RBL Bank launched its standalone Signature+ debit card sometime back. As the name suggests, it comes in Visa Signature variant.

Interestingly by default this debit card is not issued with any of its savings account or relationship banking program.

Rather you can open any RBL savings account (even digital savings account having minimum 5K AMB will suffice) and apply for upgrade to Signature+ debit card via any RBL branch or even RBL MoBank app.

In this case default debit card issued with your newly opened savings account gets closed post the issuance of Signature+ debit card.

Remember this debit card is not to be confused with RBL Signature debit card, which is issued as a part of RBL’s premium banking program.

Table of Contents

Fee Structure

- Joining Fee: 5000+GST = 5900/- (No Waiver Criteria)

- Welcome Benefit: 5000 worth GV

- Renewal Fee: 1500+GST = 1770/-

- Renewal Fee Waiver Criteria: Spend 3L+ in previous year

Logical question:

Why would anybody pay such a high joining fee along with tapered down renewal fee, when you can get Premium to even Super Premium credit cards with that kind of fee.

Decide yourself post going through the Features section of this in-depth review.

Note: As I didn’t receive any email for claiming the Welcome voucher, kept on checking the same almost on a daily basis via a link that will be shared with you over email.

One fine day it went through successfully. As per my experience I can say that– Welcome voucher of 5000 GV is available after ~ 1 month of paying the joining fee

Hands-on Experience

Opened RBL digital savings account (5K AMB) via an all app digital experience. VKYC was done within 1 hour of opening the account via Aadhaar authentication and PAN image capture as usual. Funded the account with 6000+, keeping in mind 5000+ GST joining fee.

Same day requested for Signature+ debit card upgrade and was processed instantly. Signature+ debit card joining fee charged immediately to account. Debit card visible in app within 48 hours, physical delivery took ~ 6-7 days though.

Card Look & Feel

Card looks are decent. Its a normal card with below average print & plastic quality. Name is in front whereas all card details are at the back. Envelope containing the card was simple as well.

Milestone Benefits

Spend anywhere on POS/Online via RBL Signature+ debit card and get 1% value-back upto 1000 as GV.

Valid transactions currently include all kinds of Online/ Offline payments done via any payment platform. Can double dip via other bill payment apps too e.g. Paytm/Mobikwik/CheQ etc.

Disclaimer: Above payment apps/platforms is just for information purpose & not a recommendation in anyway.

Total spends in a month must be more than 10K to be eligible for this monthly USP benefit.

How to claim– You will receive an email with a link to claim the monthly benefit on 15-17th of the next month (For spends made in current month). Else above mentioned link is valid for claiming monthly benefits as well.

Annual Milestone: Spend above 5L in a year and get 5000 worth GV separately

Return on Spend

Return Ratio: If you max. out the spends, i.e. 1L per month X 12= 12L in a year, you receive:

- 1000 GV per month X 12 = 12K points

- 5000 GV per year X 1 = 5K points

Total= 17K on an effective joining fee of (5900-5000)= 900 INR. Renewal fee anyway will be Zero from next year upon spending 3L+ in previous year.

- Return Percentage for 1st year= (17K-900)/12L ~ 1.34%

- Return percentage next year onwards= 17K/12L ~ 1.41%

Best Value: If your spends aren’t that high, hitting 5L in a year is the sweet spot.

In 1st year You get 5K Monthly + 5K Annual benefit = (10K-900)/5L ~ 1.82%

And next year onwards you get (5K + 5K)/5L ~ 2%

If you spend more than 12L in a year, return value goes downwards. As you can see, this card holds good till annual spends of 12L max only (preferably 1L per month spend with minimum 10K in a month to earn cashbacks as GV)

