I’ve been thinking to upgrade my IndusInd Exclusive A/c to Pioneer Banking for a while to explore the pioneer credit and debit cards, just for the design (yeah, silly!), nothing much on rewards front, yet they’re decent.

If you’re wondering about the rewards, pioneer debit card gives 0.5% return on spend and pioneer legacy gives 1% on weekdays, 2% on weekends and if you can spend 6L annually, your reward rate will increase by extra 1%.

So sometime during late Nov 2021 I got a call from IndusInd about complimentary invite to Pioneer banking. I accepted the same over call and they took a request for upgrade right away.

IndusInd usually picks new set of accounts every month for pioneer upgrade and if eligible you’ll get a call from RM or someone from Mumbai team (as in my case).

So I got the upgrade request ticket alert the same day, the welcome kit dispatch alert in 2 days and I got the welcome kit (with Pioneer debit card & cheque book) delivered within a week. It was all smooth and perfectly done.

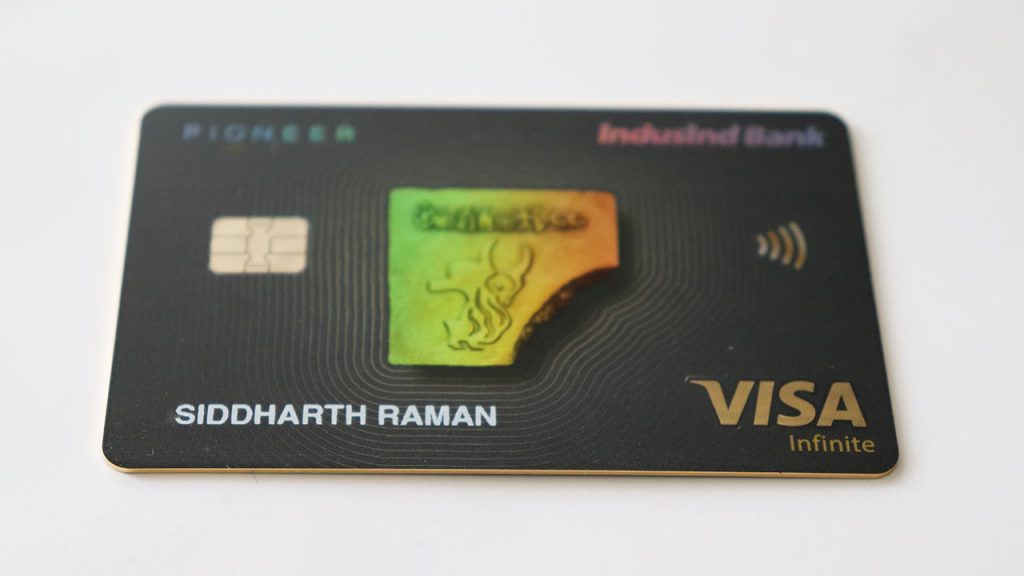

And not to mention, I was indeed super surprised to see a Visa Infinite debit card. As pioneer was launched on MasterCard platform, its obvious that they would issue a visa variant now. So I was expecting it to be on Signature platform but quite surprised to see it on Infinite.

