HDFC bank is one of the very few banks in the country to offer high credit limits on retail credit cards and during the pandemic this got even better.

As you might know, HDFC has been offering multiple credit limit enhancement offers back to back to most credit-worthy cardholders in last 1 year or so.

Most HDFC cardholders I know are now enjoying credit limits in sweet 6 digits. That’s good for many, especially at times like this, as this will help those going through huge medical expenses arising out of Covid.

But things seem to go on reverse gear now for some reason.

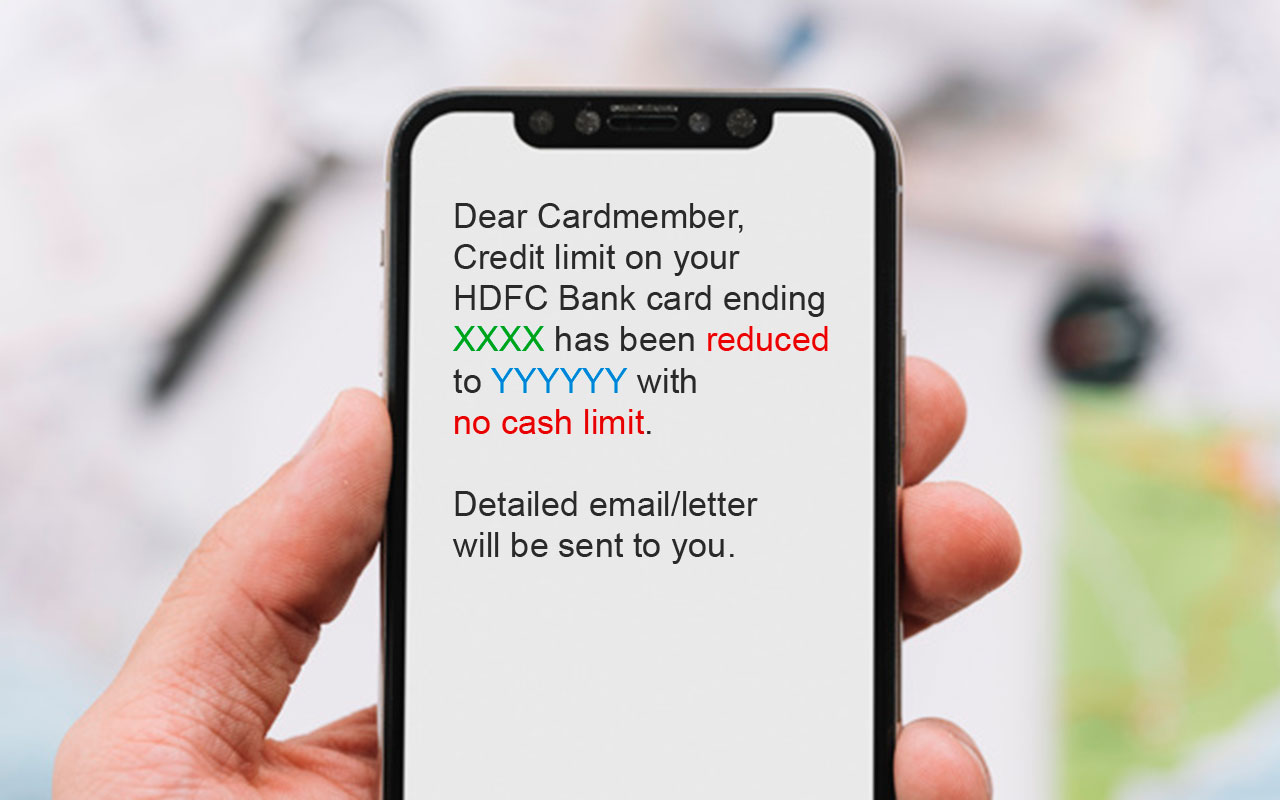

Few HDFC bank credit card holders have reported (as of June 2021) that their credit limit has dropped as low as 50% of the previous limit.

Why its happening?

Generally speaking, reducing credit limits are normal in the industry as banks consider various factors to reduce overall risk exposure.

We’ve also seen Axis bank and other banks reducing credit limits during Covid-19 1st wave. And apart from that some banks like RBL has the habit of reducing limits even before pandemic, if the card is not used for a long time.

However, HDFC bank don’t usually reduce the limit, so this makes us wonder about the reason behind this move.

