After the big launch of Paytm Credit Card yesterday, today Ola Cabs Launches its co-brand credit card called Ola Money SBI Credit Card in partnership with SBI Cards & Visa.

Before we get into the details of the Ola Money credit card, you may need to know few details,

- Ola Cabs has about about 150 million users at the moment.

- SBI Cards, the 2nd largest credit card issuer in the country has about 8 Million cards.

- SBICards recently raised Rs.700 Crores funding, which is a part of Rs.1500 crore funding. Now we know where they’re going to spend it.

So to reach the mass customer base of Ola, just like Paytm, Ola too need to take the approach with a Beginner card. Here are all the details that we know for now,

[TOC]

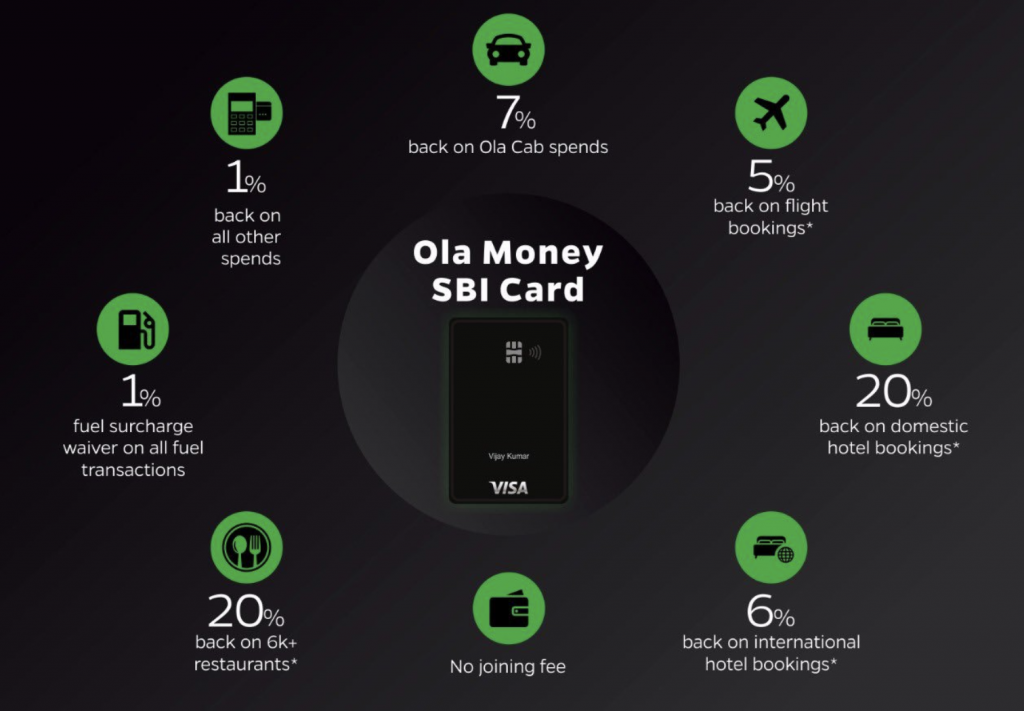

Ola Money Credit Card Benefits

- Joining fee: Rs.500+GST (charged at the end of the year, waived on Rs.1 Lakh spend)

- Card Type: Works on Visa Platform, contactless enabled.

- Rewards: As Cashback – as Ola Money Credit, Credited to Ola Money wallet within 3 days. Cashback has no Expiry Date

- 7% on Ola rides (upto Rs.500 a month)

- 5% on all flight bookings via Cleartrip (upto Rs.5k domestic, 10k intl)

- 20% on all domestic hotel bookings via Cleartrip (no limit)

- 20% on 6K+ restaurants, up to ₹200 via Dineout (upto Rs.200/txn/month)

- 1% on all other spends

Looking at the numbers, I should say its overall “good”, especially for a beginner card.

