Disclaimer: Its theoretical numbers only, not practically possible unless you’re a big shot celebrity.

Its a known fact that HDFC issues only one credit card for majority of their customers and for a selected few, they do issue two credit cards on exception, provided they’re eligible for such higher line of credit. Usually getting two credit cards is easy if you’re a High Net Worth Individual due to which they can provide you a high credit limit so that you can split across two cards.

Getting approved for Multiple HDFC bank credit Cards:

It becomes impossible for many when they have credit limit like 1 Lakh and wants to hold two cards, as most premium credit cards with HDFC has 2L or more limit and there is no point in holding two beginner level cards.

So having 5 Lakh or more limit on a single card increases your chances of holding multiple credit cards from HDFC, usually limited to maximum of 2 cards per person. Getting such higher limits takes time, you can learn more ways to increase your credit card limit here.

Trick to get 4 Credit Cards from HDFC Bank:

Well, that was a tough challenge just for getting approved for 2 cards right? So how are we gonna get 4 Credit cards? and is it really possible? Well, i got 2 answers for this.

No – You can’t. Yes – You can. (in eyes of cibil)

- To be more clear, Yes, you can have four credit cards “theoretically” as per CIBIL records.

- But, No, you can’t have 4 different HFC cards in reality.

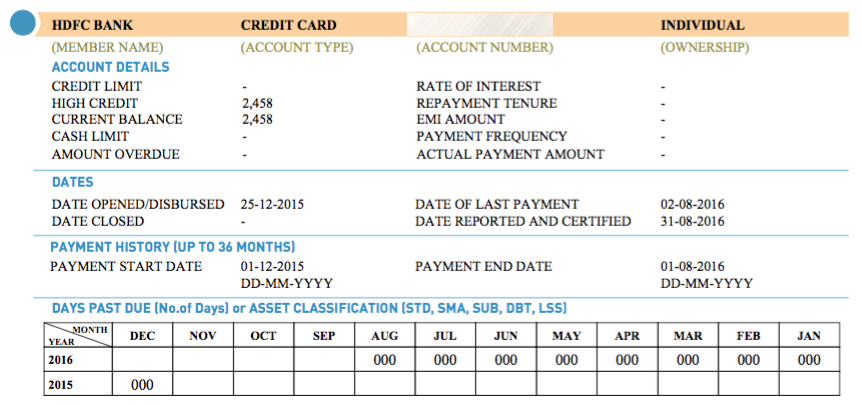

You should be wondering where does CIBIL get into picture here. Well, i recently wrote about the Insights into HDFC Insta Jumbo Loan wherein Jumbo Loan (a credit card loan) is treated as a separate credit card (see image below) as per CIBIL records for reporting your credit usage behavior.

Now, if you have 2 HDFC credit cards and if you apply for a Jumbo Loan on each, technically, it will show as 4 HDFC Bank credit cards on your Cibil report (2 actual cards & 2 Jumbo Loans). So this is how you can have 4 credit cards from HDFC without actually holding them 🙂

Tip: Insta Jumbo loans if paid on-time improves your CIBIL score as its reported without any hard inquiry on your CIBIL account.

Enjoyed the article? Feel free to share your thoughts in comments below.

taking a insta jumbo loan will reduce your cibil score because for cibil score it is not good to get too many unsecured loan after taking a jumbo loan cibil will see you as a credit hungry and reduce your score around 30 to 40 points for proof check your cibil score before getting jumbo loan and then after three month you wiil see the picture

Pankaj,

Jumbo loan is reported without a hard inquiry, so it wont drown the score at all. This is more like a secured credit card reporting.

As long as you’re using the credit well, you can even have 10 credit cards and have score above 800.

Siddharth,

I generally like your posts and i consider you are contributing to the financial wisdom of several of us.

However, Frankly this article lowers your standards buddy!. This article was written for the sake of it. Sorry, does not make sense or adds any value to any one.

I will continue to look forward more meaningful ones from you.

Srinivas

Thanks for the feedback.

I do understand. Its partly for fun, but with meaningful information about multiple cards & Jumbo loan is being reported to CIBIL.

That being said, no worries, I’ll reduce such articles 🙂

Siddarth, any review on bankbazaar or paisabazaar websites offering goodies on credit card application & approval?

Any offer should be good as its over and above the Welcome bonus on CC.

I agree with Srinivas too. Didn’t expected such an article.

Hi

I’m a HDFC credit card customer since 2011. Initially I was issued A platinum plus card in that year which got upgraded step by step and I’m using Regalia for last two years. The credit limit also improved step by step from 1.20 lakhs to 6 lakhs over the last 5 years.

I’m really fascinated by the priority pass programme. But I find it really tough to limit my lounge visits to 12 in a year. I’m not sure if I can get upgraded to Infinia in near future. But in the meantime how can I get one more credit card like Diners Club variant.

It will be great if you can guide

Thanks

Anoop E S

Hi team I am souvik .i am facing a problem last 18 month . When I was working company provides me credit card. I shopping 2200.00 but after a lose my job and now when I call to cc it will increase 5500.00 something and I request them for late fees discount but they are not listening my word .now it will around 12000.00 how to I shorten , full and final this one please help me .minimum how much I will pay for that. Thanks.

