The credit cards that are issued against a fixed deposit are also called as secured credit cards and it is one of the easy yet under utilized way to improve the CIBIL score. I’ve had a credit card based on fixed deposit for about 4 years since i was in college and it had undoubtedly contributed a lot to improve my CIBIL score.

Unsecured credit cards or loans are not easily given to you when your CIBIL score is below 750 as lenders donot know your credit worthiness and can’t predict you without data. So you have to start with secured credit cards, usage of which can tell credit bureaus like CIBIL as how good you’re managing the credit.

Your credit card usage over a period of time gives them enough data to arrive at a proper CIBIL score, which then helps you to get approved for loans & unsecured credit cards in future. Here are some of the most famous credit cards issued based on FD for starters.

Best Secured Credit Cards in India (FD Based)

1. Axis Insta Easy Credit Cards:

Axis Bank Insta Easy Credit Card was the first credit card i’ve ever had in my life. Axis Bank credit cards are pretty good to use and their customer support is responsive for any queries you initiate. I had a nice time with them and their Edge Loyalty rewards program has evolved very much in recent times. I used to redeem my reward points for Flipkart vouchers and use it to buy some cool items those days.

Interesting Facts with Axis Bank Cards: Axis is generous in giving the credit limit on FD that one of our reader had 16 Lakhs credit limit on 20Lakhs FD. Some banks do not give such huge limits even though your FD value is high. Usually banks provide 70%-80% of the fixed deposit amount as your credit limit.

2. ICICI Instant Platinum Credit card

ICICI is famous for its instant credit card. You simply visit the branch and walk away with a credit card in matter of minutes with basic documentation. ICICI Instant Platinum Credit card is one of my most used credit card in my earlier ages. With all these Payback promotions, i thought its the best card in the industry which helps you get a lot of payback points. Well, now it turned out to be one of the worst rewarding card i’ve ever used in my life.

I accumulated thousands and thousands of points in a span of 3 yrs or so and filled my home with Speakers, card holders, saree’s for my Mom, etc. If i had the knowledge on credit cards those days, i would have saved 4 times more than what i earned with this card. That’s a huge loss as i had been using the card for quite a lot of transactions.

However, its one of the best cards for those who simply need to improve your credit score with no joining fee.

Tip: I personally like this card as they instantly increase your credit limit if you pay online. Infact, you can even increase your credit limit as high as you wish to carry out bigger txn’s simply by depositing an extra amount to the card account. I’ve done it countless times.

3. SBI Credit Cards

I recently opted for SBI Signature credit card which is now SBI Elite Card based on my Fixed Deposit of 1.25 Lakhs and its one of the best premium credit cards. I was able to earn Rs.18,000 Cashback with SBI Signature Credit Card reward points with this card. I have this even now as on Oct 2016 and might cancel it as its recently devalued to Elite card.

I had to go for this secured card as my city was not serviceable for SBI credit cards an year back.

Tip: Apart from CIBIL benefits, if you plan to spend a lot on your card, say 7 Lakhs or so, consider this one. BookMyShow Offer on this card is my Favorite.

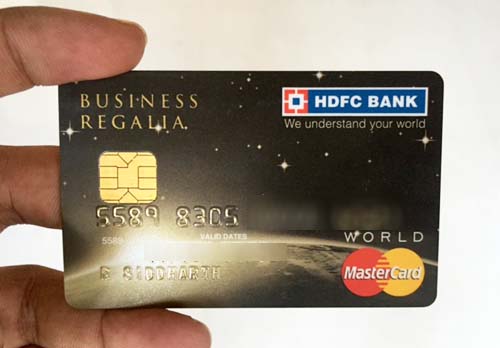

4. HDFC Credit Cards

HDFC like any other bank also issue credit cards based on FD and they are the leader in credit card industry in India having the maximum market share both in volume of cards and also in amount of transactions.

Most of HDFC Credit cards can be obtained based on FD including premium cards like HDFC Regalia if you have FD of approx 4L or so.

5. Indusind Credit cards

While i’m still not a fan of Indusind credit cards because they charge a very high joining fee for almost all credit cards except one, which is Indusind Aura Credit Card. You can apply for this card based on FD with Rs.899+ST as joining fee which they’ll waive off after spends of Rs.25,000 within first 3 Months of applying the card.

Tip on CIBIL Score: Usage of secured credit cards for 2+ years can easily lift your CIBIL score to a very good level. If you need a quick way to boost your score its fine to have 2 or 3 credit cards, as long as you can manage them properly.

