Update: HDFC has re-launched the Millennia product by relaxing the restrictions and limits – It’s now lot better. Please find the updated review below.

HDFC Bank few years back came up with Millennia series of credit/debit/prepaid cards for Millennials, targeting customers who’re new to credit cards. And here we’re going to see a detailed review of one of those products: HDFC Millennia Credit Card.

Table of Contents

Overview

| Type | Entry-level Credit Card |

| Reward Rate | 1% – 5% |

| Annual Fee | 1,000 INR+GST (usually issued free) |

| Best for | Online & shopping spends |

| USP | Quarterly Milestone Benefit |

With so many entry-level credit cards flooding in India here’s HDFC with their optimized Millennia credit card trying to do their best for the segment.

Joining Fees

| Joining Fee | INR 1,000+GST |

| Joining Fee Waiver | Spend INR 50,000 & above in the first 90 days |

| Welcome Benefit | 1,000 Reward Points |

| Renewal Fee | INR 1,000+GST |

| Renewal Fee Waiver | INR 1,00,000 in a year |

The joining/renewal fee waiver conditions are pretty good for the card of this range. Note that HDFC usually gives most credit cards as First Year Free, especially if you’re upgrading from other HDFC cards.

Reward Points

| Spend Type | Cashback % | Max. Cap / cycle |

|---|---|---|

| Select Onine Merchants | 5% | 1000 |

| Other Online/ Offline / Wallet Spends | 1% | 1000 |

- Select merchants: Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber & Zomato

- Points Validity: 2 Years

The rules are okayish, as we get decent return on spend. Yet, I wish these rules were set quarterly or half yearly rather than monthly so that those who do seasonal shopping gets the maximum benefit as well.

Note that this is the only HDFC credit card that gives rewards for wallet loads at the moment, which is good.

But you don’t earn these points in real-time. Instead you get points added in bulk by beginning of every month.

While industry demands instant earning/redeeming, HDFC takes opposite route. This is like going back to stone age, hmmm!

Reward Redemptions

- 1 CashPoint = INR 1 (for stmt credit)

- 1 CashPoint = INR 0.30 (for flight/hotel redemption)

- Redemption requirement: Min. of 500 Points (for stmt credit)

Redeeming for statement credit is indeed the best way to maximize the benefit on the Millennia credit card.

Milestone Rewards

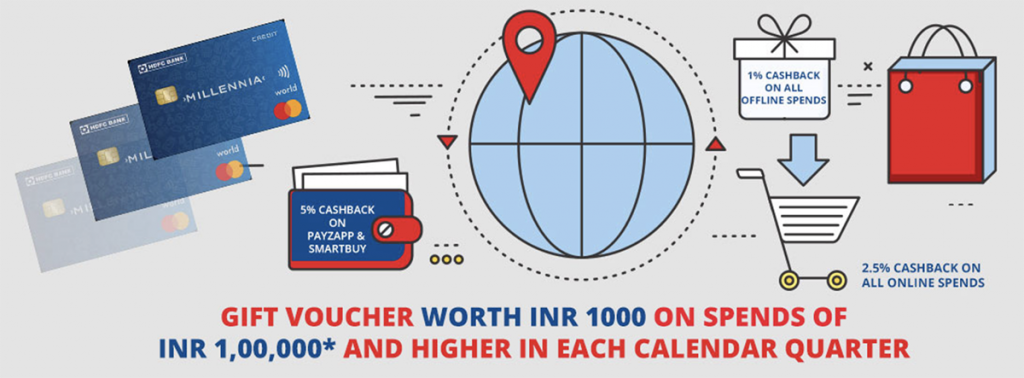

- Rs. 1000 Gift Voucher on spends of Rs. 1 Lakh in a calendar quarter

That’s a pretty good lift of 1% on reward rate, meaning you’ll get at-least 2% on all your spends if you can spend 1L every quarter.

Also, fortunately the fulfilment of this reward is also pretty fast than expected. On testing, it came within ~1 week of completing the transaction.

Coming to the redemption of this benefit, they have quite a list of brands as below, but as always Amazon voucher is the best among the options and it was available for instant redemption post which you’ll get an email with the voucher details like this.

Variants

Speaking of HDFC Millennia, you should also know the different variants of Millennia, meaning the different card networks on which the card is issued. Millennia is issued on:

- Visa (Signature)

- Mastercard (World)

- Diners Club

These days its interesting to see entry level cards like HDFC Millennia & Axis ACE on Visa Signature variant, as you get additional platform benefits as well.

HDFC may likely rotate the variant from time to time to keep them in a specific ratio. It may also differ based on sourcing medium, for ex, most card members are getting “Diners Millennia” if the upgrade was done via net-banking.

Generally you can’t choose the variant but if you’re facing issues in acceptance like with Diners, you may request bank to get it changed to your desired card network stating the reason.

Design

If you’re new to credit cards you would be surprised to see a neat and clean minimalistic design without the card details embossed on front of the card, except your name.

I recently got this card (as an add-on) and it looks pretty good in hand. The colour is bright and good. It’s a nice, cool & formal design.

On a quick comparison, HDFC Millennia debit card which has similar design with minor change in the colour gradient looks better.

