Kotak Mahindra Bank has recently come up with a new super premium credit card called “Kotak White Reserve” for its affluent customers.

This stands above the Kotak white card which they launched few years ago. Here’s everything you need to know about the newly launched product.

Features & Benefits

- Joining/renewal fee: 12,500 INR+GST

- Welcome benefit: we don’t know yet

- Renewal fee waiver: 12L spends

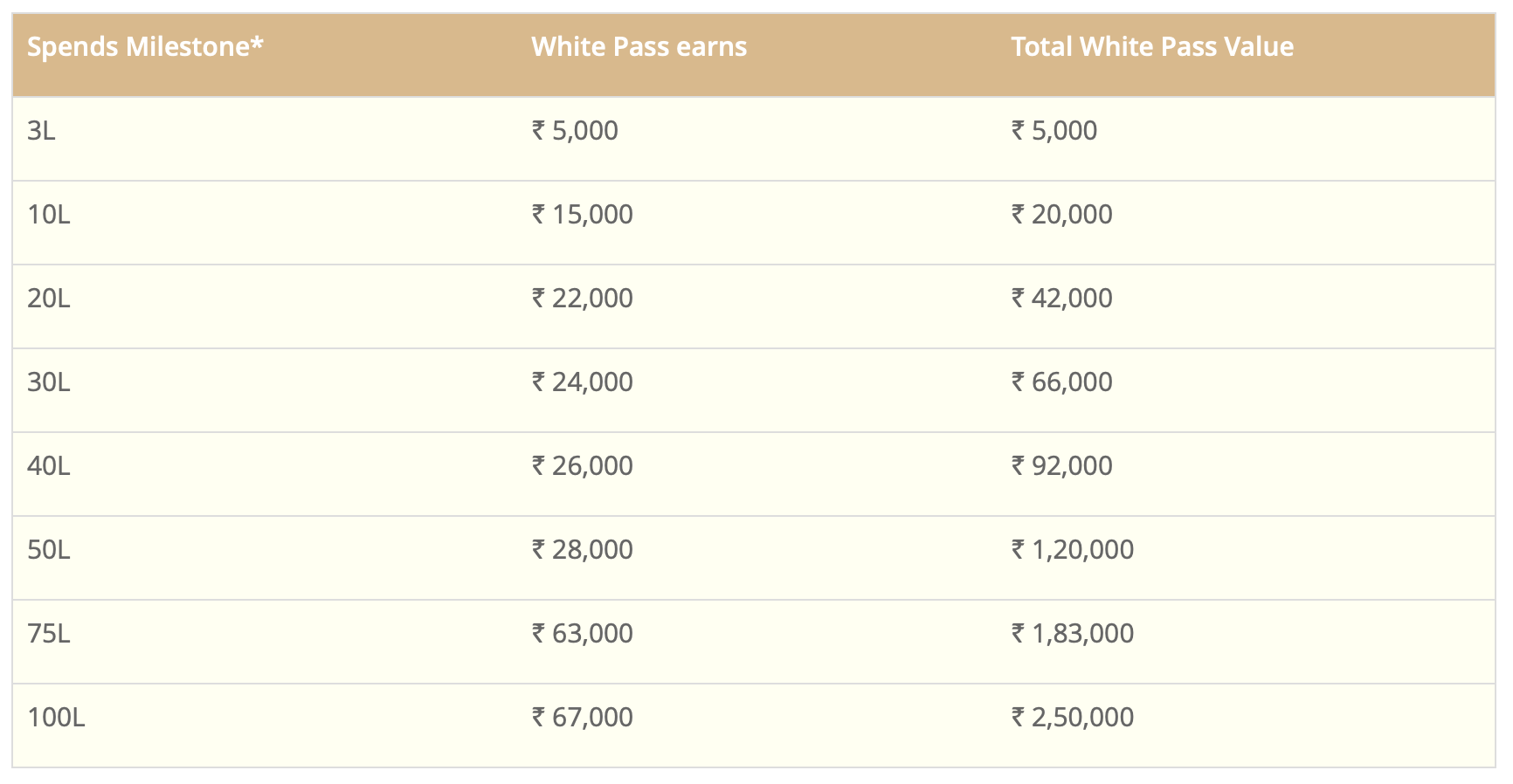

- Rewards: upto 2.5% (milestone system – as below)

- Lounge access: Unlimited for both primary and add on

- Golf: 2/month across the world

- Membership: Club Marriott

- Concierge services

Below are the spend slabs to hit various milestones that gives about 2% on 10L spend and goes upto 2.5% on spends as high as 1 Crore.

