Update: This service has been discontinued at the moment.

HDFC came up with this free CIBIL score & report feature back in Aug 2019 and lot of us made use of it. But after sometime they stopped taking new accounts, yet old logins were still active and can be refreshed.

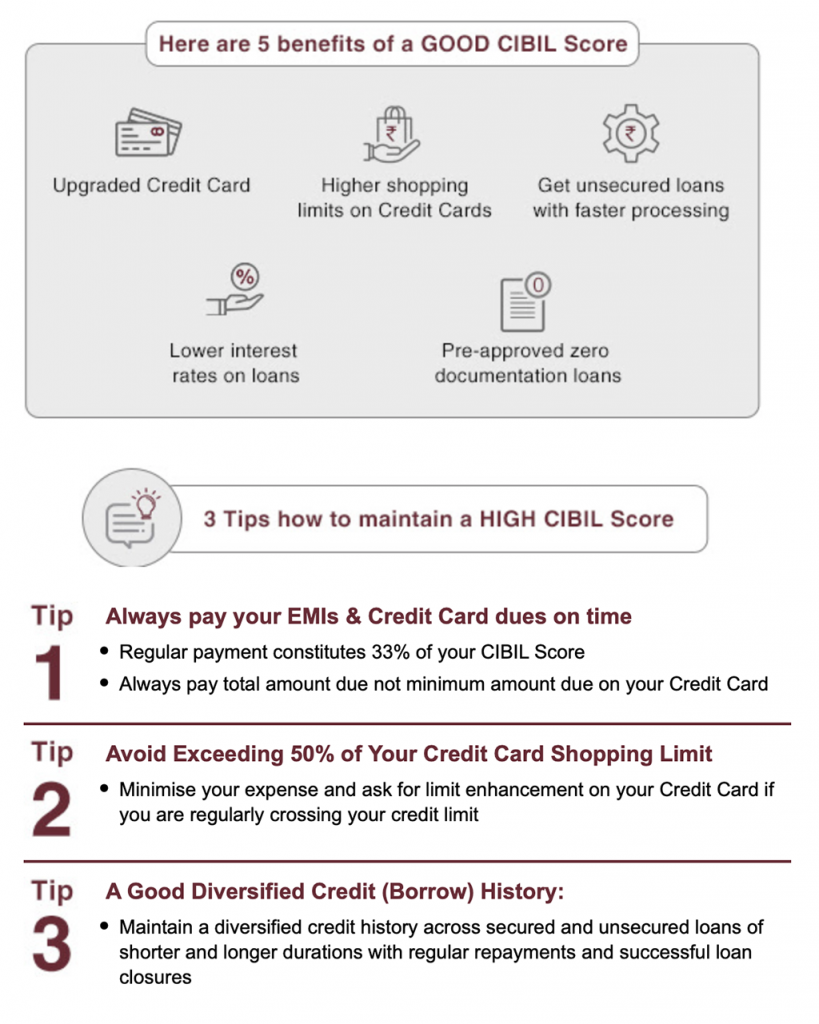

This got re-enabled few days back as reported by Vish and now HDFC Bank sent the promo mail as well. What caught my attention was the content of the email. Look at it if you haven’t already.

In short, you “may” get a better limit or an upgraded card if you have a high score, among other benefits.

Final Thoughts

While I don’t use this benefit for my a/c as I anyway have the annual membership plan with CIBIL, its definitely useful to check reports & scores of family members.

With this free a/c you can also refresh the report every 3 months, which is more than enough for most of the regular cardholders.

And if you have ICICI Wealth ac, you can get Free CIBIL score there as well twice (once via app, then via net-banking) and so you no longer need CIBIL’s paid plan.

Are you availing these Free CIBIL reports from various banks? Feel free to share your experiences in the comments below.

Hi, One query. In my CIBIL report it is written that I am Self Employed. However, I am not. I work for a company so I am a salaried person. How to correct the same in CIBIL or I can leave it as it is?

Does getting a cibil report affect our credit scores?

Not at all.

It seems refresh report duration is 1month now.

I can see next refresh date of June

For me it showed the score as on March. Next refresh is in Jun.

I think it is for 3 months (Mar-Jun)

It is one month for me too.

You’re not registered for this via HDFC before?

If so HDFC might have tweaked the refresh time to 1 month for new accounts.

What if I already have an account on Cibil website?

It didn’t work for existing account for me.

I got same mail. It’s showing as Free Cibil Score with Simulator. Is anybody got free simulator also?

