There are few changes happening to the the most popular credit card from American Express India which is: Membership Rewards credit card.

The changes are going live from 1st April 2021 and here’s everything you need to know about it.

The Changes

- Monthly Bonus: Eligibility for monthly bonus of 1K MR points raised to INR 1500/txn (instead of previous INR 1000/txn)

- Extra Points: Additional 1,000 MR points upon spending INR 20,000 in a month. (you need to enrol for this – Clever, Amex!)

- Welcome Benefit: 4,000 MR points for spending INR 15,000 in the first 90 days (instead of Rs.2K in 30 days), for paid cards.

First change is bound to happen as previous numbers were very lucrative for this segment. So now this makes it sort of in-line with the spend requirement for Amex Gold charge which is 1000*6 = 6000 INR.

Second change is a welcoming move as you can grab extra 1000 points on spending 20K INR a month. This makes it a nice value for those who already spend well on MRCC.

3rd change is for newly issued paid cards and its just fine as well.

Analysis

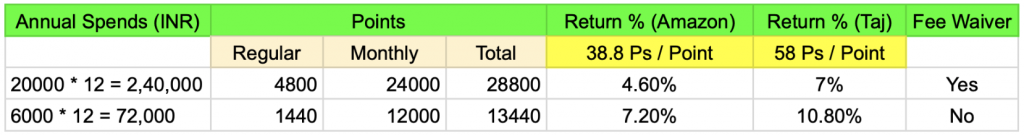

Below calculation is sufficient to explain what you get out of it:

As you see above, spending 72K a year gets you best return on spend but no fee waiver, also you get only 13K or so points with which you can’t redeem for 18K or 24K.

While you can pool in the points from other cards, its still not a wise way to use it.

Hence, spending 2.4L a year gives you a return of minimum 4.6% as Amazon voucher, which most of the members holding this card go for. On top of it, you also get the 100% fee waiver on crossing 1.5L a year.

If you’re into Marriott or Taj then you get an amazing return of 7% as Taj Voucher (or even more with Marriott). However, remember that you can book only non-discounted rates to redeem Taj Vouchers issued by Amex India.

So is it Good or Bad?

Overall its good for those who spend well in the range of 2L a year but not for those who hold the card just for monthly bonus on 4K spend.

While it may not be a welcoming move for low spenders, not to forget that you’ve the BOB Select credit card to serve that purpose – but yeah you’ll have to compromise on the support quality.

What do you think about these changes? Feel free to share your thoughts in the comments below.

While 1000 points for 20000 spends (~2.5% extra returns) is a positive but an additional 50% spend requirement for the same 1000 points is a huge negative particularly when:

1. PayTM now charges for wallet load and generally offline merchant particularly fuel stations prefer UPI (most don’t even accept wallet payments).

2. MRCC points was already devalued in the recent past (less valuation for statement credit/Amazon vouchers)

3. Lesser small/medium merchants accepting Amex cards off late. Even those who were accepting previously now don’t and some add extra charges to the bill if being paid by Amex.

I’m still not being charged for Paytm loads. Wish Paytm makes it clear on what parameters it is decided.

Yes, its an extra 50% spend, but spending just 4K a year doesn’t even give 50% off on the renewal fee. So its good only for 1st year isn’t it?

Hi Siddharth, they state: if you have used Transfer to Bank option in the past > 50k or so last two months then 4.07% or 2.07% . Lucky if they aren’t charging you. Enjoy the period until they charge !

Maybe because I never used the bank transfer option.

i think you are loading paytm through the zomato or uber app. then paytm doesnt charge .if you directly use the paytm app it charges

I’ve noticed asking charges once.. but now it doesn’t ask even while loading directly.

How come you are not charged for patym wallet recharges using your credit card. Because they clearly mention 2% will be charged for using credit card.

While loading money in paytm it gives you two option, first is paytm wallet and second is paytm Voucher.

To avoid paying 2% to paytm, i always load in paytm Voucher (not paytm wallet).

Paytm Voucher balance almost works like paytm wallet balance.

Where is this option to load in paytm voucher ? Are you talking about the brand voucher purchase ?

works only once not working after that, asking for 2.65% charge.

As Per New Updated T & C , PayTm also takes charges on,Add money to Gift Voucher via Credit Card.

It’s not good for those who have this MRCC LTF.

Agreed. I’m one of those who holds this card LTF and have been spending only little over 4000 per month on it.

Hi Sid, not sure why you’re not being charged for PayTM Wallet loads, but you’re the only on who seems to have that privilege

The rest of us a message that says an extra 2% will be charged for VISA/Mastercard Credit Cards, and it’s 3.07% for American Express cards.

