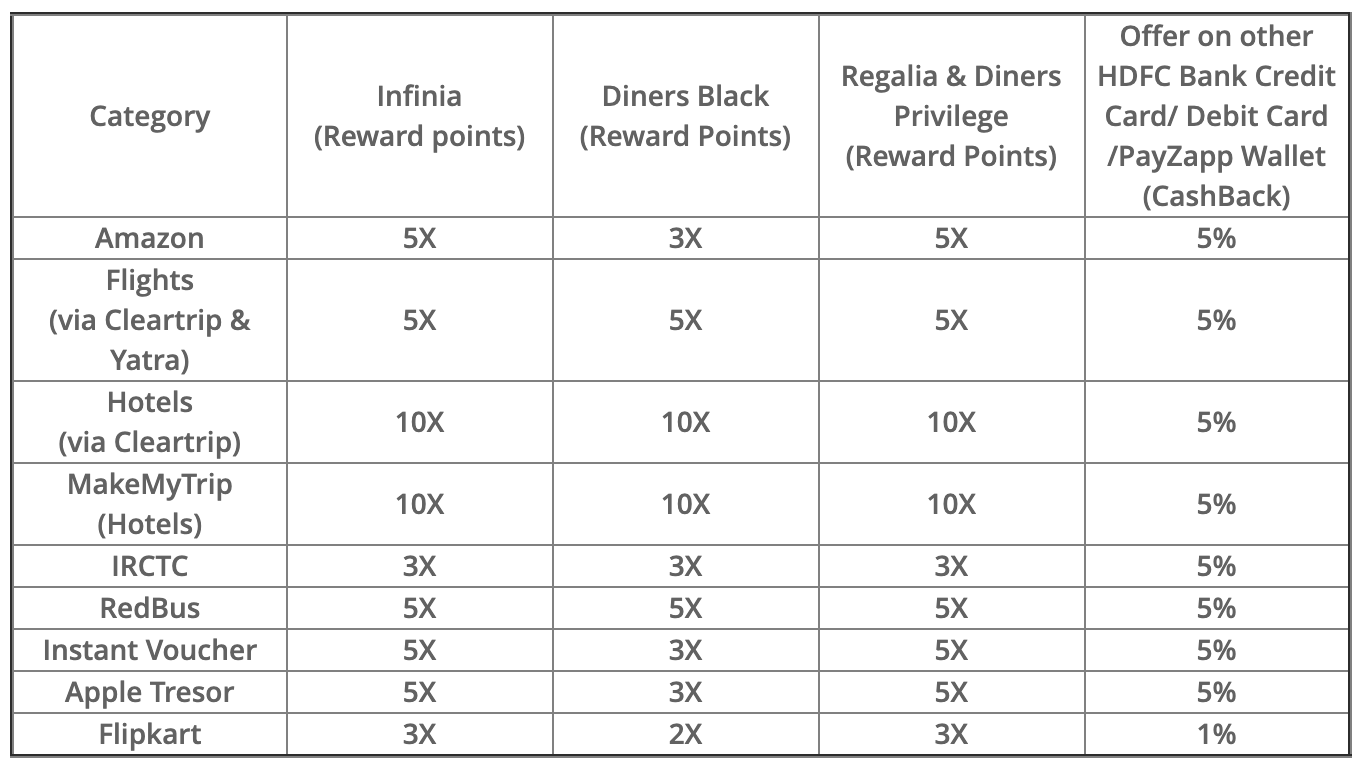

HDFC Smartbuy 10X Program has gone through a re-structuring plan which gives a lot of bad news and some good news as well. Here’s a quick look at the important changes of the offer. If you’re looking for the detailed t&c, do check out the updated smartbuy t&c page.

Diners Black is hit

- Amazon Spends: 3x

- Insta Voucher: 3X

Above are the important changes that might affect you, among few others like for flights its now 5X for both infinia and diners black.

Overall, the changes are expected and I think most existing users will be okay with it. Only the new comers might feel the pain.

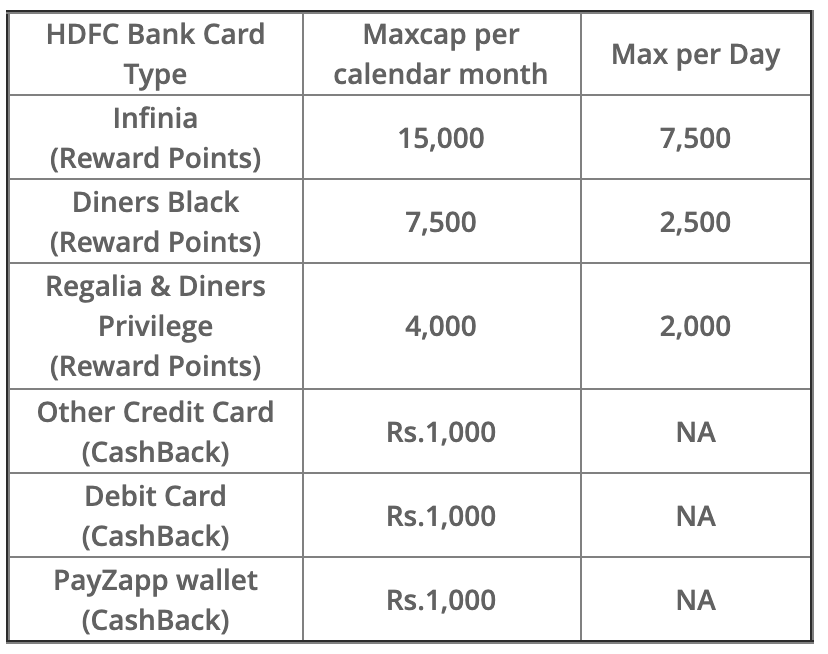

Per Day Capping

The worst move of all is here: Daily capping on bonus points. And not to forget the rule: “A day is considered as a settlement date”.

