Mobikwik in partnership with American Express launched the Mobikwik Blue American Express card for select Mobikwik customers by mid August 2020, later extended to many others by late Nov 2020.

This is technically a prepaid card but in this case it works more like a debit card that’s linked to Mobikwik Wallet balance. That’s a good innovation for sure.

Table of Contents

Application Process

It was issued to only a few by August 2020 when it got initially launched and I got it by then. From late nov, its given to everyone who did the KYC process with Mobikwik.

Virtual card got generated instantly and they don’t have any plan for sending physical card as per tnc.

Benefits

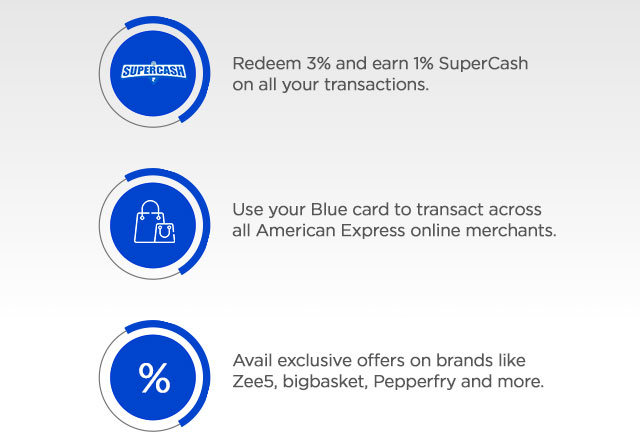

- Every transaction with this card redeems 3% of value from supercash

- Every transaction earns 1% supercash to your wallet

- Merchant Offers

Max. cap of Rs.1000 per month applicable for redeeming Supercash. Apart from that, You might get a credit limit of 10K once spends through this card exceeds 10k via their Zip offer (buy now pay later).

Cons:

- To redeem 3% of transaction value from supercash, you have to apply the offer in the app under Rewards section of the card each time

- Supercash concept itself is complicated (though much better now than its inaugural version)

- Merchant offers with this card are limited at this point

Mobikwik-Amex History

Amex partnership with Mobikwik goes back to April 2015, when it bought a stake in it. Mobikwik was a brand name few years ago with generous cashbacks on adding money and recharge, until it started a new concept of providing supercash instead of cashbacks and very few of its existing customers liked its complexity and benefits.

Even after demonetization Mobikwik was unable to capture the digital boom thanks to its supercash concept whereas others like Paytm, Phonepe, Google pay thrived.

Being a shareholder of Mobikwik, this partnership should have come much earlier (though in its present form, it is unlikely to please its customers in a big way).

Bottomline

Because of its dwindling user base & transactions volume, Mobikwik had to do something as it missed the digital bus. Amex being its major stakeholder had to step in to protect its investment from becoming dud. While launch of this card is welcome as this is 1st of its kind, much better innovation could have been done to woo premium customers.

As Mobikwik runs generous supercash offers time to time, regular Mobikwik customers will find this card useful as they can now get direct 3% discount via this card (if they have earned supercash). In other words, Mobikwik has made supercash redemption easier via this card.

Apart from that, post the introduction of 2% fee by Paytm for wallet loads, now Mobikwik with Amex network access is a good alternative.

- Update: Paytm revoked the 2% fee again. This is probably the 2nd time Paytm is doing this.

Apart from small rewards, overall its not a great product, especially because of low acceptance compared to other wallets like Paytm/Amazon Pay, but its worth it when you are not able to use the others above for some reason or other.

Do you use the new Mobikwik Blue Amex card? Feel free to share your thoughts in the comments below.

I like this card a lot. Earning supercash is easy you can earn by credit card bill payment. And instead of using credit card directly anywhere. I use them via this card. Say you gotta pay school fees, instead of paying with Apay card I load Mobikwik and pay with this card. So instead of saving 1% I saved 4%.

My rule is this. If there’s not a card specific offer then I’ll load Mobikwik and use this card.

Dear Ankit

Was aware of the rules very much. But never thought it like that. Thanks for the insight.

Thank you… One addition you can do is pay the credit card bill using mobikwik website with debit card. In my case it gives extra 1% cashback through my debit card

Can you please tell which debit card is being used

I currently have 800 super cash. The card offers says that I can use 2% super cash. That 2% is 2% of 800 or 2% of my transaction value?

2% of transaction value limited to a maximum of 1000

Paytm still charging 2% for me.

