It’s been a while since I was holding Sbi Simply Click credit card. So I was trying to upgrade it to SBI PRIME card and finally got it, after chasing for couple of months. I got to know few things while doing this and so this article will help you understand more about SBI’s upgrade and credit limit enhancement process better.

Table of Contents

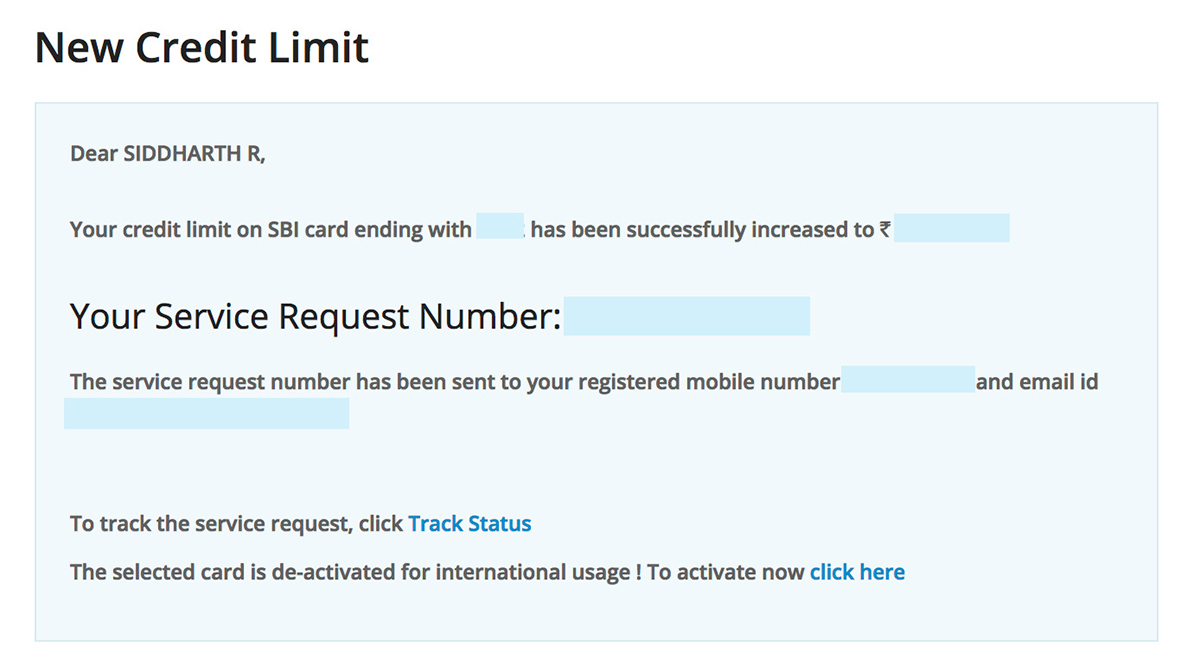

SBI CREDIT LIMIT Enhancement

Before you go with a credit card upgrade, it’s better to request for credit limit enhancement. This is because the premium cards are usually eligible when there is a good credit limit.

How to?

All you need to do is: Login into your account->Benefits->Card Limit Increase

Enter your income details and it’ll show eligible limit. If there is a pre-approved offer, you don’t even need to enter any details, it’ll pop up automatically. If this is not showing up even after 6 months of card opening, upload your income docs and submit using Mailbox->Compose.

You can expect the limit to be increased in 24-48 hrs. It’s pretty fast than I expected.

My Experience:

- Manual: They gave close to 2X for me on one of my LE application with IT docs. New limit reflects in ~48 hrs. Side note: I’ve also heard someone who got 4X as well. Totally depends on Spends & income.

- Auto LE: I got exact 50% increase offer on netbanking the second time. Got the limit increased instantly.

What’s your experience with SBI CC limit enhancement?

- Also Read: How to Increase Your Credit Card Limit

SBI Credit Card Upgrade

SBI says you need to wait upto 6 months to initiate any credit card upgrade or downgrade. If you’ve previously downgraded your card, SBI actually need you to wait for 1 year, even though they mention only 6 months on their FAQ.

How to?

Reach out to customer care and request for the credit card upgrade. Or, you can also use net-banking to request for the same. I prefer Netbanking as there will be a record for you to escalate just incase if it doesn’t go through.

Note: Escalations (both offline & online) don’t usually help with upgrades, at-least in my case. They’ll send the request to an eligibility team and if they deny, it keeps repeating again & again.

Even-though my Limit was good enough with card age being 6 months old post downgrade, my case was running for 3 months and they upgraded it only after 1 Year was completed. That brings me to the next topic!

CIBIL Effect on Upgrade

For some reason or other, SBI opens a fresh account on CIBIL even though you upgrade or downgrade your existing card. This is probably why they don’t want to do upgrade/downgrade in 6 months time.

This is very bad for cardholders because CIBIL will show as if you’ve closed the old card in one year. For ex, I was initially holding SBI Air India Signature card and downgraded it to SBI Simplyclick and then upgraded to SBI Prime. With most banks, this should show only as one account on CIBIL, but with SBI, it shows 3 different accounts: 2 closed, 1 open. NOT GOOD!

Bottomline

With SBICARD, you need to consider sticking to one card for longer period. This is quite important for those who’re already using multiple cards, as this will add up lots of accounts in your CIBIL history.