Which means, its better to give a gap of 2 days or at-least 1 day between the txns to be on safer side.

With this rule in place, HDFC super premium cardholders may soon go on for shopping with other cards, like Axis Magnus.

Note that this capping applies only to the bonus rewards and not to the regular rewards earned!

Premium Cards back on Rewards

Regalia and Diners Privilege card holders have some good news here. HDFC has been running these cards on 5% cashback all these time but now they’re lifting them as well to 3X/5X/10X rewards.

New comers, You may see the premium cards at 5X where Diners black only gives 3X. This of-course doesn’t mean 5X is better, because “X” is higher on Diners black. Do go through respective card reviews to get the picture.

That said, this change is certainly good for “some” of these premium credit card holders, as long as they redeem the points for travel. For those looking for vanilla cash-back, I’m sorry, this too is a bad news for you!

My Thoughts

Given that the program is running for so many years most changes we see here are expected and its OKAY, except ONE.

The ONE major problem that I personally see with this change is the max cap per day. Generally “any restriction” is put in such a way that the gamers are controlled but in this case it affects legit users.

For ex, I don’t usually max out the monthly caps since past 2 yrs or so but if I do, I may do it once a year and if I look further, that’s because of a high value purchase like a mobile/laptop.

But with the max cap per day, I would loose a lot on that as I can’t break an iPhone purchase into two. And with this rule in place, even if HDFC runs the Smartbuy sale it would be almost USELESS.

Pretty bad move of all time I would say. I wish HDFC revokes this daily cap before its too late!

While that’s my point of view, what do you think about the new changes to HDFC Smartbuy Program? Feel free to share your thoughts in the comments below.

Hello “Magnus”

Good one 🙂

Looks like Axis has timed the new features/benefits for the Magnus card perfectly!!

5% cashback on HDFC Regalia and Diners privilige is better than 5x rewards. the cashback is used to get credited in the next month.

Purchase value – 15000 with 5% cashback gives Rs.750 (in addition to 400 reward points but with 5x, we get 1600 points. when we convert the 1600 points to amazon voucher, we just get Rs.560

A 1000 rs Amazon GV shows me an effective price of 880 rs on choosing regalia credit card. No reward points just straight up CB. Not sure what is going on

The discount is in addition to the rewards

First the spend linked vouchers and now this. Time to move on to other cards seriously.

Do you know if Axis allows two cards, I already have a Vistara infinite, may try for a Magnus

Yes, Axis Bank allows a maximum of three credit cards to an individual. I personally have three cards issued by Axis Bank.

Yes I was holding the Magnus with a Vistara Infinite, limit was not shared.

Amit AXIS allows 3 credit cards and in some cases it allows upto 4.

Axis allows a maximum of 3. I’ve already applied the third one, Magnus, approved and getting delivered tomorrow

Thanks for collating this useful information, Siddharth.

What are good super-premium card alternatives to DCB/Infinia?

Pretty Bad. I hope they dont devalue points as most of us sitting on heaps of points.

I don’t think they would do anytime soon. 70% rule is sufficient for them to discourage ppl from redeeming.

The points already got devalued, if you notice 5x on flights. As u need to pay 30% for flight, u will get back half the reward points on that compared to earlier. In those terms, it carries 3-4% less value now.

That’s not the meaning of devaluation !!

Huh? What?!?

This was absolutely expected when bank started giving DCB and Infinia to all.

In 2019 when I got DCB requirement was 25 lakhs ITR and for Infinia 60 lakhs ITR. I had huge investments with bank and got invitation for infinia but bank was very addement with 60 lakhs ITR. So had no option but to settle with DCB. Funny part was fee was just 5k and i guess after 2 or 3 months they made it 10k even though i have been getting fee waiver due to spend based 5 lakhs criteria.

Now slowly International travel opening bank has played master stroke by making flight has 5x and 2500 daily limit 🙂 🙂 for DCB.. if bank doesnt give me infinia now then I will change my account to 10k balance 🙂 🙂

I already lost enough investing with HDFC at 4 or 5% interest during pandemic. If i invested elsewhere would have got more.

It would be nice if you write an article on alternate card to Infinia or dcb.

Much needed….Siddhartha, please bring that rabbit from your hat and let us know what card to jump on….high time to dump these

@Prashant Gupta

Devaluation would never happen because it becomes a case of cheat if they do that. I remember in 2016 or 17 when they devalued i filed a complaint to top management and they immediately did a lot for me without hesitation and after that i have never seen devalueing card..All these smartbuy offers are temporary so i dont think anyone can do anything because they have mentioned things very clearly in T&C and it is expected some day it would happen because it has been HDFC practice i have observed from past 10+ years.

Thanks Sid for your update.

Day capping is the worst move. Is it also conveying that Smart buy 10/15 rewards point will not be there anymore?

Tough to predict. Let’s hope our collective views here help them to think on this per day capping.

Hope for the best things, Sid.

I sense a card on top of DCB in Diners Club, till now we were expecting something on top of Infinia

HDFC bank is going downhill, both in terms of product and service. I hope ICICI plays it well and ditch payback for more lucrative rewards system.

Payback is pretty good actually, in a way. Reward Rate is what is the problem.

@siddarth

How do you say payback is good. Can you write an article on that..These days I found it one of the worst coz you will have to spend some 100 or 200 to get 2 or 3 payback points for ICICI rubyx i guess and value of each point is 0.25 .Never in my life i even checked how many points got accumulated and always ignored it.

Recently even ICICI bank devalued their Gem stone cards.

Daily cap on bonus RP of Infinia is a bummer.

Comes to Rs.50,000/- under 5x and Rs.25,000/- under 10x categories, respectively.