Speaking about the upper caps, I feel they could have raised it to 1k a month for Ola rides, as that would help for those who’re relying on Ola for daily commute or just for those doing Ola outstation once in a while.

Not to forget, domestic hotel bookings has no cap, yet you can’t combine other promos. Though, I think it should help for booking high end properties. Need to explore this space. Other limits are acceptable.

Last but not the least, I wish “1% on all other spends” could have been better. Maybe 1.5% or 2% could have done a lot of magic to this card.

How to Apply

Ola has a landing page for this credit card where you can express interest. They would probably fetch the Experian score & call the customers based on the score.

Ola users will be able to apply, view and manage their Credit Card directly on the Ola app.

Its an Amazing Deal – Why?

Comparing Amazon-ICICI, Paytm-Citi & SBI-Ola partnerships, I think SBI-Ola would be a BIG WIN for SBI because even if SBI manages to tap into 3% (4.5Mn) of Ola’s customer base, SBI would beat the market leader HDFC Bank in card accounts, likely in a year or two max. Btw, SBI is eying at 10Mn in next ~3 years.

But HDFC also appears to be gearing for their new card launch as well, maybe HDFC-Flipkart card as HDFC already has strong integration with Flipkart with its 10X rewards program.

As HDFC bank very well “Understand your world”, they may come up with even a better card for starters and eat the competition for lunch, as always. 🙂

Bottomline

Overall, the Ola Money SBI Credit Card looks very much promising and is worth holding one for a beginner.

If you’re interested, you can Express Interest on above link. but I would rather suggest you to wait for a week or so to see how things turn out with new card applications and then take a call.

What’s your take on the all new Ola Money SBI Credit Card? Feel free to share your thoughts in the comments below.

Seems to be a launch in hurry. No Ola logo on front, no particular design.

Logos are in the back. They’ve just decided to make it more Clean, like a super premium card.

Sidh, What is the foreign currency mark up fee on the card

Should be 3.5%+GST

The design looks better than most of the credit card.

The true black card 🙂 Got to give it to SBI for their designs. Standard Chartered has good design on the Ultimate. HSBC then revised their cards to the 3d prints and now CitiBank has also started issuing cards with details printed on the back. But this takes the cake by far. Now if it turns out to be Visa Signature then that is the icing on top. And I was beginning to think that cards are going to die as merchants may realise they can save on MDR with UPI.

Shhh..shhh…don’t utter these things….we are dead without credit cards…:-)

But still Ola drivers don’t accept non-cash rides.

Lol. That’s indeed a real challenge that Ola needs to solve.

True. This is a frequent issue with Ola and I’ve rarely seen that with Uber

Since I don’t have a sbi credit card. I used the invite for ola sbi card and applied as well, assuming that all sbi credit card cashback on shopping sites will be applicable on this card as well. Any thoughts?

Yes true.. If we select the degital payment, they straight away reject our ride request

Looks interesting for cleartrip cashback. What about international hotels.

Ola is biting a lot more than it can swallow.

Their Ola wallet/ Postpaid is a disaster. I never made even a single late payment and my account was blocked for violating *terms and conditions *.

The payment date nears and then expires, and I start getting calls ten times a day asking me to pay or face legal consequences. If I tell them I am ready to pay and ask them to unblock the amount, they ask me to call customer care which is a bunch of retards sitting there can’t do anything.

The whole cycle repeated until I blocked all the numbers.

Given a choice between ola and uber 90% will prefer uber and ola money penetration is also low. However its a good card for starters. Waiting for uber card then although it has good offers with Hdfc diners and sc ultimate.

Ola has the coverage which Uber lacks. That’s the major advantage of Ola at the moment. And I wish Uber has some loyalty/premium tier system.

Hopefully Uber will launch its card tomorrow making it 3 in 3 days….

Ola Money is basically crqp. Even their drivers don’t accept it. It has happened so many times that I have stopped paying through it. Plus there have been numerous reports with the wallet money going missing. Amazon pay seems very reliable in this matter.