Yes

Same for me as well

I wasn’t charged 2% till october , November onwards being charged , though other readers have suggested a few ways to avoid in other posts , please do read them

For me too.

Yes…from me too

I thought I am the only one…. but looks like paytm is charging 2% wallet load for few and not for others. Anyway, other option is to charge GiftCard in paytm instead of wallet. Gift card has restriction (can be used only to pay merchants no p2p payments.) But then my paytm wallet without KYC has same restriction as well…. so I am at no disadvantage.

Check again,if u are getting same problem, complaint to coustmer care @paytm

HERE IS A HA*K FROM A HAC**R.

Why you are adding to wallet, instead purchase paytm gift voucher.

Same value, same uses, but no extra charges.

Nice idea indeed. Are you sure it works? Wondering why no one mentioned this before!

Paytm gift voucher was mentioned in few posts, have purchased and used them. The beauty is paytm is now levying 1% fee on that also. Balance from paytm gift voucher can be used for merchant payments, and not for wallet or bank transfers.

Any idea what are the repayment options available for mobikwik zip pay later? Do they accept wallet balance or credit card for zip bill payments?

Amount added through credit card cannot be used for repayment of Zip outstandings. Its mentioned in Help.

What about using the credit card directly to pay the zip bill?

You can’t use credit cards to repay any kind of debt.

Ok. Thanks

Paytm still charging me 2%, so I load it via Uber. Reg mobikwik, I have had to constantly update myself with changes in its supercash policies ever since I started using 3.5yrs back. Its kind of stable now, and I have stuck with them for all these years, having burnt thousands of supercash. As long as you don’t have to get into contacting customer care the wallet is good. For some time they even allowed monthly upto 10K wallet balance to be used to pay off credit card bills at no fee, but not any longer now. 3% supercash burn offer with their Amex VCC is until 31Mar only, I do hope it continues beyond.

“so I load it via Uber” – Sorry, didn’t get you, please elaborate…

It means that you can load paytm wallet using uber without any charge as Paytm has started charging 2%. Hope this clears.

login to uber account -> payment tab-> link paytm(uber and paytm same registered number required) -> add money …it wont charge you 2% … disclaimer : Valid only till Paytm plugs this workaround…credits to the person who suggested this method in other posts

Also works on Zomato. Should work on all apps where paytm has been linked and supports recharge of paytm wallet via the app.

Paytm started showing me the same 2% message even via zomato. And on Uber it no longer takes the credit cards once already used, so they only want you to use UPI or debit card. Mobikwik Amex Blue was already enough for me to shift lot of my spends away from paytm and now their 2% levy has simply called curtains. Paytm wallet acceptance in local stores has also dwindled, as most QRs are increasingly UPI only. My wallet loading paytm has almost come to an end, and in turn the app’s usage.

Just checked in Uber app. It allows loading Paytm wallet via credit card once you link your Paytm account with Uber

Yeah, true, btw if we load wallet via credit card on paytm website, then 2% charge is not levied, any idea about this..?

You can’t load wallet via credit card on paytm website.

Dont load paytm wallet with this card as it is mentioned in its FAQs that a charge of 5% will be done for wallet transactions. I lost some money while doing that.

When I add to Paytm via Uber through Mobiqwik blue card, it is charging me 5%

3% supercash discount got reduced to 2% now

Excellent virtual card MOBIQUICK american express virtual card holders sent also physical card online it works credit card dicounts at online amex card offers

Updated the app today. Why the Rewads tab has vanished from VCC page? How do we apply 3% supercash offer now?

Now it’s visible on the offers page itself.

No – can’t apply from that. It only shows the offer, no way of activating it.

Also, it’s quite a buggy app – not able to apply supercash coupon on credit card bill payment even after multiple attempts and by default there is no supercash earn in credit card bill payment.

I wonder how people claim about saving 4% through this route.

Don’t used the this card its have very high transaction fees which is not mention any where after doing the transaction we come to know even we are not able to use super cash of 3% it’s say refer to terms and conditions

I stopped using paytm because the cashback has become way too complicated. MobiKwik has become easy in terms of getting redeeming its supercash compared to before

I have used this card to pay electricity bill, utilized 3% supercash and also received 1% supercash.

I stopped using mobikwik couple of years back because of their frequent changes to the supercash redemption rules.

