Update: The Uni Pay 1/3rd card has been discontinued, however Uni now has other Credit products which you can explore on the app.

Uni Cards that raised $18.5 million in funding has recently come up with their Uni Pay 1/3rd card as their first offering in an attempt to improve the user experience in credit card industry. Here’s everything you need to know about the Uni Pay 1/3rd card,

Table of Contents

Overview

| Type | Buy Now Pay Later Card |

| Reward Rate | 1% |

| Annual Fee | Nil |

| Best for | Dining offers & split payments |

| USP | Customer Support |

Uni Card is one of best new-age cards that’s circling in the cards industry.

While there are countless options in this segment, I would any day prefer Uni Card among others because of the customer support and offers that includes but not limited to dinings offers & spend linked offers like the Grand Uni Carnival.

What’s Uni Pay 1/3rd Card?

Uni Pay 1/3rd card is technically NOT a credit card even though it works largely similar to a typical credit card on the surface. Its basically a PayLater card (or) Pay 1/3rd card, meaning, you can spend 30,000 INR this month and pay 10,000 INR a month for next 3 months without any interest/fee.

The tech layer is quite interesting as it uses:

- RBL/SBM bank’s Prepaid card system on the surface that gives access to Visa

- NBFC partner (LiquiLoans) that gives access to the credit line.

So ideally speaking its a domestic prepaid card and so you cannot use it for international transactions or cash withdrawals and may also have problems in loading wallets, as RBI rules prevent that to happen, which however is expected to be cleared in few months.

Here’s a nice and short video by Uni Cards which reminds me of the movie: 47 Ronin.

Fees & Charges

| Joining Fee | Nil |

| Renewal/Annual Fee | Nil |

| Interest on revolving amount | Late fees only, as per the slab |

It’s ideally a Lifetime Free card (for now) and comes with a decent late fee slab system (instead of daily interest).

