American Express India just sent out an email to all platinum travel credit card holders on 29th June 2020 about the discontinuation of SpiceJet vouchers issuance from 1st August 2020. Here’s everything you need to know,

The Change

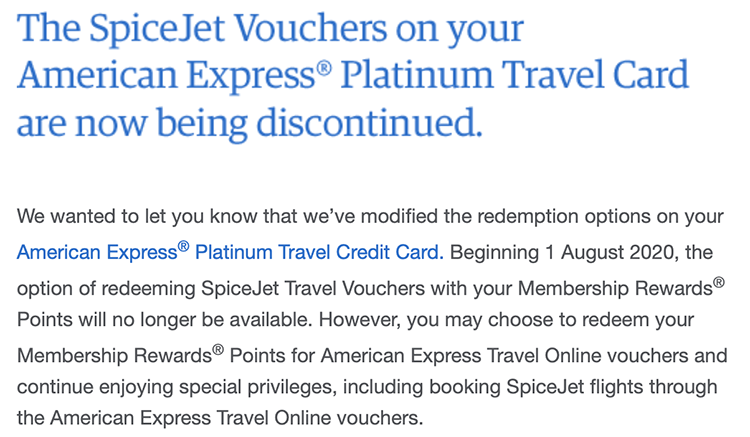

Here’s a quick look at the email just incase if you haven’t got it yet:

How does it affect?

Here’s how the redemption looks like on Amex Plat Travel Card from 1st August 2020:

- Regular points

SpiceJet: 50ps- Domestic Travel vouchers: 40Ps

- Bonus points / 1.9L spend / 7,500 points

Spicejet: Rs.6000 (80ps)- Domestic travel vouchers: Rs.5000 (67ps)

- Bonus points / 4L spend / 10,000 points

SpiceJet: Rs.10,000 (Rs.1)- Domestic travel vouchers: Rs.8,000 (80ps)

As you see above, redeeming Amex MR points for spicejet vouchers gives you accelerated value per point but now as it’s taken away, the max. reward rate drops to 6.5% from 7.5% overall.

In reality though, hardly very few of Amex cardholders use SpiceJet and I never liked it ever since Amex replaced Indigo with SpiceJet vouchers in 2017.

So overall I don’t see this as a devaluation. I feel it’s more of a quick decision, possibly because of the pressure on airlines industry.

It is still the best travel credit card in India, without a doubt. You may apply one for free (limited period offer) just incase if you don’t hold it already.

Will there be a replacement?

I’m pretty sure there will be one.

I’m expecting Amex to reveal that likely in a month or two as SpiceJet voucher goes away, but we don’t know for sure when that will come.

If I do a wild guess, it would be easy and simple for them to replace it with Taj Vouchers, perhaps at higher point value just like they did so with Gold collection revamp.

It would be even lot better to modify the rewards system (by keeping reward rate intact) on Plat Travel card as it feels complicated for many to get into the numbers.

Final Thoughts

While this is not a major concern for most, I’m afraid if other airline cards would be touched during this pandemic period, especially the one like Axis Vistara Infinite.

That aside, I’m quite confident with Amex that there will be something or other to replace SpiceJet vouchers at similar conversion rate.

Infact Plat travel is one of their premium product, so I see no reason for them to not take care of their valuable cardholders. So let’s wait and see what’s coming.

Have you used Amex SpiceJet vouchers in the past? Feel free to share what you think about this change.

Well often times they give enhanced value while converting to Amex Travel Vouchers. Last year I got conversion at Rs 0.73 to a point (if my memory serves me right). I used it on Vistara (there is no Indigo on Amex Travel site), and I got CV points as well. So it was almost at Rs 1 conversion – even with discounted valuation of CV points.

That I believe is the bonus points redemption, which gives ~70ps value per point, combined. Or, did they run some other promo under “Hot Rewards”?

Yes it was under bonus point redemption.

I am quite sure that Axis Vistara Infinite will also be effected In some ways, as I come to know from few who had applied for this card in March ‘20, having got their card but their charges of Rs 10000+ GST have been reversed in June ‘20.

Today i saw mail from amext for my platinum travel card for 2x offer.Its valid for today only that is july 1st and max bonus points 2000 for any online spend.Does it mean i can even load wallets.did u receive this sid

I too got the offer and i paid my rent using my plat travel.

lot of websites dont give points now for paying rent. which website did you use? how much % extra did you pay??