It’s a very good attempt to serve the super premium customers of the Bank. There are certain type of profiles with very high spends for whom this card will be definitely useful.

Also for affluent Kotak customers looking for a premium credit card to stay within Kotak, this card does make sense.

But I don’t see any reason for most other existing super premium credit cardholders to go for this one.

That aside, note that redemption options with these White Pass points is not that attractive except for one or two voucher brands.

Final thoughts

It’s good to see that Kotak Mahindra Bank is concentrating on super premium segment and not just do away with the Kotak White Card that gives about 2.25% on 12L spends.

From the aggressive Kotak Indigo Credit Card promotions that I get even on shareholder communication emails, I can see that the bank is very much into business lately.

Looking at how thing are moving, let’s hope Kotak comes up with more interesting products and also probably speed up their application processing time.

Hasn’t this card been there for quite some time. I remember seeing it on their site long time ago, like at least 6 months before.

Is it? I never knew, maybe as I’ve stopped tracking proactively.

Possibly he meant the white card

I think you’re right. I got it mixed up with the regular White card that is not Reserve. I just checked it up.

If you see wealth Infinite and white Reserve card. Both looks similar

with such a high joining fee and low rewards, an insignia card always seems like a better option

With someone like Uday Kotak building it, one would have expected something better from Kotak Mahindra range of credit cards. Somehow, they don’t seem to match up. Haven’t really come across a Kotak card that is any better than strictly average. Doesn’t seem to be different for this one too, a super-premium card with high fees, the average rewards should have been better. Think people in that class would find the unlimited lounges attractive, particularly since it is for add-on as well.

Good to see but this card doesnt seem to be lucrative. Just received an email from Axis bank.

Axis bank has launched 2 new card variants with a tie up with Spicejet.

SpiceJet Axis Bank Credit Cards in two variants – Voyage and Voyage Black.

Few points to note:

1. Waiver of ₹12,500 fee on ₹10,00,000 annual spends

2. White Pass Validity

White Pass balance remains valid for an additional 90 days after every anniversary cycle. For example: If your card is booked on

1-June-2021, the balance earned for the anniversary year 1-Jun-2021 to 31-May-2022 can be claimed till 29-August-2022.

The White Pass value will be reset to zero on every card anniversary date.

AXIS ACE card sounds “super premium” after reading Kotak White rewards

“But I don’t see any reason for most other existing super premium credit cardholders to go for this one. ” .. totally agree with this. Also, I guess they are too late in the bandwagon.

Are there any other super-premium credit cards that offer unlimited airport Lounge access for both primary and add on card?

Both HDFC Infinia and Diners Black give unlimited lounge access (Domestic and International) for card holders and Add-on members as well

Citi Prestige, HDFC Infinite are amongst one that provide

HDFC Diners Black offers unlimited airport lounge access for both primary and add-on (up to 3 additional) cards at domestic and international lounges. Has a default reward rate of 3.3% and a 10K annual fee which is waived off at 5L (I think). This Kotak card needs to do better.. IMHO.

Yes Private, Citi Prestige and HDFC Infinia/Diners

Hi Siddharth Kotak official website says that the annual fees can be waived for annual spends of Rs. 10,00,000.

Could you tell us how often you usually get limit enhancement in Kotak credit card ?

What credit limit do we need to upgrade to this? I have white card with 5.37 limit

10L base

It’s invite-only card.

I have 7.8L on white. I requested for LTF white Reserve. was denied.

I know a person having 15L was offered FYF.

I have a card with 9.5 lakh limit .

can you please help me how to raise the request for upgrade ?

Can someone please tell me if rental spends are counted for in the rewards? Also, please recommend best reward credit card for rental payments of Rs 70K pm. Thanks

I had a limit of 9L on my existing kotak indigo credit card, and i was given a choice to apply for this card as LTF. I did so and now i hold both the cards with a shared limit.

Did you got a call or contacted your relationship manager for upgrade ?