While there maybe other banks issuing credit cards on FD, these are my top 5 picks. What’s your experience with secured Credit cards? Share your comments below.

Hi Siddharth,

Currently mulling about SBI Elite Card. I have a FD of 8 lacs.

Is it possible?!

Sure, possible.

Sir, can you please review the newly launched Axis Bank Reserve visa infinite credit card.

Jeet,

Its in the pipeline.

Hi Siddharth,

I was planning for a secured Credit Card, so recently paid a visit to my local HDFC branch, I was offered HDFC regalia card for 4 lakhs, and Regalia first for 2 Lakhs, since regalia is being downgraded from Nov 1, should i go for the Regalia first for 2 lakhs FD ?

Depends on your usage, benefits that you need etc. Regalia is still better than Regalia First.

Thanks for the reply Siddharth, I have another question.

I have almost decided to got for the Regalia First for 2 lakhs FD, but sometimes I have transactions that are almost 80%-90% of the credit limit(in this case 85% of 2 lakhs), I do not want these high utilization transactions to affect by CIBIL score. In that case can I Increase the credit card limit by depositing more money into the credit card account, is this possible with HDFC secured credit cards(Regalia First) ?

Simply pre-pay your bill to keep it in good level.

Yes even i was wondering is the option to Pre-Pay into the credit card account exists with hdfc regalia cards like they do with Icici Platinum cards ?

Thanks a lot for clarifying, i really appreciate your responses.

Its available in every credit card 🙂

hi akhil iam using credit cards since last 10 years and my cibil is 856 now credit utilization has no affect on your score if you paid your bill regularly i have 6l limit on my my regalia card and most of time credit utilization is 100% but my payment history is awesome and bank regular give me insta jumbo loan offer and at present bank offered me for 925000 jumbo loan without blocking credit limit try to understand bank loves top spenders and regular payers in my case every time credit utilization is 90-100% and bank still offer me 9.25l jumbo loan because for bank iam like a old friend and credit manager clearly knows my payment behaviour from last 10 years so if iam not capable to handle 6l limit on main card so ask yourself why bank is again agrree to give you 925000 extra

thanks for the info Amit, i appreciate it !

I have f.D.of rs . 25000.with SBI Bank new Delhi.i want to be member of SBI elite card. I’m eligible for the card.

What is the minimum FD required for SBI Elite card and how much percentages of FD would be the limit of credit card ?

1.25L on FD, 1L on Credit Limit 🙂

Standard chartered Super Value Titanium Credit Card is offering 5% cashback on fuel(including surcharge), telecom bills and utility bills on every payment of more than 750 rs.

My total monthly expenditure on fuel and bills comes at around Rs. 10,000, 5% of which will come around 500 rs which is quite good. I haven’t seen such an offer in any other credit card recently. I am planning to get this card. Kindly share your views regarding this card and associated pros and cons.

Hi Siddharth,

Is the SBI Elite Card still being provided against Fixed deposits? The product page of the Elite card doesn’t seem to mention it. As far as i can see currently they seem to have only listed the “SBI Advantage Plus Credit Card” against FD in their website.

Regards

I think they should be. They din’t do this transition of the elite card clearly on website.

Hi Siddharth,

Also, i think in addition to the instant platinum, ICICI also offers coral credit cards against FB which offers better rewards and privileges.

Regards

I Think Axis and HDFC are best in India. Their services are really awesome.

I think best service is provided by American Express, using since an year. Second best is Citi, using 2 CC and as per my opinion ICICI is worst, as they do not have any offer except buy one get one movie ticket, which i never used since took it. Just started with IndusInd, will see how it goes. Even SBI is better than ICICI. I’m using all of them.

HI SIR

iam intrested to deposit 20000 rupees and take credit card which bank is best

go for icici platinum card or coral card

platinum in free for the lifetime while coral in chargeable with 500+ GST

So if i take ICICI Instant Platinum Credit card against FD of 2.50 lakhs and build good CIBIL score over a year… will i be able to close FD after 1 year and keep the credit card for lifetime??

No, you have to close the card and then apply for a new one based n IT.

if i made fd today i got cc tmrrw

Immediatly ull get cc

I am student and want to take a secured credit card with a fd of 50,000₹ to build my CIBIL score by the time i come out of college

Which bank should i approach to get the beat bang for the buck including offers

As i keep seeing that HDFC offers huge cashbacks while axis bank offers 10% discount or should i go for any other bank ?

