Important Update: YesBank is unstable as a bank and hence their credit cards are no longer suggested for primary/secondary usage. Kindly update your credit card strategy accordingly. Here are some of the other best credit cards in India to choose from.

This is a review by our reader Manish R Khetwani who recently got hands on Yes First Preferred Credit Card. Here’s another latest review of Yes First Preferred Card done by Siddharth.

Yes Bank recently launched its own Credit Card portfolio (earlier they used to offer Amex Co-branded Cards), the last of the major Private Sector banks to do so. They have 7 variants (2 under the Yes First & 5 under the Yes prosperity proposition). The best among them is the Yes First Preferred Card reviewed below. They also offer the Yes First Exclusive Card, but as the name suggests it is for only the top few.

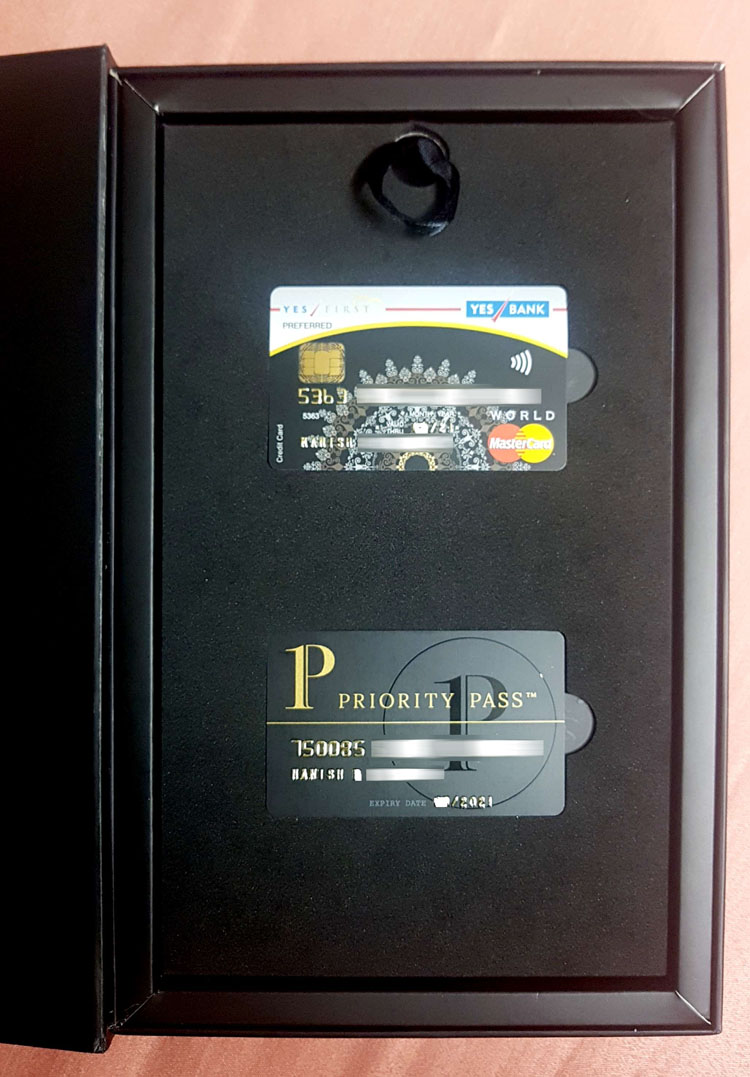

I recently applied for the Preferred Card, and the Card along with the Priority Pass was delivered in one of the best packing I have seen for any Credit Card (ScreenShot Attached). The name/number print embossing on the Card is of very good quality, and probably would not get worn out as easily as the print embossing on some other cards.

Reward Points on Yes First Preferred Credit Card

The Yes Bank Preferred Card offers 8 points for every Rs. 100/- spent. Considering the reward point value (1 RP = 0.25), it works out to 2% savings on all card spends (Except fuel, where you get fuel surcharge waiver), which puts it at par with HDFC Regalia/ Diners Premium. Also a milestone feature of 20000 RPs on spends of Rs. 7.5 Lakhs in a year, which works out to a saving rate of approx. 2.7% for spends of Rs. 7.5 Lakhs

Interest Rate & FCY Markup Fee

The distinguishing feature of this card is the lowest interest rate of 1.2 % per month (14.40% annually) on revolving balances for Yes Bank Customers. For non-bank customers interest rate is 1.99% per month (23.88% annually. Also a preferential Foreign currency mark-up fee of 1.75% on all international transactions, which is again the lowest in the industry (compared to the general average of 3.5% except for a few top HDFC Cards).

Lounge Access

Complimentary priority pass with 4 complimentary lounge access in a calendar year, and complimentary access (3 per quarter) for the MasterCard Lounge access programme.

Other features

Contactless technology (NFC), Golf benefits, 25% discount on movie ticket bookings on BookMyShow (capped at Rs. 250 per month), Rewards Portal for booking flights, hotels & movies), Concierge Services & Insurance Coverage.

Joining / Renewal Fee

Joining rewards of 15,000 Reward Points against fee of Rs. 2,500 in the first year and Rs. 2,500 Renewal fee which is compensated by 10,000 Reward Points from the second year onwards. However, joining fee is waived for the 1st year for applications upto Oct. 30th 2016.

Note: You can apply for this credit card through “Card on Card” basis for which you need 3L Limit on your other credit card & the card should be minimum 12 months old.

Pros & Cons

Pros: Best for those who revolve balances & spend on Foreign Currency Transaction

Cons: As recently introduced, still to launch its mobile interface for cards

Cardexpert Rating: 4.5/5 [yasr_overall_rating]

What are the requirements to get a ( any ) credit card from Yes Bank ?

The eligibility for the various variants are mentioned on the website with Income requirements varying from Rs. 5.5 Lakhs for the lowest variant to Rs. 50 Lakhs for the Yes First Exclusive Card. As a limited period offer, all Yes Prosperity Cards are being offered life time free, and first year fee waiver for the Yes First Preferred card.

That’s indeed great packing, not something you see often in Indian cards.

I couldn’t find anything on cards being Life Time Free on the website. Any link? I’m planning to do a card-to-card.

For Card on Card,

you need 3L Limit on your other credit card & the card should be minimum 12 months old.

I have an Infinia and my wife has an add on Infinia. Will she be eligible for Yes Preffered/Exclusive via card on card offer? And how does one apply for card on card?

