IDFC Bank opened 2022 with an amazing new year offer for credit card holders and now within 2 weeks we’ve yet another wonderful targeted offer here that allows you grab upto 6000 Reward points based on spends. Here are all the details,

Offer Details

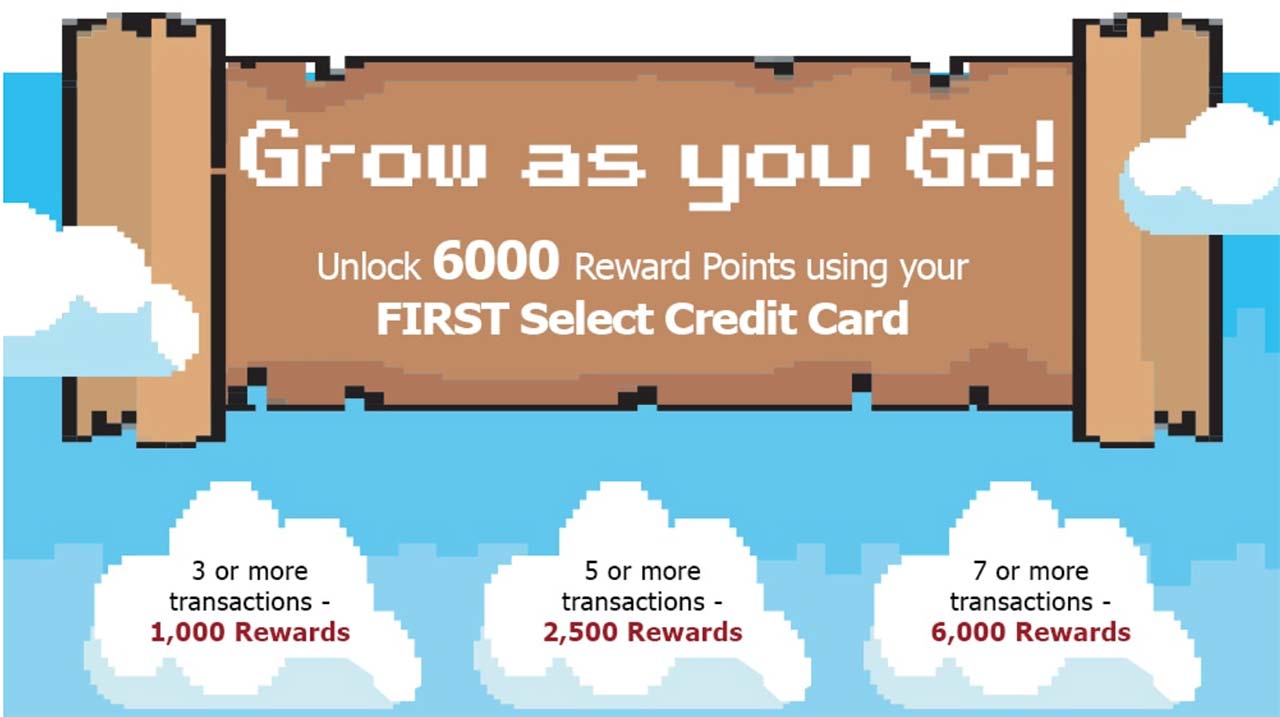

- Offer: Get upto 6000 Reward points on performing X txns (3 slabs)

- Offer Period: 15th Jan 2022 – 15th Feb 2022

- Offer Type: Targeted

- Min. Spend: Not required

- Min. txns to take: 3 transactions

- Fulfilment: 45 days after offer end date

- Source: SMS & Email

That’s a super sweet & simple offer. Interestingly, no min. spend requirement for this offer either.

So just like the previous offer, this time too, let’s praise the good soul: Whoever designed this offer, may he/she be blessed with health, wealth & happiness this 2022. 😀

It seems this offer is only for IDFC Select Credit Card holders. Any idea what offer they’re pushing for other cards?

Bottomline

Looks like IDFC Bank has gone aggressive on credit card promos lately. The promo images/animations shows how deeply they’re into it.