Hey, I know it doesn’t matter now but yes, this offer was applicable for every transaction for which you get regular points which include wallet transactions. You will NOT get bonus points for utility, fuel and insurance spends since you get 0 points for those transactions and 0X2 is 0.

It came at a perfect time since on the 1st I pay my rent, and I needed to buy a couple of things for the month including the groceries for the month.

You should follow SIddharth on twitter for such instant and flash updates. And you will realise, he is always one step ahead 😀 .

I have been using this card for 2 years, and twice I have availed SpiceJet vouchers worth ₹10K (1:1 ratio). Both the times, I was able to book a return journey (ie. 2 tickets) free of charge. But now I don’t think a ₹8K voucher can cover cost of two tickets. And sure, one may argue that Indigo is more on-time than SpiceJet etc but I can happily accept 20minutes of delay from SpiceJet if I am getting a benefit of ₹2K (10K vs 8K voucher) and so I always preferred the free tickets from SpiceJet. No doubt, this move is obviously a loss for existing Amex Plat Travel Card holders and this card provides less benefits now as compared to other Amex Cards. Not sure I would like to spend 4lakhs again with Amex, since HDFC/SBI have good offers of converting points to air miles.

this article has unusually less reader comments than expected – I believe it is a big devaluation and a card lost one of its signature offers. I dont know why people are not reacting to it the same way they reacted to other devaluations in previous article

Amex website is not updated yet, it still has the same narrative on the milestone points saying 6K and 10K. That’s probably going to be updated from 1Aug to 5K and 8K, when devaluation actually takes effect. Although people applying as of today won’t be aware upfront that devaluation is taking place, going by what the website shows. That’s because in theory, one can apply for a card today, get it in a week, spend 4L in a few days and redeem all the milestone points for spicejet vouchers by 31July, lol.

Received targeted offer for 3X on education spends. Bonus points capped at 3K.

Have any of guys experienced suspension of card services and received request for re-submission of financial documents? I received the same for some high value transactions done in Feb.

Yes, they are doing financial review.. One Mr Manish called and asked for data. He is little rude which i have experience first time from Amex. They also reduced my limit to 80% of previous limit. I have been asked not to use for NPS. If I use on NPS they will cancel the card. I did not like his behavior hence i told him after i redeem my RP i myself will cancel the card.

No..feb month I did for 4 lakhs…how much amount you did?

1.97 lacs in May

Most likely a phishing attack. Don’t reply to mail/send docs on mentioned address/mail Contact CC instead.

It was genuine call, lot of friends here have already undergone credit review. But first time I had really bad experience. Manish also asked me to send NPS receipt to which I said please give me over mail. He said he cannot give it in writing to which I said I cannot submit documents on oral requests. Rest all documents I shared which took 8-9 working days for review. 8-9 days is actually sufficient time to review RIL balance sheet.

This is very bad and bizzare. Why would any card company ask for resubmission of documents. Regarding NPS, they must be thinking that you have invested in Tier 2 and withdrawn after a few days. This is a real loophole but other card companies are happy with the 1% charge they make.

Agreed but if they think it is a loophole they can plug it by simply blocking usage on NPS Tier 2. Instead Manish asked me not to use for NPS else my card will be blocked. I didnt like this so I am closing my relationship with Amex after redemption of RP

yes. I did for my high value transactions done in March. they asked for my documents and although my salary/ITR hasn’t changed and my cibil > 780 but still they decreased my credit limit. I dont know why amex is doing that to its customers.

Did you spend on NPS, Parul?

I dont know about parul but I spent some amount on NPS in same month. but my nps value was not that high but instead I spent high on a new phone and TV …

I have received the complimentary CPP credit card protection plan from Amex for my Platinum card. Did anyone receive this benefit and started using it? Any positive review on CCP credit card protection plan? Can we go ahead and enroll all of our credit and debit cards?

Sudheer,

how complementary ? can you explain pls.

Rakesh, i have received a post from Amex states that “In our endeavor to back you at every step, I am please to share the details of CPP Wallet Protection plan. This membership ones to with our complements. Another assuring way we have your back”

Next day I have received the welcome kit from CPP group india

Read the TnCs very carefully before opting for a CCP , many of them have fraud protections only for transactions above 5000rs , but now a days most fraudulent transactions are kept to less than that per transaction… its better to keep intl transactions off through customer care or app/website until you need it