There are still workarounds (not making it public, lest PayTM gets word and blocks it), but there’s definitely a push by PayTM against credit card wallet reloads. Not sure why though. They anyway charge for Wallet to Bank transfers.l

I wish they retained that ceiling of 10k per month for wallet reloads, beyond which they would charge, which would prevent abuse.

@WallStreetBets,

Even I am not charged for loading money to PayTM directly using my credit card.

As Sid mentioned, even I saw the charge for a little while and then it vanished.

Even I didn’t use Wallet to Bank transfer option since they started charging transaction fees long time back.

Can you share the workarounds please? We all are sharing credit card knowledge on this platform.

We can pay rent through PayTM. They charge ~1.65% as convivence charge. I think this will help most people to get 20k spends each month without much effort. Do you think it is wise to shell out few hundreds (mostly <300) for 1000 reward points?

@ Sidd, >>Wish Paytm makes it clear on what parameters it is decided>> here’s the reason : they dont mess with the creator of cardexpert 🙂

LOL

If I upload my Paytm wallet using Uber app, I am not being charged anything. Otherwise 2.07 pc is being charged.

Hey Amitabh, Can you please check one more thing. I loaded Paytm wallet using Uber App for 10k.

Secured 1000 MR points.

Next I tried loading wallet via Uber for my wife. Didn’t go through with same card. And also tried with her add-on Amex card. That is also failing. Hoping if you could try this?

PS: I am able to transfer money to bank account for 0%. So taking chance to load wallet with 20K.

Recently paid by credit card on petrol bunk(via PhonePe App – Phoneme UPI QR scanner), initially it used to be pay via Linked Bank UPI, now there is an option for credit card as well.

Do you know which QR code was at the petrol bunk? Was it Bharat QR? Right now, only Bharat QR UPI will accept credit card payment, I think.

There is a workaround for PayTM wallet load charges. Just use any other app with PayTM account linked like Uber and load money using that (Uber) app. Its working and no extra charges !

This works for 10K per month only.

“However, remember that you can book only non-discounted rates to redeem Taj Vouchers issued by Amex India.”

I don’t think this is true. I recently stayed at Taj Fort Aguada and have set off my discounted stay with Amex issued vouchers as well as Citi issued Taj experiences gift card.

Why should Taj care how we got the voucher/gift card. Any expenses-stay, food and beverages, spa, activities, taxes, even taxi can be set off with the voucher/gift card.

Oh yeah, its not yet made strict, just like how they use voucher for tax portion too. But yeah, that’s what they say legally.

Because Amex issued Taj vouchers are sold at lower rates by Taj.

Last few times I have booked as a TIC member and got the discounted rates as mentioned for TIC members. While paying the bills you can produce the GVs to pay. Only issue is that they don’t give any TIC points for payments made by using GVs.

“Because Amex issued Taj vouchers are sold at lower rates by Taj.”

I feel this doesn’t make sense. Taj sells the voucher/Gift card for 10% less (Amex, Mastercard offer, Diwali offer, etc.) most of the time. If they feel they are selling at lower rate, they should increase the stay rate and accordingly TIC member discount. Anyway they are not giving TIC points for stay paid (even partially) with vouchers. They do not give points even for dining when paid by cash for Epicure members when the dining is during the stay.

Disappointing move from Amex. The attractive aspect about this card is the monthly bonus points. At a high enough fee even on referral, the card doesn’t offer lounge access and other semi-premium features. Moreover, having used the card for more than a month now, I have realized that Amex offline acceptability even in a place like Delhi, is pretty poor. I tried it at 7 outlets, was accepted only at 2 places, a reputed retail chain 24/7, and Apollo Hospitals. Even there, they asked me if I could transact with a master or Visa card… So effectively, it has to be online only, these 1500 transactions, and not on Paytm there too.

Unless there are really good offers making it worth keeping the card, will have to rethink at the end of the first year…

Hahahaha! Lots of Sarcasm regarding Amex Acceptability.

Let me put down my thoughts as a guy who holds 3 Amex Cards (MRCC, Gold Charge & Platinum Charge) and an Amex Cardholder from 2017. Amex is definitely not for low spenders & I mean none of the Amex except maybe Smart Earn.

Coming to Acceptability issue, yes, there are a lot of acceptability even in a city like Mumbai. But there are workarounds. You want to make or save money, you need to give some time.

With a family of four (3 Adults & 1 Child), I have the following bills to pay:

1. Electricity

2. Landline / Broadband

3. 3 Nos. Postpaid Mobiles

4. 3 Nos. Prepaid Mobiles (One Number gets recharged every month on an average

5. Piped Gas Bill

The above is definitely more than 4000 Rs. a month (Takes care of the 4 x 1000 Rs Transactions of MRCC)

All these are paid via Amazon Pay. Fuel Expenses every month are done via Amex on HP Pumps. Be a little shameless. Ask the Pump attendant to swipe in multiples of 1000. Two Tanks fills every month and it takes care of the 6 x 1000 Rs.