Please suggest me the best one

Thanks

HDFC is good to go Vamshi. They’re the market leader as well 🙂

Hi Siddharth,

I am NRI. Can I apply for credit card against my NRE FD In India? Usually NRIs usually can not apply for credit card for various reasons.

Awaiting for your early response.

Pradeep,

It varies from bank to bank.

Some bank still issues credit cards for NRI’s. I’m unsure about them though. Its better to talk to your bank.

Hi Siddharth,

I am planning to take a credit card on FD. My main goal is to do big shopping for home and pay them via EMIs.

Which one would be better ICICI or SBI ? Please suggest

Ananthi,

HDFC is good with offers/reward points and much more than ICICI/SBI.

Would suggest Regalia/ Diners Black.

Read reviews of both to get an idea.

Diners Black on FD. Can you tell the FD requirements? Will 4 lakhs suffice?

5L may help.

Hi Siddharth

I had applied for IndusInd credit card 2 times in a span of 6 months respectfully but both the time they have rejected without giving any valid reasons. All my documents are clear but no idea on the rejection. Is there a option of credit against fixed deposit. Please confirm. So that I can approach IndusInd bank for a credit card.

Yes, you can get based on FD as well.

Hi. Am settling my old credit card balance by 3000/month in hdfc. So obviously my credit rate is poor. Will any bank still give me secured credit card against an FD of 1 lakh, so as to improve my cibil score?

Sir,

I am stay in cuttack, odisha.I am interested to F.D Rs35000/- , can I applay credit card ? which bank provide me & how much credit limit. Thanking you.

Hi Siddarth,

M looking forward to Opt CC against FD as my CIBIL score not good. My personal chose is SBI with FD of 80K to 100K.

Pls suggest if any better option for me.

In which bank i will get instant credit card in hand or next day against fd.

Did u read the article?

For ICICI, I am unable to choose between Insta Platinum and Coral Credit Card against FD. I also have an option to go for SBI Elite. Please suggest best option between Both in ICICI and ICICI vs SBI.

And Thanks for pretty informative article. 🙂

Coral Mastercard is good, as it also has lounge access. SBI Elite of course stands above ICICI.

Hi I want cc against FD . But I want with free airport lounge access. Pls guide.

Check HDFC Diners cards Nitin.

Hello Sid,

Is axis CC against FD application is fast? Like that of ICICI?? How long to get the card and get it activated? Awaiting reply . Thanks !

It took me long time when i applied, now it should not be longer than 2~3 weeks.

Don’t be 100% sure that you can get a secured credit card by offering a fixed deposit as ‘collateral security’ against the credit card for which you are applying.

In order to get a secured credit card from SBI Card recently (in JAN 2017), I offered to place a lien on (i.e., offer as collateral security) a fixed deposit of more than INR 90,000, which I have at a branch of State Bank of India in Chennai. I completed all the credit card application paperwork as required by SBI Card.

In spite of this, it looks like my application has been declined; at least that is the information I get when I track my application, both on the SBI Card Official Website, and also when I call SBI Card’s Customer Service. It appears there is ZERO TRANSPARENCY in how these decisions are made.

I have no liabilities of any kind (no home loan, no vehicle loan, no personal loan).

Here’s an update to my previous post that SBI Card has declined my Jan 2017 application for a SECURED credit card: I found out a few minutes ago that my CIBIL TRANSUNION score is currently close to 850. I believe that a score close to 850 is a good score, but some one please correct me if I am wrong. Despite this, SBI Card has declined my application.

Thank you.

850 is indeed an awesome score. There might have been some other issue with the application. You need to check with the bank.

Hello Siddharth:

Thank you for responding. I spoke with an officer in the bank.

The preliminary information I have got is that the problem seems to be related to the method/policies that the credit card company uses to process term deposits (i.e.,fixed deposits) for lien/hold purposes. They have asked me to wait for 3-4 working days, during which they will try to find out more, and will then try to solve the problem.

Now if I contact other banks or credit card companies like Kotak Mahindra Bank, or ICICI Bank for a SECURED credit card, would they know that there has been a “denial” by the above-said credit card company? More importantly, would the “denial” negatively affect my chances of obtaining a SECURED credit card in India? I have never had any kind of account with them thus far, meaning I don’t have any relationship with them.

I would appreciate having your thoughts on this. Thanks again!

They know that you’ve applied but not “denial” as they’ll report the new card ac only after a couple of weeks.

Yes, all new applications will lower your score a bit.