Just incase if you’re wondering, not to worry, the card details are at the back.

Airport Lounge access

- Domestic: 2 complimentary access/quarter

- Network: MasterCard, Visa or Diners

These days lounge access is limited to only few lounges on entry-level cards like Millennia. Speaking of HDFC, even premium cards like Regalia has limited access. So donot expect access to all lounges with this card.

If lounge access is your concern you’ve to choose the variant based on the cards/networks that the lounge you visit gives access to.

Golf Benefit

- Complimentary Golf Games: 4/Year

- Complimentary Golf Lessons: 12/Year (1/month)

This is a Mastercard World benefit and not the feature of the product per se, still good enough. However, note that this is applicable only if your Millennia Credit Card is issued on Mastercard network.

Note that if you’re on Visa platform, you may instead enjoy the Buy1Get1 offer with bookmyshow.

HDFC Benefits

Apart from the features and benefits of the card there are certain benefits that you would enjoy by being with HDFC Bank. They are,

- Higher Credit Limit: HDFC is one of the few banks in the country that can give extra-ordinary credit limits.

- Merchant Offers: HDFC is known for good merchant offers, for example their tie-up with Apple is quite strong and you get good discounts because of that.

- Upgrade Offers: If your usage on HDFC credit card is good, they will be happy to upgrade you to the next premium credit card, usually for first year free.

- Premium Banking: If you’ve premium credit cards with HDFC, you’ll get an invite to open a complimentary premium banking account with them. For ex, Regalia cardholders usually get inviteed for Classic program.

These are some of the wonderful unique benefits which you generally don’t get with other banks in India.

Bottomline

- Cardexpert Rating: 4.2/5

If you’re new to the credit cards ecosystem, HDFC Millennia is definitely a must have credit card in your wallet. You get lounge access, good rewards and get access to HDFC merchant offers.

Even if you intend to upgrade from lower end HDFC cards like HDFC Moneyback card, Millennia is a very good option in terms of rewards and benefits.

Do you hold HDFC Millennia Credit Card? Feel free to share your thoughts in the comments below.

Hi,

Thanks for your post and all these details..I had clubmiles cards and have being saving points on it..I blocked the card for using on the wrong site and told them to resend it. But they sent me milliena dinners card instead without any information. After a lot of complain on twitter, email, finally they told me they are stopping club mile card and have upgarded to this. and they transferred my points from clubmile to millenia.

Is there anything else I do? How can it be a upgarde? Also, Dad felt this card is good for using it for insurance purposes. Is there any other card you can recommend for insurance purposes? I have prestige but they dont give points.

Go with Axisbank Ace or Axisbank Flipkart credit card for insurance spends. They provide 2% and 1.5% cashback respectively in your statement without any limits.

Hi, I will suggest SBI Prime for Insurance payment including Insurance where you get 5% reward rate by 20 points on bill payments and redeemable for Statement credit.

Unfortunately, Ace card no longer provides cashback for insurance spends.

If you are current account holder then you can upgrade your debit card to business Debit card for insurance purposes.

Hi,

I am facing the same issue, the customer care even told me that I manually clicked the link bank shared to me, which seems to be like a scam.. I was holding Clubmiles card for International Airport Lounge access across many countries and especially no limits were set for using the free 6 usages, where as this SO CALLED UPGRADED card Millenia by HDFC is only offering domestic lounge access that too twice a calender quarter.. Anyhow I am about to apply for downgrade as advised by the customer care executive, and if I an not receiving the Clubmiles card, then no more point to trust HDFC who just makes bogus updates to the system deliberately and creates such unanticipated situations…

Hi Siddharth,

Apologies if it is crossing the line, but could not resist.

HDFC is lately taking a stand that 1 customer can be given only 1 card. How did you manage to get this ? Further, basis previous articles, I understand that you had Infinia and DCB as well.

So how many cards from HDFC do you have?

This one is an Add-on card. Dual card is bit strict lately, but you can check with branch for the same.

Ah okay. I already have Infinia and Indigo XL. Wanted to know how you got the 3rd one.

Understood. Thanks.

Dear Pratik,

It’s all about the relationship you make with the bank.

I am having HDFC Intermiles VISA Signature, HDFC Diners ClubMiles, HDFC Regalia Business and HDFC Times Platinum, total 4 cards under my customer ID.

I haven’t got any upgradation offer or limit enhauncement on my fourth card Times Platinum only since 2017.

“CashBack of 5% on 10 merchants are calculated basis the Terminal / merchant IDs (TIDs & MIDs) shared by the respective merchant partners. If in case the TID / MID is not available in the set-up, such transactions will not qualify for the benefit”

Hi Sid,

I am using this card since last six Months and HDFC is continuously disappointing me till now. Wherever i spent through this card they Credited reward@ flat 1%.

After talking to my RM he suggested to send mail. After so many mails they didn’t credit correct rewards till now.

I had spent on Payzapp, Cred Rent payment and Amazon but no use they traeted all as offline Txn and credited flat 1% Seriously they have gone mad this time. I am not using now.

