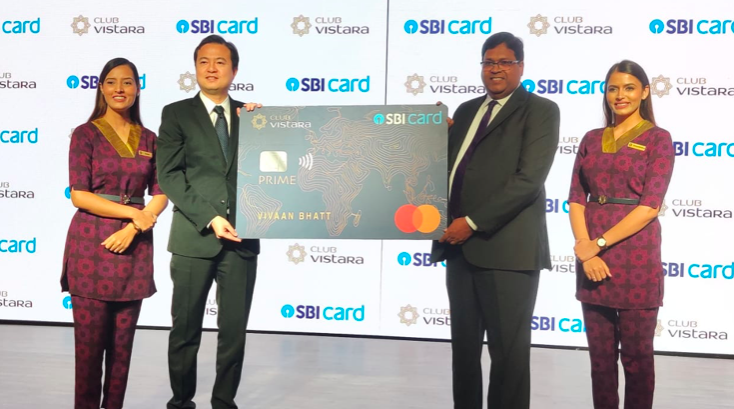

SBICard – the 2nd largest credit card issuer in the country has launched a new airline co-brand credit card in partnership with Air Vistara – the premium airline of the country. There are two variants and the cards run on MasterCard network, gives complimentary flight tickets, hotel vouchers, free cancellations, lounge access & more based on the credit card spends. Here’s everything you need to know.

Table of Contents

Club Vistara SBI Card (Basic)

- Fees: 1499+GST

- Welcome Bonus: 1 Economy tkt + 1000 CV Points (on 50K spend)

- Regular Rewards: 3 CV Points/200 Rs. Spend (Reward rate: ~1.1%)

- Milestone 1: Complimentary Economy tkt on 1.25L spend

- Milestone 2: Complimentary Economy tkt on 2.5L spend

- Milestone 3: Complimentary Economy tkt on 5L spend + 5K Yatra Hotel Voucher

- Insurance Benefit: Cancellation – Up to 4 cancellations, each covers up to Rs 3500

- Lounge Access: Domestic via Mastercard (4/yr – 1/qtr)

So if you manage to spend Rs.5 lakhs, you get ~6000 CV Points & 3 complimentary Vistara economy Flight tickets (excl. welcome benefit). If we consider all these, the approx. return on spend is 4% (assuming 1 eco tkt = Rs.3500)

Ofcourse the numbers may vary if you fly busy routes like BOM/DEL.

Club Vistara SBI Card PRIME (Premium)

Oops! they’ve successfully messed up the name by adding PRIME here and confuse customers.

- Fees: Rs.2999+GST

- Welcome Bonus: 1 Premium Economy tkt + 3000 CV Points (on 75K spend)

- Regular Rewards: 2 CV Points/100 Rs. Spend (Reward rate: ~1.5%)

- Tier Benefit: CV Silver tier

- Milestone 1: Complimentary Prem. Economy tkt on 1.5L spend

- Milestone 2: Complimentary Prem. Economy tkt on 3L spend

- Milestone 3: Complimentary Prem. Economy tkt on 4.5L spend

- Milestone 4: Complimentary Prem. Economy tkt on 8L spend + 10K Yatra Hotel Voucher

- Insurance Benefit: Cancellation – Up to 6 cancellations, each covers up to Rs 3500

- Lounge Access: Domestic via Mastercard (8/yr – 2/qtr) & International via Priority Pass (4/yr – 2/qtr)

So if you manage to spend Rs.8 lakhs, you get 18,000 CV Points + 4 complimentary Vistara Premium economy Flight tickets + 10K hotel voucher and some upgrade vouchers. If we consider all these, the approx. return on spend is well over 7% which is AMAZING. (assuming 1 prem. eco tkt = Rs.7500)

Should u apply?

SBIcard allows only two cards, usually one regular card like Elite, prime and one co-brand card.

Speaking about the best SBI co-brand card, I would go with Air India signature over Vistara cards unless SBI allows me to hold 2 co-brand cards and that’s not because Air India card is superior, but its unique.

But if you don’t need Air India card, then Vistara Prime gives amazing value and is better than the Axis Vistara Signature which is of same range.

Note: Given the history of SBICard dealing with newly launched card applications, I would suggest you to wait for a week or two before clicking that apply button.

Bottomline

The card is well designed, brings in similar benefits from Axis Vistara credit cards (which is a great hit) and adds hotel vouchers & free cancellations to make it bit unique. Interesting part is, you get points even on fuel spends.