Hi Sid,

I have a lifetime free DCB. Would it make sense to move to Infinia considering their annual fee + I hope DCB is still giving the monthly milestone of 1k on spending 80K. Is there any offer for lifetime free for Infinia?

My annual spend on Amazon/Instavouchers is not more than 3 Lacs probably.

Hi Sid,

Thanks for the detailed information.

Day capping is the worst move.

Is it also conveying that Smart buy 10/15 rewards point will not be there anymore?

I have written to the customer care expressing the disappointment. I belive if they get more emails, there is chance to withdraw the same….

We all need to email the customer care to show our resentment and request them to withdraw this move

Day cap is seriously the worst move hdfc has done. Most of us buy a high value purchase on a particular day and now with this daily cap we can’t even get the full allowed amount of reward points for that month.

And this hits really hard for DCB users where daily cap is measly 2500. The monthly cap was already low and with this daily cap this card has been devalued extensively. Hdfc must remove this day cap or else time to move out spends to other cards.

Disappointing future of these cards. I have already moved a lot of my spends to Axis. Applied for the Magnus as well which I presume would also get approved. There is atleast a guarantee of 6+% on Magnus and good value in the Vistara Infinite.

HDFC is acting cheap after being a great card all along. Whoever designed these offers seems to have moved on and the new one is hell bent upon losing customers. 🤣

Daily cap is something very questionable with many of us like not hitting our daily spends. I mean it has been more than a year since I would have gotten a LE offer as well, whereas other cards I own give me period LE.

Out goes my Diners Black Card, @Sid – any better alternatives from other banks or institutions that may give give better returns compared to DBC?

They better remove the daily capping atleast during the smartbuy bonus points sales, unless they have decided to not offer any such sale going forward. There hasn’t been any in last couple of months anyways, so not sure if they plan to persist.

The flight 10x to 5x is the major down-fall after they reduced instant vouchers few months back. Generally you tend to max-out the upper cap with high travel months, but now even flight tickets booking from other portals may become better option.

worst move by HDFC, i am sure it will hit their business now. why would one try to spend 8L annually (to get annual fee waived off) with such non-existent offers?

3x on amazon, really? any day there will be some card on amazon which will give 10% cashback, why would one use 3x on amazon? same applies for instant coupons.

Flipkart 2x is ROFL deal

hopefully other banks grab this opportunity, give better deals and acquire all diners/infinia customers from HDFC.

Hey Sid,

I got DCB on 31st Jan (based on the eligibility via salary). It has 5 Lakh Limit. Ts was really sad to see this news the very next day after I got the card. My card isnt LTF and I have to pay 10K + GST . This isnt acceptable at all , if you are devaluing the card,and you should reduce the annual fees as well.

What are the options that I have Sid ? Anything from your exp ?

Also I feel that I will be able to make it first year free by spending 1.5 lakh in the first 90 days but what about next year etc ? what is the probability of update to infinia within an year ( current DCB limit is 5L )

Please help me in making the decision

They are setting up the stage for Galaxia. True on the daily limit part, no more laptops and phones bought through them now.

Daily Cap is the worst thing they could have done; especially as I have DCB. I hope they atleast upgrade high value DCB users to Infinia to soften this blow.

Another thing that I find poor from HDFC Bank is the failure to notify their customers. I found out via Sid’s Instant Email Alert 😅

While they have simplified Millennia in recent times, they have complicated Smartbuy.. must be the same guy who was behind Millennia’s initial goof-up behind this as well!

lol.

Sid,

Expected one but the daily cap is the worst and unexpected one.

Hdfc devaluation happened and I received Axis Magnus on the same day !

” they’re lifting them as well to 3X/5X” this is not exactly the case even now those cards are giving 1X rewards along with 5% cashback so the actual lifting is only 2X/4X

Just got the DCB. Hasn’t been a month and this is what I’m greeted with. lol.

Are there any alternates to the DCB, for a usage range of ~5L per year? The infinia doesn’t come free for me (I tried) and my spends wouldn’t reach the waive off limits.

The daily cap

is a big deterrent to buy from SmartBuy now. But I still feel that with minimal 3.3% Reward Rate, Infinia is the best card in the market. My SCB Ultimate looked better but still hasn’t given me a limit upgrade after almost a year. It’s useful only for small spends like fuel.

Is there a replacement card which is as good as Infinia in terms of RR? Mine are all POS swipes. For flights, hotels I continue to use Smart but with the heap of accumulated Reward Points.

For DCB users, daily cap is worst thing.

May be they want people to move to Infinia and pay fee, as spend limit is also more for Infinia.

but even with all these changes which card is better than Infinia/DCB?

And Magnus got delivered on 1st February. Definitely the universe gave the sign

I have been using Standard Chartered Ultimate for most of spends.. As their is no limit on points and I get same value vouchers which suffice for me.. I don’t have wait for travel as in case of Infinia..

I still think Infinia is v.good for example instant vouchers which I buy for offline shopping as its a pretty great deal and I don’t have to wait for out of season sales..

Hi Siddharth, any idea if hdfc is planning to launch galaxia anytime soon which is expected to be a more super premium card than infinia hence this devaluation?

@Sid – would you please do an article/ suggest alternatives to DCB please ?

The only reason i am sticking with DCB and not moved to infinia is cause of monthly milestones & the hope that some good 10x partners come back !!

Hi, Besides this devaluation in SmartBuy, Diners have also removed the 10x partners. Though they were in infrequent use, still another loss on DCB.

Switch single big ticket spends and voucher accumulation from DCB to Amex reward multiplier, well if you don’t have one already you can’t even get it now coz of the ban 😜

What is your opinion about Axis Burgundy savings account sir

With this daily capping on reward points, HDFC bank is going to loose to its competition for sure. Better for them to revert it before its too late.

I am paying 12k including GST Annual fees for Diners Black, all the downgrading in the last couple of years were bad but this one may actually convert my card into a liability.