I have always covered the 4 x 1000 and 6 x 1000 Transactions for the past 12 Months by loading on Amazon Pay if any of the transactions are balance at the end of the month. Why? I use this balance to pay Insurance premiums through Amazon Pay.

Platinum Charge Card is used for major spends and its offers.

Between the 3 Primary & 1 Addon card, I took benefit of 6000 Rs. Cashback within a month during the Shop Small campaign. The same Transactions also covered part of the 4 x 1000 and 6 x 1000 transactions of MRCC & Gold Charge Card. With this 2000 Rs. increase in monthly spending for 1000 Bonus points, I will just focus on part of the Groceries to be purchased via this.

I do also have Infinia, SCB Ultimate, YFE, HSBC Platinum & SCB SVT. The last three are LTF and stay somewhere in the cupboard with only HSBC getting some usage based on offers. SCB Ultimate is being closed as it doesn’t line up with my Credit Card Reward Redemption plans.

Infinia remains my go to card for offline Shopping, groceries by purchasing Instant Vouchers via 10X.

I know you will comeback to me saying that I am losing out on higher rewards on some of the cards like BOB Eterna etc etc. But then I am not accumulating for cashbacks. That’s way behind me. For me, its now all about Airmiles & Hotel Loyalty Programs. Amex is second only to Citi Prestige / Premier Miles to provide so many different Airline partners for Miles conversion. So an Amex MR point holds more value to me than something similar on other bank cards.

With these changes, my advise to anybody applying for MRCC now is to look elsewhere if you are taking this card for cashbacks or statement credit.

Do we need to register every month for 20k spends to get 1k mrcc points or just one in a lifetime?

Only once in life.

No, you have to register only once for this offer.

In the TnC of the offer, it is written as such – “This benefit require one time enrollment only. Once a Cardmember enrolls, he/she will be eligible to get 1000 Membership Rewards Points on spends of INR 20,000 or more in a month.”

Amex is ensuring it looses it’s customer base in india. Acceptance is a huge issue these days with increase in mdr which makes it a struggle to reach milestone spends. Without addressing the basic issue all it does is make it more difficult for customers by increasing spend thresholds. Yes customer service is very good but at the end of the day it’s a credit card which should serve it’s basic purpose. Plat travel also got devalued.

Oh noo! Look at them, Sabotaging their company by ignoring a “blueprint” from a random person. How will their company survive now??!! Please Sir, with Your many years of experience in the credit card industry, make Your own company and teach Amex a lesson.

Hi Prateek,

I would like to know what the strategy was. Would you mind sharing?

Thanks

Not sure about South Delhi (but I agree with you), but in Gurgaon acceptance is not even close to being an issue. My neighbourhood paan shop, vegetable shop, fruit mandi type shops all accept Amex happily, so does the tiny outlet in my society. Besides, Gurgaon has things like BB Daily and Milkbasket who require prepaid balance to shop and are used by just about everyone, and they all accept Amex, so it is easy to do 1500×4 payments for us. I think Delhi small merchants will fall in line when hyper/morning delivery startups arrive. In 3 years of moving to Gurgaon I have found one shop that says no to Amex.

It makes no sense to not accept Amex. Most Amex customers don’t haggle for discounts on groceries which almost every merchant gives, neither do they keep balances with these shops. All of them are using mSwipe/Paytm/Pine machines which require one additional form and 1% extra MDR over what you’re already paying. If they will give 5-10% discount to make a sale but not extra 1%, they won’t be around for long.

The bigger issue here is that Amex merchant onboarding has slowed down, which was already glacier slow. On every merchant I enrolled for corporate payments for my company, Amex took solid 2-3 months to open their merchant account, despite having a large push by my RM. And this was before they slowed down even further. If a shop has to wait 6 months to get an account with Amex, they already have a solid non-Amex customer base and aren’t willing to part with more MDR. They also need to resolve their beef with Google India.

On your other points, I think Amex is banking on spends returning with vengeance once travel opens up. What Amex will likely do is offer upgrade to Cent for Plats without the initiation fee or wedge a new card between Plat and Cent to recoup the COVID losses. But I doubt they will (or need to) change their core strategy.

Few days ago, I got this email too – “We are writing to let you know that from 27 March 2021, 1000 bonus Membership Rewards® points will no longer be issued on the first standing instruction registered within 5 months of the Cardmembership to pay utility bills and insurance premiums on your American Express Membership Rewards Credit Card.”