Though the only disappointment is that they don’t have a card with complimentary business class tickets. But why? Maybe SBICARD don’t have enough customers willing to pay high fee & do spends in that range, or maybe Vistara thought they shouldn’t give away too many business class tickets for free.

Overall it’s a great work and I hope they add a new variant for biz class tickets in few years down the line, when the demand arises.

What’s your thoughts on the newly launched SBI Vistara credit cards? Feel free to share your comments below.

I think applying link has not yet opened or let me know if you know any other way to apply to this card.

It should be live later today or tomorrow max.

Yea let’s c

Can Axis Vistara Card holder get SBI Vistara Credit card?

yes,Axis Vistara Card holder can get SBI Vistara Credit card with same cv id too

Yes I got both

I already have Axis Vistara Signature but want to add the SBI Vistara Prime too.

Problem is I already have an SBI Prime and an Ola SBI card.

In the recent past, they rejected my application for Etihad Premier SBI card as I already had 2 cards.

Do you think they will allow me to swap 1 of my existing cards for this?

I don’t think they will. But they may change this rule in future as SBI has so many co-brand cards.

Theoretically they should let you product change from Ola SBI to SBI Vistara if you satisfy criteria (credit limit, sourcing city, etc.). Try putting in a request thru online portal after some days.

But Ola SBI is a good card at least for the first year, especially with 7% conversion to Ola Money and increasing number of websites that accept it now, and maybe consider Axis Vistara Signature instead.

Sid,

You mentioned about Upgrade vouchers,is that hotel upgrade voucher or Vistara upgrade voucher ?

In what way SBI Air India card is superior than this ?

I referred to the CV Silver which gives one upgrade voucher.

SBI Air India isn’t superior as such, but we don’t have other options for AI miles to access them & their partners.

So, there is one welcome PE ticket and 4 milestone tickets. In all, these are 5 complimentary PE tickets. Please correct me if I am wrong.

You’re right. I don’t consider the welcome benefit as you anyway pay for it.

Do they also give a complementary Club Vistara membership here, like they do with Axis Bank?? No info on that one….

Its not clear, but they do mention Silver tier for the premium variant in press release.

Yes, they do similar to Axis Vistara cards. Prime gets Silver membership 1 year.

Free Cancellation and Yatra vouchers sounds good. But any mention of complimentary ticket on Anniversary after renewal?

Also, in basic variant Axis gives free ticket on 1.25 lac milestone. But 2 points on 200 spend while SBI giving 3 points/200. If there is no anniversary free ticket than I think Axis is more better.

Hi Shailesh,

Yes. There is a complimentary ticket like Axis cards.

Complimentary ticket for what ?

I just applied for this card.

Also, can you confirm if the ticket is fixed to the card holder or it can be redeemed for other also ?

for availing the 6 free cancellation, does the ticket booking need to be done via this card only or we can use other cards for initial booking?

i guess these tickets are only for domestic routes?

Yes

May be we will see an co-branded card with Amex soon. I would wait till then.

They first need to bring Marriott Card. Let this be of least importance to them 😛

That aside, I think they should go with Singapore airlines for airline card instead of Vistara.

Amex Marriott card is the dream. Are you hearing anything in the grapevine or its part of a wishlist 😛

Still in wishlist!

Will the validity of cv points increase if i have a co branded card or stay infinite as long as i have a valid transaction done on card ?

I have sent an email on this regard.

If it still stays at 3 years , it doesn’t make sense to get this card.

What’s your take on this ?

No, CV points will remain to be valid for 3 years.

cv points WILL EXPIRE ON MONTHLY BASIS I.E. cv points earned in the month of november will expire in november 2 years later. i.e. similar to what hdfc bank credit card does.

or

it will expire in the nearest quarter where the cv points were accrued i.e. similar to emirates skymiles

or

it will expire like amex reward points – the whole points accrued in one year will lapse the moment THREE years are over. i.e. all points earned in first year will get expired in start of four years.

TIA.

IRRESPECTIVE OF co branded card you own – cv points will continue to lapse after 3 years

Its not 1.5L its 1.25L

I’m having Simplyclick and FBB Styleup (co-branded) cards. Recently applied for Elite which was approved but the condition was I to cancel Simplyclick. I didn’t and again applied (this time through Customer care over phone) for Elite (by cancelling FBB). Few days later, it was rejected.

Maybe, we can have only one regular and one co-branded (as Sid mentioned).

I was thinking to switch this time from FBB to CV Prime, but the absence of spent based waiver of annual fee put me off.