Rewards

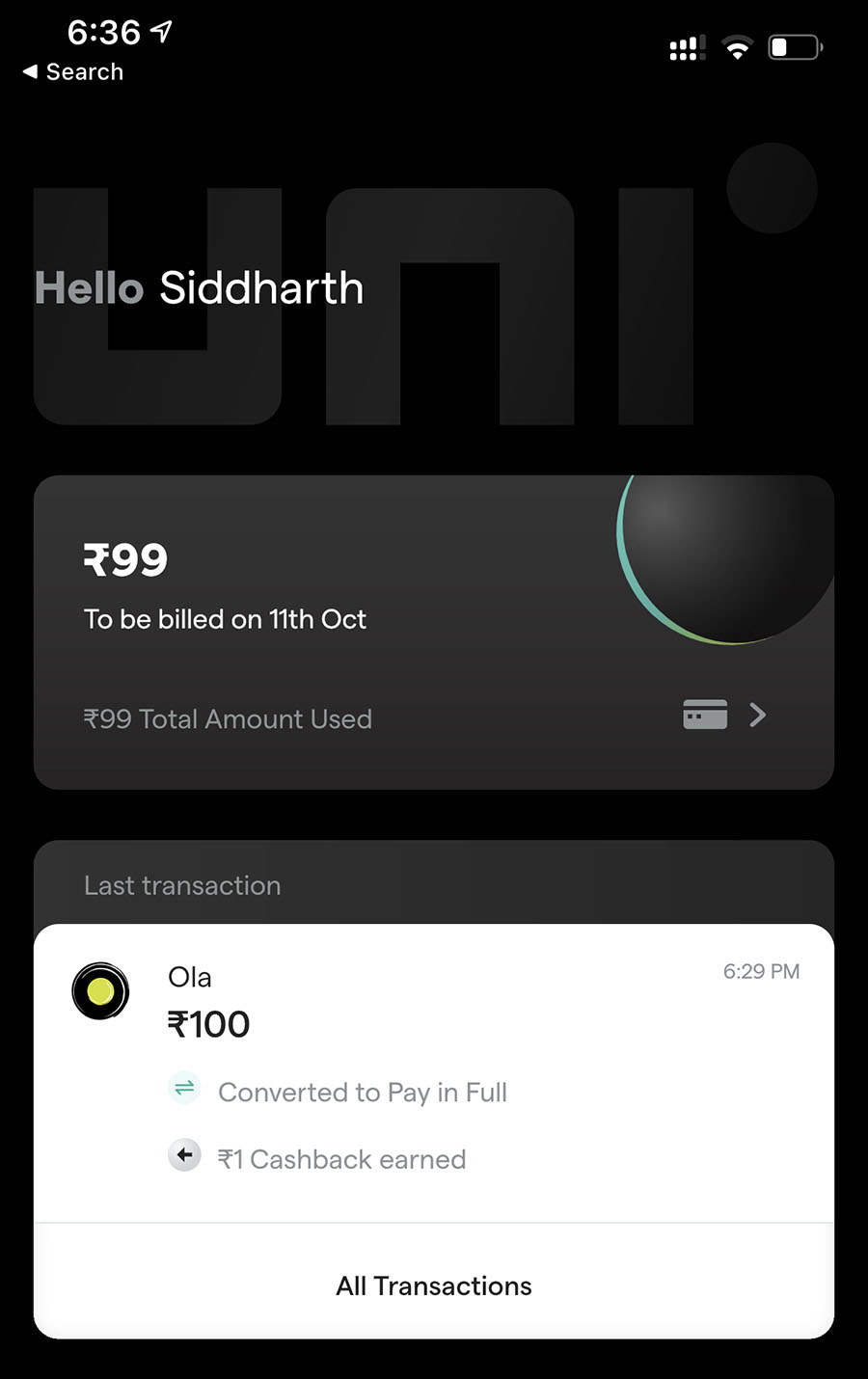

- 1% Cashback to card (if paid in full)

The system splits “each payment” into 3 parts by default, but you can however choose to pay in full and enjoy 1% cashback.

The cashback system is super simple as you can choose the transaction you want to pay in full in few taps and it instantly adjusts the cashback to unbilled stmt, just like below.

It’s definitely a good experience, however 1% is indeed bit low even for entry-level cards as we’ve cards that gives 2% cashback these days.

That said, Unicards does mention that they’re working on a rewards system that allows you to earn Uni Coins along with a Uni Store that gives 5X rewards (maybe like HDFC smartbuy).