Hi again Siddharth, and thanks for the prompt replies.

I still have a couple of questions:

1. I don’t understand what you mean when you say, “they’ll report the new card ac only after a couple of weeks.”. Do you mean that if a credit card is issued, then the credit card company would take a couple of weeks after issuing the credit card, to report the new credit card account to Credit Information Companies like CIBIL TransUnion?

2. About the (SECURED) ICICI Bank Instant Platinum Credit Card, is it REALLY issued instantly over the counter if the applicant satisfies all the documentation and paperwork, or are they just saying “instantly” in the sense that it will be issued much faster than the usual amount of time it takes? It seems too good to be true that a proper credit card gets issued instantly! I don’t know much about credit cards, and am learning. 🙂

Thanks again…in advance!

i think u may have applied a card within 6 months with sbi

For Mazar SAYYED:

No, I had not applied for any credit card with any company in the years of 2016 and 2015. I used to have a credit card from SBI Card, which I closed in 2015 WITHOUT having made any late-payments during the time that I held that card.

In my opinion, SBI Card has demonstrated poor transparency in handling my application of January 2017; even though I telephoned them and emailed them several times asking why they turned my application down (and I offered to rectify any shortcomings in my application), every reply from them effectively merely gave the reason as their “internal policies”.

Now I have obtained a secured credit card (Assure card) from Bank of Baroda (BOBCARDS). They processed the application much faster, and the interest rate (1.6% per month) is also noticeably more attractive.

i never file itr nor i have any account in axis bank . but i want to have a credit card from axis bank.

i have a sum of rs 25000 to fd is this possible to have a credit card in this case

Yes, you can.

Hi Sid,

I have a 20-30K to park as an FD. As you know, I already have an HDFC moneyback at the moment. I want to maintain a good relationship with a new bank. Do you have any recommendation? Is it possible to get an Amex card based on FD?

Anwar

Yes, you can get cards on FD, from Axis, ICICI suggested as you already have one with HDFC. No, Amex not possible as its not a bank in India.

I think I should go with ICICI as they instantly raise limit if we paid in advance. Also, my ICICI rejected my last credit card application. Hope I can compensate the CIBIL lose by doing this. Regarding the Amex, I was talking about the AMEX cards from the banks like this – http://www.cardexpert.in/icici-bank-coral-credit-card-review/

Is it feasible? I think maintaining relationship with Amex in this way can help in future.

Yes, you can get it, but its ICICI, you get no advantage with Amex reg. this in future.

I did some research and decided to park a little more money as FD to get a better limit. I want to spend around 35-40K / month. Shortlisted banks are SBI, HDFC, ICICI, AXIS, KOTAK and Induslnd bank. Preferably the one gave maximum limit and didn’t report the credit limit to the CIBIL (HDFC won’t do that). Also, quick processing time and good customer service.

What will be the suitable bank/ card for me?

HDFC is good to start with due to the offers they have from time to time.

If you have a FD at ICICI Bank and also have savings account then you can easily place a request online through netbanking for the Credit Card based on the FD from their service request menu. NO need to visit branch or fill any form.

My advice is try to park a FD for more than 50k then take the credit card on that basis. FD with 25k-30k will be useless.

If you have a good credit limit on the card then later you can apply with other banks on the basis of that FD card.

i have ICICI Credit Cards against Fixed Deposit, card limis 90,000, it’s good credit limit on the card then later you can apply with other banks on the basis of that card. like sbi , Citi bank

Hi,

What i want to know is These secure cards actually hep in getting un secured credit cards after a year or two? Because most people who go for secure credit cards already have settlement/written off against a old credit card or loan in most cases. So either way the banks still can dig up that old card/loan account and still deny the credit card.

Then it defeats the entire purpose of these cards. If i make 2,3 FDs against 3 secured cards will i actually get unsecured cards in a year? Even when ur CIBIL score is 800 to 900 still banks are rejecting the applications solely because of the previous settlements.

2 Yrs, 3 Cards, good usage & repayment on all every month can for sure increase trust. Just that you’ll get low limit maybe at start on unsecured cards.

I first applied for 2-3 unsecured cards at HDFC, ICICI and Kotak, all got rejected with CIBIL enquiries. My mother’s score was -1 which meant no credit ever taken. I was amused as account were almost 10+ years old with HDFC and ICICI and IT at that time was 4L but still rejected.