While the calculations look good in theory, it’s hardly practical especially for people using multiple credit cards.

1. For online transactions were often get 5-10% discounts or cash backs upfront with other cards.

2. For big ticket spends on Flipkart/Amazon/Myntra we have the axis/Amazon cards.

3. We have cards tailor made for flights/hotel booking, I have icici mmt. Add to that the regular offers (10-20% discount or cash back) on all different bank credit cards. So Amex card hardly gets used here as well.

This is how I use my MRCC card. Get those 1000 points by spending 1000×4 every month. And look to use it for some offline transactions to maximize the spend and wave off the annual fee if possible.

Now, with offline spends getting reduced day by day, I am already struggling to get those regular 1000 points 🙂. Having to spend 2k extra on this card REGULARLY is going to be a pain. While it is a master stroke from Amex, it is hardly any good for users.

Best is to use it to load Amamzon Pay wallet. Amazon Pay has lots of acceptance nowadays. For last more than 1.5 years I have been doing that only 1000X4 load into Amazon pay. I don’t even carry that card. Totally useless otherwise. Luckily it is free card for me as add on to Plat travel.

if one has ICICI amazon credit card that give 5 percent cashback on amazon why would one want to use this to load money?

use it to pay bills, insurance, merchants, etc. for which the Amazon card gives only 1 or 2 percent.

Because, you don’t get 5% for loading amazon wallet for the Icici Amazon pay card

I have recently started using this card. I had it LTF for the past 4 years now almost.

I use it to load up Paytm Wallet and use that for all payments in place of UPI. With the pathetic service of Gpay, I prefer using paytm now and 4k in a month is no big deal.

It can also be used for phone bill payments and all and even 6k per month will not be a big deal.

Almost all vendors accept paytm payments. There are hardly any who don’t. So it is not a problem at all.

For any other spend, I use my LTF Diners Black and utilise the reward points to get a huge benefit.

Wallet reloads on Paytm using Amex is around 3.07% so best way is to use this for offline/petrol spends considering there are much more rewarding cards for online spends like ICICI Amazon Pay/BOB Eterna etc. So this one certainly pinches a bit but the 20K/1000 MR points is a relief. Can route some payments this on most months to get that back.

Hi sidd, i still cant figure out above return nos. Can you please give an example. Personally i may not renew the amex mrcc and gold this year. Paytm wallet is charging and difficult to us it oterwise. These days i am using the combo of SC Ultimate+infinia +dcb for everything SC ultimate is a no nonsense card use it get 3.3%. Already startes using SC for fuel also and closed my icici hpcl amex.

can anyone tell the order of Amex cards

from smart earn up to platinum charge ?

and where is MRCC positioned

thank you

I have Amex MRCC LTF and so far have been using it to load Wallet (4*1000) each month and try to redeem for Cash Stmt as per 18 and 24 Karat Gold Collection.

Prior 1st April 2021

18K points (~collected over 17 months) redemption to 6K stmt credit came at 8.8% Cashback

24K points (~collected over 23 months) redemption to 9K stmt credit came at 9.8% Cashback

From 1st April 2021, with need to do min 6K transactions each month

18K points (~collected over 17 months) redemption to 6K stmt credit came at 5.9% Cashback

24K points (~collected over 22 months) redemption to 9K stmt credit came at 6.8% Cashback

While it is still decent, but for me not worth the hassle considering the increased spends . I will stop using card once reach 24K points

This is disappointing move for the customer 1500x 4 is not acceptably ..Even amex card is not working at many outlets. Amex team must work to support customers for the use at all outlets

I got MRCC free with plat travel.

Will not renew either and move all spends to Infinia

Amex Customer Service level has been significantly downgraded so now it should not be considered premium in terms of support.

Does this change apply for all existing cards also? Or only new cards?

For those who get charged for wallet load in Paytm, use Uber-Paytm load from Amex. It is still no convenience fee.

1. I do twice a month load for the Same.

2. Upload money in Amazon pay and use for groceries or electricity bill or mobile bill

3. Buy bigbasket gift card and use.

Uber allows to load paytm wallet up to 10000/- month. so, did all 4 transactions at the start of the month (March 1, 2021) and got the bonus reward points, next day…

If you calculate wisely the cashback is 4.5% either ways as you need to deduct the fee of 1500+GST in case you spend only 1500*4.

So better option will be to Spend 1500*4 = 6000/month = Rs.72000 in year and nothing else

To maximise benefit, One can spend 20000*6months + 1500*4*6months = 6.5% cashback

While spending 150000 per annum in any case is mandatory for fee waiver, we need to spend only 90 k extra in a year which will give a further 13800 points equivalent to about Rs 5250 of Amazon vouxher. This will give a return of about 5.82% .

