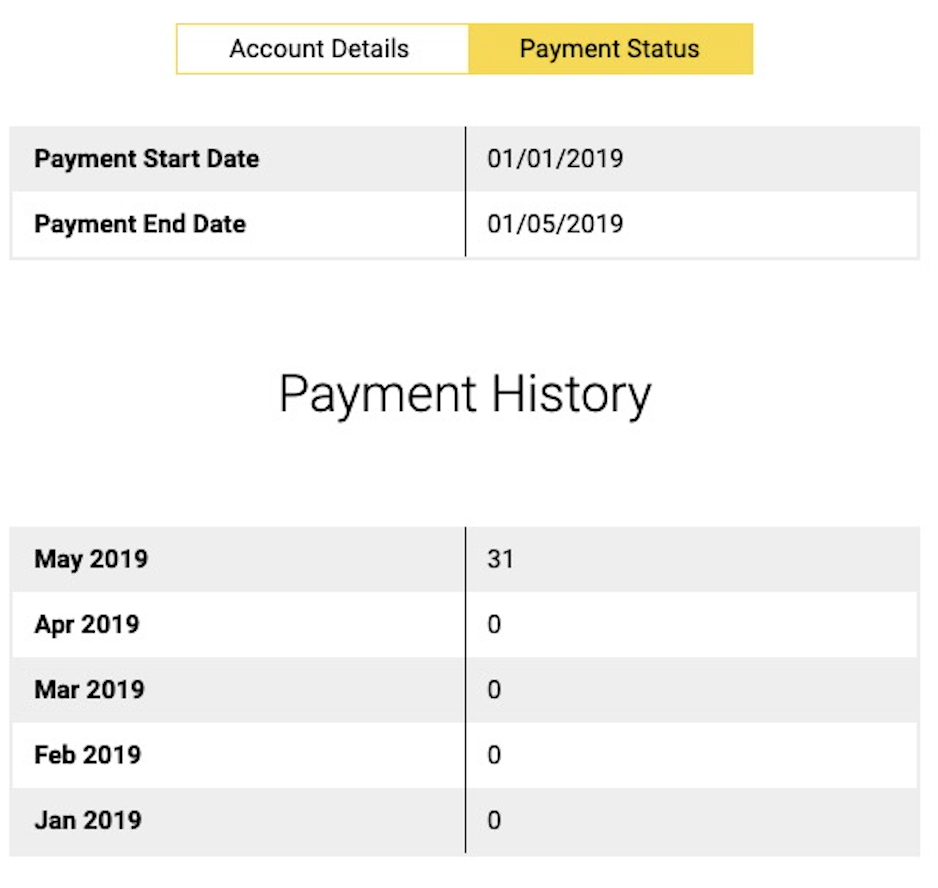

Few days ago I went through my CIBIL report and found that Axisbank has reported to CIBIL that my last payment was delayed by 31 days. As soon as I noticed that, I checked my past statements and found the Issue that caused this. Here’s everything you need to know about the same.

The Extra Credit Issue

I recently paid my bills via CRED and got some cashback to the card with which the statement got generated, with “extra credit”. The subsequent month I spent less than that extra credit and the statement got generated with “Extra credit” for that month as well.

Now, as there is extra credit on the ac already, I didn’t mind to pay the bill and this is the problem. Axis sees it as if I did not even pay the minimum due and reports it to Cibil & probably to other credit Bureaus as well.

Checking CIBIL Reports

I check CIBIL reports atleast weekly once and that’s when I found this issue. Once i spotted it, I reported to Axis Bank via Chat and they took the request, promised to fix in a week time.

