As you might know, almost all credit card issuers are making changes to their rewards program by cutting down the benefits left, right and in center.

As everything looks fuzzy at the moment, this article would give you some clarity on whats happening in the country across all credit card issuers and what you could do to prevent or minimize the impact.

Here are all the devaluations live at the moment, so far:

Table of Contents

HDFC Bank Credit Cards

Changes

What to do?

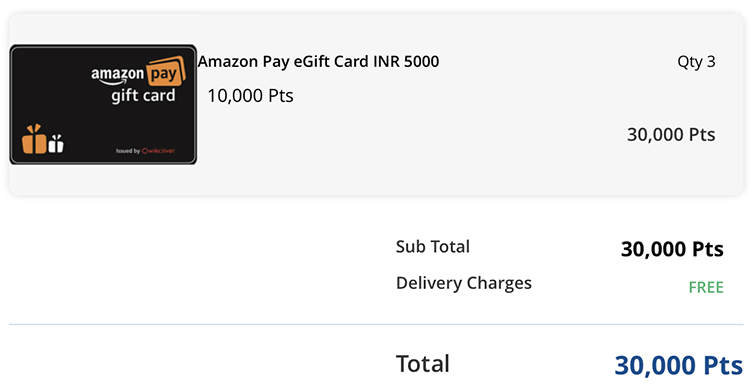

Consider redeeming them partially for vouchers like Amazon Pay gift cards via Smartbuy portal that would give you 50Ps/point value (Infinia/Diners Black). It might get you lower value if you have regalia or other cards.

To do this, Visit HDFC Smartbuy -> Infinia/Diners Black -> Rewards

This non-travel redemption makes sense especially if you have too many points, like over and above ~2 Lakh points, as even if travel opens up, you may not be able to redeem all of them in a short time.

Ideally, I think we should be back to normalcy for travel by March 2021. This doesn’t mean Virus will disappear, but we will learn to live with it.

SBI & Axis Credit Cards

Changes

- SBICard: No reward points on wallet loads

- Axis: Effective 14th April 2020, crediting of EDGE REWARD points on transactions for wallet spends and reload using your Axis Bank Credit Card has been discontinued – T&C

What to do?

Feel free to use American Express credit Cards like MRCC to load wallets, so you get the monthly bonus along with the regular reward points.

IndusInd Credit Cards

Changes

- Point value for cash redemption is now 75 Ps (previously: Rs.1/point) on most premium cards. Refer T&C.

- Note: Customer care still takes requests for redemptions @ Rs.1/point for cash redemption. So maybe this is an error on website as they changed the design recently. Or maybe they will make this change go live later.

- Update: The point value is back to Rs.1 for Iconia, Pinnacle & legend.

What to do?

Indusmoments still gives you the ability to redeem @ 1Rs/point.

Since I’ve never redeemed points on Indusind Iconia Amex card since last 1 year or so, I do have a healthy point balance.

So I went ahead and redeemed significant part of that for instant vouchers on Indusmoments website that gave Rs.1 value per point. Vouchers delivered in under 5 minutes.

Note: Rs.1 value /point redemptions are usually hard to find and I ended up with some vouchers on Apparels category. Many vouchers on apparels category still carry Rs.1 value and with the ability to redeem 100% of points. May not last long!

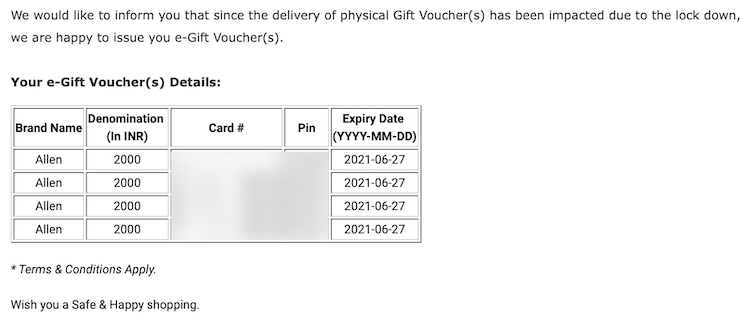

YesBank Credit Cards

Changes

- Point value for non-travel redemption changed to 15ps (Previous: 25ps).

What to do?

The latest catalog which is live NOW on Yesrewardz for credit cards seems to be all enabled for e-vouchers.

I was successfully able to redeem the points for Allen Solly e-voucher after an issue with redeeming my pantaloons voucher. Got it delivered in under 24 hrs.

RBL Credit Cards

Changes

- Previously, RBL bank rewards were valued at the range of ~25ps/point considering the available redemption options by then, but now it has gone down to as bad as 16ps/point on select redemptions.

What to do?

Simple, go ahead and redeem all the points and close the card if you don’t have a significant credit line with them. More in detail about this here.

