I never wanted to get into the EMI trap in my life and i’m clear that i’ll have to pay in full at the end of each month. If i don’t, there is no point in choosing the right credit card just for saving 2% or 3% of the transaction amount. With interest rates as high as 12%-20% on credit card loans and revolving rates, i would end up in net loss even if i pick the best rewarding credit card.

However, my Dad is in need of money every once in a while and he don’t mind about paying the interest rates as he got used to it for quite sometime. I secured him Diners premium recently with a good credit limit that it has eye popping EMI/Loan offers on his card from time to time.

Facts about Insta Jumbo Loan:

- Credit limit unaffected

- Treated like a personal loan, no Service Tax on EMI

HDFC Insta Jumbo Loan Eligibility:

As i mentioned in the previous article on HDFC credit card loans, he had already taken Rs.50,000 on Smart EMI and another Rs.50,000 on Insta Loan at a nice 11.88% Annual interest rate and now Insta Jumbo Loan offer is available for his card account for 1.25 Lakhs. To my understanding, you can increase the probability for Insta Jumbo loan Offer by following below:

- Take Smart EMI or Insta Loans

- Payback existing SmartEMI/Insta Loan on time

- Spend on Shopping/entertainment/travel Websites

- Ask for Limit Enhancement, sometimes you won’t get better limit, but Jumbo loan might get enabled

My dad’s card got the Jumbo Loan offer within a month of requesting a credit limit enhancement. They increased the limit by a very small amount but Jumbo loan (amount equal to old limit) was eligible within a month of this happening. I’m unsure if this is coincidence or there is a formula behind.

Applying for HDFC Insta Jumbo Loan via Net Banking:

So coming to point, my Dad was interested in this offer as he needs some floating money. So i logged into his a/c and submitted the form for full 1.25 Lakhs @ 13.2% for 5 yrs and boom, funds credited into his savings a/c within 5 seconds. There was an OTP verification while submitting the form and nothing else.

Processing fee was waived as per the offer at that time.

It gets more interesting now. Next day i logged into his a/c to see that he’s now eligible for another 50k insta loan @ 11.88%. I’m yet to inform this to Dad 😀

Its clear that more you take HDFC EMI offers, they come up with better eligibility on other loan products at low interest rates. Yes, makes some sense.

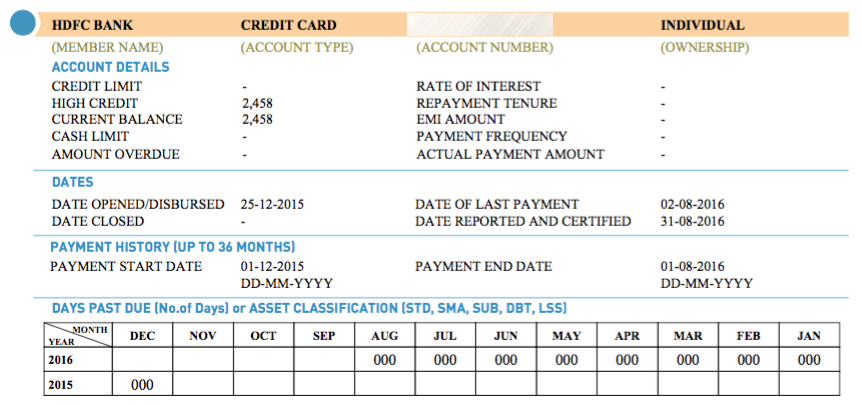

Important Note: Insta Jumbo Loan has nothing to do with your credit card and it acts more like a personal loan and is linked to our savings a/c for EMI debits. It is reported as a “Credit Card” to CIBIL with your EMI amount. So any defaults on Jumbo loan will affect your CIBIL negatively.

Got any queries on HDFC Insta Jumbo Loan? Feel free to ask in comments below.

If instant jumbo loan is eligible is only once a card

Yes,

Insta Jumbo Loan: once

Insta Loan: Twice

Hiii

I have availed HDFC jumbo loan once, will I be able to get another jumbo loan? What is the eligibility for the same?