Last year HDFC panicked and randomly gave Lifetime free Infinia/Diners Black to lots of people, some even holding moneyback card. So, this massive downgrade was bound to happen but they should have equalised things for older customers and converted to Lifetime Free instead of this two class division.

I have two diners black (one LTF, one paid), should I close the paid one (spent >8 Lac so it is free anyway till 2023) or try upgrading it to infinia?

Also does hdfc bank allow to have multiple cards these days? i.e Can i apply for a fresh infinia card if I close my DCB.

With such restrictions and reduced value, it will be tough for Infinia and DCB holders to continue with their cards at 10K/12K per annum.

Daily cap and 70% redemption is surely a downside. No clarity on balance 30% will be treated as 5x/10x. (Should be 5x though).

Lastly, for Infinia, redemptions against Apple/Tanishq, balance 30% doesn’t fetch any 5x/10x.

I have already seen my spends shift to other cards over past few months and seems like it will be difficult to reach 8L threshold for Infinia this year.

Have you or anyone else tried redeeming against Tanishq here. How does 70:30 work. Do we need to pay 30% at Smartbuy at the time of getting the voucher or do we need to pay 30% at the tanishq store in addition to the voucher. Basically asking that if I redeem for a 10k voucher, would I have to pay 7k points + INR 3k, or would I pay 10k points for the 10k voucher and then Tanishq store would insist that I buy something for 13k to use 10k voucher.

Also, on the 30%, do we get at least 3X?

Some people are planning to move to Axis Magus.

How’s Axis Magnus any better?

Default reward rate of Magnus is pretty low @1.2% (12 Edge pt per 200 spend).

Nothing interesting in popular spend like Amazon/FK as well.

Also has 10K+tax annual fee.

Axis gives 25k reward points on a monthly spend of 1 lakh.

Totally Agree. After reading the comments, I saw a lot of folks considering a move to Axis Magnum. But, 1.2% or in the best case a 2.4% reward ratio is pathetic for a super-premium card. Thoughts?

For a user spending 1 lakh a month , including several offline transaction and/or those that do not come under smartbuy. we get 6.2% + on Magnus

Yes, due to that I prefer to stick with my LTF Infinia.

How did you get this as LTF? My RM keeps saying no one has it…

Lots of people have it. I had the Regalia since a lot of years, and then automatically got upgraded to LTF Infinia. Only thing with that is you don’t get the annual bonus points too, so doesn’t matter much.

Simple!

You spend 100,000 on Infinia, you get 3300 Rs worth of points per month

You spend 100,000 on Magnus, you get 6200 Rs worth of points per month

Not including the smartbuy offers in this but that is just worth 1300Rs per month even if you exhaust complete 10,000 limit on amazon. Other insta vouchers are not worth unless you go out of your way and spend 10s of thousands on brands like Myntra/Flipkart.

Axis Magnus was publicized as being on the Mastercard platform on which the ban has still not been lifted. Are they issuing new cards on the Visa Platform ? Do the benefits and the recently launched Milestone benefits change in case of Visa.

Hi sid, are you hearing anything about hdfc launching a card above infinia. I’ve been holding DCB for a few years and have been able to keep it free basis usage but don’t see any major benefits now. Was thinking of moving to Infinia unless there’s something better coming. I should be able to manage 10 lacs+ with infinia also but don’t want to block myself with infinia for 6 months if something else comes along.

Even their Dineout dining discounts have gone down -15% to 10% with a cap of 1000Rs

Additionally, if you notice while booking hotel via smartbuy (cleartrip) these days, the rates are 30-40% higher than the rates what you get from MMT for the same hotel. This way, even if we redeem points in hotel booking, the effective discount is highly reduced. The most attractive feature of DCB, RP is getting valueless with time.

I did notice recently that Smarbuy is showing higher prices when compared to the prices at the vendors directly. too bad. HDFC cards are loosing their shine.

It was same since 4-5 years. Only flight tickets prices same as other portals including airline website

As per my experience of 15-20 bookings pre covid, the room tariff was same as MMT or other websites (except the cases when inventory of rooms was over with smartbuy). Post covid and post 70% of points redemption rule, they started showing the prices higher on smartbuy compared to other websites.

This way, the effectiveness of points have become useless for hotel booking.

The Settlement Date condition for Daily Cap seems to have been removed from the T&C Page.

And they have added some crappy IGP website for 10x.

Lol, yeah

Most of the items are over priced than FnP

And FnP is 50% over priced than normal rates !

After devaluation, HDFC has now started credit reward points in 2 days

I purchased the 3X inta voucher 2 days back and today i got the message that 660 reward points has been credited

So now we don’t have to wait for 90 days to get accelerated points

All those years, holding on to Regalia’s poor reward, one day hoping it to be Infinia and recently CL got to 10L. All waste!

@sid , please find us a good alternative!

Smart play by hdfc over a decade

One good news among these devaluations is that HDFC started posting bonus points on T+2 days basis from 1st Feb onwards ! Let’s see how long they will continue this.

Interesting, I have not got points for January spends.

Yes Jan is still pending.

Hey Sid, I got my Infinia Metal card upgrade approved through bank manager request from DCB today sans my average annual usage on DCB was 12 – 15 L p.a from past three years. though the privileges have been reduced, the privileges of Infinia now seems to be same as DCB old privileges.

Couple of questions.

1. Do you think Axis Magnus is still worth than HDFC Infinia

2. What happens to my 3L DCB points after the Infinia card is isssued?

Axis Magnus << HDFC Infinia

Your 3L DCB points will become Infinia 3L points on the upgrade.

can anyone let know step by step for transfer of dcb points to krisflyer?

It is asking for the expiry date of the krisflyer card which I can’t seem to find.

Enter any date in next year and it will work.