How Much Is The Max Credit Limit Anyone Has Seen On Yes First Preferred Credit Card?

This card got devalued today

Only use is lounge access

Plus limit issued is only 10% of the card submitted while applying

1.Eligibility for this card

2.if u r apply card to card Base for this card

Most banks should be fine to issue to the card if you can convince the manager about your net worth or simply by depositing few Lakhs 😉

Siddharth, I agree with you that banks prefer issuing cards to their customers especially if you have a good relationship with the bank.

The eligibility for this Card (Preferred) is mentioned as Rs. 18 lakhs. But you can also apply on Card on Card Basis for all Cards except for the Yes First Exclusive Card. For the preferred card, you need to hold a higher limit card from any other bank.

Thanks Mr. Siddharth and Mr. Manish your answer was very helpful.

Mr. Manish you please answer following questions :-

1. If I open a Yes First account and I maintain Average Monthly Balance of Rs. 1 lakh than will I be offered a credit card and if yes than after how many months can I expect it.

2. When you applied for the card have they asked you to submit income proof.

3. Will they give Yes First Preferred Credit card against fixed deposit.

Captain Bishuddha,

1. If you open a Yes First account, you will definitely be offered the Card.

2. Income proof will have to be submitted either in ITR copies or on Card on Card Basis with higher limit.

3. I am not sure about the Card against FD basis for this card. You can inquire on this with the Branch or with Customer Care .

Hi Captain Bishuddha Bharatiya,

Any info on how much FD required for this card?

You need to have at least 5L FD for Yes First Preferred Credit card.

Limit will be 4L.

I got yes first preferred on account basis.i have open yes first account with maintain 8 lakh.within week card approved with 4lakh limit

The fee waiver bit is true. However you do not get the 15k joining bonus points if you avail the waiver.

In that case let bank charge annual fees.. As 15000 points turns out to be 3750INR.. I.e. Net saving of 1250INR.

I guess you’ll be paying 2500+15% tax on that. Also, where you utilize these points matters a lot.

how do you utilize these reward points properly to ensure you got your money’s worth?

I was told today that for one time payment of 2500 rs, they will provide 15k reward points every year ( no need to pay renewal fee next year).

Can you get a cash redemption for the reward points earned on this credit card? I got a call from my yes bank branch offering me this card for lifetime free offer.

Not possible. You can still use it for catalog redemption.

What if My limit on the other bank card is 2,97,000? ? Am I still eligible for this card if my limit is 3000 short of 3 lakhs?

They would certainly consider it as an exception. Give it a try.

Not possible, I had tried.. you have to have 3L minimum and that too if you have done any swipe and your statement shows available balance as 2.99L also they reject.

But not worth getting this card as I got it against a card having 4.5L and yes gave me limit of only 70K.

My limit is 2,94,000 and I have A/C with YB. I applied on 2 weeks back and received card on Yesterday.

Whats the use of SO MANY POINTS when there is no cash redemption available – I use SBI ELITE (Rs 5000 per annum) and get 72,000 points – this translates into 18,000 INR (at Rs 0.25 per point) – CASH BACK. Not some silly freebies that arent waorth even half of what the catalogue show them!

Tip: Amazon Voucher!

Could someone refer me to an Executive from Yesbank for this card? Im from Chennai .

Write to yesbank, they will call in a day 🙂

if we apply on card on card basis what credit limit they offer in new card ? for ex. What if limit on the other bank card is 3.2L ?

Any other bank which providing credit card on card with no annual fee and regular credit limit enhancement ?

try indusind contact number 9594627086 in mumbai got Platinum Credit Card lifetime free card on card

Hi,

I hold the Citi Indian Oil with limit of 4.5L and Amex Travel Platinum with a limit of 90K.

I mainly spend on utilities, shopping (offline and online) and restaurants.

I`m planning on cancelling the Amex as i dont get much use out of it.(not much travelling happening recently)

Which card do you thing i should go for. I`m confused b/w Yes Preferred and HDFC Regalia. Both are looking good !

Help Needed Please !!!

Yes preferred is better if you’re eligible for it. Regalia is equally good, why not both? 😉

“Complimentary priority pass with 4 complimentary lounge access in a calendar year, and complimentary access (3 per quarter) for the MasterCard Lounge access programme.”

What does the mastercard Lounge Access programme entail us to. And what does the complimentary lounge access entail us to?

Dear siddharth…Please review yes first exclusive credit card…

Sure, shortly.

Hi,

If you are an Yes bank Savings account holder and apply on Card on Card (which is now 2L), they are waiving all fees and it is completely free.

I got it same way.

By the way great blog, i have approx 8 credit cards and i also use my credit card for expenses based on where i get best offers.

For example, i pay all LIC policies via smartPay in HDFC and get lifetime 1% cashback and they are standing instructions.. So i save almost 8oo per year..

I think in india we need more blogs like this so that people know and enjoy the rewards.

That Sounds good.

Even I added LIC premium to Smartpay and it said 10X points on my Diners Black. That’s 33% savings on the LIC premium. Lets see if it really works. Will know in a month time.

If that happens, it’ll be a crazy deal Sid!!

Did you get the 33% Sid?

LIC payment not being charged as its past due date. Let me wait and see for sometime.

Did u get it?

My understanding based on the above 2 comments is for a standing instruction payment for policy premium of 300000.The cashback is 3000 and 1lakh reward points ,please let know if my understaning is correct and still applicable.

Just received the card packaging is great, however the limit offered is very less have applied card on card with HDFC Regalia having credit limit of 6lacs plus however the limit offered by yes bank is 1 lacs really shocking.

However good part is its LTF so we wait for six months and apply for a limit enhancement.

When we apply for card on card, do we have to surrender our previous card or we can keep continue both the cards?

No, you don’t need to.

How many days did they take to process your credit card? thanks

I finally got the card today after FIGHTING with the bank for two long months. They were initially not ready to give me a card because I am self employed. I already hold 10 cards with other banks 😀

Hi Vamsi,

What was the fight about and why were they not offering your initially ? Please write some lines about it so that other readers can also benefit from your experience.

10 Cards 🙂 I don’t know how you manage

Hi Sid…do I get the same 8 points per 100 rs for LIC payments made via Yes First preferred credit card?…Secondly, which is the best credit card for LIC payments?

Yes, very likely.