There is an ‘Early Bird Offer’. If you apply before 30 June, you get ₹500 as Ola Money, which will be credited after first transaction on the card.

Filled out the intent just for the cold design. Now waiting to see how SBI screws this one up.

Ha ha. You must have waited for sometime. As you know SBI always screws up the applications on newly launched cards, for first few weeks.

I’m assuming they’ve already done that. I hold a DCB but not priviledged enough in SBI terms to hold this card. My application got cancelled coz I didn’t meet their ‘stringent my ass’ criteria.

Which will be a better choice between Ola Money SBI Credit Card and SBI SimplyClick Credit Card?

This one is nothing special. DCB gets 33% back on Uber, and HDFC Smartbuy gets 33% back from Cleartrip, MMT etc. Rest is covered through Amex or Citi Prestige. So will duck this one, as I have ducked the PayTM First, and Amazon card.

But you’re comparing an entry-level variant with tough to get super premium cards 🙂

TBH, you don’t need to apply for any other card (not just this one) since you already have all the best cards.

American Express Every day Spends Gold Credit card already is giving 10x rewards on OLA spends, maximum of 500 points per month. With 1 Amex point ~ 0.41 paise, it turns out to 8.2 % cashback. (500 pts ~ Rs. 208 through Gold collection). Additionally it gives 10x on Flipkart (I prefer SmartBuy though) and it gives 5x on selected departmental shops. So, for people who use OLA less, the Amex card seems to be better option.

Ola SBI seem to just taken note of “INTEREST” …. no furrther updates.

Seems like it was launched in a hurry without any backend ready

I am presently holding SBI Prime & IRCTC cards. Does anyone think if it makes sense to switch the IRCTC card with the OLA card? I anyway don’t buy as much railway tickets as in the past.

Absolutely, makes total sense. Infact, I am planning to dump SBI Prime for Ola Card as the reward rate on this is double of Prime (0.5% on most spends, as I dont have many utility bills to pay which give 5%) and Airport lounge access is covered on my other CC.

Hi

Ya…no update from Ola …

Has anyone got Ola card?

I’ve applied for Ola credit card and Ola money has taken me for a ride since then. I received last week (after a long delay) & done several transactions with it. Their welcome offer is not delivered yet. I tried to contact the Ola customer service, through in-app service request also email. No one respond. Now I’m trying to reach through twitter. I’m not sure about this card, I’ll probably close it.

Deepak Kumar Naik,

Welcome offer was valid 30 June 2019 & not extended. If you got card before 30th June and did 1 transaction then are eligible for welcome offer else not eligible.

Do share whole process of card issuance- how you applied and all further process. It will be very much helpful to Card Expert community.

Edit to above comment: Early bird offer (welcome offer) is Valid till 31 July 2019(extended).

I applied on 15th july.when can I expect any notification from ola credit card department? I have cibil of 853. What documents they need? Is Office address mandatory like paytm credit card?

Ask SBI credit card personnel.

Hi Sid, What does conditionally approved mean in credit card application status?

@ Eshwar:

After you click ‘Apply’, the card provider’s computers quickly check your credit status and the basic information you have provided. If your credit history looks good and all your info matches up, you will usually be told that your application has been conditionally approved.

The card company then needs to do further checks to decide whether they want to provide you with credit. They will usually check your background info more fully, including your employment status and your salary, your current debts, and your credit worthiness. If you already have financial products with the credit card provider – such as a mortgage or a bank account – this process will usually be much faster.

Once the card provider has made a decision, they will contact you to advise you if your application has been approved or declined. If your application has been approved, you may just receive the credit card in the post, along with activation instructions.

Latest OLA App having credit card application option like Paytm. In OLA MONEY Section, allowing to sunmit OLA Credit Card. I had submitted and status updated as provisionally approved.

@muralimr Kindly keep posting your application status here. Whether or not they verified your place of residence and work, credit limit, card delivery etc

Regards

Yes , the option to apply is now open to lot more users now.