In all appears a positive.

Siddharth, can you clarify if the Taj voucher we get can be used for dining in Taj Hotels when not staying in the hotel.

Else, how to save maximum for fine dine in ? I am expecting a 10-15 k one time spend in any 5 star in delhi.

Try and use easydiner. 25% or more savings are possible. If you can pay the bill with infinia or diners black on a weekend then another 6.6%.

Not sure how one, who is holding Infinia or DCB, would use this card for value here on. With Diners acceptability improving, not sure where to use this card. These days my DCB doesn’t get declined anywhere (assume >95% strike rate)

With Paytm charging 3. 67% (Yes that’s in my case) for wallet loading, and patching all loopholes (loading via other apps) not sure how generate value out of it. Even Amex’s 5x/10x doesn’t beat Infinia/DCB’s regular reward rate.

If someone can provide some suggestions on the ways to load wallets without incurring charges with Amex would be awesome else I wouldn’t be sure what to do with this. May be I will still hold it for fuel and any offers that might showup on it once in a while. As it LTF for me, I’m OK else would have closed it by now.

I am one the unfortunate ones who has been going to office since May 2020 (after lockdown opened). So I use the card to pay for fuel at HP pumps in 1000 Rs. lots. My broadband bill is also paid through Amex and all these combined take care of the 1000 x 4 spend. Misc spends for office work take care of the rest of 1.5 lacs required for fee waiver.

Going forward, have to see how to optimize. May be fuel 1500 x 3 and a BB gift voucher to cover the fourth one.

Hi Prateek,

Thanks for this update regarding improved acceptance of DCB,

On the Payzapp option, we won’t get any reward points for loading Payzapp using the DCB card right? Because it will be a wallet transaction na

Yes. There will be no reward points earned in that case.

However, if you recharge on the payzapp platform and use the DCB to pay, then you will get the points.

The best way for DCB is to buy Amazon Gift Vouchers worth 5k every month from Smartbuy. Use that money for train tickets and recharges

For flight use smartbuy. This will give enough of reward points I feel.

Added to that, if the card is LTF, then its even better

Thanks Sayantan for the reply.

Ok – I got it. The trick is to use Payzapp as Payment Gateway – and yes I do see same when paying bills using BharatBill Pay or so.

Yes, for me its LTF and so have not focussed on diverting major spends here.

But am getting bit of hang now, thanks to this great site of Sid and helpful members like you 🙂

I’ve had the DCB for a few days now and I’ve already seen a few rejections – mostly at small time shops. Having said that, there have been instances where it got accepted at small time shops too.

What I understand is that the POS merchant can configure to accept/not accept Diners Club cards.

I tried to make a payment online – the payment gateway was SBI e-Pay where even the Payzapp card (which is a Visa card) was refused !

All of this is in Bangalore – maybe in other cities and towns, the story is different.

I see lot of DCB rejection every now and then. If it is HDFC POS, very very few will reject DCB (makes sense) but on other machine, I see it getting rejected every now and then, irrespective of what anyone says. More so after HDFC got greedy (Increased MDR)

If anyone has doubt, try paying a BharatQR using HDFC’s own Payzapp with DCB. You’ll get a limbo.

I use AMEX MRCC card to load Amazon pay wallet. There are no loading charges on Amazon pay wallet even via credit card. You can use the wallet balance to pay utility bills and to pay health as well as life insurance premium. It can give you approx 6-7% cashback in the form of AMEX statement credit.

Beware of 25K bill limit though (good enough for most non commercial bills)

I have Infinia, SCB Ultimate, MRCC, Gold Charge & Platinum Charge. Some other LTF cards too like YFE & HSBC Visa Platinum. Infinia & Amex cards are my primary. Infinia is only being used for 5X / 10X Category. MRCC & Gold Charge is being used for the 1000 bonus points on each card. The target is 3-3.5 Lacs Marriott Bonvoy points for hotel bookings & Infinia RP for Flight bookings.

So its all about what redemption options you are looking at.

Hi Prateek,

Thanks – got it. You & Sayantan have helped me understand the nuances. I will now try to use the same.

I have to order lots of medicine each month for family and even 1mg doesn’t accept Diners Card. Hence was curious when you talked about using Diners via Payzapp card. But now it’s clear – will defeat the purpose.

This appears fine. Those spending in excess of 1.5 lakhs per annum , annual fee is zero which can be paid easily. 🙂

hence, should be applicable to all.

