This is a review by one of our reader Bhavye Goel who holds couple of Kotak Credit Cards in his family.

It was in 2017 when I started research to start my journey into the world of credit cards and ultimately landed on this blog. So here it is me presenting to you all my first review for this great community.

I am starting with one of the most underrated card of Kotak Mahindra Bank which is ideal for I think everyone here, Kotak Essentia Platinum Credit Card. As per my knowledge this is the best grocery credit card in India. For anyone living even in tier 2 or tier 3 cities this will be highly beneficial.

I was holding a Kotak Savings account since last 3 years and opened it due to 6% ROI on savings balance. Majority of their cards are very low in rewards and everyone I know around are having one of those only due to lack of research and awareness among the card holders in India.

This was my third credit card after SBI Simply Click and HDFC Bharat Cashback card as my spend areas were limited to Amazon, fuel and grocery.

After going through all the cards in Kotak’s stable I narrowed down on three cards which I am holding right now, two of them in my name and third one on my father’s behalf which I will be reviewing soon after this.

Table of Contents

Joining Fees

- Joining fees: Rs 1499 + GST

- Welcome Offer: 2 BookMyShow vouchers worth 200 each on first swipe if you apply online directly with Kotak.

- Annual fees: Rs 749 + GST (2nd year onwards non-waiverable)

- Add on card fees: Rs 249 + GST

Application process was simple and all online for me because of a good CIBIL score and savings account relationship with Kotak. After applying, card was delivered to me in 10 days.

The limit was not generous though, but was close to my SBI card. The card looks like this,

Rewards

- 10 saving points on every Rs 100 you spend on Departmental & Grocery store spends (Reward Rate: 10%)

- Minimum spends: Rs.1500 and Maximum Spends: Rs.4000 per transaction.

- Maximum saving points for grocery per month is capped at 500 Points.

- 1 saving points on every Rs 250 you spend at other categories without any restrictions. (Reward Rate: 0.4%)

- 1 Saving point = Rs. 1

- Milestone Benefit: Spend Rs. 1,25,000 every 6 months and get 6 free PVR tickets (or) 1200 Reward Points.

So if you use the card to spend Rs.1,25,000 in six months the total reward value comes out to be ~1.4% (0.4% of regular + ~1% as milestone benefit) if redeemed as cashback.

Redemption Options

- Cash | Airline tickets | Air Miles | Movie Tickets | Mobile Recharge | Branded Merchandise

Double Dipping

Big Bazaar: Use this card to load money in Big Bazaar future pay wallet in multiples of 1500 per day and get a maximum of 75 cashback in the wallet and 10% savings from Kotak.

PayZapp: Till last month PayZapp wallet was giving 25% cashback to a maximum of Rs. 250 on Big Basket and I used to checkout through Payzapp and used my essentia card to pay. Keep in mind that loading Payzapp wallet would not give 10% savings.

Big Basket: Big Basket is running an offer of 10% instant discount on Kotak Cards every wednesday which can be clubbed with this card easily to get 20% discount.

