ICICI has recently made changes to existing reward structure on their gemstone credit cards collection that includes Coral, Rubyx & Sapphiro range of cards. I see the changes to be more positive with the milestone benefits. The changes will get into effect from Oct 7th, 2017 and here is everything you need to know.

Changes to ICICI Coral, Rubyx & Sapphiro Credit Cards from Oct 7th 2017

ICICI Rubyx Credit Card:

- Joining Fee: Rs.3,000+GST

- Welcome Benefit: Rs.5000 worth of Travel, Shopping & Dining vouchers.

- Annual Fee: Rs.2,000+GST – waived off if you spend more than Rs.3,00,000 in the previous year.

-

Milestone Rewards program: Get 3,000 PAYBACK points on spending Rs. 3,00,000 on your card and 1,500 PAYBACK points each time you cross Rs. 1,00,000 spend thereafter in an anniversary year; maximum of 15,000 PAYBACK points per year

- BookMyShow Offer: Buy 1 Get 1 offer every month on movie tickets worth up to Rs. 300 on BookMyShow on first serve first come basis.

- Golf: 2 complimentary rounds/ lessons of golf every calendar month if the total retail spends on your card is equal to or more than Rs. 50,000 in the previous calendar month.

- Introduction of Railway Lounge Access: In addition to the existing Airport Lounge Programme, introduction of 2 complimentary railway lounge visits per quarter and access will be applicable only for primary cardholders.

The USP of this card is now railway lounge access capability. The only card of its kind in India to give access to Railway executive lounges. Its currently located only in Delhi & Jaipur. More on it in a separate article shortly.

Apart from that, on availing milestone rewards, you save as good as ~1% Reward rate on Amex variant. If you use the railway lounge access benefit, its sure worth holding one.

Coral credit card also has similar railway lounge access benefit (1/qtr).

ICICI Sapphiro Credit Card:

- Joining Fee: Rs.6,500+GST

- Welcome Benefit: Rs.10,000 worth of Travel, Shopping & Dining vouchers.

- Annual Fee: Rs.3,500+GST – waived off if you spend more than Rs.6,00,000 in the previous year.

- Milestone Rewards program: Get 4,000 PAYBACK points on spending Rs. 4,00,000 on your card and 2,000 PAYBACK points each time you cross Rs. 1,00,000 spend thereafter in an anniversary year; maximum of 20,000 PAYBACK points per year

- Airport lounge: 2 international airport lounge visits and 2 spa sessions at selected airports in India every year, through complimentary DragonPass membership. You will receive the complimentary DragonPass Membership Card only after generating two transactions on the ICICI Bank Sapphiro Credit Card within 45 days of the card set-up date.

- BookMyShow offer: Get up to 2 complimentary tickets worth Rs. 500 twice every month, on any event tickets, in addition to movie tickets under BookMyShow

- Golf: 4 complimentary rounds/ lessons of golf every calendar month if the total retail spends on your card is equal to or more than Rs. 50,000 in the previous calendar month

Apart from ability to save close to ~1.2% on Amex variant by availing all milestone rewards, we’ve a major differentiating benefit on ICICI Sapphiro cards compared to other cards in industry. It is,

Airport Lounge Access through DragonPass, instead of the commonly issued PriorityPass by rest of the credit card issuers. This gives you access to some lounges that are not under Priority pass Programme. You may find it hard to spot such lounges, but they do exist as I noticed it during my trip to Indonesia.

For ex, Dragon Pass allows you to access T/G lounge in Bali, Indonesia Airport while Priority Pass doesn’t. This lounge is usually reserved for business/first class for some airlines, so you get better atmosphere here.

Also, as you see, they say that you can avail complimentary “spa” sessions as well in India. On contacting ICICI on that, here’s what i was said: The complimentary spa session can be availed by displaying the DragonPass – ICICI Bank co-branded Membership Card. We may know more about it in coming months on how it actually works.

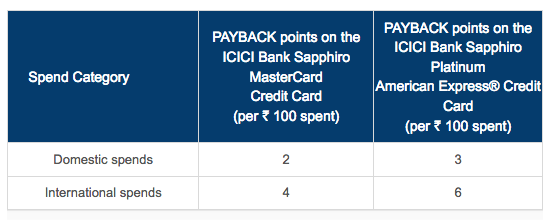

Coming to reward points, earn rate on both sapphiro/rubyx cards is same as above. Good for domestic spends. You loose a LOT on international spends, you can be better off with other credit cards for international transactions.