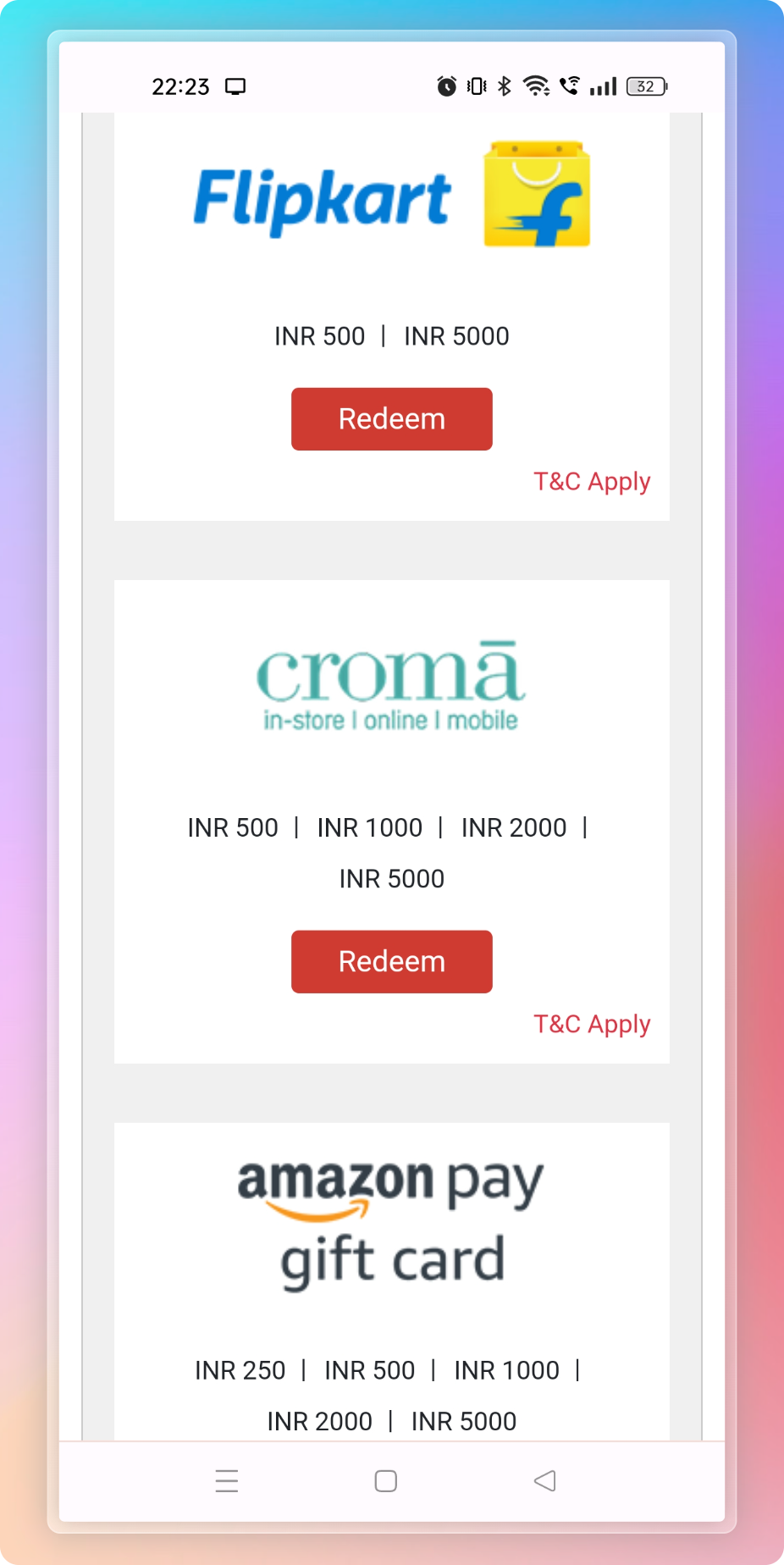

GVs available: Wide range of GVs with multiple price points are available for redemption against both Welcome/ Monthly benefits. Notable ones are Amazon, Flipkart, Croma, Bigbasket etc.

0% Forex Markup

Zero markup on Foreign currency transactions is another very useful benefit of this card (3.5% markup applicable for ATM cash withdrawals done in UAE via Signature+ debit card)

Other Features

Lounge Access: 2 Complimentary domestic airport lounge access per quarter (Large number of domestic lounges are covered)

Insurance Cover: Air accident & other covers available, comparable to other Premium credit cards in India.

Bottomline

Apart from the high joining fee, which is adequately compensated with equivalent GV value except for the GST part, this debit card ticks almost all the boxes.

Kudos to RBL bank for launching such a debit card, which can be termed as possibly best rewarding debit card in India currently.

Been using it for almost 2 years now to pay my CC bills. Alas! the secret is out now and benefits will be tapered 😉

Will one get points on wallet loading?

Yes

I have used this card for past 1 year, got 1K voucher every month and a 5K voucher at the end of the year. Total 17K worth vouchers on spend of 12L. Was not charged renewal fee as its waived after 3L spends.

Great one Satish a long wait for so many DCGeeks….😍

Thanks for your kind words.

The team at RBL made me upgrade to this card during one of their drives. Both me and my wife have this card which we got 5 months back but only my welcome gift of 5k has come. For the other pending 5k I have sent a mail to the BM and am waiting for the same.

Now comes the rewards I can confirm that it gives 1% with a cap of 1000 but sometimes the period when this reward gets deposited can cross a few months easily and one has to keep a diary for the same. In the past 5months I have tried to pay for quite a lot of things but most times they did not consider my fuel spends as valid for 1% cash back.

As an exercise I had also tried to spend all my rent/electric/gas/insurance spends via this card which exceeded 5lac but I am yet to get the 5k as bonus.

The card is not worth it if the payments can be done via credit card also the 900 tax the put on each card is quite much since that eats into the profits. Thinking of upgrading to a Enterprise

Debit Card since it’s benefits are superior.

I was offered Enterprise card too, but declined it and stuck to Signature+ , mainly because benefits on Enterprise are restricted to certain categories like flight booking, utility bills, fuel, telecom payments, etc. And AFAIK there’s no renewal fee waiver also, 2360 renewal fee.

Are you saying cc payments are not considered for cashback/vouchers?

So far all fine.