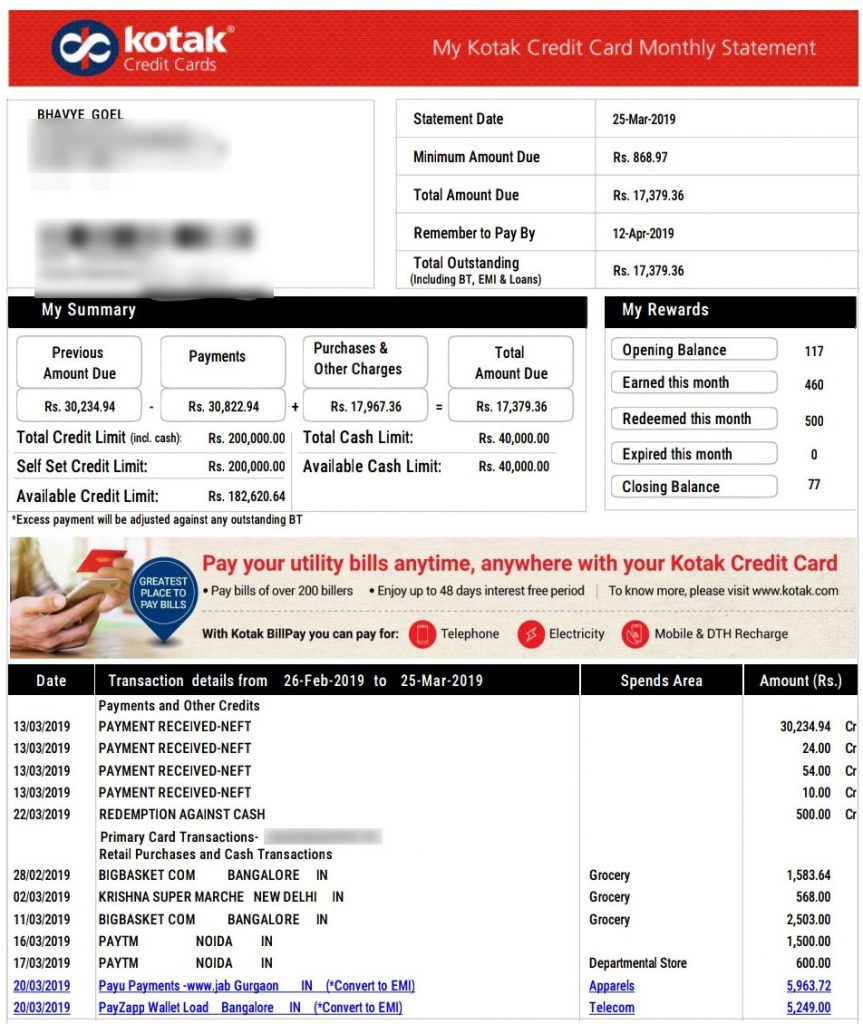

Here’s a quick look into my statement.

Bottomline

- Cardexpert Rating: 3.8/5 [yasr_overall_rating]

This card is good if you spend approx. Rs.6,000 per month on groceries and prefer to buy from big and local grocery and department stores in your city. And good thing about it is, we get 10% even on Online departmental/grocery stores like Grofers, Big Basket etc.

I am saving almost Rs.500-600 per month using this card, which is about Rs.6,000 a year, which is a very decent amount. Even if you factor in the joining fee, returns are close to 8% or so. Further, paying credit card bills via CRED gives you extra rewards as well.

So this is just one of the ways how even a very basic and not so popular credit card can get you very good return on spends.

What say? Feel free to share your thoughts in the comments below.

Need to grab this one once the diners 10x on BigBasket is over.

It’s a hidden gem. Thanks for throwing light into it. Did you provide income doucments when you applied. How often they give credit limit increase ?

No my card was done on just applying online and filling in all my details. I didnt give them any documents as I has a savings account with them. They review credit limit every 6 months. I started at 40K and now it is 2lac.

Hello Bhavye you mentioned in this review that you hold a HDFC Bharat Cashback Card. I wanted to know whether you get cashback on adding money into PayZapp wallet because I was trying to pay electricity bill directly using the card on PayZapp but it was not going through and was prompting authentication error. I have the Rupay variant of Bharat Card.

No idea because I usually use it for a one tank full every month or a train ticket to get 150 cashback.

Rupay/Diners/Amex is not supported in PayZapp

Rupay is supported now.

I Have Heard that when we Upgrade the Kotak card, the bank Enters a new Fresh entry on CIBIL ?

Yes for Kotak it will be new enquiry and will be a new account in CIBIL

And worst thing is they dont close the old account. I am ex kotak card holder and my cibil is still active after 3 years. That too two accounts.

Same with with stanchart cibil shows account open after 3years.

I do not hold hdfc acc still i got increased my limit from 40k to regalia 6l just bcoz of my cibil score

How do you know that HDFC increased your limit because of high CIBIL score and not because of any other factors?

Directly from 40k to 6L? Or in steps?

Kotak has a scheme wherein they automatically revise your credit limit by 30% on your existing limit every 6 months.