Hi Sid

I have Hdfc CC with good limit from more than 3 years no orther relationship with HDFC, how to get second CC from HDFC ?

They are providing Insta loan, any way for Jumbo loan ?

That depends on your Limit. You’re less likely to get the second card as you don’t have any relationship value with HDFC, though, if the limit is high, it will help.

Hi Sid ,

I have regalia first from last six months this is my first credit card with Hdfc bank and my limit is 1,70,000 and I am a government employee and my annual income is Rs 10,00000 can I also apply for a diners card . Will I get the approval. And I do have SBI credit card and Citibank credit card too .

Also have insta loan offer of Rs 1,00,000 on Hdfc regalia first .

Will I get approval for diners card . Please let me know .

Thanks

Varun

Diners Premium you may get, but Black is tough with this limit.

I AM USING HDFC jetprivelege titanium CREDIT CARD Last 14 Month.

I AM HAVING A LIMIT OF RS 81000

HOW CAN I UPGRADE TO A BETTER CARD.

I AM NOT GETTING ANY BENEFITS WITH THIS CARD.

I AM SELF EMPLOYED AND having an itr of 468000, but till now not a single benefit gained from hdfc credit card deptt, how can i upgrade to better card with easy emi & jumbo loan and insta loan facility

Hi Siddharth

According to you, what is the trigger for HDFC to issue a second credit card to the same person? I want to give a try.

I am holding a Diners Black with Rs.7.50 lakhs limit. Want to try for a JetPrivilege HDFC Bank World card within the same credit imit. Coz I am finding it little bit difficult to use the Diners Card everywhere.

Thanks

There is no trigger, but you can talk to RM to split the card limit and issue accordingly. If you’ve good relationship value, it should go through.

I wish to have credit card for as first card but HDFC bank while oral enquiry not obliged due CIBIL score 694 on may 2017 – salary class My facts as under.

1. My present gross income level Rs21.55 lacs per annum and net income Rs18.00lac

2. Credit score not increased due to ‘ No loan taken in the past’ except a demand loan taken against deposit for small amount Rs61000/- and closed thereafter in between 62 days gap for non payment emi during 2013 revealed in cibil

3. at present ‘ No remarks ‘ no other loan taken except recently a month back – loan of Rs2.00 lac availed to improve the credit score and one EMI paid – Now I want to get jet airways card from HDFC or any bank -guide us

4. Latest report not taken due to fear for ‘ reduction of marks\points on tracing the cibil – how to deal with it

Hi Sid

Just wanf to make a point here. When banks make a cibil enquiry they do not get info about which bank you have loans/cards from. Rest bank names are hidden.

Thy only get the bank name if it is from the same bank enquiiring which has given the credit facility. Eg. When hdfc enquires it will only get clearly its own current & past loans. Rest will be hidden (xxxxxx).

Only you can get your own report without any hidden info. Letting you know from on hands experience

That’s obviously not true. You can request a copy of report that bank used to process your card. Citi and Amex have portals where you can download it. That report is almost identical to the one I pay for. It has all the information and bank names, including some remarks that are not on the report you can download directly.

I’ve also had a barclaycard shut down long back because their quarterly risk assessment indicated that I now have too many cards and they can’t have me as a customer anymore. So even on soft inquiries, banks see the exact same report you see.

This isn’t true. Banks can see almost every information including your defaults and other pending loan and credit card applications.

It seems HDFC bank has stopped reporting Credit limit of a credit card to CIBIL. In my CIBIL report, this was not reflecting for my Diners card. On raising a dispute on the portal, CIBIL told me to contact HDFC. On contacting HDFC, they replied,

“Please note, the bank does not report the following details for any credit card accounts. Alternative to the credit limit, the high credit amount is reported, which is the highest usage on the card since its inception.

1) Credit limit

2) Cash limit

3) Rate of interest

4) Payment frequency”

Can anyone please, is it just with HDFC or other banks have also stopped providing these details? For my Citi card, such details are reflecting in the CIBIL report as usual.

Yes, HDFC reports only High credit. Amex doesnt even report that. The’s why most of us cant get nice limit as Amex. SBI & Axis reports most fields.

Hi Siddarth, thanks for the reply.

Does that mean, credit utilization ratio doesn’t make any sense? Because then it becomes as (sum of expenses of all card) / (sum of credit limit of only few cards). Bascially, in that case credit utilization doesn’t provide a true picture.

Credit utilisation does affect the CIBIL score, I saw a 4 point drop recently due to my credit card utilisation creeping to 28% after a 37 point run in a year. Mainly due to one card limit not being reported and possible the other high limit not reporting payments.

And how do you find out credit utilization for no credit limit reporting cards?

Sir I am using Regala first Credit card from last 2 year but my credit limit is still the same I have only 1.62 lakh credit limit… So.can I apply for 2nd Hdfc bank credit card

Second HDFC card allowed only for very special case.

I have regalia with credit limit of 8.9 lakh, no other relation with HDFC, I am a 15 year old customer of cc is there any chance of second ?