Crediting of reward points for this card has some serious technical issues. They credited some points, then said those were erroneous credits and debited them. I realized the original credits were on wrong dates, but a number of transactions including Payzapp transactions were never credited. Grievance Redressal was absolutely obnoxious when I wrote to them, they were not even clear about Millennia reward structure. I kept at it and wrote mail after mail to Priority Redressal, and after 3 months, senior management 2 days ago informed that some 2500 points that were earlier not credited, will be credited to my account in 5 working days.

I also know of a couple of friends who have been facing dificulties with reward pints credit on Millennia. Probably, a public compain of some kind is required to get the issue fixed.

Hi, I am also facing same issue since last 2 months.

Did you get correct reward points after complaint?

If yes, let me know the process.

I “upgraded “to this card from the Regalia First in July. Have I erred? How do I go back to Regalia First or Regalia, or ideally – Diners Privilege which I have set my eyes on recently?

Am sorry but unfortunately its a bad “UPGRADE”. Months before, my RM said he can only process Milliennia and I took it up with branch manager. BM added me to the last batch of CC holders to be given Regalia First.

I like hdfc ecosystem for its merchant offers but Milliennia is too restrictive with TnC. Inside hdfc ecosystem, try asking for upgrade to Diners club privilege or Regalia .

Outside hdfc, as suggested in the article by Sid and on personal experience , Axis Ace is a great daily card .

You can find my comments in Axis Ace article

Cheers,

Kamal

Thanks for your reply. Let me upgrade to the HDFC Diners Privilege if possible.

Thanks Siddharth for sharing the details.

One of the biggest plus point I see to get this card, is to get 1250/- cashback on rent payment using Nobroker.

They have this offer since they launched rent payment.

And it seems many are facing issues in getting that cashback.

Hi Siddharth,

I am holding Diners Club variant of this card since July 2020 as I applied for Regalia First but received this one. I am facing major problems on this card:

1. Cashback Points are not properly counted and credited (As I have send a brief email regarding this to CC of hdfc)

2. I bought Samsung Galaxy S20 on 11 July 2020 and still not received cashback of 6,000 which was an offer and also mentioned on the charge slip. (it should be credited with in 90 days)

3. I made a rent payment on Noborker.com on 11 Aug 2020 and received only 5% cashback of payzapp side still waiting for 5% cashback points of Milliennia which should be credited on 1 Sep 2020. (Call and Mail send to hdfc CC but no positive response received.)

4. Card is not accepted everywhere. I have called to hdfc to change the variant but they refused to do it and as of now I didn’t received and limit enhancement / upgrade offer. I want Regalia First or Regalia card. Please help what to do ?

Hi Manish,

I have faced the same multiple times especially for payzapp transactions. Escalate to HDFC customer care and if they sort it post a complaint at consumer forum.

Too many condition

Like minimum spends have to be 2000 else you won’t get any cashback

The offers are attractive but if you read the conditions the card falls flat on it’s face

Joining Fee of 1000 for such an underwhelming card seems dubious

The card is another fuzzy representation of rewards you could earn but eventually won’t be able to redeem

How Do i get a credit card if i own a small business and have no source of proof for income as we handle it by cash only

currently using HDFC Millenian debit card for almost 1 year and i recently upgraded to Platinum debit card

By marking a lien on FD

I am holding millinia master card a year 1 lakh spend on per quarter is good and get on the achievement month i.e 2 or 1 month not wait for the completion of the quarter.but the cashback points are not regular and not correct also. Eventhough as per terms and conditions i should get more than 1k cb points for last 4 continuous months but I got only 358 cb points in last month as per waiting period of 90 days to reflect the points.

For that matter already mailed to hdfc but I didn’t get reply in within 7 business days and send reminder also..if you could please tell the reward points/cashback points calculation in hdfc.

Can I apply for it if I’m already having hdfc regalia first credit card?

If yes, does it provide any other benefits from regalia first?

Kindly explain

Hi Sid,

Is millennia card being issued as Lifetime Free for non hdfc account holder? If yes then what is the conditions? The link that you provided does not clarify the conditions for converting card to LTF…

Yes, U have to provide the details of two utility bills like dth electric bill etc. The amount due on both the bills will be auto debited from your credit card every month.

Hi Siddharth.

Is the monthly max cap of 750 on each of the categories of payzapp, online and offline (i.e total 2250 per month) or it is 750 for all 3 combined ?

Its 750 for each category, so 2250 a month.

Nice detailing

Should we upgrade from clubmiles since i got an upgrade in netbanking

Probably this is a downgrade not an upgrade

Will loose out money on trxn less than 2000

And the limit monthly is 750 which is a joke

Two points are very bad for this card.

1 Reward points is not showing real time and. If you are process any transaction by smart by then maximum earned point is 150 Rs.

2 Same maximum earning condition for payzapp.

Sid how did you managed to get 3rd Hdfc card?

You didn’t read the article fully 😐

Diners Millenia is a very interesting card. Millenia, in general, is like a textbook Discover card offering. That’s how they position their cards globally. I won’t be surprised if the success of this card will push Discover to launch their own variants here, now that the acceptance is nearly ubiquitous.

Hi Siddharth, thanks for such wonderful article. I am using HDFC Diners Clubmiles card from last 1 year and Have a good score and spending pattern. But i have got a limit enhancement option once till now. I want to upgrade my card and but unable to do so talked with the manager but he has no clue how to upgrade this card. Could you suggest me a way to upgrade? I am not satisfied with the rewards of clubmiles.

