While I was recently having a word with American Express Chat support, the executive went out of the way and explained about the card benefits including various options about redeeming the Amex MR points to get best value. That’s when I came to know that Amex silently added a new redemption option for Gold cards (both MRCC & Gold charge cards).

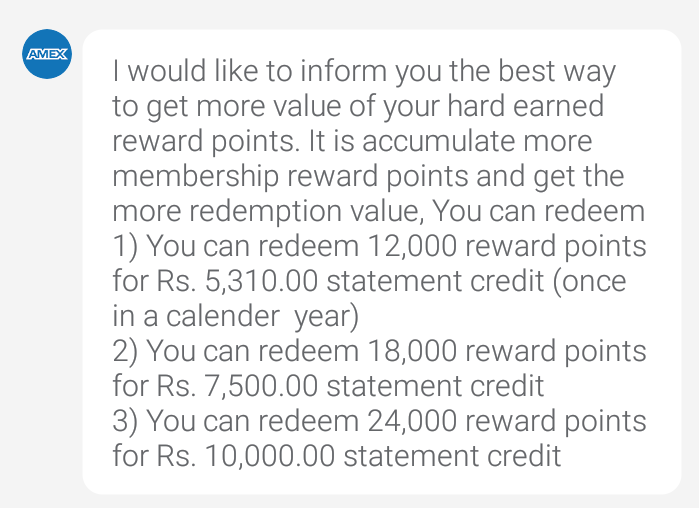

Here are the available options if you want to redeem your Amex MR Points for Statement credit.

- 12,000 Amex MR Points (NEW): Rs.5,310 Statement Credit (once per calendar year)

- 18,000 Amex MR Points: Rs.7,500 Statment Credit

- 24,000 Amex MR Points: Rs.10,000 Statment Credit

If you do the math, you’ll get to know that 12K points give you slightly more value (44Ps over 41ps) than other options. But remember that it can be availed only once in a calendar year and it looks like we’re in right time of the year to do this redemption 🙂

Note: I cross-checked again with customer care over call and this appears to be a “temporary offer” and maybe revoked anytime.

Bottomline

That’s a great move by American Express as always and I think this was added because Gold card users might find it tough to redeem their points as getting 12K points (thanks to monthly 1K bonus) is lot easier than accumulating 18K/24K points.

So basically the gold collection now comes with redemptions options of 12K (temporary), 18K & 24K points. Here are ways to maximize your Amex MR Points Value other than redeeming for Gold Collection.

This is the sign of American Express “listening” to its cardholders. So if you need something to see with American Express, go ahead and “tell them” either via their online ac survey or via customer care.

What’s your take on the new 12K redemption option? Are you gonna make use of it? Feel free to share your thoughts in the comments below.

This is pretty good option

Not able to see this 12K MR statement credit redeem option in my MRCC rewards catalogue.

Let me know if anyone able to see this 12K MR redeem option for MRCC

Not a regular option. You need to Call/chat.

Oh, will try.Thanks.

I have 35k reward points

Suggest best way to use it

try to collect 1k more points and then use 12k points redemption for 5310 INR and then 24k points redemption for 10k INR.

Need to talk to customer care.

Amex is best card that I have used till now.

Their CC is the best part and redemption of rewards.

Only card that is paying me to use them.

Offers are great.

Hdfc gave me regalia while icici HSBC SBI elite Citi didn’t benifit me. Hdfc is having great offers these days but amex has best spend based target and rewards points .

Recently used 5310 credit.

Best part Tell the CC what do u want n they are happy to help you and suggest.

While in others it’s like CC guy is giving info n used then it would be from.his.pocket.

hDFC customer care is pathetic.

Yes, I availed this in Jan 2019 and now will avail in Jan 2020 because it can be availed once in Calendar year.

hello,

I also just called customer care, they told me if i redeem 12k points now in dec-2019 than i can go for another 12k points redemption after dec-2020 not in jan-2020

Wonder when they will start listening to Tier 2 city residents and start issuing cards to them!

I really don’t understand the logic or the lack of it behind the exclusive Tier 1 city coverage.

The logic is simple. If they issue to Tier 2/3, they’ll get hell a lot of complaints and escalations about acceptance. They’ll get more angry customers.

But yes, they may start issuing silently based on request like they do for “Tiruppur”.

So, i need to be physically working and staying in a Tier 1 city as per AmEx CC team. They won’t even give it to me for staying in Tier 1 city while having my work in a Tier 2 city!

Forget this, 10 years back when I applied for my first amex card, they declined my application stating my work and residence cities are different – and they were Gurgaon and Delhi! Beat this logic!!

