Getting a new Credit Card and holding it in hands for the first time is a pleasure in itself, irrespective of what card it is. The package, the card design, the logos, numbers and above all seeing your name printed on the card definitely feels good.

That said, to better manage your card & for your financial security there are few things that you should do as soon as you get your new credit card in hand. Here are they,

Table of Contents

1. Activate Online banking

Activating your online banking account is probably the first thing to do once you get your new credit card in hand, as without which you can’t do anything else.

If you’ve a relationship with the bank, they might have linked it to your existing NetBanking a/c already but some may not do so for security reasons or other.

Activating online a/c is essential because that allows you to manage the card easily. With online a/c, you can do these below things,

- View Credit limit

- Setup auto debit

- View reward points

- View offers & more

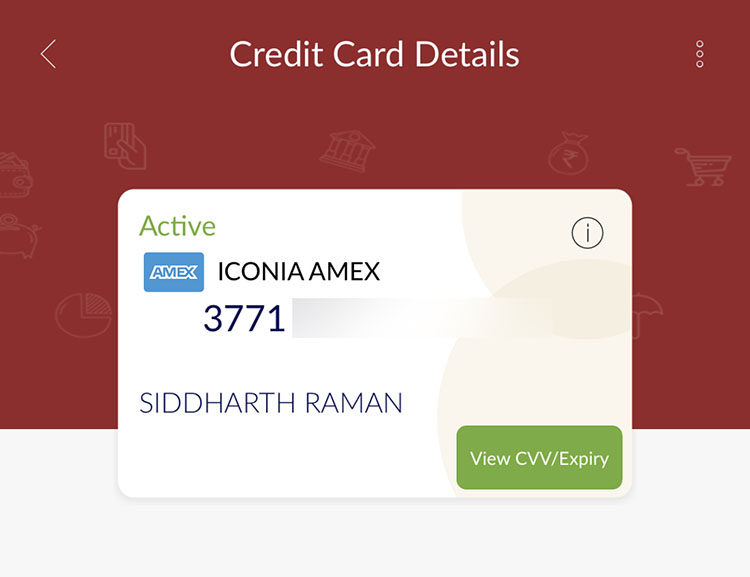

2. Activate Mobile App

Almost every bank/credit card issuer allows you to view/manage your credit card on the go using their mobile app. Some issuers like Amex have a dedicated app while other banks integrate it into their usual banking app.

You may need to activate the app and setup MPIN for some apps, while for others you may just use the NetBanking Credentials.

These days you may do most actions on mobile app that you would otherwise do through online banking.

3. Setup your PIN

Once you setup your Online banking a/c, the next most important step is to set your preferred credit card PIN. You shall do this via online/mobile banking or through phone banking as well.

This is most essential to do it right away, especially when you’ve multiple credit cards like me, because you never know when you might need this new card to use in lounge/hotel etc. Mobile banking used to help me during such situations by generating PIN through app on the go.

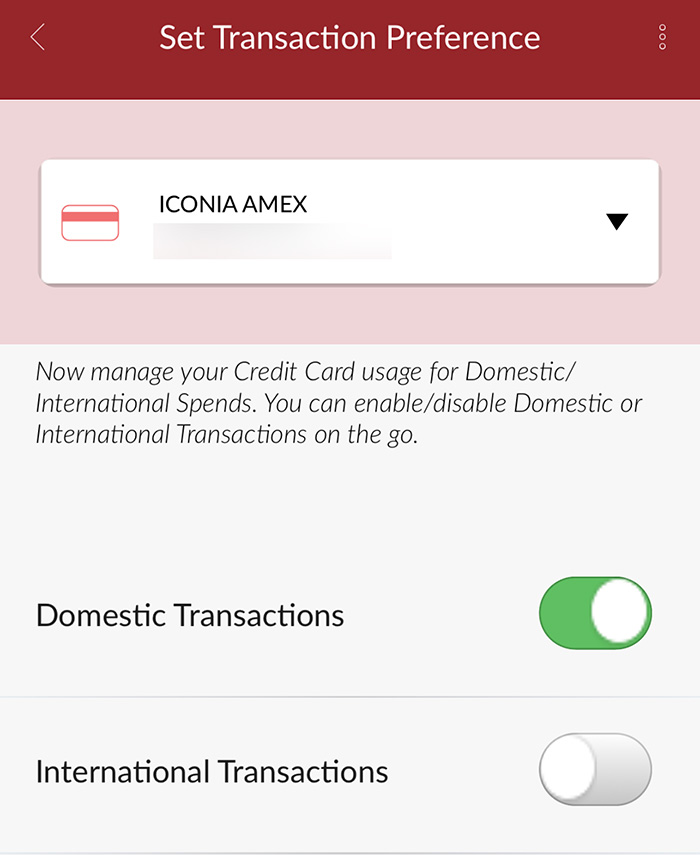

4. Disable International Transactions

Credit card frauds are very common and the most common way it happens is through international transactions. Just incase if you don’t know, anyone can use your credit card on an international website without an OTP, sometimes even without CVV.