Diners cards giving 10X points on smartpay for all bil payments including LIC. The Best.

This has got to be the “Find of The Century”

But it was thing of the past.

How about contributing to NPS through Diners Black and getting 33%.Anyone tried this?Or is this possible?

I checked today Diners black is limited to just 2000 RP per month for insurance payments 🙁

had submitted docs on 28Dec16 approved on 04Jan17 got in hand on 06Jan17

very fast processing considering it was new year week

Hi Saurabh,

Do you receive a msg for card approval and dispatch? Or we need to call the CC to know the status? I applied for the preferred card on 12th Jan . Got verification calls and house visit last week but no communication after that.

Got my card delivered today . Had applied in Card on Card basis using my HDFC ALL MILES card .

The packaging of the card was awesome as though it was gift pack.

Felt the limit was low . It is only 1 lac . My limit on the ALL MILES card was 2.1 lacs

Suhas congrats. How old was you All Miles Card and what are the documents you submitted ?

HI Suhas,

How did u applied card to card (offline going to branch or online or email ?) and did u have any prior relationship with bank ?

Hi I applied for the card on 8th of Jan, on 12th received a call from the document collection dept verifying my address. I called on 23rd to 18001036000 number to check the status and provided my application form number YBLxxxx, they could not find my application, he said they will send a email to sales team to call me. Yet to receive a call, do you guys have any other number to contact them or email id.

Contact on face book message .They are prompt in reply

Anything happened later? I have the same issue.

Hi siddharth,

I had applied for this card on Card to Card basis. The limit on my other Card is 2.5 lacs and the bank said itself offered me to apply for this card. Now the application has been rejected for no reason. Is it difficult to get this card??? Or worth it.

Is CIBIL score & the report is in good standing?

Yes, my cibil is very good…with no delays ever. I don’t know why the card has been rejected. Should I apply again. Is it worth applying?

No, it hurts the CIBIL score. Try to find why was it rejected.

same here i applied for exclusive card, the branch says the status is showing OK, but they cannot locate my file, when i called the cc they said application rejected will know the reason in the letter they will send.Surprisingly the Sales rep got the bonus for my application,he is also clueless.

Hi Siddharth

I am curious to know whether there’s any credit card which has a tie up with low cost airlines?

Amex Platinum travel card with Indigo as vouchers. Check the review for more detail 🙂

In official site they have mentioned,

8 Reward Points on every INR 100 retail spends(c)

and

(c) – Only applicable for retail transaction. Not applicable for Fuel Transactions

So I want to confirm that If I send money using PayPal to outside India in USD (of course I will be charge currency conversion + paypal fee etc.), But Do I get 8 RPs per 100 INR?

Waiting for reply.

Yes, you’ll get Rahul.

A silly question,

I have VISA CC from SBI ELITE that works perfect on PayPal.

Does credit card with MasterCard branding works on PayPal?

Best,

Yes it does.

Today the YES bank executive came over to collect the documents. He said that there is no LTF option for this card. They can only give it free for the first year only. No LTF even when applied using card-on-card basis. It is LTF only if you have a YES bank account. Is this true?

I don’t think so. On other hand, they might have changed the offer as well.

Ok. But pratically with the rewards points they are giving after the first swipe and for renewal which are equivalent to the fee, it looks like it doesn’t matter whether we get the card with membership or LTF. Is this correct or did I miss considering any charges ?

You’re right Praveen. Its designed that way 🙂

Got my card today and it is LTF (Don’t know how after the RM denied that option).

The embossing though is of bad quality. It is flat print like how it is for debit cards and not a raised embossing. I don’t know if this is cost cutting but not the best option for their premium card.

Congrats on the New card!

They might be testing few things, we need to give them some time to upgrade their quality and service 🙂

Just my 2 cents..

I started using this card for most of my overseas spends since it had a lowest markup fee of 1.75%. However I noticed that their conversion rates are too high compared to HDFC or SBI. Having 2% markup fee on my HDFC Regalia works out cheaper compared to Yes Bank card.

If anyone notices the same, please confirm

Will it be possible for you to make a foreign currency transaction of the same amount with both HDFC and Yes cards & then compare? Also, do note that the rates of Visa and MasterCard (Not the banks) vary marginally.

I have already done it. I did pay for a merchant using PayPal same time using both the cards for two separate transactions. I used Bank Conversion rates and not PayPal’s. However Yes Bank transaction amount was like Rs. 14 more compared to HDFC even though Yes Bank Card had lower markup fee.

Can you tell it in percentage please? was Rs 14 on transaction of Rs 500 or Rs 1000 or how much?

Hi siddharth,

I had applied for the card again and this time it has been issued to me. But the limit issued is only 1.5 lacs which is even lower than my Citibank card.

A similar case with me too. I have 3.65L limit on two other cards but got only 1.75L on my preferred card.

But I’m not worried about it. I’ll do decent spends and ask for a limit increase in 6 months.

Hi Siddharth,

I recently got a Diners Premium as my first credit card from HDFC with ₹2L credit limit and LTF.

I am really inclined towards the Yes First Preferred, keeping it as a back up card for my diners club and more over since i could get it LTF on card on card basis it becomes all the more attractive.

The only issue is that i am yet to receive even my first credit card statement and the card does not fulfil the criteria for 12 months.

Shall i apply for the card ?

Another option i have is to close my Axis bank prime saving account and open a Yes bank select account and then apply for the card. What do you suggest?

Is the lifetime free credit card offer still going on for yes bank credit cards?

Yes. I got one 10 days back and and it is LTF.

As per their website, they have removed LTF variant now. Still you can check with local bank for the confirmation.

YES BANK IS NOT ISSUING CREDIT CARDS IN AHMEDABAD YET.

CALL CENTRE SAYS, YOUR PIN CODE IS NOT IN OUR SERVICE AREA YET.

ANYONE HAS ANY IDEA ?

Yes, they’re adding more locations from time to time.

Hi ,

My yes bank credit card due date was 3rd. I paid using pay with other banks option on 1st April amount amount didnt get reflected till now. They are saying it will take 3 working days. I read a RBI circular that no interest or penalty can be levied if the payment is done withing 3 days. Are the banks following this? or do i need to pay penalty in this case?

If they charge, ask for reversal citing the same.

I put up my application for Yes First Preferred card today and have been offered the life time variant, since I meet the eligibility criteria.