Just goto Ola Cabs –> ola money. If enabled ,You can see Apply for SBI Credit card on it…

Just submit 3 step basic details : Name, Address, Office , PAN , Salary / Income etc….

I applied on 19th Aug…. got Document Pickup call on 20th morning.

Executive came on 20th evening …. Asked for Only address proof. Took Photos & 5sec Video via Sbi Card App.

No PAN requested by him. As per him, since I have Ola Postpaid activated, ola must have all financial info information at backend.

Call verification happened on around 2and or 23rd Aug. And Application confirmation sms has come asking for 11working days to process the application.

Ola seems to be in a hurry for this card. On the day it was enabled for me to apply, i got call from Ola representives who were polished & well spoken…. not like usual 3rd party callers.

@Ashu

What are the acceptable documents for address verification?

Are they accepting office ID card?

@sid

@Ashu

In my Ola money section of Ola app,It’s showing that you are pre-approved for this card…

Have everyone see the same banner…kindly revert back @ASHU..

*Update*

Card approved.

Had applied in Ola app on 19th Evening, doc collected 20th Afternoon. Approved on 26th (shows in Ola app with credit limit, pin reset etc options)

Super Super speed by sbi in this case.

Ola seems to be in a hurry…

@Ashu

How much limit they have assigned…is it same at the time of conditionally approval or changed after final approval…

My ola money page showed me pre-approved for this card. Filled all the details. Reached final page and got a declined message.

No cibil enquiry has happened

Is there anyone who can share their experience regarding application procedure when the card is showing as pre-approved in the ola app? Like document collection, verification of residence/office, approval/denial?

In my app, it is showing as pre-approved in the left tab–> Ola Money –> “Get Ola Money SBI Card You are pre-approved for the card”. Not really sure whether to apply or not.

I’ve applied yesterday and received acknowledgment/application from both Ola and SBI Card. PAN and Aadhaar were collected today.

@Amit

Please count pre-approved as invite only…once you submit the application with relevent detail..they will determine you eligibility from bureau records and if all well you will get message that your application is conditionally approved with credit limit…later physical verification and call verification have carried out by SBI card..and within one week ,you will get final decision …

HI Amit,

Pre-approved is majorly a marketing gimmick to lure potential customers to apply.

There is no Guarantee a “Pre-Approved” Credit Card or Loan will be Finally Approved.

PROCESS:

1. Ola Cabs App – Ola Money – Get Ola Money SBI Card

2. Enter 3 Step Details: PAN no & Name , Address Details, Employment details etc

3. Document Collection (Next day in my case) : For me, agent took Photo & Video in his SBICard App only and only document taken was Address Proof (not even PAN copy required in my case, maybe possible as I have Ola Postpaid Activated)

4. Verification Call in 2-3days

5. Status can be checked on OLA Money section or SBI Card site.

6. If approved, you will soon receive the Card

The Whole process took just 7days for me (Applying to Delivery of Card) which is extremely FAST Speed in my opinion ………… FAST & SMOOTH PROCESS

P.S – Card is Amazing Looks wise…. one of the Best I have seen.

What about the credit limit..?? Is it the same as committed after application submission..??

Yes Nick,

Credit limit same as what was shown in Pre-Approval stage….

However , it depends from application to application. Bank is within its rights to give Credit limit as per its discretion & rules / logics.

I applied for the card on 22-08-19. Card is approved today. Documents provided are PAN and Aadhar. I currently have an SBI card.

Thank you @Viswanath, @Ratnesh kumar, @ashu and @Hari for your response. Keep up the good work in the exchange of valuable information.

This card seems to be finally up for actual roll out. Applied but only since First year is free. The 7% discount doesn’t add to much considering Uber regularly has 10% discount coupons you can get through them or paytm

Hi all,

I got invitation for this card through the Ola app. My card was conditionally approved with the credit limit of Rs.5,00,000/-

Aadhar, PAN card and a digital photograph were collected the next day. Phone verification was done within two days.