Coming to reward points, earn rate on both sapphiro/rubyx cards is same as above. Good for domestic spends. You loose a LOT on international spends, you can be better off with other credit cards for international transactions.

ICICI might need to shell out atleast ~15 Payback points to compete with others, considering ICICI charges 3.5%+GST as markup Fee on Intl txns while most other premium cards charges 2% or less. Here’s the whole list of 7 Best Credit Cards for International transactions with low markup fees and better reward rate.

FYI: Yes, Everyone is wondering what the “Travel, Shopping & Dining vouchers” refers to. Will update the article once i have more info on that.

Bottom Line:

Finally ICICI decided to give importance to their premium card which was hanging around without any importance for quite a time. I believe these changes should help them hold their #3 position in the market to certain extent. Though, their premium card – Sapphiro is still nowhere close to the reward rates offered by other bank premium credit cards.

I’m planning to have hands on with Sapphiro in coming days, just for the Dragon Pass membership experience. What’s your thought on above changes? Feel free to share your views in comments below.

Is it only for Coral or includes HPCL Coral also

Its only for Coral. These benefits are not applicable for co-branded cards like HP/Jet.

Railway Lounge ….. Haven’t tried this out ever..

Which station do these exists and what are the facilities??

Delhi/Jaipur for now, as i mentioned in the article. More to come, but will take years!!

It’s there in Agra too I guess. But the facilities are only free wi-fi and unlimited tea/coffee from a Nescafe machine. The food is chargeable and of IRCTC standard. Best part is that literally no one uses this facility (especially in Jaipur) as there is a Rs. 100 entry fee otherwise for 2 hours. So you kinda get the whole space to yourself.

Delhi and Visakhapatnam at present.

Any updates for coral credit card? It also comes in their gemstone collection.

Yes, there is, as i mentioned in the article. But nothing much attractive You can check it on bank’s page.

Sid, are any of the gemstone collection cards available on secured option (i.e., against FD)? I’ve been reading several mentions but not willing to go with yet another unsecured card this year. Or do ICICI limit secured cards to their insta card?

I doubt on that as i haven’t seen any of their gemstone cards on FD linked, maybe because its not worth it, in the past 🙂

Ideally secured/unsecured doesn’t matter much as i recently noticed most banks still do CIBIL hardpull even on secured cards.

Hmm, let me ask somebody at the branch so we can know.

You’re right about the CIBIL hardpull. My cousin got a Prime card on FD, not only there is a hard request on CIBIL by SBI, they did not put the FD as collateral and it’s value in CIBIL. So technically, as far as CIBIL is concerned, it is an unsecured debt with a hardpull.

Yes, that’s how it works with most banks. Its not possible to find whether its secured/unsecured through CIBIL. Most banks don’t disclose the limit to CIBIL as well. Its kind of unregulated system.

Dear Siddharth

Any changes to the Jet cards?

No, that stay same Anoop.

Hi Sid

Good to hear finally ICICI is waking up to competition.

And again thanks for ur amazing inputs thru thus blog.

But can u put light into the VISA variant of Rubyx/Sapphiro card, are there any benefits added to them also? I am holding the Rubyx Visa variant since many years and accumulated good points thru it but have stopped using it after Yes Exclusive and Amex Platinum were issued to me.

Yes, all these are applicable to Visa variants too. Just that Amex variant will get you better rewards.

Yes, You should never touch Rubyx when you have YES Exclusive. Its in no way near to it 🙂

Seems ICICI has changed its reward program for VISA variant to:

2 reward points for every 100 rupees spent domestically.

4 reward points for every 100 rupees spent internationally.

And they have added a milestone program:

->3000 points on spending ₹3,00,000

->1500 points each time you cross ₹1,00,000

->Maximum of 15000 points per year.

These Handpicked reward points are equivalent to Rs. 1000 for 1250-1500 points (Shoppers Stop voucher for 1250 points & Amazon voucher for 1500 points).