I currently have Regalia (LTF) with a limit of 3.5L. Given the recent de-valuation of Regalia, should I switch my spends to the Yes First Preferred card or continue using Regalia as primary ?

I have banking relations with HDFC (SavingsMax account and loans). No other banking relation with Yes Bank. I would like to ultimately upgrade to Infinia or Yes First Exclusive in a year or two. Keeping that in mind, how should I plan my spends?

For Infinia, spends alone doesn’t count. lot other factors are there as discussed in the respective article.

Yes preferred is still good for all spends as long as you get max value from points.

what is the minimum FD required to get this card?

I recently got a bump in credit limit to Rs 2 lac rupees on my HDFC credit card last month. For getting this card basis card on card, should i be having Rs 2 lac credit limit for 12months or credit history with HDFC for 12 months with lower limit is also enough?

+1. Have Diners premium with 2L CL, card is 8 months old but new CL is a week old.

Bump!

Credit history with HDFC for 12 months + 3L limit is required now.

Damn! I believe CC owning date is considered & not CL (==3L) date.

Anyway, thanks.

Hi Sid,

Whats the difference between Yes First and exclusive?

Thanks for the help!!

Its actually “Yes first Exclusive” – single term.

The Yes First Preferred credit card is life time free as of now(June 13, 2017) as stated on their website.

I have applied for this card on a card on card basis with my HDFC Allmiles card with limit 3.25L, though I also meet the salary criteria, which they asked for in the verification call (no documents asked for salary)

I received a call today for verification and card is under process. I am looking forward to receiving the card in case this is approved!

I received the card today. The packaging is amazing, though there is no embrossing on the card.

Though the limit on my card is just 80k while my AllMiles card has 3.25L. Maybe because I hold multiple different cards, I can’t say exactly why. Anyways reading the comments, I see that people generally have lower limits.

After reading the review for this card, I applied for it. The process was very quick and I got my card in 2 weeks on 17th June 2017.

Same packaging as shown above. I look forward to using it.

The card is free for the first year, but not lifetime free. But if it mentions on the website that its Lifetime free, then I need to check again.

You can call the customer care and check whether your card is LTF or not. The documents don’t say anything about the card being LTF, though I confired it with CC, it is LTF.

I applied for Exclusive card with card to card using my HDFC Diners black (4.95L limit) and I was informed that I will get exclusive card only but today I got Preferred card only with 1.5L limit.

Is there any way to apply for upgrade as I don’t want to close the card which in turn will affect my CIBIL Score

My YES First preferred card got rejected. I hold 2 card, first is hdfc Regalia with limit of 4.5 lacs and another Standard Bank Card with limit of 5.5. I applied on C2C basis using SC card. My current salary is approx 24lac/annum. Applied it one month back when Yes bank execute called, the only reason I was it for its low forex transaction. Today i checked status and saw its rejected due to some bla bla bla…. internal process.. What could be exact reason for rejection. My cibil score is 810. I have dropped a note to Yes bank too for giving the exact reason. Lets see what they respond.

Hi ALL

Just to update that after initial rejection of yes bank preferred card, I wrote the letter to Yes bank to know the reason for rejection. I got a call from them that there was some issue in verification. They did some verification again and my credit card was approved later. Few days back I received the card along with priority pass with the limit of 3 lacs. I had to agree the packaging of card was great. So in case of rejection its best to write to banks to know the reason. I am travelling to Dubai next month hopefully it will useful.

Does anyone know any card where me and my wife can get unlimited priority pass access. Currently the limit on Regalia card is only 6 which got utilized in last trip.

Also can any one confirm that on Yes bank preferred card, does add on card member also get priority pass and is complimentary free visit applicable on it.

Varun you are not the first one, check on their FB page there are many like you including me and my wife. They are cheaters and just collecting data, I have raised a complain on social media and they are still trying yo solve it. In the mean time they have fired the executive that misleadingly applied for other card for my wife and the branch executive has been given a warning. Their internal system is simply ****** up. Me and my wife both have cibil score of above 800 and i have many credit cards including diners black.

No bank gives a proper reason for rejection. I was trying for an upgrade to Diners Black from Regalia within HDFC. And they initially rejected it. Branch in fact couldn’t give me a reason. Then finally after 2.5 months of first rejection, I got the Diners Card.

In short: The rejection reason across Credit Card Providers, are not to be told to customer.

Hey varun ,my card too got rejected dont know the exact reason ,i am holding yes bank account for more than 5years & have other credit cards from citibank & standard chartered too.even my branch guys are unable to comment on it.

Branch people know the reason. True story.

I had once applied for StanChar card, the person who had come to verify my residence had simply reported address doesn’t exist..

Did anyone ask for a credit limit in the recent times? If yes, by how much percentage was the limit increased? If not a number, then was it a decent increase?

I just got the above card delivered today.

Mine is a LTF card which is a bonus and soon ill apply for a Zero Balance account with Yes Bank to make the payments and all.

Overall a very good deal considering I dont have to pay anything yearly.

The only downside is that the credit limit they gave me is very less(1 Lac Only)

But since i hold Regalia and Amex Platinum so i dont have to worry.

Finally got my card today. Amazing packaging. This time YES Bank was fast. Got the card in 1 week, no home or office visits for verification. Limit is only Rs.1.8 L. I applied through card on card basis.

Congrats!

Limit seems to be less.

Hi sir I applied for yes bank cc based on my salary slip . My take home salary is 25k and I updated my previous house address for present address proof just 3days back I changed my house . When yes bank verification executive came and called me for address verification and he told I gave wrong address and I am not residing in that address. Now what I can do and will my Card will reject ?

What is your other card limit sir

Reward Redemption fee is 100+GST per transaction !

This is a high fees compared to rest of the cards

Got My card in December with a limit of 5L. More that my Citi Indian oil (3.4) and Amex Platinum Travel (1.2)

BUT Reward Redemption fee is 100+GST per transaction !

This is a high fees compared to rest of the cards

Are they still issuing this card on card on card basis?

If yes, whats the criteria.

yes they are i recently got one. criteria is limit above Rs.3L on other card and it should be atleast 12 months old.

Sid and others

UPDATE:

I just walked into a YES Bank centralized branch, Jayanagara, Bengaluru and applied for the YES First Preferred, though my request was rejected on the basis that my salary is NOT 50 lacs, which I’m ok with.