This is not so good in eyes of your new lenders as they’ll see you as a short term card holder. And it “may” also cause problems if you use your new upgraded card for ‘card on card’ applications as they’ll see mismatch with the age of your card.

How’s your experience with SBI Credit Card upgrades and Limit Enhancement? Was it easy or you faced tough times with upgrades like me? Feel free to share your thoughts in comments below.

SBI has started a new way for Limit Increase. You can check by logging into your account->Benefits->Card Limit Increase. They are giving an estimated increase right away after entering the income details.

Thanks for sharing this. SBICard is acting fast on improving this. Impressive!

#Article Updated accordingly

Hi Sid, did you get your SBI Prime as LTF , as simply click is LTF, or you pay normal fee/charges?

No LTF with SBICard. But you can get waiver on spend.

I have SBI simply click card and was planning to upgrade to prime. But didn’t request because of amazon cashback date is coming up and cibil score might go down (reason as mentioned in your article)

CIBIL doesn’t get affected directly as they don’t do any enquiry. Its just that you’ll see multiple accounts.

I agree. I did card upgrade on HDFC and in CIBIL it showed up as new card. Tried raising dispute but no luck. So I am not willing to lose my oldest card history for an upgrade. SimplyClick still is a good online (Amazon) shopping card

Never happened to me with HDFC, as long as its within Visa/MC. Maybe they’re doing it for Diners switch?

My wife’s card was upgraded from Diners Rewardz to Clubmiles and it did not show as new card and no new inquery as well.

I mean upgrade from “Visa/Mc to Diners” for which they do some changes in the backend.

1. SBI cards has different numbering system in different types of cards. In CIBIL card number is considered as account. Because of this when we change card a new account is considered.

2. Presently (in 2022🤣 as I m replying for 2018 message 🙆) SBI on fully giveaway mood and repeatedly giving new pre-approved cards with credit limit sharing.

3. Don’t close old card when you get pre-approved new card. Transfer maximum credit limit to new card. When you set least credit limit for old card then within very short period they offer increase old card limit again.

They did it in my case. Got upgraded to sbi prime card. Cibil effect down by 8 points.

Off topic: What is your experience with the new Amex plat that you got?

Will share in detail shortly.

Wait!!! It is Amex Platinum Charge card? O.o

Nooo. Its not. Diff one. Surprise 😉

“For some reason or other, SBI opens a fresh account on CIBIL even though you upgrade or downgrade your existing card.”

The same thing happens on Kotak Cards as well. I was offered Kotak Urbane Card with Kotak 811 account which was upgraded to League Platinum in 3 months and again upgraded to Royale Signature. Though they offer card upgrade very often but they open a separate account in CIBIL for every upgrade.

Thanks for that info!

But, Why on earth you’re getting Kotak Cards?

Kotak Essentia card is a good deal for me. There is a fixed yearly Rs. 750 + GST annual charge.

In return every month, I get Rs. 500 worth of cash credits on using my Kotak card for loading Amazon Pay balance for Rs. 1500 and Rs. 3500 (a total of Rs. 5000 ) ~ 10% reward rate.

It is charged as a departmental store expense on the credit card. Hence, I get the reward of Rs. 500 every month.

Earlier the same was applicable on Paytm wallet load as well. However, it has stopped now and works only on Paytm Mall and not Paytm.

Annually it turns out to be Rs. 6000 on a fee of approx Rs. 880. Not bad, right?

Do check it out!

u got upgrade so quick,

I’m holding league platinum from 2 year but i didn’t got even limit enhancement,

can u help me with ur credit utilization,spends.

reply appreciated.

Limit increase is possible without documents in sbi cards?

I am holding SBI card from last 18 months but they have not increased limit even once. I requested multiple times. My ITR is 3 lakhs.

Dude!!

I am using SBI SimplyClick card last 24 months and request multiple times for limit increased but feel like fucked up at last and give up. My ITR is more than 6 lakhs.

I vote for HDFC and Kotak for upgrades cards and credit limit increase.

Start using your cards aggressively. I did that for three months. Limit raised to 2X.

Siddharth I know you are online now. Please allow my comment on your article named ” Citibank Prestige Credit Card review ( India ) “.

Patience please. I’m clearing them one by one. There are about 100’s in queue as i was away for a while.

Dear Sid,

as i was away for a while.

Marriage?

Regards

No. Just some commitment at work.

I hold a sbi simply save card for a year now and want to upgrade to prime …But the online platform as well as customer care say that I am eligible for upgrade only to elite card. The spend limit for fee reversal is way beyond my annual spending. How can I get my card upgraded to prime.

I have SBI Prime from last 10 months with Rs. 75,000 credit limit. I have ITR of 3.20 Lakhs. Siddharth do you think that they will increase my credit card limit ?

If I give my HDFC card’s statement ( Rs. 2.25 lakhs limit ) will it help ?

I also have SBI FBB card from April 2018.

Maybe tough with mentioned ITR.

Dear Sir, how u able to get 2 credit card from sbi same time i am holing SBI prime card since 2 years..

Captain –

just out of curiosity, how did you the apply the SBI Prime? Are u an SBI a/c holder, or was it on card-on-card basis? Not sure if SBI does that. Or because of high CIBIl?

I’m asking because my Prime application got declined ( with ITR of 11.5 and CIBIL of 800! ) so trying to figure out what was wrong. Thinking of writing to Nodal officer or just try for another Bank card like Yes Premia.