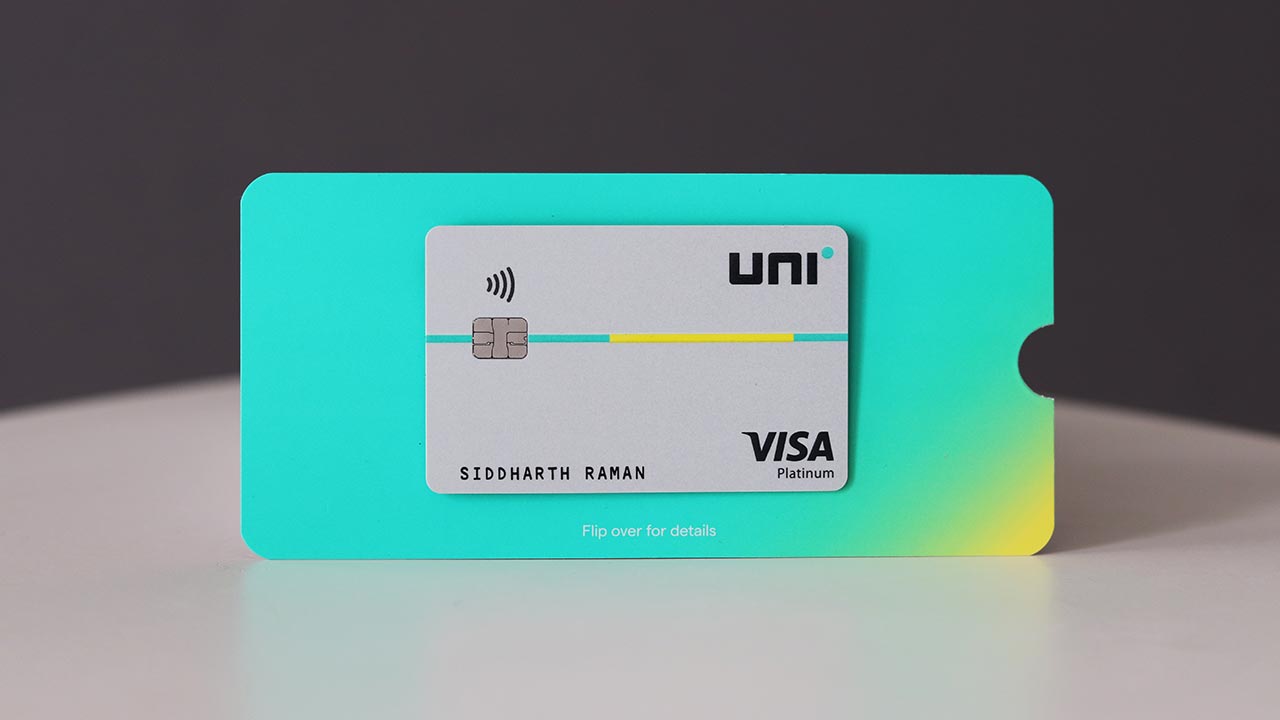

Design

Uni Card comes with a neat and clean design with name on the front and card details at the back, just like most other modern premium cards issued these days.

The card comes in a mild grey/silver colour that looks decent.

Credit Limit

One of the most important aspect of an entry-level card is the credit limit, as most card issuers give a relatively low limit especially when its the first card with the bank.

Uni however states that they can issue cards with credit limits ranging from 20,000 INR to 6 Lakhs which sounds promising.

That’s good for an entry-level card and my credit limit was somewhere in the mid.

Credit Limit Enhancement request can be sent after 6 months of card issuance.

Unboxing

The card comes in a neat and well designed box that gives a very good premium feel. Initial impressions were like unboxing an iPhone instead of a card, great work on that!

The box comes with:

- The Uni Card

- A Toblerone chocolate (Yeah!)

- A Mask (good quality)

- A personalised baggage tag (looks beautiful)

Here are some pics:

Support

Yet another important aspect when it comes to entry-level cards is the customer support, which is almost non-existent in the industry because of the volume.

However, Uni Cards comes with an excellent customer support.

For ex, as soon as I showed interest for the card on website I got an email from someone in the team to which I replied (asking about IOS support, which is now available) and got a callback in under 30 mins. Mind blowing!

Was also able to follow up on the same via WhatsApp support. That was a good experience.

Should you get Uni Card?

As always, it depends on your profile and the needs. To sum up, You get the following benefits with the Uni card:

- Lifetime Free Card

- Freebies: Mask+Chocolate+baggage tag

- Cashback: 1% cashback on all spends – useful if your other cards don’t give rewards/cb on certain txns

- Pay Later: Its like 0% EMI card for 3 months – very useful on high value / emergency spends.

- Offers: Zomato pro for 3 months – we may have more such offers in future.

Except for the rewards, it scores well in most other aspects. If you’re new to credit cards, it makes a lot of sense to hold one.

How to Apply?

The application process is super simple. Just download the app and follow the process. It hardly takes ~5 minutes (or) less to complete.

They authenticate your identity via Aadhaar and a selfie.

The app uses CRIF to check the eligibility, but once you proceed further and apply it likely uses both CRIF & CIBIL reports together for under-writing, as I could see an enquiry on CIBIL via the NBFC partner (marked as NDXP, which is actually LiquiLoans).

Your virtual card will be instantly generated and ready for use as soon as you complete the application process. Just make sure you turn on “online transactions” via app before going with your test charge.

The physical card reaches in approx 3-5 days via Delhivery and the good news is that you can choose your delivery address, just incase if its not the same as on Aadhaar – pretty useful feature.

Note: The card currently ships to select cities (~36 cities for now) and is expanding its footprint rapidly.

Final Thoughts

- Cardexpert Rating: 4/5 (in this segment)

Overall the Uni Pay 1/3rd card comes with a good onboarding experience, premium welcome kit, good credit limit, decent rewards and a great support system. However, if you’re into premium cards and just looking for “rewards” then this may not look attractive to you.