Not sure if I understood this wrongly, I activated Blue card and then loaded money into wallet using MRCC and then when I tried to pay my electricity bill through pay bills section it showed that my blue card has been blocked by zaakpay and i tried using my wallet amount and it showed “wallet amount added from credit cards is not applicable”

Any help on what I might be doing wrongly

Try paying the same bill using the Blue card from some other app/site, e.g Amazon Pay, etc..

I was one of the early users of the Amex Blue Card from Mobikwik. Mobikwik is the digital wallet I have been using the longest, though since 2018, I was using it rarely. But the with the Supercash rules being made more sensible, and credit card bill payments giving a steady suply of Supercash, I found the new Amex card to be a very good option. I had to recently pay my Excitel internet bill. They had only Paytm as a wallet payment option, and the max return I would have had had on any of my credit cards would have been 1.5 percent. However, I loaded money into my Mobikwik wallet using my AmazonPay ICICI card, got 1 percent return there, then used the Blue card to pay the bill, also redeeming 3 percent Supercash in process besides getting 1 percent Supercash back. So overall, I could get a 5 percent return on the transaction.

This would work only for smaller transactions as there are restrictions on Supercash usage, but particularly when Paytm is taking the customer for a ride, the Amex Blue card does give a vry good alternative….

Now to redeem 3% Supercash, user need not activate in the app, rather they have to select the usage of supercash on the OTP page.

A major update.

Thanks thats a useful update.

Earlier I was paying utility bills on paytm app using my paytm balance loaded via credit card. Now I use Amex Blue as the credit card on paytm app to pay the bills. It treats this as a PG transaction and not as wallet load, so there’s no 5% fee involved and I m able to burn 3% supercash. Effectively I could use mobikwik in competitor paytm app 🙂 . But once when I made bigbasket payment from freecharge using Amex Blue, there was a 5% charge from mobikwik, although 3% supercash was also burnt. There it got considered as wallet load even though I was only making a payment.

can’t we use the same blue card to pay bills through mobikwik itself? I tried but getting error ‘your card has been blocked by zaakpay’

Why don’t you directly pay using mobikwik? That way you can use 5% supercash. Also, how do you use this card on paytm or Amazon pay? I entered the details in credit card section and the alphanumeric cvv code but neither paytm nor Amazon accept it. Is it supposed to be used as a credit card or debit card and what about cvv?

You have to add under Credit Card only and it works fine in paytm and CVV is the 4 digit numeric code not that alphanumeric one

Where you have option to pay via mobikwik directly its better to use that and burn 5% supercash. Where it’s not accepted but Amex is accepted then use Amex VCC and burn 3% supercash and get 1% back. Recently did a single transaction of 37K using Amex VCC and burnt 1000 supercash, my monthly quota, in one go. And I got back 370 supercash. Note that the burn has a monthly cap of 1000 but the 1% earn doesn’t have any cap. Since Oct, on one day in a month mobikwik has been giving 2% supercash on credit card bill payments. So supercash is now easy to earn, easy to burn.

Thanks abhi & beginner. Have you paid amex credit card bill using mobikwik? I tried it long time back and it failed and I didn’t take a risk the next time. For visa, master card credit card bills, I haven’t encountered any failure yet. Any idea about amex success rate, how it has been lately?

Yes Shikhar, have paid Amex card bills successfully on mobikwik. I have encountered failures in past but thats regardless of network, earlier even payment to Visa has failed and reversed. But of late it has been more stable, sometimes takes longer to process but eventually works.

It shows the offer but not able to apply it. Is there anything I am not getting or that’s a bug in the app?

The supercash burn is to be applied on the OTP page, just before the OTP input box. Also, you will see how much SuperCash you will earn on this transaction.

It’s not working in iPhone. Try doing it in android. After it’s done, it works in iPhone too

Exited Mobikqwik long back… they kept on changing their supercash rules.. lost trust on them. Like AMEX cards they are awesome in terms of rewards & service.

best alternative for paytm is amazon pay balance. load it via amex and pay bills. p2p not possible though

Amazon pay had utility bill payment limit of 25k, paytm has none.

Can we add amex blue card as normal card on amex app?

I tried.. but unable too.

Also this card cannot be added to Uber as payment method. I have tried that and its not working.

They ve added offer on zomato 20% cashback credits. Many other offers, such as bigbasket, are same as you get with regular Amex cards. Just that with this VCC you can burn supercash to get additional 3% discount.

They have changed super cash discount to 2% from 3%.