Also they have changed the Bookmyshow 1+1 value to Rs. 300 for Rubyx variant.

A little sad to see that before they used to give 4 reward points for every 100 rupees spent on selected categories, now its 2 reward points fo all categories. But now they have added milestone program.

how is ICICI customer care Service, interested in ICICI Sapphiro card , how good is ICICI bank in increasing in credit limit ?

Atlast, some light is being thrown on their premium cards after they had been put to dark by the limelight on other bank cards!!

They’re supposed to act, else they’ll loose the position to Yesbank 🙂

Sid, you mentioned “I’m planning to have hands on with Sapphiro in coming days”. I trust you are already holding Jet Sapphiro. Are you planning to give it up or ICICI allows holding multiple variants of top tier cards?

Yes, i’m thinking to swap Jet Sapphiro for the plain one.

But siddharth jet miles are better than payback points. Right?

I really didn’t like the concept of payback points. Although there are many ways to earn it, its conversion rate is peanuts.

Jet miles got 2 or 3 years validity. So even if you don’t travel often, you can accumulate it for yearly business class travel.

Mostly yes, JPMiles are always better. But if you play in high numbers, diversification is good 🙂

It seems like ICICI heard your request. Now they have replaced travel and shopping vouchers worth Rs. 10000 as the joining bonus instead of kindle. Please check ICICI website

Yes Anoop, it seems so. Surprisingly, they even called me a day back requesting to update the article with new features, which i’ll be doing in sometime.

Glad to see banks being responsive to the blog 🙂

Sid,

Great , this blog reached to a level that you can dictate the features to the Bank.

Yes. Indeed… They are seeing our discussions. Good for all of us, if they did take all these in a good sense.

Couldnt find any details about the vouchers, useless if these are discount vouchers.

Plus changes made to BMS offers have still not been activated even though almost 2 weeks have passed since the planned date for change of features.

But they have not specified which vouchers they are giving. The mastercard variant of Sapphiro now offers 4 lounge visits per quarter. Seems really attractive

I’ve asked them, but it seems they’ll take some time to respond on that.

Gr8 to see bank following ur posts to know its current market position. It definitely is a feat…congrats !!!

That’s a feat achieved I would say. Congo!

So we have a medium here to directly reach card issuers (at least ICICI Bank for sure)

Going to use the Dragon Pass for the first time tomorrow for a complimentary spa session at Bangalore airport. Will post my feedback shortly after.

I spoke to ICICI helpline and they said that complimentary lounge access and spa session are counted from calendar year, i.e Jan to Dec. Good thing for me that I just received the card at beginning of this month and i will be utilising it right away. it will renewed by Jan again 🙂

That’s great. Keep us updated.

Meanwhile, what kind of 10k vouchers was given as welcome bonus?

Hey Sid,

Just used the dragonpass for the complimentary spa access at O2 spa in Bangalore airport. As I had expected, the attendants were clueless about dragonpass as I was probably the first user in that spa 🙂 Anyways, she quickly looked up on her PC, then called her supervisor and finally told me that I could take any of short therapies like back/neck massage or foot massage for 30 mins. I took a foot massage and it was great. This is the best you can get when it’s free. 🙂

The strange thing was that dragonpass was not accepted at AGL lounge in Bangalore airport even though it is listed on the ICICI website. I will have to report it to the bank. I anyways got the access with my DCB.

I have ICICI Jet Sapphiro and so the bonus was 10k jpmiles . I guess you were referring 10k vouchers on the normal Sapphiro which I don’t have .

Great man!

I tried to apply for Dragonpass on jet Sapphiro but it seems only newly issued cards are eligible fro the same.

Hey sid,

To get dragonpaas you just have to ask bank for replacement of priority pass for any reason like lost, damaged etc and they will send you new dragonpass without any fees. I recently got dragonpass within a day of calling customer care 🙂

I have ICICI JET Sapphiro Visa Amex dual card.

Hope this helps

I tried it and was said they’ll revert in 2-3 days.

Brilliant idea though, coz when i asked dragon pass directly, i was said that it cannot be issued to old cards – comes the answer from their supervisor.

Hi Siddharth,

Does the maximum rewards limit apply only for the milestone rewards or does it apply for the total rewards?