Thanks

Mickey sorry for late reply. I saw your post today. My CIBIL was only 770 when I applied on October 2017. In past 2 times SBI rejected my credit card applications. So I tried some experiments to find ways to get approve for SBI cards. I suceedeed in finding the hack and after that at least 5 persons out of 6 suceedeed in getting approved an that also in 1st try.

I found applying for card on card basis is useless and somehow SBI do not favour businessmen. I applied through www. sbicard.com and said them that I am a salaried person ( even though I am a businessman ). They took only KYC ( no documents for salary verification) than they did phone as well as physical verification ( of shop ) . Within 4 weeks I got the card delivered.

Hi Captain bishuddha Bharatiya,

Thanks SIDDHARTH SIR for this wonderful platform.captain sir my question from you is what salary did you mention in online form for SBI PRIME CARD and what designation you mention in designation column.as like you i am also self employed businessman and my ITR IS 3.5L Only.

please guide me applying this SBI PRIME CARD .thanks in advance

Ashraf I divided my actual annual ITR ( maybe Rs. 3 lakhs ) by 12 months. But you don’t have to do that. From last 1 year lots of peoples has applied SBI cards being a businessman and everyone got approved. Few months ago my Mom got approved and she has Rs. 3 lakhs ITR. They never asks for income proofs.

If you don’t get approved than always raise a complain through email.

75k for 3lakh ITR? I have close to 10 Lakh ITR but limit is just 50k.

One point. Never opt for a banking partnership card from SBI. You will be stuck with the same card for years. No upgrade possible. I’m holding KVB SBI Platinum for 6 years now. In the same time period, I got 3 upgrades from HDFC, i.e. from platinum plus to Diners Black.

Depends what you are looking for. I am happier with SBI Air India card than I was with SBI Prime. Also, you can always close your current SBI card and apply for a new one. I do intend “downgrading” it next to SBI Simply Click

I mean banking partnership card and not a co-branded card. You cannot even downgrade a banking partnership card. I tried all such things. You are stuck with it and of course, you can close it.

Aha! Got you now; i didn’t quite understand the “banking partnership” thing at first!

Thanks Siddharth for the post. I would really love to also see a post on credit limit enhancement for HDFC Regalia and any other hacks for this card. Thank you.

“For some reason or other, SBI opens a fresh account on CIBIL even though you upgrade or downgrade your existing card.” – Please recheck, maybe there are different parameters here ~ I upgraded from SBI Prime to SBI Air India card (after 6 months) and the same account opening date is continuing (Original Account opening date of SBI Prime in CiBiL)

Maybe i was unlucky!

Hi Sid,

I have Axis Bank privilege credit card. I received it on 7th august, did 3 txns, received 12500 rewards points in Edge axis account. But, I m not able to find out how to convert these points into two Yatra vouchers. I went to redeem section, but there r no Yatra vouchers. Can u please help me? It’s a kind of urgent as I m waiting to book a ticket though these vouchers.

You can search for yatra on axis edge portal and you’ll find yatra(product code E177) Rs.2,500 voucher. But I’m struggling for last 3 months to redeem the yatra voucher, raised issue to axis support and it’s not resolved yet, maybe issue specific to my account.

Thanks for your reply. But it is not showing any Yatra vouchers. Will it refect after I settle first Cc statement bill?

I’m not sure, maybe shown after making annual fees payment. But I tried after 2-3 months of privilege card usage and it’s available in edge portal.

Actually, SBI opens a different account whenever you upgrade or downgrade a card. It closes an account and opens a new account. I have as of now 3 different SBI cards being shown out of which two are being shown as closed. One is open but I think this negatively impacts the CIBIL score. Citibank, HDFC and Stan Chart just update the card number and continue the same account in case of upgrade or downgrade.

In my experience Only Stan Chart uses relationship number to report to CIBIL . CITI & HDFC used credit card number to report to CIBIL. in My report every upgraded card from CITI and HDFC reported as unique account.

No, actually we have been using Citibank, HDFC, Stan Chart, SBI and other cards. With Citibank, HDFC and Stan Chart even though we have been upgraded wnr downgraded multiple times, it only reflects as a single account. With SBI, each upgrade or downgrade is considered and reported as a different card. However it should be noted that there is no hard enquiry.

This is what is printed in my CIBIL; 4 months after the SBI card upgrade. The old card (Prime) is showing as “closed” while the original Opening date of Prime is now reflecting as the opened date of the upgraded card ~ without any enquiry as you rightly mentioned.

Hey Sid,

Currently my score is 784 with 13 enquires made in 2 years. Had no clue that time but good thing is have made 100%payment. I hve got 3 cards. SBI(1 year old) , hdfc(oldest) and yes card(newest).

Tell me how i can improve cibil in 4 months or so. Have been staying within 30-40% from 2 months.

Should i go with FD based cards. Indusind or axis?

Which one doesn’t make enquiry on cibil?

My current ITR is 8 lacs.

FD based cards too have started making CIBIL enquiry before giving THE card to you. It hold true for ICICI, SBI and HDFC.

In the comments and article, it is mentioned there are multiple accounts opened in CIBIL on upgrade/downgrade…May I know how to check them out, how many accounts created in our CIBIL..??

Once you have your CIBIL report in hand you can see it listed there

Guys, i have SBI Elite and SBI AI Signature. I use Elite for INR 5+ lacs to get 50k reward points. Don’t use AI card much as i already have 1+ lac miles. Do you think i should continue with same or change the cards?