I was given LTF based on my CITI rewards platina CC , which has a credit limit of 6Lac. The customer care who i dealt with was confident of delivering the card within 10 days, which i am ok with.

Asked for the Master card variant, as well, hopefully it gets delivered.

Shall update all, once i get my hands on it

Raamu

This might be interesting info.

We swiped an add on card in the airport lounge in bangalore and got free access.

I heard it working on Exclusive. Its good to see that on Preferred too!

I wanted to see how good is the concierge and here is my experience.

On Monday, I’ve asked them a very simple question. To tell me public places in Hyderabad with free wifi where I can work. It’s almost 4 days and I didn’t get any response from them for such a simple question.

Sadly all banks are same. Only Amex Platinum concierge stands out i guess, maybe citi too.

HI Sid,

Been an ardent fan of your blog and I have managed to replace most of my credit cards for the ones that actually adds value. Meanwhile, I had requested for Yes Preferred Credit card but sadly my salary is shy by 25k they say and suggesting me to go with Yes Prosperity Edge card.

I am not too impressed with it as I don’t think it falls in the premiere line of cards or giving great Value.

Currently, I have the following cards and with some, I am happy to continue and I feel Yes Prosperity Edge card would be replica of one of these cards

HDFC Regalia First – LTF (For the same reason of falling short by 25k couldn’t get HDFC Reglia. Argh!)

IndusInd Iconia Amex Card – LTF

Amex Platinum Travel

Amex Platinum Reserve ( Going to have it canceled soon as its not adding the kind of value that I thought it would)

SCB Manhattan (My fav in terms of overall package that it offers)

To be honest I am not that Uber rich guy who spends the most time in Airport Longue. But I might start from this year to travel and I know Iconia variant already provides unlimited Longue access and Amex Platinum Travel variant gives a limited number of International Longue access.

Thought the Preferred card would be a nice variant to add to this profile with 25% BMS offer and awesome low-interest rate. But sadly till my appraisal happens, I dont think I can have much luck. Help me if you have any suggestions, please.

Love your blog keep it alive 😉

Can someone tell me the eligibility criteria for this? I have a diners rewards card with 1.5L limit would that work?

Also, if this is not eligible can i opt for YES Prosperity Edge?

i got yes-first-preferred-credit-card with limit of only Rs.50000/- although i got same on card on card basis of other bank (hdfc regalia with limit of Rs.3 lacs).i am also holding Indusind bank card with limit of Rs.3 lacs.

please advise how can i increase its limit?

Any bank, you might need to wait for 6 months to request for LE.

Even my limit was lower initially so I submitted my Diners Black Statement & Salary Slip with Bank Statement 1 week after receiving my card.

After 3 weeks of following up they increased the limit . So not sure of 6 months waiting period.

I am going to send the documents tomorrow for a limit increase. Will update you about it soon.

I see no reason to consider this card over SBI prime card.

It got better rewards which can be redeemed against outstanding balance

Get it LTF and use it for lounge access only.With SBI prime lounge access is only free for first 2 years.

Just got this card LTF with 2L limit on basis of salary account w/ Yes bank with 1st month salary of 2.5 L. Awesome packaging. Gr8 stuff considering it’s the first CC ive owned that’s not an add-on 😀 😛

The card is being currently offered by Yes bank , free for life. I just got mine.

Looks like a good time to apply.

BTW was anyone able to create online yes bank account with credit card.

I am trying to register through card, but getting an error. Have raised a complaint with the customer care though but wondering if there is some other way to get the registration done

I started Yes Bank Association with Credit Card, Saving Account opened later. So Yes online YB account via CC is possible.

Balpreet

Piyush, it takes a day or two after getting the card for your details to be activated. Without that, you won’t be able to register the card online.

Very poor service from bank. Have applied for it in July, docs collected by 5 Aug, still application doesn’t exist. Cust care guy could locate it but solution apart from assurance could not be given. So, I decided to read replies from everyone here. I could found many like me suffering from procedural delays from Yes bank. On the contrary, SC delivered a cc within 11 days of online application.

hi there,

Just got this card LTF with 2.6Lacs limit on basis of my CITI Rewards card which has a good limit.

Awesome packaging came with a huge book explaining rewards, the Priority pass card and also the YES FIRST preferred card.

It came with Mastercard varient, which is good for lounge access.

The customer care is useless and i dont like to tlak to them at all

@ramkumar nagaraj

Yes Bank has THE rudest customer care i have ever faced. I don’t know how banks allow them to speak like that.

Their products are all good but due to customer care being like this, it gives very bad image for the bank.

Very true. They sound like tough BOSS’es at times.

Team,

I got an email saying spend 30k and get upto 3X bonus points.

Earn 3X Reward Points Spend Rs. 15000

Offer Period: 20 th to 30 th September 2017

I am yes first credit card holder, as already suggested

ramu

Hi Manish,

Just wanted to know if there are any redemption charges on Yes Bank Cards like HDFC charges Rs.75 per redemption?

Also, is there an option for redemption against statement credit?

Thanks.

Rachit

I have applied for an Yes Bank Credit Card on August 21st after thier sales team called multiple times, since I have a savings account with the bank. Documentation and verification process finished in the first week and the executive told me that I shall get a confirmation email. I had waited for 2 weeks, but no response. Called up to the credit card customer care and asked, they are clueless about my application and it’s status. I asked why is it getting delayed ? They politely told me that they don’t know the reason, and they believe that there is some problem with verification process. I requested for a call back from the concerned team from the past two weeks, but no response. My concern is that if they don’t know what is happening with the application process and why it is getting delayed, even in future after I get the credit card; how they gonna help me with their customer service support ?

So I’m planning to cancel the application, because I already have two credit cards with different banks and much happy and satisfied with the customer service than yes bank credit card customer service team. So guys think multiple times before applying for it, it may turn into a headache in the future.

Mine is rejected and even after 3 levels of escalation Yes bank is not giving the exact reason. Just mentioning about some internal matrix.

Their CC team is hopeless. They have no clue about anything and would like to pass the buck. Eventually they will ask you to drop an email.

Are they still giving First Preferred on card on card basis. if yes than how much credit limit is required on the other card.

Same question. Bump!

Yes, 3L

Got LTF Yes Preferred today. Thanks Sid for the awesome post 🙂

Interesting thing is the Priority Pass received has 17 digits, while the PP with StanChart Ultimate has 12 digits. Any idea whats the big deal regarding this ?