Then came across ICICI FD based secured card, got one for mom on a mere small FD of 25K. Got the card in 4-5 days and started using upto 50% of the limit paid in full every billing cycle. Used to pay the bill through the HDFC portal. 14 months later I got a pre approved offer from HDFC in net banking instant card. That card was generates instantly without any IT Docs, they sent an e-card on email within an hour. Based on that credit card got a Bajaj consumer loan for about 1L for new house electronics. Fast forward 24 months, I got the HDFC Card upgraded to Regalia with 3X limit, and Bajaj also pre approved for Platinum Supercard without IT Docs.

So yes a secured card does help in building and boosting score. On the basis of Regalia Credit card last week I got an SBI Prime Card. My CIBIL was 809 when I was using the secured card last year. This year due to some increased applications and a lot of smaller digital loans taken on ZestMoney My score kept on deteriorating and it is 773 now.

ZestMoney was great picked up more than 25+ loans in the last 6 months for shopping on Amazon. They provided loans in the form of Amazon Vouchers for as low as 1000. So I kept using. Recently when I checked my score noticed the enquiries for Rs.1, Rs.1000, Rs.2000 and all those small loans but they have also reported repayment behaviour in the accounts section. So my enquiries are 48 in the last three years and account opened are 55.

While cards can help build excellent scores, more than 800. Multiple credit lines and improper use can lower your score as well.

Hi siddharth

Whether my name appears in axis insta secured card or else is there any option to have my name in card.

Yes, you get the name on the card if its not issued instantly.

Any idea on RBL bank card against FD? I was thinking to get as I applied for a one and they already hit my CIBIL.

I talked with them and they need a minimum FD of 1 L and will offer 80% of that Credit limit. I ruled out.

Hi Siddharth,

i was planing to take a credit card for my sister on the basis of FD

kindly suggest me the best bank and min FD amount

I hope the article serves the purpose.

Is it possible to apply online for a secured card without having a account with them?

If I take secured card, do I still need to pay joining fees on sbi elite ?

Is there a way I can get sbi fees waived off ?

Yes, you have to, Sadly no other way.

Sir can you please suggest which bank should I choose for FD with good interest rate and credit card against FD

Is it possible to apply completely online for a secured card without having a account with them?

I doubt. ICICI may allow you to do so. Ask Phone banker.

Hi Siddarth,

I have some questions about Insta Easy Credit Card. I have it since 2014 April. I did a FD of Rs. 40,000 and received Insta Easy Card from Axis Bank.

Later on I did another FD of Rs. 80,000 for Credit Limit Enhancement. But in November, 2015 I have received a letter from Axis Bank saying that because of my payment pattern and good relation with Axis Bank, they have marked my card as free from lien and I have to no more care about the Fixed Deposits.

Now at present, Rs. 40,000 FD is free from Lien but recently Axis Bank’s Branch (My Home Branch) called me that the FD of Rs. 80,000 is matured but it is marked in lien.

I’m continuously talking with the branch over the same and they have told me there might be chances that they would free it from lien in next few days and make my card unsecured card (just like a normal card).

Now there are certain questions:

1. How can I keep the same card but have my Name Written on it instead of Insta Easy Card?

2. How can I apply for Credit Enhancement without making any further FDs.? (Note: My card will be an unsecured card).

3. My previous years and this year’s usage is in lakhs + my payment routine is like spent today, payment done today. I don’t want for the due date to come or statement to generate. (example: Rs. 1000 spent today, I would pay Rs. 1000 back again to the card via. Mobile App of Axis Bank). Is it bad habit?

4. Once my card will be turned into Unsecured Card, Can I apply for the Insta Easy Credit Card against FD again? (So that I can have two cards from Axis Bank). I need it for my use (work use). I know about Add-On but I need card on my name not Add Ons.

5. How can I ask the bank to upgrade my card to the better variant seeing my usage history, ITR or Savings Account Usage/Balance?

Thanks!

Adi,

All your qns are related to FD linked card which i’m not aware of it as they’ve changed the rules recently.

To have the name on your card, ask for a replacement, the same way i got it long time back.

Sid, Whenever I ask for the replacement, the new card comes with Insta Easy Written on it. What is the procedure you have followed?

Initially they issued Gold card which was then upgraded to this variant and so they replaced themselves to this card with a name on it.

In your case, maybe you need to request via email. Give it a try, though, am not sure how it works these days.

What do you mean by upgraded to this varient and so they replaced themselves to this card with a name on it?

Could you please tell me what is “this” here?

When they upgraded, you still had fd against the cc or your card was converted into unsecured card?