These kinds of promos are mind-blowing and it’s surprising to see a new player doing this good. But I don’t think such promos would return anytime soon, with such offer construct. So don’t forget to avail them!

If you’re new to IDFC Credit cards, do check out the review here IDFC First Credit Card Review (All Cards) or just go ahead and apply now.

That said, I did a tiny txn (under 1000 INR) on Amazon with IDFC First Select credit card and it got denied stating Security reasons. Are you facing such issues as well?

Did you get this offer or some other? Feel free to share in the comments below.

The promo cartoons are modified Super Mario (Bros.) – Nintendo. Quite a retro touch there!

Yeah. Perhaps someone born in late 80’s or 90’s designing these animations. 🙂

Is this targeted too? Didn’t get the previous spend based offer either.

Yes, targeted.

Not recd this offer on my Select card.

Is this for all idfc credit card holders or is this a targeted offer?

Seems to be targetted.

Received offer, 6000 points on 7 spends, no minimum transaction criteria,offer separately applicable on add on card too. Blessings & wishes to IDFC CC product managers 🙂

Hey Nikhil, Does the add-on card has the same credit card number as the primary one, similar to HDFC or does the numbers differ like SBI – my point is to know if I can use IDFC CC twice for any merchant offers like we can with SBI?

Hi Raghu,

IDFC add ons come with different card numbers like SBI but guess what?!, Add-on cards share the privileges along with Primary cards (basis the reply mail from customer care for my query).

Thanks a ton Chakradhar.. this is certainly helpful to know

Hi Chakradhar,

Does that mean that domestic / international lounge access and spa access is shared between primary and add on cards?

@sid Just check whether you have locked the card in mobile app?

It’s enabled. Can transact elsewhere but only Amazon was causing the issue. Will try again.

Also they automatically blocked and re-issued my debit card few months back as well stating security reasons.

It’s their fraud system. Had the same issue

Also linked to how much you use the card I guess as didn’t have this issue on my wife’s card

Hi Sid,

I have recently tried making a payment on Agoda but the IDFC Wealth Card (Visa Infinite) number has shown as invalid and did not let me make the payment. Although, the Agoda website stated that they accept VISA, MasterCard, and AMEX. I raised a complaint but nothing happened. Is there anyone who faced this problem?

Similar issue using Select Visa CC – Airtel app says invalid card number

Does your card start with 4405? This is a new series from Visa and yet to be identified by some gateways. You need to talk to merchant, gateway or Visa. Bank cannot do much here.

Same offer received on IDFC Select credit card. Also, no issue is faced with transactions on amazon or elsewhere.

Have done lot of spends on my Wealth card in past 4 months, probably that’s why am not getting any of these targeted offers.

“…did a tiny txn (under 1000 INR) on Amazon with IDFC First Select credit card and it got denied stating Security reasons…” : After enabling online transactions, never faced any such problems.

Haven’t received this offer yet…..I rarely use this card… Only for fuel etc but now even for that using RBL Zomato….. primarily I use hdfc infinia……maybe usage is less that’s why no offer or might receive in a day or two.

Once my 50 day old card was skipped.

Anyone who got card post Nov end, received the offer?

No. I haven’t received.

Im holding IDFC Select from Dec 2021.

Siddharth u asked about ….That said, I did a tiny txn (under 1000 INR) on Amazon with IDFC First Select credit card and it got denied stating Security reasons. Are you facing such issues as well?

No.such issue with my select card. U may check transaction control.

Received 2 offers:-

> Simply use your FIRST Select Credit Card 3 times from 15th January to 15th February and get 1000 Bonus Rewards.

> Do 3 or more transactions using your IDFC FIRST Select Credit Card and earn upto 6000 Rewards. There is no minimum transaction amount to earn Bonus Rewards!

Not Received this offer yet, No such issue has i made 35000 trx one go.

No offer on my IDFC Wealth credit card..

I think its targetted offer. I checked my email and SMS but haven’t received anything anywhere. Even I didn’t recieved previous offer of IDFC as well.

I have a 1-month-old wealth card and did not get any offer. This happened with my Diners black as well. I did not get any spend-based offer over there as well since 2012.