Thanks for the article. I instantly applied for limit increase online and within 1 day the limit was increased by further 1.25L. It was recently increased by 80k few months back. Although i dont use the card much as I completed the 2l milestone on simplyclick, but who can reject limit increase.

Congrats Prashant. If I may ask how much was your income and what was the percentage of limit increase ?

I submitted Form 16 and income is more than 10l. Limit increase was 50% to Rs.3.64 L.

Good. I am too waiting for my limit increase. Will apply soon for limit increase with documents.

Hey Prashant, Sid

I am been using SBI cards for almost one year now. Have read they have introduced new limit increased feature under benefits section.

Have entered my current ITR, it shows we have given you max limit (which is 50K from start). Even entered 50 lacs just to check whether i get initial approval/increase but didn’t work.

Is there something wrong? My last ITR was about 4 lacs now its doubled.

Please help.

Have i been using your card regularly……also check the offer section if limit increase offer is there. As your limit is only 50K try to use it more for next 2-3 months and check again.

Hi Rajesh

Kindly try to enter some realistic values, it asks for monthly gross income try to enter some real value like u said your ITR is around 8 lacs so divide it by 12 then enter. If you enter too high values it will reply with a sorry message everytime 🙂 .

Hello Siddhart Sir

I am using SBI simplyclick card from 1 year. Decent spend of Rs 1.5 lacs annual. Not getting any offers LE/upgrade.

My Cibil score is 765. Should i get LE manually? It will hurt my score as you have written they will open a new account.

I am worried. Help me!

You can try for manual application. More spends would help, as without which they may think the given limit is enough!

I have SBI Gold and More card and Amex Travel Platinum cards. I am being offered SBI Prime card. but haven’t upgraded it yet.

Is there any point upgrading to Prime as it costs Rs. 2999/- +taxes (for expense less than 3L in a year) whereas Gold and More was like with zero annual fee.

My first priority would be to spend 4L on Amex card and then on other cards. I wouldn’t be able to reach 3L after Amex spends.

I applied for a new SBI SimplyCLICK credit card and they approved it with 5L limit without asking any income documents.

Bharat

How you get this much limits ? did you applied on card on card basis , what was your credit limits at that time ?

I have gone with manual application but they have rejected as 3 months before my ITR is just 3 lacs but now its 9.

I will try to go for LE if not what would you suggest my next card be?

I am leaning towards amex Gold charge/Mrcc. Eligiblity is 6 lacs. Do you think i would have get a card from them as i have 9 lacs ITR

I hold SBI card from last 18 months. They have not increased limit even once. My spends are more than 7 lakhs. I have raised a complaint to nodal officer. Lets see what happens.

I have ICICI platinum card.I m working in ONGC.

ICICI agent have setup a camp for providing lifetime free coral cards for ONGCIANS .

I want to know that can I close my previous platinum credit card and apply fresh for ICICI coral card for free lifetime.Is it possible?will it be hurting my credit score?

Kindly give your suggestions.

Thanks

I hae 3 SBI credit cards mapped to my cibil. Whenever i changed the card type, they have updated it as a new card by closing the old one. 1st is Platinum, then Signature n then Simply Click

Hi Siddharth

I am using SBI Simply Click with 1 lakh limit for the last one year. I want to upgrade it to SBI Prime. Should I first go for credit enhancement of my existing card and then apply for Prime. With my existing salary the sbicard website is calculating my credit limit as 2.25 lakh. Will this limit make me eligible for SBI Prime. After how much time of my credit enhancement can I apply for Prime.

In august, 2018 SBICard on my request had enhanced credit limit from 1 lakh to 2.25 lakh on my SimplyClick card. Now, in December, 2018 I got a message for pre-approved limit of Rs. 3.38 lakh, which I accepted and my limit has been enhanced to Rs. 3.38 lakh. Great work SBI Card

Pre-approved?

What triggered limit enhancement?

Where and how much did you spend?

Got of prime and upgraded to elite.nits 14 months now in total, but haven’t got any limit enhancement till date.

Here’s my upgrade story:

I applied for SBI SimplySave in November 2017 which was approved in December 2017. After exactly 7 months from the date of approval, I got an offer to upgrade my card to SBI Air India Platinum Card. (That was really quick)

I thought of upgrading my card to SBI Prime and called customer support for the same. They told me that I can upgrade to SBI Prime and I’ll be receiving a call back from eligibility team for the final approval but the eligibility team rejected the upgrade request stating some internal policies.

One month later, I got a call from SBI Cards and they told me that I can upgrade to Air India Platinum Card. I told them I just want to upgrade to Prime. The customer care rep connected the call to some team where they took the request again and the card arrived within 7 days.

Now the struggle didn’t end here. I am unable to do any online transaction with this new upgraded card. I have raised a complaint via mail, call, and SMS but they have closed the complaint without solving it.

I am getting the following error while trying to do any kind of online transaction:

“Your SBI Card details are currently not available on our system.”

Has anyone any idea about this issue?

SBI is unbelievably fast in increasing limit. Within 8 hours of submitting documents they increased limit in my friend’s card.

I’ve SBI Signature with a limit of 1.45L

I entered my gross monthly income as 10L just to check how much LE is available for me. It said I’m already at the max limit available for my card. Is it true? I mean 1.45L is really the max limit for SBI signature cards?