Can we get another cc against fd once our current card (which was once secured card, against fd) is made unsecured?

“this” i mean my card displayed in article. Rest qns you might need to ask Axis. Generally Axis don’t allow 2 cards.

Sid, I applied for SBI Simply Save Advantage card (secured) on the basis of FD 1 Lakh through bank branch. Strangely, my application was rejected. Any idea why? Do you think I can email SBI cards customer service and ask them for a reason? If there was some discrepancy in documents, I’m sure it can be corrected.

How soon before I can place an application again? Rejected card application would have negative impact on my CIBIL score, so I want to be sure. Do you think applying online using website is better than applying through branch.

Thanks in advance!

Maybe there is some issue on your CIBIL. SBI checks CIBIL even for FD cards as i noticed recently.

Hi, There is no more a reply option to our conversation happening above. So I am making this new one.

Current Situation: According to the Axis Bank Branch, there is no more Fixed Deposit linked to my Card and my card is marked as unsecured card now (I’m myself not sure though about this).

I have checked the FDs in my Net Banking and none of them has Lien marked on them anymore.

1. When they issued you the Gold Card, that was against FD or without FD?

2. When you had replaced your card on which your name was written, then also you had it against FD?

3. At any point did Axis Bank sent you a letter saying your FD are free from lien now?

P.S.: You can read my first comment if you feel confused.

Thanks

Hi Adi,

Good to see your post!

Is there any further update from Axis on your card? I also hold Insta easy card from Axis since 2.5 years. Can you kindly tell us what special did you do with your Card and Axis bank that you got such a nice offer (FD free card).

Thanks,

SKG

Man! SBI rejected secured FD card ~ SBI Unnati~ @ CIBIL score of 840 & credit history of 14 years!!! WTF?!

Check for reason!

FOR SHIVI:

Did SBI Card clearly tell you why they rejected your application?

They rejected my application as well, and gave only the reason “internal policies” every time I asked them what the problem with my application was (even though I have a TransUnion CIBIIL score of almost 850).

Now I have obtained a secured credit card (Assure card) from Bank of Baroda (BOBCARDS). They processed the application much more quickly, and the interest rate (1.6% per month) is also noticeably more attractive.

Their reason for rejection was: – I held a simply save unsecured credit card; they rejected secured Unnati credit card because “I cannot hold more than one credit card as per their internal policies”. So i closed simply save and got unnati against FD.. then SBI Prime came out and they rejected unsecured Prime as i held secured unnati! So i had to closed Unnati to get Prime! LoL!

AND now SBI and ICICI etc. check (hard pull/enquiry) CIBIL score for Secured (against FDs) as well! Loads of enquiries on my 2017 CIBIL report for applying for Secured credit card with SBI, ICICI, Axis and Yes Bank! Even a “Pre-Approved” credit card is checked for CIBIL related information if you click and proceed to accept it on the offers list.

Hi Siddharth, I am self-employeed freelancer whose last year IT returns was 3.55L and looking at an estimated ITR of 6L this year. I visitied HDFC after reading this article in order to apply for a secured credit card but I was told that the option no longer exsists, The manager also said the same. This will be my first credit card. What are my options in getting hold of one? Thank you.

Banking with HDFC/Axis? if so you can get one based on transactions + ITR.

Banking with icici, but their card offerings are miles behind hdfc. Should I just go with icici and change over once I get a decent credit score?

U can start with ICICI and then go for HDFC. If spends are high, you can consider even SBI FD based cards

Dear Siddharth

I am using a SBI fbb card but i also want a SBI simple click it is possible to take both card want a expert advise

thank

U can get one fd based and one IT based.

i am a shopkeeper where all my customer pay electricity bills by giving extra 5 rupees i m looking for an fd card in which utility bill payment give cash back please suggest a was thinking lf sbi…

SBI Prime card.. it gives u 5% as value back for all bills being auto paid.. am not sure if you get this as a secured card though..

Which are the top 3 banks for the fd of 1.25 lakh.

Read the article?

Dear sir,

my credit cibil score 550 +, in this case i have to go the secured credit card, when the cibil score should be increase, if any time limit please suggest

6 months to 1 year+

What is the best credit card to buy against FD, if my sole intention is to increase Cibil score. And FD amount is minimum 20000Rupees

Read the article… I do feel the author has explained a lot

Go for HDFC , good security future.