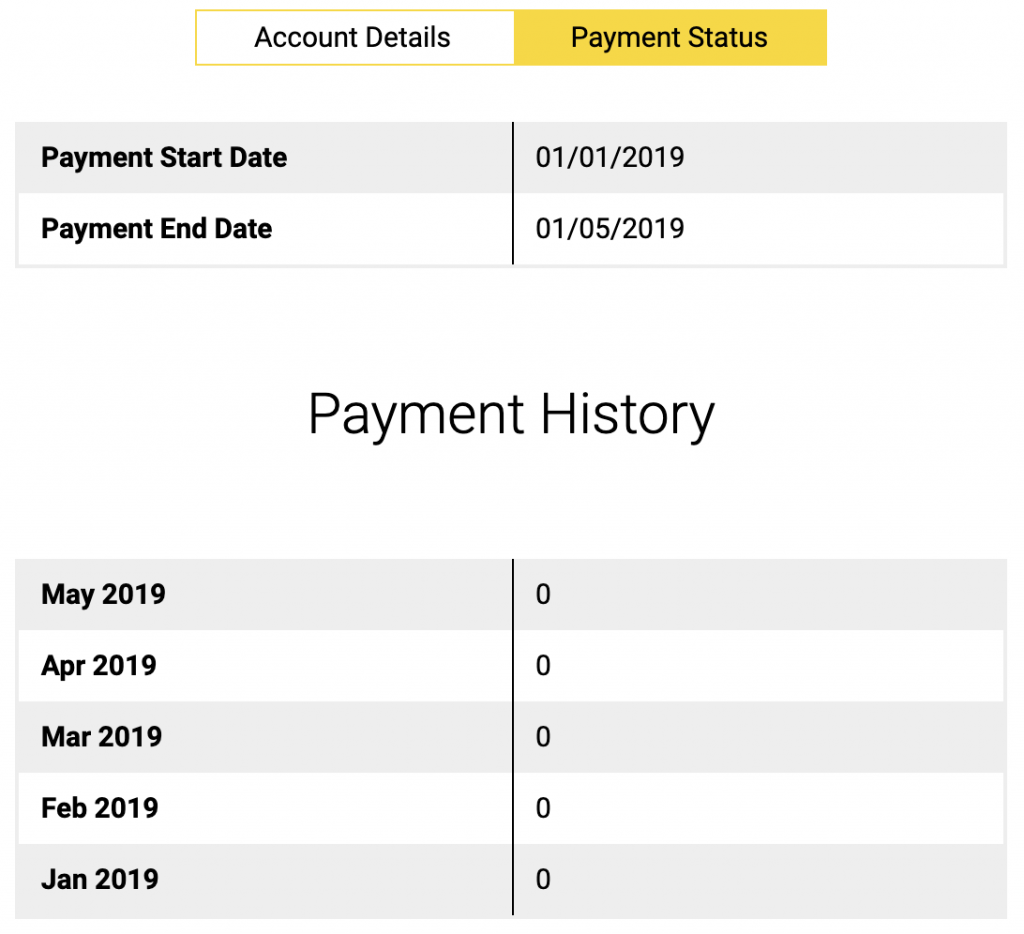

Now after 5 days, as I check the CIBIL report, its now fixed!

Bottomline

It is essential to track your CIBIL reports atleast once or twice a year and report issues to make sure your report doesn’t get any bad remarks. Fortunately my score didn’t go down at this point in time, but it may affect others if left un-noticed for long.

Ideally, in such cases, when you have excess credit on the account, consider paying atleast min. due to save yourself from the hassle.

Remember, the excess credit happens not only when you pay extra to the card, but also at times when you get refunds & Cashbacks to your account.

Have you ever had such CIBIL issues in the past? Feel free to share your experiences in the comments below.

I faced similar situation with SC Manhattan credit card. When I got cash back on this card they did not count this as a payment. When I spoke with cc they suggested me to pay the bill always and they will adjust the cash back in next cycle.

Hi Sid,

Thanks for the article. How do you check CIBIL weekly? Which service is it?

Is CIBIL refreshed weekly?

Inder

CIBIL has the service. You can refresh even daily.

Check: Get Your CIBIL Score for FREE with Full Report, Every Year

P.S. These days only score is being given for free (once a year) I guess.

@ Sid

Free CIBIL Score is a news for many (even once a year).

I would request you to mention the link in main article as well for benefit of all.

Updated. Thanks.

@Sid

Thanks.

I appreciate the hard work u are putting in for benefit of all.

Warm regards & success to u.

Recently I checked my cibil report and I found that 2 extra icici credit cards which I never used, and 1 idfcfirst personal loan of 60k which I never applied or used shown on my name. I called icici customer care for details and they said no such cards are issued on your name except the 1 i am using, idfc issue not able to connect to their customer care. How to remove those extra cards and loan details from my report.