What are my options? Is Signature the best card SBI has to offer or is there any other higher card available for SBI?

After reading this article I also applied for LE on my sbi prime card the site calculated enhancement of 54000 from my previous limit. I uploaded 2 recent salary slips. But after 2 days it was rejected. Called customer service team they told me to re-upload the salary slip after self attestation. I did it. My limit was enhanced today.. Thanks siddharth.

Hello sid sir and everyone

What should be credit usage to be considered for SBICARDS to increase the limit?

I also have HDFC regalia card. In past i use almost 80-90% of credit limit. BUT thanks to sid sir and many others at cardexpert now i stay within 30%. I am getting offers like insta loan and insta jumbo loan. Even my limit was increased to 4X two months back.

I have given Self-attested ITR for the limit increase in SBI CARD. Let’s hope for the best.

Maxing out credit limit once every 6 months is good too.

Incredible website Mr. Sid! I have discovered it too late I think!!

Since so many years I’ve done tons of transactions across 3 very basic cards – ICICI coral, Citi rewards and HDFC money-back with a total limit of 5l. All have offered me LE, but I don’t need more on these cards.

I thought I had great cards till I read your website since last 5-6 days. With great enthusiasm I applied for the SBI Prime card online, and after 2 Tele+physical verification, they rejected it. Talk of rubbing salt into wounds😣.

I have always paid before time, CIBIL is 805, ITR is 11.50, self employed.

Any ideas why they declined?? Should I apply to some other card?

My own update – escalated to Nodal Officer and the card was still declined with the same reason- internal policies.

Looks like SBI really don’t like self employed people even with a CIBIL of 800 and my oldest card is Citi with 20 year old history.

Which really brings up the Q – how much does the CIBIL score really matter??

It’s strange, I received a call one fine day from SBI employee offering me Simply Click credit card without ITR or any Card on Card offer, I took the offer immidiately and received the card after 15 days,

I have an account with SBI Bank and employee was sitting in the branch who was probably working for SBI Cards.

May I ask

How much is the Citi card limit as it is 20 yrs old ?

Also please share any Tip how to increase limit in citi card

Hey Mickey,

That’s very weird actually. Try to escalate to Nodal. Your income + cibil is good. You will get a SBI card for sure. One of my friend have similar case he escalted to nodal and after 2 days he got the message that card is approved and will be dispatched in 3-4 days.

Hope it helps.

Thanks for the post 🙂 being this site from couple months, brought hdfc dinner miles credit card after checking review, kudos to this amazing site for every detail on credit cards appreciated! Upgraded my credit limit after this post from 30k to 63k by spending itr it showed 90k but still they upgraded to 63k! Thanks sid for wonderful site on credit card!

Sid –

How does Card against FD work? I know they put a lien on your FD, so this lien remains forever while you hold the card?

Yes. The lien remains as long as you hold the Card. if you want to close the FD, the card needs to be closed first (and all outstanding dues paid).

@shivi

In some cases if high NRV is maintained with good usage and payment . They release from lien.

Never happened to me. Might vary from branch to branch/city to city. I live in a village!

Hi Siddharth,

I tried to check my eligibility for limit increase and this is what I saw. I tried with higher income numbers as well. But, error remains same. I have limit of 2.04 Lakhs and I have pretty good spends here. Card age is 17 Months. Also, I tried on my dad’s account as well. it shows same error. He has 3.5 L credit limit.

——–xxxx————-

Sorry!

Based on our internal assessment, you already have the maximum eligible credit limit. Please try again later.

——–xxxx————-

Today for the first time I got automatic limit emhancement offer for my SBI Prime. Old limit was 70k and now new limit is 98k. I am so so happy. Card is total 18 months old and total spends was about 9 to10 lakhs.

Wondering about the loss you are incurring in RP at those levels of spends!

Shivi I cannot get other premium cards as I have only Rs. 3 lakhs annual income. Therefore I try to maxismise returns from my current list of 6 credit cards. I will earn at least Rs. 42,000 from SBI Prime in 1 year. Do you have any suggestions for me ? I have folowing credit cards :-

1. HDFC Diners ClubMiles – Rs. 90k.

2. SBI Prime – Rs. 98k.

3. BOI India – Rs. 50k.

4. SBI FBB Styleup – Rs. 73k.

5. AXIS Neo – Rs. 40k.

6. ICICI Platinum – Rs. 20k.

Hey Madhuri

How did you got so much cards while having only 3 lakh ITR ?

I am struggling to get cards

I have hdfc regalia first( limit -1L)

Simply click -50,000

Rajesh it is very easy. Just follow Siddharth’s advice.

1. Got HDFC Business Moneyback 2.5 years ago with 20k limit. After 2 limit enhancement ( first requested through ITR and second automatically ) I am currently at 90k.

2. I applied SBI Prime and they didn’t asked for income documents. Got 70k l

mit and after 1 automatic limit enhancement its now 98k.

3. BOI gave 50k limit ( through ITR ) and shamefully they have me wrong PIN. It has not worked ever both offline and online.

4. FBB SBI card I got by showing recent statement of my HDFC credit card. It was in March 2018.

5. I hold AXIS saving ac. and hence I applied and got Neo card like a month ago.

6. I applied for ICICI credit cards for 2 times during last 1.5 years and every time it got rejected for unknown reason. So finally a month ago I opened a regular saving accont by depositing an initial cheque of Rs. 1 lakh and instantly they applied for the credit card. I received card after a month but with only 2k limit.