The Supercash burn rate seems to have been reduced to 2% from the earlier 3% with the earn rate remaining same at 1%

The maximum monthly supercash earning on Credit Card Bill payment seems to be set @500 now from the earlier 1000 and also the day when there is double rewards to credit card bill payment all my transactions failed except for AMEX cards and it took about 7 days for the same to be credited back to the account

Thats the max supercash per transaction. You can still earn much more than 500 per month on CC payments.

The Wallet Loading change of 2% is also introduced beyond 10K per month which makes the Blue Card in effect providing 0% returns

Going the paytm way. But still little better.

It can never be better than paytm..

I had to dump mobikwik within a week of introduction of supercash concept coz I can’t waste my time twice for such complexity..

After that I have rarely used mobikwik five to seven times.

One time you browse offers to earn supercash and second time waste your time to redeem it… What a Joke.

Paytm is now not giving much cashbacks than before, but at least it’s not trying user to keep in a spider web.

Its human nature to be free and love for simplicity, not to be kept entangled in anything particular.

Biggest example of success as a result of freeness and simplicity is ANDROID, on which platform these apps are working, still they are not able to grasp it.

Paytm has understood it clearly from beginning. I don’t know why Mobikwik is not able to understand it.

Even author of this post has confirmed. He has clearly advised users that if you are not able to use other options, then you can go for it.

Paytm has upped its game. From recently imposed 2% its now asking for a “nominal” fee upto 4.07% to add money via credit card. Not able to load via Uber or zomato anymore. Wonder if anyone in this forum is able to use paytm anymore (loaded via credit cards). Even paytm gift voucher is now being charged atleast 1%.

Am not getting charged. Are they still giving this advantage to few accounts?

P.S. I never transferred wallet funds to bank. Maybe that is helping now.

It’s 4.07% for Visa / Master Credit Cards and 1% for AMEX cards, Haven’t checked with Diners yet since HDFC doesn’t provide RP’s on Wallet Loads.

The above is when I try through their app but when I load through the website it allowed me until 10K without any charges through AMEX Platinum Travel Card.

Well if you have citibank credit card you can still load money for free on paytm using citibank wallet recharge option. There is limit of Rs. 5000. I did the transaction 2 days back and it is working.

I have done wallet to bank transfer few times (after loading via uber), and only well after they introduced the 2% fee. But its true they giving different treatment to different users.

Recently at a shop, when I scanned QR to pay, it displayed a list of payment options including all my saved CCs and DCs, so I chose a CC and was able to pay without using my wallet balance, no fee for that.

Meanwhile, Payzapp has revamped itself and will introduce scan to pay soon. They dont charge for loading wallet yet, and if they can get their act together, they can help phase out paytm.

In barely 5 months of launch, the supercash burn rate has been reduced from 3% to 2%.

Supercash usage restricted to 2% now

They’ve decreased supercash redemption to 2% now

Wallet loading charges (2%) for monthly load of above 5K using credit card..

I have more than 2000 Rs as super cash… to redeem will have to use UPI load now.. 🙁

The message I received was that 2% above 10K load per month and not 5K .

This was about 10 daya ago, probably new rule introduced post that to limit that to 5K per month

Added 11K using crcard yesterday, no fees charged.

Am getting the following message when trying to load through CC , beyond 10K . (it was 5K when I checked few days before)

“Why are we charging processing fees from users?

Whenever you load your wallet through a credit card, MobiKwik has to pay a high fee to the bank. We charge this fee to compensate for the cost.

Please note that we only charge this convenience fee, once the total wallet load amount through credit card exceeds Rs.10,000 in a calendar month

We recommend you use Debit Card for zero convenience fee and instant payments.

How is the processing fee calculated?

Below are some examples

A user loads Rs.10,000 in the wallet at the starting of the month. No fee is charged for this transaction. The user again loads Rs.5000 in the wallet. A fee of 2% (Rs.100) is charged on the amount of Rs.5000

A user loads Rs.15,000 in the wallet at the starting of the month. A fee of 2% (Rs.100) is charged on the amount of Rs.5000”

I need to know any annual fee for Mobikwik Blue American Express Card. Please confirm

There is no fee for this card

Alert:

There has been a massive breach at MobiKwik with over 37 million KYC compromised. From multiple sources, it seems that Mobikwik has allegedly suffered the biggest data breach ever. It is showing account name and IFSC code, saved credit cards & also CVV codes.