Hi sir,

I am intreated at cc,but I have don’t yet now

So I can choose option Fd and I intreated at

Andhrabank, how much minimum FD against

Credit card option Please reply me sir

ICICI (minimum 20 K, Coral or Instant, no savings account needed)

Yes Bank( Minimum 50K, Prosperity reward plus, saving account Minimum Balance requirement becomes nil on FD of 50K)

Indusind ( 60K, no savings account needed)

RBL ( 1 Lakh, no savings account needed).

Axis (Install Easy)

Kotak ( Aqua Gold)

SBI

BoB

The HDFC branch near my place denied even the existence of credit card against FD option. The manager said the option is only for raising credit limit. She started asking uncomfortable questions on whether I was employed , filing ITR etc.

Axis : Was very welcoming and explained the details well. 80% credit limit but opening an account was necessary which means another 10K locked up with them.

Yet to contact Yes bank and ICICI bank. Kotak and Indusind not considered as offers on Amazon , Flipkart are very less with them.

do we require to have saving account with bank to get credit card against fixed deposit

thanks

There are other cards against FD which are better than these. But first about these cards. All of the banks mentioned insist on opening a savings account with them. Axis and ICICI insist on having your signature match with pan card. in Axis bank you cannot open a FD account also. It takes more than a week. You have not mentioned annual charges etc for these cards.

Hi Siddharth ,

As of tdy my cibil is 550 and there is write off . Can u suggest me how to increase my cibil and normalise my record . I have plans of home loan in near future.. Kindly suggest

you have to rebuild your credit history , lets say by paying all your existing loans \ credit card bills on time. But this will definitely take time. I doubt with such low score you will get Home Loan soon.

Hi

I have a query, is it possible to get a unsecured card if there is an existing secured card?

Possible with some banks, like SBI.

Definitely possible. Icici allows you to have both secured and unsecured card. Sbi also.

Hi Siddharth

If i apply for a credit card based on FD. Then how much time it will take to get the card.

Varies from bank to bank. Icici will give you the card instantly from the branch in matter of minutes as soon as you book the FD. For SBI it will take around 10-15 days.other banks also it will take around 1-2 weeks. Once it took more than a month for axis to approve the card against my fd.

dear siddharth

i am planing to appy for credit card against FD

my yearly spent on credit card is 90k to 1 lakh.

preference

1 air ticket benefit

2 onlone purchase benefit

3 no cost emi

4 maximum expiry time on reward

5 balance between reward and annual fee

fast processing of card

From your question I think most of your spends will be online. If so, you may opt for SBI SimplyCLICK card against FD.

What is no cost emi?

I would like to get information on same please.

Thanks in advance.

In no cost emi the applicable interest amount is given as discount by the merchant upfront while billing so that the total cost of purchase remains the same without any extra interest burden. You need to pay applicable gst though.

For example- you buy a smartphone from amazon worth 10000/- from amazon under 6months of no cost emi offer. Say the applicable interest for 10k for 6months is 500/-. Now amazon will give you discount of the interest amount and your card will be charged for 9500 and then your bank will add 500 to 9500 to make it 10k and then convert it into emi. So that you are not paying extra interest. Though you need to pay gst on interest amount in this case 90 rupees for 500 rupees interest.

Hope this helps.

Narrowed down Indusind, SBI and City Union Bank.

May I know whom to contact for the SBI cards . None of the SBI branches have a counter for SBI cards and are not aware of the FD option .

Ask the SBI Branch Manager if they have a credit card agent/representative. If not, then probably your city/town is still out of reach for credit card issuance. Easiest is to take from ICICI bank.

Hi, will taking cc against FD & manaing it properly will help in getting regular cc in future from same or any other bank…?

Yeah. After 1 or 2 years of its (CC against FD) usage, you can apply for any other card from some other bank at your place of residence. HDFC issues cards without much hassle.

Axis insta credit card is useless. I just cancelled it. The card doesn’t even have our names. Even renewed card has only insta easy card and not our name. If we go to any merchant outlets, the slip doesn’t print our name. It prints only insta easy card. What is the use if nothing of the card shows our name anywhere. I think a debit card can be without a name but not a credit card. It is better to opt for other bank credit cards and not axis bank. Useless bank ever

Chill dude. You need to call up the Axis Bank/any bank customer care credit card department and ask you to send a new card displaying your name.

How long does it take for you to get the card after you have done your FD?

Just a heads up – ICICI Bank is checking CIBIL even for taking credit card against FD! First got updated about it in 2017 March in my hometown, now reports coming in from elsewhere too.