My next target is Yes Bank’s card as soons as they start issuing unsecured credit cards. My favourite card is SBI Prime.

I would like to know about your Axis bank Neo card application. Was it pre-approved?

Did you apply from internet banking portal?

Did you need to provide documentation?

Hi madhuri, u have to use ur cards to increase credit limit.. dont over use.. I mean dont use more than 50 or 60 percent of card limit which will hinder ur credit limit enhancement. Use axis bank card as much as u can.. they are very generous to increase credit limit . Also make use of sbi card… sbi increases limit once in 3 or 4 months if u r heavy use without crossing percent..

My axis bank card limit after 18 months is 158000 while initial limit was only 38k. My sbi card limit after 11 months is 148000 while initial limit was 72k… axis increased thrice – 38 k to 58k to 88k and now 158000 as I used some loan features heavily this time.. Sbi increased thrice in 11 months.. from 72k to 108000 to 148000

Please ensure u make payments on time.. so far I never defaulted any payment..all paid on time.. now sbi offering me upgrade offer to elite or air India signature.. axis offering me upgrade to axis privilege card..

Besides I also hold rbl card with 76k limit.. got just 7 months before.. but although they never increased limit so far, they have given me separate credit line offer upto 147000 besides credit card limit.. I can take loan offer from rbl card just like that without any docs.. I thinks banks offering such things only for my usage and on time payments.. I always pay in full on time..

Hope u get the secret of enhancing automatic credit limits… pls follow for better credit limit offers.. good luck..

Not even 3 months is completed SBI has again increased my credit limit from Rs. 98,000 to Rs. 1,37,000. I can’t believe it. Now SBI has become much more liberal than HDFC in terms of credit limit enhancement.

Ravi there was no pre-approved offer from AXIS. Hence I applied through branch by providing ITR ( Rs. 3 lakhs annual income ).

How to change simply save to simply click? what is the process?

Call up SBI cards customer care and ask for the switch!

I have been using SBI SIMPLY Click and my recent upgrade request to SBI Prime is rejected even though I have been using Simply Click for the past 2 years with a decent spending. I had a successful LE in August month for Simply Click. Is that the reason for my upgrade rejection? Even escalation to Nodal Officer level didn’t help. Should I try after 6 months of LE for upgrade?

Drop an email to [email protected]. Thats how i got my IRCTC card

Try once again

I was also denied few times for LE/ Card Upgrade regardless decent spending in 2 years and no LE done. But now my application got approved I don’t know how.

SBI Card Sales team taken new application for prime. Got approved in 15-20 days post home verification. No documents taken btw SBI cards already have enough info on my a/c anyways.

Hey siddharth,

I need an advice , i currently hold 5 credit cards vis. HDFC, PNB, SBI, AXIS, &ICICI.. where the last two are just new ones i got them pre approved through my netbanking.

Now i want to upgrade my sbi simply click with a limit of 1.03 lakhs to some other more beneficial card and here is what is got as options in reply from sbi care ..

SBI Card Prime Master Unsecured

2999_Annaul fee

SBI Card Prime Master Flip

2999_Annaul fee

SBICARD Elite World Upgrade

4999_Annual Fee

SBICARD Elite World

4999_Annual Fee

Suggest me what this prime unsecured and prime flip means and which one to go for.

Regards

Udbhav

I applied for upgrade to sbi prime from simply click…they agreed but provided me 2 options…to go for master prime unsecured or master prime flip…what is the difference between two..and which one is good?

How did you applied for the upgrade? Did u have pre-approved offer on your account?

I requested the same via customer care but my request got denied. Limit is 50K simplyclick

Hey Udbhav,

How did you got pre-approved offer for icici and axis? Can you share how old your accounts are and balances maintained?

If anyone knows any tricks for axis& icici getting cards approved.Do let me know. Thanks

Today for the first time I got pre-approved offer to increase credit limit from Rs. 75,000 to Rs. 1.05 lakhs in my SBI Prime.

Captain

Tell me how did you manage to get Auto Offer? Using SbI click for 1.7 years now. Limit is 50K only. Never got any offer for LE it card upgrade. Requested manually for both but got denied.

Rajesh I got SBI Prime card in November 2018. Since beginning I was using about 50 % of credit limit ( even more in birthday ) basically for rental payments through Redgirraffe and some other payments also. During the last 6 months I began to use 100 % credit limit every month for rental payment.

Everyday I wake up and the first thing I do in the morning is that I check for automatic credit limit enhancement in my varoius credit cards. Sometimes I check twice a day ( maybe thats not normal ). One lucky morning I saw the offer for LE in SBI net banking page and with overwhelming joy I accepted it.

I also tried multiple times for LE by sending my ITR but limit was never increased because they said I already have more limit than what they would have offered me based on my ITR of about Rs. 3.47 lakhs.

I think they want us to use SBI cards aggressively.

Again I got LE offer. New limit is Rs. 1,47,000.

Captain,

U said that ur paying 100% credit limit every month for rental payment through RedGiraffe. How much rent r u paying 75000 ? R u really paying this amount to landlord or is it fake agreement and the same shared with RedGiraffe ?

Ankit yes I pay Rs. 75,000 to landlord through Redgirraffe every month.