I have the AMEX MRCC as a LTF card as long as I hold on to the Platinum Travel Card, but except for Reliance Retail stores none of the other stores that used to accept AMEX cards are accepting the same now probably as many stated due to the higher MDR.

Paytm has loading changes and to add to it anything more than 10K cannot be added through a CC and Mobikwik charges 2% on anything more than 5K per month so the only pending option is Amazon Pay and for that I always use the HDFC DCB route using Smartbuy Vouchers or purchases through Smartbuy which are much more rewarding than any AMEX csrds and the remaining can be covered by ICICI Amazon Pay card which gives flat 2% for any utility payments.

The problem is that I have no way to use this or any other AMEX cards offline and so getting to the sweet spot of spending 4Lakhs on Platinum Travel and using 6K per month on MRCC is a tough ask , but for people holding only the MRCC card I see this as a welcome move to get to 24K points to redeem the Gold collection a good opportunity.

The only opportunity I have is my monthly xx contribution to NPS but as per earlier articles it seems AMEX and HDFC doesn’t like to see regular or high value spends to NPS and so haven’t used these cards to pay the regular add on contributions to NPS.

I might end up closing one or more of the AMEX cards going forward mainly due to acceptability issues and not particularly related to this change from AMEX as I have to always have a Visa/mastercard as backup to pay at almost all regular places I go to.

Hi Sid,

I have a doubt in your excel calculation.

You mentioned that there would be 24,000 extra points (in a year) on spending Rs 20,000 per month (Rs 240,000 in a year). But Amex mentioned that they would be giving extra 1000 points per month. So this way it would be 12,000 extra points not 24,000 points. Then Total points would be 16,800 (instead of 28,800).

Am I missing something. Can you please clarify?

Thanks

I think Sid has arrived at by adding both the monthly offers of 1000pts (4×1.5K and the 20K spend). Thus, effectively 2K pts pm = 24K pts pa.

Btw thanks for all the great tips/reviews of cards/lounges/airlines Sid!

@KiVi,

Math is like this:

1. Rs 4500/month for 12 months = Rs 72000; Total points: 1440 regular + 1000*12 bonus = 13440

2. Rs 20000/month for 12 months = Rs 240,000; Total points: 4800 regular + 1000*12 bonus = 16800

Total 30240 points worth about Rs 15,120 so about 4.875% return on spends. Of course there may be other targeted and general Amex offers where returns will end up around 5.5-6%.

Around 6% return on spends is decent however with Amex it is getting progressively difficult to achieve all this with limited (and diminishing) offline acceptability. More so for folks having multiple Amex cards.

AMEX acceptance is going down.

During their shop small offer, I had tried to use it on the listed shops. Except one all others refused to accept AMEX.

Earlier medplus used to accept it offline. Now medplus does not accept AMEX online and offline

Iam left only with HPCL fuel pumps

Hi,

Can someone explain me how u get 4.56% return from Amazon vouchers and more through Taj vouchers. I believe spend of Rs.240000 will cover both 20K per month and 4 monthly transactions for total of 28800 points.

As per me the total return on spending Rs.240000 will be 3.96% as u get 18800 points. Amazon Rs.7000 voucher for 18K points (gold collection), Rs.2000 voucher for 8K points and Amazon Rs.500 voucher for Rs.2300 points.

I assume fee will be automatically reversed based on spends.

hi,

4 times 1500 equals 6K – gives 1K Bonus points

14K more spends per month takes tally to 20K spends – gives 1K bonus points additionally

So, total we have to spend 20K monthly, not 26K (20K+6K).

Am I right? or missing something.

You are right

Is rent agreement considered as a valid address proof by Amex? I want to apply for my first Amex card and this is the only address proof I have. All others have my hometown address.

Other banks have issued on this address though.

Seems that Amex don’t want customers.

First they have acceptability issues and they are not accepted everywhere. So in most of the shops they get declined. Recently happened with me at Ahemdabad airport.

Imagine getting said no at Ahmedabad airport.

After this my family where we have 5 separate amex accounts are planning to get canceled even 1 platinum 😂

Happy with infnia

Just to confirm, no cost EMI transactions monthly can be used to.fill up those 4 transactions for bonus points right? All it takes is 4 EMIs preferably no cost and you are all set.

@Nishant,

You are right. Need to spend Rs 20K out of which there need to be a minimum of 4*1500 transactions.

@Prashant Gupta,

Total spends of Rs 240K nets you 28,800. I value each point at 50 paisa. So Rs 14,400 value and 6% return on spends. Only Taj Voucher or transfer to Marriott nets you 50 paisa or more and I don’t mind redeeming for either of these.

6% ROS is fine but too much work particularly when the offline acceptability is a huge issue.