I am using this since 4 months not get any rewards as per car features, they are giving flat 1% cash points on every month basis, I am also not getting 5% cash points when use through payzapp or HDFC smart buy programme, so I think after getting first year benefit of card like 1000 voucher on 1lacs qtly spend and other welcome benefits , I will close and cancel this card, if they seriously not crediting correct cash points

This is the worst card i have ever seen. Hdfc does not credit the reward point as per the offer . I emailed they said offer will be applied if correct MCC code is detected. They cannot do anything. Till now i should get around 1800 point but only 636 point is only credited in last 4 months , i got my card on 15 june 2020. Waht i noticed is important for all. As per my scrutiny on reward credited to my card. When i used on smartbuy to shop on amazon for 2000 and above , hdfc credits 2.5% reward point. When i do txn on smartbuy for shopping on flipkart for 2000 and above i get 1 point for each txn. And i get 1% cashback credited after on flipkart txn for those txn i got 1 point per txn. I did txn of INR 9147 totalling 2 txn during june month on smartbuy flipkart, i got 91.47 credited on my statement on 25 sep 2020. For txn on normal online txn of 2000 plus i get correct txn of 2.5% . For wallet i have not tried yet. For payzapp bill payment above 2000 , they credit 1 point per txn . Generally points are credited in next month before 10th. For october month points will be credited by 10th of NOV.

What is the offer on millennia credit card as per HDFC terms and condition and product page???

1. For 5% category – use smartbuy / payzapp for txn in flipkart amazon hotel bookin flight booking. Min txn 2000 per txn eligible for reward point.

Here how much you get on Amazon??

You transact 2000+ you get 5% cashback on amazon smartbuy upto max 1000 per month This cashback will be credited to card statement within 90 days from end of txn month. PLUS , 5% reward point extra upto 750 per month ( incl. All smartbuy 5% category) as per card benefit. Total benefit on amazon smartbuy 5%+ 5% = 10% ( max. 1750 per month)

How much you get on flipkart??

You transact 2000+ you get 5% reward point as above max 750 per month on 5% smartbuy category PLUS 1% cashback upto 1000 per month. This cashback will be credited to card statement within 90 days from end of txn month. Total benefit 5% +1% = 6% ( max 1750 per month)

These are the HDFC claims as per product page and terms and condition page.

2. For 2.5% category – use any where online excluding wallet reloads credit card bill payment etc. You get 2.5 % flat cashback which is credited to card reward point correctly every month. Max cashback 750 per month.

Note – During last 4 months i have noticed 2.5% cashback is correctly credited every month.

3. For 1% category – use anywhere offline and online wallet reload get flat 1% cashback min txn. 100 and max. Cashback 750 per month.

Note – I have never tried this category so i cannot comment on this category reward point creding correctly or not.

Total benefit on card as reward point = 750 +750+750= 2250 per month.

Note 1- cashback on smartbuy category depends upon the offer on smartbuy page some times its 5% on amazon and flipkart both or some time 2% on flipkart or 1 % on flipkart. Kindly check smartbuy page before you transact on smartbuy. Max. 1000 per month

Note 2- smartbuy additional cashback as per above note can be earned on all hdfc debit card.

Note 3- hdfc smart buy cashback is max 1000 per month per mobile no. Including hdfc debit card and credit card. Totalling of txn. Amt. On credit card and debit card is 1000 per month.

Who can get this card??

If you are not concerned regarding 5% category cashback or reward point then you can get this card.

If you do not want to get in this mess get an Axis bank ACE credit card.

I have few more points to elaborate the benefits and which will be the best option hdfc millenia card or axis ace card.

Comment if you need more details.i will reply .

I am facing the exact rewards point issues u mentioned here.

As per their terms, Amazon Shopping should fetch 5 points for every Rs 100 spent. And if redirected to amazon using smartbuy, then I should get additional 5 points i.e total 10 points for 100 rs spent on min 2000 txn but I never see this happening.

My rough estimate is that I should have been getting close to 2000 points but till now received only 622 points. Its been 5 months. God wish I knew before HDFC was so awful in their reward system.

Hi bro I also struggling for the same.every month I made more than 16k transactions in payzapp ,atleast 10k on online and 10k on wallet and offline. But I didn’t get correct cb points for the last 4 months that means shortage of 1k points. Before that some hundred points shortage but also low points from actual.And now I think to get axis ace card.so can you explain me the benefits and how to get ace card

DCB points to cash conversion is 30p from 50p earlier. Ye kab hua?

Thank you Siddarth for the detailed review. I totally agree that rules are really restricting and unnecessary. Also it seems like i dont get points Rewarded properly.

Like by paying through smart buy I should receive 50% more points and it’s been 5 months still i dont see those points in the hdfc portal. I don’t understand if ever those points will get credited or am I being duped.

Thanks again for acknowledging my request and posting this long detailed review.

Sid,

I’ve applied for this card and I received communication from bank via mail and sms that my card is principle approved with abc ref number and bank executive will call me for further process.

But till now no one has contacted me.