I got the card within 6 working days after documents were picked up.

Can anybody please let me know if there is an option to enable/disable/modify International Usage on this card in particular, or Yes Bank Cards in general, like there is with HDFC bank card or even with RBL & SBI cards??

Yes. Login to yesbank.in as credit card.

On the left hand side bar, you would see an option to enable or disable internation usage.

You can do it through the app also , updated version of Yes bank is supporting credit card option also

Thank you for the input! I just came across RBL bank app & they allow you to “Switch off” your credit card completely.

Lovely! Thank you so much for replying.

I crossed 7.5 L spend on the card but not sure when I will get the Bonus 20k RP for crossing the 7.5 L.

Anyone here got those 20k bonus points ?

Checked with CC , they said though I achieved the milestone ,20k RP will be posted only after completion of 1 year from the card activation date.

I raised another query what if my card is upgraded within one year ,response is in that case also 20k points will be credited.

Good to know. But that’s too much time to wait.

Music to my ears…

Thanks Mouli

By the way Sid, we got the 1% cashback after escalating it. 🙂

The cashback on international spends upto 31st August.

Got my YFP delivered last week, although I was very much impressed with packaging but not much with the card, only change I can see from people previously got this card is that they have replaced mastercard logo to latest.

My SC Ultimate card looks much better.

Also the credit limit they offered is just 35% of my SC Ultimate.

Also registered for Yes Bank Netbanking and also downloaded the app, both are so outdated!

Hopefully there would be some offers to convince me to keep this card. As of now SC Ultimate is still my Primary Card.

For the last 4 months we all have raked up loads of points due to their offer. Its certainly one of the best card out there now.

Posting for the 1st time in this blog. I have been following this blog for quite a while and must say I am quite impressed. The salaried class typically saves/ invests only after all mandatory/lifestyle spendings are done. Hence, it’s imperative one spends smartly and this is a great blog where one is encouraged to spend smartly, and also earn very good reward points in return.

I had received the LTF YF Preferred card (card-on-card basis. I had HDFC Regalia with limit of Rs. 3.6L) in June 2017, with verbal promise of YBL RM that after 6 months of good history, they ‘may’ consider to upgrade it to YFE. After spending Rs. 5 lakhs+ in the following 6 months, I was aggressively chasing the YBL CC team, listing all possible reasons for an upgrade. They finally upgraded my card to YFE. Feels great to finally hold 2017’s best CC…and that too LTF.

Special thanks to Sid/Abhishek Roy/Manish & all other regular contributors, for sharing their knowledge and experiences to all.

What is best way to Pay YFP CC bill considering I dont have Yes Bank Account?

For Visa cards I used to use Billdesk, but since then I have switched to PhonePe for all my Visa cards payments and they are very good. Payment normally gets credited on the same date as you do the payment, although it might take few days to reflect in card statement. As of now PhonePe only supports Visa Cards, till they start with Mastercards what are other best options?

Hi Sid,

My YFP card was approved yesterday, still haven’t received the card. Strangely I haven’t seen any reduction in my CIBIL score even though enquiry is showing up in the report. Will it take some time to reflect in the CIBIL, or would they have done just soft pull, instead of hard pull, which is a good thing, if that’s the case.

Hi Shankar

It may take upto 30 -45 days as they have to report your card in cibil (usually at / after month end). They will then take into account new CC and generate a new score later.

I received my Yes First Preferred card today.

1. Awesome packing for just a couple of plastic cards !! Make you feel good. 🙂

2. Applied card on card basis – using Standard chartered card with 5L limit. Got YFP with 3L limit

3. Got the card life time free, not mentioned in the welcome kit, but confirmed by customer care.

Thanks Sid, your reviews helped me in chasing right cards, This is my first step towards YFE, long way to go, hope I will get there eventually….

Got my YFP yestarday. Got 70% of my Diners Black limit. No where it’s mentioned as LTF. But while applying online it clearly stated as LTF for limited period. Even the agent who collected documents showed no fee for first year.

How to find out it is LTF or not?

Yes Bank needs to spruce up their card acquiring team. Got the card after escalating the matter to CC channel head.

Hi Sid and Friends, I got 1.5 L credit limit in YFP card last month, which is very less of my other standard chartered card limit. what is the steps to get YFE card as LTF sooner, Please advise.

If one apply for Yes cards than statement of how many months are required of old card.

Last month statement only

Is it better than SBI Elite Card? or do we have any credit card better than SBI Elite Card

sir

i have HDFC CREDIT CARD ALL MILES

with 7.8lakh limit .

am i eligible for YESBANK EXCULSIVE LTF CARD or

YES BANK FIRST PREFERRED LTF CARD if

i apply with card on card apply?

Hi Sid,

Is this card available only in select cities ? I m eligible for this card but am based in Panaji, Goa..For my city, it doesnt allow to apply for this card but if i select bangalore as city, then all works fine..Their support tells me this is because the card is not sourced in Goa presently..Bit silly since they do have bank branch in Goa..They r also not sure whrn it will be made available in Goa..Anything I can do to get this card asap ?

Regards

Veeraj

Veeraj

You may try via card on FD. Please contact nearest branch.

Hi sid

i am having HDFC DINERS BLACK with credit limit

8L .

is it worth to switch over to yes bank first preferred card now?

or

contiue with HDFC.

regards

sandeep

I dont see any reason to switch to yea prefered instead have that card as a back up.

I read that Yes First Exclusive can be provided card on card basis for cards having 8L credit limit. I don’t have any personal experience on it.

Elementary my dear Raabert! Keep Diner’s Black for lounge access and use on 5x or 10x promotion partners and use Yes Preferred on sites/merchants where Diners Black is not accepted.

Yes first rewards have taken down amazon voucher from reward redemption. I don’t see any reason to use yes bank cards now.

@Raghu

First of all you should get your hdfc card upgraded ASAP. you are wasting ur money by having All miles cc.

Then apply for YFE via card on card and see what happens.

Hello , I am having SBI elite( annual fee 5000, Limit 7.20 lakhs) , HDFC regalia first( LTF, 2.0 lkhs), Citibank indian oil (LTF , 1.5 lakhs). I am expecting my yes first preferred in few days.