I got the card just on 1st Feb. And already booked 2 flight and 4 train tickets from other portals, as discount was better. I see it now only for normal spends, where I don’t get any offer and for 10k amazon voucher. Don’t get more than 5% from anywhere else. Keeping it, as I got it LTF, otherwise I would have been running behind customer care to close the card.

Hi

Are you sure that the card you got is LTF? I think it’s just FYF. Please confirm. Thanks

Hello Raja

How did you get LTF infinia card?

Can you please share your experiences?

It is LTF DCB, not Infinia. There was some LTF offer for alumni of few top colleges.

which portal you use for discounted train tickets?

Amazon Voucher is now restricted to 5000 per month. For a few days Amazon was removed from SmartBuy altogether so that may be the way they are going. I saw amazon today so quickly tried to purchase, it gave me a limit of 5k per month on Diners Black.

HDFC gave a perfect example of “Aim for the Topmost card (Infinia), Don’t settle for less (DCB)” when you are eligible !

I got the Infinia recently. I see there is 10k limit for buying amazon instant vouchers. Does the direct add money in amazon pay also come under 5x if went to amazon from smartbuy?

I did a sample load in amazon pay by going from smartbuy and it charged the card with AMAZSMARTBUY. With this way even upto 1 lakh can be loaded in amazon pay and qualify for 5x rewards?

In their terms, they clearly exclude wallet loads and gift cards. So, please confirm if you actually get the 5x points. These days anyway they are crediting in 2-3 days, so it will be quick.

Request you to let me know where can I check if the rewards has been credited.

you are saying within 3-4 days they are crediting reward points? How are you able to check?? Can you please let me know.

No it does not, Amazon Pay or Gift cards purchased on AMazon Site is not eligible for 5 X

I doubt but check in next month points and update everyone the status for the same.

I am laughing at situation. I am serving notice period & i thought i will take DCB with my first month of salary slip because now i meeting their salary requirements with the new job.

And now this happens. 🙂

Where were you able to get discounts on Train tickets?

I generally have used either Amazon balance or Smartbuy for booking. Mind sharing where the reward rate was better?

Also did you get the card LTF from the start or did you convert to LTF ?

There was an offer going on EMT for 50% cashback. Booked one ticket and used the cashback for second ticket. Overall, it covered all the IRCTC/EMT charges plus around 50-60 extra discount. I paid via Amazon pay only.

I got DCB as a part of LTF offer for alumni of top colleges. It is my first hdfc card ever. Last time when the offer was live in 2019 or so, I knew about it only after it expired.

Buy Amazon voucher from smartbuy and then use it to buy train tickets.

Disappointing developments. Though Sid has been alluding to this for some time. The per day limit is the worst change.

My monthly spends don’t consistently cross 1L so Magnus isn’t as beneficial for me. Better to focus on using up stored points of DCB in case they also get devalued like YBL did. Maybe the best time for point accumulation is behind us.

Would be interesting to see what rejig Sid does of his card rankings for 2022 and if any issuer (Bank) comes out with a offering to capture this space.

My suggestion to all Dinersblack and infinia card holder to stop using these cards for two months do not spend a ruppee for all over india then hdfc will do something other wise these cards are not well all 10x will stop one day and all they will come 2x 3x only as u all see they from last 3/4 years all thing decreasing

I downgraded my Diners Black to regalia, Contacted HDFC multiple times to upgrade my Diners black to Infinia but they denied. So i dont see any point of paying 10k+gst for Diners Black without any renewal rewards. I got diners black mainly for 10x amazon and Unlimited lounge access. Priority pass had some limited lounge options in UA.

I’m in similar boat. Hdfc is not ready to upgrade mine, and I’m not keep on regalia. Thinking of closing this card and applying for infinia as a new customer. Any idea what is banks cool off period after which they’ll issue a new card.

I am not sure if SBI also cashing this opportunity, as I got 60% increase in CL without informing me.

And like most others here , I was preparing for DCB upgrade. Could the increased demand be a reason?

Got metal card today….not of hdfc but from one card. It is also life time free and they give 1 point on Rs 50 spend. And they give 5x points on any two categories in a month. I liked this card so far. Opened in few minutes online…..i happened to see 25% off in Apollo pharmacy in medicines using this card, that’s how I found this card and made it.

I own a DCB and i’m disappointed. But I also own an Amex gold membership rewards card where i get 1000 points (38ps each) on doing 4 transactions of 1500/- each (wallet load included) . Also, if my monthly spend is 20k or more i get 1000 more bonus points. Apart from this reward multiplier offers every now and then are pretty good.

So in short 2000 bonus points for 20k spend in a month which is roughly 4% return.

And when the ban is over i will also get a gold charge card so I have 2 cards with same bonus points offer. And gold charge has default 5x on reward multiplier !

Cancelled my Diners black and downgraded to Regalia Visa. Anyway Diners was not working outside India. Don’t want to pay 10k + gst without any cashback rewards.

@vishal verma : What is the procedure of downgrading the Card from Diners Black to Regalia? I am also looking into it, don’t want to pay 12k fees when loads of people got it for lifetime free and it was devalued as a result.

Hi Siddharth,

Do we get 5x points via Smartbuy Amazon if payment is done partly via amazon pay balance and rest via HDFC credit card? That seems the only way to may be go for high purchases and get some decent points with the daily cap on.

Yes, you do get 5x points for the credit card component of the transaction. It is mentioned in the T&C.

And I agree that it is a nice way to exceed the daily cap.

Hi

I think it’s possible. 5x RP only for the amount spent using HDFC card

After many many years in netbanking I got card upgrade from DCB to millenia /regalia…

Diners black is loosing all its sheen now. The benefits could be little better than some of the other popular cards but the rewards have been downgraded a lot in last 2 years.

Can I book a hotel via MakeMyTrip on Smartbuy (10x RP infinia) and use 3 MMT Instant Vouchers (5x RP infinia) to pay for it?