Hi Mr. siddharth, past 4 yrs I am using sbi advantage plus card against my FD of 25k, But now I would like to Deposit more than 1L, so please guide me which bank credit card will be best. Thank you in Advance.

Sir i have 20k and i need a credit card… icici or axis

My cibil score is nothing like maybe 1, becz didnt taken a loan or anything

MY PURPOSE IS TO INCREASE MY CIBIL SCORE, thats it

Hi I want credit card to hdfc against FD,my FD limit one lakh its possible?what type of card available, please help us

You can take Regalia. They will give you up to 90 percent of yr FD limit.

Regalia is not issued against 1 Lakh FD. It requires a minimum of 5 Lakhs

Which bank allows increase in CC limit issued against FD OF 1 LAKH?

You cannot increase the credit card limit for cards against FD. The only thing you can do is to make a new FD with higher amount & then apply for a fresh card accordingly.

What is the minimum FD amount for Hdfc Bank Regalia and Regalia first card ?

My friend got DCB on Rs.4L FD.

Hi Prashant, Can you give a little details. When and How ? For my wife they are asking for 8L fd and saying max they can stretch is 6L since I am imperia customer.

i have a scured axis bak credit card against my FD of 40k.bank has given me limit of 32k on behalf of my FD ..so my query is ,can i increase the credit limit of my secured credit card

Hi, Why SBI cards are repeated with same name and same benefits by adding ‘Advantage’ in their name?

Eg: SBI Card Elite – SBI Card Elite Advantage, SimplySAVE SBI Card – SimplySAVE Advantage SBI Card, etc.,

“Advantage” Cards are FD based cards.

Hi Siddharth, Thanks for the reply.

May i know the FD amount needed for the following cards?

1. SBI Card Elite Advantage

2. SimplySAVE Advantage SBI Card

3. SimplyCLICK Advantage SBI Card

4. SBI Card PRIME Advantage

Minimum FD amount required for Simply Click & Simply Save Card is 20000 & card limit is 70%. So you can keep FD as per your limit requirement.

Simply click and simply save are issued against 25k+ fd. Sbi prime and sbi elite are issued against 50k+ fd. It also varies from branch to branch.

Hello,

I had two small loans in past (2008) which i defaulted but in 2015 i paid the full amount. Recently i checked my cibil report and there was one loan amount of ₹ 120000 was showing written off on one credit card. I never had any credit card in past. I researched and found that my brother got made an add on card for me in 2005 but i never used it.

Unfortunately My brother had a huge loss 10 years back and became defaulter on these cards.

How do i improve my cibil profile? Please suggest

Sir

Myself Joy Singh want to apply for a credit card against a fixed deposit of 50000/- .

Which credit card should I apply .

Thanks

Joy.

Hello Sir,

Due to some financial circumstances in 2014, I settled a PL and Credit Card account from HDFC Bank. Now I want an HDFC Credit Card against 30000 Fixed Deposit. Is it possible that HDFC Bank will provide me Credit Card and what will be the process.

My cibil score is 806. Currently I have Axis Bank Neo, SBI Prime, RBL Titanium and ICICI Credit Card.

Joy Singh – whichever card you apply for, check the annual fees before applying. Try to LTF cards, or at least the card where renewal fees is waived off depending on how much you can spend.

Most important.

I think union bank of india provides a best one named usecure card which is applicable low interest rate and a zero annual fee for lifetime. You should include that among first five.

I have applied for secured SBI credit card against FDR in my home Branch where I have more than RS Ten Lacs in saving account and regular pension more than RS 30000 pm since I am 70 + Retired/pensioner but SBI has declined me credit card with the reasons best known to Bank.,

I want to apply for sbi cards vistara prime on my fd of 80000 whether sbi provid this card on fd .. sir n the same for axis vistara signature fd of 80000

Just wanted to know whther they give this card on fd

I would like to apply secure card around 30k,i hv issue with icici,hdfc,banks can suggest me which best one among all. can i take secured card in hdfc and icici bank as well

At what amount of FD can I get HDFC Diners “Club Miles” card ?

Plz guide.

Regards.

Dear sir,

I have opened my wife women’s saving account in HDFC and trying to get Credit card in HDFC, every times it is declined/not approved while her credit score is 809. Could you please tell me the reason for rejection and when she will be eligible for credit card easily.

If I have done 20000 on kotak a/c then I will get cc from kotak bank

Hi, Is UNION BANK Usecure card any better with a 5lac FD?