What next I need to do ?

Worst card ever. They don’t deposit rewards for months. They don’t respect autopay or standing instructions. They don’t have any human customer executive on any of their bank or credit card lines. Plzz stay away from this cheater bank and rather go to kotak or icici or axis. Amazon pay icici is best card ever. No bullshiting with terms and all. Maybe as it is an one of the major American company tie up with strict rules. Indians companies are also great lookat Flipkart axis card or Kotak 811.

Hi Sid,

Don’t you think based on such a bad feedback and so much t&c, card rating should be below 3 stars.

Considered the same wile rating it at 3.8. Anyway, as you’ve pointed it out, dropped its rating to 3.5 now.

They do indeed have the offer, but the reward points actual credit is a major problem. I paid rent through NoBroker thrice through Payzapp using the Millennia card with Payzapp being the gateway. Not a single time did I get the rewrd points credited correctly. After writing lots of mails to different levels of redressals, I was told that 2500 odd points would be credited. Even then, they didn’t exactly get the calculation right.

If points are correctly credited though, it would be a great rent pay option through No Broker/Payzapp.

Thanks Siddharth for this much awaited review of Millennia. Think you have been a touch generous to give it the rating you did.

The card fees are on the higher side for a card with such silly restrictions. And as I did point out on a different thread earlier and many have pointed out here, the Millennia reward points credit system is utterly broken, you never get what you are promised.

By the way, I got this card as LTF. The condition was that I needed to register a smartbuy autopay recharge/bill payment for more than 300, and keep it active for at least 4 months. I didn’t have a good customercare experience with HDFC on this card, even the executives are not quite aware of the reward structure… But HDFC does have good merchant offers consistently, they usually give good credit limit, and they didn’t create any fuss about issuing cards to persons with disabilities if they are otherwise eligible. And the card is LTF. So I am keeping it, but would restrict usage to instant offer specific, like the 10 percent Amazon instant discount, though any HDFC card would have done there.

useless card and deserves zero rating.

HDFC cards stand nowhere vs competition except infinia/dcb

My Diners Millennia card is not supported in merchant POS machine transactions, it shows error everytime except shopping mall POS machines. I don’t know why also not supported in some online transaction due to 14 digit number.

What to do to exchange to other hdfc credit cards

Hi , everyone

I been using this card from March 2020 constantly via smart buy & payzapp never i got rewards as promised now i stopped using this card gonna w8 90 days more if they credit any more cb otherwise its cheater bank earlier i had diners premium it was big mistake to upgrade in millenia its worse card better any other card even with 1% cb without any limitations

Is paying redgirraffe rent via payzapp considered for 5% cashback? I have same question for millennia debit card also.

Suddenly, I have started receiving SMS alerts from HDFC informing me about credit of some reward points in my account. But even then, I don’t think they are getting the math right. I got an alert saying I have been credited 60 points for a 2.5 percent online transaction 1500. I don’t know if the number 1500 is some category number, else, 2.5 percent of 1500 can’t be 60! I wonder if other users are also getting similar messages. Or is it a personalized response to the many, many emails I wrote to them.

In any case, the Millennia reward points system is completely, utterly messed up, and is giving the bank a bad name across the spectrum!

Hi Mahesh,

For transaction value less than 2000, you earn just 1%. You must have done some other transactions like these as well so you got 60 points. For each transaction above Rs 100 and below 2000, irrespective of POS or online you earn 1% so those must have accumulated. Also, in my card suppose for all transactions done in month of November, I get cumulative points on the first week of December which gets added subsequently in December statement. Try to calculate points based this method. I noticed I am not getting any points credited for transactions on Payzapp using this method. Maybe they credit those later on. Always use the card for transaction volume over 2k, you will definitely earn 2.5% rewards. Hope this helps.

For the Millennia users, if the bank is messing up with your reward points as they in all likelyhood must be, pleae also try using the HDFC Facebook page. Try sending them a message, and use the comment option on some of their posts, you are likely to get a response much faster than is the case with the customercare.

Don’t know whether that would change their overall approach towards reward points, but at least there will be some response. I did mention a few general points about Millennia on a comment reply on the FB page, they immediately replied asking me to contact on messenger. When I did and detailed my issue with the reward points, I got a couple of responses within an hour.

Don’t know if anything would come of it, but an option that you can consider nevertheless.

Hi siddharth and all fellow ppl

Pl advice, I hold a diners premium (LTF) which I’d due to expire dec. 2020. I have recvd msg from Hdfc that ur credit card is due for migration and u will be getting hdfc millenia card. As per ur thorough analysis, it seems millenia is not much of an upgrade, further even I dnt know whether the new card will be LTF or not. Can I ask them to upgrade if they want to say diners privilege or let it be diners premium only.

Pl advise so that I can follow up with them at this stage rather than after rcvng the card

Hi Ashutosh,

In my opinion don’t upgrade in Millenia as you will get a lot of problem in offers and cashback rewards. I am facing a lot of problem in this card. Customer care always asked to send an email for cashback points but no one is there to respond on email. My last mail was sent 8 days before but still no reply from their side.

Immediately send the card upgrade form to Chennai without any further adieu.