So far, about 5 Cardexpert readers have reported this, but its tough to figure out the factor that’s causing this as there are no sufficient inputs from these reports.

From my understanding, it could be because of less usage with high limit or could also be due to various inputs that banks know through Machine Learning.

What to do if affected?

You may ask the bank for a detailed reason reg. the same. But in most cases it wouldn’t be required. If you’re not using the high limit that the bank has given you, this change wouldn’t hurt you anyway. So you may simply ignore it.

Continue to use the cards for future transactions and you may very well get limit enhancements based on your spend/repayment pattern.

Final Thoughts

While it’s fair for banks to reduce credit limits, it would be lot better if a reason (detailed) is given for the same to those affected, instantly. Delaying the reason not only hurts the cardholder but also adds an unwanted pressure to the bank’s credit card phone/email support.

That aside, I haven’t seen this reduction in credit limit with any of my/family HDFC credit cards and those I track via friends & relatives who use the card day-to-day for regular use.

So this seem to have affected very few % of HDFC cardholders for sure. But if you’re affected, do let us know your inference on the same.

My limit was raised some time last year, and I have not yet gotten a limit decrease. But honestly speaking, I don’t need the high limit at all; I pay my bills weekly.

Also, given that HDFC doesn’t report its card limits to CIBIL or any other bureau, I don’t think that there is any benefit of a higher limit if it’s not being used; because credit utilization ratio can’t get calculated (the denominator is missing), the score won’t be able to factor it in anyway.

Hdfc do report data to all bureau month on month

Not only HDFC many banks do not report actual credit limit to CIBIL or to other credit bureaus. Atleast that’s the case with me. In my case reported credit limit is much much less than actual limit

In my case it’s from 7 digit to 6 digit is the reduction and limit decrease is more than 100%. Never defaulted any payments and had been using the card actively until I put it in Cold since April’21.

Cheers,

Kiran

How can the decrease be more than 100%? Even if it was 20 Lacs and got reduced to 2 Lacs, its a 90% reduction only. What am I missing?

Seems he said so from current limit, more than 50% is what he meant I guess.

Right, from my current limit to what I used to have earlier is what I actually compared to.

I assume, May be this 100% is related to the earlier limit. Like, if earlier limit was 6lakhs, which was increased to 12lakhs previously has now been reduced to 5lakhs.

Regards,

Kallol Chanda

Hi Siddharth, My limit of 4.5Lakhs also reduced by 55% and I was using my card to the tune of 20-25% every month and closer to billing date the outstanding used to be around 2Lakhs but still credit limit reduced. So the algo is based on something else.

In your case bank might have thought you are highly dependent on credit so high chances of defaults. Does bank have your updated financial status? Is your income in bank records in proportion to your card utilization? If not this might be the possible reason.

-Cheers,

Sandeep

On contrary-Today I received limit enhancement on my card, By about 15% which take my DCB credit limit in 7 digits.

Indusind too did it on my Iconia.. 50% reduction in one go(1.3 lac to 65k). No default/delay in any payment ever and card is in active usage (though quite less abt 1 transaction avg a month)..

And on calling CCare they said it has been done on many cards based on “internal review process”. Review can only be done after 6 months.

Had it not been LTF, I would have closed it then n there..

On other hand ICICI revised my limit to abt 300% upwards! (1.2 to 3.2Lac)

Strange times! 🙂

Yeah , ICICI increased my limit by 100%

Actively Using every month HDFC Card from last 7 years upgraded from moneyback with 30000 limit to Regalia with 3,27,000 in these 7 years and never delayed payment but suddenly HDFC reduced my limit from 3.27 to 2,49,000 without giving any reason.

Strange..

Same with me…my credit limit has been reduced by more than 50%.

60% drop here 7 to 6 digits as well. Only card to have reduced my limit. Good payment history and fair usage even during lockdown.

Not sure what’s the thought process here.

Today I got limit enhancement on DCB card by 20 percent.

Limit on my regalia has been reduced by hdfc from 3.45 lacs to 1.38 lacs which is 60% reduction. On enquiring at all levels in HDFC, they have told that limit reduction is in lines with the bank’s periodic assessment of credit limits subject to multiple parameters/guidelines on card usage. I have been using the card regularly but still they have reduced the limit.

Got enhancement on the contrary to the tune of 69k.