I applied for SBI SimplyClick Card at a Mall kiosk. The guy applied it through a mobile app and after furnishing my details, the app showed that no documents would be required. I applied the card on 21st Jan, and today(25th Jan), I got the “Dispatched” message. I must say, this is the fastest I got a credit card.

But, the issue is that the CL I got is very low (50k), anyone has any idea how to increase this limit? Shall I upload my ITR form? (given that they didn’t ask it). I have a Gross Total income of 8L.

Also, on the same date, at the same mall, applied for an Amex Everyday Spends Gold CC at a kiosk adjacent to the SBI Kisok. They “conditionally approved” the card very next day but field verification is left. Let’s see how much limit I get on Amex.

Thanks

Vishal

Hi Vishal,

Did you see the Probable Max Credit limit shown in the app? If you have got credit limit low in the app, You could have provided your existing credit card statements if any to increase your credit limit applying on card to card basis.

HI vishal

create account in sbicard , there is one option to increase credit limit, fill your income data mostly you will get limit increase , uplode your document within 2 days your limit will increase

Also a silly doubt, do banks allow spends exceeding the Credit limit given that I pay the Credit Card before making the transaction?

For Eg, My Credit limit is 50,000 but I want to do a transaction of 80,000. Now. can I pay 30,000 to credit card in advance and then do the transaction of 80k? Is it allowed? I once asked HDFC CC about the same, they denied saying you cannot make a transaction more than your credit limit.

I think bo one allows to spend beyond the credit limit. Uou may have to pay charges for using overlimit. You can log in online and check for limit increase based on ITR.

I have done it a few times but it doesn’t work with all banks. The best way to do it is call the bank and request for a temporary limit enhancement and tell them that you are willing to pay for the difference up front. I have gotten HDFC to do it for me. In case of SBI, I have successfully initiated transaction above my limit and have paid the difference immediately to avoid their overlimit charges.

Yes, you can make it. Once you pay in advance you can see the available limit being increased to 80,000.

Thereafter, you should be able to make the required transaction.

Hope it helps.

Hi Vishal

It differs from bank to bank. But mostly no. If you can split the payment in 2 you’ll be able to pay 40 k 2 times and do the transaction.

Some banks like RBL allow such prepayment and then transact more than limit. Best way to check is prepay and see in netbanking if available limit is higher than credit limit.

You will get same limit on amex (50K)…

Hi Siddharth , you mentioned that first you hold SBI Air India Signature card and downgraded it to SBI Simplyclick and then upgraded to SBI Prime. So whenever you are downgrading or upgrading, are you paying the joining and annual fees for the new card variant ? What about PRIME , it is 2999/- and have you paid for it ? And are you getting joining benefits (such as Welcome gift worth Rs. 3,000 in case of PRIME card ).

Hi Anonymous, you need to pay the annual charge on the actual renewal date/month of the CREDIT CARD ACCOUNT (anniversary date of the account opening) and not on the date you upgraded/downgraded the card. And yes, you get corresponding rewards – you can upgrade /downgrade any number of times as per SBI card policy but the joining gifts will be once a year when they charge you the annual membership fee of that particular card variant

Hello Everyone and Special Hi to Sid !

My ITR is 8.5 lakhs , have been using axis select ( 2.10 l limit) , amex gold charge card ( charge in 7 digits ), and very recently got SBI prime . I got a starting limit of INR 4.20 lakhs and didnt even gave my card to card or income documents . One random guy called me , and said you have pre approved sbi card offer and we require just aadhar and pan. With this i proceeded and got the card in a week. Now i have applied for Amex platinum travel card and waiting for its approval.

Want to knw that if i spend aggressively on sbi prime , do they consider spend based limit enhancement or would need documents? Because as per ITR , i wont be getting LE so asking the same?

Rakshit, a pre-approved offer you say, Do you have any prior relationship with sbi bank?

Hi all,

I am going to apply for prime card.

Is they any benefit in first applying for simplyclick card and then upgrading it to prime?

Below is something which I think can be considered as a benefit:

1. You apply for SBI Simplyclick/Simplysave and pay joining fees of 590/- fees after first statement generation and get welcome gift worth 500/-

2. 1-2 months later you can give them a call to upgrade to SBI Prime/Elite and if upgraded, you can go ahead and use it for next 10 months at the initial fees of 590/- as they charge you with fees only once in a year.

SBI isn’t that liberal that they will provide card / upgrade within 2 months.

They have stringent setup.

I had upgraded my SBI SimplySave to Prime 1-2 months after the 1st year renewal fee payment of 499/- + GST for SimplySave.

Hi All,

What is the maximum credit limit SBI has ever given tilll today. I hold SBI elite card and my limit struck at 4.9 Lakh from years.

And also wats the best way to redeem SBI reward points. I hold some 2.3L Points. so

I have a limit of 7.5 lacs since ~3 years. Started off with 5 lacs. SBI refuses to increase the limit or match limit on any of my existing cards, though 7.5 lacs is decent enough

Best way to redeem the points is to get them adjusted to your outstanding bill. Call the customer care, they should be able to help you with that.

Though Yatra and Shopperstop vouchers gives better value for your points, as you said adjusting points to the bill is the easiest way.

Nagaraja,

May i know what is redemption value if we go for yatra or shopper stop vouchers?

Hi Himanshu,

I couldnt find any shopper stop or yatra vouchers now.. I think SBI has removed it.