Right decision

Does enterprise/signature cards offer 1% even for wallet load like paytm?

Don’t think so.

Currently we are getting 1% for credit card bill payments ?

Instantly get rewards?

For this month spends, you get GV redemption email link by 15-18th of next month.

can you compare this card with “IndusInd Visa Signature Debit Card?. Both DC’s can give around 1k/month.

This gives bonus 5K also, which isn’t the case with Indus DC

3.5%+gst markup applicable for ATM cash withdrawals done in ALL INTERNATIONAL countries from 12-April-23 via Signature+ debit card

Credit card payment eligible for Milestone?? Let me know so that I can Apply

Yup, so far all good.

Hi Satish,

Does loading MobiKwik/Paytm or cc payment through MobiKwik/Paytm gets counted for 1%? Kindly help share

Yup

Thank you Satish.

It is good to know wallet load earns 1% too, since they don’t charge for wallet load (paytm), its good it earns.

Getting 1% even for cc payment is add on. So users can choose between cheq, cred, paytm, MobiKwik etc for payment.

Hi @Satish,

Could you pls. share if the Signature+ DC allows wallet load like Paytm and earn 1% and be part of milestone?

Any idea if cc payment like cheq/mobikwik are considered for 1%/milestone?

Yup. Sometime Paytm doesn’t allow any debit card for bill pay. Otherwise all fine.

This happened Satish, thanks for the heads-up 🙂

Added to wallet and then paid cc bill.. hope they count!

I got this card couple of days back, when tried to use it on Cheq app it giving me error “Card not supported currently” 🙁

Except CheQ app and Paytm app, you can use this apps too –

1) CRED app (if you do Rs50,001+ payment then debit card option available but some user also get debit card option on 10,001+ cc bill payment.

2) HDFC bill pay portal

3) Mobikwik

4) Paytm also allow paytm wallet balance to cc bill pay, load to paytm wallet and pay

Could you share the steps on how to pay via HDFC bill pay portal using other bank DC?

If you use this this card in CHEQ app for CC payments, transactions are getting declined saying due to Non compliant RBI merchant. Anyone else tried this recently?

My May and June transactions both went through.

While opening digital account, after aadhar OTP, it is throwing error saying “digital account opening facility is not available in your location”. Any idea for workarounds?

Hi,

I am planning to apply for this card and i am some doubts/questions.

1. is it easier to get this card via digital savings acccount or directly from bank ?

2. in other forums i saw some issues in delay in redemption/ no response from bank. is that the case or is it smooth.

3. lets say I complete 5L/year in first 5 months. will i receive the voucher on 6th month? or i have to wait until card anniversary year ?

1. Anyway it’s fine

2. Reward email comes by 10th-20th of each month without any issue, atleast in my case

3. Post Anniversary

Can I use this card international share market for buying share/stocks/crypto etc..?

Not recommended

Is there any option to avoid joining fee and annual fee by maintaining specific balance in the account?Is it still giving cashback on wallet loading in Paytm or mobikwik?

Joining fee can’t be avoided. Annual fee is waived basis spend, as written in article. Cashback on Wallet spends-Yup

Website description says 1% Cash Back as vouchers above INR 10,000 per month. Is minimum spend is 10000?

Cumulative spends every month must be 10K+

What is the best account I can open for this card? Digital account or any other lower Variants available? I don’t want to maintain much balance in this account.

And which platform you use for credit card bill payments with this card?

Digital account is best with 5K AMB

I have some doubts…

1 =if I spend 45500 in a month ( or any random amount above 10k) will I get 455 rs gv? Is it possible to reedem the same points or we have wait for next months points to be added?

2=can we collect points and redeem once in 4 or 5 months?

1. Yes, any amount above 10K and upto 1L qualifies proportionately. For 45.5K spend you ll get 455 pts. Those pts can be used to redeem across a variety of vouchers. But most of the voucher options are multiples of 250 or 500.

2. They usually give about 3 months time redeem the points. The validity date of the pts is mentioned in the text message sent. So you can accumulate pts over 2 to 3 months and redeem together.

@vikas 455 is correct and can be redeemed next month or later

From May onwards min monthly spend is 25K for 1% benefit. Wallet loads and card repayments will be excluded.

After recent devaluations, is it still good card? Any credit card payment apps to bypass recent devaluations?

Any other app or anything else to be use to get 1% Voucher from Signature+ debit card. Pls suggest

With recent changes in rbl terms and conditions. Rewards of 1% of spends on rbl signature plus debit card are not received for payments of credit card bills wia paytm, cred.

Is there any other platform where we can rotate money get benefits.

cashback is in the form of G V only , and not cash or equivalent. As in cant it be adjusted against card outstanding balance or monetized in any other way or we have to use it for shopping on ecommerce sites only

Signature+ RBL zero markup forex card. If we don’t carry the phone linked to the account on the foreign trip will we still be able to use the card for merchant TXN or tap & pay or on POS machine.

Because we will not be in a position to receive SMS because of Indian SIM without global roaming.