All banks have rule engine to understand one’s income and then give loan/CC limit basis that. Mostly the limit is factor of your usage and current leverage across all loans. If someone acquired a new loan (especially Unsecured loan like PL or new CC), you might become risky profile and hence decrease in limit. Banks check and monitor their portfolio regularly, sometime every month – for enhancing or reducing limit or offering loans at preferable interest rates. In some cases, it can also be a silly reason like not using your card for decreasing your limit, but normally it would the first reason I mentioned.

Having multiple unsecured credit lines specially credit card is not much considered a risk now a days but your payment history and earning profile. Your usages and credit limit should be in proportion to your earning. One should have his/her earning profile updated with bank time to time.

My previous enhancements were only once a year, can get to know by next month mid, no reduction thus far.

On RBL once they put on temp closure, now they closed permanently for not using for 3m. Is it normal? I am really surprised! Is it because it was LTF?

Reduction in my infinia card limit. By about 54%. Down from 7 digits to 6. My monthly usage was roughly about 7-8% of the limit.

Called customer support – they did not have a reason and registered a request for further details. While I did not need the limit, it was good to know that it was available. On the other hand icici is offering to increase my limit to 7x. Was holding off so far but now might take it

Hi Sid,

It happened with my brother in law also. The limit has been reduced by 50%. He didn’t use the card much and didn’t maintain a good amount of money in the account. He also missed the due dates 2/3 times but paid the total amount.

50% credit limit has been reduced on my ICONIA also as I’m not using the card much and I didn’t consult the CC anymore.

Credit limit on my ICICI Amazon pay card increased from 6.85 L to 9.70 L, even exceeding the limit of my HDFC Infinia, which is 9.60 L.

ICICI gives that much limit ? Also on Amazon card ?? Maybe you have long/fat relationship with the bank. I have ICICI Amazon limit of 1L less than any card I hold. Infact my wife’s HDFC millennia has more limit without any income.

Yes, mine increased by more than 170% last time…

I have ~15L limit each on two separate ICICI cards, and no, it’s not a single “shared” limit across cards. Even I was surprised as I keep almost nil balance with ICICI, both cards are LTF and are used maybe once / twice a year. I use my SBI card > 7 figures a year and was denied an upgrade to the by invite only card despite my credit card being almost a decade old with no default / delayed payment ever.

Bank systems are strange.

As far as I know , there is no way to increase credit limit on Amazon pay credit card. Could you please tell me how did you increase yours?

I received an SMS from ICICI Bank saying I can increase my limit to 4.5L from current 1.6L for my AmazonPay CC. I believe it is automatically triggered by their system for everyone. I have no other relationship with ICICI.

In imobile app check the limit enhancement.

Send an email to the customer care with payslips attached. Worked for me.

Same for me on ICICI Amazon card, got an upgrade from 2.1 lacs to 8.7 lacs. Its a surprise move on this card, though my primary ICICI Rubyx is still stuck at 2.25 lacs limit for many years.

My CLE increased from 3l to 4l. Does that make me eligible for DCB? Currently posess clubmiles cc.

They are probably recalibrating everyone’s limits, so for some maybe decreasing and some others would see an increase, some status quo as well. Got a 21% increase just y’day on my DCB after a steep drop in my May’21 spends on this card.

I had a limit of 15 Lakhs in my INFINIA card until recently it got reduced to 6lakhs… My spends are above 7 lakhs in a month.. called up the customer care they were clueless. First they told me, I have defaulted my payments.. which I had never in my credit usage history.. then they told me I used

my card above my credit limit.. when I asked them how much.. they said 7lakhs. I reminded them my credit limit is 15 Lakhs. So basically it’s not about, not using ur card… in some cases it’s because of over using this card also… Which in this pandemic scenario they want to play safe.. just my thoughts.

Agree. Was your earnings in bank records as per your usages (7 lacs/month)? If not, you got the answer.

My regalia card’s credit limit got reduced by 60%. I use my card for everything be online or offline which sums up around 70% to 80% of earlier limit. No payment dues. When called cc they said its due to some backend problem and it will be rectified in a day or 2. But when contacted via twitter got answer as its due to precautionary measures which is funny and totally illogical. Am a premium customer having relationship more than 11years. Now have decided to close my card and get another. Sid pls lemme know which card can I opt for. TIA

Banks have to provide capital for a sanctioned credit limit, if a large limit is left unutilised, it costs capital without any benefit. Moreover, as banks use credit card limits for calculating unsecured loan eligibility, it is beneficial for customers too.