Sid, For basic card 1st milestone is at 1.25 L not 1.5 L. Please update.

Just did it.

I just closed my 3 year old SBI Prime card account as SBI Cards cheat their customers left and right. I upgraded my Simplysave to Prime last year in june. My Simplysave annual fee payment date was from october to october. Hence even though i upgraded the card in june the Prime annual fee of Rs. 2999/- plus GST was charged in october 2018 only. Now on completing milestone spends of Rs. 5 lacs by october 19 when i didnot receive the milestone benefits voucher option even after 15 days i called CS and asked for my milestone benefits voucher of Rs. 7000/-. They started delaying the matter by raising internal service requests. When i put a mail to them they replied saying that since the card has been upgraded in june the milestone benefits will be calculated from june 2018 to june 2019 and that the same falls short by Rs.10000/-. I escalated the matter since my annual fees was waived in october 2019 considering my annual spend from oct 18 to oct 19. They kept on saying the same thing till i escalated to Principal Nodal officer. I got a call from PNO and she clarified that my demand is correct as annual and milestone spends are both to be considered from month of payment of annual fees. She assured me that i would received a confirmation from the concerned department however i received a mail after 2 days with the same copy+paste statement that my milestone spend fell short by Rs. 10000/- from june 18 to june 19.

I finally escalalted the matter to the last tier the Customer Services head and got a call and was assured a positive resolution by 22 nd nov however i didnt receive a reply till 26th nov and finally being frustrated with their pathetic customer service I closed my oldest card account with a limit of 3lakhs on 26th nov yesterday.

So anybody going for Premium SBI cards kindly note that SBI doesnot understand the meaning of premium and doesnt have any idea how to cater to HNI cuatomers. They are only good for catering to basic beginners cards so goodluck with your milestone rewards.

This is exactly my point with SBI. They are a basket case and there are so many leaks that is a playground for fraudsters. Last year for two months I have been getting calls from SBI (or someone posing as SBI) asking me to confirm my name, PAN, and other details so that they can dispatch my card. I used to ask them for their names and then they used to shy away. But the point being that no matter how much of a premium card they launch, their service will make you feel that the card is cheap.

Siddharth with respect to my above post what do you feel. Wasn’t the milestone benefit payable in my case?? As per the MITC and Card Issuer’s agreement shouldn’t the milestone benefit spends be calculated from card renewal date ?? A reply from you will give some mental peace.

it is a very bad move on the part of Vistara to tie-up with SBI Cards. They just want to issue the cards in bulk quantity just like SBI cards issue fbb cards to everyone who visits big bazaar. i think this tie-up is going to spoil the name of vistara brand.

Worst i think is that voucher value gonna go down drain.

I too closed my elite last year. I had SBI CC for more than 10 years with good spending on it. But since GE Cap decided to sell its stake, SBI CC has really gone down the drain.

Don’t close go to the highest officer including ombudsman

We can hold two co branded cards I guess.. I m currently having air India and Etihad variants..

how you manage to pull of with both different miles games

Do we need to have sbi account for this. ?

of course not..having a credit card doesnt mean you need to hold an acct with the issuing bank

No

SBI allows one person to hold upto 3 credit cards and sometimes even more.

I tried to apply for SBI vistara prime card. but I was told that they used to allow to hold upto 3 cards earlier, but now it is reduced to 2.

The online application process is pathetic. Application process didn’t complete and then i got a email confirming that I have successfully applied for star bazzar card. Is the how the tech developed by India’s biggest IT company works ?

Saurabh,

I had a different issue,first time after applying it said thanks for applying for SimplyClick

When I applied again it didn’t allow,saying resubmit then otp not present though I entered OTP

Pathetic banking service from SBI,when I applied for Axis Vistara almost a year back it was a smooth experience just apply .no docs. agent will come home take pic and upload the scanned copy

I have a SBI prime card. Its the last month of its first year. With 3L+ spends, annual charge would be reversed, but is it worth to use after 1st year? Or should I replace this with Vistara Prime?

irrespective you use vistara – cv points will expire after 3 years. so first earning should be veyr good and redemption should be good too

The silver status is only for a year!? Any way to get it renewed?

Hi Sid,

While redeeming the free economy vistara ticket milestone vouchers, is the ticket free regardless of the price? Are there any conditions/restrictions?

Thanks for this review. Very helpful.

Yes

Hoping to receive the prime variant in the next 7-10 days!

I had written a mail to Vistara regarding the SBI Prime card. Here is the reply. Think it might be useful to some.

Dear Mr. Gaur,

Thank you for writing to us.