Though I eventually got the card when I became Amex employee and this rule didn’t apply then. I’m sure they would have some sensible policy in place for such cases now.

Citi denied me a second card saying my work and residence pin codes are same. I am based out if gr Noida. Beat that 😂.

I too availed this redemption benefit. It’s a cheeky option. Glad you noticed. Amex never informed about it. Nor is this offer visible through regular online redemption option. Can be availed only via Call/Chat

Availed.

thanks a lot.

Sid, this option of 5310/- against 12k reward points has been there for almost 2 years now. They have arrived at this value basis the renewal charges for this card of 4500/- + 810/- (GST) and hence can be redeemed once in a year as soon as the fees is charged to adjust against it or any other time one wishes to during the calendar year

Interesting. Kindly update us about such info’s in future as most of us were not not aware of it for years 😐

Yes, GTMAX is right. Even Amex is the only credit card provider who allows Third Party Authorization of your credit card account. It means the authorized person can talk to customer care on your behalf, can redeem points, change personal details etc. As my wife is not very much friendly and card lover so i maintain her account on her behalf all the time. 🙂

Yes, aware of this. Infinia too has this ability. Wish every other credit card issuer has this feature.

My bad! Didn’t know that this was a mystery for many until I saw this post & comments. In my case, the Amex customer care representative was quite proactive in communicating this to me on my first ever redemption request.

Agreed with Shivi.

Not fully agreed with Sid’s statement on ‘Acceptance’. I’m having 2 Amex cards (issued by ICICI), having few problems on acceptance. But I don’t have any problems on that as 90% of my transactions are online. Only offline use is on HPCL fuel stations.

Not to mention, AMEX don’t issue cards to my city of residence, no hope of anytime soon.

Same goes for Citi, but somehow I managed to get a Citi last year.

You’ll fully agree to the statement once you start using offline, other than HPCL outlets 🙂

True, the issue is that even if the store has Amex acceptance the shopkeepers are reluctant to accept it since it has higher merchant fees.

They will ask you to use another card preferably a Visa/Master.

@Pranab

Hi Pranab. Which city you are from ? And how did you manage to get Citi Bank Card. Please explain in detail, it will be very helpful. I am from Indore. Amex issues Credit Card here but Citi Bank does not. Thanks.

Any idea if only for Gold/MRCC or also for others like Plat reserve?

Do check this: 2 Amex Credit Cards to Accrue Reward Points in Single Account

I have just redeemed 18K points for Rs7500. Per the agent other than 12K points redemptions , the remaining options can be done multiple times in a year. No limit for this.

I have 36k points wondering what to do.last time redeemed for satya paul vouchers. Was thinking of redeeming 2-Rs8k amazon vouchers. But again cash is king. 😀 lets see what i do.

I redeemed this around 1.5 years back. They never published on any website.

Lots of discussion on reward points conversation to statement credit. What about I Tax implications? We have the options of not redeeming the points (AMEX/HDFC), but what about Axis Flipkart Card! Is there a chance of getting a surprising love letter from IT?

Just placed my request through chat. Thanks for the info. Chat was slow to connect though. Took about 40 mins.

Yesterday only requested to redeem 24K reward points for 10K statement credit, will call and check whether any options to change that. So it will gain Rs.600+ by making one now and another on Jan.

Awesome. I immediately redeemed those. Just fyi when i spoke to cc I was told this can be redeemed once in membership year and not calendar year.

I have just talked with customer care executive, he confirmed that 12K can redeem now and another 12K on Jan.

Its there since last 2/3 years and it’s available online too. They had communicated through email about the same 2/3 years back.

Hi Sid,

Thanks for an amazing website and I must tell you that I frequent your website almost daily, if not more.

When I read this article, I went straight to Amex MR website, and in first go I was not able to find this redemption option. I then opted to see all redemption options, moved the slider to show rewards starting 12000 points and there it was. the header says “AMEX Statement Credit – 100% Fee”. however it looks like that they have not updated this information for quite some time now. point 5 reads something like this:

5.The Cardmember can redeem 12,000 Membership Rewards Points for a statement credit equivalent to the standard annual fee of INR 5,175 (INR 4,500 plus taxes)

With 18% GSt it sums up to 5310 and not 5175.

Nice. I was able to find it online as well. A quick search for “statement credit” in mem. rewards page helped. Thanks.

I tried searching for it like you mentioned but its not there for me, may be because my MRCC is LTF?

Isn’t it better to convert 24K points to 24K Marriott bonvoy points and use for booking hotels, than redeem for 10k statement credit? I am assuming here 24k Marriott points have more value than 10k INR

Looks like this option is not available for people with LTF card

It is. I have MRCC LTF, and placed the request through Amex chat.