All having MobiKwik accounts should change password, delete account & block domestic & International usage of the credit/debit cards linked to it and subsequently ask for cancellation & re-issue of such cards.

I hope this is verified as I had seen this in multiple news outlets although this has beed declined by MobiKwik.

If this actually happened would have an impact on the IPO plans for Mobikwik.

If we need to cancel the card in future, is it possible to do so through Mobikwik app ?

Mobikwik continues to disappoint me. We can no longer use SuperCash while making transactions in NPS. They will definitely not have a successful IPO.

I had done a small transaction for NPS Contribution last Saturday through Mobikwik and there was no issue in using 2% SuperCash.

Not sure if this change came over the weekend , but my NPS Transactions through Mobikwik were all smaller value ones in the 10-20K range.

Which payment gateway allow nps payment using mobiwik

Nowdays there’s issue with applying supercash even for wallet transactions, sometimes it doesn’t give option to apply supercash and entire payment goes from main balance itself. But neither do paytm or payzapp give any such benefit, so all the same.

I Agree. But we can load money into Paytm using multiple tricks for free without any charges and can transfer amount to bank at 0% Charge. Payzaap doesn’t charge any fee for wallet loads. Mobikwik is worst according to me, I pay 2% charges with the thought of getting them nullified while making transaction with Amex Card. This gives me a benifit of meeting 4L spends on my Amex Travel Card. This strategy is no longer applicable. Need to find other ways.

i could use 2% supercash for a 35k nps payment yesterday.

Yes Vicky. I was able to use it as well yesterday. When I tried on 19th July, it was not working. Magically, it worked yesterday. Could be an issue from Mobikwik. I am glad it worked, I had close to 60K stuck in my wallet. Thank you.

You can still add 5K a month at no fee. If there are couple of more wallets in family, add another 5K each there and transfer those 10K to yours. That way you can add upto 15K pm at no fee using same credit card, like Amex PT.

True Abhi. I agree. But, I am not a fan of this method. I am somehow scared of getting a tax notice/ITR problems. I want to keep my profile clean. Thank you for your inputs.

It’s a credit card or not and we upload a statement of other credit card apply

It’s not a credit card. You can top it up n use it upto your wallet balance.

Did anyone manage to get that free Zomato Pro or Zee5 subscription for using Amex VCC so far?

Mobikwik has disabled use of Supercash burn for all the below now –

A) Online merchant except Bestprice and Spencers,

B) Offline merchant except Metro cash&carry, Reliance Digital, Reliance Fresh, Apollo, Medplus and Vishal mega mart

C) Pseudo merchant except Milk and Petrol

It’s a pretty useless wallet now.

Amar, This seems correct. But, How did you get this info?

What is the source of the information ? I just now used it to make Ola payment.

Hello Amar,

Can you please let me know where did you see this? I don’t see any such thing in the app?

Then which wallet is useful now?

Amazon can’t be used offline, and there are only few petty cashbacks online.

Payzapp has little to no acceptance.

Paytm has practically stopped cashbacks and heavily moved to the unrewarding UPI. Add to it their ever changing and complicated rewards system such as paytm first points worth nothing more than dust.

Phonepe is synonymous with the unrewarding UPI like Gpay, with next to nil rewards (permanently Better luck next time).

Freecharge never got anywhere, and its hardly rewarding.

Mobikwik Amex VCC still gives 2% supercash burn and wallet can be loaded 5K a month via CC at no fee. Some people can still load without the 5K cap. You can also buy certain gift vouchers with 5-10% supercash burn. You also earn payback points, at a measly rate though.

Suggest any good options pls.

@Amar, even I was not getting option to redeem super cash yesterday, surprisingly I got option to redeem today

@anuj Where did you redeemed the Supercash?

I reached out to customer care since I wasn’t getting option anymore for redeeming supercash.

They gave me this information. What I payed archive is a copy paste of the chat with cc.

The restriction is NOT for Amex card usage – Only for redemption option that was available when Mobikwik directly (used to be 5%).

Indeed the list of merchants where online/offline supercash redemption of 5% is available now is very few. Add to it, per transaction cap for 5% supercash burn is 100, so ok for transaction upto 2K only. Amex VCC is the way now for utilizing supercash. Surprisingly, on wallet transactions, mobikwik seems to be moving from supercash to real cashback, for some months they have been running cashback offers on Jiomart, bbdaily, reliancefresh, spencers, metro, apollo pharm, medplus, pharmeasy, swiggy etc.