Please find below the replies to your queries:

1. On the free premium tickets, do I need to pay for the taxes and fees?

CV Member will have to bear the taxes and surcharges.

2. What is the validity of these premium economy tickets?

The Voucher is valid only for travel within 6 months from the date of its issuance and the expiry date of the voucher cannot be extended.

3. Will I continue to get the silver status benefits on the renewal of the card? Or are they only for the first year?

You will continue to enjoy the Silver Tier benefits as per the renewal of your Prime card.

For further details, we would request you to please refer to the link below:

SBI Vistara Cards

Please feel free to get back to us in case of any further queries.

Warm regards,

Club Vistara

Hi Sid,

Is there a renewal benefit on this card on the payment of annual fees.

Will there be a complementary ticket ?

And also do the Axis Vistara cards have any renewal benefits .

There is renewal benefit of base fare waived ticket as per your card on payment of annual fee. It is same in both Axis and SBI.

Thanks for the update.

Got rejected.

Salaried. Income>12LPA

CIBIL 808

Have only one credit card at the moment.

hi,

I recently got this card (last week).

At the outset, disappointed by the low credit limit received, so low that existing cards have more than 3x the limit on this one.

The card got blocked automatically during online transactions, which resulted in 4 failed transactions, 3 of which were flight ticket bookings.

I am an existing Club Vistara member, which was specified at the time of applying. Despite that, I got a new membership number on the card. Customer service at both SBI Card & Vistara has been pathetic, with more than 10 mins of wait on call and still no response.

I also can’t find the link to pay the membership fee (1499) to get the benefits activated.

Has any of the users faced similar issues & can suggest how to get it resolved?

Hi Nachiket, given the incompetent team at SBI even I got a new CV number though I had an existing CV number giving by Axis. You need to write an email to contactus [at] clubvistara.com and they will merge your account. The welcome benefits take upto 30days after payment of fees. I receive my axis related voucher on time but SBI takes more time to issue the same vouchers. Surprisingly I’m yet to receive my lounge voucher for Delhi airport and one class upgrade voucher from SBI end.

Hi Sid and others,

I’ve SBI Prime (4.9 lakhs limit) and Ola Card (10,000 limit and I don’t use it much as I’ve got my own car recently). I also have the Axis Vistara infinite card. (3 lakhs limit)

I want to have the Vistara Prime Card too to have the milestone benefits like premium economy tickets and hotel voucher. I’m a frequent traveller and a high spender.

1)Is it a good idea to swap the Ola card to SBI Vistara Prime Card?

2) What would happen to the Vistara Gold tier membership?

Hi ARR,

You can close ola card if you don’t use ola and Cleartrip offers and apply vistara card.

Vistara gold should continue as in many countries people have multiple airline cards, but just to be on safe side do call vistara customer care and confirm from them what will happen in case you add a new vistara card.

Hey guys, I recently applied online for SBI Vistara Prime Card, being my first SBI experience, but it has been a strange one.

No contact from SBI, its been a radio silence over the past few days, reaching them on twitter is of no use.

Now, I am thinking of applying for Axis Vistara Signature coz cards are similar and I am hoping Axis has better customer support.

During online application they took my PAN number.

QUESTION 1: HAVE THEY ENQUIRED MY CIBIL, OR WILL THEY DO IT AFTER TAKING MY DOCS. (Coz I will apply for Vistara if they haven’t)

QUESTION 2: DO WE NEED TO OPEN A SAVINGS ACCOUNT FOR AXIS VISTARA SIGNATURE ?

My first SBI Experience has taken a new turn altogether,

Received a call from LADY1 today asked me for my details, sent a KYC guy who took my Aadhaar card photo and everything was smooth.

Later in the afternoon LADY2 calls up saying she is from SBI and my online application will be processed through her and she will be sending a new KYC guy.

She also asked me to cancel the LADY1 KYC and not pick up their phones with a reason that their process is wrong.

When I called back LADY1 to understand situation, she said don’t give docs to LADY2 otherwise due to multiple submissions, your card will get rejected.

I gave them each others number to sort it out and give me one point of contact from SBI.

THEY JUST WONT TALK TO EACH OTHER and keep messaging me pleading not to give docs to the other.

VERY CONFUSED. ANY SUGGESTIONS ?

Give to Lady1 and keep calm. If nothing happens in 7-10 days call lady2 and give docs. No harm.

Better to apply directly through site or branch.