Its abt 2.5k worth more (redemption of 40k points = 10,000 rupees to card = 12500 worth Yatra voucher)

Hi All,

Thanks Sid for the awesome platform, I have been holding SBI Card since last 3 year, initially they provided me an SBI Platinum card after that they have changed the name from platinum to card prime. Initially, my limit is 50,000/- which is same till today. Note: I’m holding SBI Tata Titanium Card also with the same Limit, this card is offered after 6 months of SBI Platinum card. The age of this card is now 2.5Y

I had also dropped an email on 6/11/2018, below is the reply I received

Credit Limit: We wish to inform you that as of now we shall be unable to increase the credit limit on your SBI card account.

May we request you to apply for credit limit increase after three months or pre-approved offer available in your SBI Card Account

Please note that increase in credit limit on your SBI Card account is subject to approval, after completion of the necessary formalities and adherence all applicable policies.

Thanks & Regards,

Naeemahemad

Important update received in my SBI PRIME statement:

From 5th sep 2019 SBI will be charging for credit limit request, change in billing cycle and change of network (visa/master). The amount will be Rs 200 +GST per successful request.

I received the same! Which card company charging for Credit limit request.

This is interesting.

I guess people could have more successful credit limit modifications, if bank starts charging. 🙂

Hi Sid ,

I have a query regarding points while upgrading SBI card.

i hold SBI Prime with 20,000 points on that card and i am eligible to upgrade the card to AI signature card.

what will happen to my points balance?

will they be transferred in the 1:1 ratio to my AI card and subsequently i can transfer them to my AI FF account or any other treatment.

would request your response at the earliest.

Thanks

In my opinion , burn points for statement credit before switching

Hey MT

Burning points will give me 5000 bucks but if i can transfer to AI FF 20000 points then i can redeem a business class ticket valuing more then 20k INR.

Am i missing anything??

Sid…please enlighten your view

Hi Mahesh,

How you are finding Air india card better than Prime?

Hi Amit,

My city is only served by air India and for me living in Bangalore have to take a one stop flight always …and ticket in points is cheaper then revenue ticket …so thought of accumulating 50000 air India points per year on my approx 5 lac expenses ….on prime i get points and vouchers worth around 15k INR.

Thanks

If i change my sbi card network from visa to mastercard, will it show up on my cibil? Anyone has any idea?

Yes it will, speaking from experience.

Today i got my sbi bpcl credit card with 5l limit with no income proof and no card on card .on seven day ago i received a call from a girl from chandigarh for this card and i give my details on same phone call and she said your card is approved with 5l limit and on same phone call i also give details of my wife and she also get approval for fbb card with 5 l limit and next day we both received verification call from shit chandigarh at 10 am and same day a boy from sbi visit our home for document pickup and he ask only our pan card and aadhaar card and click our photo on sbi card app thats it and next day again received a verification call for physical visit at our home and agent comes to our home at 4pm and click door photo of my house for me and my wife and at night i checked status of both application and both were approved and next day i got sms from sbi of approval and after two days i received dispatch message and next day received our both cards this is fastest approval in my life and after receiving my card my friends applied their card through same sales girl and and all are approved with credit limit 52k and 1l and 4.5l and 1.33 l and 1.5l .thanks i told my approval journey hope this will help you

Hi Sidharth,

I’m holding SBI simply click and fbb cards, realized fbb is of no use for me. Looking for options to upgrade fbb to simply save or prime.

I will use new card only for offline transactions.

Please suggest best card to upgrade.

Hello everyone here, I am in bit of an tricky situation. looking for suggestions.

Applied for an add on card for my hdfc clubmiles diners club in Nov 2019, resulted in a cibil enquiry.

Requested ICICI Bank to increase credit limit based on increase in salary in December 2019, another cibil enquiry.

Upgraded to hdfc DCB from clubmiles in January 2020, another cibil enquiry. Not sure if will be reported as a new account or separate accounts.

Now, need to take another add on card for my family member for DCB, another enquiry for sure.

4 cibil enquiries within last 3 months. I am very worried about this. And it’s affect on my cibil as I plan on taking an education loan around September 2020.

Can anyone suggest how to proceed?

Thanks!

I am getting an option for a limit increase when I input my salary as 1.2 LPM. but not at 1.5LPM or 90KPM. LOL.

can anyone say why?

Hi all,

Requested for Club Vistara Upgrade from my existing Simply Click (CL 5L+), but received the following communication. Which card do you suggest? Also is the new card FYF? I also hold Infinia.

This is with reference to your communication dated 6/9/2020

Account flip: We wish to inform you that you can opt from below mentioned cards having annual fee plus GST.

Air India Signature: 4999_Annual Fee

Air India Platinum: 1499_Annual Fee

SBI PRIME VISA: 2999_Annual Fee

SBI Card ELITE Upgrade Visa: 4999_Annual Fee

Hi.

I applied for simply click cc sbi in jan 20 n rcvd d card in feb with 21000 credit limit wheras my ITR is 7l. I don’t understand why they provided me with such a low credit limit wheras i am working in a PSU and they took all d required documents. I applied for credit limit increase but they denied it. Please help how cn i increase my credit limit.

Have a 13 month old SBI Prime with a mere 40K limit. Submitted pay slip for 2 months as income proof for 16L. Rejected in 8 hours. Has other 3 CCs including a 10 year old HDFC (now Regalia) and 750 CIBIL score. Wonder why?