Baseless theory

No Jayesh, I don’t think so with my limited experience of working in a bank.

My Credit Limit Was 15L And Now It’s only 6L 😭

I was waiting for your post regarding this issue .

Thank You

I got a limit enhancement of 2.4x a couple of weeks back.

In contradiction to this post, i got a LE of 100% from 5 L to 10 L on my DCB. Sent an upgrade request for Infinia. Lets see.

Have you got upgraded to Infinia?

yes

To circumvent the card issue ban, I think HDFC might have raised limits willy nilly so that they can offer existing customers a better card/limits and retain them. They knew other banks are gonna pounce on the opportunity.

But now since they’ve claimed that they’ve sorted out the issues, they’re ready to get in the market again, they’re reducing the limits increased earlier as an increased limit comes with an increased risk.

I think it was just a play to benefit maximum they can from situation.

But this is not the case. Mostly, no one received a cut who got LE in recent past. Its purely seems based on risk profile of a customer. Your earnings in bank records should justify your usages and credit limit.

This is possibly a sound explanation. But I would also add a bit of what others have said – along with this process, some rationalization of limits (decreases for many, increases for some) has also happened.

According to me if card holders had taken EMI moratorium on their cards or their economic profile is vulnerable due to Covid according to their respective banks credit card limits will be decreased.

Could be those who are reduced where doing business spends with personal card?

No, most of my purchases with INFINA was for amazon. So I don’t think business spends was the issue with my case.

Cheers,

Kiran

What about excessive use on Amazon? Could that be the reason? Like, fully utilising the 15K reward point limit on Infinia (through SmartBuy) again and again?

Can we arrive at a somewhat set pattern here? Were the cards used in paying some major hospital bills/ “new purchases” which were totally off from existing pattern of expenses? What’s the trigger?

Well the reason I got from the cc executive is they reevaluated the enhancements over past one year and decreased the exact limits in my case , got 2 enhancements and reduced the same , despite 0 payment delays and good credit history and cibil score all they say is back end team and internal policies, so do any of you fall in my line ?

or may be change in credit score?

Being abnormal is normal with hdfc

Just like a few days back i got a spend based offer to spend 1.4l on my millenia card when my credit limit itself is 1.28l

Now how am i supposed to do that?

Only god knows how there system works 🤷

You are supposed to ignore such ridiculous offers the bots(ai) is obviously triggering it.

And I think all these stupid limit downgrades are also part of this Bots implementation- Welcome To Terminator Land Folks. I wonder when a stock market crash will happen because of these stupid bots. Judgement Day doesn’t seem to be that far off Guys.

My credit card limit increase to 250000 from 100000 within 8 month of using DCB privilege

i think you mean 1000000 instead of 100000

One of my relative got 162% of limit enhancement and apart from that he is getting Jumbo Loan Offer of 9.5 Lac….

My CL on DCB got reduced from ~12 to ~7 lacs. Never defaulted on payment. Rather, added more money to saving account. Only thing that I can point is – I had limited my usage to 10x RPs partners since RPs were devalued since last few months, and did not claim any spend based offers. Shifted regular spend to SC ultimate and BOB eterna.

I got a 70% increase on my Regalia. Here’s what happened in my case. (This is not a tutorial.)

Except for a handful of spends after receiving the card, I had kept off on using it for several months because I wasn’t happy with the Reward Rate. I was also regularly checking for LE and Card Upgrade offers on Net Banking, but in vain. I recently used to card for multiple small purchases in the last month, and received an LE yesterday. Maybe I’ll continue the intermittent spending pattern, and update this thread in case it’s a success.

My CL is now 39% of past Credit Limit on Regalia. Interesting fact is HDFC is offering a Credit Card Upgrade to Infinia also few days back and it is still live but with a miniscule credit limit.

paid variant or LTF

Paid was automatic offer. Spoke to Customer care and they offerfed First Year Free. This conversation was on June 8 , The CC limit reduction was on June 12th. Need to followup and check is it still live

There’s no reason you shouldn’t go ahead and take it IMO.

Take the upgrade till it’s on offer.

Just because we are trying to find pattern here… A little info..

No moratorium, no business spends on personal card, no unusual high spend in Corona period.