Uni Pay 1/3rd Card is certainly UNIque and overall gives a very good experience for someone who’s new to the world of credit cards.

That said, I would be highly interested in seeing a premium credit card from Uni Cards – perhaps a black card with a black chocolate. 😀

Have you applied for the Uni Pay 1/3rd Card? Feel free to share your experience in the comments below.

Sid, have you looked at the Slice Pay card? This Uni Card is still in beta if I am right but that’s already rolled out and has a decent amount of customers. It offers 2% cashback if we pay in full. It’s also a 1/3 rd card just like Uni Cards and predates Uni Card. Check it out and post a review of that too. Max credit limit can be up to 10L for Slice Pay card.

Slice had negative impressions initially hence was staying away from it, but yes they updated a lot since past 6 months or so as they changed their target group. Will cover it sometime.

Even i would probably use Uni before Slice, it charges even for 1/3rd but Uni doesn’t. Presume this is the case

Is it? But they say we can slice into 3 for free.

slice app is much better and gives loads of cashback on their feature called spark. Plus 1% guaranteed rewards.

The downside is: The Slice app asks for contact & location access while applying.

Hi siddharth

While i am trying to get my uni card after filling all the information why it’s taking days to process ,i m trying from last 15 days and still the app says it processing

Slice also gives 1% only in case of full payment. At-least for me , it is the case & since this is standard feature of card, it can’t be different for users.

Right, I think Slice gives higher % cashback based on spend slabs. For low spenders both are equal I guess.

I thought Slice gave 2% cashback when you repay in full.

One thing I would like to add here is that if users try to add this or Slice Pay card on Cred the app complains that debit cards cannot be added. So payments cannot be done through Cred app from what I know.

I confirm this happens for Uni cards too

Any joining fee or annual fee

Nil, for now.

Hey Siddharth,

Since these new gen fin-cards (Slice, UniPay) are not technically “credit” cards, does it still impacts the Credit score?

These would get posted as “personal loan” if I understand it right, but again credit bureaus would know it and adjust their algo accordingly. So I don’t expect any negative impact on the score.

Score is anyway bit over-rated, its the report that matters.

Experian has changed their algo & these personal/consumer loans (Pay later schemes etc.) do more damage to the score/ are frowned upon by lenders.

which other card gives 2% and are good ones ?

Axis Ace is the fav. 2% cashback card in 2021. Do check out the list of Best Credit Cards in India for 2021 for more.

Sid, Axis FreeCharge plus card has been removed monthly cashback limit. Now give 5%cashback for all FreeCharge spends excluding rent payment (1%). So even insurance premium and utility will give 5% cashback in 380rs yearly charges. And yearly charges are reversed if spend 50k yearly. So who can’t 2L spend, this card makes much more sense.

Plz write a review on this card.

Sure, will explore. But otherwise why would anyone use Freecharge?

Axis freecharge have limited 5% cashback so I had to close that card though I m regular user of freecharge. Cashback is not unlimited.

Slice or uni card which one is better and is there any other card which give 3 EMI with no extra charges

Uni or Slice are how hard to get for anyone not having credit history?

Considering the fact it is almost similar to paylater which are pretty easy to get from flipkart or amazon even if we don’t have credit history.

From what I know these are specifically aimed at people without credit history, like students, freshers etc. But applications do get registered as I read from the reviews on the Slice app in Google Play Store. The criteria is not quite well known but they do not ask for any docs from the applicant.

I applied for this card and got 6 lakhs limit instantly. It’s superb good as it doesn’t ask any permission like slice as we need to give all permission for slice to work.

I really like the card delivery package and i got all mentioned in your article.

What r the others cards u have and limits of each so as to get u eligible for 6lakh card?

Received a mail from UNI Card –

“Uni Pay 1/3rd Card | Next set of features !

Scan and Pay (UPI) on Card :

Yes, you heard it right! You will be able to scan any QR code and pay through your own Uni Card.

Scan and pay on any QR using your card (Coming soon)”

Hi Sid, i guess you are holding most super premium cards so what made you go for this entry level card?

Just exploring these new-age products. No plans to actually use any entry level card as primary card.