I have existing CIBIL account and logged in with same credentials through HDFC page and not able to see simulator option. Is anybody got the same?

Create a new login, the same email id will work

I have tried that but getting error as “Username not available”

Are we getting simulator through HDFC link?

How is this free CIBIL score different from the one that websites like Policy bazaar offer for free? Please answer.

CIBIL Score from Bank’s = Free

CIBIL Score from any “Bazaar”s = Free + lot of spam calls 😀

I see big difference in CIBIL Score when I checked using HDFC and Paisa Bazaar. How to fix ?

CIBIL Through HDFC: 798 (I have complete credit history & all closed & active cards listed)

CIBIL Through PaisaBazaar : 780 (it is only last few years history & limited credit cards & incomplete information ) . Paisabazaar provides Experian & CRIF Credit scores as well & I donot have any issue right now with Experian and CRIF reports.

I Never understand how this works.

I have never had a single late payment in 12 years. No issue what so ever. But my CIBIL score dropped around 30 points from 830 to 805.

And there is no one to go to ask the reason for the same.

It is due to their recent method of calculating through algo. Most of us have seen the dip. You can check the post here too regarding the same.

Thanks A lot.

That explains it.

I have never checked CIBIL score in my life and HDFC RM few months back told me that score would reduce if we keep checking our score. Is that true. I never got mail from HDFC regardng free CIBIL check. How can I check or login for free report

There are 2 types of inquiries for CIBIL, hard and soft. Applying for credit cards or loans needs a hard inquiry while for knowing the score, its a soft inquiry. Hard inquiries hit your score while soft doesn’t.

No score never impacted by checking your cibil score

Checking the score doesn’t affects it. Go through the link for Hdfc accounts, just create account for free and check

With the moratorium on loans in effect, CIBIL data won’t be updated till June 30. Effectively means data update may not take place on its own till August.

I had the link from earlier and used it to refresh the score in March first week and it has 3 month wait time. now I can refresh it in june. Waiting for that.

I have a free account with CIBIL. Then I used the above given link to get the report through HDFC. The first time I could see the report after giving the details and OTP verification. But I am getting “System Error” page at fresh login attempts.

Can anyone please help?

Thank you.

Hello,

I came to know through this link that 2 credit enquiries has been generated by HDFC and ICICI for issuing Credit card even though both cards have been provided against two separate fixed deposits. That has hampered my credit score quite a bit.

Can anyone confirm that is it legit, because AFAIK banks do not generate hard enquiry for credit card issued against FdS??

If not how can I get those enquires removed from CIBIL?

@Anurag, Its legit as you already must have agreed on this while signing the form. Almost all the banks check credit score even if you take card against FD or its card to card. Those inquiries cannot be removed now.

Does having multiple credit card impact CIBIL Score

It has positive impact if you don’t default. I have 14 credit cards & my score is in top 1%

I have noticed that my cibil score range reduced less than 800 when i got two icici cards even though i have never did delayed payment in my entire life. the cibil range score is something which shows when i login into icici netbanking. I have never checked my cibil score by paying.

One additional query : I have Cred App. It shows a Higher Score (CRIF).

The HDFC Link shows a Different Score (albeit lower than CRIF ).

Which one to beleieve

Neither. Use that report to see if you have any error/omission. Other than that, it’s the banks’ own report that matters while taking loan

A new update in 26AS form effective from 1 June 2020.

If, total annual Credit Card bill payment (done by any mode other than cash eg. netbanking, upi etc.) exceeds 10 Lakhs rupees, it will be displayed in the Credit Card section of 26AS form.

Similarly, if Credit card bills are paid in cash & if annual bill payments in cash exceeds 1 Lakh rupees, it will be displayed in the Credit card section of the 26AS form.

So, beware ! especially those revolving credit among Prepaid wallets, NPS tier 2, Merchant POS like Mobikwik etc. etc. Keep a check on total annual credit card bills !

SFT came into effect long time ago , but banks used to refrain from reporting, now Govt has cracked the whip , so they have reported of past 3 years … its just information being sent to IT department, then an algo will be configured to compare with your declared income , if there is a possible mismatch , scrutiny will start

Hi bro, my question is that how can i get a unsecured credit card without income proof just based on credit score i have a good credit score, but i’m a student so it is obvious i dont have a income proof, so which credit cards are easier to get for me?

What is the minimum CIBIL SCORE needed for AMEX PLAT CHARGE CARD?

Usual ~750, no higher requirement of CIBIL score for Plat charge.

Has anyone checked this lately as i am not able to check for the past 2 months

Its throwing system error after logging in.