I need to get full information about the HDFC insta loan plus jumbo , where should I approach.

Please help

If it allows, you can. Varies from profile to profile.

One can use it creatively. Wait for the stock markets to tank. Take the loan. Invest at lower levels by buying high quality blue chip companies at discounted rates. But yes, come what may….pay the EMI’s on time and in full…duh:-) Disclaimer – You can’t use the loan for speculative purposes as mandated by the bank:-)

Am planning to take an Insta Jumbo Loan of Rs.15lakhs.

Could you please advise me whether there is any hidden charges or activities with this plan?

Found some cheating news from the web like some medi-claim policy and all.

Pls support

Regards

Sreejith

sorry.. kindly read the amount as 1.5 lakhs

There may be some processing fees. No medi-claim policies. That’s generally sold with CC approval 😀

I heard that extra gst is applicable for instant jumbo loan…are you paying any extra gst other than the amount given in emi table

Yes, it’s applied on interest amount and applies for all card loans.

Will insta jumbo loan will impact my borrowing capacity in term of unsecured loans

Not actually. Its reported as yet another “credit card” which is better than “personal loan” in eyes of CIBIL.

Sid,

The Insta and Insta Jumbo loans or any other bank loan on credit card when applied, will the banks fetch CIBIL Report ? I mean will they go for specific hard pull CIBIL Enquiry, which brings down the score?

No, they don’t. They already have your updated information somehow 🙂

I want to preclose my Jumbo online. How can i do it? I havr the loan account number and also got the amount which i need to pay after talking to Credit card representative. But not sure how to pay it online.

Please help

Talk to customer care.

how to pay jumbo loan emi hdfc netbanking

Hi,

I Have taken Jumbo loan I don’t no how to pay can you please help and my bill date is on March 4th, 2017.

Confirm.

Thank you.

Talk to customer care. Usually it gets debited automatically from your linked savings a/c.

I don’t have HDFC savings account, How can I?

Hi I had taken insta jumbo loan for a period of 12 months which got cleared last month….If required again how can I apply….

You need to wait for the offer.

i have got offer for insta jumbo loan but i thought of applying after two weeks .sadly i do nhot know offer will be for limited period so, when i am ready for taking loan i came to know that offer has expired . Is there any process for availing again and any tips to activate again

Even Im facing the same problem

I am using HDFC credit card from last one year but I have not received any offer like Jumbo loan.

My credit limit also very low, I want increase my credit limit.

please advice what should I do?

I am in the need of insta jumbo laon but the offer is not yet activated on my card..I have contacted hdfc several times regarding this but they are also saying that they will notify me once there is an offer..And moreover i regularly perform transactions using my credit card..even i have enabled the option for “notify me” when there is an offer on my card..i am using the card since august 2016..Even there is no option for “smart emi” and “insta loan” on my card..And i urgently required the insta jumbo loan..Please tell me what to do..

I am planing to take a instant jumbo loan to pay as a down payment for a flat, will this effect my home loan borrowing limit?

Its a terrible mistake, as home loans are way cheaper.

HI,

I am planning to take a loan against equity soon,but I need cash urgently so I am planning to utilize jumbo loan offer,will it be shown as loan is cibil report ?. will it affect my eligibility ?

sir

I take HDFC INSTA JUMBO loan . and I am a non HDFC account holder. so how to payment insta jumbo loan using sbi net banking.

Treated like a personal loan, no Service Tax on EMI??? who said? they are charging 18% GST on Interest each month. it increased interest rate to 2%. It must be treated like personal loan and hdfc should remove GST on Interest.

They changed it recently.

Hi Sid,

When I enquire with the Customer Care they are saying that there is no GST on EMI interest for Insta Jumbo Loan. But the terms and conditions say that they charge GST on EMI interest. Am really confused. Took the loan 2 years back. Then I remember that there was no service tax charged. Any insights pl

Earlier it wasn’t there, but now they’ve added it.

Sir,

I have taken Hdfc jumbo loan,but I don’t have Hdfc bank account.how to pay EMI with sbi account.