My queries

1. Keeping in mind 5000 annual spend I wish to downgrade elite to sbi prime. Should I do . My yearly spend is around 3lakhs. Only lucrative thing with this card is BMS 2 tickets. that work out to be 200/month.

2. Which card would be best for – day to day shopping, online shopping and insurance payments among all – HDFC regalia first, citibank indian oil, future (?) sbi prime or Much awaited yes first preferred.

Thanks in advance

Deepak

1. i had the same query , the only reason i am holding on to the Elite card is the BMS offer , but i make sure i use the full 500 rs limit of BMS tickets or anyhwhere near to the amount so as to get value back for the annual joining fees of 4999 plus GST equivalent to almost 5900 rs a year in annual fee , if your working is just 200 a month , i suggest you downgrade to prime , it has more value for your spending…. on the other hand , i suggest you push for Regalia upgrade from Regalia First

2. for day to day spends , cashback cards are best , but the trick you can use if you get a Yes bank card , load up your mobile wallet (i use paytm) , earn reward points on that , pay your utility bills using wallet , i dont have SBI prime which gives 5% value on it , but i do get 2.5% value on the spends on my YFE…the only downside , no more amazon vouchers which i use to enjoy for my free movie tickets

Anyone has any idea on what the reward points can be used now for YFP,since i am hearing amazon vouchers are off limits now.Which other things provide a good value for points now?

Hi,

Just got the card after multiple rounds of escalation through nodal officer and social media. Had applied through card on card basis using regalia with a 3.3 L limit. Three CL on my YFP is just 50k. Any advice on how can I get my limit raised?

wait it out , they dont increase limit on card on card basis , only income documents can do that , i suggest , stick to the limit for 6-8 months and then apply for increase…i have YFE with 2.5 lakh limit (where they promise a higher limit) …. i haven’t even applied through income documents because i feel they might reduce my limit even further considering i have exorbitant approved limits on my HDFC Infinia , AMEX platinum travel and Kotak Royale CC

Will Yes Bank consider the ICICI coral card ( 10 year old card ) with 4l limit for card-on-card application for Premia/ or Preferred?

Do ICICI cards hold as much weight as Citi or HDFC cards?

I am eligible for YFP but when I applied for it, I got the message that it doesn’t meet the requirements. Any reasons why and what could I do to apply.

Based in Bangalore

Same happened to me and also showing as enquiry in my CIBIL.

My CIBIL is great except 7 enquiries in past 3 years…. salaried employees but still got rejected.

Hi Sid

My yes bank credit card application was rejected…. through my CIBIL is 784 and no adverse reporting….don’t know why it got rejected…..can anyone clarify plz

Hi all,

Can anyone help me understand how does card on card application works, what are its benefits and what all documents have to be submitted for the same? I have an HDFC Regalia card with 3.79 lakhs limit and I am thinking of applying for this card.

Do not apply for YES card this is not right time , applied for this card on card of card basis thinking premium card his hsbc card has more than 9L limits but he cot this card with 32K credit limit , now only use of this card is for lounge access nothing else as his minim usage is monthly nearly 2L , there are so much negative going on with yes bank

@prashant

I have visited yes bank branch and to my surprise staff didn’t know anything. When I asked them about yes first credit card, staff 1 asked to another do we have anything like that 🙂 . They are ready to give LTF first preffered but they want me to open an account which is their requiment. I am asking them to give LTF exclusive since I also have a plan to open an FD of around 4 lakhs with them. How come did you get such a low limit. In general people were getting 15 to 20% of their existing limit. This was the first question I asked and they said for sure it won’t be less than 1 lakh might be because I agreed to open an account. Does SBI give elite as LTF card. Main reason I am here because I want LTF exclusive but might have to try after 6 months of usage as suggested by siddarth.

Points have been reduced to half, only 4 points on retail transactions instead of 8

i have checked online rewards page for yes credit card. i do not see amazon voucher or any other reasonable option to choose from. is it the case ? or the page is not updated with correct information.

Is it good to apply for YFP card (LTF) after the revaluation? Any suggestions please?

Just got a call from Yes bank that my YFP card has been approved and will be dispatched shortly. Had applied on card to card basis (HDFC regalia with limit 4.60 lacs). Lets see what is the limit they provide me on the card.

Will update you guys next week once i receive the card.

If you are a yes bank account holder, just login and see your card details.

Not a yes bank acc holder. In fact i had applied for a preferred card 2 months back as well on income basis from my job. However it fell short of merely 5000 rs. of their criteria and they instead sent me a prosperity edge card. I was furious and got it cancelled immediately over the call to their customer care.

Now i applied it on card to card basis and initially they gave me a call saying i cannot apply before 6 months of previous application. Basically they told me my application will be rejected this time.

I told them its not them who had denied me a card. Its vice versa so the 6 month criteria shouldn’t be applicable. To my surprise after 2-3 days of this conversation i got a message that the preferred cc has been approved.

Congrats Abby.

Use it for 6 months atleast and call for upgrade to Exclusive.

Thanks for that suggestion Praveen. Will definitely try for Exclusive as well by around year end.

Finally received the YPF today. To be honest the card doesn’t really look like something that has been earned !

Even the name has not been embossed on the card. Its plain in print. They have sent it in an envelope like the ones we get for our credit card physical statements. No priority pass provided as such. It will be provided on demand as mentioned in a one page welcome letter they sent along with.

CC limit provided 50k against HDFC regalia CC limit of 4.60 lacs.

Frankly speaking even if this card boasts of a few good features when compared to other best cc in the market, the feel good factor is missing when you have this YFP in your hands.

They seem to be too much possessed with cost cutting that they have even chopped off the cc limits 🙂

Hello. I have Yes Bank Yes Premia Account. How can I get a credit card?

Today I got approved for Yes Prosperity Edge credit card after complaining to so many peoples . Thanks to Siddharth for this card. Anyone here who can share his/her experiences regarding upgrade from Edge to Preferred ? How much should be my spends every month ? I can’t maintain more than Rs. 10,000 in my savings ac. due to financial constraints.

Congrats captain….but sorry to say there are so many good cards out there better than edge and preferred……

Thanks a lot Prashant.

I don’t qualify for any premium card as my ITR is only 3.40 lakhs. Have you succeeded in upgrading your and your spouse’s Yes credit card ?

Do you have tips for me for upgrade to Preferred and than to Exclusive in future ?