Spend 1 L every three months and get 1000 voucher fulfilment is very fast

I got the voucher 4 days after crossing the threshold

And i got some points credited on 1st Dec

Though they dont tally with the overall total but lets give them 90 days

Seeing all over that hdfc messes up your points lets see what happens

@Nitansh Did you get proper points?

in my case , still some points missing for old transactions before november 2020. rest for all txn i am getting correct cashback points. only one wrong cashback points. i purchased charger and headphone from apple.com and it gave points for wallet load 1%. rest all correct. best card for me.

Is there anyone using this card and has been getting reward points as described?

using this card since one year, spent more than 10 lacs ,received mere 4k as cashback.

yes I m using this card never got reward points as described

I’m currently using a HDFC Freedom credit card, any advantage for me if I upgrade to millennia. Most of my spends are on online shopping and utility bill payments.

Hi Siddharth,

Can we have two cards one Regalia and one more millennia as add-on card!

@Ganesh Yes I have Regalia and Millenia both having different limits.

Hi Siddharth.

A very nice and detailed article.

Hi Siddharth,

Can you review the RBL Younique credit card. The first ever card which can provide customized benefits to users.

To me seems to be very unique card with awesome milestone benefits.

Hi Siddhartha!

I need to know if the HDFC Millennia card is internationally valid.

Thanks.

Hello. I have a coral payback credit card from ICICI, HDFC Millenia, MMT ICICI, Amazon ICICI, Amex Platinum Travel and OLA SBI card. I use the cobranded cards only for their merchants (or card specific offers). Primary is Amex Platinum Travel but utility is diminishing due to merchant specific card advantage and less acceptance of Amex. My secondary card should be coral payback or millenia? I think both have similar rewards.

Hi Sidd, Thanksfor the informative article.

Would you know if 5% cashback on payzapp also applies to bill payments through payzapp (electrcity, insurance , etc).

In my past experience I have not recieved 5% on such transactions.

Thanks,

Hitesh

Post checking with cc they said they are only crediting 1% for recharges through Payzapp. Currently in the card webpage it says the below.

“5% CashBack on Amazon, Flipkart, Flight & Hotel bookings on shopping via PayZapp and SmartBuy (minimum transaction size of ₹2000)”

Is anyone else experiencing the same when recharged through Payzapp??

Would love to know this too:

Since they are writing

Feature 1:

* Earn 5% cashback on spends done via PayZapp and SmartBuy

* Minimum transaction value to avail the cashback is Rs 2000

So does this mean paying insurance or other spends via Payzapp (except wallet load) more than 2k is eligible for 5% cashback

Hi Siddharth,

After several rejection done by me to upgrade my money back card to Millenia card they offered me LTF on smart pay condition. I got message today that they dispatched a new card of Millenia with new number. Also I got message that my old moneyback card will get deactivated automatically. My doubt is upgrading to new card with new number is going to effect my credit score? Money back card is the only one card I am using since 5 years. If I get a upgraded card with new number, does is effect my credit score please let me know. Sorry If my doubt sounds silly to you.

Hdfc moves the history to new card

Hia sid, I have below cards and want to close few of them, plz help me to choose….

(1) ICICI PLATINUM CHIP CARD

(2) ICICI AMAZON CARD

(3) CITI BANK REWARDS CARD

(4) HDFC REGALIA FIRST (OFFER OF UPGRADE TO HDFC MILLENIA)

(5) AMEX SMART EARN CARD

(6) AXIS FREECHARGE CARD

I hope you would answer…..

One card also left

(7) SBI BPCL CARD

Don’t upgrade to Millenia and keep life time free cards.

Axis Freecharge card is not worth it when you have superior Amazon pay card. Axis ace is good card.

You can keep amex for amex offers.

Check if you are able to avoid paying fee on citi and sbi then you can keep it else you can close these.

Best would be to wait for Sid’s 2021 cards list and analyze your card strategy from there.

A question regarding this

Points earned per month 750+750+750 maximum benefit

Now the month is calander month or statement month

Like my statement date is 20th every month so can i earn max points from 20th dec to 19th jan, can i earn 2250 750+750+750 or points are credited based on monht like from 1st dec to 31st dec

Is it month limit by months or by statement billing month

So I experienced something weird. I was given an upgrade option from Regalia First to Millennia some days back and I decided not to upgrade it. Now today I came to know that the card has been upgraded without my consent by the marketing team when checked with the customer care team. Is this not totally illegal and unjustified? When I asked them to cancel the upgrade, they told I have to write a letter to Chennai office for the same but why should I go through this trouble when I have not upgraded it myself. Can someone please help me with what options I have? But definitely this experience has left a bad taste and I would consider switching to other better banks rather than such lousy bank which gives no regard to customer consent.

My ITR is 36 Lakh salaried. HDFC account and credit card holder for 8 years and current Credit Card is Regalia First (Limit 10 Lakh) with high usage including international transactions. Today i was offered upgrade to this card with same 10 Lakh limit. My Disappointment is immeasurable and my day is ruined. HDFC doesn’t know how to take care of loyal customers.

i got a call from hdfc that they are are providing a free upgrade for my regalia first credit card to millenia credit card, should i accept the upgrade or not go for the upgrade and keep the regalia first credit card. Which one id a better card Hdfc regalia first or the Hdfc millenia credit card??