Fair usage of 10-20% (occasionally 50%) of limit.

Apprx avg. usage of 1-2 times/month.

No defaults (in fact, I have credit balance, as I pay rounded off, many times on my card).

Pincode is a affluent one. 🙂

Still 50% reduction in Indusind Iconia limit.

What do we know of these algorithms… 😀

Iconia is not issued by HDFC, is it?

All banks got different criteria/pattern for increasing or decreasing credit card limit(s).

Hi, having read all of the comments according to me and this is my opinion, it only seems fair to say that the banks seems to be reducing limit of mist who they might consider is nit making enough money to them. TBH when a credit limit is issued to someone that’s a capital that the bank is blocking for that specific card account, so they will rather assign the limit to someone who they think will to make them more money rather than cost them money.

When ever we use lounges etc on a card account it’s actually costing the banks money and so does blocking the capital for that card account, so they would rather free that capital and assign it to another card account or cross sell another product using that capital which they think will which they think will fetch them higher rate of return either in the form of interest or through emi conversations etc or high volume transactions. They are just re aligning the limits to enhance profits given the current market scenario.

Just one last thing I have cards with multiple banks including IndusInd all with high 6 figure limits and never saw a decrease in limit (KnockWood) with any of them inspite of regularly using close to 100% of the limit with most of them and yes on occasions have gone over limit too and have converted a few purchases to EMI’s too but yea never been late with any of my payments with any of them, ever.

So my guess is, if the bank is making enough money from you and see that you are actually utilising the limit they have given you and have a high income to repay back to them, they will most likely not decrease the limit.

Take AmEx charge cards for an example, they have a dynamic limit based on this very fact of card usage, risk assessment and payment history.

Most people here who have got a decrease are not either NOT using the limits or not making the bank enough money for them to justify that credit line that was assigned.

Just to add, RBL actually increased my credit limit twice by almost 30% when I went over limit with them. Banks will NOT decrease the limit “unless” a card account is not making them as much profit as they initially assessed it would or for some reason if the risk assessment increases beyond a point for a particular card account than the bank is willing to take. Hence there are periodic internal reviews. Trust me it’s all part of the “underwriting” process !!

This theory makes a lot of sense.

Have been using Diners Club Previlege card for more than a year now. Recently upgraded the HDFC savings account to Imperia and now it is LTF. Earlier minimum spend of ₹300000 was required for annual fee waiver.

Limit for my regalia card was increased by 100% last month, close to 8L now.

My infina limit increases from 12lacs to 14.4 lacs.

I got 20% limit enhancement of my Millennia card today.

How does it affect the profile if I use about 2x-3x of my credit limit by clearing the outstanding balance everytime and reusing it within a month. Like My CL is 50K but I end up spending over 1 Lakh in a month but just before bill generation I almost pay 90-95% of the outstanding balance. So even if I spend 2x to 3x of my credit limit but the generated bill is of maximum 10-15%.

So how does it affect in both the cases.

@Shreyansh Soni

Your comment:

Being abnormal is normal with hdfc

Just like a few days back i got a spend based offer to spend 1.4l on my millenia card when my credit limit itself is 1.28l

Now how am i supposed to do that?

Only god knows how there system works..

====

My comment on this:

Spent and pay within the statement cycle. I mean, for example, do transact for 30k and immediately make payment to the card. Then you will end up using much more than your credit limit in a statement cycle.

What I am understanding is, HDFC is reducing the limit for card holders whose spent is very high or who is using maximum of the credit limit. The maximum of the limit may be even 40-50%.

Probably the bank foreseeing non-payment of higher dues.

Just got an SMS offering an upgrade from Regalia to 6E XL. Offer made it sound like it was LTF. No limit downgrade….yet!

Even I got an email and SMS, “upgrade” from Regalia to Indigo 6E XL. But when we compare the benefits then it’s a lose-lose deal. Any thoughts?

On the contrary, HDFC have finally offered me a way out of the Millennia sinkhole by offering me an upgrade to the Regalia. The limit remains the same though – 2.47 Lakh.

How long millenia stayed with you?

Around 11 months or so.

Rushed to check the limit after seeing the post, thank god !!,limit is intact with

same 7 digits..

In my case, spends at 5-10% of old CL per month. Mix of 10x partners and others. No defaults or part payments for 10 years. I have never had a salary account with HDFC. They have always offered LE of their own without any prompt from my side. No loans or CIBIL enquiries for the last 18 months. Reduction of CL by 60%.

