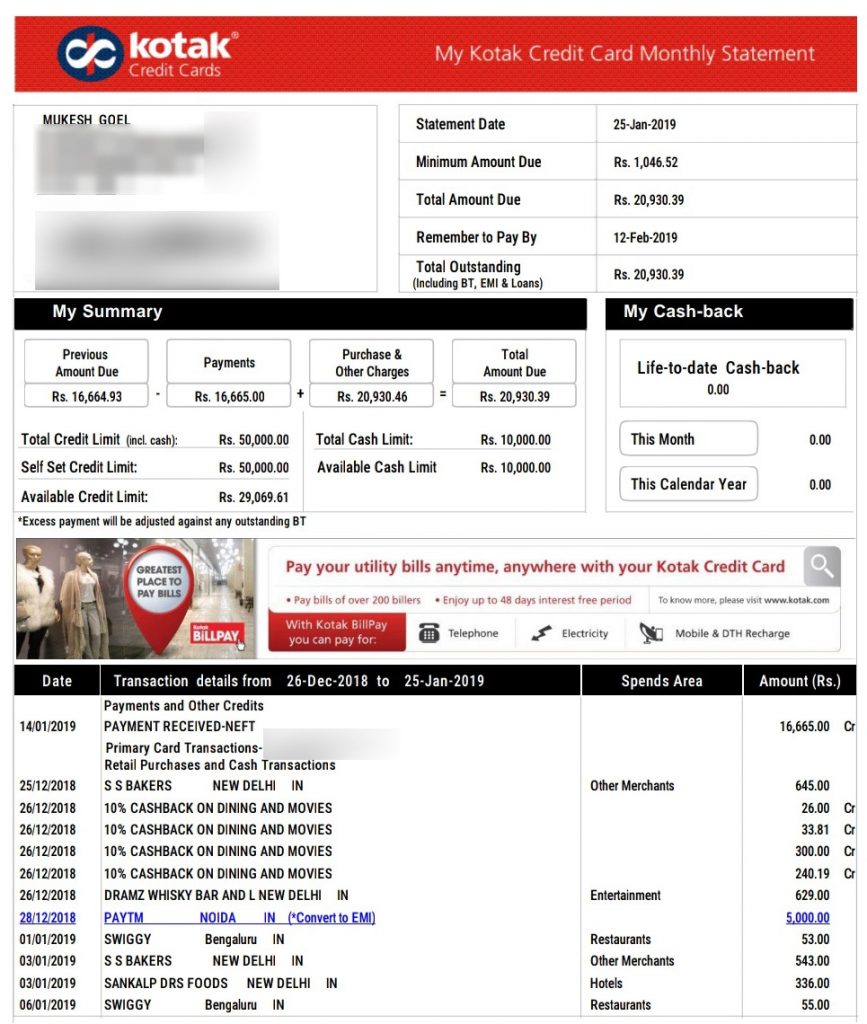

Cash-back for a particular billing cycle will be credited in the next month billing cycle. I am attaching a statement screenshot of the same. Redemption is totally hassle-free.

Cashback Condition: The only deal breaker about this card is that you have to spend Rs.10,000 per month on categories other than restaurant and entertainment within the same billing cycle to get the 10% cashback. To fulfill this condition I generally load online wallets. If someone has a card which gives 1-2% on wallet loads then this means a loss of 100-200 per month.

But still it gives a decent benefit to me even if you factor this loss it gives around 7% cashback at non partner restaurants. Here’s a quick look into my statement.

Bottomline

- Cardexpert Rating: 3.8/5 [yasr_overall_rating]

This card is good if you spend approx. Rs 6000 per month on eating out and you dont have to think about partner restaurants only. I am saving almost Rs.500-600 per month using this card, which is about Rs.7200 a year.

Though sometimes merchant category at touristy places is wrongly set as Hotels/Grocery and hence no cashback. but mostly it works.

The good news is, It works on Online food delivery portals like Swiggy and Zomato too. So whenever there is no wallet offer going on them I use this card and get a sweet 10% cashback. 🙂

Do you have Kotak Delight Platinum Credit Card? Feel free to share your thoughts & experiences in the comments below.

I have Kotak Feast Gold Card & find that better then Delight Platinum which was launched later

Feast Gold need just 5k spends in any category whereas Delight Platinum require 10k in categories other then Dining / Movies

Fuel/Railway waiver & Milestone benefit is extra in Delight Platinum

Comparison :

Delight Platinum

10% Cash-Back on Dining / Movies

Minimum Spends Rs.10,000/month on categories other than Dining / Movies

Max Cash-back of Rs. 600 including both Dining / Movies

Transactions up to Rs. 4000 are eligible for cash-back

Cash-back for a particular billing cycle will be credited in the next month billing cycle.