For eg: for Sapphiro card the maximum limit is mentioned as 20k points. If I spend 8lakhs in a year; under milestone rewards, I’ll be getting 12k points (4k + 4*2k). As normal reward points, I would be getting around 16k points (2 points for every Rs 100). So, the total comes out to 28k points. So, would I get the entire 28k points or would I get only 20k points?

I read the icici coral credit cards are giving 50% extra rewards on online shopping. Can you elucidate on that. Does that mean I get benefits on shopping at amazon?

Hi Siddharth,

Recently got offer on my ICICI account regarding issuance of LTF Sapphiro credit card (Amex+master card variant) which I grabbed it immediately. Also, Dragon pass is also issued the very next day. I am eager to use the complimentary spa session in my very next trip.

LTF is awesome and how?

Even I got LTF sapphiro credit card 🙂

I have salary account with icici and through the mobile app, we can check for preapproved credit card offers. for me it showed LTF sapphiro credit card and grabbed it immediately.

And it looks like 8 domestic lounge per quarter. 4 via master card and 4 via amex card.

i am using it only to book bookmyshow tickets. i get 2 tickets free every month 🙂

Siddharth

How to increase credit limits with ICICI cards , they are not giving any offer to increase credit limits, did you success to increase credit limits of your icici card ?

A call should do. But they did only after 12 months. They ask for papers too at times.

Got the offer in netbanking section…earlier I was offered LTF coral CC which I didn’t took…few months later I got this LTF offer on Sapphiro. Advantage is that my account is now under their wealth management section and customer care is just a call away (without any IVR). Plus the credit limit in this card is pretty decent.

Guys anyone paid renewal fee? They are not at all waiving the renewal fee for me even after good amount of spent on the card previous year.

I hold LTF saphhiro card which I got as I have salary account in ICICI. But they have not given any dragon or priority pass with it. Are there any additional charges to get these lounge pass.

No additional charges for membership to these.

Recently used Dragon Pass at “Heaven on Earth” spa @ Goa Airport. Wonderful experience. Had a “Foot Reflexology” massage for 30 mins complimentary with the Dragon Pass which otherways is worth Rs. 2450 /- including taxes. Other 2 options – Neck & Shoulder and Back massage for 30 mins were also available. The receipt from the swipe terminal mentions the number of remaining free spa visits & other transaction details. There is no compulsion as to who takes the spa therapy. Even your spouse or friend can take the therapy instead of you. This is one among the reasons mentioned for paying the renewal fees for Sapphiro Cards. Spa visits is something unique benefit which no other card has. Also, surprisingly, the Port Lounge, Goa was shut down. May be some renovation going on. There’s a lot renovation going on at Goa Airport.

I have ICICI Rubyx card which I used to my international spend and I get 1.5% reward rate. Which card is best for international spend where I can get the maximum reward rate?

I have ICICI wealth management saving account and ltf coral credit card. Though I have wealth management saving account my nrv with bank is not very high.

Is there any way to upgrade my coral cc to ltf Rubyx or Sapphiro.

Can anyone pls share the fuel benefits on rybyx amex credit card. Thank u

I received my ICICI card sometime back and have not used it till now because of which I received this offer on email and SMS to get me started. Can any existing ICICI customer give an idea as to what exactly this offer means? As in will it be discount coupons or gift vouchers as the link does not share any details and also does not give any clarity on which variant of Rubyx is eligible for this? Is it worthwhile to do transactions for this offer or rather give it a pass to receive something better in the future?

“Dear Customer, use ICICI Bank Credit Card to do 3 or more transactions this month and get exclusive discounts up to Rs. 3000 on Yatra, Swiggy, Spykar & more. Hurry, avail the offer now! Details at goo.gl/fuet5W . T&C apply.”

Hi all,

I used to have Jet sapphiro dual cards with the credit limit of Rs.50,000/- since September 2018. Later, I requested ICICI to change my card. I was offered normal sapphiro dual cards LTF. I was told to send salary slips, if I wanted to increase the limit. I sent the three months salary slips.( my salary is only Rs. 50,000/- a month). They increased the limit to Rs.80,000/-. To my surprise, the limit was increased to Rs.5,10,000/- within a week. The limit was increased two times within 15 days. Thank you ICICI.