AmEx discontinues SpiceJet Vouchers

Changes

American Express India just sent out an email to all platinum travel credit card holders on 29th June 2020 about the discontinuation of SpiceJet vouchers issuance from 1st August 2020. More in detail here.

What to do?

Overall I don’t see this as a devaluation and it is still the best travel credit card in India with 6.5% reward rate. You may apply one for free (limited period offer) just incase if you don’t hold it already.

What about other Amex cards?

As you might have noticed, while everyone devalues the points, Amex on other side adds more and more value, especially to their top tier cards with offers like double rewards & 100% cashback offer.

This is because they play a totally different game!

Does this mean there won’t be any devaluations at all? I doubt.

I “think” they might modify something on monthly bonus eligibility criteria when it comes to Gold cards, as many of us use wallet loads to earn the points easily.

Other cards, especially Amex Platinum might see some new offers (expected by July) as they get rolled out worldwide.

What Banks could have done better?

These changes are all happening because credit card spends are down by ~50% (as of June 2020) while redemptions continue to happen, except maybe for travel but that too is picking up now as Air traffic is up by 50% or so.

But how come banks afford to run the business with “low revenue” and without a significant drop in redemptions? Hence we’re seeing all types of devaluations.

That said, I think banks could have done these changes in a “customer friendly” approach. Something like below would have helped cardholders like us to have a peace of mind:

- Extend the points validity through Dec 2021

- Limit redemptions to 75% (temporarily)

The most important point to note here is, this situation is only “temporary” and we will be all back to normal, and so the credit card companies.

So whatever devaluations the banks does to shield themselves for the upcoming impact (as our country’s infection levels continues to get worse), I wish they communicate to us as “temporary” or till a certain date or simply “until we are back to normal” which might give us all a peace of mind and stop us from panic redemptions.

Yet the most important question is, “Will the banks revert back these changes to pre-covid levels if revenues are back?”. I wish they do, but only time will tell.

Final thoughts

Devaluations at this time of pandemic is inevitable. This doesn’t mean you have to go ahead and redeem all your points but if you are sitting on lot of points balance its good to redeem them for a fair value, as travel continues to be risky in near future.

I’ve always said and will repeat: “Reward points are a poor long term investment“. Wise are those who earn and burn as fast as possible, else we would get stuck in situations like this.

Happy sailing through the tough times!

We may need to wait till mid-2021 to see the credit card game get back in action. Or maybe if we are lucky, we may see some happy days during 2020 Diwali.

I will keep this page up-to date, so you may bookmark this page and refer anytime in future to have a birds eye view of all devaluations in one place & their progress (if any).

Did I miss any other important changes? Do let me know, will update it, so that it would help many others to stay up-to date on the changes.

Good sid. Thanks

Pretty good list, Sid.

You missed out on Yes Bank devauations and offcourse, RBL’s silent devaluations

Thanks for reminding them Harshvardhan. List updated.

Rbl is issuing an offer where you can convert your points to cash at 20 p a point if you open a digital bank account with them. I have just opened the account and sent in the redemption request. Will update once it happens

I don’t think amex will change eligibility criteria for bonus points they might increase number transactions but i hope they will continue to allow wallet transactions with capping limit like ₹2k, and amex already devalue their point wef 1st February so there is very less chance that, they devalue points again.

That’s what I meant as well.

But “amex already devalue their point wef 1st February ” – What are you referring to?

He meant by the 18k and 24k gold collection devaluation

https://www.cardexpert.in/amex-membership-rewards-credit-card-review-2020/

All bad news in one page.

BTW very well written. No second thought for “Reward points are a poor long term investment”

I second this. Credit cards main purpose is to make everyone spend spend spend.

Encourage people not fall for reward points and avoid spend monies on unnecessary things.

Sid

Yes Bank portal is only showing physical voucher or gift cards. But the send e-Vouchers of the same brand you redeemed for or alternative (after calling to confirm change.)

Its same brand. The updated catalog is all e-vouchers it seems. But not yet sure on that.

Yes Bank – 40% devaluation is live. All e-gift voucher vissible. No physical vouchers.

Although I Can see Amazon, Big Bazaar in Brands list, no voucher is available.

May they will be added soon. A silver lining. But at 0.9% reward rate, and a Bank which will constantly need to raise capital, better to not spend on this card. It was good while it lasted. Time to move on.

Hi,

Does anyone have any suggestions on how to get the best value while redeeming amex MR points (No hotel voucher preferably)? I have a MRCC card.

How to redeem points at 50p for Amazon pay card for Infinia and DCB.

Where is this option?

To do this, Visit HDFC Smartbuy -> Infinia/Diners Black -> Rewards

How long doe the amazon vouchers take to be delivered ? I am still waiting for them after redeeming.

Did you get your vouchers ?