Is this scheme is still there? I am having this scheme on my account, when I tried this for my wife, executive told that they stopped this automatic increase scheme

what if the transaction amount on departmental store is more than 4000. For example if my transaction amount is 5000? Will i get 400 reward points or no accelerated reward points?

You will not get any Cashback

No cashback at all if amount exceeds 4k. Split your bill in 1500 and 3500 and get 500.

Please hide the primary card no in transactions.

Please hide the partial card numbers shown in the middle of the statement.

Thanks for this review,

I hold kotak league platinum from 2 years with a limit of 57k,they did not increase my limit since 1.5 year,

I took a loan of 1.42lac I cleared that loan but still they aren’t increase my limit.

How did u manage to get 2lac limit,

What is ur credit utilisation I usually used my total limit.

Thanks for sid.

I’m not sure if this will work but you can give it a shot. I was holding a Kotak Urbane card which was upgraded to League after so much pestering the customer care team multiple times. Since I wasn’t too happy with League, I started chasing the bank for an upgrade to Royale. They kept refusing by stating that I didn’t meet their minimum eligibility requirements. So as a last ditch attempt, I called the relationship manager at my home branch. I’ve a savings account with Kotak for nearly 10 years now. I told him that I hold multiple bank accounts with various banks and if he doesn’t take care of my best interests then I would not consider Kotak for any future requirements in terms of investments or loans. He bit my bait and asked me to send an email request after which he followed up with their team in Mumbai and got the card approved for me. Now coming to limit enhancement, it is best if you can put high spends on your card and then place a request for enhancement stating that the present limit is not sufficient. They may deny the requests initially but keep at it once every 3 months or so. Once they are convinced about your spending and repayment patterns, then expect a 30% increase every 6 months. When I got my first Kotak card, the limit was 15k in 2014 and through automated enhancements, it is now at 2.83L

Thanks poornith ninan for your valuable feedback,

As per your description I called customer care they first said that u will be eligible to apply for limit enhancement after July as in the month of Jan my loan got closed,

I said them thia card isn’t much rewarding I want to close this card than he pop out by saying that u can apply for royal signature online directly they will consider my application without any income proof as my annual spends are good.

I hold kotak 811 account which I’m not maintaing and also kotak securities account.

Does they see my account details for considering approval.

My utilization is around 15%. Its almost 2 years old card so it gradually got increased.

If your yearly spend is more than Rs500000 then the best card is SBI prime. Joining fees is Rs3000 but you can coupon worth Rs3000 from shoppers stop ,hush puppies or pantaloons. For every Rs100 spent you get the points linked this.10 points for grocery, restaurants and movies.15 points for bigbasket. 25 points for bill payment standing instructions. Other spend 2 points for every Rs100.

The points can be redeemed against card outstanding. 1 point is equivalent to 25 paise.

The annual renewal fee is waived if you spend Rs300000 in a year. Other best part is milestone benefits. Every quarter if you spent Rs50000 you will get Rs1000 pizza hut voucher. Snd again if you spent Rs500000 in a year you will get Rs7000 voucher of yatra.com or pantaloons. After using 7 to 8 banks credit cards I have boiled down to SBI prime and I felt that is best card in the market.

Even more offers are there which is very exhaustive to narrate here. Visit the sbi card website.

Same here bro enjoying pizza every 3 months

Thanks sujith,

I don’t want to apply for any sbi card because I tried hard to get sbi card they rejected my application 5 times,This is only bank who has rejected my application all my other banks application got approved anyhow whether they give less limit but they not reject it.

Same has happened with me as well

They rejected my application almost 5-6 times on the other hand my every card application got approved in one go now have 8 credit card except sbi 🙄

Axis.Hdfc.Kotak .Rbl.indusind.icici.standard charted.

Amazon pay card as well.

I Have Heard that when we Upgrade the Kotak card, the bank Enters a new Fresh entry on CIBIL ?

How to apply for this card

You need to open an SB account and at the time of opening SB account they will also open the CC account

Apply online through their website or with your local branch.