Same here, no offer on my Wealth card..

So will wallet load and utility bill pay transactions be considered under this offer?

If I get this offer SMS, do it be applicable to my addon card also?

Check on email & mobile number registered for add on card. You have got communication then you are eligible. It’s mentioned in T&C also.

Is this offer applicable for IDFC Wealth Credit Card too?

Can somebody explain the chargeback/dispute process of IDFC Credit Cards

IDFC took back 35k points of mine in this month’s bill (that was what i had), apparently this is for the rental transactions i had done – about 15 of them in the last 1 year – 35k to 50k each; they are claiming this is a “commercial transaction” and not a “personal transaction”. Asked me to look at terms and conditions. They are likely to claw back more points as i earn.

I have been using IDFC Select CC for rent payments on Cred for the last 3 months. Looks like i should give it a break based on what happened with you. Also start redeeming points as soon as possible.

This is bad! Rent is a personal expense.

Which platform were you using for rent pay?

Do you have rent agreement as backup for the rent payment or was this Managed Spending?

Is there anyone who also lost their rewards points earned (from rental transactions), like what @Flame had experienced?

@Flame & @Avish,

Never ever heard of such thing happening. I use my cards for rental payments on RedGiraffe & NoBroker but I have a rental agreement provided to these sites. But in this case action is taken by the card provider. How can they do that & how can they decide if its a commercial or personal transaction? Redgiraffe deals with commercial rents, does that mean, using that platform could raise red-flags?

This is strange as CRED markets that pay rent through IDFC cards and get 10X reward points on transactions above INR 20,000. Although this reward system is a basic feature of the card, CRED anyways markets it. I also made my last rent payment through the Wealth card and got the reward points. Now I will redeem those reward points ASAP and shift back to Diners Black for rent payments.

Had used cred, paytm, housing and no broker. Rotated around / not sure what triggered it – maybe crossing more than 12 did. Below is the sms I got after i spoke with customer service. No email received. Anyone – any ideas what to do. I do have a rental agreement, but never uploaded at any of the websites.

Dear Customer, we have observed from your recent Card transactions that you are violating the terms of use of the cardmember agreement by using the IDFC FIRST Select Credit Card no. ending xx1234 for commercial purpose and in excess of the given credit limit. Please note that we will withhold the excess reward points accumulated in your card account, through above transactions for the current statement cycle. A mail has been sent to your registered Email ID regarding the same. Team IDFC FIRST Bank

CRED has removed the offer of 10x reward points through Rent pay from IDFC First Credit Card.

@Avish,

True, they have mailed today mentioning 10x rewards will be reduced to 3x from 17th April,2022 for Rental payments.

But I used my First Select credit card for making Rental payments in RedGiraffe, they did not give any RP’s and when asked they stated these transactions fall in MCC of Insurance, hence, no RP’s will be given. I had a fight with the rep. and the marketing team person, but in vain.

Avoid using IDFC cards for any rental payment, you never know which MCC it may take.

I checked with Cust care. Its applicable only to IDFC select credit cards customers from jan 15th till feb 15th.

Anyone received that 6k points yet?

6000 Points credited yesterday

Yes, credited to my account too.

Got 6K points yesterday

Get Up to 10% Cashback On Utility Bill Payments With Your IDFC First Bank Credit Cards .

It is valid for all the eligible transactions made between April 12, 2022, and June 30, 2022, i.e. the cardholders have almost three months to maximize their benefits.

The Offer:

The IDFC First Bank Credit Cardholders can avail of a cashback of up to 10% on utility bill payments made during the offer period. In the first month (April), a cashback of 5% will be offered on all your utility bill payments, then in the second month (May), a cashback of 7.5% will be applicable, and a 10% cashback will be offered in the third month (June).

However, no eligible transaction in April is done, then the month of May will be considered as the first month and earn a cashback of 5% in May and 7.5% cashback in June.

Similarly, if no utility bill payment has been made in April & May, the month of June will be considered the first month and a cashback of 5% will be offered in June. The maximum cashback that can be earned during the offer period is capped at Rs. 3,000 per cardholder.