Applied right after reading your review. After a few hiccups, the card got approved. Physical card in printing as of now. Waiting for it to be delivered.

Also sid, what’s your take on ‘one’ card? . Its the same category and still in beta. They are providing metal cards. Don’t know much about them.

Does uni card give Cashback on fuel transactions? Any one tried it yet?

There are no charges, I tried it

Issues with Slice Card

1.You will get only Three days to clear your bills.

2.No advance Payment option .

3.Two personal Loan accounts reflect in your Cibil.

4.No credit card payment acceptance from cred,Amazon ,Phonepe and Paytm.

Payment only throuth their app.

5 .Any delay in payment,They will slice your Cibil.

I told them to introduce advance payment option and increase Days between due date and bill generation date but no proper response.

#1 is shocking!

Hi Sid, how much credit period do we get in Uni card?

The bill generates on the last day of the month and needs to be cleared by the 5th of next month..

Coming to CIBIL, for Slice card, I neither have enquiry nor account in my report.

I had applied for slice card in June. No cibil enquiry till now. Also it does not reflect yet in Cibil, no new account added yet. Strange. For unicard, there was an enquiry with name of NDXP, got 6 lakh limit, but still no new account in CIBIL for unicard also.

Applied for both Uni and Slice cards last month in span of few minutes and was approved for both the cards. No CIBIL enquiry for Slice card. They fetch the score from CRIF. Got a handsome limit on Slice card.

The Slice card is actually a pre-approved personal loan.. they give you a credit limit as per your CIBIL scope.. it’s like an overdraft account & first few days are interest-free that’s all its not a credit card..

@sid,

Tried to load money on wallet with this?

Wanted to see if that’s possible

Just tried on Paytm and it went through. 🙂

Hi Sid, I tried to add UNI Card to Paytm but it was failed stating unusual transaction.

Surprise. Maybe this is because my card is issued by SBM bank and yours probably by RBL?

Either way, these wallet load issues with prepaid cards are expected to be sorted soon with the updated regulation by RBI.

Well mine is also issued by SBM, however, I am also getting a similar error on doing transaction at PayTm (loading wallet). Don’t know the reason why the transaction is going through with some people and some are facing errors!! 😀

I have tried for this card during the launch time. My pincode was not serviceable at that moment. Have to try again.

@Siddharth

Could you make one single article with all such instant credit cards like Uni card, slice card, etc ?

Hi Sid,

each transaction gets 30(cashback)/90 days from the date of transaction?

or its monthly statement?

It’s split into 3 and each gets billed via monthly stmt.

Thanks Sid,

applied now as fee is waived, I am more interested in Scan and Pay feature. hope it will be live soon

This is a personal loan where loan amount is same as card limit.

Disbursement of money will happen when card is used.

If Disbursed amount is paid back monthly, no interest and 1% reward.

If paying back in 3 months, no interest and no reward

Also there is condition of freeze.

“Please note if the Loan is not utilized for a continuous period of 6 (six) months by the Borrower, the same will be frozen and will not be available for use till the Borrower activates the Loan by completing due diligence as mandated by the Lender.”

Also there will be sub-limit for certain transactions:

”

Scan and Pay, bank transfers, cash withdrawals or on other channels

Yes. Can use upto Sublimit

Pay in Full Upto X, there are no charges. If Outstanding Balance exceeds X, then charge upto 3% on Transaction Amount

If such Transactions are converted to Pay 1/3rd , then charge of upto 3% of

Transaction Amount

“

where did you get the piece of information which says, use upto X, they are no charges more than that it is 3%?

And what in the world is X?

It is mentioned in “LoanAgreement” document which they sent in email after approving card.

2.7 Sublimit

2.8 Charges

Note: This exact sub limit, the value of X and the charges will be communicated to the Borrower electronically or in the Sanction Letter.

After reading your post. Even now I am interested in applying UNI card.

Also I want to know the statment can be spilt in 3. So does this act like EMI or revolving amount(as we pay partial/MAD) on CC

Its more like a 0% EMI.

Hi Sid. For UNI Cards, for first month dues, I will have 3 months for the amount to be paid. What about the second month bill? Will it be added to the amount of the first?