Thank in advance.

The min. amount due and total due should be 0 in this case. I have had this happened with HDFC and Citi and Min. amount Due was 0 in both cases. So no payment needs to be done.

I think Axis messed up reporting for April 2019. It reported my payment was 899 days late which was not the case. It was fixed after reporting though. No extra credit in my case though.

Hi Sid,

If the statement shows Credit balance, then minimum payment due will be 0 right, if I am not wrong. Then what is the problem?

Didn’t you notice “31” instead of “0” in one of the snapshot for May 2019?

@ Siddharth – What Sharathkumar Anbu is saying that if you have an excess credit balance (till the statement generation date) after adjusting all the spends, did your Axis credit card statement still showed a minimum due amount (greater than Rs. 0) to be paid before the due date? If your total due is Rs. 0 (till the statement generation date), in all probability minimum due amount, should also be Rs. 0, right?

Same happened to me, in my report days past due is shown as 900 and my score took a hit of around 128 points , raised request today with axis bank & cibil customer care, cibil cc intimated that axis bank issues are due to some technical problems & will correct the with in 48 hours .. no response from axis bank after sending cibil report to them..

@Sid did you get any drop in points previously and now after restoration of dpd whether ur cibil score too got restored.

Fortunately I didn’t see a drop and so there is nothing to restore.

Axis reported 899 days overdue in my case. It was fixed and score returned to previous level in a few days after reporting to CIBIL.

Generally, if I I spent less than that extra credit. Then, I get credit card statement saying NO PYMT REQD or negative balance. Should we pay minimum amount in that case?

Yes.

What is the minimum due amount then? In all my cards with different banks, whenever there is excess credit, the minimum due is always 0 and no payment is required. Some banks even specifically write, “No Payment Required”

This looks like a goof up from Axis side and I don’t think should be taken as the norm.

I had the same issue. When I checked my CIBIL on Friday, my score came down by 128 points. I went through my CIBIL and found that there was a late payment reported. I checked all the credit card accounts and found that my Axis account was showing 900 days past due date (My card was issued in Feb 2019). I raised a dispute with CIBIL on Saturday and they have resolved the issue today. I haven’t had any o/s dues on the card but a credit of INR 14/-.

how did you raise dispute , my dispute are not getting registered

How can you access cibil reports twice a week ? Is it free?

On CIBIL portal. Paid.

Hye Siddharth,thank u for the article…

What is way to check cibil score every week

Visit CIBIL website.

Hi this is common in HDFC also. Long time back i had the same issue. I didint made the payment as the credit i received was more than that. I got calls from recovery team threatening me 🙂 to make the payment, i tried to tell them about the credit, they said its not a payment made by i have to clear the dues which i did subsequently but its strange. I thing this happened within the grace period so not reported on CIBIL.

Yes with HDFC also the same problem exists. I had some reversal of transactions and HDFC without considering as minimum payment due charged me with late fee. Some the banks policies like Hdfc are just non-user friendly. Also if you are somehow lucky to get ur late fee reversed they don’t reverse GST.

I have yearly CIBIL subscription, where one can refresh CIBIL score every 24 hours once. On Friday, I refreshed my CIBIL score and I am in for a shock because score reduced by ~150 points. I had exactly same issue as Siddharth mentioned on Axis credit card, where they mentioned late payment by 900 days(but card step date is just 1.5 years). So raised dispute immediately, which is not yet solved. But today morning, I refresh my score and it’s back to normal.

I have different loans account in Central Bank. But I have repaid 3 4 account. But in my cibil report it is showing that amount is pending and account is open they are closed years ago. Also report showed default in one payment which never happened . In bank website the account is closed and no pending amount. So what to do to correct my score.

Sanjay,

U can raise a dispute with cibil in the website itself by selecting the account in question. Also u should send a mail to your bank to send a closure of loan account to cibil. For default case raise a dispute in cibil website.

Sid,

“Checking CIBIL report weekly once”, wont that impact your score ?

Nope. At times I also check daily 😀

It doesn’t affect our score.