So every year they charge me an annual fee on my GC card, and when I ask them to reverse it, they give me a target to spend (like 60k in 3 months).

So, as some members have said this reversal is equal to annual fees, if I choose for this 12k option, will they deny me any option to get my annual fees reversed?

No they won’t deny it

I am getting an offer to pay my card fees i.e 5000 in exchange of 10000 MR, is it worth it?

or they are asking to spend rs 120000 in 2 months so they will waive of my charge.

This is a great deal. You get the waiver and the reward points for 1.2L as well. Go for it.

Hey Siddharth,

Will we be able to redeem the 12K points for statement credit even if our annual fee is waived off in case of spending 1.5Lacs on the MRCC card?

Or can we just redeem the 12K points for Rs 5,310 when we have not been able to waive off our annual fee?

You can do that in either of these cases

This option is not available for membership rewards card.

I have confirmed this with customer care. The 12K point redemption option is available on MRCC and we can redeem it even if we have our fee waived off by meeting the spending criteria of 1.5lacs.

@abhishek Indore,

I’m from Jamshedpur. One of my colleague was a Citi card holder and his home city is Kolkata. He referred me mentioning his address as mine and ‘Managed’ the documents pick-up representative. After my card was issued, I changed my address on Citi database. After taking a good round of 1 month, finally I got my card.

you are smart!!

Have been a payback Amex card member from last 5 years but was hardly getting accepted to the Amex card programme. Fianally I got companion card offer to Accept Smart Earn Card.

Well at last the initial relationship comencement…. But really disslike why dont they give upgrades?

Just redeemed this. Thanks for the info. What GTMax said is absolutely correct (this is 4500+GST) for those who arent on LTF. However the option is available to all. I’ll redeem again in January 2020.

Thanks for this post. I just redeemed for 12k Points and going to get 5310 credited to my gold charge Ac. Very exclusive information. Thanks

I called up the customer service and azked about this. Got both the good and the bad news. Bad news being, amex gives this option for customers whose renewal is coming up and the renewal fee of 4500 + GST is adjusted against 12000 points. Good news being, mine is a lifetime free card so it doesn’t apply to me, apparently.

My MRCC card is on LTF but customer service took the request for statement credit with out any questions. They told me I can get this type of redemption in once in year.

12K points already deducted and waiting for 5310 Rs credit to my account.

I just redeemed my points for 5310 rs statement credit

Also confirmed with representative that i can again redeem this once in calender year that means from 1st Jan to 31 dec.

Planning to redeem again in Jan

Hi people,need your advice.

I have amex platinum and am being offered MRCC now.

I have diners 10x (which I’m trying to upgrade to infinia).

I’m looking for the best option for rent payment for maximum points/cashback/rewards for a rental of Rs. 5 lakh pa.

1) Kindly suggest whether to go for mrcc and if this is the best option or i should go for something else.

2) What would be the benefit for using mrcc for paying rent of 5 lakhs thru the year, would an amount > 4lakhs be rewarded as well?

3) Also amex plat is chargeable from next year, so if I’m using mrcc to pay rent would the spends on mrcc count for minimum spend on platinum or will I need to make minimum spend from paltinum as well?

Lot of questions. Pls help me out with these queries.

Thanks in advance!

I too used it…I used in 2018 and 2019 for Gold charge card

I should have informed in this fourm

Great update.. Just redeemed 12k pts with 5310.

Thanks a ton!

Thank you for the post. I got my 12k points redeemed for 5310 Rs.

I redeemed 12000 now – only catch is redemption is once in 12 months from date of first redemption.

Hi Siddharth,

I spend close to 4 lakh Rs, every month on my credit card. Which is the best credit card for me in terms of earning and redeeming reward points? I currently have Regalia First credit card from HDFC.

Just redeemed today and was told by the CC that this offer will be withdrawn after January 31st 2020 indefinitely.

So if you haven’t gotten around to redeem this offer yet, you know what to do!

Can anyone tell me if this offer is still around. Can I still redeem 5310 statement credit for 12k reward points even now. Thanks in advance.

This offer is no longer around, checked with customer care couple of weeks ago.

Nope. They changed their redemption program around 2 months back. You also don’t get the same value as earlier for cash redemption on 18k & 24k points.

I was luckily helped by one of the executives to redeem 60k points for 26,550/- (5310 * 5) cash credit just before they updated their rewards program.

Yes. Its still available.

Siddharth,

Not sure you saw my tweet – but are you aware that AmEx has now reduced points value? 24,000 MR points are now worth only INR 9,000. Likewise, there has been a drop in the cumulative value of 18,000 MR points too.

Any idea when this happened? Not sure this offer you speak of here is still valid. Never saw it in my mailers.