I didn’t see any use of the card except auto emi conversation. I feel Axis Ace and icic amazo pay is better. On boarding is similar to OneCard.

i already apply this but there show me to pls wait we will get back to you

Applied…got the card and then closed my account without even using it.

Main issue was it is like a loan account, cant be used to load wallets, 3rd party apps cant be used to make payment…even at entry level one loose so much using this card.

Though they don’t allow 3rd party payment as of now. They do allow debit card payment allowing further 1% return on that. Also I can load wallets using my uni card. Till now no new account in cibil report, so can’t comment on that(using card > 3 months).

Hi Nikhil, which wallet you could load pls? Unable to do at my end.. barring Paytm which is showing 4.65% charges!

I used it to load paytm, for me it shows no charges. I don’t use paytm frequently & never used transfer to bank. I tried at phonepe too & it worked. FYI- mine unicard is issued by SBM.

Mine too issued by SBM ..Paytm shows 2.65% wallet loading charges.

I am confused between the two (Slice and Unicard), heard slice gives better offers where as Unicard gives better user experience. Could anyone please help me with this?

Thanks Sid. Applied using your link. Got 1 Lac instant limit.

how good are the offers on the card?

I found slice much better, considering frequent offers (sparks) and separate monthly offers. They have 2% cashback slab for 5L spends too. Sparks are the reason i am more inclined towards Slice since offers like instant cash back on petrol refill, Swiggy amazon, Flipkart, phonepe, irctc etc are mouthwatering.

Which option is better arithmetically? Pay in 3 interest free installments? Or take the 1% cashback?

Is there any element of GST charged due to splitting the purchase.. like in a zero interest Emi, there is Gst paid on the notional interest.

No, not with 3 months split.

Application stuck at trying to connect to CRIF to fetch your credit report. Tried everything including reinstallation of app but stuck at the same point.

Mailed the customer services several times but NO answer from them either, however getting 8-9 mails and sms a day asking me to complete my application.

Seems they need to sort out a lot of bugs, NO wonder they are clear that they are in beta !!

How uni card is going to effect cibil? Can you explain it?

Do using these pay 1/3 cards negatively hampers one’s cibil score please confirm.

So if a 30,000 bill comes at 10,000 for first month and then so on…

how can pay the full 30,000 at the first month itself ?

This is the criteria for the 1%cashback . Am i right ?

Hey everyone,

Will this uni card perform exactly the same way like a credit card ??? Will the purchase and the due effect the cibil score…

Is uni card have any connection with cibil score ???

Sid Unicards is not a credit card. It is loan which they are giving and it is reflected as loan in your CIBIL

Many people asking about Slice — While I was initially impressed with Slice, it has been an absolute nightmare since then. Got the card in August, and in October they abruptly changed underlying NBFC for my account from Quadrillion to DMI. I haven’t checked the report but many are reporting that they keep two personal loan accounts on the reports which is plain stupid. Then, earlier this month they abruptly “temporarily blocked” my card citing a KYC issue, a very common complaint on Twitter. Apparently this KYC issue gets solved in anywhere between a week to several months.

Very very scared of touching any of these new age nonsense Fintech products. Definitely can’t rely on these for emergencies, which I know a lot of people get these low reward free cards for.

When trying to take selfie. it is not working. i have given more than 100 selfies to approve my account but every time it is asking to retake. How difficult process it is.

Unable to load PayTM wallet with Unicard, nor able to add it to CRED… Very limited usage…

Is there any support number for the Uni cards for India. I have tried to complete the process but there is an error on application that Aadhar services are down due to which unable to do the KYC. And its also showing that team connect with me. But I’m not getting call and error is still coming up. Aadhar services cannot be down for so long. There is some other issue.

They have started new Uni Pay 1/2 Card variant as per offered to me today, similar to 1/3rd card the 1/2 card give option to split payment to two months rather than 3.

But it is coming with added advantage of 1.2% cashback on full payment after 30days compare to 1% on 1/3rd card variant.

Rest all features, T&C remains the same.