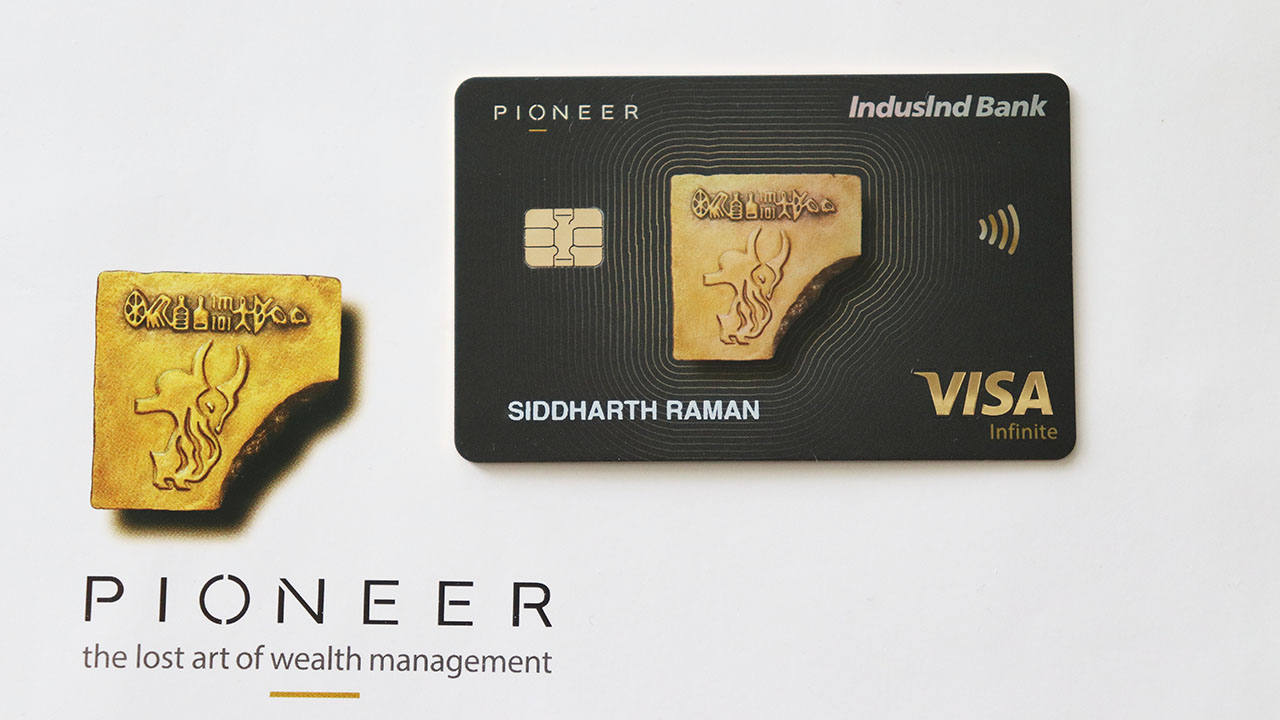

The debit card design is simple & beautiful with numbers at the back. The edges of the card are golden (seen from side). Also the logo and certain parts of the card shines in different colours when exposed to light. Some snaps below:

I quickly checked if I can get the Pioneer Legacy Credit Card, but unfortunately it seems they’re yet to go live on Visa.

Final Thoughts

Overall, from what I see, IndusInd Pioneer banking concept is pretty good and is infact better than HDFC Imperia in certain cases, for ex, no markup fee, better debit card benefits, better debit card rewards, etc.

Have you received upgrade to IndusInd Pioneer lately? Feel free to share your experiences in the comments below

Hi Sid, what are additional benefit with it compared to credit card which gives better cashback/return !!

Further, is there any charges associated with pioneering banking and if yes then how to get it free?

10L S/B bal or 30L Dep, if they agree they can allow for lesser sum and you can increase in some time.

Is the 30L deposit needs to be maintained in the primary account or can be held across the clubbed accounts?

hii…..my my indusind exclusive savings account got a 0 balance maintainence tag when i bought the Pinnacle credit card.Now if i upgrade myself to Pioneer banking and buy a Pioneer Heritage Metal card,will my pioneer a?c also become 0 balance?

Yes premia debit card is on Infinite too

Is that free with Premia a/c? I thought only preferred a/c’s have these new Visa infinite debit cards.

Yes. Free 🙂

Poineer Legacy, better you get in writing on reduced markup if you are going for free variant, i had to fight to get it, took 1 yr almost for the markup fee difference credit.

Debit card i feel less rewarding than HDFC, initially after few usage on Mobikwik it stopped giving out points and I stopped using it too!

Overall i had a horrible experience with inexperienced RM and their great team.

Products are good, people are too bad.

But nice to see the Infinite variant!

I replaced my Yes first, that i received Infinite as well.

By looks need to think i should replace , as rewards are not useful any more.

Thanks for the warning. Yeah I’ve noticed that trend on other IndusInd debit cards as well, w.r.t. mobikwik.

True, I wish banks train RM’s better.

🙂 raised a request for Infinite after your article with the pics 😊..

Kindly share if you find anything useful on rewards front. ty Sid

What markup are we talking about here? I am planning to open the account day after and this markup thingy has got me worried.

How much I have to maintain in the account

10,00,000 in Savings Account or Current Account (group based) OR a Net Relationship Value of Rs. 30,00,000 (group based)

You have mentioned different platforms like Visa Infinite, Visa Signature, similarly, we have different platforms for Mastercard too. How do these platforms make a difference? Are there any positives and negatives of holding any specific one over any other? You have many articles covering individual credit cards and point redemptions, but none is present covering different platforms(Visa, Mastercard, DCB, etc), if you can write one then it would be helpful for everyone.

Google it. You’ll come to know.

I did try but did not get detailed differences. If you could point me out to a link then it would be a great help.

Copy/paste in google search – “Difference between visa platinum, signature & infinite”.

Atleast 7.8 million results came up in 0.5 seconds.

You’re welcome 🙂

Is there any significant difference with respect to benefits of visa infinite? What is the need if basic credit cards are offering better rewards than these premium debit cards?

On what basis does indusind upgrade to pioneer?

I’m assuming you didn’t give any additional deposits than what you already would have with exclusive banking

Basis same eligibility criteria.