Fuel Surcharge Waiver for Rs. 400 and Rs. 4000, Max 4500/year

Railway Surcharge Waiver Max 500/year

Milestone Feature Spend Rs. 1,25,000 every 6 months and get 4 free PVR tickets or Rs. 750 cashback

Feast Gold

10 Dining Points on Dining / Movies

Total purchases including Dining & Movies spends of 5000/- or more

Dining points given on the first 5 Dining & Movie transactions

Maximum 600/-dining points per month

Dining & Movie Transactions up to Rs. 4000 are eligible for dining points

Dining points for a particular billing cycle will be credited in the next billing cycle.

Why is Kotak bank launching cards with so many conditions. It would be very difficult for someone holding multiple cards to remember all these conditions. I would never go for this credit card.

That’s the reason I don’t recommend kotak cards either. But it does work for some who can manage it properly.

Sid, On a different note. Can you please write an article on credit card for NRIs? I did some research and only found HDFC Regalia and Infinia cards only against FD of 4 & 11 lakh.

I hold Kotak card since the time they launched

They had come to make a difference LOL

I used to hold Trump Gold and it was instant 10% cashback with no minimum

Finally they modified with several conditions and that card is called Feast Gold now

Delight Platinum is updated version of that card with higher fees and few more benefits but spending condition is poor

Kotak Rewards are most pathetic among peers

@A2Z I also hold Feast card and before Feast it was Trump card for many years. In last few years I have managed to accumulate around 17k of dining points (equal to Rs. 17k). I normally target to use this card on dining & entertainment if my transaction is above Rs. 500. Normally I do get approx 500 dining points per month using this card.

The only issue with this card I find is only first 5 transactions are eligible for cashback and no normal reward points structure of any other spends.

Taking your statement as case study

600 cashback you got for 16,600 you spent last month.

600 / 16600 = 3.6% value back.

Paying one time 2360 fees for this + annual fees + to make sure to spent 10k.

Not everyone’s cup of tea.

If your dad got 7 digit balance in account.

Open account in HDFC, kotak gives extra roi however sweepin account can easily fill the void.

Your dad can easily qualify for infinia which gives 6.6% dining benefit without any upper limit.

Nice insight! That high spends were due to a trip on which I didnt had other options for a trip. Even then for 10K + 6k on food I get 600/16000 which is 3.75%. Sweep in account has its pros and cons. The balance if kept constant then only then sweepin makes sense else if you break dynamic FDs then there is total loss of interest. I have got Iconia for now for my general spends.

And for the last line of your comment I would say if only everyone could get infinia then noone would need any other card. His age doesnt make him eligible for Infinia. And I take pride that there is only one card which is beating it in dining spends and ie Infinia.

I’m not saying these cards are bad. I’m saying these are so bad that there are debit cards better than both these Kotak cards combined.

Get a DBS account (not digibank) and the Visa debit will give you10% cash back (up to 1000) every month on every spend on the cheapest account. If you can get a higher NRV account, it is 10K per quarter.

Thanks for the info. I didnt know about this. This can replace many of my cards.

Hi Amex Guy,

Could you please give more details and links about the 10% cashback.

In google, i am finding only digibank ones.

https: // www . dbs . com / in / iwov-resources / pdf / deposits / cashback-offer-terms-and-conditions . pdf

Remove spaces

Which credit cards offer rewards on Wallet load?

All cards except hdfc gives reward points on wallet load.

I HAVE AXIS BANK PRIVILEGE CARD FROM 2 YEARS THIS CARD GIVE ME REWARD ON LOAD WALLET BALANCE IN PAYZZAP ,PAYTM & WALLETS

I used to hold a Kotak Royale Signature Credit Card which I took in exchange/downgrade of a Privy League Signature “Traveller’s Plan” as my everyday card but their TnC is very difficult to recall when paying up.

Privy League “Traveller’s Plan” was fine for Hotel’s restaurant eating but then I could not buy things from the super market for the 5x benefit. For 5x benefits I would need to have Privy League with Shopper’s Plan and this they dont allow you to change on the fly and for a card with 2.5k fee this was a let down.

Coming to the Royale Signature Credit Card its the better card from Kotak but it has a lot of T&C’s associated with it but still better than most others. After I crossed 8lac spends and got the additional RP’s I cancelled the card and got a SBI Elite CC which has most of the benefits of Privy League “Both Plans” and Royale Signature rolled into one.

@Ajai Could you please elaborate on d Redemption options and Reward Rate for Royal Signature and Privy league credit cards? What is d actual Earn rate? Heard that d earn rate is very meager compared to other cards. How is Kotak Customer Service for credit cards?

Request if Someone can Through Light on Privy League Signature Credit Card

I have privy league signature card. Not a big fan of this card. I got this free for my wife. She is self employed and does not hold a steady income but she has privy account due to high relationship value with kotak.

This card has two version free and Paid for Rs 2500/- . Everything is same except 4 International longue access and 4 PVR tickets in case of paid version. But the only real benefit I can see is BMS visa Signature card offer of Rs 500/- per booking for free version as well.