Hi Madhav,

You need to pay by cash in any of the HDFC branches or drop cheque in you loan account.

Online transfer is possible only if you have an HDFC account.

Cheers,

Kiran

Bank haven’t take cash, and for credit card if we deposit cash then 150 charges will apply due to cash deposit.

Today is my due date and I m not getting how to pay.

Can I take the second Insta Jumbo loan within the tenure of my existing Insta jumbo lian which I am going to pay the emi for the third month?

Insta Jumbo loan available – 1.5 L

Already I took 50k

Now when I enter OTP for confirmation it prompts stating “Request cannot be processed now”.

Can I expect your answer Sid ?

I brought insta loan using credit card for 35k. my daddy is planning to get housing loan in another bank. Will they consider the insta loan and will it affect of getting housing loan ?

Hi siddharth

I am having an offer of 160000 insta jumbo loan and i am planning to take insta jumbo loan of 150000 for the period of 2 years and the EMI will be 7273 .i want to know it will increase or it will be same for 2years.

Waiting for your revert.

Thanks

Kashish

How to paid Insta Jumbo Loan EMI. I did not recived insta jumbo loan card no.

Dear

I am planning to get Instant Jumbo loan and Instant loan .Also Planning to get Housing loan from other bank.Will they consider the Insta Jumbo and Instant loan .Will Insta Jumbo loan effect to eligibility of housing loan. Will Insta jumbo loan effect /reduce my CIBIL SCORE

Current interest rate for insta jambo loan ?

I am getting near 16% + GST for 12 months jambo loan ! Also processing charge extra

Hdfc insta jambo loan not good option to get loan

why there is gst on interest. this is sheer loot

hi,

thanks for all infos & tips you’ve shared. does this tricks apply for sbi prime card with sbin savings a/c?

No.

Just for reference – You’ll be paying Rs.3,461.44/- on an Insta Jumbo Loan of Rs.10,000/- for 1 year. Calculated inclusive of Rs.500/- Processing Fee and 16.2% per annum Rate of Interest.

Currently (April-2018), whether GST is there for EMI of HDFC Insta jumbo loan. In customer care they claim that there is no GST fo Insta jumbo loan. It is there for only Insta loans. Kinldy help me if GST is not there it will be a good option for me in comparison to personal loan.

You should ask customer care about GST, and confirm before taking loan,

on hdfc site they have written GST For FEE & Charges / Interest transactions

In HDFC site also (Credit card EMI calculator), it shows no GST for EMI interest for jumbo loans where as for other loans like insta loan, smart EMI it shows GST..im confused..

Siddharth

1) HDFC charging 18% gst on interest

2) Hdfc interest rate is 16% PA + processing fee

If we consider above charges we have to pay 18% on loan amount means 1.5% per month extra , this is very very high interest expense ,

This is not a good option to take loan from HDFC

The loan once approved, it can only be pre-closed.

In case of pre-closure of the loan, a charge, currently 3% of the balance principal outstanding plus GST will

be applicable.

Along with pre-closure charges, pro-rata interest applicable and credit card outstanding balance at the

time of pre-closure have to be repaid for pre-closure of the loan.

This was the statement given in HDFC insta loan, what is pro rata charges and how it is applicable

Siddharth

You should update this blog ! there are so many changes happen

hi Siddharth,

Plz help me, i want to know how to pay my emi for insta jumbo loan. kindly reply.

Hi,

This is quite complicated if you don’t have an HDFC account, you need to drop a cheque wiriting your loan account number and drop atleast a week in advance.

No online payment option at all, have tried all options available but all in vien.

They even don’t accept cash payment in branches also in can of urgent payment.

Cheque dropping is the only option available if u don’t have HDFC saving / current account

Cheers,

Kiran

open google > hdfcbank > netbanking > continue to net banking > just below credit card login you’ll find “Retail Loan Customers Click here for online loan account access (if you do not hold HDFC Bank account) ” click the “click here” link, you’ll be take to new page, at bottom of login column you’ll see “register here” do the needful process. hope it helps.

to my knowledge those who dont have a/c with hdfc need to have separate login id for credit card and loan a/c.