Hence, disabling International transactions are very very important. Incase if you use your credit card for international purchases, consider reducing “International spend limit” on your card.

You may either do these by calling support or via mobile/online banking.

In past 3 years I’ve had three such fraudulent transactions, one each on Amex, ICICI & Indusind. Its not usually about the issuer as there are many reasons behind this as your card could be exposed for 100’s of reasons.

Speaking about fraudulent transactions, Amex have the best support in place to tackle them. More about that experience with Amex here: Fraudulent Transactions: How American Express Saved My Day

5. Enable e-statements

One way to show some love to mother nature is by stopping Physical Statements as it anyway goes to bin within 5 mins of reading through the statement.

Moreover, you can also view/download all statements via mobile app & online banking even if you haven’t received the email for any reason, so why waste paper?!

You may enable e-statements via online banking or by phone banking.

6. Do Test Transaction

Oh, I love doing this always!

Whenever I receive my credit card, first thing I do mostly is go ahead and quickly do a test transaction of Rs.100 or so, usually through Paytm or PayZapp to check if the card is fully setup and ready to use.

This is done for three main reasons:

- The bank knows that you got the card and will start logging the transactions so you get the welcome benefits on time.

- Sometimes credit cards may not be properly setup or maybe its in in-active phase. My first indusind Credit card didn’t pass this check, so do consider testing prior to doing real transaction.

- Some credit card companies might block the card for security reasons if you don’t do any transaction in ‘X’ months post dispatch as they assume customer did not get the card.

So its wise to make some test transaction for all reasons as mentioned above even if you plan to keep the card in cold storage for sometime.

7. Know your Statement Date

Knowing your statement date is essential to keep your finances in control and also to keep a track on spends just incase if your card comes with welcome benefits of Rs.XXXX given on spending Rs.YYYY in ZZ days.

- Find Statement Date: While you won’t be able to know the statement date anywhere via online/mobile banking with most banks until you get your first bill, you can still know the stmt date by calling customer care.

- Change Statement Date: Now as you know the statement generation date, its wise to change it to fit your cashflow – yes, you can change the statement date if you’re still wondering.

I usually make sure my statement dates are either at beginning of the month or during mid-month for various reasons.

If you’re salaried, you may probably set to 5th of the month or so, as per your convenience.

So far I’ve changed the statement dates on Amex, ICICI & Indusind – all of them by calling customer care, they just need nil outstanding while placing the request. Have you tried others? Do let me know in the comments below.

Bottomline

Its a good habit to check these basic steps everytime you get your new credit card so that you don’t go through any unpleasant surprises in future. Do them even if you plan not to use it for next couple of months for the reasons mentioned above.

Whether you follow all of them or not, you SHOULD at-least disable the International transaction first. You may thank me later!

These are the steps I follow when a new plastic gets delivered to me. How about you, do you check all or some of these? Do share your experiences in the comments below.

Nice suggestions for all.

AmEx support maybe best for handling fraudulant transactions, but I don’t like the fact that for AmEx you can’t proactivly stop it. AmEx doesn’t offer International transaction disabling.

Changing statement date is a nice idea, now I need to think should I align my dates to the oldest card date since I always remember that (15-17 yr habit) or should I align all to be more in sync with payment flow spec.

Abhi,

Normally, Statement date should be alligned in a way that you get maximum credit tenure of 45 days for your purchases.

Remembering a small date will not be of much problem to you i guess.

Nipun

I don’t utilize credit time. Mostly I keep paying my CC dues even before statement gets generated. I don’t like to keep a debt on me, it is just for those occasional forgetful months. In fact many time my statements are generated with -ve or recently spent only. For me it is as simple as that, if I have money then only I spend (many ppl won’t agree with my philosophy, especially considering the fact that I sold my house after 2-3 yrs and moved back to rented one just as I preferred loan free life more that own home 😀 )

Dear Siddharth,

Can you publish an article related to how to manage multiple cards? Say each card due dates, pins, features to use right card at right time etc. Is there any credible app for maintaining these details or just manual work?

Use cred app.