Do we get points if payment is done at DMart

Yes you will get points at DMart 10% cashback

Hi,

Do we get the 10% CB on Kotak Royale Card ?

Cheers,

Kiran

Yes I think you will definitely get. I am getting points at my city’s local departmental stores.

I Have Heard that when we Upgrade the Kotak card, the bank Enters a new Fresh entry on CIBIL ?

Yes, They will do a new CIBIL check and it will be new enquiry and it will be displayed as a new account in CIBIL

Hey Himesh,

Kotak does not go with Hard Enquiry in CIBIL if you are upgrading your existing credit card. I got Urbane Credit Card which is their entry level card in February 2018. I have a Kotak 811 Account with almost no balance. The application process was just too simple. It asked me a few questions and that’s it. No verification call or documents pickup. The card arrived in less than a week. After using the card for two months, I got first LE to 2X of the given limit. I was really surprised that I was getting a LE offer within 2 months of card setup and same was the case with Kotak Customer Care. They told me it normally takes 6 months for the LE to trigger automatically. Just 1 month after the LE I got an offer to Upgrade the Card to Platinum League with the same limit. Again, Suprising but the surprises don’t end here. In August 2018, I got another Upgrade offer to upgrade the card to Royale Signature with double limit. I really don’t know how it happened but I upgraded from Kotak’s entry-level card to their so called Premium card with 4X the initial limit in just 6 months.

Here are the few points I noticed with Kotak Cards:

– The LE offer is not instant. As confirmed with the Customer support, once you accept the LE Offer, the same request is checked by their backend before approving the higher limit.

– Though they don’t put hard inquiry while upgrading the card but they do open a new card account every time you upgrade the card with the same date of opening as your initial card setup date. So, it shows up as multiple cards on your CIBIL report.

– They don’t even close your old card account in CIBIL automatically and you have to mail them regarding that matter to get the credit card account closed. This has happened with me every time I opted for the upgrade.

I am experiencing a bad customer service for kotak mahindra bank. I opened a salary account on April 22nd and was promised that the account will be activated with 2 days. Its been 2 weeks still its not active and whenever I try to contact the representatives they give unreasonable excuses. Please don’t opt for kotak mahindra. Worst bank experience I ever had

Apparently they have a stupid system where all applications are sent to their respective Back offices for processing , means all branches of the city send their applications to 1 centralised processing center rather than opening at the branch level like PSBs leading to the delay

Sir,

Same is the case will all big banks i,e. HDFC, ICICI Etc…. EVEN SBI send forms to there Regiional processing centres,

Online application is not good option I applied it online got call from Kotak ,also got principal approval but they never come for document pickup and when I visited branch they are not able to process as this is different channel

Kotak is worst at online application processing

Still chasing them to process application from last one month

Hi

Can you please guide on Kotak Royale Signature credit card? What is the value return? I could not find a review in net.

value return is bad,

go for it only if u getting LTF or do card collection

Which one is better? Kotak essentia or sc Manhattan?

Both r good but in essentia every month u can 500 rupees means 10 percent discount upto 500 rs

Hello BhavyeG,

Amazon & Paytm are Departmental stores as per Kotak Credit card? Please share if you did transactions at Amazon & Paytm.

Transactions at Amazon & Paytm will give 10% Back ?

No 10% for Amazon and Paytm.

Paytm transaction is counted in Departmental store as per your snapshot.

Btw at any online merchant we can get 10% cashback?

It is not a permanent for Flipkart, Amazon and Paytm. Sometimes category comes in books, telecom and departmental store etc.

Sure shot online Merchants are Future Pay wallet, Jiomart, BigBasket and Decathlon(online/offline).

Which is better Manhattan or Essentia?

i already have manhattan credit card , got card upgrade offer from kotak league to kotak essentia…….can i agree for upgrade offer or not

is it possible to get it Life time free?

hi geni,

no chance to get this card LTF , I talked to customer care….

one reward point how does that equal to 1 rupee ?

If i want to buy a amazon voucher worth 1000 rs

i have to spend 4000 reward point

so how 1 reward point is one rupee?