Thanks Anuj – just tried and yes it’s working now.

I hope it’s not a bug and stays as before.

Now mobikwik has stopped loading money via Amex. This applies to ICICI Amex as well. Anybody able to load money in mobikwik wallet using Amex?

Amex still works, but add-money-without-fee limit has been dropped for credit cards from 5K to 2K. Bummer for my MRCC 1500×4 monthly target. eNPS contributions which help burn supercash also will be hit due to the low limits.

Mobikwik has promptly followed paytm in limiting wallet load without charges to 2000pm.

I was able to load mobikwik wallet with cc for 5k without any additional charges.

I have added 5000 on 1 November on mobikwik. May be they changed this limit after 1 November or it is still valid for few accounts

5K worked on 1Nov, but not since 3Nov. Tried on different accounts.

I think, it’s 5000 pm without charges, if it crosses then they will charge fee.

I cant even load patym through uber app every time it gets struck with web processing and disappears. i could load only once that too six months back after that same issue.

Are others facing the same issue with uber app. Is it only me

Yes I am facing the same issue. This is done by Paytm intentionally to not allow some users to add money from Uber at all. Meaning, those users are blacklisted by Paytm.

from last month onwards we cant load more than 2K from zomato to paytm maybe even for mobikwik too. It has become 2K per month now.

Doesn’t say whether Amex Blue will be discontinued or not. Key thing to find out is whether the Rupay card will allow supercash burn and when will it be rolled out. They say wallet limit will be raised to 2L, but their main push is towards Pay Later.

You can add money to mobikwik using credit cards directly or via swiggy, zomato, but its limited to 2-5K pm without fee.

Abhi, Thank You for Sharing tip of loading Mobikwik Wallet Via Swiggy.

Not seeing 2% discount using the supercash anymore. Is it same for everyone?

Same here , they have probably revised the terms where super cash cannot be used when paying through Blue card

Seems the benefit lasted merely 15 months or so. Burn rate reduced from 3 to 2 to 0 %. The blue card now just remains for making online transactions where Amex is accepted, which is already much lesser than other networks. Hopefully the upcoming Mobikwik-Rupay helps.

Not sure why have they now disabled Add Money. And not sure whether it will be enabled ever again.

Add Money enabled today.

Is it ? I already uninstalled Mobikwik since recharge was disabled. (Still with no supercash benefit, not very interesting.)

I , yesterday loaded 15k with credit card, In fact, last month I added 60k with credit card on mobikwik directly, had to trasfer to bank though , after could not use 2% super cash on payment page

Add Money is working fine now. I just could add money now

It’s probably the drop in usage or whatever be the reason, Mobikwik has again allowed 1% supercash burn on its Amex VCC, but now the monthly cap is 500.

And I don’t see any limits on adding money for free using credit card. Earlier there was a 5K monthly cap. So works well with the 1% supercash burn offer using VCC for transactions upto 50K pm.

Charges for transfer from wallet/cc to bank and fee for rent payment have increased to well beyond 3%.

Maybe user specific..I still have the 5k limit

Mobikwik is still charging 2% for my account to load money into the wallet. Free option may be not for everyone.

1% burn offer also is gone it seems. Now stuck with loads of balance in wallet.

Now the virtual card is being closed on 30 Sep, reason given RBI’s tokenization deadline. But they also say there’s something else ‘exciting’ coming up, but no clue when.

Yup. Got the notification too on yesterday.

Maybe some uniquely structured Hybrid product launch or Amex Mobikwik credit card.

Got to know from Amex Sources that they will stop sourcing all the basic level cards.

They are focusing only on HNI costumers, also got to know they wouldn’t give any great offers for signing up on Plat charge card till this year end. 1 lac MR points would only remain for sign up.

Cheers,

Kiran

Interesting rumour, but it’s high time that they should focus on improving Plat.

Mobikwik will do away with the virtual Amex card by Sep-end and is coming up with Zip Plus virtual card, which will also be linked to wallet balance. Additionally it can also be linked to Zip and Zip EMI balances.

Zip virtual card is live, Rupay platform, site says physical card “coming soon”.

On a separate note, seems only mobikwik is allowing rent payments using Amex cards, at a fee of 2.36%.

For account not having Blue card, Rupay card has been live since long. I think I got one couple of months ago (for my wife’s account.)

Now can’t use the mobikwik vouchers for most bill payments other than electricity and dth….