I think SC ultimate is best option as it gives 3.3%.. what about Flipkart / Amazon card is it worth if a person uses these 2 merchants most of the times

So basically AMEX finance team has calculated how to lessen the burden of giving out more by increasing the customer spends.

Those who have this card as LTF please don’t bother to spend more than 72k a year as your returns will be diluted if you get attracted to the additional 1000 points and spend without calculating.

Spend 6k per month and get amazon voucher worth 7.2%

The day u start spending 20K extra per month your reward rate drops to 5.25%. Please calculate your overall return and not just additional returns.

@Vishal R, Savi,

After spending 4*1500*12 we get 13440 points or 9.3% ROS as per my valuation of 50 paise per point. Now each month additional Rs 13,500 spend would net you 1000 points or 3.7% ROS. Combined spends of Rs 240K nets you 28,800 points or 6% ROS.

3.7% ROS (post 1500*4) is great ROS and even better than SCB ultimate’s 3.3% ROS. I have SCB Ultimate also and feel SCB redemption is poor (though improved over past). I would any day prefer earning Amex points over SCB points.

Unless one reached Gold collection (18k or 24k points), each point is equal to 25 paisa.

I had written to Amex CC about the difficulties with acceptability and other issues that makes these changes problematic at many level. Today got a call from the escalation desk. They accepted that there are some acceptability issues and that they are working on it. The agent tried selling the changes on the basis of the new 20000 spend bonus points.

Think MRCC users should let Amex know as to what we think about the changes. I did also point out that other cards are providing significant other benefits like lounge access for cards with much lower charges. Some pressure should be there from the customer side, that when they take business decisions, a more holistic approach should be there. Amex is very professional in many ways, probably they’ll listen when thre are genuine issues.

Hello Mahesh,

How did you write to Amex? I thought they had shut down their email support?

They only listen to their Dumberican bosses.

Where to entroll for that extra 1000 points on 20k spends? And I got my card today, on 20th March 2021. So will I get the benefit mentioned in the third point as I am a new user?

Hi. Can you please tel how we get a value of 58p per point on Taj voucher.

As I can see from reward redemption page, it gives 5000 voucher for 13400 reward points.

By redeeming it for Gold Collection

MRCC additional changes from 19th May 2021

Dear American Express Cardmember, effective 19th May 2021 , there is a change in charges on your transactions at HPCL. A charge of 1% will be levied on transactions of INR 5,000 or more at HPCL fuel stations. Please note that transactions less than INR 5,000 will continue to enjoy waiver of charge at HPCL fuel stations. T&Cs Apply.

Is it possible/safe to use AmEx MRCC card for auto payment of Netflix and YouTube Premium services? Is anyone using for such payments? Many credit cards give option to set limit on International usage but don’t see such option on AmEx website.

If yes, it will cover nearly 1K of 20K requirement

Amex stands #1 when it comes to transaction safety. I’m using Plat Charge on YT/Apple and its all good.

Has anyone received the 1000 additional Bonus points on 20K spends in April.

I had tried it out on my MRCC card and is yet to receive any bonus points credited for the new 20K spends criteria, although am receiving the 1000 bonus on minimum 4×1500 spends.

@Niju

Same for me. I remember and have the email/screenshot for subscribing to the additional 1000 MR Points option as well. Lets see how long it takes, may be initial teething problem.

When I reached to customer care, they advised that the additional 1k points on 20k spend will be credited at the end of the following month. E.g. 1k points for transactions in April will be credited by May end.

After spending 20k (1500*4+14000) every month you will get 2400 (2000 bonus+400 normal) points every month. In 10 months you will spend 2lacs and you will get 24000 points. Which you can redeem for various options.

Cash option 9000 Rs which is 4.5% return

Tanishq Vouchers 10000 Rs which is 5% return

Taj Vouchers 14000 Rs which is 7% return

Let me know if there is some error in calculation or any comments please

@Manoj Singh

Seem perfect to me. Thanks for bringing it out. It makes MRCC quite good to hold, considering the option of cash redemption, which is what I always do.

This is correct…I follow the same to atleast achevie 2400 Points PM,

However Insurance Payment and Reward Multiplier will help to get bonus RPs.

Also Statement Credit is best Option and use that to Purchase Gold Jewelry at “Malabar Gold” which offers almost Rs 2000 less rate per 10gm that others Jewelers like Tanishq, PNG, Kalyan/Market. This is how u can get more return %

Does anyone know how to check annual Spend in Amex? i want to how much i need to spend for a annaul fee waiver.

Amex Chat support can share you that figure.

If you have annual spend based waiver, you should see the spend and remaining in AmEX app (similar to milestone reward spend done/remaining for Plat Travel) I don’t see it since I don’t have spend based waiver on MRCC (mine is companion with Gold charge) however my friends see it who have spend based waiver applicable.