There won’t be option to pay by gift card..

10x applicable only if you pay through your credit card

Infinia devalued again!!!

New Apple products are showing at 1RP=0.50Rs

This is in addition to 1:1 benefit for apple products.

As you can see that 1RP=0.50Rs apple products can be redeemed without 70% condition.

Tricky play once again!

HDFC introduced igp.com recently on smartbuy and one can buy gift card from it. Will the gift card purchase on igp.com eligible for 10X. I don’t see any T&C for it.

Are you able to buy the vouchers there? It has a field of “voucher code” – not sure what one should fill in there.

The gift cards do not earn 10x. Go to the igp website through smart buy and then click on terms and conditions. Gold, silver, electronics, gift cards and shipping fees don’t earn any points

Does DCB earn base reward points on Amazon Pay load ?

Has HDFC removed amazon and other gift cards from the redemption options in smartbuy. I’m not talking of 5x/3x instant vouchers, but the reward redemptions.

I tried today and could only see luxury vouchers / apple/ and some other products.

Few updates on Smartbuy:

*Bonus points are credited on T+2 days (Amazon, Gyftr) but not Flight bookings.

*Flight Bookings (Cleartrip) being billed as ‘SMARTBUY CLEAR TRIP HOTBANGALORE IN’.

*23rd Feb onwards, ‘Partner convenience fee’ is applicable for flight bookings which is very much dynamic. Just 2 days ago, I booked 7 passengers round trip, the convenience fee was only 236, now it’s 3220!!!

*The convenience fee is not under 70:30 as it was earlier. You can pay 70% booking amount (excluding conv. fee) with points. If your booking amount is 10000, conv fee 500, you can pay 7000 with points (not 7350 as earlier), rest 3500 need to be paid by card.

@pranab

3200 for convinience fee 🤭.. May I know what was your flight cost? Looks like hdfc has given infinia and dcb to most of them during pandemic where people cannot utilize the card to the maximum and bank collected 12k fee.. Now with these devalue bank is forcing most of them to cancel their cards.. This is very bad way of doing business and it would hit them hard..

By the way can anyone tell if we pre order a phone from Amazon then how to do a transaction through smartbuy? Whether EMI in amazon still we get bonus points?

another devaluation ?

Now smartbuy portal charges convenience fee on per passenger as on cleartrip/ yatra

Convenience Fee for flights is a major turn off! 450 per pax for roundtrip!

Indeed this is a considerable devaluation ! 🙁

It doesn’t make sense to book flights on Infinia Smartbuy anymore especially with them charging a convenience fee of 1200 for international flights. Better to book directly on ClearTrip using their various discount coupon codes. If the CT discount coupons would be applicable through smartbuy then it would be worth it.

I just compared total cost – benefits for a roundtrip London flight:

Infinia Smartbuy: 1,34,792 NET cost (after accounting for reward points gained)

Cleatrip: 1,24,386 NET cost (after using a coupon shown on the website itself)

As a mark of protest I spent just a single rupee on my DCB in the whole of Feb 😀, my lowest with DCB ever. Yet today they have posted more than 2K RP, I don’t know for which spends (awaiting statement). Have shifted my online 1X spends to Eterna which gives 3.75% (encashable) against DCB 3.3% (value only if used on travel) and offline spends to Amex PT which gives 7-8% RP. It’s the accelerated category which takes a big hit but won’t give up my DCB yet coz of LTF and unlimited worldwide lounges.

@abhi

Imagine people who are holding paid DCB.. I Will use only till I reach 5 lakhs and I don’t know how I would reach 😁.. You shouldn’t crib when you got LTF dcb.. I am having huge savings with hdfc and still bank doesn’t want to give LTF card to me wherelse people with 3 lakhs limit got LTF infinia upgrade from regalia last year Jan..

Exactly. I echo @Rohit’s feedback. I have LTF DCB since many years with average run rate of ~8Lakh/annum and significantly higher monthly income than many people who got upgrade from Regalia to India, but HDFC is unwilling to provide LTF Infinia.

Just to understand, is it possible to take the issue to RBI as malicious discrimination or else the bank should have the same policy for everyone.

@Ashutosh

Its a private bank and it is their wish to give LTF or not.. But worst part is bank should know for whom to give and whom they shouldn’t..what is illegal is they raising the fee on same card . For eg DCB WAS 5000 per annum and I signed a document and got card. They raising fee to 10k becomes illegal and case of cheat.. But most of us don’t care because based on our spends we can also earn 10k points in a month so in the end we are the loosers.. RBI can bring a rule that banks cannot give so much benefits and bring a ban on that.. So question here is it’s not worth the time and loss would be ours .

If some financial fraud happens then yes you have every right to complaint.. But rest all is just a bonus is what I take it.

Another devaluation. Dineout which had unlimited 15% discount on Infinia and DCB cards now has capped ₹1000 discount per month….

Someone at HDFC is making sure people shift to non HDFC cards.

Does the 1000 cap apply to Infinia as well? I thought it was only for DCB

I used multiple times in Feb there was no cap. When I tried using in March, it’s showing 1K cap per month. So I assume it’s effective 1st March. And yes on Infinia.

What I find disappointing in the drastic cut. 1K cap per transaction was still a bummer but digestible… but 1K per month?? That’s just insulting TBH…

Amazon Pay spend is not eligible for 5Xreward points from 20th Feb Onwards.

Another downgrade. Is it same for all?

Wallet loading (including APay) aren’t eligible for any reward points, even you won’t get the 1x. Somehow APay loading was ‘Missed’ by HDFC, but no more.

I got a FYF Infinia in January and now the below:

– 10x rewards on flights changed to 5x

– flat 236 convenience fee on flight transactions changed to dynamic convenience fee per passenger for flights 🙁

– Daily reward points capped

– Amazon 10x to 5x and Flipkart is now a joke

I really don’t know if this card is still worth it. If nothing changes AND no new higher card is launched, might shift my whole banking to Axis. I spend 10L+ yearly on credit cards (rent + utilities + insurance + flights).