The card was approved today with the split limit with the existing Prime card (4,99,000/-)

Can we change the card variant from Ola to some other card variant like Simply Click/Ethihad/ Air India after using for some time?

I dont think Co-Branded Credit cards can be switched to another variant ……… Not to my knowledge

How much time they took for approval..?? I received same credit limit and I’m using SBI Elite card. Applied on 27th. The card is still in processing.

It can take two weeks, in my case a week back documents collected and two days back some one called to confirm all details and said you will get card in 7 working days. Usually with in three weeks you get the card. I am also holding an existing sbi card.

I had applied on 24th Aug and card approved on 31st Aug and Card Received on 4th Sep.

I worry about the way SBI handles customer data. Even after card approved, I had received two calls (STD code GURGAON) to collect my personal details in name of card application verification. These calls are clearly fraud calls as they were not having any information about my application number, variant of card applied, full name as in application form..

Somebody insider in SBI Cards dept passing mobile numbers to fraudsters.

Got an invitation from OLA executive today through a call. He asked me to furnish details and apply through Ola app…and of course got a message “conditionally approved” and is being processed and also told me that an executive would be coming for document pickup in the next 2-3 days.

I already have a Simply Save and Ethihad Guest co-branded card.! Will I still be able to get an approval for this Ola card from SBI??

I got an invite too and I applied…waiting for document pickup!.

I already have a Simply save and Ethihad guest card. Will I be able to get this Ola card approved by SBI??

Card dispatched in less than 10 days of document pickup. Already hold SimplyClick and also have high Ola PostPaid limit of 5000/-. Card approved with only Aadhaar copy and app based photograph.

Card data is visible in SBI Card Web/App and Ola app integration is not up to the mark. Also applied and got approved within 2 days for 2 Add on cards as soon as the card was visible in SBI Cards Web/App although actual card was still to be dispatched to me. Overall SBI Card backend has to be commended here.

Important update : SBI Card now delivers through Delhivery instead of BlueDart and the experience with them is horrendous to say the least. It is entire SBI Card rather than Ola Card alone as my SimplyClick AddOn was also routed through Delhivery.

I think maximum limit you can get on this card is 500000, If you are an existing sbi card holder having less than 5 lakhs limit then the remaining credit will be given. For example having simply click with limit of 2.9 lakhs then you get 2.1 lakhs limit on ola card. If existing card is having limit of 5lakhs and more than the limit would be shared between two.

Do we get 20% cashback if we top up our dineout wallet and then make payment rather than directly making the payment at the restaurant?

Yes you will get it

The worst part is when I am trying to use Cleartrip for my flight tickets, I don’t see the OLA Money Wallet among the Wallet options. This is really bad. Is anyone else facing the issue. So how does OLA Cleartrip 5% cashback work ? Is it I just have to make the booking using the SBI OLA credit credit card or I have to prefill the OLA Wallet with the SBI OLA card and then make the booking. Any info on this would be highly appreciated.

Hi I got an update on my application from the Zipcard team (Ola Financial Team).

I have applied for the card on the OLA app on 1/9/2019 and its pre-approved with 4,00,000. I received the call next day asking for a date and time for document collection. I gave them the time and date, a collection guy from a different city called up and asked my location and I told him, I live in a different city and he told he would forward my file to someone in my city. However that never happened.

So I followed it up with Zipcard team via email on ([email protected]), they asked for my pincode and after I gave them, they said

“We checked on the reason as to why the appointment was not fulfilled all these days and we found that the area you are residing in is not a serviceable area.

We are only serviceable in few cities of India right now at our first phase and unfortunately your area is not under the list we can offer our services

So your application will not be processed further right now and as we expand our horizons and cover more cities during the launch of our second and third phases we will include your area. ”

So I would like to know if this is true , which I assume is not true as, I have OLA Cab services at my area and when I applied on the OLA app the application went through with my area pincode. It just baffles me as to how they screw up on multiple levels.