Reason mentioned for offering 1/2 card is my profile under wait list for 1/3rd card at present, so 1/2 card is offered but extra cashback on full payment.

Cool, thanks for the info Rishabh. Hope they next come up with a Uni Pay Card (1/1) with 1.5% or above returns. 😀

LOL, agree. And for real credit card enthusiasts like us, that variant will be something to attract considering the 1.5% or 2% reward rate as I feel most of us don’t use credit cards to split the amount into multiple months tenure.

Sid

Please have one article about niyoX bank, jupiter and FI bank. These are new age banks. Let’s have one article about the same as well.

Any reason why you think you need those products?

How to make payment to unicard, app is not working

Not sure about other debit cards but Fi money or even neo could make sense in the light of border opening. I believe a lot of us could potentially visit foreign countries in coming months and Fi could be of help in making purchases outside India considering the fact that majority of credit card holders are not privileged to low forex markup while Fi money allows this on 0 forex markup.

I received 1/2 card with 2L limit.

But I can’t use it anywhere (Amazon/Paytm) as it’s getting marked as ‘Prepaid card’. Also while trying to add in Cred, it’s showing as ‘Debit card’.

Useless!!

Got an amazing offer with upto 20% off upto 150 on Uni Card. Limited period targeted offer though.

How you came to know about the offer? On email or SMS or app notification?

can anyone tell if spends greater than 10 lakhs a year done through prepaid or pay later cards is reported in latest annual information statement of form 26AS

Poor customer care service, lost my card asked for replacement card and still card not delivered. more than a month now. Not recommended at all.

No Dude, they are better than any other NBFC or the bank, I might agree with your experience as it changes person to person but on a wholesome, I really liked their support function on whats app, accessible to me at the time I need, unlike the other banks or slice to reach for help only at the particular time which they defined.

Even my card didn’t work at Paytm while paying the electricity bill when I tried to pay the bill along with my wallet balance and learned from them as they do not allow a wallet load facility.

Waiting for the Scan and Pay Option along with 1% cashback.

Hi Siddharth,

I received a call from Unicard today.

They are offering that 1/3 card. Please clarify:

-> How the CIBIL score will be affected for:

a) Pay in full?

b) Pay in 1/3 mode?

-> What are the charges / hidden charges for that 1/3 repayment mode? How are they making business? How are they making profit out of 1/3 payment mode without any interest?

-> Is the underlying NBFC safe? Are the participating banks and NBFC recognized by RBI?

I am concerned about possible legal issues with such card, as some NBFC is related.

Just did a transaction on Dmart Ready online and it failed. I used it under credit card option mayb I must have used it under debit card? Can some1 confirm if they have faced same issue?

Hey Sid,

Looks like you have not looking at your Uni or One cards. They started rolling out decent target spend based offers. hope you write an article on it too!

Covering the Carnival shortly. Can you share what spend-linked offers are there on One card?

Hello

Could you tell whether they are active in Delhi or not? Or Active in certain pin codes of Delhi.

I am from Delhi, but after applying the app is showing ‘we will be at your location soon’.

Thank You

Which is best for someone new to build a credit history having only Uni card?

Paying in full

Or Paying 1/3rd

without any missed payment of course in both options..

Also, Which is better to build a Credit History for 20 yr old?

Uni card or

One card against FD ?

Hi, Sidhardh,

After PAN and Adhar Verification , UNICARD guys keep silence. They offered 1/2 Card. Is it cheating…..Still no response. Can you brief the use of UNICARD

hi

I am not able add money or any kind of transaction with my UNI card

please help

Hi Sidhrath,

Thanks for the awesome information about UniCard. I have applied about this but they keep silence after getting my Aadhar & PAN.

However can you review EnKash Credit Card? because your genuine opinion helps many people about the card. I’m planning to have that, if Unicard didn’t reach out to me.

Thanks again for giving clear cut information.

I had applied unipay 1/3 card before one week, but still i am not getting unipay 1/3 card. every time i checked card status on unipay 1/3 card application so, every time get the same message that you are on the waiting list. I think people are being cheated, because nothing is happening the way they are being advertised on YouTube channel and other social media sites and there is no help line number to contact them.