I applied through website. Got a call from customer care executive & processed my application. Today I got my card. It took around 13 days to processed & to receive the card. Entire process was smooth. Got a vistara SBI prime card.

Sir 800000 par 16000 point +3000 = 19000 points total

Hold a DCB and other cards where the least limit i have is for 1.5 lakhs. And these jokers issue me a SBI prime card with a limit of 51000. And with no idea as to if SBI ever increases its limit. My SBI card elite is still stuck at 1.5 lakhs limit for 3 years . Will close elite now

Hi Sid,

Are these milestone air tickets cover tax fare too or only base fare ? Is there any capping on per ticket fare ? Can i booked this ticket for someone else other than primary card holder? Can CV points be used for redeeming products other than air tickets ?

Hi all

I am having SBI Club Vistara Prime Card.

My due date of payment was 9 th June and I did full payment on 10 June morning. Actually I am very punctual with my payment ,but this one my mistake skipped of my mind. Please tell me how much charges will be levied and whether I could get it reversed? Secondly will this affect my CIBIL ?

I am worried. Please help how to go about it.

Hi,

I have been using HDFC CC for about 8-9 years with present limit around 4 lakh in regalia variant. After going through your website I decided to apply SBI Vistara prime through their SBI card website which is not a success. Then I tried through one local agent who has been selling CC at BigBazaar. Again he is clueless as they only sell fbb prime and simply save. Finally contacted local branch where they made few calls to understand actually what is this variant. Now she takes my application and multiple follow ups, two stage confirmations (and correcting them Every time that it is Vistara prime not just prime) I finally got my card after 1.5 months with name misspelled on front 🤦🏻♂️.

– packaging is good and card looks premium in blue.

– it is contactless Mastercard.

– I received mail indicating voucher codes for free economy ticket, upgrade and lounge access after payment of annual fee.

– Once they had levied check bounce charges mistakenly. On contacting customer care and telling them that I have already paid cc bill on time and this charge is undue, they immediately reverted the charges.

– points accrued months are fair and they are transferred every month to your club Vistara account.

– validity of PE ticket is only six months but where would I go in this COVID situation.

– I got credit limit for Rs.1,18,000/- only

– could not pay my car insurance premium online with this card due to certain new guidelines.

I think I will not use this card beyond 3 lakh for maximum benefit and will only use it next year if they either reverse the annual fee or they provide annual fee payment benefits.

Have they given the 3000 bonus vistara points on reaching the 75000 rupee spend threshold. Do they do it automatically or tis it done after the generation of the bill for the month. Do you need to remind the customer care for it.

Asking all this since every aspect of this card, right from application to the premium economy ticket was given only after escalating to the nodal officer.

Their customer service was caught and recorded by me making fun when I placed a request for help in the aforesaid matter( put me on hold but didn’t put themselves on mute) . Cut my call since I wasn’t cutting it on my own

It has been a nightmare with this card so far

My overall conclusion is this a very good Card in terms of returns. If your routine expenses are getting you 2-3 premium economy tickets every year and you get CV silver membership with associated benefits and upgrades, life is good. Moreover we get travel insurance, lounge access, free cancellations frequent amazon deals besides reward points at attractive rate. Only downside is they charge fuel surcharge, although they give points on fuel expenses but it should have been waived.

If I have Axis Vistara Visa Infinite which comes with CV gold membership and also acquire SBI Prime Vistara which comes with CV silver membership, then would I have both gold and silver memberships under my same CV ID?

You will have gold. Higher tier is maintained.

Understood, presumably the benefits will get clubbed. Like spends done on vistara will accrue 10pts per 100 as per gold tier instead of 9pts based on silver regardless of any card used, and the one upgrade voucher of silver will get added to the overall account. Guess I should clarify once with vistara CC also.

Got this spend based offer on SBI Vistara Prime card:

Spend ₹36000 or more using your SBI Credit Card ending with XXXX, during 20 JUL 2021 – 20 AUG 2021 and get a Myntra Voucher worth ₹2000.

Is the international airport lounge access only for two years

I am having SBI co-branded with Central and now the tie up has comes to an end it seems so I cannot redeem vouchers in Central Square mall and they have stopped issuing new cards also. I would like to upgrade to some other cards in SBI, so pls suggest me something like Vistara Prime or any other card which has some milestone benefits.

I have some queries like regarding Vistara tie up card.

what’s the value of premium economy ticket they provide and whether we can able to choose the destination where wanted to go or they’ll issue random tickets whichever is cheaper?!

CV silver tier is only for 1 year. Axis Vistara Signature is better than sbi?