Let us know here if it worked or not

my card is 3 months old. when i will elegible for insta jumbo loan because my card not shows any offer.

Hello siddharth,

This is kirankumar.Am using HDFC money back credit card with the credit limit of45000/-.

I am looking for the jumbo loan based on credit card account.

how much jumbo loan is eligible baes on my CC limit.

Please help..

I just received an email about the offer for Insta Jumbo loan for Regalia card. When I spoke to the customer care they say there is no GST for the EMI payments. He said GST is applicable only on Insta loan.

There is an ongoing offer (Nov 2018) on the processing charges which is just Rs 500+ GST if booked through customer care. Other wise the processing charge is 1%+GST.

Can anyone who have availed Insta Jumbo Loan confirm if GST is being charged on their EMI?

Same has happened with me. I have an hdfc card since 8 years and in all these 8 years I did not get any limit enhancement or card upgrade offer. Recently got my card upgraded to regalia first through form. Asked for limit enhancement through customer service but did not get LE instead got insta jumbo loan of three times my limit. And can you please suggest how can I increase my limit. Should I spend more or should I stay within the 30% limit bracket. I have always payed the full amount on time all these years. Kindly suggest me ways to increase the limit on my hdfc credit card.

Thanks

I have taken Insta Jumbo loan of 1,15,000 for 3 year, ROI is 1.15% months, EMI there is no service tax or gst, my stament show Jubmo Loan Pri and Jumbo loan Interest only.

GST is charged in next month for previous emi on the next date to statement generation.

No there are no such charges in the next statement also.

I have smartbuy emis and being billed gst in next month….also global value cashback is also credited in the same way…

The hell of a ROI of 24% for 12 months duration. HDFC CC jumbo loan sucks ! Getting eligible for jumbo loan is one thing, but does taking jumbo loan at this high rate positively affect the LE & upgrade process ?

@Ashish

Do not ever take a loan/jumbo loan till you absolutely need it.

Don’t take it cos it ‘may’ take you closer to LE/upgrade.

Wait and you would get LE/upgrade.

LE/Upgrade/Happiness are like butterflies, if you chase them you wont get them. Sit patiently and they will come to you.

Jumbo loan makes sense if you really need personal loan, and with HDFC jumbo loan haing an added benefit you ‘might’ get LE/upgrade.

Just my way of thinking.

24% is too high. Its showing 18% for me for 12 Months duration.

The Insta Jumbo Loan is quite personalised with respect to ROI. Have seen some people get as low as 14% in HDFC and around 10% in a non-HDFC credit card.

To answer the second part of the question, yes, it affects the LE and Upgrade Process as you give more business to HDFC which is what HDFC looks for while giving out LE and card upgrades.

The interest cost is very high when compared to other banks. I took insta and Jambo last two years back that was half of now how much they are willing to charge.

I have taken insta jumbo loan of 200000 for 12 months through phone baking customer care but they have processed for 24 months what should I do to get it for 12 months that was phone baking customer care mistake. Please suggest me thanking you

You can ask to reverse it. Then you can do it for 12 months.

I’ve done it in the past when they enabled it without my confirmation.

I am using Hdfc money back Card just 5 months old, my card is enabled for insta loan but jumbo loan till not enabled, customer care said first you take insta loan and payback atleast 2 months afterthat only you can avail jumbo loan offer, so I need to pay processing fee 799+Gst and pre-closer charges. I understand Its indirectly I pay commission to activate jumbo loan offer. They offer ROI also to high 21%, Please tell is there any other way to avail this.

Wait! Bank will refresh your card

I took a preclosure request for my insta Jumbo loan from the customer care for 86675. After that I was not able to pay the amount for 14days. I was confused how to pay in net banking. I didn’t get the payment option in net banking.

I have paid after 14days later.

Will I get any charges for next billing time for delay payment. Iam scaring alot for this. Please reply me.

I want 10 second loan offer for atleast 5 lakh . How can I get that ?