Since a lots of users are asking about Slice cards, here’s my negative review based on my experience. Also, I own dozen+ cards, so am aware of card safety, customer care experiences, etc.

Slice is basically a virtual +physical card, where virtual card is generated within an hour of application and physical cards gets delivered soon after.

There were recently 2 transactions made on my slice card when the card was safely in my locker and I was travelling. I called their customer support but the hold time was long. Finally, I got a way to block the card on the slice app, without having to clear the outstanding dues that slice app was asking for.

Customer support is really poor for slice. The executive kept blaming me, there might be a spyware in my mobile! (to justify how transaction got processed when card was not with me).

They also wanted me to file for an FIR. (which I filed). But I never had to do such thing in past, credit card companies would issue refund/credit and then start their back end investigations.

Also, reading several such online reviews, I am pretty sure by now that there is either some data leak within the slice employees or hackers have found backdoor entry to their card database/algorithm. Since its a known issue now, slice customer care should have been even more helpful rather than reading the same scripts!

As for customers/users, I advise exercising extreme caution with such prepaid and virtual cards till they can streamline, improve customer care and beef up security.

Maulik,

Thank you for sharing your experiences. This is the main reason , even with attractive offers, I refrained myself from any PREPAID cards(UNI,SLICE etc.) or BNPL (Do not like as personal loan in CIBIL) instruments.

Till now managing with traditional credit cards.

My friend had similar problem where his credit was getting used unknowingly and money got deducted on due date from bank. When we looked into it, we thought it was a security breach, called up HDFC for it and decided to file an FIR. But next day my friend refused to file an FIR. When asked about reason, he told me that it was none other than her wife who was secretly using the credit card and didn’t speak until thought of FIR came in.😁😂

Hey Sid, UNI cards can be used in petrol pumps??

Yes it can be used. I regular use it both PSU and Pvt. Fuel Stations. Any place that accepts Visa cards should be able to accept Uni Card.

ATTENTION: THIS IS IMPORTANT!!!

It indeed is. I just happened to do some study on the differences between these options like Slice, Uni Card and PostPe which claim to be competitors for credit cards. I came across an important point in the Terms & Conditions of at least PostPe and Uni Card and I am not sure of Slice but I would assume the same.

It seems that they will not mediate between the customer and the merchant should there be a disputed transaction. It’s up to the customer to deal directly with the merchant. This is a HUGE RED FLAG for me. On many occasions it’s the bank (HDFC mostly in my case) that has helped me settle disputes with merchants and has aided me in getting my money back for failed transactions or for multiple charges for a single service. If these so called credit card competitors are not going to do that then you’re at the mercy of the merchant. Imagine traveling with a card like this. Beware guys. I was thinking about trying PostPe and once I came to know of this term in their T&C I completely dropped the idea.

Impressive. The only Thing that I don’t like is “Visa”, why not our own ” RuPay”?

I got to change my card to SBM from RBL PPI, may be rbi circular, BNPL market bit confused and brittle.

Unicard really helps balance your payments with the pay by 1/3 option. If i spend one lakh quarterly, i end up paying around 8k in regular 45 day credit card interest amount. But with the pay by 1/3rd option on this card, i save on the interest. So far, I have saved over 50k on regular credit card spends. Though the 1 percent cashback on full payment is low, it is wiser to stagger the big amounts and avail cashbacks for small amounts within 1000. In general, this card works best if you want a 3 emi option over regular cards without interest rates. The billing happens at the end of the month and i receive a week to make my payments which I feel is sufficient. With a regular credit card, the outstanding amount is charged daily till the payment is made after the statement is issued to you. So if you make the payment the first day, after the statement is sent to you, you end up paying lesser on interest on your next cycle. If you pay on the last day, you end up paying more interest. This is the cardinal rule which earns big bucks in the credit card industry. However, with this unicard 90 day 3 emi interest free cycle, you spend one lakh ond the principal is converted to 3 emis based on your choice within the app and you get a greater interest free period. Never seen any issues with card acceptance as it is a Visa card. In addition, you also have part payment options at same rates as regular credit cards. You only pay based on the choices you make within the app.