As the Vistara Silver benefit was revoked from HDFC Regalia from March 15th 2019, HDFC Bank has replaced this benefit with complimentary Zomato Gold Membership.

The HDFC Regalia card holders on-boarded on or after 20th March 2019 and have spent Rs.75,000 within first 90 days from card set up date are eligible for this membership.

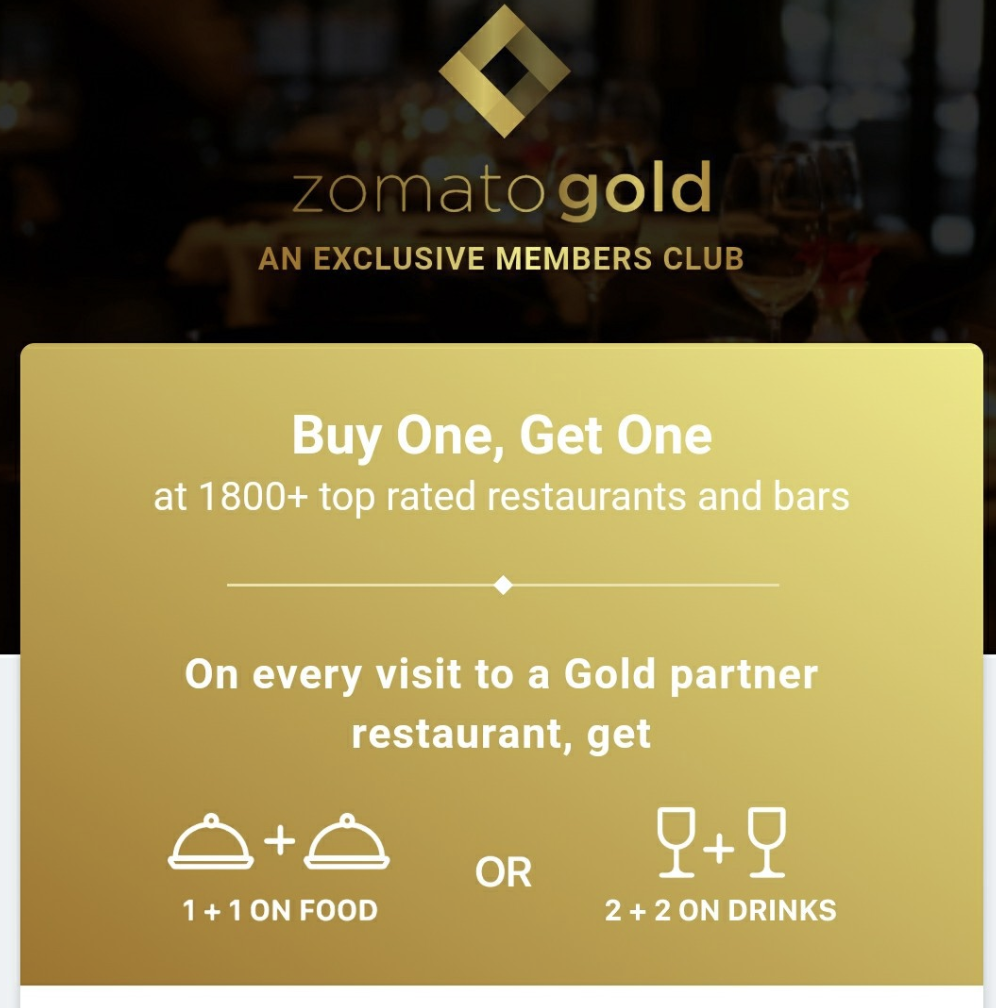

Zomato Gold Benefits

Each partner restaurant offers only one of these BUY 1 GET 1 benefits,

- Food partners offer 1 complimentary dish as a part of the meal.

- Drinks partners offer up to 2 complimentary drinks per visit.

- Each partner has a tag that allows you to distinguish between Food & Drinks

- Regalia customers are offered a one year unlimited Zomato Gold pack.

- Detailed T&C here

Bottomline

Given the Regalia userbase and the Zomato Gold membership benefits, its definitely a good value addition to the product, better than the Vistara Silver benefit.

Though, as some of you might already be having Zomato Gold, this might not sound attractive. Anyway, its only for new cardholders, so nothing much to worry here.

What’s your take on the complimentary Zomato Gold membership that comes with the new Regalia Credit Cards?

Wow good move by HDFC.

What about existing customers who haven’t taken Vistara silver membership❓❓❓❓❓

Anything for DCB?

What about existing HDFC regalia customers?

Great for those people looking for upgrade from Regalia First/ any other HDFC card to Regalia. I hope it will work for upgraded card as well as new, like it worked earlier with Vistara Silver membership.

Hi Sid, I am confused about my first card, which one to get? I have ITR of about 9.5L. I had applied for MRCC but got rejected . Now I don’t know which to get, thinking of Regalia First or SBI SimplyClick. Which one is good or are there better options also?