Hi Sid,

How long does it take for the gift card to be generated and emailed to you? I redeemed some points Yesterday and have not received the gift card yet.

Thanks,

Shawn

Would you know how long it takes them to send the e-vouchers of amazon? I just bought 4 amazon gift cards from SmartBuy redeeming rps, and it is showing success. Yet I have not received any gift card yet on email! The reward points are already deducted.

~5 dyas is what they say. I’m yet to get them either.

did u receive the gift cards?its been more than 5 days since i redeemed..yet to receive the vouchers

Yes, took about 4 days for me.

Took 4-5 days for me as well.

its received by sms or email?anyway to login and check the codes..in orders am able to see only smartbuy voucher code n not amazon codd

Hey Can anybody please tell me how do i buy Amazon pay gift cards using HDFC Diners black or Infinea credit card.

Thanks

As stated by Sid above: HDFC Smartbuy -> Infinia/Diners Black -> Rewards. You have to login and buy. I tried this and it is showing as success. But I have not received the gift cards. Was expecting them to be immediate via email.

I think, following Amex communication is what he is referring to. Earlier you used to get an stmt credit of 7500 for 18k points and 10k credit for 24k-

Now –

18 Karat Gold Collection

Once you reach 18,000 Membership Rewards® Points,

you are eligible to choose from any of these

Taj Voucher worth ₹9,000

American Express® Domestic Travel Voucher worth ₹7,000

Amazon Voucher worth ₹7,000

Statement Credit worth ₹6,000

24 Karat Gold Collection

Enjoy even bigger rewards, once you reach 24,000 Membership Rewards® Points, you are eligible to choose from any of these

Taj Voucher worth ₹14,000

Tanishq Voucher worth ₹10,000

Statement Credit worth ₹9,000

Sid brother, Greetings from coimbatore 🙏

For DCB you could have added points can be converted to AVIOS/KRISFLYER/CLUB VISTARA for 1:1 ratio and can be redeemed/upgraded at a good rate la?

Yes, miles transfer makes sense Aakash. But have decent CV points already and I’m still not into AVIOS/KRISFLYER yet, neither can think about it in next 1 yr. Hence this redemption.

I ordered Amazon voucher using reward points yesterday. Haven’t received them yet. Is that normal? What should I do?

Yes. I’d done this last month and it took 5 days.

Have you received them? I booked them yesterday. No communication from HDFC…

Not yet, 3 days already but no communication.

If reward points are converted to airmiles .Which one do u think is a good option to convert to ? hdfc diners black

I spoke with Indusind customer care twice regarding the devaluation. They informed me that as of now cash credit redemption is still 1P=1Re in their system and they aren’t even aware of this devaluation. Even the senior management told me its still 1P=1Re. Also if any devaluation happens, we will be communicated in advance. Also they took a request to rectify this issue on their website with their back end team. But if indeed the devaluation has happened, they will communicate that to me via call.

I’m talking about my Legend Signature card here. I’m not aware of other cards like platinum aura etc. There the redemption is already 50p.

Thanks for the inputs. Updated the article accordingly.

Now their website is updated as 1 point = Re.1.

I have HDFC Regalia First. Yesterday I logged into smart but and found out that there are no longer 10X rewards on Regalia and Regalia First. We only get 5 pct cash back.

Citi has introduced 10 pct cash back on Amazon on all cards.

tried calling indusind customer care now..was informed that the new redemption is already live..can redeem 75p per point

@Pratik Can you kindly tell me which variant do u have from INDUSIND. I again spoke with customer care today regarding my Legend Signature card. They informed me that for my card, its still 1Re/P. And the agent asserted that its a recorded line and she received the updated communication today morning only, atleast for my legend card that its still 1Re/P.

Very rightly said about RBL. Definitely have to close right now. And I’m going to.

You can add ICICI rubyx card. Their devalue is worst.

BMS buy 1+1 is gone . Now they are giving max 150 plus to use airport lounge you should spend 5k in previous month. Since ICICI has been giving it as LTF card to all privelage account holders might be they took this move.

People with paid variant can blindly close the card 🙂

Hi Sid,

Just got an email from AMEX that they have discontinued SpiceJet vouchers, that means all MR points for Platinum Travel Cardholders now stand at 50p instead of 80p.

You can add this to the list.

Same here. As an example executive quoted that against 7500 points a 6000 rs worth of SpiceJet voucher was redeemable but now it’s an open voucher of 5000 rs of Amex Online Travel. Moreover if anybody places a request for redemption now then they need to ensure the travel date is before 1st August,2020 to utilise them.

I got the email as well but has the value of milestone points been confirmed? Like for 4lac milestone there used to be 10K bonus points worth 10K spicejet voucher (1 : 1 value). So will that now be treated same as ordinary points, meaning 40-50ps value?