In HDFC mobile app, it is showing upgrade option next to credit card type for me. Clicking it shows option to add you mobile number to dnc registry. Do you guys are also seeing this option. I am holding infinia visa at the moment

Oh man the 1k cap on Dineout is such a bummer. Any workaround on that yet? I haven’t found any yet. Infinia is toast.

Hi, while booking flight tickets through smartbuy noticed they have started charging convenience fee of appx INR 236 per person no matter its booked through clear trip, yatra or easy my trip.

Earlier this was flat INR 236 irrespective of number of passengers in a single ticket. Another downside of using smartbuy from now.

Amazon GV limit reduced to 5k from 10k

“A customer (a combination of registered mobile number and card number) can buy a maximum of INR 5000 worth of Amazon Pay Gift Cards in a calendar month”

A customer (a combination of registered mobile number and card number) can buy a maximum of INR 5000 worth of Amazon Pay Gift Cards in a calendar month.

Going down day by day.

New terms for Amazon Gift cards on Smartbuy..

“A customer (a combination of registered mobile number and card number) can buy a maximum of INR 5000 worth of Amazon Pay Gift Cards in a calendar month.”

One more devaluation – Limit to buy Amazon instant vouchers from Smartbuy reduced to 5k from 10k for Diners Black. Not sure about Infinia.

w.e.f 1 st april , amazon flipkart buying reduced to Rs 5000 per month

Another devalue of infinia and dcb.

3x payzapp removed and maximum Amazon voucher that can be purchased is 5k.. I used to get 660 points for buying 10k voucher and now that is gone making DCB absolutely useless card. Is there any way to upgrade from DCB to infinia?

Amazon GV limit now down to 5k on snartbuy

The devaluation continues every subsequent month

Hi thala.

SmartBuy+Infinia makes it a no-brainer for someone who travels a lot. For instance my nature of work demands extensive travelling (Monthly 8 to 10 flight trips mostly indigo and 10 to 12 nights stays). Flight trips at 5x (16.5% RR) and stays at 10x (33% RR) are unparalleled. I stick to SmartBuy for travels+GVs.

However with the monthly cap of 15000 RPs for Infinia, my travels beyond 15000 RPs earn me just 3.3% (base RR).

Siddharth, any suggestion for a secondary CC to route this spillover travel spends where I can squeeze >3.3% RR?

I would suggest you look into Amex Travel Platinum if you can spend 4 L or more. Or Amex Gold / MRCC if lesser.

They give a good ~7% return.

Check it up with a good travel agent. He may provide you better deals. Don’t hesitate. Just check it once.

Hi Everyone, can we get 5x rewards on Tanishq vouchers (30% component)?

(I plan to redeem my 100k points as per 70:30 ratio)

please please share your experience.

It looks it is not really related to HDFC/Infinia about the Amazon voucher limit to Rs.5000. Now Amazon voucher is not available from Axis bank too.

Also to note that HDFC/Infinia still allows to buy Rs.10000 Flipkart voucher.

So the Amazon voucher limitation may be because of restriction from Gyftr.com

These are really bad moves from HDFC at Infinia cards , Two things must be add again :

1) Lift up the maximum points limit for the day .

2) Infinia customers used to get 15% discussed at payment through dineout which has been restricted to rs 1000 / max ..Why , It must be as before .

The Infinia is for elite class customers , they are paying 12000+ rs a year as fees for this card .

HDFC must differentiate and put it above of all cards in the country . They must not be conservative.

Can anyone post the best calculations / limits for each card now with the new limits for smartbuy. Is travel portal / grabdeal with Magnus getting extra points. Need flights and hotel stays for a trip. Have infinia and Magnus. One question the only reason to book flights now via smartbuy is to use the points isn’t it, if points over isn’t it better to buy mmt vouchers and use in mmt app. Also flipkart amazon flights section do we have any offers with 10x rewards using these cards.

From May 1 onwards, there is processing fee for amazon gift cards in gyftr.

Please note: There is a Processing Fee of 2.5% + GST on Amazon Pay Gift Cards

From this month buying an Amazon voucher will entail an extra cost of 2.5% + GST. It works out to be 147 rupees extra for a purchase of gv worth 5000. Everyday HDFC gives me one reason less to use the diners black card. The net points that one gets is 495- 147= 348 points. This is just 6.96% return and that also only if you are redeeming it for hotels or flights

Now a new processing charge of 2.5% + GST is applicable for purchase of Amazon gift cards, A very bad move by HDFC!

Is there any other platform that offers good discounts on Amazon?

SmartBuy portal has started charging additional 2.5% processing fees + GST on buying gift vouchers, including Amazon GVs!

Processing Fee (2.5% + GST) (* only on Amazon Gift Cards) on smartbuy gyftr

Now there are no 5x Reward points on Insurance and Bill payments on Smartbuy.

Can we avoid the max per day cap by converting transaction in to EMI if we getting No cost emi?

As per T&C of smartbuy Bonus RP program is eligible for emi transaction as well.

Has anyone tried this before?

@Nirav Shroff

I did that for 80k product in 3 months EMI and I got 10x for it. This was 2 years before and from flipkart. That time Amazon was not eligible for points for EMI. Also customer care told me that it’s not applicable for no cost EMI so I took with interest. Just confirm with customer care and read terms and conditions carefully or you would miss your points.

Since a few days I am unable to apply points on Smartbuy. It shows some connectivity issues while generating the 70% voucher. I am facing this while booking a hotel on Smartbuy. Wanted to check if others are also facing the same and if there is any workaround?