When you check your own report after using CIBIL subscription, it has nothing to do with decreasing your score. Your score decreases when a hard enquiry is made by a credit lending institution like banks which is seen by other banks as credit hungry behaviour. So don’t worry about refreshing your credit score everyday in case of an annual CIBIL subscription.

Hi Sid – “as there is extra credit on the ac already, I didn’t mind to pay the bill and this is the problem. Axis sees it as if I did not even pay the minimum due and reports it to Cibil” – Till date I have at least 2 Cards from different banks with credit balance but have never faced this issue. It is very strange that you faced this issue , it is purely wrong reporting on the part of Axis .

Some banks are good at handling the extra credit. Unfortunately Axis is not.

You have mentioned you check your CIBIL score weekly. where do u check the same or are u paying fees every time to check the score?

I’ve yearly paid subscription with CIBIL.

Do you also check / subscribed to reports by other Credit Bureaus?

This happened to me too. Can you tell me the process in a more detailed way how did you raise a complaint?

Catch Axis support on Chat.

You can raise a dispute directly with CIBIL as I did. Just login to CIBIL, go to the disputed item under Account Information and change the disputed details. In my case changed the past due date info from 900 to 0.

Having the Same Issue With Axis Bank Credit Card. They Added 900 Days late Payment And It Affected To My Cibil with 141 Points. Raised The Dispute From Cibil Website And My Issue Got Resolved In 3 Days.

btw,

which axis cards are u holding,

which is the best axis card for travel,ITR 7lac

@ axisguy

Check Axis bank cards on cardexpert.in.

Axis Vistara cards are gud if u can use Vistara Network. (Rewarding & without annual fee reversal)

Axis Privilege is gud as you get Yatra vouchers. (On spending 4L your annual fee gets reversed).

Hope it helps.

Hi

I have paid RBL Credit card with settlement. But they are neither updating nor providing Noc. I have been trying to convince them but the are dumb people’s.

Now they are telling me that your settlement was cancelled because you paid less amount than First Installment.

My question is if it has been canceled at that time did they told me?

Even the executive who was appointed to collect payment did not intimate us. Even now he is out of picture,

It happened to me with the citi card, any cash back or debits will reflect on the next statement, when i asked with citi executive she mailed me terms and conditions sheet and asked me to refer, some how i got late fee back. Sc and rbl also does the same. So paying min due is safe

Same happened to me with SBI IRCTC credit card.

I have the same issue with ICICI Credit card. Have logged a ticket with them, but the support has been poor.

I hope they sort this out quickly.

Anyone Aware of CIBIL score SIMULATOR here…

It’s showing me if a new credit card/personal loan added to my CIBIL ,the score will increase by 42 points ..

Is that right…?

Axis bank upgraded my three year credit card on May, and they update the open date in civil also in same. It impacts my civil score. I raise dispute with civil but no changes in report. Anyone have this issue and how did you solve it ?

In my case 2014 was changed to 2019 after my card was upgraded & the disgusting thing is the old card no was not updated in cibil, only the year was changed from 2014 to 2019, that’s a solid loss of 5years & my cibil score took a hit of 25 points 826 to 801.

Hello Sid,

I have a concern regarding Late Payment Marked in my CIBIL because of COVID-19 issue in December 2020.

I have been using SBI Card (Credit Card) since 2019 and I have maintained good standing with them. I have always paid my dues before the due date.

But, in December 2020 I couldn’t check the statement and I missed to pay the dues because of which late-fees was charged because of COVID-19.

I did contact them (SBI Card) and they did reverse the late-payment but they have marked it to the Credit Agencies now, including CIBIL.

Which is the first time happened with me, that I am marked with late payment because of the Genuine Health Issues during such bad times.

It was not even my intention to make the payment late because of this genuine reason, I missed it.

What I should be doing now and have that CIBIL Late Payment Remark reversed?

Card: SBI SimplyClick Credit Card.

Thanks.

ICICI amazon pay card had a limit of 1Lakh when issued. But over the time the limit has been increased to about 7+lakh which is not updated in CIBIL.

I have 2 questions here.

1. CIBIL report for ICICI amazon pay shows

Credit Limit – 1Lakh

High Credit – 4.5Lakh

will this affect the score ?

2. How to raise dispute if I have to ask them to correct it ?