I had spent roughly 20k on covid tests and treatments from a hospital and diagnostic centres last month.

My card limit was cut abruptly by 100%. Never defaulted. Am an occasional user though.. planning to stop using and return the card. My SBI n Kotak cards give me much higher limits and hasn’t treated me like this at least! At least a decent explanation is the minimum that a supposedly ‘Preferred Customer’ of 20 years deserves!

My initial reaction was similar to yours. I too chose them as my primary banking partner because of the long credit card relationship and found the ‘no explanation’ bit disturbing.

HDFC CARD:

My HDFC credit limit of 12L was slashed by 60%. Excellent CIBIL score, excellent credit history and never defaulted in any loans or repayment of any cards. I have checked and reached out to my friends, colleagues, families etc whoever is holding HDFC Cards, most of their credit limit decreased. Apparently, HDFC Bank is decreasing card limits for most (if not all) in batches.

So, today or tomorrow or next week etc – if you have received a message saying, “credit limit decreased”, don’t be surprised, you aren’t alone, we are all in the same boat, please don’t disappoint.

2 days ago, I spoke with my HDFC RM and said, it’s “internal” and one of the reason is stated “COVID credit crunch”. However, RM assured me that there is a possibility it might fall back to it’s original credit limit after the post COVID economy is recovered. As for now, my suggestion would be not to surrender the card or cancel it at any cost but retain it.

KOTAK CARD:

My Kotak Credit Card limit of 9L was slashed today! *sigh*. OK, this card limit was decreased almost 70%-80% (cries) Yet to call the customer support to have a talk regarding this. However, I assumed the reason might not be much different from the reasons HDFC had shared as stated above.

As a hardcore fan of credit cards, it’s a nightmare now : )) I fear for my SBI, AMEX, ICICI, RBL and IndusInd. They might get ax anytime.

May I kindly request Sid to cover this topic, “why banks are decreasing their customers credit limit”.

Have a blessed day, folks!

Stay positive! I hope, it’s going to be all right.

There is an article already on this topic:

https://www.cardexpert.in/covid-19-impact-banks-started-reducing-credit-card-limits/

I got an option to increase my credit limit from 5L to 10L on my Regalia. There was also an option to upgrade the card to 6E Rewards XL which does look good at all. Anyone has experience with this card, Is it work it?

Strange for me….

Got Axis fipkart card 1.5 year ago…After 8 month applied for Ace credit card via customer care and got it approved on shared limit basis..earlier limit on Flikart Axis was 1.2L.Today got limit enhancement call from Axis and they particularly told me that we are enhancing the limit on my axis flipkart card by 60k…Now on axis app New credit limit is available for axis flipkart 1.8L but on selecting Axis ace its showing 1.2L (old limit)…How its possible if both cards are sharing the limit then only one showing higher limit and other remains as earlier…

Not quite sure how it happens but it happens all the same. I have both and when I spend on say Ace, available limit gets reduced by whatever I spent but the available limit on Flipkart card remains exactly the same that it was before the spend on Ace

Axis has it’s own set of weird technical issues at back end.

Have a diners black, credit limit reduced from 675000 to 329000 for no reason and no cash limit also! Total bummer.

I received a offer of a Rs 500 /- voucher this week conditional to my accepting a increase in my limit. Not going to as i already have a near 7 digit limit.

Take it.

I hold HDFC regalia card. Recently I got an upgrade from the bank but the card offered was Moneyback. Though I didn’t accept the offer, but don’t really know the reason behind offering a lower-tier card and calling it an upgrade.

I am using hdfc cards from past 10 plus years and from past 3 to 4 years I have been getting constant auto enhancement of 2 lakhs. I have come across people whose limit directly increased from 1 lakh to 10 lakhs which is absolutely a joke.

So I guess pattern here could be for people who got their cards recently say 3 or 4 years or even less like I mentioned and got a drastic increase in limit. I just got a limit increase of 2 lakhs so I am not sure whether mine would get reduced.

Extra RP/cashback offers on HDFC SmartBuy from 01st-03rd July.

Hope it’s not a sign of devaluation.

Yes bank also used to bring frequent offers directly or through yes cart earlier a lot of times but now it’s devalued too much.