How did you calculate this “80p” and “50p”?

Yes lol. Amex also followed HDFC in devaluing credit card benefits. All the travel benefits are gone

I’ve used my Infinia points for TATA sky recharges 😄

1RP = 1₹

Pretty good return for a small amount though

Is there a way to use Dinners club points for recharge option?

looks like dth recharge only available to infinia customers

Hi Apoorva, is this available for DCB also?

Not aware if DCB. It shows when I login to the Infinia section in smartbuy.

How and where did u do that ?

Please teach

On smartbuy portal privileges section , choose infinia , it will redirect to infinia page , login there , once your card details are authenticated , you will be able to access DTh section , put consumer if and choose amunt as per plan , redeem points via voucher code

Thanks bro

I have a customised plan on tata sky. How do I recharge, it ask for a defualt plan as given on the right side of the page.

Just take any plan close to the amount you need. Or recharge multiple times.

Traded all Regalia Points for Amazon Vouchers at a conversion of 0.35 per RP. Seemed like a decent conversion with 0.5 per RP poised for flight and hotel booking…

However, still holding my Infinia points tight… Lets hope for the best! Cheers.

Can you please tell him how you got a conversation rate of 0.35 for Regalia. It’s showing 0.15 for me for Amazon, Flipkart etc on the rewards portal. TIA!

This is going to be ‘new normal’ for banks and they will make us to adopt them. I don’t think, the CC providers will ever come to pre-COVID era, atleast even after 2 years.

I second that, benefits once revoked would never been seen back at my opinion.

Regards,

Kiran

Hi,

I had applied for HDFC credit card. It got approved. I have received an email containing PDF of the card but I have not received a password in my mobile number. Currently, HDFC is not receiving any call. Can I get a password online?

Sid, you should also warn users of another strange change by HDFC for DCB customers. When I log into netbanking, and choose the “Redeem reward points” link from there, it takes me to a page which offers a 500 Rs. Amazon voucher for 3330 points!

I’m sure this is a recent change since last month I had redeemed points for Amazon vouchers at 1:2 ratio using the same method, and even before that used this for a 1:2 cashback (when that was still a thing).

Thankfully, your approach of going directly to the SmartBuy page still works and I was able to redeem a further 20k points today.

I agree with this, even I tried the same and i was wondering why there was so much difference in redemption for amazon vouchers. Sid, this point is very important and if you can highlight this as not the way to redeem points for DCB to get amazon vouchers, it would help a lot of users.

Certainly, will update.

+1 I literally had my jaw dropped 33300 points for 5000 value amazon gift card. I thought it was further devalued.

I came here first to check, Thanks to Aayush for his comment.

Siddharth. Good news. IndusInd has updated their TnC page after I repeatedly inquired about it. Got a call and a mail too regarding the correction. Now on IndusInd Legend, Iconia Amex and Pinnacle page, its showing 1 reward point = Rs. 1 of cash value ie 1Re/P. Never been more happier.

Thanks for the update.

Hi Sid,

Pls also add the Amex devaluations to this list:

1. Gold collection devaluation wef 01/02/20

2. Plat travel devaluation wef 01/07/20

Hi Sid, curious why Amazon vouchers instead of cash redemption? Infinia

Cash redemption takes place at 35 paisa per RP while Amazon voucher redemption is at 50 paisa per RP. Only for Infinia

HDFC Moneyback online double reward points restriction was missed in above list

As AMEX plat travel is now not offering Spicejet vouchers what are the other ways to get maximum benefit for plat travel?

Yes, Sid please tell how to handle Amex devaluation.

Article live. Replacement may come shortly, is what I heard from my reliable sources.

Received 5% cashback(upto Rs.300) target offer from SCB, seems only SCB not devalued in current situation and also improved reward redemption options.

Thanks Sid. Due to your article, I was able to redeem my 80000+ Yes Bank points on time. Ordered a few appliances for home (and got bonus points from my family 🙂 )

I also have an Amex Platinum Travel Card, with almost no redemptions for the year. Wondering how I would use those points and also maybe try and get a year of reduced/no fees since I don’t see much travel for the next 6-12 months.

You may use the points to lower your fees expense next year. For instant gratification, you may consider redeeming some points for amazon vouchers (1:4 basis).

I had 3600 points with Yes Bank and was waiting for 4000 points to redeem 1000 rupees voucher but they lowered the points value.

hdfc charged rs99 redemption fee for redeeming points on smartbuy for amazon vouchers

Very strange. I did 4 seperate transactions (amazon vouchers) but wasn’t charged anything. In fact, on the redemption confirmation page it was clearly written “FREE”. Which card are we talking about here?

Others can also share their experiences.

I think you went on to redeem via netbanking and not via smartbuy coz there are no redemption charges!

I redeemed for vouchers via net banking and was charged Rs 99.