Cards issued after Jan 2020 have this feature that you are talking about. My friend’s amex app also shows the same but for me it is not visible. When I asked customer care for my card, they informed me that this service is not available for cards issued before jan’20.

Has anyone received extra 1000 points for spending more than 20k for the month of Apr 2021. I have not. I enrolled for the offer.

you should see it next month.

As per terms and conditions, same will be credited next month end. e.g. spends if crossed more than 20000 in Apr 21, 1000 bonus reward points will be credited by 31st May in your account.

Will be credited by end of May for April transactions.

Bonus 1000 points will get credited on the last day of next month as per Terms and conditions. I.e if you spend 20K in April 2021, you will get additional 1000 points by 31st May 2021.

Hi Sid,

You have mentioned that one can get even more than 7% returns with Marriott. Can you please explain how to get that?

Hi guys

Since few days , I am no longer able to recharge paytm using any credit card via Uber. any idea if paytm has stopped allowing Wallet reload via Uber app ?

Yes, I am also facing the same issue. Paytm has restricted wallet load from uber to just rs 2000.

Please let me know if you find a convenient way to do 4 transactions of 1500 without using paytm wallet.

For me its not even allowing to add 1500 to paytm via uber/zomato it just says max limit in a month is 2000 , where as I haven’t done any cash load transactions in paytm at all for that month or in the previous months.

Now I am just adding it to Mobikwik 3*1500 and use the mobikwik blue card to make the transactions via paytm/amazon. and buying Amazon voucher via reward multiplier (2x for voucher purchase) and use it for amazon pay transactions .

Can you explain this Mobikwiq blue card? Havent been using Mobikwik for long now.

I am also looking for a way to load paytm /use MRCC 1500 better with the new Paytm limit of 2000 per card per month.

OK.. no more BLUE cards as AMEX card issuance is at a halt. 🙁

Anyone facing issue with rewards multiplier site. Its giving an error: site is under maintenance for last 4-5 days.

Same here… need some smart way do 1500 * 4 transactions per month now.

Same here. I did 1 transaction using the Uber/Zomato trick and another transaction at POS. I’ll have one more when I eat out this weekend but still struggling to find the 4th transaction for October. Might pay the 2.7% added cost for 1500 and load it on Paytm to get this month’s rewards and skip next month while I figure another way to do 4 confirmed transactions each month.

Amex MRCC – 20k spend milestone use trick –

Buy 10k Zingoy RuPay gift card using your Amex card.

Load Zingoy RuPay card to Dhani, Paulpay card, Payzapp or Muvin app card wallet (muvin wallet load multiples of Rs100, no extra charges).

Loading Dhani wallet via credit/prepaid card is chargable 1.6% but My Paulpay card is already added on Dhani wallet and Paulpay card saved as a debit card. No extra charges. So, i first load money Zingoy RuPay to Paulpay RuPay and Paulpay RuPay to Dhani wallet. No extra charges.

Tips – Buy ₹10,000 denomination Zingoy RuPay gift card because “A single user can register a maximum 20 gift cards in a calendar year”.

Note – Those who dnt know, you can use Dhani wallet load balance to pay Amex bill via billdesk page, Select RuPay card on billdesk page option and pay. Use chrome incognito mode, if you face any problem on billdesk transaction via Dhani card and dnt pay full due amount on a single transaction and you will also get 1% Dhani freecharge card benefit.

Guys, do note there’s capping on bonus points. 1000 monthly bonus for doing 4×min1500 spends is 12 times a year. But 1000 bonus on reaching 20K spends in a month is max 8 times a year. So you can get upto 20K (not 24K) bonus points in a year, apart from what you get in regular RPs and campaigns.

That’s a surprise. Is this a new addition in t&c? Never knew it.

The existing system of 2000 Bonus points is still being offered, clarified by Amex representative on 13.04.2022

This is a Surprise , haven’t seen this in the Terms earlier .

Probably a recent addition

Haven’t received any such communication from Amex. Wasn’t part of the original communication introducing the 20000 offer. Surprising.

Hello Siddharth,

How is the monthly 24000 points for 20000 spend? I was in an assumption it’s only 12000. Kindly clarify.

regards,

Vijay

Fee free funds addition (upto 4k/month) to Paytm using MRCC on Uber app is now chargeable.

Yes. Also, I was loading money in Amazon gift cards until last month which is also not working. Ability to achieve the milestone reward points seems almost impossible now. Contemplating to close the cards, if I do not find any other way to spend 20k using this card, as their offline presence is still poor even in Bangalore.