Don’t upgrade unless it’s necessary. If you do shopping regularly then only it’s better opt for it. Those stupid conditions for rewards is time waste. Instead we can choose Amazon icici card unlimited rewards. For this card rewards limitations are there. Specially I would like tell you, if you still want to upgrade then you demand for life time free card only without conditions.

DON’T ACCEPT UPGRADE OFFER , YOU WON’T GET ANY UPGRADE OR LIIMIT ENHANCEMENT OFFER AND REWARDS POINTS SYSTEM IS COMPLICATED ,I’M USING THIS CARD SINCE THEY LAUNCHED , THOUGH I’M PREFERRED CUSTOMER,STICK WITH REGALIA FIRST YOU WILL GET UPGRADE EITHER REGALIA OR OTHER CARDS

Thank you Selva, we got your point. Could you please use small caps for messages in future.

Hi Siddharth,

I was upgraded to this card last month. I keep on receiving calls to convert purchases to EMI but I always denied. Still today I saw that my account is showing the two EasyEMI loans have been opened on my card (transaction amount above 1k for each). I tried reaching HDFC Phonebanking but there is no option to directly talk to customer care executive about this. Complained on there portal too.

Can you suggest what to do in such cases. I had HDFC credit card from 2016 but never faced this issue before upgrading to this card.

Thanks,

Siddharth

Hi Siddharth, As you know that customer care of HDFC is too worst. Need your expert opinion in below points:

1. In case of Spend based offers, EMI txns are covered?

2. I need to go via Smartbuy to get 5% cashback on Flipkart or can go directly?

3. On Smartbuy it is mentioned that 1% Cashback will be provided on Flipkart whereas as per Millenia t&c 5% ?

4. On EMI txns how cashback will be provided? per month or instantly

Hi,

currently having moneyback card , got option to update to visa millennia or emv visa regalia fist with same credit limit

please advise which card should i opt for or continue with my moneyback.

Don’t upgrade to millenia or any other co-branded hdfc credit cards.

Go for regalia first credit card, mostly they will send you regalia credit card, as regalia first has been discontinued. Do update us here once you receive the card.

Hi

Which card you opted for?

Did you recieve regalia?

My father has a Diners ClubMiles Card, he is getting a LTF offer for Millennia Card.

Please suggest.

If I apply add-on card how the rewards system would be?

Is it really a upgrade from Regalia first to Millenia?

yes 100%, you will not regret. mind my words. read my above comment to explain the details/ benefit of millennia card. 5 star rating for millennia card. i am using from june 2020.

But on OCT31, 2020, you mentioned this is the worst card ever.. This is not clear with this comment, Can you please explain that is millennia gives the cashback and reward points correctly now?

Please reply

yes , currently Hdfc has improved the systems. i get the correct cashback now a days from November 2020 transactions. currently i get sms also for which category points are credited . every month 2nd date i get my points credited . but still 5% points are being delayed but getting credited after few days with a sms that xxx ,5% reward points credited for month of xxx . i also got old points credited but still some old points missing. hdfc now has toll free reward point complain helpline. now card is worth it.

Hi Dipak,

On the 2nd, are you getting points for previous month or previous card statement month?

Also how much delayed are the 5% points credit. Also Can you tell what is the reward point helpline.

Hi siddharth.. firstly, thank you all! On seeing comments and your article, the conclusion is not to upgrade from regalia first to millenia. In that case, what upgrade should we ask from regalia first?

@Nev i got my 2.5% and 1% category points credited on 2nd april but 5% Still not credited for month of feb , it should get credited by march but still pending. i should get those points by this months. lets see when hdfc credits . else i will have to complain. Helpline no. 18005728236 between 09:30 am and 05:30 pm on all days.

are you getting 5% for payzapp transactions like rentpay in payzapp billpay, or recharges in milinea plz anyone confirm this

Dear sir, if I pay electricity bill through Amazon pay what will be the percentage of cashback I expect.

If you pay directly on amazon you get 2.5% reward point max 750 per month. Do not pay directly on amazon.

Method 1. Use payzapp , payzapp gives 5% cashback on bill payment + you get 5% reward point on millennia credit card. Total 10%

Or

Method 2. Use hdfc smartbuy to purchase amazon gift voucher using millennia credit card and get 5% cashback for smartbuy purchase gets credited in card statement on last day of month + 5% reward point for millennia card txn which gets credited 2nd day after month end . If you purchase GV in may 2021 ,5% cashback will be credited in card unbilled section on 31 may 2021 and 5% Reward Point will be credited on 2 june 2021 in credit card reward section. Total benefit = 10 %. After purchase of the amazon GV , add GV to amazon and pay your bills.

Hey, for method 2, do you get 5% extra cashback separate from the 5% cashback that Millennia gives on SmartBuy spends?

That’s what you said, but my understanding was that the 5% advertised in SmartBuy is the same 5% that Millennia is giving.

Got my Millennia today after upgrading from Moneyback. Had an option to choose Regalia First but preferred this one.