@Ananta – If you shop mostly online, then SimplyClick is better any day

What about SBI Prime assuming my expenses wont cross 3L in a year?Is it worth 3K fees if I get it? Isn’t customer service of HDFC better than SBI? If not I’ll just get SimplyClick 😀

I recently called up cc regarding upgrade from Regalia First to Regalia (1.5yrs with >7L spends) and was told to submit written request to Chennai office. Was told since Regalia First was LTF no upgrade offers were being offered.

I also have my sbi prime which I primarily use for utilities. The sbicard app is excellent and overall a much better experience with sbi cc as well. Im even eligible for elite upgrade( I know its paid but still worth it imo).

5X and low forex markup are the only pros for hdfc imo.

What is the maximum credit limit for Hdfc Regalia credit cards? Anyone has credit limit more than 8 lacs ??

Hello

I recently got Business Regalia. I were told that it is LTF if I activate any utility bill on smartpay within 90 days which I did. When I inquired the same on customer care they are reiterating that threshold spend limits are required for fee waiver from next year onwards and are silent on the smartpay condition.

There was a form along with the application form which I signed clearly states the charges and different waiver conditions.

Anyone faced similar problem? how should I take it up.

If You have taken Regallia after above-mentioned date, eligible for Zomato Gold and already have gold. Then you can extend your gold membership.

Hi Sid,

Is this offer only for Regalia clients or extended to Regalia first clients also?

I have been using Business regalia first for the past 3 months. I spent more than 75000 in the first 90 days.

If yes, how can i avail this offer?

My personal banker has no clue about this offer.

Thank you.

Yaaa same question.

I recently completed 75k spends well within the first 90 days but didn’t receive any Zomato Gold code.

Even though my welcome kit has a mention of this offer, Customer care is not aware of it.

Please advice on how I can redeem.

Thanks

I applied for HDFC Regalia first by the method of CC against CC, i presented my Amex MRCC card for the same.

I have two CC (2nd is Kotak Privy). To my shock the application got rejected! Even though my Cibil score is pretty high, above 800.

My RM tried to apply for the 2nd time and it got rejected once again, and the reply for refusal was lame and unclear. Has anyone else experienced this?

Kindly advice on how can I get the this card. I need this card only for the low forex fee.

PS – I only have a current a/c with hdfc.

Thanks. 🙂

Hi Pratik.

I applied for Regalia (Not Regalia First) on card to card basis and mine was approved and the card was delivered within a week. A few details I’d like to share so that it may help you get your card. Also note that Regalia First has been discontinued now.

Card Given for card to card basis – IndusInd Platinum Aura Edge

Limit at time – 3,00,000.

Cibil at time – 793

Account – HDFC Classic Savings Account

Other Credit Cards holding at that time-

1. Icici Coral Amex

2. Icici Amazon Pay

3. Axis Flipkart

Now coming to your 2nd question, you mentioned you only need it for low forex mark up but as far as I know, Kotak Privy has same 2% mark up fee as on Regalia and you’re already holding it.

Kotak Privy’s RP rate is too less so in the end he would end up paying more. Regalia is still his best bet.

Another Card that you can go for is “IndusInd World/Signature Exclusive Debit Card” which has a markup fee of 0% and which is only for exclusive account holder with aqb of 1l/2l depending on location.

If you find it a little above or high then you can go for IndusInd Select account with IndusInd World/Signature Select Debit card which has forex markup fee of 1%. It’s aqb is 50k / 1l depending on location.

Since both are debit cards, you will not have any problem whatsoever in getting access to any of them.

Cheers!!

Hello Sid..

You are doing a fantastic job of comparing cards and giving us reviews..

I have got a query..I am holding Regalia first since a year.

My annual spends are nearby 6 lacs..

I have requested them to upgrade me to Regalia.

My sole purpose of the card is to get maximum airmiles so that I can travel for free or get a class upgrade..

I do one international trip and one domestic trip every year..

We generally end up spending 3lacs on international trip.

Could you please suggest the best card that earn airmiles as well as the one which has best redemption rate for that miles while booking?

Axis Vistara Infinite, SC Emirates, SBI Etihad, SBI Air India Signature, CiTi Bank Premier Miles etc.. Else any Super premium credit card which has option of transferring RP to air miles. You can also aim for Infinia credit card which effectively reduces your ticket price by 30-40%.

Playing miles games is a different field altogether & usually doesn’t fit well in non-airlines credit card purview. As far as I have noticed from personal experience, buying miles from airlines & transferring them to partner program work out best. More time consuming, more per-planning needed, more tedious, but satisfying end results.

How can I get a Add-on card for HDFC Regalia?

PS: I don’t hold any savings account with HDFC.

Download add on application from the bank website, fill out the primary card member details and add on card member details with photo and attach self attested copy of add on member pancard and address proof and drop it in any hdfcbank branch or courier it to chennai office.

HDFCBANK.COM => Forms Center => Personal => Credit Cards => Add on card Application

PS – Leave blank the hdfc ac no and customer id column in add on details if the add on member doesnt have hdfc ac