Hello..5x rewards from HDFC Smartbuy is ending from June 22//Message in Smartbuy- Amazon.in benefits of 5X Reward Points / 5% CashBack on SmartBuy end soon! Users can avail of existing benefits till 30th June ’22. Effective 1st July ’22, Amazon.in benefits will no longer be available via SmartBuy. Continue to get accelerated reward points/cashback on Flight, Hotel, Trains, Buses, Flipkart, Instant Vouchers, MMT Hotels, Imagine | Tresor & IGP.

Amazon is removed from smartbuy transactions from 1st July. Another downgrade for all hdfc cards.

Hi,

Unable to complete payment for any Gyftr vouchers. Payment get directed to Razorpay, where the HDFC Diners card is not showing up as saved. When trying to add the card, it says “Bank verification required”. After continue it says error “Transaction failed”. Anybody else facing similar issues?

Purchased Flipkart vouchers a few minutes ago. No problems at all with Infinia. May be a problem with the diners network.

@deepak

Amazon voucher did not work for me for DCB when tried on 30/07..yesterday got flipkart voucher and had no issue with dcb.. Looks like something wrong with Amazon vouchers. Let me know if you are able to find the issue.

There is problem with Amazon vouchers on Smartbuy. Other vouchers work fine.

Yeah.Same with Flipkart. Not accepting HDFC Diners payment for both FK and Amazon.

Dont call useless HDFC customer care/ smart buy customer care numbers. They are cheaters and time wasters.

Call 1800-103-3315. They need only the HDFC registered mobile number to track the voucher buying issue and resolve it.

Was gyftr able to resolve this issue?

I am facing this issue on my Diners card too today

@Mugunthan

Just call infinia/dcb concierge and raise complaint.. They are suppose to take care of it.

Rohit

HDFC registered complaint asking to send screenshot by email and all. After one day, HDFC called me to give this 1800-103-3315 number (of payback/ gyftr) to contact. So it looks there are so many complaints* and HDFC is now directly asking customers to call Gyftr for faster resolution.

*Gyftr staff said to me this.

My transaction for buying Amazon vouchers on gyftr failed due to incorrect OTP entry. But now gyftr thinks I have already reached montly limit of buying vouchers and no longer allows me to buy. Any ideas?

Wait for few hours or max 1 day, it’ll unlock automatically

Max limit for amazon has been increased to 10k for Oct 22. But my dcb transactions are failing now. Hope they fix it.

I purchased 10K amazon+ 10K flipkart vouchers on 27-Sep, so I think limit increased in the last 1-2 week(s) of Sep 2022 itself.

use the option as new credit card and add all details without saving it.

Using saved card option is failing for some.

I was able to purchase 10k Amazon vouchers today 2-Oct.

Tried to buy Shoppers Stop vouchers today but looks like they have been discontinued too. One by one, the better brands are not available any more.

Anyone else facing the same issue?

There are two type of Amazon Voucher now Amazon Shopping Voucher with no 10K limit and Amazon Gift Card & Gift Voucher with 10K limit.

Amazon Shopping Voucher are great purchasing a product from amazon.

Another bad news. Points on rent payment going away on Diners from Jan 2023.

In fact, 2nd rent txn per month onwards, HDFC will start charging 1% of txn value

Another devaluation:

Revision in the Reward Points Program & Fee structure on your HDFC Bank Credit Card xxxxxx w.e.f 1st January 2023.

Dear Customer,

We have an important update for you.

There is a revision in the Reward Points Program on your HDFC Bank Credit Card as below, w.e.f 1st January 2023:

1. On the HDFC Bank SmartBuy portal, the redemption of Reward Points for flights & hotel bookings will be capped at 1,50,000 Reward Points per calendar month.

2. On the HDFC Bank SmartBuy portal, the redemption of Reward Points for Tanishq vouchers will be capped at 50,000 Reward Points per calendar month.

3. Redemption of Reward Points against statement balance (CashBack redemption) will be capped at 50,000 Reward Points per calendar month w.e.f 1st February 2023.

4. Rent payments and government transactions will NOT earn Reward Points.

5. Reward Points earned on grocery transactions will be capped at 2000 Reward Points per calendar month.

Revision in the Fee structure w.e.f 1st January 2023:

1. For rent payments made through third-party merchants, a fee of 1% of the total transaction amount will be levied from the second rental transaction of the calendar month.

2. If you conduct a transaction (in-store or online) in Indian currency at an international location or with a merchant located in India but registered overseas, a dynamic & static conversion markup fee of 1% will be charged.

We assure you the best of our services always.

Warm Regards,

HDFC Bank

Rent payment will NOT earn any reward points from now on. Just received the email yesterday. Major downgrade 🙁

There is a revision in the Reward Points Program on your HDFC Bank Credit Card as below, w.e.f 1st January 2023:

1. On the HDFC Bank SmartBuy portal, the redemption of Reward Points for flights & hotel bookings will be capped at 1,50,000 Reward Points per calendar month.

2. On the HDFC Bank SmartBuy portal, the redemption of Reward Points for Tanishq vouchers will be capped at 50,000 Reward Points per calendar month.

3. Redemption of Reward Points against statement balance (CashBack redemption) will be capped at 50,000 Reward Points per calendar month w.e.f 1st February 2023.

4. Rent payments and government transactions will NOT earn Reward Points.

5. Reward Points earned on grocery transactions will be capped at 2000 Reward Points per calendar month.

Revision in the Fee structure w.e.f 1st January 2023:

1. For rent payments made through third-party merchants, a fee of 1% of the total transaction amount will be levied from the second rental transaction of the calendar month.

2. If you conduct a transaction (in-store or online) in Indian currency at an international location or with a merchant located in India but registered overseas, a dynamic & static conversion markup fee of 1% will be charged.

thers is one more Devaluation hitting hdfc smartbuy from jan2023, rent no rewards, govt related trans-no rewards, groceries rewrds limited to 2000points, etc