To whom did you send the salary slips?

As far as I know, ICICI doesn’t issue sapphiro credit cards with anything less than 175000 to 200000 credit limit. Maybe he got lucky.

It’s not necessarily be a luck! I was having ICICI cards since 2005. Till Mar this year, I was having a paltry 92K limit. Made many unsuccessful mails, calls to raise my limit (not to mention, also being a Privilege Banking customer). Then in April, it was raised to 2L. To my biggest surprise, last month received an offer message to increase it to 8.15L, which I did immediately.

Last month icici increased my limit from 25k to 9.6lakh for amazon card.

I did not send any documents to them.

@Gautam

Ohh.. that’s a huge LE

Congrats..

Thanks Praveen

I think this was triggered because I have same limit on my hdfc black card.

@Gautam

Did u shared ur HDFC card statement with ICICI somehow ?

How did ICICI know ur limit on black ?

Which Method do you apply for limit increase request?

Il be writing a full review of my icici sapphiro card pretty soon along with pics of welcome vouchers original packaging etc pretty soon. Every month im literally accumulating 2000 to 3000 points which I then use for petrol refilling at hpcl pumps at 2000p @ rs500 ratio. Sometimes even more. At this rate i save more than 6000rupees on petrol alone and also i manage to get the 3500+gst reversed after spending 6 lakh last year. I really love this card and its my primary one. I was offered emralde but chose to stick with it as amex only emralde has low acceptance in nagpur and outside also. So better to have the mastercard variant as sapphiro is a dual variant one unlike emralde.

Siddharth, I want to let u know that from 15 october 2019 onwards icici..rbl and axis bank no longer have ties with mastercard and they are operating their own lounge access system or program. I called mastercard toll free 18001026263 and got the info from there..u cant check the available lounge access on that number for these three banks anymore. But lounge access will continue as usual.

Interesting Info, thanks for reporting the same. Have also checked with Dreamfolks and was said they’ll have a way to check the available lounge access shortly.

Hi.

im a complete noob when it comes to credit cards. i have been offered ICICI Saphiro Credit Card without joining fee or annual fee ie lifetime free.

Does it mean that i dont ever have to pay any fee? or will it depend on my spends?

If I dont use the card for a year or more, Do i need to pay any fee?

thanks in advance

No you would not need to pay any fees under whatever circumstances

Yes. LTF means no fee every year.

The members who got this card LTF kindly throw some light on how to get it for free. My salary account is in HDFC but I can shift that to ICICI if that helps in getting the LTF saphhiro offer. I already have 10+ lacs FD in icici.

You need 2lakhs take home salary credited to your ICICI account to get it LTF. This is what my RM told.

I get around 1.7 lacs net pay per month but ICICI has issued Sapphiro LTF card for me

I just got LTF Rubyx Combo card without any document, just on my saving account which is just a normal gold account without any FD. On Receipt of this two different variant card i wrote them email to confirm about the LTF since the same was not mentioned on welcome letter. Then i got reply and call to confirm that it is LTF

Thanks Amit.

Same case with me. The letter came with the credit cards say that the joining fee and annual fee is as per “welcome email”, but I couldn’t find the welcome email. However it was the bank representative who had called and helped me with the online application, wrt to my savings account, and he said it is life time free.

I’ll give them a call if the welcome email is still missing after a couple of days.

Hopeful to see more rail lounges come up in future.

However for me the icici payback rewards are worthless system as they charge redemption fees, which no other entity charges.

ICICI has updated the conditions for domestic lounge access on Saphiro and Rubyx. Access is now linked to a minimum spend of Rs.5000 in previous quarter and the number of access is shared between dual cards. For Saphiro : 4 complimentary access per quarter to select airport lounges in India, two each on Mastercard and American Express variants by spending minimum of Rs 5,000 or above in a calendar quarter on your ICICI Bank Sapphiro Credit Card to avail this facility in the next calendar quarter.

This compulsion of 5000 each quarter is very bad move from icici. Is this applicable on its all cards for lounge access?

Yes, now it is applicable.

What do we get post paying the annual fee for second year in sapphiro card ? Any reward points or benefits ? Please let me know

No renewal benefits.