If the above thing is true (area not being serviceable) they could at least take leaf out of Paytm Citi Bank card application process, where when you enter a pincode it automatically tells if the area is serviceable or not serviceable.

Has anyone received cashback on Dineout payments yet?

I made two transactions 1 each in August and September and didn’t get any points.

Raised with CC and they said this offer has been out on hold!

Has anybody tried to purchase anything online i mean through big Merchant sites like Flipkart/Amazon, I am having issue with the EMI option. I am unable to see/get EMI option on both the site, on Flipkart it says card is not supported, and on Amazon the card is accepted but i am not getting any EMI option available. I tried calling all SBI/Flipkart/Amazon all are telling to contact other, like SBI is saying contact the Merchant and the Merchant is saying contact the bank don’t know what to do, Please share any incident if somewhat similar has happened to anyone or any suggestions.

Hey guys does SBI allow to merge the credit limits for two cards issued by them so that the same limit is split between the cards?

Yes I Sbicard allow to merge the credit limit of two cards into one. I have SimplyCLICK limit of 22000 for last 3 years and applied for irctc card got approved 260000. But after receiving the card it shows 53000 limit. So what I have done closed irctc card transfer the 53k limit into SimplyCLICK so now one card holding limit of 75000.

UPDATE:

They increased 7% for ola & ola postpaid spends to 15% for first year for cards applied from 15th Nov 19 to 15th Nov 2020. (existing customers are not eligible)

First year free and 15% for one year for ola postpaid are good reasons to use this card for 1 year.

A query to users holding Ola Money SBI Card – do you get 7% Cashback also on the Ola Postpaid spends.

Suppose I use Ola Postpaid for making payments at 1mg etc and then settle this bill using Ola Money SBI Card will I get the cashback too?

Marketing Agent from Ola says yes but am not sure.

PS: Seems like for now, Ola has increased Cashback to 15% for Ola Rides

I did not find a option to settle ola post paid due via credit card. Let me know if you find the option any where.

Hi Gagan and SS,

Yes, the Postpaid dues can be cleared with Ola Money SBI Credit Card and you will get 7% cashback for doing the same. The same thing has been written in the Welcome Letter as well. In fact, you get 7% cashback for loading Ola Money Wallet.

PS: I haven’t seen 15% cashback info in the app yet. Where did you find this?

Last time I checked (Oct 25th ) I was able to pay Ola post paid through credit card.

Caveat – Amex & Diners card can’t be use to pay post paid bill . I used one of the Visa CC to pay .

Hi SS, You need to click on “Other Payment Modes” to see option for Credit Card 🙂

That increase is only for a year and you are supposed to apply for the card between 15th Nov 19 to 15th Jan 20. Cashback capped to 1000/month for first year and 500/month next year onwards.

Applied for the card and got it in a couple of weeks. Main driver was 15% cash back for an year if I apply before Dec 31st.

Absolutely let down by the low credit limit (10k) on this card – I have simplyclick with 2 lakhs limit and was initially told limit would be shared with it.

Called the customer care and was give a canned answer – ‘Internal credit policies’ :\ Can apply for CLE only after 6 months apparently.

I have just applied and it is there as 15% might be this Dec month offer

Is 15% cashback for calendar month or statement month?

Got this card issued today, seems SBI allows more than 2 Co-Branded cards now 😉

@sid Now that ola is available internationally in some countries, does this card look enticing to you to pay for rides when abroad? Do we get the same 15% cashback upto Rs. 1000/-?

Do I have to do another KYC for ola money to get rewards from this card or will it be done together with credit card application.

It will posted in your ola money wallet account.

Yes. Ola Money KYC to be done seperately. Confirmed !

I am not getting 7 perct cash back on loading ola wallet from last month. Does anyone else face such issue?

Yes .. facing the same issue .. got it LTF so holding for sbi offers only now

This is the response i got from Ola CC

“As per RBI guidelines, SBIC has discontinued giving rewards on wallet recharges hence the below transaction is not eligible to get cashback.”