Hi….no somehow they are not upgrading our cards….this time i have taken a loan also for 12 months as I mentioned earlier….still no offer of upgrade to yfe……we dont use my wife’s edge card…….

Just use your card normally and after 6 months check with them for upgrade…..

Congrats Captain.

Tips:

1. Spend as much as possible

2. Take No cost EMI wherever possible

3. Interest EMI/ loans give more profit to bank and hence higher weightage. But will not recommend it. Take only if really required

4. Maintain high balance to the extent possible.

5. Use this card for International spends, if any.

Cheers.

Thanks everyone for your valuable reply.

Last year in 2018 i spent Rs1.4 L in international spends…..and sues to 2x and 3x rewards also spend high….but no offer…..now dont use the card for any transaction no offer…taken a loan offered by then still no offer 😀. So dont know what they want……

I had the Yes First Preferred Card for about a year and closed recently though mine was LTF.

1. Was never targeted for any spend based offers

2. Massive devaluation of 50%

3. Was never given LE or card upgradation to YFE even after multiple requests

4. Though minor, no Amazon or Flipkart vouchers as redemption

5. Too aggressive (multiple SMSs and emails) in asking me to pay monthly statement dues even though payment due was zero

Good riddance!

Planning to close it. Have held it since ~2017.

1.) Paltry limits. Lowest on any card by a huge margin. Feels insulting sometimes when some purchases wouldn’t go and have to check if limit is available.

2.) Devaluation of 50%

3.) No LE or upgrade after multiple requests. I spent ~ 4 Months and used it for some International expense till limits allowed

4.) As pointed out by MAA-Traveler, Aggressive campaigns to pay dues weeks before payment date. Have always paid total due

5.) Customer care is not up to mark. Maintaining decent relation with bank, but limits and no YFE feel like a blocker. Placing request for redemption, will soon close, Multiple cards is an headache itself

Surprisingly received a LTF offer today from Yes bank to upgrade my First preferred to First exclusive though its just about 4 months that i have been using the Preferred card.

Hi,

Is Yes bank still issuing YF Preferred and YF Exclusive credit cards on card on card basis?

If yes, could you please share your experience and the limits required.

Cheers.

I have limit of 8.75L on my HDFC card but these s*ckers are continuously declining my YFE application despite me having a high value FD and savings account with them with 800+ Cibil… Branch lady is telling me to get Preferred on base of the FD but I’m not interested in that because I’m fully eligible for YFE and if I take the Preferred card based on FD, my limit will never increase and I will never be able to upgrade to Exclusive…

Branch people also telling me that the card will stay active even after my FD gets matured and closed… How this is possible?? In case of all other banks, you need to surrender the card/close the card account if u close the FD… But Yes Bank is telling me that my card will stay active even after my FD gets matured/closed…

Can someone Please shed some light on this??

Shoot an email to head.grievanceredressal @ yesbank.in and ask why.

My first application rejected. Emailed & approved with disappointed limit.

FD based card are useless.

No limit upgrade, No card upgrade.

Axis has option like you can close FD after mature, Possible throw branch only as per Call centre, Talked a year ago. Not sure about Yes Bank.

got sms and email to submit kyc for re-verfication for my credit card. anyone else got the same?

Not yet. Is your card near expiry by any chance?

Now that the yes rewardz portal is down, how to redeem the reward points. Seems these all would go down the drain!

I just got a request to upgrade my yes premia to yes first preferred even though I know I don’t qualify for its income requirements (less than 1/2 of the required limit) and had spend less than Rs 1000. in the last 6 months.

The newer card is lifetime free just as the previous one.

I wonder what their algorithm is for sending the upgrade request. I am happy and hope Yes bank stabilizes.

I think all holder of yes bank cards should check their emails inboxes for upgrade requests.

I got a call from some marketing guys today and they almost forced me to get LTF yes first preferred card on card to card basis. I own regalia with 4.51L limit. Should I opt for it, I never used any of the lounge access in last year. Should I opt for it ?

I wanted infinia but I need to put more spends on regalia I guess 😀

Currently using regalia, Amazon pay icici and sbi simply click and I barely make spends on the latter.

If it’s LTF, then you’re getting a good set of benefits for free.

No reason to look back. Think of it as a bonus.

And if you don’t use it often, the bank might give you even more offers/CLEs/Upgrades to entice you to spend.

Cheers! 🙂

Got it life time free on card to card basis from regalia. Yes bank is running 10x reward points on Amazon Flipkart Myntra & flight bookings too. Upper cap for every month is 10,000 reward points. Atleast the offer is available for February

I had the Yes First Preferred *before* having the Regalia. However, once I got the Regalia, I never used the Yes Bank card. The offers on the card are also not very good. If you already have Regalia, I’d say you can skip this card even if it is LTF – you wont miss anything.

Go for it as yes cart gives you rewards points upto 20%. If you dont have diners black or infinia this os best alternative.

Hi, has anyone recently got yes first preferred life time free on card to card basis. I have a limit of Rs2.99L on my HDFC regalia. Any chance I can get it?

what is the limit required on existing card to get yes first preferred.

I just got my YFP card on card to card basis. I too had a Regalia with 3.8L limit.

congrats Angad! what the limit that you got on your YPF card?

I received my yfp card with sh*t limit of 70k only inspite of having more than 760 cibil and on all other cards I have limit of 4-5lacs

ITS WAY BETTER

I GOT 25K LIMIT FOR YFE, CIBIL 785

@Rishi

I understand this, I had YFP and now hold YFE. Start using the card and limit will increase, ask for limit increase after 6 month of usage. It’s a good card and more so if LTF.

It is the easiest way to get Priority Pass and industry lowest Foreign Currency Conversion charge in my opinion.

Get an IDFC First Card instead…They are easy to get & LTF & their Select card also have lower markup charges…

The reward rate is only 4 points for 100 rs as per the website.

It says 8 points for 200rs.

Is there any other charges apart from the 1.75%(+18% gst) markup fee for foreign pos transactions?

Say current 1usd is 74.61 inr as per Google. So, if I pay 1usd outside India for offline pos machines, I will be deducted 76.14 (including markup and gst). Is that right? Or am I missing something?

The forex cards from axis bank seem to be charging about 3.5% apart from issuance and loading fee.

Even the bookmyforex charges for currency notes go in the range of 4% including their GST in buying and selling the remaining amount. So, this credit card seems a best option for spends around 200USD.