Same as in Exclusive eligibility criteria?

Quite generous then for indusind to consider pioneer on exclusive banking criteria..

Same as regular Pioneer a/c eligibility I mean. However, how they prepare these pre-approved list of a/c’s for upgrade is not clearly known yet.

Ok

What’s the upgrade then though?

I don’t think pioneer banking is very restrictive or invite based, I’ve seen indusind RMs pushing it fairly easily

“not clearly known” unfortunately.

But I thought they’re sending this upgrade to many, given that they were not able to upgrade any past couple of months due to MC ban.

Hey Sid, can you confirm if we can pay credit card bills via Cred using this debit card ? Cred still allows debit card payment for larger amounts (>1 L)

From my experience with CRED (before they made this >1L criteria), sometimes they give points, sometimes they don’t.

Still they are accepting the debit card pymt more than 1L.

I am a Pioneer account holder for last one year and enjoying the benefit of it.

Mainly i get 20% discount max 1000 rs every month on big basket using debit card. Free bank locker. Pick up of cheque and other forms from home. Better services from bank.

I had a Indusind Legend Signature. One day a RM called and offered me Pioneer banking and a free upgrade to Legacy card and I accepted the same. Now I feel Pinnacle credit card is better than Legacy but Indusind is reluctant to downgrade the card even after escalation to Nodal officer level. I never found any practical use for the Pioneer debit card, mine is master though.

This product offering (Pioneer) is good on paper only.

Their RMs (if they remember to map your account to one) are most useless of all the premier banking i have seen across several banks.

Nice to see Visa Infinite their though! Eye catching design too.

Have this RM issue all the time with all banks, luckily the latest IndusInd RM has some good knowledge. Got a good Axis RM too recently. Looks like I’m getting lucky almost after a decade.

The only good RMs, with a working brain, I came across are from ICICI and StanChart.

I can vouch for that. My RM from ICICI bank is knowledgeable and is always there to help. Even though i just hold a silver account.

The best benefit of pioneer banking was the LTF Legacy credit card I had gotten but after covid I was downgraded from Pioneer banking to exclusive banking and my Legacy credit card had become chargeable. Thank god I was not using the legacy credit card for a long-long time and could get out of paying the crazy fee they had asked for.

The 0% forex is great but Indusind’s internal forex rate is quite a bit higher than real forex rate. For 0% forex I recommend RBL world safari credit card which I have used twice now.

Did they inform you before downgrade? I was said that downgrade is rare.

My RM was suppose to tell me and retain me since my account had only 20k at that point of time but he did not bother. The downgrade was done after about 8 months after I transferred most of the amount to HDFC.

BTW the IDFC wealth RM is recommend most of them are quite good but still can’t help much in case of credit cards.

I was offered the Pioneer Banking in October 2021( Didn’t hold any account with Indusind bank until then).

I took it, but only to experience a rollercoaster ride.

Firstly, it took over 1 month to get primary and add ons approved.

For add ons, RM decided not to give preferred account number as he thought” it did not matter!”

After arguments, I did get the preferred account numbers.(Not a pleasant experience).

Overall, it’s a hyped account with below average services(At least from the Gurgoan team).

Only perks that I went ahead for this account were :

1. Better FD rates (Basically any Indus account can get you that)

2. Upto INR 1000 movie redemption ( Vs Axis Burgundy or similar which gives only INR 500)

3. Free Locker (The branch got shifted to a far location so this doesn’t hold any value for me now)

4. Most importantly, the BEST Saving account services ( BIG FAIL !!!)

Barely using this account now, no idea where my RM is.

Bank keeps bothering with INR 2 L fee credit card ( which is probably the most over rated card in the country).

Hopefully this will change in the future.

Wov, i am not the only one 🙂

I hold this pioneer account since 2020. The onboarding was worst and RMs never respond to njoi the benefits(earlier we had eazydiner or zomato gold. To get this i did 100 follow ups , but i think now they give zomato pro for 1 year complimentary).. Another offer of Taj epicure silver membership complimentary ( i think the offer is removed now) i was tired following up and stopped asking.

These RMs interested to pull for investment and if you show them you are not interested then they never bother you for any other needs.

I prefer MasterCard is good in offers.. Even now i could see some membership upgrade like whydham hotels(Ramada and few other chain of hotels) has platinum tier upgrade..

Overall Bank at marketing on products offerings are great and attractive but RMs are not good enough

Did you manage to Get any free credit card with this account? My RM insists all the available cards are only chargeable basis starting at 30k to 2 lacs joining fee

Has anyone got Indulge CC LTF?

I dont see any major advantage with Indulge CC when compared to Infinia or Magnum, both have a much lower joining/annual fee.

Thank you