Raju, most of us are using CRED app for multiple accounts… It becomes easier… It is considered a safe app, but i would like others to shed light , if they feel security is hampered in any way

Yes Maj. I’m using Cred app from the very 1st day of it’s launch. Due to privacy reasons, I haven’t activated cred protect. Cred now pulls due dates based on text messages received from bank. This works sometimes and sometimes not! As you menioned, I’m just looking if anybody using better app for management of multiple cards.

I am not comfortable allowing access to my emails. I have not enabled Cred Protect for most of my cards.

For Amex Cards: CRED has recently launched an option to link your AMEX card without sharing your email. of course, you need to login to the Amex account via the CRED app. I am fine with this option (comparatively).

Hi,

Just wanted to ask for your experience in using CRED on the whole. I’ve been using it for 3 months now, but aside from the ease of use, I’ve had a horrible experience with the actual payments themselves.

The inbuilt pay method using UPI has never worked for me since day 1. I have 7 cards registered and 2 banks connected and not once has a payment gone through. Support is non-existent.

The other option is to pay with an external UPI app, in this case Google Pay. Here too the failure rates are high. I was only successfully able to pay bills for 3 cards in early April via Google Pay, but none since.

Has anyone faced the same problems?

UPI overall is going south due to bad implementation. I liked Axis pay as best after trying most UPI apps. But last 6-8 months it is not even working for me, keep getting error ‘Registered with other device’ . PayZapp since anyway I was using it as wallet due to lots of cashback, I started using its UPI also, but last 2-3 month it had stopped working as well and Payzapp support simply says ‘UPI is not our responsibility’ Aside from bank apps Google pay is only one I use which works mostly but have occasional failure with Cred. Apps still working all well for me are Freecharge & BHIM Yes pay (Not using PhonePe/Paytm as I use only bank apps, except google pay)

Really very helpful suggestions for all people who is holding credit card .. should be follow these step..

Nice article.

I have one question, I hold hdfc regalia, icici rubx amex, citi rewards and hsbc platinum however I am always confused when to use which card😁.

Can you pls advise on the same?

Read the write-ups on all the cards you own and decide for yourself!

Happy to see the new articles coming from you Sid!

I would also like to :

1. Check/Verify with the Customer care on the charges on my card (LTF? first-year and renewal charges).

2. Add the new card on the CRED.

3. Setup BillPay or save the card to other websites if it makes sense.

Why should everyone add their cards on CRED or set-up bill pay??

Shivi – It is not mandatory and not for everyone. But, I will definitely consider whenever I add a new card to my collection.

CRED – I already use CRED and it serves me as a single app to list all my Cards and make/track the payments (and earn rewards).

Setup Bill pay – It is optional and can be considered if only if it makes sense (higher % of cashback or rewards)

Just a heads up here – If you disable international transactions on your card then that card won’t work on Google Playstore (India) even though the playstore transactions take place in Indian Rupee!

use one of your savings account debit card for this purpose alone (international txns) , keep max 10k in account 🙂

Or you can set International limit of ur CC to 10K (HDFC has that opton)

Hi Sid,

I changed my statement date for my HDFC regalia even I have balance due. They told for statement change 118/- charge. But somehow charges are not imposed.

I also recently changed my billing cycle date from 17th to 24th. The criteria according to the customer service agent is that you must have a net spend of 5L+ excluding insta loans and insta jumbo loans. But its not chargeable.

No such criteria communicated to me. Emailed them asking for change of billing cycle and they asked me to choose any date between 2 and 28 of a month. It was free as well. HDFC and ICICI.

Thanks for your article sir. Actually I got HDFC and SC card. HDFC was providing the facility to disable international transactions from day one, but SC is still not providing that facility. I spoke to them about recent guidelines that every card issue should provide this facility but for my surprise SC still denying that.

Even I’ve written to SC. They somehow don’t have this facility in their services.

I have raised a complaint with RBI Ombudsman that Standard Chartered is not following the RBI guidelines with regards to enabling / disabling international transactions. Let see what they respond and if they force SC to implement this feature as early as possible

Is it possible to disable international transactions on HSBC credit cards? I’m not seeing any option.

Can we disable international transactions on HSBC credit cards. I’m not able to find any way to do that.

Hi Sid

All valid do’s. Apart from already mentioned i in addition would:

Sign on back of the card: though in India I have rarely seen anyone verifying signatures but this comes handy abroad where merchants occasionally do

Setup T pin

Aside, in addition to amex I recently also changed SCB statement date though with sub zero balance wasn’t required prior to changing statement date as with amex

Yeah I came to know about the in-depth about the credit cards