How it is a sign of devaluation? Hdfc is running these offers to engage their existing customers when no new customers can be added due to RBI ban. Devaluation might happen once hdfc is back in business but not to relate these two things.

Agree, both are different things.

But the trend is similar to YES Bank credit cards.

I hope it never devalues. Everyone will be happy.

Good day friends, I am very regular on this site, thanks for bringing in such informative blog, surprisingly I got my Regalia Credit Card limit was enhanced to 3,4L two weeks back. And now I see Amex is also following the same footstep, increasing the limit to 4L. I know HDFC is upgrading the backend infra and Application platform. Let’s wait for the big bang. Hope they don’t devaluate the card benefits. No information on Amex upgrading infra to RBI norms on data storage.

Please don’t expect anything like BOOM or BANG from HDFC. Their recent devaluation and limit reduction make even their best credit card (Infinia) look like a joke. The only saving grace is 10X reward platform. I know people who are left with credit limits like 150k on DCB and 250k on Infinia after recent event. Once this ban thing is over, present top of the line HDFC credit cards will become even worse piece of crap they already are. HDFC as usual, will forget the majority of existing Infinia and DCB holders and we will start spending tooth and nail for their to be launched super premium card(s).

Whatever the reason behind decreasing the credit limit now a days, but it sounds pathetic to get your limit decreased from 13.5Lac to 4.74Lac on HDFC Bank Infinia Card, without any serious reason. Plus you get rewarded with ₹500 voucher for the sudden and unexpected decrease in credit limit.. Seriously it feels like being a joke..

My limit was enhanced from 2.4 lac to 12 lac on May 2020. I’ve upgraded to ltf Infinia on Jan this year.

They’ve now decreased my limit to 3.6 lac and sent me a gift voucher to celebrate.

In this 1 year any changes to your card account?

FYI got a 20% CLI today which took my limit to 7 digits. There was a banner ad and everything, which wasn’t there in my last CLI, so am guessing there could be a systematic increase for a bunch of people.

On the contrary, I got a 125% limit increase on my DCB just today which took my limit to 7 digits.

I hope I can get an upgrade to infinia based on the new limit of DCB.

The only difference this time with CLI is that I received this through an SMS pointing to a new page in HDFC to check for limit increase and not as an option within the net banking portal.

My Credit limit has been increased from 4.5L to 15L – good that HDFC has finally taken note of me

How was expenditure pattern overall. this would give an idea to others who wants to increase their limit.

How does credit limit work at HDFC? If I have two cards with credit limits of ‘x’ and ‘y’ respectively, and if i cancel one of those will the limit on the remaining card increase to ‘x+y’ or remain at original levels?

Asking since i have a LTF DCB + a paid Visa Intermiles Card… so have cancelled my Visa Intermiles Card but the limit has not been automatically transferred to DCB. Do i need to call HDFC to ask for that?

No. You will have to forego the limit on the card to be cancelled. It happened in my case.

I got an upgrade in credit limit from HDFC during June 2021

My infinia limit was increased to 25L and ICICI sapphiro increased my limit to 44L.

25l are you serious sir? I thought for infinia 15 lakhs is maximum and infinia has no restrictions on swiping like penalty beyond card limit.

My limit in 7 digits is not touched. It started with 1.25 lakh, 11 years back and HDFC increased gradually. I have never defaulted in bill payment. So I think, my limit wont get touched in future too, provided I use the card regularly.

Mugunthan

CBE.

Today I got a mail that HDFC is offering me credit limit enhancement by 5000 . Funny

I was offered enhancement of credit limit with with up gradation to diners club from 5.5 to 8.85 lakhs(which i didnt opt as acceptance with diners card is low

). I am doctor by profession infact recently opted for business loan of 24 lakhs from them .I thought they will reduce limit in contrary they enhanced limit and also offered jumbo loan . i was surprised

Today I got CLE from 6 digits to 7 digits on my INFINIA.

For Infinia Card holders whose limit is reduced to less than 8L (for some its reduced to even less than 5L), how are the cards treated ? Will there be downgrade of card too ?

I was having a LTF Regalia Card with 15L limit. A couple of months ago, they offered to “upgrade” me to LTF Regalia Gold with the same limit, which I accepted. Now, I’ve received an intimation that the limit is being reduced to 11.25L with no cash limit.

Never been a defaulter, and my bills are paid by auto-debit. So I wonder why.