I am using HDFC JETPRIVILEGE card from 2017 but now one of the ph banker customer executive says that JetPriVilege has convert as intermiles card so my question is that due to my JP card expiry date they need to renew card expiry date with same card but after expiry date renewation they sent me wrong card as Millennia card instead of intermiles card so what should I need to do to get intermiles card

Actually, it is an upgrade they have done from their part. Millenia card has more benefits and offers than Intermiles.

Thanks for the review OP.

I have got an offer to convert my Moneyback CC to either Millenia CC or Regalia Fist CC with both having LTF benefits.

I also have these following cards

ICICI Amazon CC,

SBI Simply Click CC

Axis Flipkart CC

Which one should I choose for the upgrade?

I also got the exact same Upgrade against my HDFC MoneyBack CC cant decide which to opt Millenia or Regalia First, plz suggest.

Millennia’s reward system is very messed up, so Regalia first would be better if you don’t mind less rewards, and use it till you get upgrade to Regalia.

Hi Sid & All

I had a doubt in this card and was not able to find the answer anywhere, so per month here refers to calendar month ?

Hi Shashwat, it is calendar month for the points

Hdfc roll out new limit increse. almost 2x check yours.

Hi Sidharth,

Could u tl me plz which card is best

Millennium or intermiles signature

And in diwali festival they are life time free or not

I got an upgrade from millennia to premium regalia with no LTF only first year free …my current millennia is LTF card.. and in one year I already redeem 10 k cash points with value of 10k ( 1rs for 1 cash point) and 5k gift voucher in a shopping of near about 5- 7 lakh… Regalia have very less reward point value .30 rs but u can earn 3 times more reward point but I have 2500 annual charges as compare to millennia 1000 in my case it is free… What u people suggest

I also got regalia LTF offer on 2 september but i did not accept and now it was updated as annual fee 2500 , i am in no mood for upgrading. As i have redeemed 15k points in around 1 yr + i have currently 3007 points (including just today i got 1832 points) ,my millennia is LTF. I think its not a good option to accept millennia .

Please update new Features of this card

The new features in this card are very good I have stopped using my SBI simply click card.

I have spend 20000/- on Amazon via Smartbuy and got Rs.750/- cash back and cash point 1000/-

Total rs-1750/-(one month)

Amazon 5% cash points (Limit 1000 cash points’ pm)

Smartbuy 5% cash back (Limit rs.750 pm)

So got Total – 8.75% reward rate.

Also spend 1, 00,000/-(Oct to Dec) and got Rs-1000/-Amazon Gift Voucher.

(New Features as follow)

5% Cashback on Amazon, BookMyShow, Cult.fit, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber and Zomato(Maximum limit 1000/-CP)

1% cashback on all other spends (except Fuel) including EMI & Wallet transactions(Maximum limit 1000/-CP)

₹1000 worth gift vouchers on spends of ₹1,00,000 and above in each calendar quarter

Hi Rahul….Is it possible to buy amazon vouchers thru smartbuy-> amazon and get Rs.750/- cash back and Rs.1000/- cash points?

thanks

Hi Vinay,

If you buy voucher thru smart buy you will get 5% cash back of total value of voucher that is 1000/-max. but I m not sure how much cash point you will get.My be you get 5% or 1% cash points of total value of voucher.

Can you please tell that whether the new benefits are for new customers only(who subscribed card after the cut off date) or benefits are also for existing cardholder also

How do they appear in card statement? cash points as reward points and cash back as credits ?

Hi,

Am getting an online upgrade from Diners premium to Diners Millennia to premium regalia with no LTF only first year free. Is it worth an upgrade, What u people suggest?

What is the benefits on paying utility bills by millennia card

It will come in 1% category upto 1000 per month category.

Hi Siddharth,

Fee waiver is for spends above 50,000 INR not 30,000.

Anyways, Great article as always!

Hi,

I currently have a HDFC Millennia card being provided by MasterCard, i need suggestion about staying with MasterCard or change my provider to Dinners Club, i am confused, i have heard DinnersClub is a bit more of the premium segment, is that the reality or it wont matter in this card.

Did you go for Dinners? I am comparing between Millenia & Dinners Privelege. I am a frequent traveller & I’d need lounge facilities but also card acceptance in Asian countries.

Wow.. they have 0.30 redemption value on flights/hotels and 1.00 on statement credit?? Amusing these hdfc guys are.. its opposite with DCB and Infinia from the same bank. I would love to downgrade my DCB to millenia 1:1 and redeem lakhs in statement credit.

Is there any reward redemption fee while redeeming cashpoints into statement balance ?

No, totally free

Yes. Rs. 99…

For cash redemption, it is free. For catalogue based redemption, they will charge Rs 99+ gst

Is this a new development? I have always been charged for cash redemption.

Hey Sid,

I got an HDFC Millennia CC but it says Diners club international on it instead of the VISA logo. Is there a difference?

After reading all the comment, looks like stay away from millennia as well as regalia.. nothing is given for free and in case of hdfc, most of the things are looking unfair too.. just based on reviews above…

Axis airtel and Axis flipkart is far better than these.. looks like Ace is not being issued these days

Airport lounge axis based on 1Lakh spending in a quarter.

BMS Buy1Get1 offer is only for Visa infinite. Not available on Milennia.